-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Eyes On Flows After Flattening

US TSYS: Asian Players Use Recent Richening To Initiate TYZ0 Downside Plays

After a flurry of headlines in the NY/Asia-Pac crossover, covering everything from probable lockdown measures in Germany and France to the flagging of a Wednesday briefing from the FBI & U.S. DoJ on security matters surrounding China, headline flow cooled. T-Notes stuck to a 0-03+ range, last +0-01 at 138-28, with cash yields sitting little changed across the curve. Market flow provided the highlight overnight, with downside expressions noted via block trades in both the TYZ0 137.50 and 137.00 puts. That theme spilled over into screen flow, which saw the following package trade: TYZ0 138.50/137.50 put spread vs 139.50 calls, receiving 3 ticks credit on the package (buying the put spread), with 4.0K trading (-54% Delta).

- To recap, the Tsy space flattened again on Tuesday, with familiar themes i.e. the lack of a forthcoming U.S. fiscal pact and the European COVID-19 situation front and centre. This bull flattening saw cash 30s close ~4.0bp richer, with the space going out at richest levels of the day on the aforementioned European lockdown headlines. The latest 2-Year Note offering from the Treasury was solid, coming in virtually on the screws, while the cover ratio was steady vs. prev., but a touch shy of the recent average. Dealer takedown metrics were in line with the recent averages.

- Eurodollar futures sit unchanged to +1.0 through reds, with flattening flows seen in EDZ2/Z4 during Asia-Pac hours, as well as a round of EDZ0 lifts.

- 5-Year Note & 2-Year FRN supply is due today.

JGBS: Holding On To Overnight Gains

JGB futures had a look through their overnight high in early Tokyo trade, but the move was fleeting, as the contract faded from best levels. Futures last +10, with 7s outperforming on the cash JGB curve, owing to the uptick in futures. Swaps marginally wider vs. cash across the curve, excluding 30s and 40s (with receiving seen in the super-long end).

- Local headline flow has been light. Japanese PM Suga noted that the government will deploy the measures required to safeguard employment, while stressing that the sales tax is an integral part of social security in Japan.

- Elsewhere, Yomiuri sources suggested that the government will extend the period of its "Go To Travel" scheme beyond its current expiration date (end of January '21).

- The latest BoJ monetary policy decision headlines the local docket on Thursday (expect our preview to hit during Wednesday's London session).

AUSSIE BONDS: Locked In On RBA

Aussie bonds were willing to operate in narrow ranges, even as RBA board member Harper flagged the potential for further easing (as the rhetoric deployed was in tune with what we have heard from RBA Governor Lowe, among others), while domestic Q3 CPI was never going to move the goal posts for the RBA. YM closed -0.5, XM +2.0, holding flatter after the latter extended above its SYCOM range in early Sydney dealing on risk-off news flow re: European COVID matters.

- Swaps were generally biased marginally wider across the curve for most of the session (expectations re: the outline of a broader round of bond buying at next week's RBA decision is likely the explanatory factor here).

- Elsewhere, Australian PM Morrison downplayed talk that the Australian economy is out of recession, pointing to a long road back and the need for gov't support of the labour market.

- Bills finished unchanged to -1.

