-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Muted Into FOMC

EXECUTIVE SUMMARY

- ECB STUDYING IF DIFFERENCES WITH FED POLICY BOOSTING EURO (BBG)

- YELLEN CITES TREASURY-FED COORDINATION IN NEW CRISIS CAMPAIGN (BBG)

- BIDEN TEAM TO BUY 200 MILLION MORE VACCINE DOSES, SPEED UP VACCINATIONS (BBG)

- GERMANY PRESSES BRUSSELS FOR POWERS TO BLOCK VACCINE EXPORTS (FT)

- JOHNSON PROMISES PLAN TO EASE UK LOCKDOWN IN COMING DAYS, WEEKS (BBG)

- CHINA CALLS STRAIT DRILLS 'STERN WARNINGS' TO EXTERNAL FORCES (BBG)

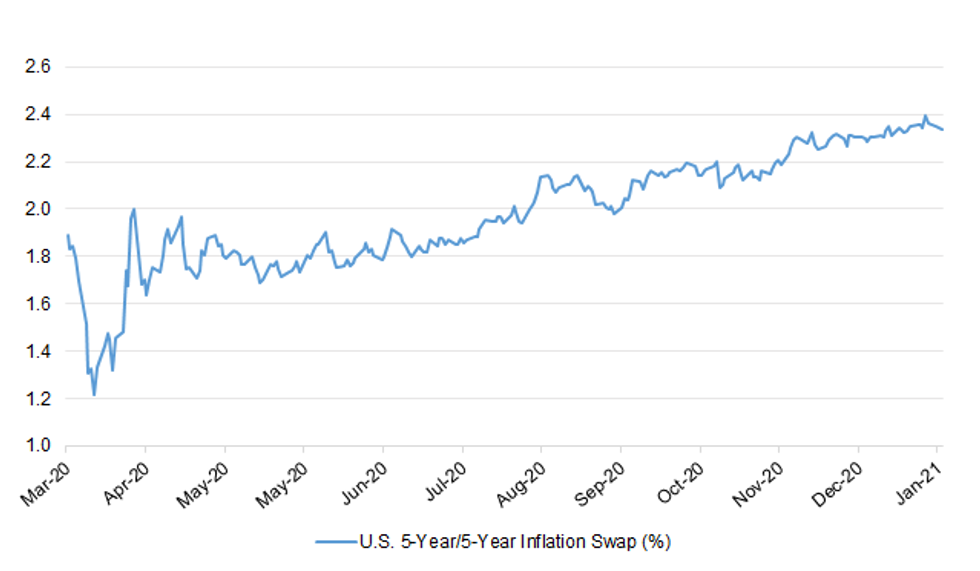

Fig. 1: U.S. 5-Year/5-Year Inflation Swap (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: More than 100,000 people have died from coronavirus in the U.K., the first country in Europe to surpass the threshold. (BBG)

CORONAVIRUS: "What I will be doing over the course of the next few days and weeks is setting out in more detail when and how we can get things open again," U.K. Prime Minister Boris Johnson says at a press conference in London on Tuesday. (BBG)

CORONAVIRUS: Boris Johnson said schools would reopen only "cautiously" as parents were promised news within days about the chance of children going back after the half-term holiday. The prime minister suggested that schools could reopen first in English regions with a lower infection rate. Reception, Year 1 and Year 6 pupils in primary schools, and those sitting GSCEs and A-levels are expected to be the first to return under plans being drawn up by Gavin Williamson, mirroring the first national lockdown last year. (The Times)

CORONAVIRUS: Boris Johnson has warned against the placing of restrictions on COVID vaccines after the EU threatened to put controls on the export of doses to Britain. The prime minister, speaking at a Downing Street news conference on Tuesday, said he expected the EU to "honour all contracts" in the supply of vaccinations to the UK. (Sky)

CORONAVIRUS: The government will announce today a limited hotel quarantine system for arrivals from high-risk countries after Boris Johnson rejected calls by Priti Patel for the temporary closure of Britain's borders. The Times has been told that the home secretary pushed for a travel ban to stop potentially vaccine-resistant strains of coronavirus being imported into the country. Ms Patel suggested the move to allow time for the preparation of a blanket hotel quarantine system for all arrivals. Mr Johnson is expected to restrict the requirement to stay in quarantine hotels to Britons returning from 30 high-risk countries that are covered by a travel ban. (The Times)

FISCAL: Rishi Sunak has warned Tory MPs that the cost of new coronavirus bailouts they are demanding could reach £30 billion, but insisted some further economic support is on the way. (Telegraph)

BREXIT: The EU official tasked with overseeing the post-Brexit deal with the UK has warned that London's refusal to grant its ambassador full diplomatic status has stoked concern in European capitals. Maros Sefcovic told the Financial Times that the snub was "very important politically" and meant the UK "would treat the European Union delegation in worse terms than any other country on the planet". In a further sign of growing tensions, Mr Sefcovic, a European Commission vice-president, also highlighted EU worries about the potential for the UK to diverge from bloc rules in areas such as labour rights and pesticide regulation.

