-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Core FI Happy To Hold Tight Ranges In Asia

US TSYS: Consolidating In Asia After Head Fake Retrace In 30s

Marginal reversals of Tuesday's moves in e-minis and Tsys have placed modest pressure on the Tsy space in Asia-Pac dealing, although ranges generally remain tight. T-Notes last -0-00+ at 139-06, with the contract holding a 0-02+ range & cash Tsy yields little changed across the curve.

- The continued fiscal impasse on the Hill, delays surrounding the COVID-19 vaccine process (as both J&J & Eli Lily experienced worry re: test subjects) and some idiosyncratic pressure points for equities provided support for the U.S. Tsy space on Tuesday. Elsewhere, U.S. CPI slowed, as expected. The sum of those parts saw the curve bull flatten, with 30-Year yields retracing back into familiar territory and below the 200-DMA (see earlier bullet for more on that matter), with that particular metric richening by ~6bp on the day.

- Eurodollar futures sit +/- 0.5 through the reds. The first round of BoJ US$ ops covering year-end received 0 bids, adding credence to calls for a sanguine year-end in US$ funding markets.

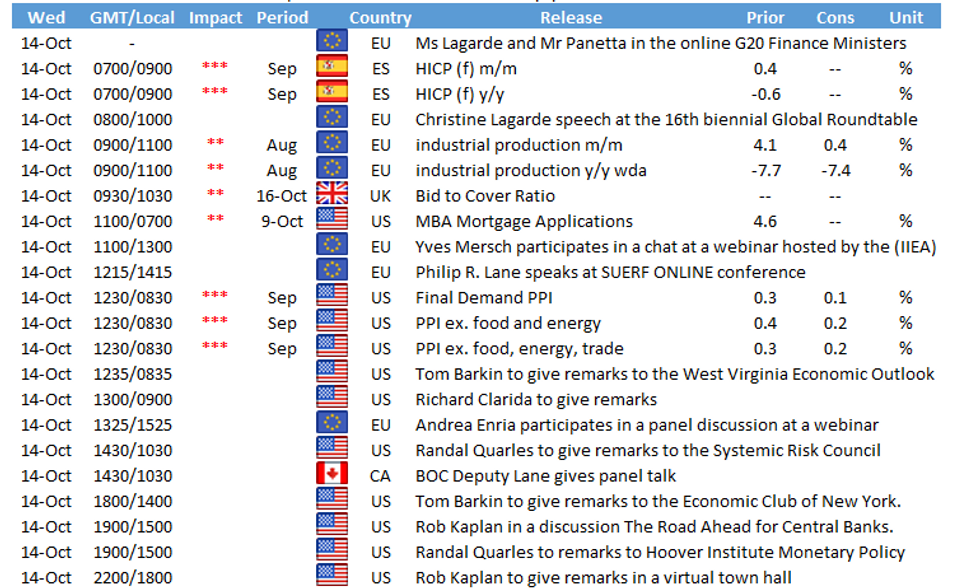

- Fed's Daly and an address from Chinese President Xi failed to add to broader discussions in Asia-Pac hours. Local focus on Wednesday will fall on a deluge of Fedspeak and the latest U.S. PPI reading.

JGBS: Futures Struggle For Meaningful Upside, Again

JGB futures couldn't better the overnight high in Tokyo trade, last +5 vs. settlement levels, again struggling for any real traction above 152.00 and trading below the figure at typing.

- The 10-20 Year sector saw modest underperformance, cheapening at the margin, while the remainder of the cash JGB curve traded richer. Swaps were wider vs. JGBS across the curve as the swap curve twist steepened.

- The BoJ left the size of its 1-10 Year Rinban ops unchanged, with the following offer/cover ratios: 1-3 Year: 2.53x (prev. 2.01x), 3-5 Year: 2.35x (prev. 3.50x), 5-10 Year: 3.44x (prev. 1.97x).

- The first round of BoJ US$ ops covering year-end received 0 bids, adding credence to calls for a sanguine year-end in US$ funding markets.

- On the data front, the final Japanese industrial production readings for August were a touch softer than flash.

- Focus on Thursday moves to the latest liquidity enhancement auction for off-the-run 1-5 Year JGBs.

