-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: E-Minis Away From Wednesday Lows, ECB Eyed

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* US ALLOWS SALES OF CHIPS TO HUAWEI'S NON-5G BUSINESSES (FT)

* REGENERON COVID-19 THERAPY REDUCES VIRAL LOAD, NEED FOR CARE (BBG)

* ELI LILLY STUDY SHOWS TREATMENT MAY BE EFFECTIVE AGAINST COVID-19 (RTT)

* ADVISERS: BIDEN, IF ELECTED, WOULD CONSULT ALLIES ON FUTURE OF U.S. TARIFFS ON CHINA (RTRS)

* PELOSI SAYS DETAILS OF CORONAVIRUS PACKAGE COULD CHANGE AFTER ELECTION (DJ)

* BOJ SEES BIGGER CONTRACTION THIS YEAR WHILE HOLDING POLICY (BBG)

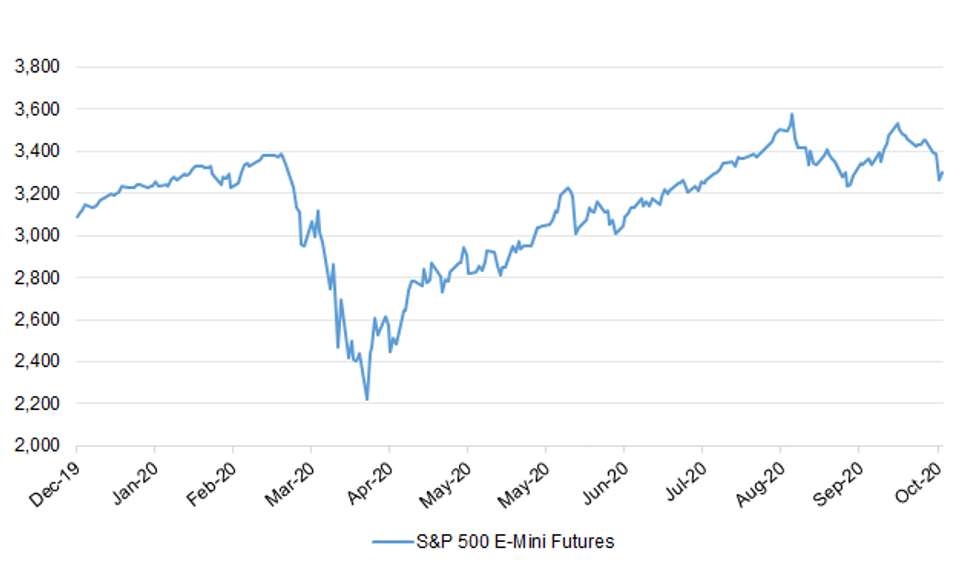

Fig. 1: S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain's death toll from the second coronavirus wave could reach 85,000 – almost double the total so far – according to leaked documents from the Scientific Advisory Group for Emergencies (Sage). The "reasonable worst case scenario" suggests the number of fatalities could remain high for at least three months, continuing long after Christmas and even into March. The modelling, leaked to The Spectator, comes as the UK's total deaths rose by a further 310, bringing the toll to 45,365. It comes amid suggestions that the whole of England could be placed under Tier 3 Covid restrictions by Christmas if infections continue to rise. The modelling, drawn up in late July, outlines a situation in which deaths remain above 500 a day for at least three months, peaking at 800 a day. During the first wave, deaths remained at over 500 a day for five weeks, peaking at 1,100 a day. (Telegraph)

CORONAVIRUS: Bristol has entered "Tier 1 plus" of coronavirus lockdown measures, according to the city's mayor. Marvin Rees said Bristol would be taking a series of further actions amid "rising" rates of COVID-19 infections, although the government dismissed his introduction of a "plus" system to the three existing tiers of localised restrictions. The city is currently in Tier 1 of the government's three-tiered system, otherwise known as the "medium" alert level. (Sky)

CORONAVIRUS: Ministers are scrambling to hire consultants who can offer emergency help to their central Covid-19 Task Force amid fears Whitehall will be overwhelmed by a winter coronavirus surge, according to documents seen by The Telegraph. The Cabinet Office has issued a request for consultants to help it respond "rapidly to any worsening Covid crisis" until at least March 2021. It came as sources said that NHS Test and Trace is separately being forced to hire extra contractors because of claims that civil servants refuse to work on the project. (Telegraph)

CORONAVIRUS: Up to 10% of England's population could be tested for coronavirus every week after government officials asked local health chiefs to deploy 30-minute saliva kits in an acceleration of Boris Johnson's controversial "Operation Moonshot" mass screening plan. In a letter seen by the Guardian, NHS test and trace claims it is embarking on an "important new front in our fight against coronavirus" and asks all directors of public health to sign up to receive rapid-result test kits for up to a tenth of their populations every week, to contain outbreaks and preserve freedoms. (Guardian)

ECONOMY: British employers planned making redundancies at close to a record level in September, as the second wave of coronavirus took its toll on jobs. Some 1,734 employers notified the government of plans to cut 20 or more posts, close to the peak levels seen in June and July. Those were the highest levels seen since 2006, the earliest date for which figures have been published. The data was released to the BBC after a Freedom of Information request. (BBC)

ECONOMY: The number of companies in significant financial distress has risen at the fastest rate for three years as businesses face increasing difficulties given the end of many government Covid-19 business support schemes. More than half a million companies were in "significant distress" in the three months to September, based on data from court orders to pay off debts, according to corporate restructuring firm Begbies Traynor. This was an increase of about 6 per cent compared to the previous three months. (FT)

HOUSING: "Severe delays" and a "large backlog" in home sales may result in people missing out on the stamp duty holiday, housing experts have told Sky News. The sector is under pressure as 140,000 more people than last year are waiting to complete the process of buying a property, according to Zoopla. It reports that 418,000 sales across the UK - worth a total of £112bn - are in the pipeline but are yet to be completed. (Sky)

EUROPE

ECB: MNI ECB Preview - October 2020: Ahead of Events, Or At Their Mercy?