BREXIT: Freight companies are rejecting one in five contracts to take goods from France to the U.K. as border rules put in place after Brexit added to delays in moving goods across the English Channel. The rejection rate, showing how many companies pulled out of long-term delivery contracts to move goods, was 158% higher last week than its average during the third quarter, according to data from global logistics platform Transporeon. The reading was marginally lower than the week before. (BBG)

BREXIT: U.K. Chancellor of the Exchequer Rishi Sunak will hold talks with his Swiss counterpart on Wednesday as the two countries seek to deepen financial services ties in the wake of Brexit. (BBG)

EUROPE

ECB: European Central Bank policy makers have agreed to look deeper into the euro's appreciation against the dollar since the start of the pandemic, focusing on whether it's driven by differences in stimulus policies compared with the U.S., according to officials familiar with the matter. The review could shape how the ECB responds to an issue that has alarmed policy makers, who worry that the euro's strength over the past year depresses inflation that is already below zero. That could force the central bank to provide more monetary stimulus, even as it acknowledges mounting risks to financial stability. The ECB's Governing Council noted during last week's meeting how an increase in U.S. market interest rates in recent months failed to propel dollar gains, the officials said. Instead, the greenback has weakened. (BBG)

ECB: European Central Bank Executive Board member Frank Elderson won the backing of European lawmakers to become the region's second-highest banking supervisor. The relevant European Parliament committee voted to approve his nomination as vice chair of the ECB's Supervisory Board, according to a statement on its website. Elderson now needs the approval of the European Union Council to assume the post. (BBG)

FISCAL: France has called on the EU to overcome "blockages" to ensure faster disbursement of its €750bn recovery fund to member states, and said the coronavirus pandemic will require re-evaluating eurozone fiscal constraints. "I see there are blockages and that all this is too slow, that we need to accelerate and that if we want to emerge from the economic crisis in the best conditions, the European money must arrive as quickly as possible," Bruno Le Maire, French finance minister, told the Financial Times in an interview on Tuesday. (FT)

CORONAVIRUS: Germany is pressing the European Commission to give member states the power to block the export of coronavirus vaccines produced in the EU as tensions mounted over shortfalls in supply. Jens Spahn, Germany's health minister, urged Brussels to force companies to obtain permission before shipping jabs from the bloc. His proposals came as Brussels worked on new rules for exports, due to be unveiled on Friday, with officials divided over how stringent the regime should be. Germany, which hosts a number of vaccine manufacturing sites, has become the most vocal proponent of tougher export restrictions. (FT)

CORONAVIRUS: AstraZeneca's Chief Executive on Tuesday said the European Union's late decision to strike a contract with the drugmaker to supply COVID-19 vaccines, months after Britain, meant the company did not have enough time to iron out glitches in setting up production lines with external partners. "We are basically two months behind where we wanted to be," Pascal Soriot told German daily Die Welt in an interview, when asked about delayed deliveries in Europe. "And the issue here is we've had also teething issues like this in the UK supply chain," he added. "As for Europe, we are three months behind in fixing those glitches." (RTRS)

CORONAVIRUS: The Executive Director of the European Medicines Agency, Emer Cooke, has said the pharmaceutical company AstraZeneca is still providing the agency with clinical data, but that the EMA hopes to be able to authorise its Covid-19 vaccine by the end of this week. During a hearing in Brussels, Ms Cooke would not be drawn on the criticisms levelled at AstraZeneca by the European Commission and member states over a significant shortfall in dose supply. (RTE)

CORONAVIRUS: European Commission President Ursula von der Leyen said on Tuesday that coronavirus vaccine makers must make good on commitments to supply the bloc with millions of promised doses, according to a report from CNBC's Holly Ellyatt. "Europe is determined to contribute to this global common good, but it also means business," she said at the virtual Davos Agenda summit as she demanded a return for Europe's investments. (CNBC)

CORONAVIRUS: European Medicines Agency Executive Director Emer Cooke signaled Pfizer Inc. is gearing up to increase deliveries to EU countries of its Covid-19 vaccine developed with BioNTech SE with production at more sites. "With respect to the Pfizer vaccine, they have already submitted a protocol to include additional sites and we expect those to come through during February-March and to have an impact on supply at the start of the second quarter," Cooke told a European Parliament committee on Tuesday. (BBG)

CORONAVIRUS: European Union governments plan to remove Japan from their list of countries whose residents should be allowed to visit the bloc during the current phase of the coronavirus pandemic, according to an EU official familiar with the matter. An update to the EU's recommended travel "white list" continues to exclude the U.S. and all but seven other nations, the official said Tuesday, asking not to be identified because the deliberations were confidential. (BBG)

GERMANY: The German government is discussing drastically reducing travel from abroad in a bid to prevent more virulent mutant variants of the coronavirus finding a foothold in the country, officials said on Tuesday. Chancellor Angela Merkel told her parties' legislators that she did not want a travel ban, but with the pandemic raging this winter there should be no tourism, sources told Reuters. (RTRS)

