-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI EUROPEAN OPEN: DXY Higher After Powell Provides No Surprises

EXECUTIVE SUMMARY

- POWELL PLEDGES PATIENCE ON QE AND INFLATION (MNI)

- BLINKEN VOWS TO CONFRONT, COOPERATE WITH CHINA IN FIRST REMARKS AT THE STATE DEPARTMENT (THE HILL)

- ECB'S CENTENO: CRISIS CAN'T BE ALLOWED TO BECOME A FINANCIAL CRISIS (BBG)

- EU FAILED TO SWAY ASTRAZENECA TO TAP UK SUPPLY FOR VACCINES (BBG)

- STUDIES SHOW PFIZER VACCINE EFFECTIVE AGAINST COVID VARIANTS (BBG)

- PBOC IS EXPECTED TO OFFER LIQUIDITY BOFORE CNY HOLIDAY (CSJ)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain has more than enough coronavirus vaccines for this year and could eventually donate them to other countries, senior industry sources told The Times last night. They said that Britain had secured the doses needed to meet its targets and expected its deals with pharmaceutical companies to be honoured. (The Times)

CORONAVIRUS: There are tentative signs that the lockdown in England is beginning to curb coronavirus transmission, according to a closely watched study, although stubbornly high infection rates will continue to strain the overstretched healthcare system. The React-1 study, led by Imperial College London, concluded that prevalence of the virus had started to flatten last week, with initial indications of a small decline. Researchers estimated that the reproduction number R, which measures the average number of people one individual infects, was between 0.92 and 1.04, with a central estimate of 0.98 — suggesting that the rate of infection is close to stable or falling slightly. (FT)

CORONAVIRUS: The government will soon outline its plan for reopening schools, the economy and society, UK prime minister Boris Johnson confirmed on Wednesday. Speaking at a televised Downing Street briefing, Mr Johnson said that in the week commencing February 22, the government would put forward its "roadmap" to lifting restrictions, beginning with schools. (FT)

CORONAVIRUS: Boris Johnson overruled his education secretary yesterday and announced that schools in England will not reopen until March 8 at the earliest. The prime minister insisted it was right to "buy the extra weeks we need" to vaccinate the most vulnerable and said that the country was in a "perilous situation". The Times has been told that the delay was resisted by Gavin Williamson, the education secretary, at a meeting of the government's Covid-19 operations committee in the morning. He had been pushing for schools to reopen after the February half-term but this was rejected by the prime minister, who was chairing the meeting. (The Times)

FISCAL: Rishi Sunak has told Tory MPs that implementing tax rises soon will hand the Government greater leverage to slash them ahead of the next election in 2024. (Telegraph)

ECONOMY: UK car production slumped to its lowest level since 1984 last year as the coronavirus pandemic disrupted factories and depressed demand, industry figures show. Brexit uncertainty was also partly to blame as the number of vehicles manufactured in Britain fell by 29.3% to 920,928, according to the Society of Motor Manufacturers and Traders (SMMT). SMMT chief executive Mike Hawes said a total of around 10,000 job losses were announced over the year by carmakers and suppliers. (Sky)

POLITICS: Just 4% of Conservative voters are switching to Labour almost a year into Keir Starmer's leadership, polls suggest, and Labour insiders fear the party could lose a slew of council seats in May's local elections. Labour officials have been briefing that a "standstill" result, where the party gains no seats and minimises losses, would be a good outcome. One source said internal party projections in March 2020, in the wake of Boris Johnson's landslide general election victory, suggested the party would lose 400 council seats and lose control of some local authorities, including Plymouth, Amber Valley, and Harlow. Elections in May 2020 were subsequently cancelled because of the coronavirus pandemic. (Guardian)

SCOTLAND: Boris Johnson is flying into a storm of protest with a visit to Scotland that First Minister Nicola Sturgeon claims is not an essential journey. The prime minister is heading to Scotland on a one-day trip aimed at highlighting the value of the United Kingdom in fighting the coronavirus pandemic. The PM's controversial visit is part of a Tory fightback against polls suggesting growing support for independence and Ms Sturgeon's threat to hold an advisory referendum. (Sky)

EUROPE

ECB: "We had a health crisis, it became economic immediately, and we can't allow it to become a financial crisis," ECB Governing Council Member Mario Centeno says. "That risk is always latent," Centeno, who is also the governor of the Bank of Portugal, says in an interview with RTP3. (BBG)

FISCAL: MNI EXCLUSIVE: Eurozone To Decide 2022 Fiscal Stance By June

- Eurozone finance ministers will determine the bloc's most appropriate fiscal stance for 2022 by June, which could be crucial for the eventual decision on when to reimpose the strict limits on public debt included in the Stability and Growth Pact, EU officials told MNI. It had previously been expected that the general escape clause of the Stability and Growth Pact could be deactivated at the end of 2021, but concerns are mounting over a possible double-dip recession this year amid a sluggish vaccine rollout and tightened Covid restrictions - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ITALY: Italy is racing to find a way to take 10 billion euros ($12.1 billion) of legal risks off the books of Banca Monte dei Paschi di Siena SpA to persuade UniCredit SpA to take over the troubled bank. The finance ministry -- pushing ahead with the plans amid political instability -- wants a group of investors including state-backed Sace Spa to insure the liabilities, people with knowledge of the matter said. The ministry is renewing the plans after an earlier attempt to transfer them to another state-owned company was dropped, the people said, asking not to be identified as the matter is private. (BBG)

