-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

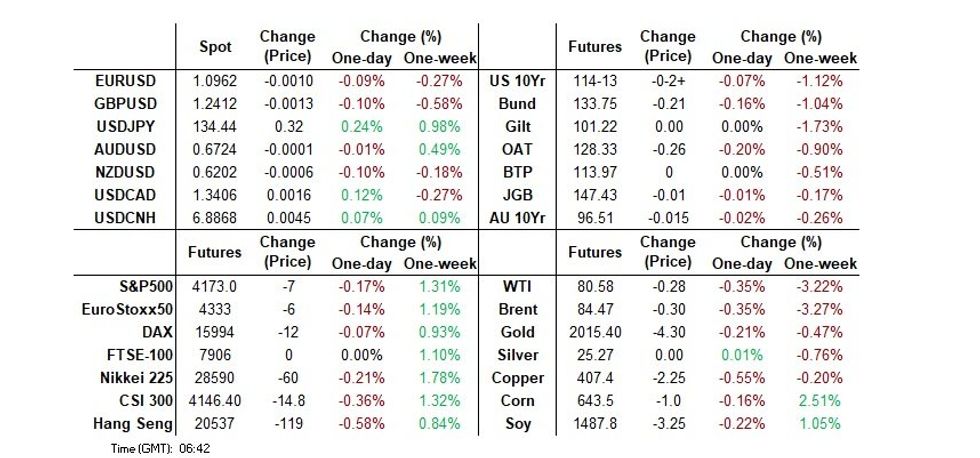

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Settles Within Recent Range

- Most regional equity markets are lower, although most losses are under 0.50% at this stage. US futures have stayed in the red for much of the session, although again losses have been fairly modest.

- The Greenback is little changed in Wednesday's Asian session, ranges have been narrow with little follow through on moves.

- In Europe we have UK CPI and the final print of Eurozone inflation. Further out, the Fed's Beige Book will cross. We will get a raft oof ECB speak through the day, with rhetoric out of the Fed, BoE & SNB also slated.

US TSYS: Curve Marginally Flatter In Muted Asian Session

TYM3 deals at 114-13+, -0-02, with a 0-04 range observed on volume of ~82k.

- Cash tsys sit 1bp cheaper to 1bp richer across the major benchmarks. The curve has twist flattened pivoting on 30s.

- Tsys were a touch cheaper in early dealing, weakness in ACGBs spilled over into the wider space as yesterday's post-RBA minutes cheapening consolidated.

- US Equity futures and regional equities were pressured facilitating a recovery from session lows in Tsys.

- Little meaningful macro newsflow crossed in the session. Ranges were narrow with little follow through on moves in tsys.

- FOMC dated OIS price a ~22bp hike into the May meeting, the terminal rate is now seen at 5.10% in June. There are ~60bps of cuts priced for 2023.

- In Europe we have UK CPI and the final print of Eurozone inflation. Further out the Fed Beige Book will cross. We also have the latest 20-Year Supply.

JGBS: Futures Flat, Narrow Range, Curve Flatter

JGB futures sit flat, off the extremes of a narrow range after domestic economic data failed to provide a meaningly local driver for the market. US Tsys also provided little in way of a catalyst with pricing basically unchanged in Asia-Pac trade.

- JBM3 is currently trading at 147.44, within the range of 147.40-147.92, where it has remained since early April. In the past two days, the JGB futures contract briefly fell below the lower limit of this range twice, but managed to bounce back.

- Cash JGBs are mixed with yields out to the 10-year 0.5bp richer to 0.2bp cheaper and beyond 1.6-3.0bp richer. The benchmark 10-year yield is 0.1bp higher at 0.476%, below the BoJ's YCC limit of 0.50%.

- Swap spreads are wider across the curve, with the swap curve twist flattening.

- Looking ahead, trade balance and weekly international security flow data headline domestically on Thursday, with 20-Year JGB supply also due.