- In the absence of fresh macroeconomic forecasts (which will be published in December alongside the new 2023 projections), heightened uncertainty over the economic path, and with a substantial amount of capacity remaining in the expanded PEPP envelope, the ECB is unlikely to materially adjust the monetary policy stance at the October meeting. The market largely expects this week's Governing Council meeting to be an opportunity to take stock of recent economic developments and to pave the way for a fresh round of easing in December.

ECB: "The Governing Council had no objection to the proposed candidate, Frank Elderson, who is a person of recognized standing and professional experience in monetary or banking matters," ECB says in a statement. (BBG)

GERMANY: Chancellor Angela Merkel will impose the toughest restrictions on Germany since a national lockdown in the spring, closing bars and restaurants in Europe's largest economy to regain control of the rapid spread of the coronavirus. The one-month partial shutdown, which will go into effect on Monday, is designed to keep most businesses operating, Merkel said Wednesday after tense talks with the leaders of the country's 16 states. Officials will gather again in two weeks to assess the impact of the measures. (BBG)

FRANCE: French President Emmanuel Macron imposed strict new curbs for the next month, closing bars, restaurants, non-essential retailers and other activities starting Friday. "The virus is circulating in France at a speed that even the most pessimistic forecast didn't foresee," Macron said in an address televised nationally on Wednesday evening. "The measures we've taken have turned out to be insufficient to counter a wave that's affecting all Europe." (BBG)

ITALY: Italy's new coronavirus cases jumped 14% Wednesday to a record 24,991 as hospitalizations climbed to the highest since early May. There were 205 fatalities linked to Covid-19, while hospitalized patients rose by 1,151 to 16,517. Almost a record 200,000 daily tests were carried out. Italy introduced Oct. 24 its strongest virus restrictions since the end of a national lockdown in May. With new infections at record levels, the government has set limits on opening hours for bars and restaurants, and shut down entertainment and gambling venues as well as gyms and swimming pools. (BBG)

SPAIN: Spain said 9,303 new coronavirus cases were detected over the past day, the highest number registered during the course of the pandemic. The number of deaths in the past seven days rose to 761, compared with 746 reported yesterday, the Spanish health ministry said on its website. (BBG)

PORTUGAL: Portugal's parliament approved by a wafer-thin margin the minority Socialist government's draft 2021 budget on its first reading on Wednesday, paving the way for a steep increase in public investment to reboot the coronavirus-battered economy. The bill was approved by 108-105 votes with 17 abstentions which notably included the Communist Party, allies of the Socialist government in the previous legislature in 2015-2019. Prime Minister Antonio Costa criticised the Left Bloc - another former ally - for joining forces with the conservative opposition, leaving only the Socialist bench voting 'yes'. (RTRS)

GREECE: Greece reported 1,547 new coronavirus cases Wednesday, the highest daily increase since the beginning of the pandemic and a second straight record day bringing the total to 34,229. The country recorded 10 more deaths from the virus in the past 24 hours, with the total number of dead now at 603. The country introduced new measures on Saturday to control the spread of the virus, including a night-time curfew, in high risk areas such as the capital Athens and the second-largest city, Thessaloniki.

SWITZERLAND: Switzerland has imposed new restrictions on public and social life following a sharp rise in coronavirus infection rates. Bars and restaurants must now close by 11 pm, while events with more than 50 people are banned. Sports and cultural activities involving more than 15 people are also prohibited. The measures will apply from Thursday and an end date has not yet been set, the Swiss Federal Council announced in Bern. (DPA)

U.S.

FED: The U.S. economy faces "slow going" with no additional fiscal support likely for several months, said former New York Fed President William Dudley. "The outlook for the economy is deteriorating," Dudley said Wednesday in an interview on Bloomberg Television with Joe Weisenthal, Romaine Bostic and Caroline Hyde. "The most likely scenario is that we continue to have a recovery with some downside risk of a double dip" recession amid worsening levels of coronavirus infections.

FISCAL: House Speaker Nancy Pelosi said Wednesday the coronavirus relief plan she has been discussing with the White House could morph in the lame-duck session of Congress, absent any formal agreement on its details and shifting incentives for both parties after the election. "There's very little that we have a commitment from them on. We have, shall we say, narrowed our differences," the California Democrat said in an interview. The speaker last spoke with Treasury Secretary Steven Mnuchin on Monday. The two have been discussing a roughly $2 trillion package but have yet to finalize details, and both sides have acknowledged there is no time to pass legislation before election Tuesday. (Dow Jones)

FISCAL: With no new federal coronavirus aid package expected until after the election—if one comes at all—House Speaker Nancy Pelosi (D-Calif.) Wednesday suggested that the stock market's three-day plunge might encourage President Trump and the White House to return to the negotiating table to hash out a deal with Democrats after November 3, even if Trump is not reelected next week. (Forbes)

