-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Vaccines Give Glimmer Of Hope As World Continues Fight Against Covid

EXECUTIVE SUMMARY

- UK PM JOHNSON: COVID RULES "PROBABLY GOING TO GET TOUGHER" (BBC)

- UK PM JOHNSON COULD LOSE HIS SEAT AND MAJORITY AT NEXT ELECTION (RTRS)

- TRUMP PRESSURES GEORGIA SEC OF STATE TO OVERTURN HIS DEFEAT (Washington Post)

- FAUCI: VACCINATIONS ARE RAMPING UP IN A "GLIMMER OF HOPE" (AP)

- OPEC SECGEN: READY TO ADJUST OIL OUTPUT INCREASES (RTRS)

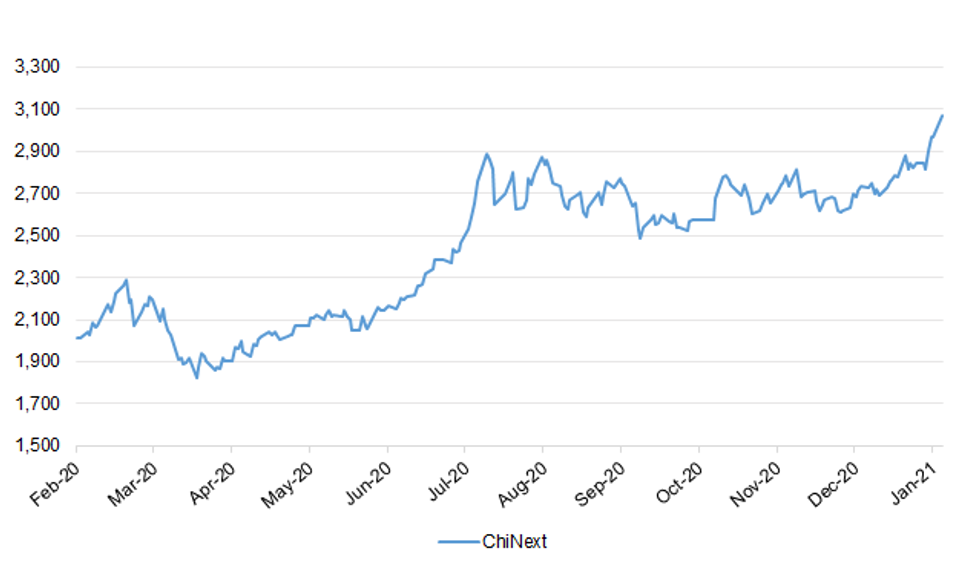

Fig. 1: ChiNext

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: British Prime Minister Boris Johnson is on course to lose his own seat and neither of the two main political parties is likely to win an outright majority at the next general election, not due until 2024, according to a new poll. This is the first detailed survey of the public's perception of Johnson's handling of the recently concluded Brexit talks and the COVID-19 pandemic after he reversed plans to allow families to meet up at Christmas in parts of southern England to combat the spread of the virus. More than 22,000 people were surveyed in a closely watched poll constituency-by-constituency poll over a four-week period in December, which was conducted by the research data company Focaldata and published by the Sunday Times. The so-called multilevel regression and post-stratification (MRP) poll found the ruling Conservatives would lose 81 seats, wiping out the 80-seat majority. This would leave the Conservatives with 284 seats, while the opposition Labour Party would win 282 seats, the poll showed. The Scottish National Party, which wants to break away from the rest of the United Kingdom, is predicted to win 57 of the 59 seats in Scotland, meaning the party could potentially play a kingmaker role in forming the next government. The prime minister is at risk to lose his own seat of Uxbridge, west of London, the poll found. (RTRS)

POLITICS: A 40-year gap should be left between constitutional referendums, Boris Johnson said yesterday as he again rejected demands for another vote on Scottish independence. The prime minister compared the wait between ballots on joining and leaving the European Union with the 2014 decision on Scotland's future. With polls showing the Scottish National Party on course for a majority in Scottish parliamentary elections in May as well as a sustained preference for independence, pressure is building to put the question to the vote again. (Times)

CORONAVIRUS: Regional restrictions in England are "probably about to get tougher" to curb rising Covid infections, the prime minister has warned. Boris Johnson told the BBC stronger measures may be required in parts of the country in the coming weeks. He said this included the possibility of keeping schools closed, although this is not "something we want to do". (BBC)

CORONAVIRUS: The Labour leader, Keir Starmer, has urged Boris Johnson to impose a new national lockdown in England within the next 24 hours to tackle the "out of control" virus. Speaking after the prime minister acknowledged that Covid-19 restrictions were "probably about to get tougher" Starmer said immediate action must be taken. "The virus is clearly out of control," he said on Sunday. "There's no good the prime minister hinting that further restrictions are coming into place in a week, or two or three. "That delay has been the source of so many problems. So, I say, bring in those restrictions now, national restrictions, within the next 24 hours. That has to be the first step to controlling the virus." (Guardian)

CORONAVIRUS: Boris Johnson has put the country on notice for a third national lockdown as it emerged that the Government is drawing up plans for the return of shielding. England could be back in lockdown by the middle of this month, Government sources suggested, prompting fears that it will be kept in a straitjacket until at least Easter. The Telegraph understands that discussions in Government about the return of shielding have already begun, and a further announcement on school closures could come as soon as this week. (Telegraph)

CORONAVIRUS: The UK has recorded more than 50,000 new coronavirus cases for the sixth day in a row - as the total number of COVID-19 deaths passed 75,000. Another 54,990 coronavirus infections and 454 deaths were recorded on Sunday, government figures show. (Sky)

CORONAVIRUS: Scotland will today enter another effective national lockdown, which is likely to last until spring, as the country's coronavirus rate spirals out of control. Nicola Sturgeon will make an emergency statement to parliament and it is expected that the reopening of schools will be pushed back beyond January 18. The government's education recovery group will convene at 9am before the cabinet meets to decide on additional measures to try to stem the virus. The possibility of shutting down construction and manufacturing is understood to be on the table as the country shifts closer towards the restrictions that were in place in April and May. (Times)