CORONAVIRUS: The European Union remains at loggerheads with AstraZeneca Plc after the Anglo-Swedish drugmaker refused to cave to demands that it take vaccine supplies from its U.K. factories to increase doses going to the bloc. The root of the dispute is Astra's decision to prioritize the U.K. over the EU following a Belgian production glitch, in what Brussels claims to be a breach of contractual commitments. The two sides spoke Wednesday evening and held their ground with another meeting expected. (BBG)

PORTUGAL: Portugal is considering asking other EU countries for medical assistance as the country's hospitals struggle to cope with one of the world's fast-growing outbreaks of coronavirus. António Lacerda Sales, secretary of state for health, said on Wednesday a request for aid through EU co-operation mechanisms was under consideration but had not yet been formalised. (FT)

NORWAY: Norway put in place the strictest border controls since March to reduce the risk of the more infectious variant of the virus taking hold. Foreign nationals that aren't residents of Norway and don't have close family in the country will be denied entry from Thursday night, Prime Minister Erna Solberg said at a press conference in Oslo. (BBG)

U.S.

FED: MNI POLICY: Fed Says Economy Has Slowed, Maintains QE and Rate

- The Federal Reserve said Wednesday the economy's momentum has slowed in recent months and progress partly depends on the pace of Covid-19 vaccinations, while keeping guidance on QE worth USD120 billion per month and near-zero interest rates. "The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic," the Federal Open Market Committee said in its post-meeting statement - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI STATE OF PLAY: Powell Pledges Patience On QE and Inflation

- Federal Reserve Chair Jerome Powell on Wednesday said it's premature to discuss pulling back asset purchases and batted away worries about a lasting inflation surge, especially with the economy hurt in the short term by a slow Covid-19 vaccine rollout. Some of his strongest comments from a press conference countered market perceptions about inflation running away, saying significant forces have restrained global prices for decades and that dynamic isn't likely to change. "Expect us to wait and see and not react if we see small and what we would view as very likely to be transient effects on inflation," Powell said. That includes an expected jump in 12-month inflation as last year's weakness shifts the price index as well as a potential rush to go back to bars, restaurants and hotels, he said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CORONAVIRUS: The US on Wednesday reported more than 4,000 coronavirus deaths in a single day for the first time a week, although hospitalisations continued to drop. Authorities attributed a further 4,077 fatalities to coronavirus, according to Covid Tracking Project data. (FT)

CORONAVIRUS: Top U.S. health agencies will collaborate to study how effective Covid-19 vaccines are against mutated strains of the virus that have been discovered in various parts of the world, White House health advisor Dr. Anthony Fauci said Wednesday. The Centers for Disease Control and Prevention is working to ramp up the country's capacity to conduct genomic sequencing and monitor for mutations of the virus, CDC Director Dr. Rochelle Walensky said Wednesday at a White House Covid-19 briefing. (CNBC)

CORONAVIRUS: US public health officials have changed their vaccination advice to make it easier for people to get a second shot, saying injections can be spaced up to six weeks apart in certain circumstances, and can even be from a different manufacturer from the first shot if necessary. (FT)

CORONAVIRUS: Infectious disease expert Anthony Fauci highlighted the need to address racial disparities in the COVID-19 vaccination process, per an interview with The New England Journal of Medicine on Wednesday. (Axios)

CORONAVIRUS: The U.S. Travel Association, an industry group that lists major hotel chains, Airbnb and several large airports among its members, is urging the Biden administration not to require Covid tests for domestic travel. (CNBC)

CORONAVIRUS: New York has seen the worst of its post-holiday coronavirus outbreak and will begin lifting restrictions on much of the state, but more contagious strains of the virus that have recently emerged could impede that progress, Gov. Andrew Cuomo said Wednesday. Triggered by dinners with family and friends, the holiday surge appears to have peaked in New York on Jan. 4 when the positivity rate, or the percentage of Covid tests returning positive, reached about 8% across the state. That figure has since dipped to roughly 5.6%, Cuomo said. (CNBC)

CORONAVIRUS: Texas National Guard troops are being deployed to remote areas to vaccinate rural populations that can't access clinics in towns and cities. (BBG)

POLITICS: The Department of Homeland Security issued its first-ever national terrorism bulletin about violent domestic extremists, warning they could attack in the coming weeks, emboldened by the Jan. 6 riot at the U.S. Capitol. DHS, in an advisory Wednesday, said violent extremists opposed to the government and the presidential transition "could continue to mobilize to incite or commit violence," though the department said it doesn't have evidence of a specific plot. (The Hill)

POLITICS: Sens. Tim Kaine (D-Va.) and Susan Collins (R-Maine) are forging ahead with a draft proposal to censure former President Trump, and are considering introducing the resolution on the Senate floor next week. (Axios)