CORONAVIRUS: The US reported its third-biggest one-day jump in coronavirus cases, and more than 1,000 deaths, on Wednesday. Adding to the worrying figures, a record number of states now have higher levels of patients hospitalised with coronavirus compared than four weeks ago A further 78,661 people tested positive, according to Covid Tracking Project data, up from 73,096 on Tuesday and compared with 60,712 on Wednesday last week. (FT)

CORONAVIRUS: White House coronavirus advisor Dr. Anthony Fauci told CNBC in an interview Wednesday that the United States is "going in the wrong direction" as coronavirus cases rise in 47 states and infected patients overwhelm hospitals across the country. "If things do not change, if they continue on the course we're on, there's gonna be a whole lot of pain in this country with regard to additional cases and hospitalizations, and deaths," the White House coronavirus taskforce member said in an interview Wednesday evening on "The News with Shepard Smith." (CNBC)

POLITICS: With the race for the presidency approaching its end amid a raging pandemic, Democratic nominee Joe Biden maintains a substantial lead over President Donald Trump nationwide, according to a new CNN Poll conducted by SSRS. Among likely voters, 54% back Biden and 42% Trump. Biden has held a lead in every CNN poll on the matchup since 2019, and he has held a statistically significant advantage in every high-quality national poll since the spring. Although the election will ultimately be decided by the statewide results, which drive the Electoral College, Biden's lead nationally is wider than any presidential candidate has held in more than two decades in the final days of the campaign. (CNN)

POLITICS: President Donald Trump has pulled into a virtual tie with Democratic challenger Joe Biden in Florida, just a week after the former vice president held a narrow lead there, a Reuters/Ipsos opinion poll showed on Wednesday. With less than a week to go before next Tuesday's election, a second Reuters/Ipsos poll showed that the two candidates remain neck and neck in Arizona. (RTRS)

POLITICS: With less than a week to go before Election Day, Joseph R. Biden Jr. is maintaining his steady lead over President Trump in Michigan and Wisconsin, according to new polls of the key battleground states released on Wednesday. (New York Times)

POLITICS: Joe Biden leads Donald Trump, 48% to 43%, in Marquette Poll's final pre-election survey of Wisconsin voters. Other polls may show Democrat Joe Biden advancing steadily in Wisconsin and opening up a wider lead against President Donald Trump. But for six months now, the Marquette University Law School Poll has barely budged. (Milwaukee Sentinel Journal)

POLITICS: The Supreme Court voted 5-3 on Wednesday to deny a bid from Pennsylvania Republicans to expedite their request to shorten the deadline for receiving mail-in ballots. Newly-confirmed Justice Amy Coney Barrett did not participate in the decision. A lower court ruling allowing ballots to be counted until 5 p.m. on Nov. 6, as long as they are postmarked by Election Day, will remain in place for now. (Axios)

POLITICS: The U.S. Supreme Court left intact a six-day extension for absentee ballots to be received in North Carolina, rejecting Republican calls to block changes imposed by a Democratic-controlled state elections board. The vote was 5-3, with Justices Clarence Thomas, Neil Gorsuch and Samuel Alito saying they would have blocked the extension. (BBG)

SOCIETY: President Trump on Wednesday condemned the mass unrest roiling Philadelphia following the fatal police shooting of a knife-wielding black man and blasted local officials for letting the violence spill across two nights. (New York Post)

EQUITIES: Boeing Co. is almost doubling its planned job cuts as the coronavirus pandemic and prolonged grounding of the 737 Max jet dim prospects for a financial recovery next year. (BBG)

EQUITIES: FCC Commissioner Brendan Carr told "Cavuto Coast to Coast" on Wednesday that Facebook, Twitter and other social media platforms "act like a publisher every single day" and that their "publisher conduct falls outside the protections" of Section 230 of the 1996 Communications Decency Act. "When they run these fact checks, when Twitter has their trending news section, these are publisher activities that Twitter is engaging in," Carr said. "And I think as we reform 230, we should be very clear about that because that publisher conduct falls outside the protections of 230." (Fox)

EQUITIES: Google is planning an aggressive campaign targeted against French commissioner Thierry Breton and other regulators in Brussels over their plans to introduce new laws to curb the power of big tech, according to a leaked internal document. The report, written in response to the EU's plan to introduce a sweeping new Digital Services Act, laid out a two-month strategy intended to remove "unreasonable constraints" to Google's business model and "reset the political narrative" around the proposed legislation. (FT)

OTHER

GLOBAL TRADE: The US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business, people briefed by Washington said, in a potential lifeline for the Chinese group. Analysts believe this could mean that tough US sanctions this year against China's leading technology group could be less threatening to its overall business than previously thought. While the sanctions would still pose a grave challenge to Huawei's 5G business, the company's important smartphone arm might have a chance to recover. (FT)

GLOBAL TRADE: The World Trade Organization's effort to select a leader and chart a new course for the global trading system hit a roadblock Wednesday after the Trump administration vetoed a bid by front-runner Ngozi Okonjo- Iweala, who is a U.S. citizen, to be the WTO's next director-general. Deputy U.S. Trade Representative Dennis Shea said Washington won't join a consensus to appoint Okonjo-Iweala because the U.S. supports her opponent, South Korean Trade Minister Yoo Myung-hee, according to WTO spokesman Keith Rockwell. (BBG)