CORONAVIRUS: Two million doses of the Oxford vaccine are due to be supplied each week by the middle of this month as pressure builds on the government to speed up immunisations. Concerns are growing over the rate achieved so far and the NHS is having to cope with record numbers of hospital admissions driven by a new, more transmissible strain of the coronavirus. Matt Hancock, the health secretary, said on Wednesday that only 530,000 doses of the Oxford vaccine would be ready on Monday, despite original plans to have a stockpile of 30 million by the autumn. A key member of the Oxford-Astrazeneca team told The Times that they expected two million doses to be ready each week in just over a fortnight. (Times)

CORONAVIRUS: Head teachers have warned that GCSE and A-level exams cannot go ahead this summer after plans for reopening schools were thrown into chaos. Most primary schools in England are due to open tomorrow, followed by a phased start for secondary schools a week later with GCSE and A-level pupils returning first. However Boris Johnson hinted today that further school closures were on the cards as several local authorities called for the start of term to be further delayed. (Times)

CORONAVIRUS: Denmark extended its ban on travelers arriving from the U.K. and also advised Danes against visiting the country on business trips due to fears over the new mutation of the coronavirus. The ban on travelers from the U.K., which covers all non-Danish citizens or citizens without a Danish residence, will last until Jan. 17, the ministry of justice in Copenhagen said in a statement on Sunday. The foreign ministry said in a separate statement that it will discourage all travel to the U.K. starting Monday. (BBG)

CORONAVIRUS: The NHS has declined to make a commitment to delivering two million doses of Covid-19 vaccine a week, according to sources, on the eve of the roll-out of the Oxford/AstraZeneca jab on Monday. The health service said the supply of vaccines remained the "main barrier" to delivering tens of millions of doses despite manufacturers insisting that doses were being delivered to the timetable agreed with the Government. (Telegrah)

ECONOMY: The powerful caucus of northern Tory MPs has urged Rishi Sunak to set aside debt worries to pump billions into the levelling up drive amid fears regions could be further left behind after Covid. Jake Berry, chairman of the Northern Research Group , warned ministers they "must deliver" on promises to spread prosperity to the North despite Covid-19 sending public debt soaring. The former Northern Powerhouse minister said the North risks being "disproportionately" hit by the Covid economic crisis, with swathes of the region being under tough restrictions for months. "It's time for the Government to make, in truth, a political decision that they are going to invest in the life chances of people in these left behind communities across the North," he told The Telegraph . He said it was an "economic imperative" to ensure that London does not enjoy a stronger post-Covid recovery while left behind areas suffer a slower bounce back. "We expect this Government to invest in and back our economy so we can recover." (Telegraph)

EQUITIES: MGM Resorts International is seeking to buy British gaming company Entain PLC, according to people familiar with the matter, in the latest move by a casino operator to double down on the red-hot onlinegambling business. MGM recently made an offer to buy the owner of the British gambling brand Ladbrokes, which has a market value of about $9 billion, the people said. The offer, which would have a substantial stock component, comes after an earlier, roughly $10 billion all-cash overture was rebuffed. The new bid comes with financial backing from the MGM's largest shareholder, IAC/InterActiveCorp., the people said. The exact details and value of the new bid couldn't be learned, but it is above the GBP12.85 a share -- currently equivalent to $17.56 a share -- that MGM had offered late last year, the people said. There is no guarantee Entain will be receptive to the new offer or that there will be a deal. (WSJ)

EUROPE

ECB: Christine Lagarde is expected to make the European Central Bank a pioneer in fighting climate change by slashing its purchases of bonds issued by fossil fuel companies and other heavy carbon emitters, according to a Financial Times poll of economists. The ECB president has pledged to make tackling climate change a major part of the central bank's strategic review of its remit and tools, which is due to be completed by the second half of 2021. Two-thirds of the 33 economists polled by the FT believe the review will result in the ECB deciding to break with its long-held principle of "market neutrality", which requires it to buy bonds in proportion to the overall market. (FT)

EU: The soaring number of infections around the world means the race to vaccinate is set to dominate the coming year. Delays in getting the vaccines in Europe were not the fault of the European Union, said the bloc's health commissioner Stella Kyriakides. "The bottleneck at the moment is not the volume of orders but the worldwide shortage of production capacity," she said. The bloc would help drug companies in their efforts to expand production, she added. "The situation will improve step by step." (France24)

GERMANY: Germany is preparing to extend its nationwide lockdown until the end of January, as governments across Europe consider prolonging or strengthening restrictions to battle highly contagious mutations of coronavirus. "Premature easing would set us back very far again," Markus Söder, the premier of Bavaria and leader of the CSU, one of Germany's governing parties, said on Sunday, after the heads of the country's 16 states met virtually over the weekend. "The numbers are simply still far too high," he added. "As annoying as it is, we have to stay consistent and not give up too soon again." (FT)

GERMANY: The European Commission has bungled the process of procuring enough vaccine doses and approving them for use across the bloc, according to Markus Söder, the leader of Germany's Christian Social Union. "Obviously, the European purchasing procedure was inadequate," said Söder, who leads the state of Bavaria, in an interview with Bild am Sonntag. "It is difficult to explain that a very good vaccine is developed in Germany but is vaccinated more quickly elsewhere." His comments underscore the uproar over the perceived slow pace of the EU's own vaccine approval system, which meant the BioNTech/Pfizer dose developed in Germany had been in use outside the bloc for weeks before it was given the green light at home. "The European Commission has probably planned too bureaucratically: too few of the right ones have been ordered and price debates have gone on for too long," said Söder of the delays. (Politico)

GERMANY: The German government approved a total of €1.16 billion ($1.41 billion) in arms exports during 2020 to countries involved in both the Yemen and Libya conflicts, reported news agency dpa citing the country's Economy Ministry. Germany, by December 17, had signed off on permissions to export weapons and military equipment worth €752 million to Egypt. Permission was also granted to German arms companies for deals worth over €305.1 million to Qatar, over €51 million to the United Arab Emirates, €23.4 million for Kuwait and around €22.9 million to Turkey. Licenses were granted to Jordan totaling €1.7 million and Bahrain amounting to €1.5 million. (Deutsche Welle)