POLITICS: The head of the Republican National Committee on Wednesday declined to encourage former President Donald Trump to run for the White House in 2024, saying the GOP would stay "neutral" in its next presidential primary. In an interview, RNC Chairman Ronna McDaniel also described the pro-Trump conspiracy theory group known as QAnon as "dangerous." (Associated Press)

EQUITIES: Apple reported blowout earnings on Wednesday. Even during a global pandemic, every single product line was up, leading to the company's first quarter with over $100 billion in sales. But Apple is still best known for the iPhone, which accounted for nearly 59% of the company's revenue during the holiday quarter. The iPhone is booming, too: Sales were up 17% year-over-year to a whopping $65.6 billion in a single quarter. That's a big improvement from last year's holiday quarter, when sales were up only 7.6% from the year ago. (CNBC)

EQUITIES: The market mania that has become GameStop -- shares closed Wednesday up more than 1,600% since the start of the year -- found itself a topic of conversation at both The White House and The Federal Reserve Wednesday. At the Biden administration's daily press briefing, White House Press Secretary Jen Psaki told the media that Biden's "economic team, including Secretary Yellen and others, are monitoring the situation," referring to the Game Stop spikes. (FOX)

EQUITIES: The Securities and Exchange Commission on Wednesday said it is "aware of and actively monitoring the on-going market volatility in the options and equities markets," in a statement that did not directly mention GameStop Corp. Earlier Wednesday, the White House said it was watching the huge moves made by the company and some other stocks. The SEC's acting chair Allison Herren Lee and other officials said they were working with fellow regulators "to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants." (MarketWatch)

OTHER

U.S./CHINA: Secretary of State Antony Blinken on Wednesday committed to confronting China while also seeking to cooperate on shared interests such as climate change. "It's not a secret that the relationship between the United States and China is arguably the most important relationship that we have in the world going forward," he said in response to reporters' questions during his first press conference as secretary of State. "Increasingly, that relationship has some adversarial aspects to it," he said, labeling Beijing as both a competitor and a necessary partner on combating climate change. (The Hill)

U.S./CHINA: The Biden administration will work to safeguard American telecoms networks from "untrusted vendors" like Huawei Technologies Co Ltd that threaten national security, the White House said on Wednesday, offering some insight into its plans for China's top telecoms equipment company, long in Washington's crosshairs. (RTRS)

U.S./CHINA/JAPAN: Japanese Prime Minister Yoshihide Suga said on Thursday he had agreed with U.S. President Joe Biden in a phone call to strengthen their bilateral alliance, as China expands its economic and military might. (RTRS)

U.S./EUROPE: Germany's foreign minister questioned whether transatlantic sanctions are appropriate even if Washington and Berlin have policy differences following a constructive first phone call with new U.S. Secretary of State Antony Blinken on Wednesday. (RTRS)

CORONAVIRUS: Pfizer Inc. and BioNTech SE said results of studies indicate their vaccine is effective against both the U.K. and South Africa variants. Research found that neutralization against the virus with key mutations present in the South African variant was slightly lower compared to neutralization of virus containing other mutations. But the companies believe the small difference is unlikely to lead to a significant reduction in the effectiveness of the vaccine. They said the findings don't indicate the need for a new vaccine to address the emerging variants. (BBG)

HONG KONG: The Hong Kong Monetary Authority will continue to monitor market developments and maintain monetary and financial stability with the dollar peg, a spokesperson for the regulator says in emailed statement. Hong Kong's money markets have been operating smoothly, with ample liquidity in banking system. HKD interest rates also remain steady. (BBG)

JAPAN: The International Olympic Committee remains "fully concentrated and committed" to holding the Tokyo Olympic games on July 23 this year, President Thomas Bach said in a press briefing on Wednesday. Bach said the IOC is "gaining even more confidence from the effectiveness of the countermeasures" to combat the spread of the Covid-19 pandemic. (BBG)

JAPAN: Nearly 60% of the 100 major Japanese companies surveyed by public broadcaster NHK said the Tokyo Olympics should go ahead as planned. 48 companies said the Olympics should be scaled down but be held as scheduled and 13 firms said the games should be held in near-complete form. 3 companies said the games shouldn't be held in July. 36 refrained from answering. The survey was conducted between Dec. 23 and Jan. 15. (BBG)

AUSTRALIA: Australia's Queensland will reopen it's border to the nation's most populous state starting Feb. 1 after a spate of Covid cases saw entry restricted in December. Visitors from Greater Sydney will no longer be required to quarantine in a hotel upon arrival, Premier Annastacia Palaszczuk said on Wednesday. New South Wales has had no cases of Covid-19 for 10 days, and in Victoria, 21 days have passed without a transmission. Australia has recorded 28,786 cases of coronavirus and 909 deaths. (BBG)

AUSTRALIA/CHINA: Australia raised concerns about the strategic threats to be posed by a Chinese fishery park project on Daru Island of Papua New Guinea (PNG), but Canberra is expected to gradually accept the fact that China has the ability and right to cooperate with and invest in Pacific island countries. (Global Times)