ITALY: Caretaker prime minister Giuseppe Conte made an impassioned appeal on Tuesday for opposition or unaligned lawmakers in the upper house Senate to give him the backing to form a new government of "national rescue." Hours earlier Conte handed his resignation to President Sergio Mattarella, hoping to get a fresh mandate to put together a new coalition and rebuild his parliamentary majority which collapsed last week when a junior party pulled out. "It is time for the voices to emerge in parliament of those who care in their hearts about the future of the republic," Conte posted on Facebook, allowing him to form a government with "a broader and more secure majority." (RTRS)

SPAIN: Carolina Darias, currently Spain's territorial policy minister, will replace Salvador Illa as Health Minister, Prime Minister Pedro Sanchez said in a televised statement Tuesday. Miquel Iceta will take on Darias's role as part of a shuffle triggered by the departure of Illa to run as Socialist candidate in forthcoming Catalan elections. Iceta was previously leader of the Catalan Socialists. (BBG)

IRELAND: Ireland will compel people arriving in the country without a negative Covid test to quarantine in a hotel for a fortnight, as Micheál Martin's government sharpened travel restrictions and extended a third national lockdown until March 5. The move on Tuesday came despite indications that new coronavirus infections, which surged to record levels after the new year, are halving every 10 days. (FT)

U.S.

FED/FISCAL: Treasury Secretary Janet Yellen highlighted the past coordination between her new department and her previous fiefdom, the Federal Reserve, as she sought to rally the agency's staff in battling an array of crises besetting the nation. "Economics isn't just something you find in a textbook," she wrote in a memo to the 84,000 Treasury Department workers that was released on Tuesday. "Economic policy can be a potent tool to improve society. We can -- and should -- use it to address inequality, racism and climate change," which along with Covid-19 are the four crises President Joe Biden has identified, she said. (BBG)

FISCAL: House March recess cancelled for votes including possibly on aid. (BBG)

FISCAL: Senate Majority Leader Chuck Schumer said he's ready to start moving on a Democrat-only Covid-19 relief plan as soon as next week if Republicans continue to reject President Joe Biden's $1.9 trillion proposal. "In keeping our options open, on our caucus call today I informed senators to be prepared that a vote on a budget resolution could come as early as next week," Schumer said at a press briefing Tuesday. "We have to see what they say in the next few days," he said of the Republicans. A budget resolution is the first step toward a so-called reconciliation bill, which allows the Senate to proceed on a simple-majority vote basis -- avoiding the need for 60 votes to cut off the filibuster. It makes all the difference given the chamber's partisan 50-50 split. (BBG)

FISCAL: Democrats in the House and Senate reintroduced a bill Tuesday to raise the U.S. minimum wage to $15 per hour, seeking fresh support for the policy during an economic crisis and with control of Congress and the White House. The legislation would gradually hike the pay floor to $15 an hour nationwide by 2025, then tie future increases to median wage growth. The measure would also end pay below the minimum wage for tipped workers, along with certain teens and people with disabilities. (CNBC)

CORONAVIRUS: US coronavirus hospitalisations dropped on Tuesday to their lowest in more than six weeks and new infections continued to trend lower. The number of people currently in US hospitals with coronavirus fell to 108,957, from 109,936 on Monday, according to Covid Tracking Project data. That is the lowest level since December 12, and the vast majority of states on Tuesday reported fewer hospitalisations compared with a week ago. (FT)

CORONAVIRUS: President Joe Biden said his administration intends to order 100 million more doses each of Pfizer Inc. and Moderna Inc.'s coronavirus vaccines, and at least temporarily speed up shipments to states to about 10 million doses a week. The new purchases would increase total U.S. orders for the two approved vaccines by 50%, to about 600 million shots, according to a senior administration official -- a supply that it expects to have available by the end of the summer, and which would be enough for 300 million people. Delivering a minimum 10 million doses to states would represent about a 16% increase from the current weekly pace, though the higher pace may only last three weeks and it's not clear where the new doses are coming from. The government also plans to give states better forecasts of forthcoming shipments -- three weeks' worth, up from one week now. (BBG)

CORONAVIRUS: U.S. officials are weighing whether to add Covid testing or other measures to domestic travel to curb the spread of the virus. President Joe Biden called last week for health and transportation officials to recommend potential "additional public health measures for domestic travel." Biden's push came in an order that mandated face masks for interstate travel, including on airplanes. "We are actively looking at it," Dr. Martin Cetron, director for the Division of Global Migration and Quarantine at the CDC, said on a call with reporters. (CNBC)

CORONAVIRUS: The mayor of the largest US city on Tuesday called on pharmaceutical manufacturers to let other companies make their Covid-19 vaccines to ramp up production. Bill de Blasio said New York was short of vaccines even though it had built the infrastructure to administer 500,000 doses a day. (FT)

CORONAVIRUS: New Jersey Governor Phil Murphy said he will consider easing Covid-19 restrictions if data continue to improve. "We're in the plateau, it would be my guess right now," Murphy, a first-term Democrat who is seeking re-election in November, said Tuesday during an interview on Bloomberg Television. (BBG)