FRANCE: In France, the government on Saturday moved a nightly curfew in 15 departments in the east and south-east back from 8pm to 6pm. The incidence of coronavirus in those areas has been climbing more rapidly than elsewhere, prompting local leaders to call for a harsher lockdown. The government has also delayed the planned reopening of museums and cinemas, promised for January 7, while restaurants and bars nationally remain closed. Schools will reopen after Christmas holidays on Monday. French health ministry official Jérôme Salomon said on Sunday that the full impact of people seeing each other during the Christmas and New Year's holidays would not translate into new hospitalisations until next week, adding that the "situation was worrying", with daily infections already hovering close to 15,000 compared with 10,000 in early December. (FT)

FRANCE: France is doing all it can to avoid a third Covid-19 lockdown, which would further hurt an economy already battered by the coronavirus pandemic, according to Budget Minister Olivier Dussopt. "A third lockdown would be bad news," Dussopt said in an interview with Radio J on Sunday. "We want to do everything we can to avoid it." (BBG)

IRELAND: As top health officials in Ireland warned that the virus was "out of control" in the country, deputy premier Leo Varadkar said further restrictions could not be ruled out even after Dublin sharpened its latest national lockdown last week for the second time in eight days. "I think the situation is very alarming. We can see hospitalisations increasing at a rapid rate, numbers in ICU increasing too," Mr Varadkar told national broadcaster RTE on Sunday. "We do need to turn off the tap. If patients continue to be admitted at the rate they're currently being admitted, then we'll run into difficulties later on in January." (FT)

IRELAND: Ireland is increasing direct freight shipments to and from mainland Europe as businesses move to bypass potential snarl-ups at British ports after Brexit. Many companies ship goods between Ireland and continental Europe via Britain, with about 150,000 lorries passing through what is known as the UK "land bridge" each year. Doing so via swift sea crossings between Dublin and Holyhead and then Dover to Calais provides the fastest route to market for traders in perishable and high volume goods. But the end of the UK transition period on December 31 means truckers now face new checks as they leave EU territory to enter Britain from Ireland or France and then return to the bloc after passing through the UK. This has prompted anxiety about paperwork at ports and potential chaos on the busy Dover-Calais route. Such risks were highlighted shortly before Christmas when France closed the Dover-Calais crossing due to concerns about a highly transmissible new coronavirus strain, leading to huge tailbacks in which hundreds of Irish truckers were left stranded in Britain. Micheál Martin, Irish prime minister, said the disruption pointed to the need for "alternative routes" to the land bridge even with a Brexit deal in place. (FT)

NORWAY: Norway will impose fresh restrictions to prevent a resurgence in the spread of the coronavirus, Prime Minister Erna Solberg said on Sunday, including a nationwide ban on serving alcohol in restaurants and bars and not inviting guests home. The Nordic country has seen a rise in cases over the past month and now estimates its R number - which represents the average number of people that one infected person will pass the virus on to - stands at 1.3. (RTRS)

POLAND: Joe Biden's victory in the US presidential election will not derail Washington's co-operation with Warsaw on plans to develop its own nuclear energy sector, Poland's climate minister has said. Donald Trump's administration built close ties with Warsaw, where the rightwing government is led by Jaroslaw Kaczynski's Law and Justice party. In October the US signed an agreement to draw up a design for Poland's proposed nuclear programme, which envisages constructing six nuclear plants with a capacity of 6-9GW in 2033-43. But relations with Mr Biden's incoming administration have been cooler. During his campaign, Mr Biden sparked consternation in Poland by mentioning the country in the same breath as Belarus — where Alexander Lukashenko cracked down brutally last year after claiming victory in a flawed election — and "the rise of totalitarian regimes around the world". (FT)

EQUITIES: Fiat Chrysler Automobiles NV and PSA Group are poised to get shareholders' sign-off on a combination that's endured two years of extraordinary drama, marked by on-again off-again talks, the transformation of their industry and a global pandemic. At two separate meetings Monday, investors will be asked to approve a merger that will form Stellantis, the world's fourth-largest automaker. The hurdles the two overcame to get to this point were plentiful and prodigious, with Fiat even managing to patch things up after a short-lived attempt to join forces with PSA's archrival Renault SA. (BBG)

U.S.

POLITICS: President Trump urged fellow Republican Brad Raffensperger, the Georgia secretary of state, to "find" enough votes to overturn his defeat in an extraordinary one-hour phone call Saturday that election experts said raised legal questions. The Washington Post obtained a recording of the conversation in which Trump alternately berated Raffensperger, tried to flatter him, begged him to act and threatened him with vague criminal consequences if the secretary of state refused to pursue his false claims, at one point warning that Raffensperger was taking "a big risk." Throughout the call, Raffensperger and his office's general counsel rejected his assertions, explaining that Trump is relying on debunked conspiracy theories and that President-elect Joe Biden's 12,779-vote victory in Georgia was fair and accurate. Trump dismissed their arguments. "The people of Georgia are angry, the people in the country are angry," he said. "And there's nothing wrong with saying, you know, um, that you've recalculated." Raffensperger responded: "Well, Mr. President, the challenge that you have is, the data you have is wrong." (Washington Post)

POLITICS: At least a dozen Republican senators will object to the certification of Electoral College votes next week as part of a last-minute attempt to overturn the results of November's election before Joe Biden is sworn in as the 46th US president on January 20. On Saturday, seven Republican senators, including Ted Cruz of Texas, Ron Johnson of Wisconsin and James Lankford of Oklahoma, as well as four senators-elect, said in a joint statement that they would object to the process of counting and certifying the Electoral College votes in Congress. Citing unsubstantiated reports of widespread voter fraud, the senators said they would call for an electoral commission "to conduct an emergency 10-day audit of the election returns in the disputed states". (FT)

POLITICS: Vice President Mike Pence has welcomed a bid by 11 GOP senators and senators-elect to delay the certification of President-elect Joe Biden's victory over President Donald Trump in the Electoral College during a formal joint session of Congress this week. (CNBC)