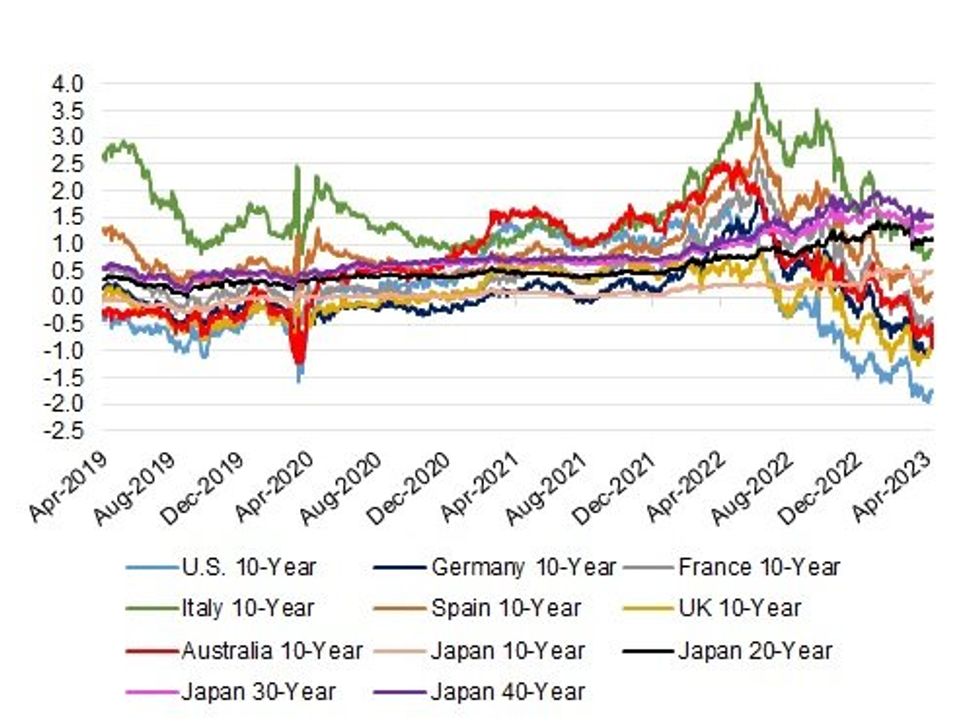

BONDS: Japanese Life Insurer & Pension Fund Investment Intentions On The Radar

Tuesday saw Japan’s Fukoku Mutual Life Insurance (~$65bn AUM) reveal that it plans to shed the entirety of its FX-hedged foreign bond holdings during the current Japanese FY (BBG noted plans for a Y300bn reduction in the company’s offshore debt holdings, Y240bn of which is FX-hedged foreign notes).

- The head of the company’s investment planning team, Suzuki, pointed to the well-documented FX-hedging costs facing Japanese investors as the driver of the move, particularly on the USD side.

- Suzuki flagged the company deploying Y270bn into JGBs and Y50bn into Japanese corporate bonds as part of the related capital reallocation.

- This comes after the company shed Y650bn of foreign debt in the previous FY, while it ploughed Y470bn into domestic paper over that period.

- Suzuki noted that plans could change if expectations for a reduction in FX-hedging costs come into play, although Fukoku deemed the prospect of a Fed rate cut during the current Japanese FY (which runs through March ’24) as unlikely.

- Suzuki pointed to the potential for some element of surprise when it comes to the removal of the BoJ’s YCC mechanism (given Governor Ueda’s recent musings), which he believes will likely take place in the current FY, with the risk of it coming “early.”

- Accordingly, Fukoku looks for 10-Year JGB yields to end the current FY at 0.80%, with 20-Year yields seen at 1.60% over the same horizon. Suzuki pointed to the firm’s willingness to invest in JGBs at current yield levels, even as they expect the aforementioned cheapening (Suzuki deemed yields of slightly above 1% as “acceptable” in the 20+-Year zone of the JGB curve).

- Fukoku look for USD/JPY to fall to Y125 by the end of the current FY, with 10-Year U.S. Tsy yields seen at 3.40% over the same horizon.

- Expect some of the larger names in the Japanese life insurance and pension sphere to release their investment intentions over the next 10 days or so.

- Fukoku’s investment plan isn’t a particular surprise. Looking at the FI benchmarks that we actively chart and monitor FX-hedging costs from the perspective of a Japanese investor for, only Italian government bonds provide a pickup vs. JGBs (at the 10-Year maturity point), showing the degree of rolling down the risk curve that is required to generate a yield pickup (which of course comes with its own risks and probably isn’t worth the sub-50bp pickup on offer at present). FX-unhedged bond positions would introduce another layer of uncertainty into what is already a very volatile global marketplace (although there were signs of such positions being put into play late in the previous FY, as the banking tumult took hold).