AUSTRALIA/NEW ZEALAND: Australia suspended its travel bubble with New Zealand for another 72 hours after two more cases of Covid-19 were reported in Auckland. New Zealand health officials are investigating the cases, which are linked to a woman who was likely infected with the South African variant of the virus while in mandatory isolation at a quarantine hotel for returned overseas travelers. The facility has been closed to new arrivals. The suspension of the bubble underlines the difficulties of restarting broad international travel even between countries such as New Zealand and Australia that have been highly successful in limiting community transmission of the virus. (BBG)

SOUTH KOREA: South Korea reported a drop in new cases to 497 after hitting a two-week high yesterday when cluster outbreaks at dormitory-style cram schools reversed a downward trend. Daily new infections had been falling for about two weeks, hovering between 300 to 400, before the school outbreaks that prompted health officials to remind the public to follow stricter social distancing measures, including a ban on private gatherings of more than five people. Health officials have said they may ease the social distancing measures if the number of cases fall below 400 for a week. (BBG)

SOUTH KOREA: The International Monetary Fund (IMF) recommended Thursday that South Korea further carry out accommodative fiscal and monetary policies, including rate cuts, in a bid to accelerate its economic recovery amid the pandemic. Despite rising budget deficit, the country also has fiscal room for increasing targeted support to people and businesses hit hard by the new coronavirus outbreak, according to Andreas Bauer, Korea mission chief at the IMF. (Yonhap)

BOJ: The Bank of Korea (BOK) said Thursday it will end a special loan scheme for local banks, brokerages and insurers next month as financial markets have stabilized from the fallout of the pandemic. In May 2020, the BOK launched the 10 trillion-won (US$8.9 billion) lending program to allow banks, brokerages and insurers to take out loans from the central bank against collateral in a bid to ease their potential funding squeeze. The BOK's monetary policy board decided to end the operation of the special loan facility on Feb. 3 without further extension. The bank has so far extended the program by three months twice. (Yonhap)

SOUTH KOREA: Prime Minister Chung Sye-kyun said at a forum that South Korea should improve system for stock short-selling before resuming it. Chung said the country can't ban short-selling indefinitely. Still, South Korea cannot ban the stock short-selling forever as other nations adopt the short-selling. (BBG)

MEXICO: Mexico's central bank said on Wednesday the country's short-term economic policy needs to focus on attracting more investment and reducing internal economic uncertainty to help steer a sustained recovery from the impact of the coronavirus pandemic. In a report, the central bank said Mexico should continue working to correct institutional and structural problems that have led to low levels of investment and productivity. (RTRS)

MEXICO: Mexican President Andres Manuel Lopez Obrador is resting and in isolation at the National Palace in Mexico City after testing positive for Covid-19, his spokesman said in an interview. AMLO, as Lopez Obrador is known, had a slight fever on Sunday, the day he was diagnosed with the virus, but took a mild medication akin to paracetamol that brought down his temperature, spokesman Jesus Ramirez told Bloomberg News on Wednesday. The president has been holding calls with cabinet members, he said. (BBG)

TURKEY: Bilateral talks between Turkey and Greece to resolve long-standing maritime disputes, which resumed on Monday after a five-year hiatus, were held in a "very positive" atmosphere, Turkish Foreign Minister Mevlut Cavusoglu said on Wednesday. The neighbouring NATO members held 60 rounds of talks from 2002 to 2016 to address disagreements over energy rights, claims to Mediterranean waters, air space and the status of some Aegean islands, but with little progress. Talks resumed on Monday in Istanbul after months of tension, and pressure from the European Union. (RTRS)

BRAZIL: Brazil's public debt load is expected to soar toward 6 trillion reais ($1.11 trillion) this year, the country's Treasury said on Wednesday, after record government borrowing last year to combat the COVID-19 pandemic pushed it above the 5 trillion mark for the first time. Setting out its 2021 debt forecasts and financing plans, Brazil's Treasury said it aims to sell more fixed rate and less floating rate debt, as official borrowing costs could rise, and that it expects Brazil's debt profile to continue shortening. (RTRS)

RUSSIA: In his first news conference since being confirmed as secretary of State, Antony Blinken expressed "deep concern" over the treatment of Alexei Navalny and the broader human rights situation in Russia. Last week, Navalny, a critic of Russian President Vladimir Putin, flew to Russia from Berlin, where he had spent nearly half a year recovering since he was allegedly poisoned last summer. He was detained on arrival in Moscow. (CNBC)

RUSSIA: Moscow will lift curbs on restaurants and bars operating at night, as Russia's president warned the pandemic would drag on for months. Nightclubs, bars, discos, karaoke, bowling and other leisure and entertainment facilities will be able to operate later than 11pm from Thursday, provided they comply with capacity and social distancing restrictions, Moscow mayor Sergey Sobyanin wrote on Wednesday. (FT)

IRAN: Secretary of State Antony Blinken said the U.S. will meet its commitments under the Iran nuclear deal only after leaders in Tehran do so, highlighting a dispute that's set to become one of the Biden administration's most politically charged foreign-policy challenges. In his first briefing as America's top diplomat, Blinken told reporters Wednesday that the U.S. wants to start meeting its obligations again under the Joint Comprehensive Plan of Action, from which former President Donald Trump withdrew in 2018. (BBG)