POLITICS: Nancy Pelosi (D-Calif.) was reelected as Speaker of the House at the start of the new session of Congress on Sunday. Why it matters: Pelosi had little wiggle room to lose votes from members of her party, as absences from the coronavirus pandemic complicated the matter. She needed the majority of votes from lawmakers present in the chamber. (Axios)

CORONAVIRUS: Anthony Fauci, the nation's top infectious diseases expert, pushed back on claims by President Trump on Sunday that the federal government has "exaggerated" the COVID-19 death toll. Appearing on ABC's "This Week," Fauci was asked by guest host Martha Raddatz about a tweet by the president calling the coronavirus case and death toll "fake news" and blaming it on Centers for Disease Control and Prevention methodology. "Well, the deaths are real deaths. I mean, all you need to do is to go out into the trenches, go to the hospitals, see what the health care workers are dealing with. They are under very stressed situations in many areas of the country. The hospital beds are stretched," Fauci responded. (Hill)

CORONAVIRUS: The U.S. ramped up COVID-19 vaccinations in the past few days after a slower-than-expected start, bringing the number of shots dispensed to about 4 million, government health officials said Sunday. Dr. Anthony Fauci, the nation's top infectious-disease expert, also said on ABC's "This Week" that President-elect Joe Biden's pledge to administer 100 million shots of the vaccine within his first 100 days in office is achievable. Fauci said he has seen "some little glimmer of hope" after 1.5 million doses were administered in the previous 72 hours, or an average of about 500,000 per day, a marked increase in vaccinations. He said that brings the total to about 4 million. He acknowledged the U.S. fell short of its goal of having 20 million doses shipped and distributed by the end of December. "There have been a couple of glitches. That's understandable," Fauci said. "We are not where we want to be, there's no doubt about that." But he expressed optimism that the momentum will pick up by mid-January and that ultimately the U.S. will be vaccinating 1 million people a day. Biden's "goal of vaccinating 100 million people in the first 100 days is a realistic goal," Fauci said. (AP)

POLITICS/FISCAL: Just hours after being sworn in as governor of Puerto Rico on Saturday, Pedro Pierluisi declared a "fiscal emergency," requiring government agencies to cut costs by limiting travel, reducing third-party contracting and refraining from opening new positions, among other measures. The executive order came after Pierluisi, 61, took the reins of the U.S. territory earlier in the day, promising to crush Covid-19, kick start a moribund economy and lead the U.S. territory out of a historic bankruptcy. Pierluisi, who served as the island's non-voting delegate to the U.S. House of Representatives from 2009 to 2017 and Secretary of Justice from 1993 to 1996, narrowly won election in November on a pro-statehood, pro-business platform. (BBG)

OTHER

OECD: The economic impact of the coronavirus pandemic should transform governments' attitude to public spending and debt, according to the chief economist of the OECD, who has warned that fresh austerity would risk a popular backlash. Laurence Boone, who has run the economics directorate at the Paris-based organisation since 2018, told the Financial Times that the public would revolt against renewed austerity or tax rises if governments sought to quickly return deficits and debt to pre-pandemic levels. Governments and central banks across the developed world have rolled out unprecedented stimulus measures in a bid to cushion their economies from the massive impact of the pandemic. After the crisis "people are going to ask where all this money has come from," Ms Boone said, adding that governments would struggle to argue they could not spend to address climate change or to compensate those who lose out from policy reforms. (FT)

U.S./CHINA: China vowed on Saturday to respond to the delisting of three telecommunications giants by the New York Stock Exchange under an executive order signed by President Donald Trump in November. The ministry of commerce said in a statement that China will "take necessary measures to resolutely safeguard the legitimate rights and interests of Chinese enterprises," according to the state-run Global Times. The NYSE said on Thursday that it will delist China Telecom Corp. Limited, China Mobile Limited, and China Unicom Hong Kong Limited. Trump signed an order in November that barred Americans from investing in companies it alleged were connected to the Chinese military. (CNBC)

U.S./CHINA: The U.S. will cause damage to the rights of global investors and undermine faith in its capital markets by punishing Chinese companies, the Ministry of Commerce said last week following the New York Stock Exchange's delisting of China Mobile, China Telecommunications and China Unicom. The measures will have a limited impact on the financing and operations of the three companies as the percentage of stocks listed and traded in the U.S. is small, the Securities Times reported citing Shen Meng, the executive director at Chanson Capital. (MNI)

U.S./CHINA: U.S. hardliners displayed their cold war mentality when they fretted over China's investment deal with the EU before seeing its content, the China Daily said in an editorial. The U.S. is sacrificing other countries' interests to serve its strategy when it asks them to decouple from China, and such a policy is doomed to fail, the newspaper said. The U.S. should focus on improving its leadership and not obstruct other countries' development, the editorial said. (MNI)

JAPAN: Prime Minister Yoshihide Suga is considering a state of emergency in Tokyo and surrounding areas, with coronavirus cases at record highs and Japan's vaccine rollout still more than a month away. Suga told a news conference Monday that the government would consult an advisory panel before finalizing the emergency declaration plan and didn't providing details such as when the declaration would start and how long it would last. He urged people to avoid unnecessary outings and said a strengthened law on virus management would be submitted to parliament when it convenes this month. TV Asahi reported earlier that the state of emergency could be announced this week and take effect on Saturday. It could last for about a month, network FNN reported separately. Japan last declared an emergency in April, but lifted the measure several weeks later as cases dropped. Suga also said he would be among the first to receive a vaccine when the country started a rollout scheduled for late February. "In Tokyo and the surrounding three prefectures, the number of infections hasn't fallen since the New Year and is at an extremely high level," Suga said. "We take this situation seriously and think a stronger message is needed." Past examples have shown that a limited, focused emergency declaration is effective, he added. The main push would be to reduce risks at bars and restaurants, which have been the source of many recent infections, he said. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga's government is preparing to declare a state of emergency as early as this week, aiming to combat a surge in COVID-19 cases in Tokyo and surrounding areas, Nikkei learned on Monday. (Nikkei)