POLITICS: Forty-five Senate Republicans backed a failed effort on Tuesday to halt former President Donald Trump's impeachment trial, in a show of party unity that some cited as a clear sign he will not be convicted of inciting insurrection at the Capitol. Republican Senator Rand Paul made a motion on the Senate floor that would have required the chamber to vote on whether Trump's trial in February violates the U.S. Constitution. The Democratic-led Senate blocked the motion in a 55-45 vote. But only five Republican lawmakers joined Democrats to reject the move, far short of the 17 Republicans who would need to vote to convict Trump on an impeachment charge that he incited the Jan. 6 Capitol assault that left five people dead. "It's one of the few times in Washington where a loss is actually a victory," Paul later told reporters. "Forty-five votes means the impeachment trial is dead on arrival." (RTRS)

POLITICS: The Senate voted 78-22 on Tuesday to confirm Antony Blinken as secretary of state. (Axios)

OTHER

U.S./CHINA: China and the new U.S. administration should restart a multilevel dialogue and reshape economic and trade relations, the China Daily reported citing former Chinese officials. The two sides should evaluate the Phase One agreement, begin new negotiations, roll back extra tariffs and cancel unreasonable investment restrictions, the newspaper said citing Zeng Peiyan, the former vice premier and now chairman of the China Center for International Economic Exchanges. (MNI)

U.S./CHINA/TAIWAN: "People's Liberation Army drills in the Taiwan Strait firmly safeguard China's national sovereignty, are stern warnings for external forces to stop interference, and stern warnings for Taiwan separatists to stop provocation," China's Taiwan Affairs Office spokeswoman Zhu Fenglian says at briefing in Beijing on Wednesday. Only by doing this can China "protect the peace and stability of the Taiwan Strait, protect common interests of compatriots across the strait, and protect the prospects of peaceful reunification". Zhu repeats China will not give up use of force. (BBG)

GEOPOLITICS: Foreign Minister Toshimitsu Motegi said Wednesday he and new U.S. Secretary of State Antony Blinken agreed to strengthen the Japan-U.S. alliance and achieve a free and open Indo-Pacific, sharing the view that the regional security situation is becoming increasingly severe. In phone talks hours after Blinken won Senate confirmation as the chief U.S. diplomat, Motegi welcomed affirmation by the new U.S. administration that the Japan-controlled Senkaku Islands in the East China Sea fall under a bilateral security treaty. China claims sovereignty of the islands, calling them Diaoyu. (Kyodo News)

GLOBAL TRADE: US, European and Japanese carmakers are lobbying their governments for help, with Taiwan and TSMC being asked to step in. German Chancellor Angela Merkel and French President Emmanuel Macron discussed the potential for shortages last year and agreed on the need to accelerate Europe's push to develop its own chip industry, according to a French official with knowledge of the matter. (SCMP)

GLOBAL TRADE: Apple is ramping up the production of iPhones, iPads, Macs and other products outside of China, Nikkei Asia has learned, in a sign that the tech giant is continuing to accelerate its production diversification despite hopes that U.S.-China tensions will ease under President Joe Biden. Sources said iPad production will begin in Vietnam as early as the middle of this year, marking the first time that the world's biggest tablet maker will build a significant number of the devices outside of China. The California tech giant is also stepping up iPhone production in India, its second-largest production base for the iconic device, sources added, with plans to start producing the latest iPhone 12 series -- the company's first 5G smartphones -- there as soon as this quarter. Apple is also increasing production capacity for smart speakers, earphones and computers in Southeast Asia as part of its ongoing diversification strategy, the sources added. (Nikkei)

CORONAVIRUS: The coronavirus has now infected more than 100 million people worldwide in just about 13 months, according to the latest tally from John Hopkins University. (CNBC)

CORONAVIRUS: AstraZeneca Chief Executive Pascal Soriot said on Tuesday that the British drugmaker is working with Oxford University on a vaccine that will target the South African variant of COVID-19. "Having said that, we're also working on a vaccine with Oxford University that will target the variant," Soriot told Italian daily La Repubblica in an interview. (RTRS)

CORONAVIRUS: French pharma giant Sanofi will produce more than 100 million doses of the COVID-19 vaccine developed by its competitors Pfizer and BioNTech by the end of the year, CEO Paul Hudson told Le Figaro newspaper in an interview published on Tuesday. As Sanofi and its British partner GlaxoSmithKline have delayed the launch of their shot to late 2021, the French company decided to approach Pfizer "in order to be helpful as of now", Hudson said, adding that an agreement with the U.S. company had been reached. (RTRS)

CORONAVIRUS: Russia should have a third indigenously developed Covid-19 vaccine circulating within a few months, the country's prime minister told state media on Tuesday. (FT)

CORONAVIRUS: A volunteer who was taking part in a trial in Peru of the coronavirus vaccine developed by China's Sinopharm Group has died from Covid-19-related pneumonia. (FT)

HONG KONG: Hong Kong on Wednesday extended social distancing requirements for another week to February 3 as new cases continued to hover around 50 to 100 daily. (FT)

JAPAN: Japan is likely to extend its state of emergency set to expire Feb. 7, Kyodo reported, citing several unidentified people. An option being considered is to extend the emergency until the end of February. (BBG)