AUSSIE BONDS: Strong ACGB Offering Helps Long End

The longer end was helped by a well received, large DV01 offering from the AOFM, as average yields at the latest ACGB May 2032 auction priced ~0.4bp through prevailing mids at the time of supply (based on BBG pricing), with the cover ratio firming to 4.4424x, despite the uptick in auction size, representing a solid round of demand (we flagged supportive factors ahead of time in our auction preview). Still, the space held to narrow ranges, with YM -1.0 and XM +0.5 at typing, as the curve twist flattens.

- Early comments from Australian Treasurer Frydenberg outlined the mutually beneficial nature of the Sino-Aussie ties, although he did flag periods of difficulty that have been evident in the relationship. This comes after a Global Times piece pretty much confirmed the thoughts of the sell side re: the recent reports of Australian coal imports into China, in that well established quotas may be providing any import limitations that may or may have not been put into place, although Sino-Aussie tensions are at least a secondary factor that must be considered.

- Australian consumer confidence data from Westpac jumped, in line with what we have seen in the ANZ-Roy Morgan weekly equivalent.

- Bills sit unchanged to -1 through the reds.

AUCTIONS/DEBT SUPPLY

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.19tn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$2.5bn of 1.25% 21 May '32 Bond:

The Australian Office of Financial Management (AOFM) sells A$2.5bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 0.9241% (prev. 1.0098%)

- High Yield: 0.9250% (prev. 1.0125%)

- Bid/Cover: 4.4424x (prev. 2.7200x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 88.8% (prev. 58.4%)

- bidders 58 (prev. 35), successful 17 (prev. 20), allocated in full 8 (prev. 12)

TECHS

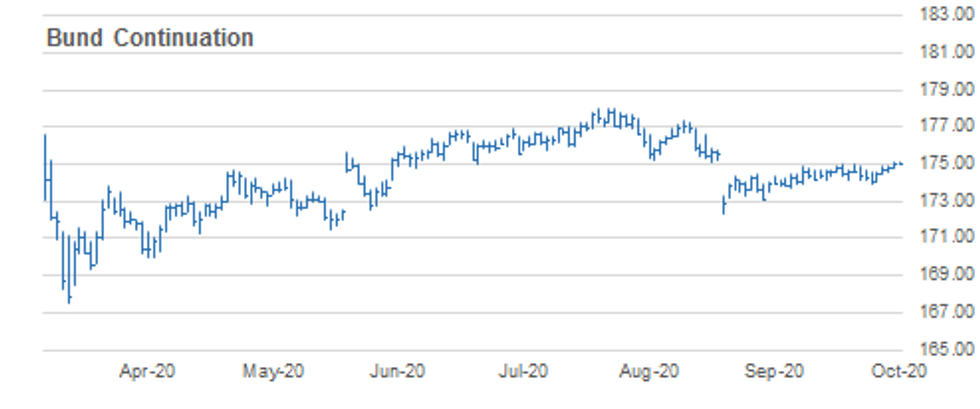

BUND TECHS: (Z0) Probes Key Resistance

- RES 4: 176.00 round number resistance

- RES 3: 175.74 1.236 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 175.23 1.00 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 174.13 High Oct 13

- PRICE: 175.08 @ 04:50 BST Oct 14

- SUP 1: 174.45 20-day EMA

- SUP 2: 173.93 Low Oct 7 and the key support

- SUP 3: 173.74 Low Sep 17

- SUP 4: 173.61 50.0% retracement of the Aug 28 - Oct 2 high

Bund futures maintain a positive tone. The contract found support last week at 173.93, Oct 7 low and the resulting move higher has this week seen futures clear resistance at 174.97, Oct 2 high and probe the key levels at 175.08, Aug 4 high. A clear breach of 175.08 would confirm a resumption of the broader uptrend and open 175.23 and 175.74, both Fibonacci projections. Key support trend support is at 173.93. Initial support lies at 174.45.