JAPAN: The Tokyo Metropolitan Government plans to ask all restaurants to close no later than 8 p.m. nightly, Nikkei reports, citing multiple people. Tokyo's neighboring prefectures, Kanagawa, Saitama and Chiba will also ask the same. (BBG)

AUSTRALIA: NSW Premier Gladys Berejiklian on Saturday announced it would be compulsory to wear a mask in shopping centres, on public transport, attending an entertainment venue such as a cinema, places of worship, hair and beauty salons, and gaming areas of establishments. Staff at hospitality venues will also have to wear a mask. A $200 fine will apply to anyone who flouts the new rules from Monday. (Sydney Morning Herald)

AUSTRALIA: Australia's most populous state New South Wales (NSW) on Monday reported zero local coronavirus cases for the first time in nearly three weeks, as Sydney battled multiple outbreaks and authorities urged tens of thousands of people to get tested. (RTRS)

SOUTH KOREA: Finance Minister Hong Nam-ki said Monday that the government will spare no efforts this year to stabilize housing prices that have been rising despite a series of measures to cool down the property market. The minister also said that policy efforts will be put into place to pull off a "fast and strong" economic recovery this year as Asia's fourth-largest economy faces growing uncertainties such as a resurgence in new coronavirus cases. "From the beginning of the new year, we will mobilize all policy resources to stabilize the property market definitely and clearly," Hong said in the new year message. (Yonhap)

SOUTH KOREA: South Korea's daily new coronavirus cases bounced back to over 1,000 Monday due to soaring infections in a Seoul prison and care homes across the country, as well as continued community infections, despite extended tougher virus curbs. (Yonhap)

INDONESIA: Bank Indonesia considers rupiah still fundamentally undervalued and will keep providing ample room for the currency to continue strengthening in line with market mechanisms, Nanang Hendarsah, executive director for monetary management says. (BBG)

IRAN: Iran has announced plans to enrich uranium up to 20% purity, just a step away from weapons-grade levels, as tensions with the US ratchet up during the final days of Donald Trump's presidency. The International Atomic Energy Agency (IAEA) confirmed it had been notified of Iran's decision to increase enrichment at the Fordow facility, buried in a mountainside to protect it from military strikes, although Tehran did not say when the process would begin. The weekend also marks the first anniversary of a US drone strike that killed top general Qassem Suleimani, with Washington apparently bracing for possible retaliation. (Guardian)

ISRAEL: Israel is celebrating an impressive, record-setting vaccination drive, having given initial jabs of coronavirus shots to more than a 10th of the population. But Palestinians in the Israeli-occupied West Bank and Gaza can only watch and wait. Israel transports batches of the Pfizer/BioNTech vaccine deep inside the West Bank. But they are only distributed to Jewish settlers, and not the roughly 2.7 million Palestinians living around them who may have to wait for weeks or months. (Guardian)

INDIA: Healthcare experts have criticised India's decision to approve a locally developed coronavirus vaccine, warning that the process of testing the jab has not been sufficiently transparent. Bharat Biotech's Covaxin vaccine was cleared for emergency use on Sunday but limited data has been publicly released on its efficacy, raising concerns that proper vaccine approval guidelines have not been followed. VG Somani, drugs controller general of India, also said the regulator had approved the vaccine made by Oxford university and AstraZeneca, which was given the green light by the UK last week. (FT)

SOUTH AFRICA: South Africa is trying to get COVID-19 vaccines as soon as February, but the timing will depend on bilateral negotiations with pharmaceutical companies, Health Minister Zweli Mkhize said on Sunday. Mkhize's comments come after a group of prominent local health experts publicly criticised the government for moving too slowly to procure coronavirus vaccines and make public its rollout plan. South Africa is participating in the COVAX vaccine distribution initiative co-led by the World Health Organization but only expects to receive the first doses from the facility sometime in the second quarter of the year. (RTRS)

AFRICA: Africa has few options to procure Covid-19 vaccines as the outbreak of the disease worsens across many parts of the continent, South Africa's presidency said. Pfizer Inc. and BioNTech SE have offered to supply Africa with 50 million Covid-19 vaccines for health workers between March and the end of this year, the presidency said in a response to Bloomberg on Sunday. Moderna Inc. has no supplies for Africa, while AstraZeneca Plc has no shots for the continent in 2021 and has directed the African Union to negotiate with the Serum Institute of India Ltd., which is making the vaccine on behalf of AstraZeneca. South Africa's President Cyril Ramaphosa is the African Union's chairman. (BBG)

OIL: OPEC sees plenty of downside risks for oil markets in the first half of 2021, its secretary general said on Sunday, a day before meeting allies led by Russia to discuss output levels for February. "Amid the hopeful signs, the outlook for the first half of 2021 is very mixed and there are still many downside risks to juggle," said OPEC Secretary General Mohammad Barkindo. He was speaking at a meeting of experts of OPEC and allies, a group known as OPEC+, according to remarks published by OPEC. (RTRS)

OIL: Iraq has selected a Chinese company for a multibillion-dollar oil-supply deal, as the Arab nation seeks funds to bolster an economy reeling from the Coronavirus-triggered collapse in energy prices. SOMO, which oversees Iraq's petroleum exports, picked a Chinese firm after receiving bids from several traders, the official Iraqi News Agency reported, citing an interview with the head of SOMO, Alaa Al-Yasiri. While INA didn't name the company or specify if Prime Minister Mustafa al-Kadhimi had signed off on the deal, Bloomberg reported last month that ZhenHua Oil Co., a subsidiary of China's largest state-owned defense contractor, was the winner. "There was intense competition between two European and Chinese companies, and the Chinese company won," INA quoted Al-Yasiri as saying. (BBG)