JAPAN: A contentious requirement for Japan-specific trials has delayed the rollout of Covid-19 vaccines in Asia's largest advanced economy and threatened the Tokyo Olympics. Small clinical trials that demonstrate the vaccines generate a similar level of antibodies when used in Japan are the main outstanding condition for approval of the jabs from BioNTech/Pfizer and several other companies. (FT)

JAPAN: Japanese Prime Minister Yoshihide Suga said his government will proceed with preparations for hosting the Olympics this summer with the International Olympic Committee and Tokyo organizers as questions are raised about holding the event during the pandemic. The government is examining specific measures to prevent the spread of the virus at the games, Suga told parliament. (BBG)

JAPAN: Japan's Finance Minister Taro Aso says the pandemic has made it "extremely hard" for the government to meet its goal of balancing the budget by fiscal 2025. Japan still needs to keep the goal and continue working toward it because it's difficult to predict how financial markets would react if the target were abandoned, Aso says in response to a lawmaker's question in parliament. (BBG)

BOJ: MNI BRIEF: BOJ Kuroda: ETF Buys Aimed At Lowering Risk Premium

- Bank of Japan Governor Haruhiko Kuroda said on Wednesday that the bank's purchase of exchange traded funds isn't aimed at supporting or boosting stock prices but at lowering the equity risk premium and stabilising financial markets. "We have no plan to stop buying ETFs now," as the purchases are part of the easy policy to achieve the 2% price target, Kuroda said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

SOUTH KOREA: South Korea reported 559 new cases in the last 24 hours, according to data from the Korea Disease Control and Prevention Agency's website. That's the biggest gain in almost two weeks. Health officials blamed the latest surge on cluster outbreaks at dormitory-style cram schools. (BBG)

SOUTH KOREA: The South Korean government is close to finalize the compensation package for self-employed and merchants whose business suffered from state-imposed social distancing measure over the last couple of months. The Ministry of Economy and Finance and the Ministry of SMEs Startups are considering coverage of a fixed amount in payout to self-employed businesses with monthly sales of less than 4 million won ($3,625.5). For business with monthly sales exceeding 4 million won, it is likely to give compensation proportionate to their sales and the amount of damages. (Maeil)

NORTH KOREA: The U.S. and South Korea agreed to "closely cooperate" on denuclearizing North Korea in a telephone call between the new Secretary of State Antony Blinken and Foreign Minister Kang Kyung-wha, South Korea's Foreign Ministry said in a statement. (BBG)

MEXICO: Senate majority leader Ricardo Monreal still backs a bill that would force Banxico to buy cash from Mexican lenders who can't get rid of it, but if it's modified or improved in the lower house, his chamber would act accordingly, according a statement. Dialogue with Finance Ministry, financial intelligence unit, central bank and securities regulators has continued. Monreal said he never wanted to put Banxico's autonomy at risk. Bill considered the interests of the people. (BBG)

BRAZIL: A group of Brazilian companies sought to buy millions of doses of Covid-19 vaccines directly from manufacturers in an attempt to circumvent a national vaccination plan that has been marred by delays and logistical difficulties. (FT)

BRAZIL: President Jair Bolsonaro and his top economic chiefs warned against more fiscal stimulus this year although his economy minister acknowledged it could be necessary if a second wave of Covid-19 hits the poorest Brazilians hard. "We are not going to let temporary crisis-related measures become permanent spending commitments," Bolsonaro said in opening remarks at a virtual investors summit hosted by Credit Suisse. (BBG)

BRAZIL: Brazil's fiscal situation doesn't have much room for stimulus policies, such as emergency aid, unless there's some compensation, central bank president Roberto Campos Neto said during a Credit Suisse event. Brazil has little fiscal space and an unfavorable gross debt situation, Campos Neto said. FX volatility and interest curve show impact of fiscal risk. (BBG)

RUSSIA: US President Joe Biden has warned his Russian counterpart Vladimir Putin about election meddling in their first call, the White House says. The conversation included a discussion about the ongoing opposition protests in Russia and an extension of the last remaining US-Russia nuclear arms pact. Mr Putin congratulated the new US president on winning the election, according to a Russian statement. Both parties said they agreed to maintain contact moving forward. (BBC)

RUSSIA: President Joe Biden believes the Nord Stream 2 natural gas pipeline is a "bad deal for Europe" and his administration will be reviewing restrictions on the project included in a bill that passed during the Trump administration, the White House said on Tuesday. The restrictions on the undersea pipeline project were included in the annual defense policy bill that passed on Jan. 1. Sanctions in the measure apply to any companies helping Gazprom, the Russian state energy company leading the project, to lay pipeline, insure vessels or verify equipment. (RTRS)

RUSSIA: Foreign ministers from the G7 called on Russia to release protesters detained on Saturday following the arrest of jailed Kremlin critic Alexei Navalny. "We are...deeply concerned by the detention of thousands of peaceful protesters and journalists, and call upon Russia to adhere to its national and international obligations and release those detained arbitrarily for exercising their right of peaceful assembly," the group of some of the world's richest nations said. (RTRS)