MIDDLE EAST: The Biden administration has imposed a temporary freeze on U.S. arms sales to Saudi Arabia and is scrutinizing purchases by the United Arab Emirates as it reviews billions of dollars in weapons transactions approved by former President Donald Trump, according to U.S. officials. The review, the officials said, includes the sale of precision-guided munitions to Riyadh, as well as top-line F-35 fighters to Abu Dhabi, a deal that Washington approved as part of the Abraham Accords, in which the Emirates established diplomatic relations with Israel. (WSJ)

OIL: President Joe Biden on Wednesday said he will ask the U.S. Congress to eliminate subsidies for fossil fuels on a day he signed executive actions to combat climate change. The comments and orders map out the direction for the Democratic president's climate change and environmental agenda. They mark a reversal from former President Donald Trump, a Republican businessman-turned-politician who sought to maximize U.S. oil, gas and coal output by removing regulations and easing environmental reviews. (RTRS)

CHINA

CORONAVIRUS: Health authorities in China reported 41 locally transmitted cases of Covid-19 on Thursday, the lowest level since early January. The number of Covid-19 cases fell for a third day, dropping to the lowest since January 8, suggesting control measures have slowed a series of outbreaks that were the largest since the pandemic began. (FT)

CORONAVIRUS: Beijing has stepped up requirements for entering the city ahead of a meeting in March that will be China's largest political gathering of the year. Travelers from medium- and high-risk areas for the coronavirus are in principle barred from entry while those traveling from low-risk regions need to provide a negative Covid-19 test result taken within seven days of entry, China Central Television reported on Wednesday, citing a local government briefing. The requirements were set to take effect Thursday and last to March 15, according to the state broadcaster. (BBG)

POLICY: China will strive to complete more than 70% of its three-year plan for reforming state-owned companies by the end of the year, according to a government statement following a meeting chaired by Vice Premier Liu He. SOEs should focus on improving efficiency, strengthen their innovation incentives so they can play a leading role in achieving technological self-reliance, as well as reduce corporate management levels and tighten supervision and shareholder responsibilities, the statement read. (MNI)

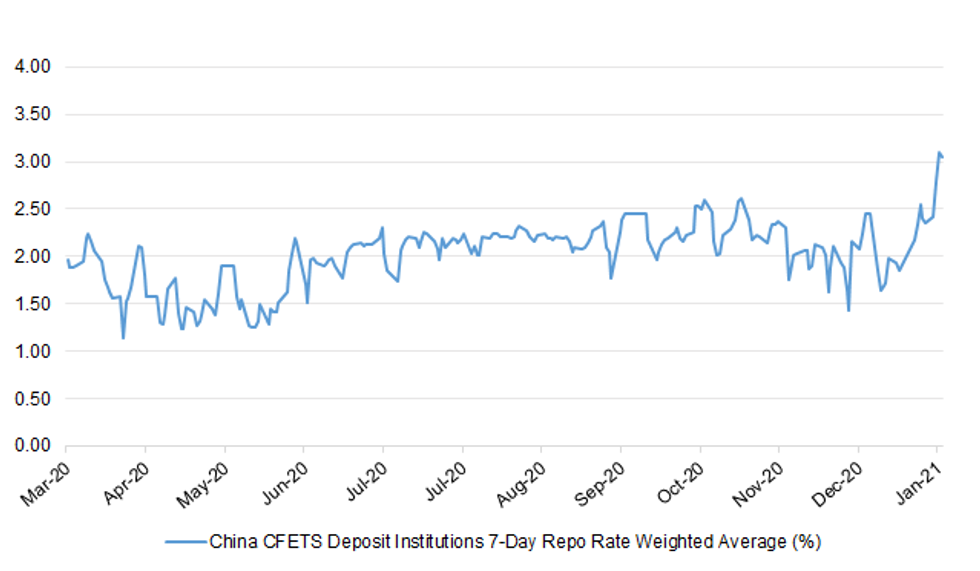

PBOC: There is no need to worry about continued liquidity tightening as the central bank is expected to offer necessary liquidity support at an appropriate time to address any shortage before the Spring Festival, China Securities Journal says in a commentary, citing unidentified analysts. Chinese central bank's caution over liquidity injection may be related to recent rapid rise in some asset prices. Another reason why PBOC delays liquidity release is that pre-holiday cash demand may not be as strong this year as the government has been encouraging people to reduce mass holiday travel amid Covid-19 outbreaks in some provinces. (BBG)

PBOC: The PBOC may inject liquidity through the contingent reserve arrangement (CRA) and the temporary liquidity facility (TLF) to curb surging funding rates before the Lunar New Year, China Securities Journal reported citing Yang Yewei from Guosheng Securities. China's funding rates have risen sharply on tight liquidity after net fund drains by the PBOC in the past week, the newspaper wrote. The PBOC may hope to avoid excessive rises in asset prices through controlling liquidity, the newspaper reported citing analysts. The PBOC might also see decreasing cash demand after policies halting the annual holiday migration due to pandemic control, the newspaper said. (MNI)