OIL: Iranian energy companies have agreed deals worth $1.2 billion to raise the nation's crude output, state-run National Iranian Oil Co. said. The signings were initially meant to take place on Monday in Tehran in the presence of Oil Minister Bijan Namdar Zanganeh, but have been delayed, NIOC said in a statement. The company didn't disclose the reason for or length of the delay. Zanganeh said in mid-December that Iran planned to roughly double oil production in the next year to 4.5 million barrels daily, as the country anticipates a loosening of U.S. sanctions after Joe Biden becomes president. National Iranian South Oil Co. and Iranian Offshore Oil Co. will sign deals with domestic contractors covering onshore fields in Bushehr, Fars, Khuzestan, and Kohgiluyeh and Boyer-Ahmad provinces, NIOC said. The offshore Reshadat deposit in the Persian Gulf is also part of the agreements. (BBG)

CHINA

YUAN: The yuan may not be as strong as the market has predicted because developed economies are likely to recover following vaccinations against Covid-19 and China's exports growth may also decline, Sina.com reported citing Guan Tao, an economist with BOC International Securities and a former official with China's central bank. Citing another view, Sina reported comments from Haibin Zhu, the chief economist with JP Morgan, who said the yuan will maintain a strong trend through the first half of 2021 and surge past 6.25 yuan by the year end. (MNI)

POLITICS: China has expanded the power of its Central Military Commission (CMC) – headed by President Xi Jinping – to mobilise military and civilian resources in defence of the national interest, both at home and abroad. Revisions to the National Defence Law, effective from January 1, weaken the role of the State Council – China's cabinet – in formulating military policy, handing decision-making powers to the CMC. For the first time, "disruption" and protection of "development interests" have been added to the legislation as grounds for the mobilisation and deployment of troops and reserve forces. (SCMP)

OVERNIGHT DATA

CHINA DEC CAIXIN M'FING PMI 53.0; MEDIAN 54.7; NOV 54.9

The Caixin China General Manufacturing PMI came in at 53 in December, dipping from 54.9 the previous month, which was the highest reading since November 2010. The manufacturing PMI remained in expansionary territory as the post-epidemic economic recovery continued. In December, the negative impact of the pandemic on the domestic economy further subsided and the manufacturing industry continued to recover. Both the supply and demand sides continued to improve. Overseas demand also steadily increased. In terms of the trend, we expect the economic recovery in the post-epidemic era to continue for several months, and macroeconomic indicators will be stronger in the next six months, taking into account the low bases in the first half of 2020. Meanwhile, we need to pay attention to the mounting pressure on costs brought by the increase in raw material prices and its adverse impact on employment, which is particularly important for the design of the exit from stimulus policies implemented during the epidemic. (Caixin)

JAPAN DEC, F JIBUN BANK M'FING PMI 50.0; FLASH 49.7

Japanese manufacturers signalled a broad stabilisation in operating conditions at the end of a tumultuous year, as the headline PMI registered at the 50.0 no-change threshold in December. This pushed the PMI to the highest level since April 2018 and ended a sequence of 19 straight declines – the longest in the survey history. The overall health of the Japanese manufacturing sector was boosted by output levels steadying following nearly two years of consistent declines. Although new orders reduced in the latest survey period, the fall was the softest recorded in the current sequence dating back to January 2019. Buoyed by improved operating conditions, Japanese manufacturing firms increased employment levels for the first time since February, albeit only fractionally. Nevertheless, ongoing issues of an ageing population have continued to hold back Japanese manufacturing employment, as firms report continued to report retirements. Businesses reported a sustained increase in optimism, with a third of respondents predicting a rise in output over the coming 12 months. This is in line with the IHS Markit forecast for industrial production to grow 7.3% in 2021. (IHS Markit)

AUSTRALIA DEC CORELOGIC HOUSE PRICE INDEX +0.9% M/M; NOV +0.7%

AUSTRALIA DEC, F MARKIT M'FING PMI 55.7; FLASH 56.0

Australia's manufacturers ended 2020 on a strong note, reporting one of the strongest upturns in production since 2018 as order books continued to recover. Many firms even struggled to boost capacity sufficiently to meet the recent surge in demand, despite the sector taking on extra staff at the fastest rate for two years. The upturn in production was made even more impressive by supply chains having been severely disrupted again by a combination of shipping delays, shortages of inputs and an increased rate of loss of exports. Businesses also remained optimistic about the outlook for the year ahead. On balance, however, expectations were reined in slightly compared to November due to increased concerns that the pandemic will stretch further into 2021 than previously thought, and the possibility of escalating trade tensions. (IHS Markit)

AUSTRALIA DEC COMMODITY INDEX AUD 104.1; NOV 98.2

AUSTRALIA DEC COMMODITY INDEX SDR +11.7% Y/Y; NOV +2.5%

SOUTH KOREA DEC MARKIT M'FING PMI 52.9; NOV 52.9

December data marked a sustained improvement in the health of the South Korean manufacturing sector, as the latest Manufacturing PMI ended a turbulent year firmly in expansion territory. A continued recovery from the disruption caused by the COVID-19 pandemic was seen throughout the final quarter of 2020. South Korean firms recorded further increases in both output and new orders in the latest survey period, as firms reported improved demand, particularly in the automotive sector. External demand for manufactured goods also ended the year positively, driven by gradual recoveries in China and Japan. Additional pressure on capacity also encouraged businesses to expand workforce numbers for the first time in 20 months in December, following stabilisation in November. South Korean goods producers remained optimistic in their outlook for activity over the coming 12 months, as the pandemic fades further and new products are launched. IHS Markit currently estimates industrial production will expand by 1.6% in 2021. (IHS Markit)

CHINA MARKETS

PBOC NET DRAINS CNY140BN VIA OMOS MON

The People's Bank of China (PBOC) injected CNY20 billionvia 7-day reverse repos with the rate unchanged on Monday. This resulted in anet drain of CNY140 billion given the maturity of CNY160 billion of reverserepos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) dropped to 2.2000% at 09:32 am local time from 2.4565% at last Thursday's close.

- The CFETS-NEX money-market sentiment index closed at 34 on last Thursday, the last trading day before the national holiday, vs 46 on last Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5408 MON VS 6.5249

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5408 on Monday, compared with the 6.5249 set before New Year holiday.