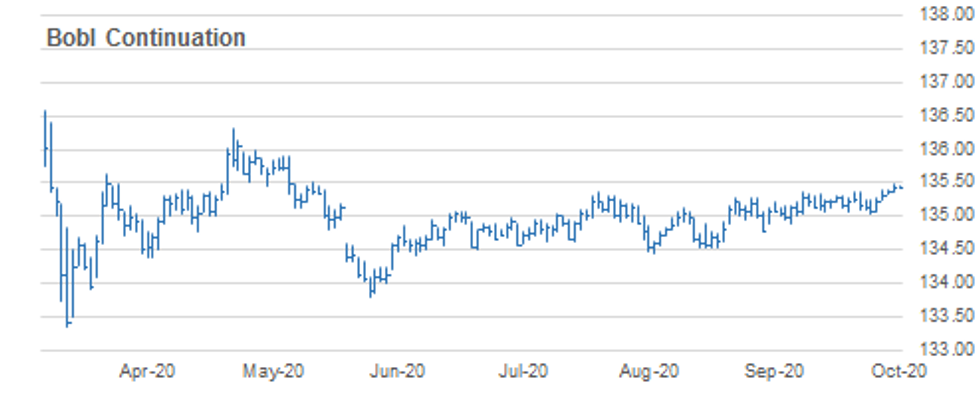

BOBL TECHS: (Z0) Bullish Outlook Intact

- RES 4: 135.730 1.500 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 3: 135.660 1.382 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 135.500 High May 22 (cont)

- RES 1: 135.470 High Oct 13

- PRICE: 135.430 @ 05:02 BST Oct 14

- SUP 1: 135.211 20-day EMA

- SUP 2: 135.030 Low Oct 6 and key trend support

- SUP 3: 134.900 Low Sep 11 and 17

- SUP 4: 134.760 Low Sep 11 and key support

BOBL futures rebounded on Oct 7 off 135.030. The subsequent recovery has resulted in a clear break of resistance at 135.370, Sep 21 and the Oct 5 high. This confirms a resumption of the uptrend that has dominated since early September and opens 135.563 next, a Fibonacci projection. 135.030 marks the key short-term trend support where a break is required to reverse the trend. Initial support lies at 135.211, the 20-day EMA.

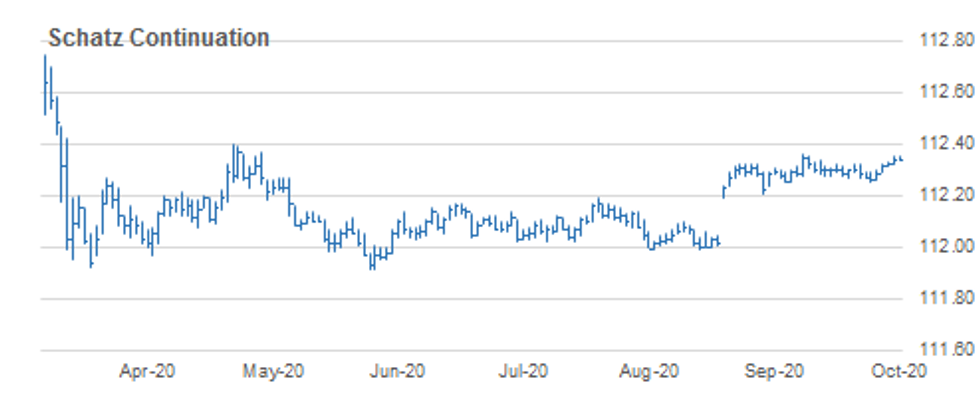

SCHATZ TECHS: (Z0) Approaching The Bull Trigger

- RES 4: 112.385 High Jul 30

- RES 3: 112.383 1.236 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.360 High Sep 21 and the bull trigger

- RES 1: 112.355 High Oct 13

- PRICE: 112.345 @ 05:08 BST Oct 14

- SUP 1: 112.298 20-day EMA

- SUP 2: 112.255 Low Oct 7 and key trend support

- SUP 3: 112.250 Low Sep 17

- SUP 4: 112.240 Low Sep 11

Schatz futures remain firm following last week's rebound off 112.255, Oct 7 low. Resistance at 112.325, Oct 2 and 5 high was breached Monday, reinforcing the current positive tone and signalling scope for strength towards the 112.360 high from Sep 21. This level also marks the bull trigger. A breach would confirm a resumption of the broader uptrend and open 112.383, a Fibonacci Projection. Key trend support is at 112.255.