GLOBAL TRADE: European Union negotiators agreed to reinforce the bloc's trade-sanctions powers in response to the U.S. challenge to the global commercial order. Representatives of EU governments and the European Parliament reached a deal on Wednesday in Brussels to upgrade the bloc's legislation on applying international trade rules. (BBG)

GLOBAL TRADE: Britain will on Thursday chide the "pernicious" trade practices of the United States and Europe, even as it tries to pin down deals with the its most important allies in a post-Brexit drive to reinvent itself as a free trading nation. (RTRS)

U.S./CHINA: Democrat Joe Biden would immediately consult with America's main allies before deciding on the future of U.S. tariffs on China, seeking "collective leverage" to strengthen his hand against Beijing if he is elected president, Biden top advisers said on Wednesday. (RTRS)

GEOPOLITICS: The European Union will allow non-members such as Britain and the United States to take part in future joint EU defence projects, but only on an exceptional basis, three EU diplomats said on Wednesday. (RTRS)

CORONAVIRUS: Regeneron Pharmaceuticals Inc. said data from a late-stage clinical trial suggest that its antibody cocktail therapy for Covid-19 significantly reduces virus levels and the need for further medical care. Patients getting the therapy were 57% less likely to need medical care within a month of treatment, with 2.8% of those given the antibody and 6.5% of those on placebo seeing a health-care worker within 29 days. "We continue to see the strongest effects in patients who are most at risk for poor outcomes due to high viral load," said Chief Scientific Officer George Yancopoloulos. (BBG)

CORONAVIRUS: Data from an ongoing phase 2 study assessing the efficacy and safety of Eli Lilly and Company's (LLY) bamlanivimab in the COVID-19 outpatient setting shows that the treatment may be effective in treating the deadly virus. The study focused on ambulatory COVID-19 patients being treated in the outpatient setting, whose symptoms did not require hospitalization at the time of enrollment. (RTT)

CORONAVIRUS: The government believes that a German vaccine backed by Pfizer could be ready to distribute before Christmas, with the first doses earmarked for the elderly and vulnerable. Albert Bourla, the chief executive of Pfizer, said that the vaccine was in the "last mile" and that the pharmaceutical company expected results within a matter of weeks. Britain has already bought enough doses for 20 million people and is anticipating that some will be available for use immediately if the drug is shown to be successful. Senior government sources expect that a verdict on whether it works will be available before Oxford's competing vaccine, which may not provide results until after Christmas. (The Times)

CORONAVIRUS: A vaccine to help control the coronavirus outbreak isn't likely to be available in the U.S. until January, if then, according to Anthony Fauci, the nation's top infectious-disease doctor. (BBG)

BOJ: The Bank of Japan stood pat on policy but trimmed its economic forecast for the current year as rising waves of the coronavirus abroad cloud the recovery outlook and spark renewed nerves in markets. The BOJ kept its key interest rates and asset purchases unchanged, according to a statement from the central bank Thursday. All but one of 43 surveyed economists forecast the result. The bank cut its growth forecast for the year ending in March to a 5.5% contraction from a 4.7% drop, citing a delayed recovery in the services sector. It raised its growth projection for the following year to 3.6%. Amid renewed concern over the trajectory of the pandemic, it said the outlook for the economy was extremely unclear. (BBG)

NEW ZEALAND: Statistics New Zealand reports experimental weekly series based on payday filing to the Inland Revenue, on website. Paid job numbers rise 510 in week ended Sept 20 to 2,197,520. Numbers rise 2,370 in four weeks ended Sept 20 after gaining 3,310 in four weeks ended Aug 23. (BBG)

ASIA: A planned air travel bubble between Singapore and Hong Kong may begin in November, the Business Times reports, citing comments from Singapore Transport Minister Ong Ye Kung. Ong said discussions have been going well and that he shared the "assessment" of Hong Kong chief executive Carrie Lam about the arrangement, according to the report. (BBG)

BOK: The Bank of Korea (BOK) said Thursday it will again extend a special loan scheme for financial institutions by three months to help them stem a possible funding squeeze amid the coronavirus pandemic. The central bank said its decision-making monetary policy board decided to extend the special loan facility, originally set to expire on Nov. 3, until Feb. 3. (Yonhap)

TAIWAN: A F-5E fighter jet went missing during a training mission off the coast of Taitung County in eastern Taiwan Thursday morning, the military said. A search effort is currently underway, the military added. (Focus Taiwan)

CANADA: MNI POLICY: Canada to Restore Fiscal Anchor as Economy Firms- Canadian Finance Minister Chrystia Freeland said Wednesday she intends to restore a fiscal "anchor" as the economy recovers, but for now she will press ahead with record deficits that save money in the long term by boosting employment and growth. Freeland declined to say when fiscal goals that earlier included deficits in dollar terms or a share of GDP will be restored during her speech. Rock-bottom interest rates and a low debt burden before Covid-19 make the red ink affordable, and the government has a moral obligation to get people back to work, she said.