MARKETS

SNAPSHOT: Vaccines Give Glimmer Of Hope As World Continues Fight Against Covid

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 209.18 points at 27239.8

- ASX 200 up 97.103 points at 6684.2

- Shanghai Comp. up 30.941 points at 3504.01

- JGB 10-Yr future down 3 ticks at 151.89, yield unch. at 0.021%

- Aussie 10-Yr future down 1 ticks at 98.97, yield up 1.2bp at 1.017%

- U.S. 10-Yr future -0-06+ at 137-28, yield up 2.83bp at 0.942%

- WTI crude up $0.5 at $49.02, Gold up $22.92 at $1921.5

- USD/JPY down 16 pips at Y103.04

- UK PM JOHNSON: COVID RULES "PROBABLY GOING TO GET TOUGHER" (BBC)

- UK PM JOHNSON COULD LOSE HIS SEAT AND MAJORITY AT NEXT ELECTION (RTRS)

- TRUMP PRESSURES GEORGIA SEC OF STATE TO OVERTURN HIS DEFEAT (Washington Post)

- FAUCI: VACCINATIONS ARE RAMPING UP IN A "GLIMMER OF HOPE" (AP)

- OPEC SECGEN: READY TO ADJUST OIL OUTPUT INCREASES (RTRS)

BOND SUMMARY: Core FI On Back Foot, JGBs Shake Off Initial Strength

A lower re-open for T-Notes preluded a further sell-off as trading resumed after 2020 became history, although e-minis struggled to recoup their early dips. T-Notes stabilised around their current levels in the Tokyo afternoon and last trade -0-07 at 137-27+. Cash Tsy curve bear steepened, with yields last seen 0.4-3.3bp cheaper. Eurodollar futures run unch. to -1.0 tick through the reds as we type. The space found itself under a modicum of pressure as participants seemingly focused on the positives re: U.S. coronavirus situation, with Anthony Fauci observing that the national vaccination campaign is picking up speed. U.S. Pres Trump's last-ditch attempts to disrupt the transition process & lingering Sino-U.S. frictions failed to provide much support to the FI space. Construction spending & final Markit M'fing PMI headline the U.S. docket today, with 3-Month & 6-Month Bill supply also due.

- Aussie bonds also faltered, taking their cue from dynamics driving U.S. Tsys. YM last sits -0.5 & XM changes hands -1.0. The latter slid early on, before ticking off lows in afternoon trade. Steepening impetus hit cash ACGB space as well, with yields last seen -0.4bp to +1.7bp across the curve. Bills trade unch. to -1 tick through the reds. Coronavirus matters dominated the local headline flow, after NSW mandated mask-wearing in indoor venues. The final Markit M'fing PMI report confirmed a continued recovery in Dec, albeit at a marginally slower pace than suggested by the flash reading. CoreLogic House Price Index growth accelerated to +0.9% M/M in Dec from +0.7%.

- JGB futures firmed up at the start to the session, after several reports circulated by the Japanese press suggested that the gov't may declare a state of emergency in Tokyo and three neighbouring prefectures as soon as this week. However, the contract wiped out gains into the lunch break and struggled to recover thereafter. It last sits at 151.91, just 1 tick shy of last settlement. Cash JGB yields are marginally mixed, though 40s still outperform. PM Suga held a presser, during which he confirmed that the central gov't considers declaring emergency in Tokyo and surrounding regions. He didn't disclose any details, but some hints trickled through via the local media, as FNN noted that a new state of emergency could last for a month & NHK reported that it would involve more limited restrictions than April's.

EQUITIES: Mixed Picture

Equity markets rose on Monday, climbing even as safe haven gold saw a bumper session. Stocks look set to continue to benefit from goldilocks conditions: expectations of widespread vaccine distribution in 2021, further central bank support, and government aid.

- The U.S. Congress is set to confirm the election of Joe Biden for the next U.S. President this week. Outgoing Pres Trump reiterated his calls for a vote recount in Georgia, while a group of GOP Senators led by Ted Cruz signalled that they will object to the certification of Trump's election defeat. Most expect their initiative to fall flat. The political outlook in the U.S. will remain cloudy at least until after Tuesday's Georgia Senate runoff.

- Asia-Pac equity markets are mostly higher, Japanese bourses are the exception after Prime Minister Suga said he's considering declaring a state of emergency for the Tokyo area for 1 month from Jan. 9 to stem the spread of Covid-19.

- Shares in China and Hong Kong edged higher. Major indices have shrugged off NYSE's decision to delist China's three biggest telecommunication companies (China Mobile, China Telecom, China Unicom HK), even as the companies themselves slid.

- Futures in the US and Europe are flat-to-slightly lower. FTSE 100 futures are the exception after the U.K. announced it is poised to give the first shots of AstraZeneca's vaccine on Monday.

OIL: Oil Higher To Start 2021 Ahead Of OPEC

- WTI last up 0.97% at 48.98, Brent last up 1.02% at 52.33.

- Oil markets are fighting the conflicting influences of a spike in coronavirus cases globally and hope that vaccine roll outs can accelerate the return to normality.

- The UK recorded another daily high in new Covid-19 cases, while PM Johnson warned that tougher restrictions might be imminent. Johnson told the BBC on Sunday that the gov't may have to keep schools shut. Opposition leader Starmer urged the PM to declare a nation-wide lockdown within 24h, while Scottish First Min Sturgeon said that the Scottish gov't will consider "further action" to contain the spread of the virus when it meets on Monday. Elsewhere Japan is considering imposing another state of emergency for 1 month from January 9.

- The OPEC+ group looks likely to increase output by 500k bpd from January, while Russia's deputy prime minister said in December Russia would be supportive of additional gradual increases in February. The OPEC+ group will meet today to make a decision on February output levels.

- Government officials from Saudi Arabia and Russian reiterated commitment to OPEC+ agreement to support oil market stability last week at a Saudi-Russian Joint Governmental Committee for Commercial, Economic, Scientific and Technical Cooperation.