TECHS

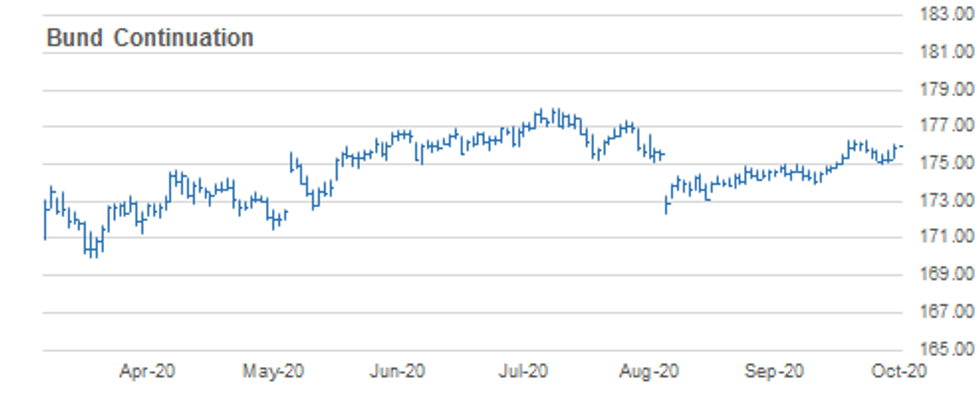

BUND TECHS: (Z0) Recovery Off 175.00 Extends

- RES 4: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 3: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.29 High Oct 16 and the bull trigger

- RES 1: 176.11 Intraday high

- PRICE: 176.01 @ 04:41 GMT Oct 28

- SUP 1: 175.27 Low Oct 27

- SUP 2: 175.00 Low Oct 23

- SUP 3: 174.84 Trendline support drawn off the Sep 1 low

- SUP 4: 174.69 50-day EMA

Bunds traded higher yesterday extending the recovery off 175.00, Oct 23 low. Attention is on the key resistance at 176.29, Oct 16 high. The recent pullback was considered a correction with underlying bullish conditions intact. Note that the key short-term trendline support intersects at 174.84. The trendline is drawn off the Sep 1 low and the uptrend remains intact while price holds above the line. A break of 176.29 resumes the uptrend opening 176.32/57.

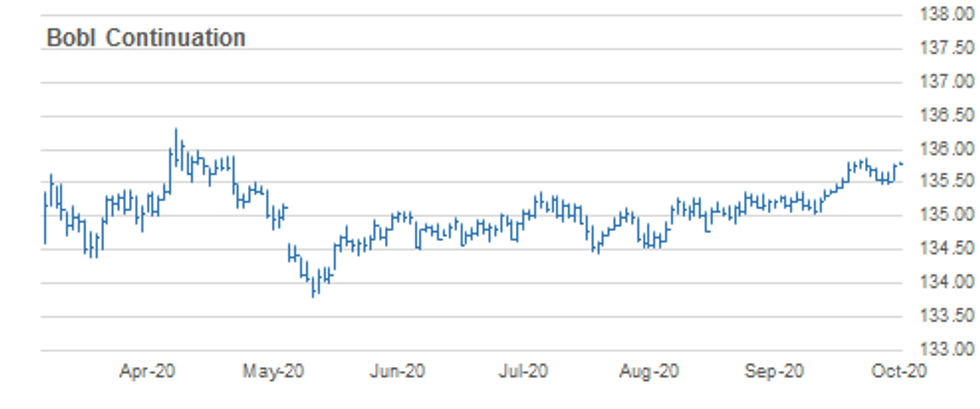

BOBL TECHS: (Z0) Corrective Cycle Appears To Be Over

- RES 4: 136.000 Round number resistance

- RES 3: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 135.860 High Oct 20 and the bull trigger