TURKEY: Turkey summoned the French charge d'affaires on Wednesday over caricatures published in Charlie Hebdo satirical magazine, a statement by Turkish foreign ministry said. The cartoon on the cover of Charlie Hebdo showed Erdogan sitting in a white T-shirt and underpants, holding a canned drink along with a woman wearing an Islamic hijab. Turkish officials described it as a "disgusting effort". (RTRS)

BRAZIL: Brazil's central bank left its benchmark interest rate unchanged on Wednesday at a record low level even as inflation has rebounded in recent months, and signaled it intends to leave the rate low for some time. The bank's policy committee left its Selic rate at 2% for the second meeting in a row, after cuts at the nine previous meetings. The bank maintained its forward guidance that there is little, if any, room for more cuts and that it won't reduce monetary stimulus unless the outlook for inflation gets worse. (WSJ)

SOUTH AFRICA: South Africa's National Treasury has defended a controversial 10.5 billion rand ($641 million) lifeline for its bankrupt national airline, saying that setting it on the path to recovery will entice private shareholders. "Government is not going to want to hold on to South African Airways at all costs," Treasury Director-General Dondo Mogajane said in an interview after the bailout was announced on Wednesday. "If that means giving up the majority shareholding, that will happen." While the airline hasn't made a profit for almost a decade and has long relied on state support to fly planes, administrators appointed late last year have a produced a viable rescue plan, Mogajane said. If it can be implemented, as many as five potential strategic-equity partners are waiting in the wings, he said, without naming them. (BBG)

SOUTH AFRICA: Eskom announced on Wednesday evening that they will once again have to implement periods of load reduction to various areas in several provinces on Thursday 29 October in order to prevent their infrastructure becoming overloaded. (The South African)

G20: Finance ministers and central bankers from the world's largest economies plan to hold an extraordinary meeting on Nov. 13 to discuss bolder action to help poor nations struggling to repay their debts. The Group of 20 ministers plan to meet a week prior to the annual gathering of heads of government on Nov. 21-22, according to a copy of the meeting's agenda seen by Bloomberg. (BBG)

EQUITIES: Tiffany's board has agreed to a slightly lower price to greenlight the sale of the US jeweller to LVMH, according to people briefed about the matter, ending a bitter conflict triggered by the Covid-19 pandemic that threatened to derail the luxury sector's biggest-ever acquisition. The French luxury group behind brands such as Louis Vuitton and Christian Dior would pay $131.50 a share for the US jeweller, down from the original price of $135, valuing the equity at about $15.8bn, the people said. In addition, Tiffany would pay its shareholders a dividend of $0.58 a share, they added. (FT)

EQUITIES: Samsung Electronics on Thursday said it expects a decline in profit in the three months that will end on Dec. 31 due to weak memory chip demand and intense competition in the smartphone and consumer electronics. The world's top smartphone maker announced a 59% year-on-year jump in operating profit to 12.35 trillion Korean won (about $10.89 billion) for the July-September quarter, which was in line with earlier guidance. Samsung said it was partly due to a boost in demand for smartphones and consumer electronics — sale of smartphones, including new flagship models like the Galaxy Note20, saw a near 50% jump in sales. (CNBC)

OIL: Personnel have been evacuated from 228 production platforms and three non-DP rigs in the Gulf of Mexico due to Hurricane Zeta, according to the Bureau of Environmental Enforcement (BSEE). Six DP rigs have moved off location. From 42 operator reports, BSEE estimates that about 66.6% of the current oil production and 44.5% of the natural gas production in the Gulf of Mexico have been shut-in. (Offshore Magazine)

CHINA

CORONAVIRUS: Chinese health authorities reported 23 new coronavirus cases in Xinjiang as a cluster in the heavily surveilled western region of the country grew. Authorities rolled out testing for almost 5m people in Kashgar prefecture after a woman recorded a positive coronavirus result over the weekend. (FT)

YUAN: The yuan is set for a strong trend with two-way fluctuations after regulators removed so-called countercyclical factors, the Chinese Securities Journal said in an editorial. The removal reflects the intention for a market-based approach allowing the flexibility of yuan exchange rates and monetary policy autonomy, the Journal said. The drop in depreciation risk will promote inbound capital and the opening up of the financial sector, and the neutral approach of multiple macroprudential policy tools will support outbound capital and the acquisition of overseas assets. A steady yuan exchange rate and high interest spreads between China and other economies will promote the acceptability and internationalization of the currency, the Journal wrote. (MNI)

ECONOMY: China can maintain 6%-8% yearly growth until 2030 while contributing around a third of global growth through pursuing the dual circulation model, the Securities Journal reported citing Lin Yifu, an economist and a former senior vice president of the World Bank. The service sector will increasingly support China's economy as the role of exports wanes, Lin told the Journal. China's advantage in traditional industries, advancement in AI, cloud computing, and 5G, and its large market will help expand its world leadership, Lin said. (MNI)

BONDS: China is likely to reduce the issuance quotas for local government special bonds next year given the accelerating recovery and rising pressure for local debt repayments, the China Securities Journal reported citing analysts. Around 95% of the quotas for the CNY3.75 trillion infrastructure project special bonds have been used this year while some infrastructure projects have failed to take off, delaying the use of funds, the newspaper said citing Pan Helin, a professor at Zhongnan University of Economics and Law. The government is unlikely to ramp up infrastructure investments next year as consumption and manufacturing investments recover, the newspaper said citing analysts. (MNI)