GOLD: Yellow Metal Reclaims $1,900

Gold has gained to start 2021, benefitting from some headwinds to the greenback as the yellow metal reclaims the $1900 handle, gold last up $24.04 to $1922.74.- The U.S. Congress is set to confirm the election of Joe Biden for the next U.S. President this week. Outgoing Pres Trump reiterated his calls for a vote recount in Georgia, while a group of GOP Senators led by Ted Cruz signalled that they will object to the certification of Trump's election defeat. Most expect their initiative to fall flat. The political outlook in the U.S. will remain cloudy at least until after Tuesday's Georgia Senate runoff.

- Aside from some lingering political uncertainty in the U.S., global coronavirus concerns are weighing on sentiment and helping boost gold.

- The U.K. recorded another daily high in new Covid-19 cases, while PM Johnson warned that tougher restrictions might be imminent. Johnson told the BBC on Sunday that the gov't may have to keep schools shut. Opposition leader Starmer urged the PM to declare a nation-wide lockdown within 24h, while Scottish First Min Sturgeon said that the Scottish gov't will consider "further action" to contain the spread of the virus when it meets on Monday. Elsewhere Japan is considering imposing another state of emergency for 1 month from January 9 and the U.S. has seen a spike in cases after the New Year holiday.

- There is some optimism around the vaccine after the announcement that the U.K. is poised to give the first shots of AstraZeneca's vaccine on Monday.

FOREX: Greenback On The Backfoot As 2021 Underway

A fairly sluggish start to 2021 trade. The U.S. Congress is set to confirm the election of Joe Biden for the next U.S. President this week. Outgoing Pres Trump reiterated his calls for a vote recount in Georgia. The political outlook in the U.S. will remain cloudy at least until after Tuesday's Georgia Senate runoff. Aside from some lingering political uncertainty in the U.S., global coronavirus concerns are weighing on the U.S. dollar.

- GBP/USD is up 8 pips at 1.3679, sterling could face some headwinds after the UK recorded another daily high in new Covid-19 cases, while PM Johnson warned that tougher restrictions might be imminent. Opposition leader Starmer urged the PM to declare a nation-wide lockdown within 24h. There was some optimism on reports that the UK is poised to give the first shots of AstraZeneca's vaccine on Monday.

- The weekend saw Tokyo Gov Koike & govs of three neighbouring prefectures urge central authorities to declare a state of emergency in the area to stop the spread of new Covid-19 infections, but the central gov't said it will consult experts before making a decision. Latest reports indicate a 1 month lockdown from Jan. 9. USD/JPY last down 20 pips at 103.00, dragged lower by a weaker U.S. dollar.

- AUD/USD last up 8 pips, getting a bit of a boost after reports that New South Wales found no new cases of Covid-19 yesterday, indicating stricter containment measures over the festive period could be having the desired effect. Markets ignored weaker domestic and Chinese data, while a bid in oil helped support AUD.

- NZD/USD has wavered around neutral levels, with liquidity sapped by a public holiday in New Zealand. The rate last changes hands at 0.7193, up 5 pips.

- The PBOC fixed USD/CNY at 6.5408, around 159 pips weaker for the yuan than the previous fix. Despite this, USD/CNH opened below the 6.50 handle and has proceeded to decline further, last at 6.4547 and touching the lowest levels since June 2018. The PBOC drained a net CNY 140bn from the system today.

FOREX OPTIONS: Expiries for Jan04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100-15(E958mln-EUR puts), $1.2220(E729mln-EUR puts), $1.2275(E561mln-EUR puts), $1.2430-40(E589mln)

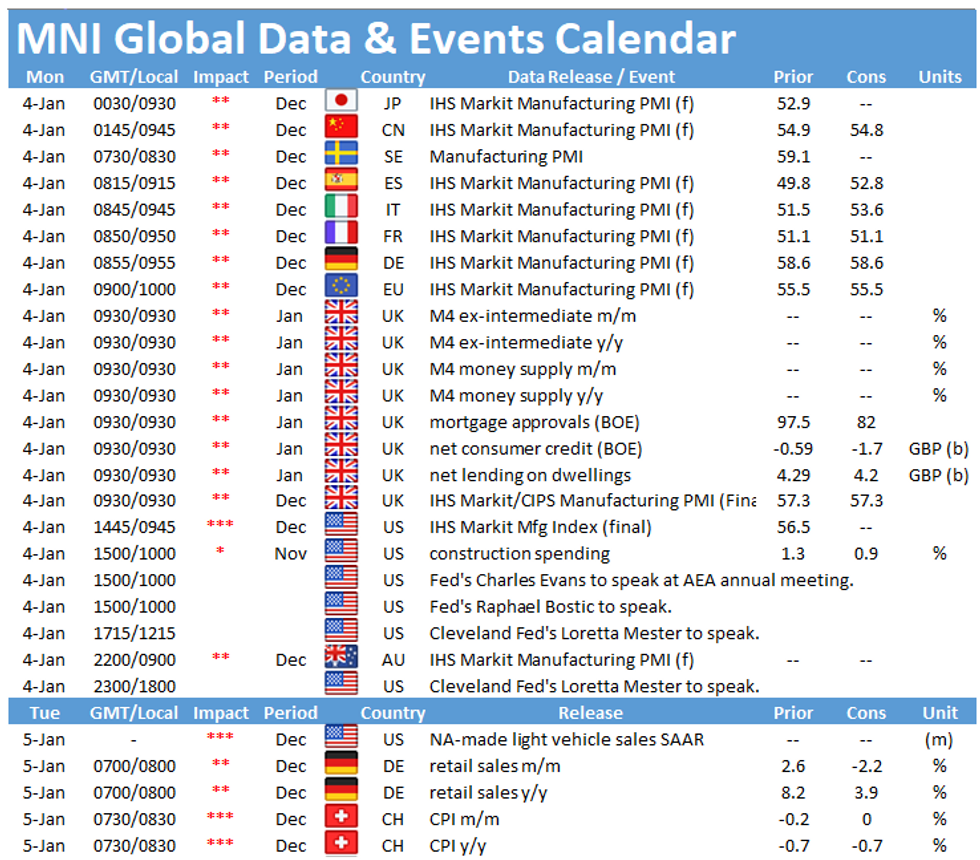

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.