- RES 1: 135.810 Intraday high

- PRICE: 135.770 @ 04:29 GMT Oct 28

- SUP 1: 135.530 Low Oct 27

- SUP 2: 135.470 Low Oct 23 and 26

- SUP 3: 135.445 50.0% retracement of the Oct 7 - 20 rally

- SUP 4: 135.370 High Sep 21 and Oct 5 and former breakout level

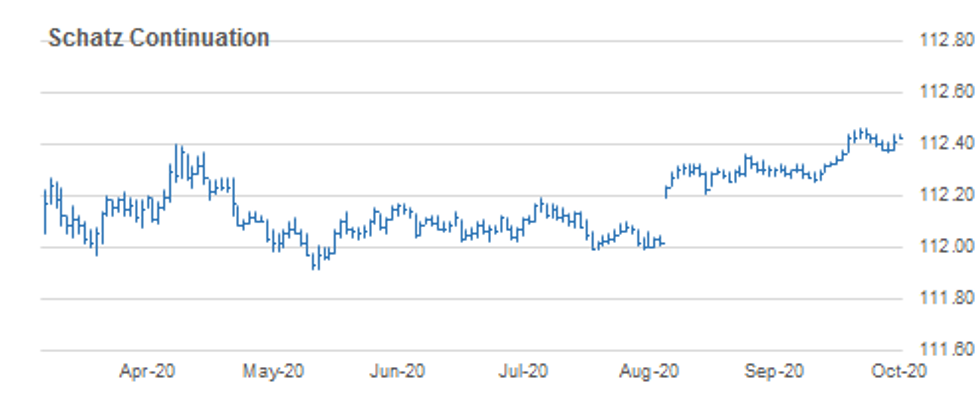

SCHATZ TECHS: (Z0) Approaching First Resistance

- RES 4: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.460 High Oct 19 / 20 and the bull trigger

- RES 1: 112.440 High Oct 21 / 22

- PRICE: 112.430 @ 05:13 GMT Oct 28

- SUP 1: 112.365 Low Oct 26 and key near-term support

- SUP 2: 112.360 High Sep 21 and the recent breakout level

- SUP 3: 112.340 Low Oct 14

- SUP 4: 112.328 50-day EMA

Schatz futures are still trading below last week's high. The contract however has found support at 112.365, Monday's low and while this level remains intact, early signs are that the recent correction lower may be over. Initial resistance is at 112.440, Oct 21 and 22 high. A breach of this hurdle would expose the bull trigger at 112.460, Oct 19 / 20 high. Weakness below 112.365 however would resume the corrective pullback.

GILT TECHS: (Z0) Strong Candle Highlights Shift In Sentiment

- RES 4: 136.97 High Oct 16 and the bull trigger

- RES 3: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 2: 136.27 High Oct 21 and a gap low on the daily chart

- RES 1: 136.06 High Oct 27

- PRICE: 135.94 @ Close Oct 27

- SUP 1: 135.34 Low Oct 27

- SUP 2: 135.04 Low Oct 23 and the near-term bear trigger

- SUP 3: 134.59 Low Sep 1

- SUP 4: 134.32 Low Aug 28 and a key support

Strong gains yesterday in Gilt futures provide early evidence the recent sell-off may have found a base. The climb has extended the recovery off 135.04, Oct 23 low and a key short-term support. The strong bullish candle yesterday suggests sentiment has improved and, if correct signals scope for a climb towards 136.27 next, the Oct 21 high and a gap low on the daily chart. On the downside, sub 135.04 level would resume the downtrend.

BTPS TECHS: (Z0) Corrective Cycle

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 150.12 Oct 26 high

- PRICE: 149.66 @ Close Oct 27

- SUP 1: 149.11 Low Oct 27

- SUP 2: 148.37 Low Oct 22 and key near-term support

- SUP 3: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 4: 147.46 Low Sep 30 and 50-day EMA

BTPS outlook remains bullish however futures are currently in a corrective cycle with price still trading below recent highs. Wednesday's gap higher at the open failed to deliver a bullish extension and price traded lower to fill the gap. Key S/T support has been defined at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement level. Key resistance and the bull trigger is at 150.46.

EUROSTOXX50 TECHS: Arrives At Bear Channel Base

- RES 4: 3282.55 High Oct 19

- RES 3: 3231.80 50-day EMA

- RES 2: 3217.96 High Oct 23 and the near term key resistance

- RES 1: 3135.48 Low Oct 22

- PRICE: 3070.60 @ Close Oct 27

- SUP 1: 3064.10 Bear channel base drawn off the Jul 21 high

- SUP 2: 3054.11 Low June 15

- SUP 3: 3012.50 38.2% retracement of the Mar - Jul uptrend

- SUP 4: 3002.66 Low May 27

A bearish EUROSTOXX 50 session yesterday saw the index extend the recent sell-off. Importantly for bears, price has cleared key support at 3097.67, Sep 25 low. This confirms a resumption of the downtrend that started Jul 21. Note, price has arrived at the base of a bear channel drawn off the Jul 21 high. The base intersects at 3064.10. This is a key support that if breached would reinforce bearish conditions. Key resistance is at 3217.96.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.