METALS: China's steel-product demand will grow by a small margin this year as the country intensifies its fight with the coronavirus pandemic and keeps economic stability, the country's top steel association says. China's apparent demand for crude steel +9% last year and steel-product demand +7%, China Iron & Steel Association says in statement on Wednesday, without giving forecasts for this year. Steel-product exports will continue a decline this year while imports will keep rising as the recovery in international demand faces challenges. Group reiterated pledges to ensure iron ore supply, improve steel-scrap supply chain, accelerate low-carbon development. (BBG)

OIL: The Biden administration is expected to announce a temporary suspension of new oil and gas leasing on U.S. federal lands and waters on Wednesday, and to order that nearly a third of federally run acreage is conserved over the next decade, three sources familiar with the matter said on Tuesday. (RTRS)

CHINA

CORONAVIRUS: Health authorities in China on Wednesday reported 55 locally transmitted cases of Covid-19, down for a second day as the country battles multiple outbreaks. China has locked down cities and restricted travel in efforts to contain a series of outbreaks in the north of the country ahead of the lunar new year holiday. (FT)

PBOC: The PBOC may need to inject around CNY900 billion into the financial system in case of a liquidity gap around the mid-February Lunar New Year, the Shanghai Securities News reported citing Ming Ming, the chief analyst at CITIC Securities. The central bank may inject funds through MLF and 14-day reverse repos while avoiding credit flooding, the newspaper said citing Ming. The PBOC will avoid making abrupt changes to its monetary policies so as to balance between economic recovery and risk avoidance, and to stabilize the macro leverage ratio, the newspaper said citing a recent remark by Sun Guofeng, the head of the PBOC's monetary policy department. (MNI)

BONDS: China should consider replacing some existing debts with central government bonds, since local governments are under growing pressure given tightened rules on the sale of special local bonds, the China Securities Journal reported citing industry experts. Local governments should, however, maintain reasonable growth and only debts backed by regulation could be replaced by government bonds, the newspaper cited Zhang Ming, a director from the China Academy of Social Science. Implicit local government debts remain difficult to resolve given their roles supporting the local economy, the newspaper wrote citing Wen Laicheng, a director from the Zhongcai-CSCI Pengyuan Research Institute. (MNI)

OVERNIGHT DATA

CHINA DEC INDUSTRIAL PROFITS +20.1% Y/Y; NOV +15.5%

JAPAN NOV, F LEADING INDEX 96.4; FLASH 96.6

JAPAN NOV, F COINCIDENT INDEX 89.0; FLASH 89.1

AUSTRALIA Q4 CPI +0.9% Y/Y; MEDIAN +0.7%; Q3 +0.7%

AUSTRALIA Q4 CPI +0.9% Q/Q; MEDIAN +0.7%; Q3 +1.6%

AUSTRALIA Q4 CPI TRIMMED MEAN +1.2% Y/Y; MEDIAN +1.1%; Q3 +1.2%

AUSTRALIA Q4 CPI TRIMMED MEAN +0.4% Q/Q; MEDIAN +0.4%; Q3 +0.3%

AUSTRALIA Q4 CPI WEIGHTED MEAN +1.4% Y/Y; MEDIAN +1.2%; Q3 +1.2%

AUSTRALIA Q4 CPI WEIGHTED MEAN +0.5% Q/Q; MEDIAN +0.4%; Q3 +0.2%

AUSTRALIA DEC NAB BUSINESS CONFIDENCE 4; NOV 13

AUSTRALIA DEC NAB BUSINESS CONDITIONS 14; NOV 7

Business conditions rose further in December to its highest level since late 2018 at 14pts. This marks a fourth consecutive month of improvement and, encouragingly, employment conditions are back in positive territory for the first time since the start of the pandemic. Business conditions are now well above average, suggesting there is strong momentum in Australia's economic recovery. In contrast, business confidence fell back to 4pts, as confidence pulled back in NSW, Victoria and Queensland. In part, this likely reflects the impact of the Sydney COVID-19 outbreak through December. Elsewhere, capacity utilisation saw further gains and is now around its long-run average (and pre-virus levels), while forward orders pulled back but remain in positive territory. These leading indicators suggest the pipeline of work continues to build - pointing to an ongoing recovery in the months ahead. Most indicators within the survey are now broadly at or above pre-virus levels, with the exceptions being export conditions – no surprise given the pandemic continues to disrupt global trade – and capital expenditure. That said, capex has been recovering since reaching a trough in mid 2020 and, should conditions remain elevated, will likely turn positive again as businesses renew investment plans, especially given government tax incentives in place. (NAB)

AUSTRALIA DEC WESTPAC LEADING INDEX +0.12% M/M; NOV +0.68%

While we may have seen the peak in the growth rate of the Index it is still signalling healthy above trend growth for the Australian economy in the first half of 2021. This is consistent with Westpac's view that the economy will grow by 4% in 2021. With activity rebounding strongly in the second half of 2020 we expect the economy to be operating at around its pre-COVID level by the June quarter. This will be an exceptional result, comparing very favourably with other developed economies. Over the six months between June and September the growth rate lifted extremely sharply, swinging from -4.16% to +4.18%. Almost all components of the Index contributed to this improvement, the sole exception being a smaller positive contribution from the yield curve which took 0.20ppts off the headline growth rate. (Westpac)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 111.2; PREV. 108.7