GILT TECHS: (Z0) Finds Support

- RES 4: 136.60 High Sep 30 and the near-term bull trigger

- RES 3: 136.28 61.88% retracement of the Sep 21 - Oct 7 sell-off

- RES 2: 136.19 High Oct 1 and key near-term resistance

- RES 1: 135.99 High Oct 13

- PRICE: 135.91 @ Close Oct 13

- SUP 1: 135.29 Low Oct 9

- SUP 2: 135.06 Low Oct 7 and the bear trigger

- SUP 3: 134.96 76.4% retracement of the Aug 28 - Sep 28 rally

- SUP 4: 134.59 Low Sep 1

Gilts futures managed to trade higher yesterday, reversing part of the recent strong downtrend. Futures yesterday also cleared 135.82, the 20-day EMA highlighting potential for a stronger bounce. Further gains would open 136.19, Oct 2 high and 136.28, a Fibonacci retracement. On the downside, initial firm support lies at 135.29, Oct 9 low ahead of the key level that has been defined at 135.08, Oct 7 low.

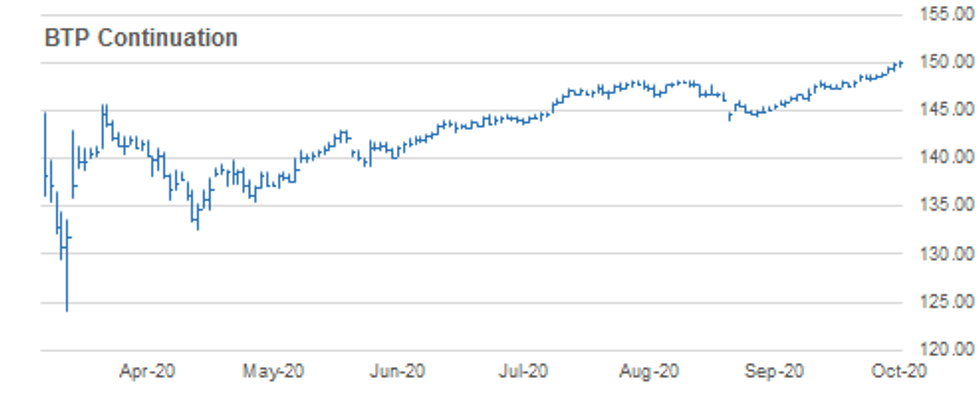

BTPS TECHS: (Z0) Clears The 150.00 Psychological Hurdle

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.92 Bull channel top drawn off the Sep 8 low

- RES 1: 150.18 High Oct 13

- PRICE: 150.07 @ Close Oct 13

- SUP 1: 149.23 Bull Channel support drawn off the Aug 9 low

- SUP 2: 148.16 20-day EMA

- SUP 3: 147.32 Low Sep 28 and key near-term support

- SUP 4: 146.98 Low Sep 22

BTPS have continued to extend gains, touching a fresh all-time high print of 150.18 yesterday. The move once again confirms a resumption of the bull trend and maintains the positive price sequence of higher highs and higher lows. With futures in uncharted territory, Fibonacci projections highlight scope for a climb towards 151.17. The initial objective is 150.92, a bull channel top drawn off the Aug 9 low. Initial support lies at 149.23, the channel base.

EUROSTOXX50 TECHS: Bullish Trend Conditions Intact

- RES 4: 3396.02 High Sep 3

- RES 3: 3348.77 High Sep 16 and key near-term resistance

- RES 2: 3326.79 High Sep 18

- RES 1: 3305.77 High Oct 12 and the intraday bull trigger

- PRICE: 3279.19 @ Close Oct 13

- SUP 1: 3254.13 Low Oct 9

- SUP 2: 3219.33 Low Oct 7

- SUP 3: 3147.28 Low Oct 2 and key support

- SUP 4: 3097.67 Low Sep 25 and the bear trigger

EUROSTOXX 50 rallied higher Monday, starting the week on a firm note. Bullish trend conditions have improved following last week's breach of 3227.43, Sep 28 high. Furthermore price has traded through the resistance zone defined by the 20- and 50-day EMAs. The move beyond these averages strengthens a bullish argument. S/T pullbacks are likely corrective in nature. Attention is on 3348.77, Sep 16 high. Support is at 3254.13.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.