FISCAL: MNI POLICY: China Tax Revenue on Personal Incomes Up 11%

- China's tax revenue from individual incomes increased by 11.4% y/y as salaries rose amid the recovery from the Covid-19 pandemic and as capital gains increased through channels such as equity transfers, according to the Ministry of Finance Despite this, the overall fiscal revenue came in at CNY18.29 trillion, dropping 3.9% y/y, in 2020. The Ministry said in Thursday's online press conference that the result was better than expected as large-scale relief policies, including tax cuts and direct fiscal transfers, helped the economy to recover after Q1 last year. Tax revenue increased by 4.7% in Q3 and 5.5% in Q4 2020 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

LGFVS: China's local governments face a record amount of maturing off-balance sheet debt this year and attempts to deal with that could undercut the economy's recovery. About 2.14 trillion yuan ($330 billion) of bonds sold by local government financing vehicles, or LGFVs, will mature this year, according to Bloomberg calculations, a record high since the debt was first issued more than two decades ago. Combined with a slowdown in revenue since 2018, that will make it harder for local governments to increase spending to support economic growth, especially as policy makers try to cut the amount of new credit. (BBG)

BANKING: China's Liaoning province will merge 12 city commercial banks into a provincial-level bank to ensure sufficient capital and better governance, according to a statement posted on the central bank website. The provincial government will take the lead in the overall reform and introduce the new bank to the Liaoning Financial Holdings Group and other large strategic investors, the statement said. (MNI)

FINTECH: The China Banking and Insurance Regulatory Commission aims to improve its regulation of high-risk agencies as a way of supporting China's development, the regulator said after its annual work meeting on Wednesday. The CBIRC will curb monopolies and unguided capital expansion by fintech companies, while also strengthening supervision over shadow banking, the statement stressed. The CBIRC will accelerate the disposal of non-performing assets and strictly regulate high-risk institutions to stabilize the macro leverage ratio, the statement said. (MNI)

OVERNIGHT DATA

JAPAN DEC RETAIL SALES -0.3% Y/Y; MEDIAN -0.5%; NOV +0.6%

JAPAN DEC RETAIL SALES -0.8% M/M; MEDIAN -0.7%; NOV -2.1%

JAPAN DEC DEPT STORE, SUPERMARKET SALES -3.5% Y/Y; MEDIAN -3.7%; NOV -3.4%

AUSTRALIA Q4 EXPORT PRICE INDEX +5.5% Q/Q; MEDIAN +5.3%; Q3 -5.1%

AUSTRALIA Q4 IMPORT PRICE INDEX -1.0% Q/Q; MEDIAN -1.0%; Q3 -3.5%

NEW ZEALAND DEC TRADE BALANCE +NZ$17MN; MEDIAN +NZ$800MN; NOV +NZ$290MN

NEW ZEALAND DEC TRADE BALANCE 12 MTH YTD +NZ$2.937BN; NOV +NZ$3.300BN

NEW ZEALAND DEC EXPORTS +NZ$5.35BN; MEDIAN +NZ$5.65BN; NOV +NZ$5.21BN

NEW ZEALAND DEC IMPORTS +NZ$5.33BN; MEDIAN +NZ$4.85BN; NOV +NZ$4.92BN

SOUTH KOREA FEB BUSINESS SURVEY M'FING 81; JAN 77

SOUTH KOREA FEB BUSINESS SURVEY NON-M'FING 70; JAN 64

SOUTH KOREA DEC DISCOUNT STORE SALES +2.1% Y/Y; NOV -4.1%

SOUTH KOREA DEC DEPARTMENT STORE SALES -16.9% Y/Y; NOV -4.3%

CHINA MARKETS

PBOC NET DRAINS CNY150BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged on Thursday. This resulted in a net drain of CNY150 billion given the maturity of CNY250 billion of reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity in the banking system reasonable and ample, as fiscal expenditures have increased significantly near the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) dropped to 2.2000% at 09:26 am local time from 3.0936% at Wednesday's close.

- The CFETS-NEX money-market sentiment index closed at 62 on Wednesday vs 65 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY 6.4845 THURS VS 6.4665

People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4845 on Thursday. This compares with the 6.4665 set on Wednesday.

MARKETS

SNAPSHOT: DXY Higher After Powell Provides No Surprises

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 404.73 points at 28228.88

- ASX 200 down 130.866 points at 6649.7

- Shanghai Comp. down 53.061 points at 3520.28

- JGB 10-Yr future down 3 ticks at 151.91, yield down 0.9bp at 0.040%

- Aussie 10-Yr future up 1.0 ticks at 98.910, yield down 0.6bp at 1.087%

- U.S. 10-Yr future unch. at 137-17, yield down 0.85bp at 1.008%

- WTI crude down $0.32 at $52.53, Gold down $5.92 at $1838.08

- USD/JPY up 17 pips at Y104.28

- POWELL PLEDGES PATIENCE ON QE AND INFLATION (MNI)

- BLINKEN VOWS TO CONFRONT, COOPERATE WITH CHINA IN FIRST REMARKS AT THE STATE DEPARTMENT (THE HILL)

- ECB'S CENTENO: CRISIS CAN'T BE ALLOWED TO BECOME A FINANCIAL CRISIS (BBG)

- EU FAILED TO SWAY ASTRAZENECA TO TAP UK SUPPLY FOR VACCINES (BBG)

- STUDIES SHOW PFIZER VACCINE EFFECTIVE AGAINST COVID VARIANTS (BBG)

- PBOC IS EXPECTED TO OFFER LIQUIDITY BOFORE CNY HOLIDAY (CSJ)

BOND SUMMARY: TY Futures Flow Grabs The High In Narrow Post-FOMC Trade

T-Notes held to a tight 0-04 range overnight, in limited (at least in range terms) post-FOMC trade, with some early modest cheapening in the Tsy space unwinding, aided by a 13K block buy of TYH1 at 137-17, with the contract last dealing unchanged on the day at that level. Cash Tsys now sit unchanged to ~0.5bp richer across the curve, with headline flow on the light side in Asia-Pac hours. The key takeaway was news from Pfizer & BioNTech, who noted that the results of their studies indicate that their vaccine is effective against both the UK and South African variants of COVID-19.