OVERNIGHT DATA

JAPAN SEP RETAIL SALES -8.7% Y/Y; MEDIAN -7.6%; AUG -1.9%

JAPAN SEP RETAIL SALES -0.1% M/M; MEDIAN +1.0%; AUG +4.6%

JAPAN SEP DEPT STORE, SUPERMARKET SALES -13.9% Y/Y; MEDIAN -11.6%; AUG -3.2%

JAPAN OCT CONSUMER CONFIDENCE 33.6; MEDIAN 35.0; SEP 32.7

AUSTRALIA Q3 NAB BUSINESS CONFIDENCE -10; Q2 -15

Business conditions rose sharply in Q3, up 22pts to -4 index points. This follows the large deterioration in Q2 across most survey variables. The trading and profitability indexes saw the largest recovery, though the employment index also saw a large turnaround. However, it remains deeply negative and well below pre-COVID levels, suggesting that while there had been some improvement in activity in the quarter as the economy opened up, the impact on the labour market will lag. Conditions were most favourable in retail, while construction and recreational & personal services are weakest. Overall, conditions remain negative in 6 out of 8 industries. Confidence rose 5pts to -10 index points. Confidence improved in all industries except retail and recreation & personal services. Nonetheless, it remains negative in all industries. (NAB)

AUSTRALIA Q3 EXPORT PRICE INDEX -5.1% Q/Q; MEDIAN -3.5%; Q2 -2.4%

AUSTRALIA Q3 IMPORT PRICE INDEX -3.5% Q/Q; MEDIAN -2.0%; Q2 -1.9%

NEW ZEALAND OCT, F ANZ BUSINESS CONFIDENCE -15.7; FLASH -14.5

NEW ZEALAND OCT, F ANZ ACTIVITY OUTLOOK 4.7; FLASH 3.6

The full-month October ANZ Business Outlook survey was little changed from the preliminary figures, with both own activity expectations and headline business confidence showing a solid increase versus September (figure 1). The main event that happened between the preliminary read and this release was the New Zealand General Election. Inflation expectations remain stubbornly low at 1.38%, the same as September, despite ongoing lifts in both pricing intentions and cost expectations. This will be of concern to the Reserve Bank. (ANZ)

SOUTH KOREA NOV BUSINESS SURVEY M'FING 76; OCT 68

SOUTH KOREA NOV BUSINESS SURVEY NON-M'FING 69; OCT 62

CHINA MARKETS

PBOC NET INJECTS CNY90BN VIA OMOS

The People's Bank of China (PBOC) injected CNY140 billion via 7-day reverse repos with the rate unchanged on Thursday. This resulted in a net injection of CNY90 billion after the maturity of CNY50 billion of reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2785% at 09:32 am local time from the close of 2.5312% on Wednesday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 39 on Wednesday vs 48 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

MARKETS

SNAPSHOT: E-Minis Away From Wednesday Lows, ECB Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 64.46 points at 23353.86

- ASX 200 down 97.438 points at 5960.3

- Shanghai Comp. up 1.236 points at 3270.164

- JGB 10-Yr future down 7 ticks at 152.03, yield up 0.5bp at 0.030%

- Aussie 10-Yr future down 2.5 ticks at 99.185, yield up 2.6bp at 0.809%

- U.S. 10-Yr future -0-01 at 138-24+, yield up 1.34bp at 0.784%

- WTI crude up $0.08 at $37.47, Gold up $5.71 at $1882.86

- USD/JPY up 8 pips at Y104.40

- U.S. ALLOWS SALES OF CHIPS TO HUAWEI'S NON-5G BUSINESSES (FT)

- REGENERON COVID-19 THERAPY REDUCES VIRAL LOAD, NEED FOR CARE (BBG)

- ELI LILLY STUDY SHOWS TREATMENT MAY BE EFFECTIVE AGAINST COVID-19 (RTT)

- ADVISERS: BIDEN, IF ELECTED, WOULD CONSULT ALLIES ON FUTURE OF U.S. TARIFFS ON CHINA (RTRS)

- PELOSI SAYS DETAILS OF CORONAVIRUS PACKAGE COULD CHANGE AFTER ELECTION (DJ)

- BOJ SEES BIGGER CONTRACTION THIS YEAR WHILE HOLDING POLICY (BBG)

BOND SUMMARY: Core FI A Touch Softer As E-Minis Bounce In Asia

E-minis pushed away from their Wednesday's trough. While there has been nothing in the way of overt triggers during Asia-Pac hours, at least on the broader wires, some positive musings re: COVID-19 treatment matters (albeit, developments that seemingly do not shift the vaccine timetable) during the NY- Asia crossover and the aforementioned FT story re: "the US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business," are the probable drivers here. T-Notes -0-01+ at 138-24, off lows, operating in a 0-04+ range, with cash yields unchanged to 1.9bp cheaper across the curve, with bear steepening in play.

- JGB futures sit 7 ticks below settlement levels, giving back overnight gains and more as onshore participants played catch up to U.S. Tsy movements in NY and early Asia-Pac hours. The longer end was lightly bid in cash JGB trade, with 1-10 Year paper a little more mixed. Swaps generally widened at the margin. The BoJ offered no surprise, leaving its monetary policy settings unchanged at its latest decision, while stressing that economic risks are tilted to the downside.

- Aussie Bonds saw of note on the domestic front, with the curve steepening in Sydney hours on the back of the broader risk impulse (namely through U.S. Tsys and e-minis). YM unch., XM -4.0. Bills sit unchanged to -1 through the reds.