The improvement in consumer confidence comes on the back of further good news on the labour market front, notably the drop in the unemployment rate to 6.6% in December. The absence of community transmitted COVID-19 cases for a number days and the relaxation in border rules has likely also supported confidence. Sentiment about current and future economic conditions has surged and both are now above their long-run averages, for the first time since mid-2019. Weekly inflation expectations accelerated 0.2ppt. This could be on back of the up-tick in petrol prices. The national average retail petrol price rose more than 14 cents in the week to 24 January, ahead of the long weekend, according to the Australian Institute of Petroleum. (ANZ)

SOUTH KOREA JAN CONSUMER CONFIDENCE 95.4; DEC 91.2

UK JAN BRC SHOP PRICE INDEX -2.2% Y/Y; DEC -1.8%

CHINA MARKETS

PBOC NET DRAINS CNY100BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY180 billion via 7-day reverse repos with the rate unchanged on Wednesday. This resulted in a net drain of CNY100 billion given the maturity of CNY280 billion of reverse repos today, according to Wind Information.

- Fiscal expenditures have increased significantly near the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.7866% at 09:26 am local time from 2.7851% at Tuesday's close.

- The CFETS-NEX money-market sentiment index closed at 65 on Tuesday, flat from the close of Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4665 WEDS VS 6.4847

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4665 on Wednesday. This compares with the 6.4847 set on Tuesday.

MARKETS

SNAPSHOT: Markets Muted Into FOMC

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 83.17 points at 28629.35

- ASX 200 down 44.111 points at 6780.6

- Shanghai Comp. up 1.907 points at 3571.336

- JGB 10-Yr future down 5 ticks at 151.94, yield down 0.3bp at 0.035%

- Aussie 10-Yr future down 2.5 ticks at 98.905, yield down 2.2bp at 1.089%

- U.S. 10-Yr future unch. at 137-12, yield up 0.17bp at 1.036%

- WTI crude up $0.26 at $52.87, Gold down $3.51 at $1847.50

- USD/JPY up 11 pips at Y103.73

- ECB STUDYING IF DIFFERENCES WITH FED POLICY BOOSTING EURO (BBG)

- YELLEN CITES TREASURY-FED COORDINATION IN NEW CRISIS CAMPAIGN (BBG)

- BIDEN TEAM TO BUY 200 MILLION MORE VACCINE DOSES, SPEED UP VACCINATIONS (BBG)

- GERMANY PRESSES BRUSSELS FOR POWERS TO BLOCK VACCINE EXPORTS (FT)

- JOHNSON PROMISES PLAN TO EASE UK LOCKDOWN IN COMING DAYS, WEEKS (BBG)

- CHINA CALLS STRAIT DRILLS 'STERN WARNINGS' TO EXTERNAL FORCES (BBG)

BOND SUMMARY: Coiling Into FOMC

T-Notes coiled in Asia-Pac trade, in a typical pre-FOMC decision setup for the timezone, last dealing unch. at 137-12. The modest bear steepening seen after the re-open was unwound with cash Tsys now hovering around unchanged levels across the curve. Eurodollar futures are unchanged through the reds, with volume there particularly light. Flow has been dominated by the now familiar TYJ1 risk reversal block trade (with another 10K of TYJ1 133.50 puts lifted against TYJ1 138.00 calls).

- It was another limited Tokyo session for JGBs, with the cash space little changed out to 10-Years, and slightly softer further out, while swap spreads are a touch wider across the curve. JGB futures stuck to the range established in overnight trade, last -6. The latest round of BoJ Rinban operations saw the purchase sizes held steady, with the following cover ratios observed: 1-3 Year: 3.18x (prev. 3.01x), 10-25 Year: 4.82x (prev. 4.78x).

- Aussie bonds added to the early Sydney weakness on the back of the slightly stronger round of domestic Q4 CPI print, although most of the gains were fuelled by mechanical moves (tax hikes and subsidy rollback) as opposed to demand-side matters, with all 3 of the major Y/Y metrics still some way shy of the magic 2.0% mark. This allowed the longer end to recover from worse levels of the day, with YM -0.5 and XM -3.0 at typing (cash trade played catch up on the back of Tuesday's local holiday).

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y570bn of JGB's from the market, sizes unchanged from previous operations.

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

EQUITIES: Mixed, Tech Outperforms Again

A mixed day for stocks in Asia; in China major bourses have drifted lower, as have South Korean and Australian exchanges. Japan, Hong Kong and Taiwan have fared better and are in minor positive territory, but have retreated from highs. Equity markets in the region endured their biggest slide in two months yesterday, which helps explain some of the mixed price action.

- US futures are also mixed, e-minis in the red but once again the Nasdaq is the outperformer after Microsoft and AMD reported strong earnings. Markets await earnings updates from Apple, Facebook and Tesla due today.

OIL: Inventory Draw Helps Oil Ease Higher

Oil edged higher in Asia on Wednesday; WTI is up $0.26 at $52.87, brent is $0.24 higher at 56.16.