- JGB futures were tight, sticking to the range witnessed during the overnight session, last -3, with a solid round of 2-Year JGB supply seen. Cash trade has seen some light outperformance for the long end, with the curve flattening a little as a result.

- Australian bond futures also held to a narrow range, with YM unchanged and XM +1.0 ahead of the Sydney close. Most of the focus fell on the launch of a new benchmark round of Aug '32 issuance from QTC.

JGBS AUCTION: Japanese MOF sells Y2.4362tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4362tn 2-Year JGBs:

- Average Yield -0.127% (prev. -0.129%)

- Average Price 100.456 (prev. 100.458)

- High Yield: -0.124% (prev. -0.127%)

- Low Price 100.450 (prev. 100.455)

- % Allotted At High Yield: 13.9251% (prev. 65.4173%)

- Bid/Cover: 4.972x (prev. 4.180x)

JAPAN: Sanguine Weekly International Flows

Little to note in terms of headline net flows in the latest round of weekly Japanese international security flow data. Japanese investors racked up the largest round of weekly net purchases of foreign bonds since mid-December, but the outright net total was nothing of any real note in the broader scheme of things.

- The 4-week sum of foreign flows surrounding Japanese bonds moved back into positive territory, after 4 weeks below 0, with a particularly large round of net weekly sales falling out of the sample.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 752.6 | 276.6 | 1473.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -264.4 | -37.7 | 140.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 143.3 | 548.4 | 486.2 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 209.2 | 177.5 | 813.7 |

Source: MNI - Market News/Japanese Ministry Of Finance

EQUITIES: Stocks Slammed After Negative Lead From Wall Street

Asia-Pac equity markets have endured a negative session on Thursday, taking their lead from the US where indices saw their worst day of losses since October. The KOSPI is down over 2% after Samsung gave disappointing guidance in their earnings report. In Australia the ASX 200 is down over 2% as iron ore futures decline again.

- US futures are lower, but have come of session lows hit at the start of the Asia-Pac session. A reversal of fortunes for the Nasdaq, the index is the underperformer today after earnings reports from Apple and Tesla saw shares sliding after market. Focus remains on retail traders after another day of outsized gains for the likes of GME and AMC, WallStreetBets Reddit forum was briefly made private overnight.

OIL: Benchmarks Lower

Oil has slipped in Asia-Pac trade; WTI down $0.28 at $52.58, brent is down $0.33 at $55.48. The commodity complex was dragged lower by a broad wave of negative sentiment that exerted influence across the asset classes.

- Developments in inventory data helped to stem the downside. Data from the DoE yesterday showed headline inventories saw a draw of near 10mln bbls, but a build in gasoline stocks and a decent rally in the greenback countered any oil strength. It should be noted that at these levels supplies are about 5% higher than the five-year average for this time of year.

- Some concerns over fuel consumption have also weighed on oil, China has urged residents to limit travel for LNY while figures yesterday showed traffic in LA has fallen in the past month.

- Comments from the IMF added to downward pressure. In their report the IMF said slow vaccine distribution and vaccine shortages could threaten financial stability. This combined with talk of vaccine shortages has cast doubt on a swift recovery.

- It is not all negative though, JP Morgan says brent could rise above $70/bb by the end of the year, citing tighter supply. The note predicted global oil market should tighten rapidly from February and supply will remain very tight through mid-2022.

GOLD: DXY Uptick Creates Some Pressure

The uptick in the DXY and steady real U.S. Tsy yields have allowed some light pressure to creep in over the last 24 hours, with spot gold having a brief look below initial support on Wednesday. A break below yesterday's trough would open the way to key support, which comes in the form of the Jan 18 low, located at $1,804.7/oz. Spot last deals just below $1,840/oz, ~$5/oz softer on the day.

FOREX: Risk Aversion Spills Over Into Asia, Greenback Catches Bid

Risk aversion carried over into the Asia-Pac session, with the greenback retaining bid tone as equity markets were flashing red. Headline flow was relatively light, focus remained on some disappointing earnings reports and lingering Covid-19 worry. The DXY crept higher but fell short of attacking the prior intraday high.

- Antipodean currencies led losses in G10 FX space. AUD/USD shed ~40 pips and printed fresh YtD lows as the Aussie landed at the bottom of the pile. NZD/USD narrowed in on its 50-DMA, but failed to test the moving average. AUD/NZD extended its current losing streak, sliding through the 100-DMA.