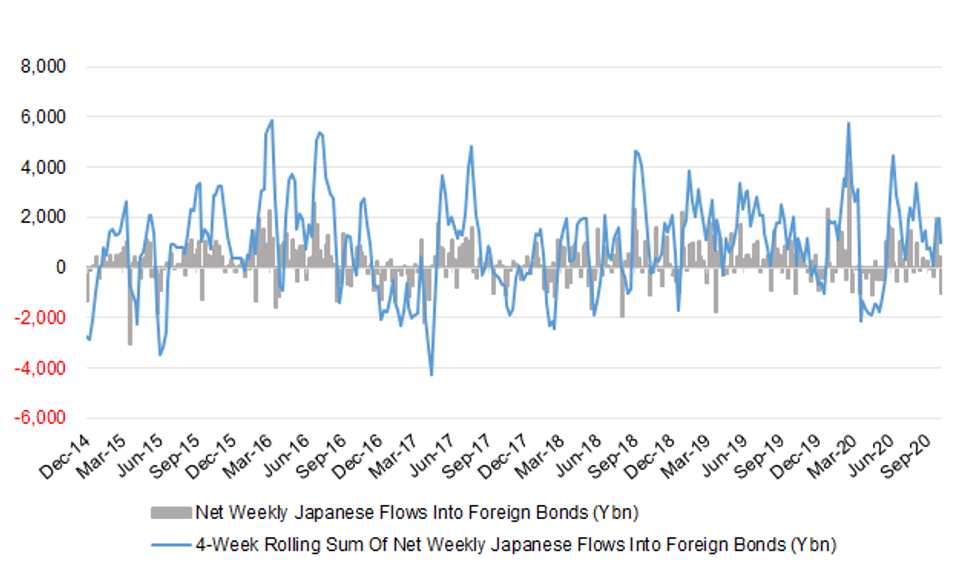

JAPAN: Weekly International Security Flows Point To Lifer Plans

MNI - Market News/Japanese Ministry of Finance

The most notable point in the latest round of weekly international security flow data out of Japan was the net sales of foreign bonds racked up by Japanese investors (Y1.0108tn), which could reflect what has been seen in some of the life insurer investment plans i.e. some interest in bringing bond exposure back onshore. This represented the largest round of weekly net sales of foreign bonds by Japanese investors since May.

- Elsewhere, the 4-week net rolling sum of foreign flows into Japanese bonds saw a notable jump, although that was a function of a chunky round of net weekly sales rolling out of the sample.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1010.8 | 422.3 | 1010.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -19.9 | -163.3 | 74.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 157.2 | 402.0 | 2247.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 228.4 | -93.9 | 2087.1 |

Source: Japanese Ministry of Finance

EQUITIES: E-Minis Bounce After Wednesday's Wall St. Wobble

Asia-Pac equities recovered from lows on Thursday, following the negative start on the back of the European COVID/DC fiscal impasse-driven slump that Wall St. experienced on Wednesday.

- The move came as e-minis pushed away from their Wednesday's trough. While there has been nothing in the way of overt triggers during Asia-Pac hours, at least on the broader wires, some positive musings re: COVID-19 treatment matters (albeit, developments that seemingly do not shift the vaccine timetable) during the NY- Asia crossover and the aforementioned FT story re: "the US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business," are the probable drivers here.

- The ASX 200 was the broader exception to the rule, with the heavyweight materials sector struggling.

- Nikkei 225 -0.4%, Hang Seng -0.9%, CSI 300 +0.5%, ASX 200 -1.6%.

- S&P 500 futures +36, DJIA futures +288, NASDAQ 100 futures +115.

OIL: Little Changed After Wednesday Plunge

WTI and Brent have moved back to near neutral levels after an early pop higher in Asia-Pac hours, which came alongside the uptick in e-minis that we have fleshed out elsewhere.

- This comes after the pressure in the equity space dragged crude lower on Wednesday, with the two major crude benchmarks shedding ~$2.00 come settlement time as the worsening European COVID backdrop and subsequent lockdowns create headwinds for crude demand.

- Elsewhere, the API and DoE weekly inventory readings provided alternate sources of pressure, with crude stocks seeing larger than expected builds in both datasets, despite some slightly more supportive developments on the product side.

- The latest daily BSEE estimate noted that ~66.6% of U.S. Gulf of Mexico production has been shut-in. This will provide some skew to the immediate weekly inventory data releases.

GOLD: Bears Looking For A Sustained Break

The yellow metal has hugged a tight range in Asia-Pac hours, last dealing little changed, just shy of $1,880/oz. This comes after the uptick in the USD and real yields pressured spot bullion through the October 7 low/key near-term support on Wednesday, although the move wasn't sustained on a closing basis. Bears will now look for convincing break below yesterday's low to open the way to the Sep 28 low and bear trigger at $1,848/oz.

FOREX: Taking Breather After Wednesday's Risk Retreat

Commodity FX outperformed in the G10 basket as risk appetite took a breather after yesterday's rout. The FX space watched e-minis move higher amid light news flow, with some noting an FT source story suggesting that "the U.S. is allowing a growing number of chip companies to supply Huawei with components". Major crosses generally swam with the mild, broader risk-on tide, with little in the way of violent price swings.

- JPY was the worst performer among G10 currencies, but EUR/JPY failed to re-test neckline of the double top pattern confirmed yesterday. The currency shrugged off the BoJ's decision not to touch policy levers this time, in line with expectations.

- USD/CNH went offered despite a softer than expected PBoC fix (CNY6.7260 vs. BBG est. of CNY6.7234). As a reminder, CPC Central Committee wraps up its four-day meeting today and should unveil the next five-year economic plan as well as a longer-term strategy through 2035.