Fig. 1: Major FX-Hedged Yields For Japanese Investors (Based On 3-Month FX-Hedged Yield Costs)

| FX-Hedged Yield (%) | Conventional Yield (%) | FX-Hedged Pickup Vs. 10-Year JGB Yields (%) | |

| U.S. 10-Year | -1.7703 | 3.5794 | -2.2473 |

| Germany 10-Year | -0.9270 | 2.4740 | -1.4040 |

| France 10-Year | -0.3780 | 3.0230 | -0.8550 |

| Italy 10-Year | 0.8975 | 4.3010 | 0.4205 |

| Spain 10-Year | 0.0907 | 3.4910 | -0.3863 |

| UK 10-Year | -0.8718 | 3.7470 | -1.3488 |

| Australia 10-Year | -0.3756 | 3.5225 | -0.8526 |

| Japan 10-Year | -- | 0.4770 | -- |

| Japan 20-Year | -- | 1.0770 | -- |

| Japan 30-Year | -- | 1.3270 | -- |

| Japan 40-Year | -- | 1.5290 | -- |

AUSSIE BONDS: Off Cheaps After Pricing Of New Dec-34 ACGB

ACGBs sit weaker (YM -6.0 & XM -2.0) but well off session lows seen ahead of the pricing of A$14bn of the new ACGB Dec-34 via syndication. A$61bn in bids were received at the final clearing price, pointing to more than ample demand.

- Cash ACGBs are 1-5bp cheaper on the day but 3-4bp better than worst levels with the 3/10 curve 3bp flatter.

- The AU-US 10-year yield differential is +3bp at -9bp, after touching -6bp before the pricing of the new Dec-34 bond.

- Swap rates are 1-5bp higher with EFPs little changed.

- Bills pricing is -3 to -6 with late whites the weakest.

- RBA dated OIS is 4-6bp firmer for meetings beyond July with 21bp of cumulative tightening priced for August.

- A Bloomberg News survey of 41 economists revealed an expectation that the Australian economy will expand by 1.7% in 2023, 1.6% in 2024 and 2.4% in 2025. The chance of recession happening over the next 12 months is 35%, according to 17 economists. The RBA cash is seen at 3.85% by end-2023.

- With the local calendar light for the remainder of the week, the local market will be guided by US Tsys as they navigate the US earnings season.

NZGBS: Weaker Ahead Of Tomorrow’s Supply

NZGBs closed the day 4bp cheaper with the NZ/US 10-year yield differential 6bp wider. The NZ Treasury’s weekly supply announcement led to a 2-3 basis point increase in yields across the curve, although this move had subsided by the close. With the composition of tomorrow’s auction the same as April 6, it will be interesting to see whether the May-26 bond will receive a similarly strong bid (cover ratio of 6.25x) and whether it will deliver the same sharp steepening in the 2/10 cash curve.

- The NZ Treasury plans to sell NZ$200mn of the May-26 bond, NZ$150mn of the May-34 bond and NZ$50mn of the May-41 bond tomorrow.

- Swap rates closed 2-4bp higher with implied swap spreads 1-2bp tighter.

- RBNZ dated OIS closed 1-5bp firmer across meetings. 23bp of tightening is priced for the May meeting.

- A Bloomberg News survey of 22 economists showed the NZ economy was expected to expand by 1.0% in 2023, 1.3% in 2024 and 2.5% in 2025.

- Tomorrow sees the release of Q1 CPI. While it is expected to moderate it is likely to remain elevated driven by higher food and construction prices related to earlier severe weather. BBG consensus is expecting a print of +1.5% Q/Q and 6.9% Y/Y.

NEW ZEALAND: Q1 CPI To Remain Elevated, Local Banks Expect Print Above Consensus

In April, the RBNZ hiked another 50bp bringing rates to 5.25%. It opted for this outsized move as inflation remains “too high and persistent”. On Wednesday April 19, Q1 NZ CPI prints and while it is expected to moderate it is likely to continue to be elevated driven by higher food and construction prices related to the earlier Cyclone. Bloomberg consensus is at 1.5% q/q and 6.9% y/y after 1.4% and 7.2% in Q4. The RBNZ is likely to look through the short-term weather effects on inflation but will be more concerned if rebuilding adds to price pressures.

- There is a variety of quarterly estimates from 1.3% q/q at the low end to 1.8% at the high end but most are between 1.4% and 1.7%. This leaves the annual rates forecast between 6.7% and 7.2%.