- Markets digest the API stockpile data after-market yesterday which showed headline crude inventories fell by 5.27m bbls last week, while stocks at Cushing fell 3.48m bbls. Upside was tempered by builds in both downstream product measures. Markets will now look towards the more comprehensive DoE inventory data in the US session.

- OPEC Secretary-General Mohammad Barkindo was optimistic yesterday at the Iranian Petroleum and Energy Club Congress and Exhibition.: "With the market currently switching into backwardation, we are hopeful that 2021 will be a good year," he said.

GOLD: Rangebound

Gold is a touch softer over the last 24 hours, although bullion has stuck to the range witnessed in recent sessions, even with the DXY marginally lower over that timeframe, while U.S. real yields have seen little net movement. Spot last deals a handful of dollars lower vs. closing levels, last printing $1,845/oz. Known ETF holdings of gold continue to flatline after that metric's pullback from October's all-time high at the back end of 2020, although the measure remains very much elevated in historical terms.

FOREX: Caution Prevails In Limited Asia Session, FOMC Decision Eyed

Macro headline flow was light in Asia-Pac hours, with G10 FX pairs happy to hug relatively tight ranges as a degree of caution crept in. The DXY edged higher but was nowhere near erasing yesterday's losses, CHF also gained on the back of risk-off feel. JPY failed to appreciate alongside its safe haven peers.

- CAD led commodity-tied FX space lower, even as crude oil inched higher. AUD gave away gains registered in reaction to a beat in Australian CPI data, with main driving factors (tobacco tax hikes, matters surrounding childcare costs) under scrutiny.

- PBOC set USD/CNY reference rate at CNY6.4665, 30 pips above sell side estimates – the second straight day of a significant miss which again underscores the PBOC's asymmetric response function to the yuan. The bank drained a net CNY100bn via OMO's, after a CNY78bn drain yesterday.

- GBP crosses were rangebound amid continued speculation re: the UK's next steps in its fight with coronavirus. The Times reported that the UK gov't will opt for a limited hotel quarantine system, applying it only to travellers arriving from the highest-risk countries.

- Focus turns to the FOMC MonPol decision, flash U.S. durable goods, German & French consumer confidence gauges, Swedish trade balance as well as comments from ECB's Lane & Villeroy and Riksbank's Breman.

FOREX OPTIONS: Expiries for Jan27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E594mln), $1.2100(E714mln), $1.2150(E612mln), $1.2190-00(E1.4bln), $1.2250(E1.45bln), $1.2285-00(E715mln)

- USD/JPY: Y102.00-05($596mln), Y103.25-45($625mln), Y103.95-10($819mln), Y104.50-65($922mln)

- GBP/USD: $1.3690-1.3700(Gbp383mln-GBP puts)

- AUD/USD: $0.7500(A$1.2bln), $0.7640-50(A$543mln), $0.7750-65(A$612mln-AUD puts)

- AUD/NZD: N$1.0665(A$530mln)

- USD/CAD: C$1.2600($940mln-USD puts), C$1.2750-65($845mln-USD puts), C$1.2850-60($925mln)

- USD/CNY: Cny6.42($1.0bln), Cny6.4960($880mln), Cny6.55($525mln)

- USD/MXN: Mxn19.77($635mln)

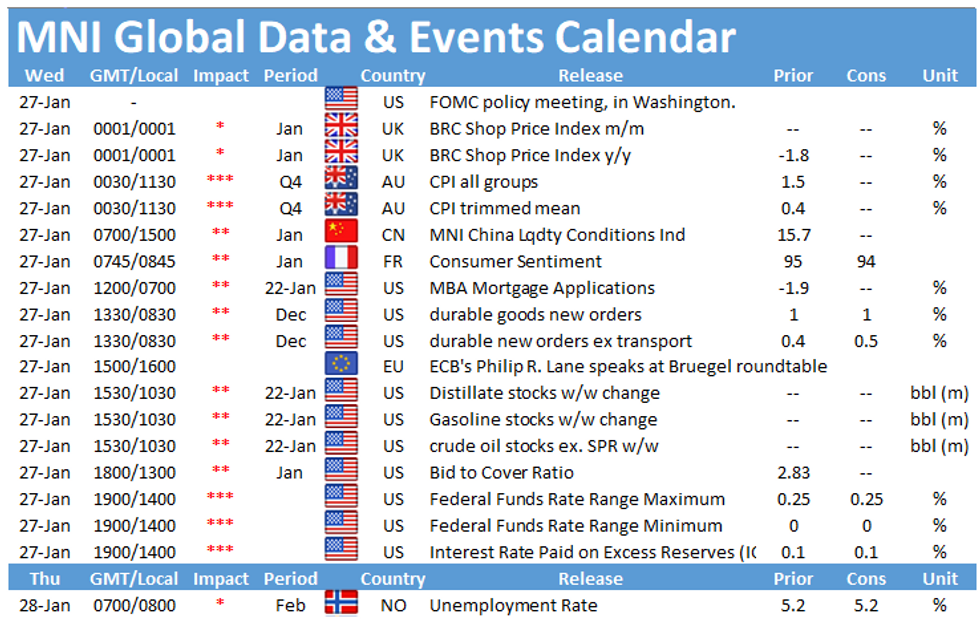

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.