- USD/KRW re-opened higher, as positive local news came with caveats, before trimming gains on the back of wider sentiment. The BoK's business confidence gauges improved, but remain considerably below the neutral 100 level, while Samsung's Q3 profit beat was accompanied by negative outlook for Q4.

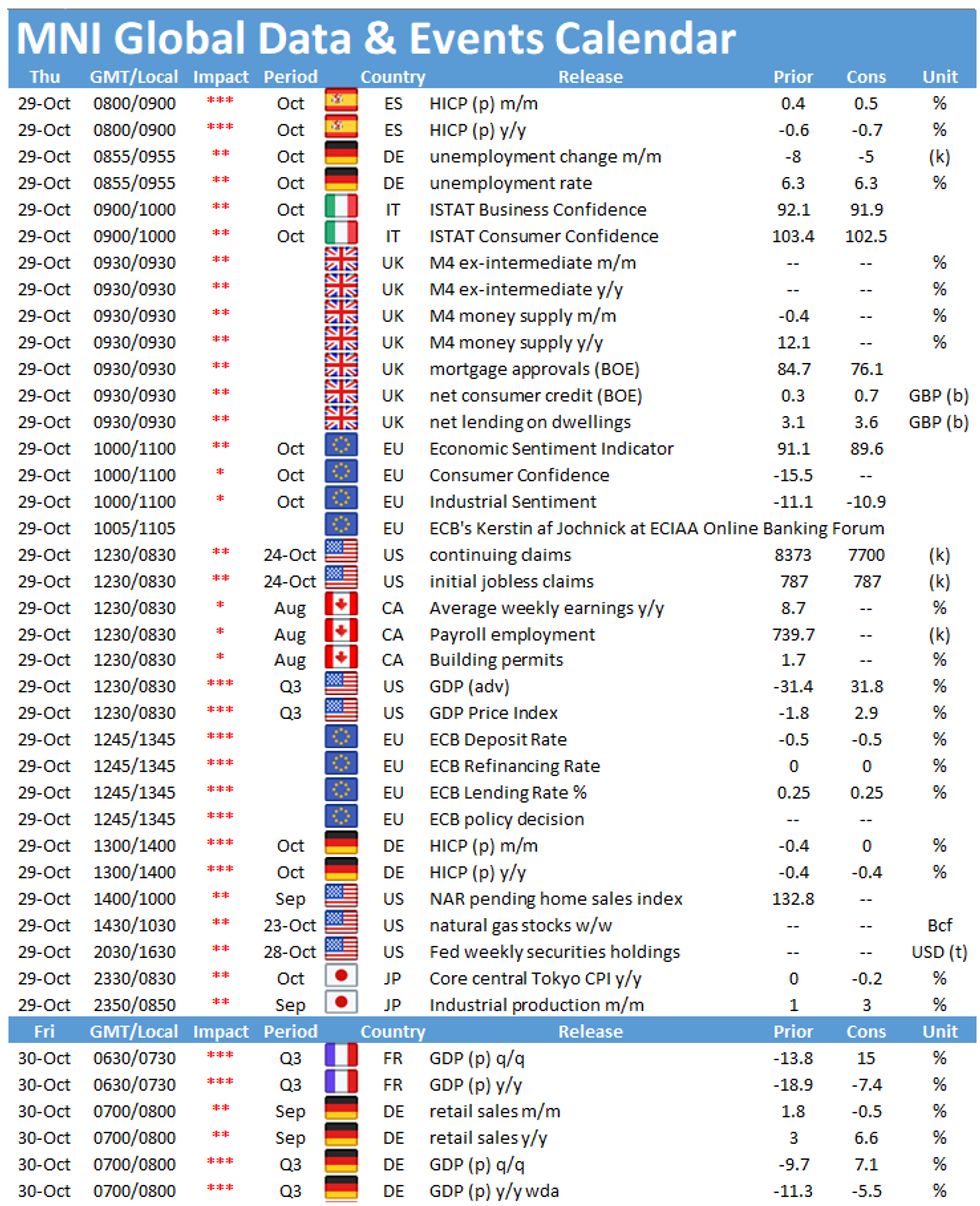

- Focus turns to ECB MonPol decision, U.S. initial jobless claims & advance GDP, German unemployment & flash CPI, EZ sentiment gauges & Canadian building permits. Central bank speaker slate includes ECB's Visco & Villeroy.

FOREX OPTIONS: Expiries for Oct29 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700(E785mln), $1.1720-25(E1.2bln), $1.1745-55(E1.6bln), $1.1765-70(E766mln), $1.1850-55(E634mln)

- USD/JPY: Y103.20-25($1.6bln-USD puts), Y103.60($1.0bln-USD puts), Y104.00($1.8bln-USD puts), Y104.75($523mln), Y105.15-16($654mln), Y105.25($1.3bln), Y105.55-65($2.4bln), Y106.00($1.2bln)

- GBP/USD: $1.2800(Gbp425mln)

- EUR/GBP: Gbp0.9050(E920mln), Gbp0.9110(E697mln)

- AUD/JPY: Y71.60(A$727mln-AUD calls), Y73.20(A$1.0bln-AUD puts), Y76.35-40(A$2.4bln-AUD calls)

- USD/CAD: C$1.3160-75($1.0bln), C$1.3325($530mln)

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.