- Kiwibank and BNZ both expect 1.7% q/q and 7.1% increases, the ANZ 1.7% and 7.2% and ASB 1.8% and 7.2%, so all of the major local banks expect Q1 CPI to print above consensus.

FOREX: USD Little Changed In Muted Asian Session

The Greenback is little changed in Wednesday's Asian session, ranges have been narrow with little follow through on moves. BBDXY sits at 1224.54, a 0.2% range has been observed in the index.

- AUD is marginally outperforming today, it is the strongest performer in the G-10 space at the margins. AUD/USD prints at $0.6730/35, ~0.1% firmer however we have been unable as of yet to sustain a break of the 50-Day EMA and sit a touch below the measure.

- NZD/USD is a touch softer, however ranges have been narrow, with resistance seen ahead of $0.6220 and support below $0.62.

- Yen is softer, USD/JPY prints at ¥134.25/35 ~0.2% firmer today. Resistance is seen at ¥134.75, a Fibonacci retracement point, and support at ¥132.96 the 20-Day EMA.

- Elsewhere in G-10 GBP and EUR are little changed. USD/NOK is ~0.3% higher however note Asia Pac liquidity is likely to be fairly poor for this pair.

- Cross asset wise; e-minis are ~0.2% lower and the Hang Seng is down ~0.5%. US Treasury Yields are little changed across the curve.

- In Europe we have UK CPI and the final print of Eurozone inflation. Further out the Fed Beige Book will cross.

AUD: Yield Differentials Dominating Short Term Correlations

AUD/USD correlations are below historical norms at present. The table below presents the levels correlations between AUD/USD and various macro drivers (note the correlation with yield differentials is based off government bond yields).

- Short term correlations, for the past week, sit more elevated for yield differentials, particularly at the 2yr point. This likely owes to the recent rebound in US yields, which has knocked the A$ off its recent highs. Longer term correlations (for the past month) look close to average.

- Whilst the US is likely to remain a key driver of the yield differential, note that next week's Q1 CPI print in Australia will be an important update for the RBA outlook (data prints on Wednesday).

- Correlations with global commodities are lower, likewise for base metals and iron ore. Correlations are higher for the past month, but below longer term averages. It's a similar story for global equities and the VIX index. Over the medium term though we would expect these correlations to rebound.

Table 1: AUD/USD Correlations

| 1wk | 1mth | |

| AU-US 2yr Spread | 0.85 | 0.30 |

| AU-US 5yr Spread | 0.65 | 0.40 |

| AU-US 10yr Spread | -0.14 | 0.46 |

| Global Commodities | -0.04 | 0.38 |

| Global Base Metals | 0.19 | 0.27 |

| Iron ore | -0.21 | 0.01 |

| Global equities | 0.31 | 0.34 |

| US VIX index | -0.11 | -0.31 |

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Apr19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850(E912mln), $1.0900-15(E623mln), $1.0930-40(E956mln), $1.1000(E705mln), $1.1015-30(E943mln), $1.1049-50(E1.9bln)

- GBP/USD: $1.2450(Gbp803mln)

- USD/JPY: Y132.50-60($739mln), Y132.90-00($522mln), Y133.35-45($929mln), Y135.00-10($616mln)

- NZD/USD: $0.6230-35($805mln)

- USD/CAD: C$1.3300($565mln), C$1.3445-55($1.0bln)

- USD/CNY: Cny7.00($1.0bln)

ASIA FX: USD/Asia Pairs Mostly Supported On Dips

USD/Asia pairs have mostly been supported on dips. USD/CNH sits back above 6.8800, although remains well within recent ranges. The USD rebounded from early weakness against the majors, which has likely aided firmer USD/Asia levels. Tomorrow, we get China 5yr and 1yr LPR decisions, no change is expected. Malaysian CPI is also out, while Taiwan export orders also print later in the session. Note also Indonesia markets are closed for the next 5-sessions, re-opening next Wednesday.

- USD/CNH was once again supported on a dip to 6.8700. On the topside we haven't been able to breach 6.8850. Overall, USD/CNH remains well within recent ranges. Onshore equities are slightly weaker, while the CNY fixing was neutral. Tomorrow's LPR outcomes should be unchanged.