- USD/JPY rallied further above the Y104.00 mark breached yesterday, but resistance from Jan 11 high/100-DMA at Y104.40/42 proved resilient. The yen struggled to benefit from broader demand for safe haven currencies.

- PBOC fixed USD/CNY at CNY6.4845, another miss lower for sell side estimates and drained CNY 150bn via OMOs, even as overnight repo rates hit multi-year highs. There was a piece in the Securities Journal that posited China will offer additional liquidity ahead of LNY.

- KRW underperformed in Asia after the IMF suggested that South Korea should ramp up fiscal and monetary support, while Samsung's Q4 earnings missed expectations & outlook for Q1 was fairly pessimistic. USD/KRW touched best levels since Nov and charted a double bottom pattern.

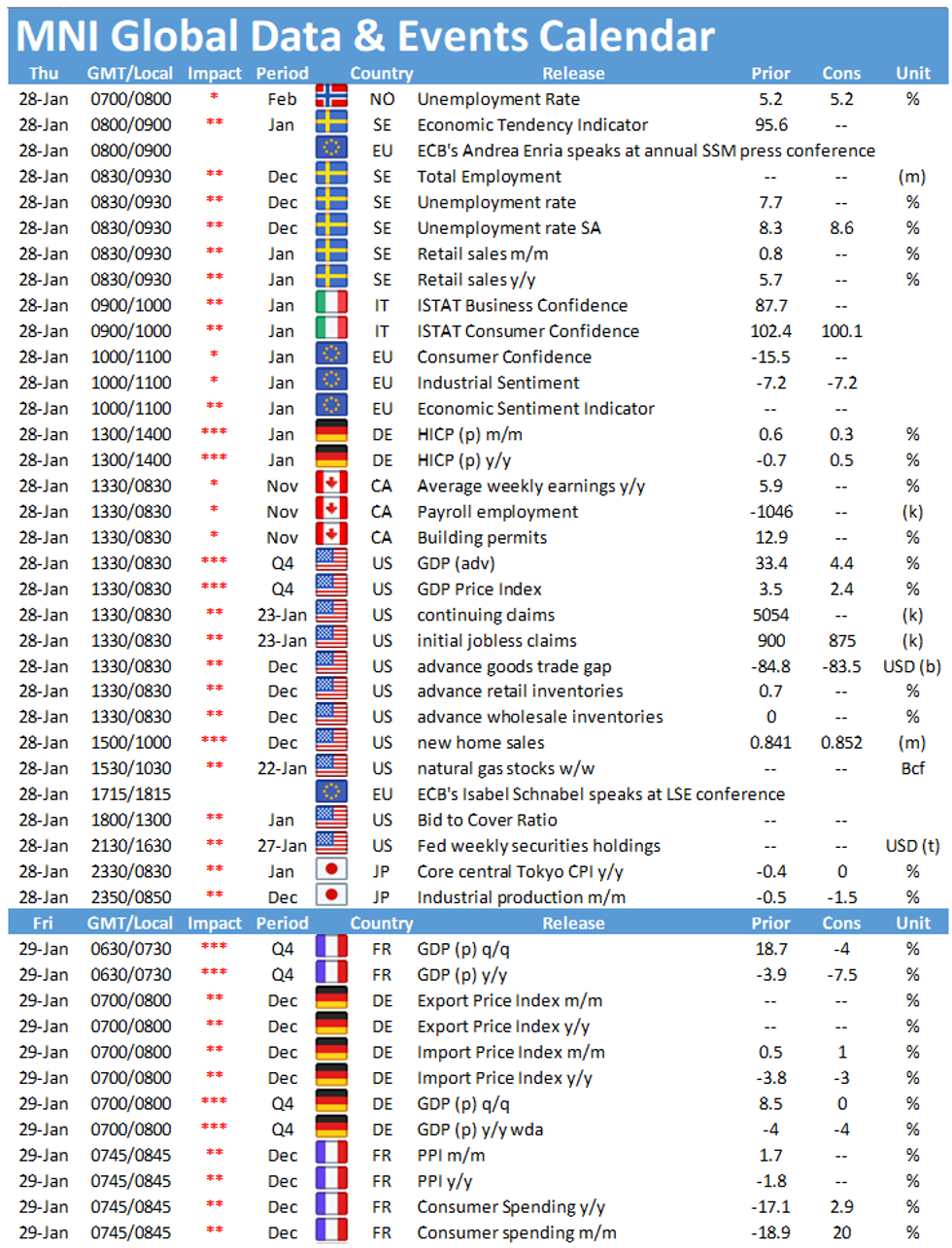

- On the radar today: U.S. initial jobless claims, new home sales & advance GDP, EZ sentiment gauges, flash German CPI, Swedish unemployment & retail sales as well as comments from ECB's Schnabel.

FOREX OPTIONS: Expiries for Jan28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2200-20(E658mln)

- USD/JPY: Y103.45-60($595mln-USD puts), Y103.80-95($560mln-USD puts)

- EUR/GBP: 0.8900(E705mln-EUR puts)

- AUD/NZD: N$1.0665(A$530mln)

- NZD/USD: $0.7050(N$645mln)

- USD/CNY: Cny6.37($500mln), Cny6.4200($590mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.