- 1 month USD/KRW dipped early, but didn't see much follow through. We got to 1311.60, but now sit back at 1316/17, in line with firmer USD index levels. Onshore equities are higher but offshore investors are still net sellers for the session so far (-$132.8mn). President Yoon gave a wide ranging interview ahead of his trip to the US next week (see this link for more details).

- USD/MYR prints at 4.43/44, the pair is little changed from yesterday's closing levels.• Marchs Trade Balance printed at a surplus of MYR26.69bn, this was a stronger print than the expected MYR20.60bn. Imports fell -1.8%, a rise of 2.2% had been expected, and exports fell -1.4% less than the expected fall of 1.9%. Looking ahead, March CPI is on the wires tomorrow, a rise of 3.6% Y/Y is expected, softening a touch from the 3.7% observed in February.

- The SGD NEER (per Goldman Sachs estimates) is consolidating in a narrow range after weakening in the wake of Friday's MAS monetary policy decision. We now sit ~1% below the top of the band. USD/SGD is holding above the 20-Day EMA ($1.3317) the pair broke above the measure on Monday and has consolidated gains in a narrow range in recent dealing. The pair currently sits at $1.3330/40, and is ~0.1% firmer today.

- Ranges are fairly muted elsewhere. USD/PHP sits back close to 56.00. We touched a high of 56.20/25 yesterday. Indonesian markets are closed for the next 5 sessions, re-opening next Wednesday. The 1 month USD/IDR NDF (last 14890/00) is still trading, but with no onshore anchor, so expect lighter liquidity in the pair.

EQUITIES: Mostly In The Red

Most regional equity markets are lower, although most losses are under 0.50% at this stage. US futures have stayed in the red for much of the session, although again losses have been fairly modest, Eminis last around 4173/74 (-0.15%).

- HK and China related equity sentiment has been somewhat volatile. The HSI was down over 1% at one stage, but now sits back at -0.50%. H shares are faring slightly worse at -0.70%. On-going intervention by the HKMA to curb HKD weakness is also prompting fears of higher rates, which could be weighing on sentiment, particularly in the tech space.

- Mainland shares are also offered, with the CSI 300 down 0.40%. Stake reduction plans in A-shares and H-shares is one factor being cited for the weakness.

- Japan shares look to end a strong winning streak. The Topix is off by 0.3% at this stage. If confirmed into the close, it would be the first dip for the index since April 6.

- The Kospi is seeing some modest outperformance, up around 0.4% at this stage.

- Elsewhere, the ASX 200 is flat, while most SEA markets are weaker except for Singapore shares (+0.17%). Indonesia's market is closed for the next 5 sessions (re-opening next Wednesday).

GOLD: Consolidating Above $2000

Gold is holding above $2000, but has mostly tracked sideways for the session. Highs for the session, above $2008, coincided with early USD weakness, but as the dollar indices recovered we moved back towards $2002. We sit slightly higher at $2003.70 currently, less than 0.10% down for the Wednesday session so far.

- Gold ETF holdings are still showing positive momentum, but the rate of change has slowed compared to a few weeks ago.

- Technically, recent lows come in ahead of the $1980 level, while recent highs rest above $2047, which came prior to the recent rebound in US yields.

OIL: Drifting Sideways, US Inventory Data Eyed Later

Oil benchmarks sit slightly below NY closing levels from Tuesday. Brent is around $84.60/bbl (-0.15%), while WTI was just under $80.80/bbl. Brent got above $85/bbl in early trade but couldn't sustain the move.

- Recent lows have come in between the $83/$84/bbl range, which have held since the start of the month. A move below this region would open up a move back sub $80/bbls, levels last seen in late March. On the topside, recent highs come in around the $87.50/bbl, while the simple 200-day MA is just under $88.70/bbl.

- The main focus coming up will be the EIA weekly inventory report, out during US trade. This follows reports yesterday of a further run down in US inventories.

- Yesterday's China data, which showed a more consumption/services led recovery, likely hasn't aided sentiment around the growth outlook. The industrial side of the economy is improving but not at the same rate as the services side.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/04/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/04/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/04/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/04/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/04/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/04/2023 | 1035/1235 |  | EU | ECB Lane Speech at Enterprise Ireland Summit | |

| 19/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/04/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/04/2023 | 1500/1700 |  | EU | ECB Schnabel Lecture at Leibniz-Zentrum ZEW | |

| 19/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/04/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 19/04/2023 | 2130/2230 |  | UK | BOE Mann Panellist at Brandeis International Business School | |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.