-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: CAD, MXN Weaken On Tariff Threat, JPY Firms

MNI EUROPEAN OPEN: U.S. Fiscal Matters Support Equites, Weigh On Bonds

EXECUTIVE SUMMARY

- BIDEN: WILL BE 'EXTREME COMPETITION' WITH CHINA, WON'T TAKE TRUMP APPROACH (CNBC)

- DEMOCRATS CLEAR PATH FOR APPROVAL OF BIDEN'S $1.9 TRILLION COVID PACKAGE (RTRS)

- ASTRA VACCINE SHOWS LESS EFFECT AGAINST SOUTH AFRICA VARIANT (BBG)

- ITALY'S 5-STAR, LEAGUE OPEN UP TO DRAGHI GOVERNMENT, AWAIT POLICY PLANS (RTRS)

- PBOC SEES LESS CASH WITHDRAWAL DEMAND BEFORE HOLIDAY THIS YEAR (BBG)

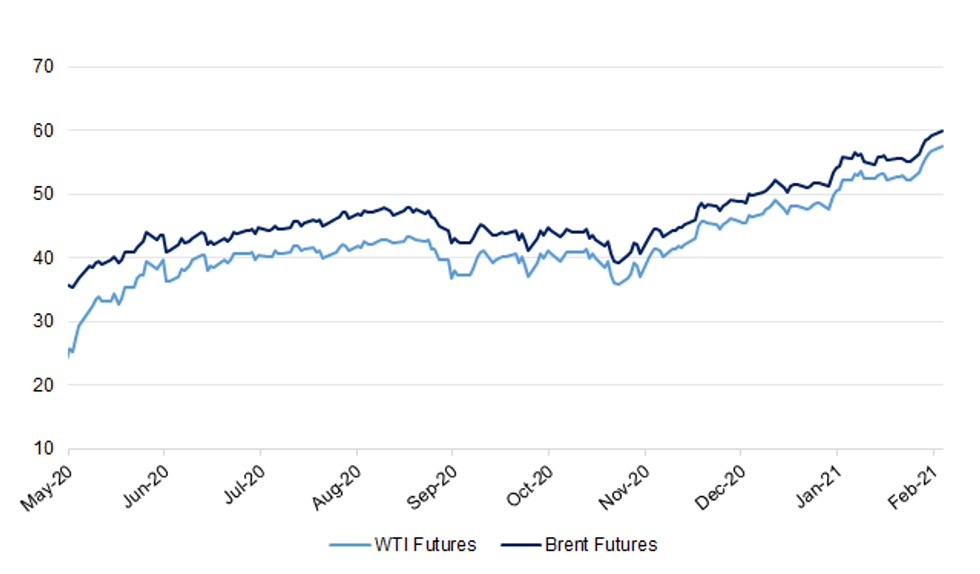

Fig. 1: Brent & WTI Crude Futures (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. is on track to vaccinate all over-50s by May, with almost 1,000 people a minute receiving shots during the peak period on Saturday, Health Minister Nadhim Zahawi said. (BBG)

CORONAVIRUS: Millions of people under 50 years old will be vaccinated at work under proposals being considered by ministers to accelerate the national rollout from the spring, The Telegraph can disclose. (Telegraph)

CORONAVIRUS: Boris Johnson is under pressure this weekend to open schools in England earlier than planned after 18 Conservative MPs backed a call to get children back into the classroom straight after next week's half term break. (Telegraph)

CORONAVIRUS: NHS chiefs and scientists have said that lifting lockdown too soon will lead to another wave of coronavirus infections. Chris Hopson, the chief executive of NHS Providers, which represents hospital trusts, is to write to the prime minister to urge him not to lift restrictions until the number of new infections drops below 1,000 a day. It was 18,262 yesterday, with 29,326 people still in hospital, bringing the total number of cases to 3,929,835. (Sunday Times)

CORONAVIRUS: Ministers are working on a "targeted" vaccine passport scheme to allow Britons who have been vaccinated to return to more of a normal day to day life. (Telegraph)

CORONAVIRUS: Pubs and restaurants could reopen as soon as April if they agree not to sell alcohol under options being discussed to allow the widespread relaxation of coronavirus restrictions after Easter. (Telegraph)

CORONAVIRUS: Millions of people are likely to need a third vaccine dose this year as ministers step up plans for booster jabs against new variants of coronavirus. NHS chiefs hope that the extra doses can be given at the same time as winter flu jabs as the government accepts that a top-up campaign increasingly looks necessary. (The Times)

FISCAL: Rishi Sunak is being urged not to increase taxes by his Labour opposite number because of concerns that they will damage the economy. (Telegraph)

FISCAL: Small firms are to get more time to repay state-backed loans taken out to help survive the coronavirus lockdown. The changes include giving companies an option to extend the length of the loan from six to ten years under a "pay-as-you-grow" initiative. Chancellor Rishi Sunak said the move was to give companies "breathing space to get back on their feet". (BBC)

BREXIT: The UK's haulage industry has called for "urgent intervention" from the government to address what it says are enormous challenges facing critical supply chains because of Brexit. The Road Haulage Association estimates that the volume of exports from Britain to the EU dropped by up to 68 per cent in January compared with the same month last year. In a letter last week to Michael Gove, the Cabinet Office minister, the RHA accused the government of failing to put enough measures in place to ease the flow of goods across the English Channel. (FT)

BREXIT: Boris Johnson is not going to let the European Union "push us around" and is right to threaten to override parts of the Brexit deal, the Government's chief law officer has revealed. (Telegraph)

BREXIT: The Irish Government is open to the extension of a grace period for the Northern Ireland Protocol to resolve a row over customs check at the border, the country's foreign minister has said. (Telegraph)

BOE: The Bank of England is braced for the possibility that a mood of national depression that engulfed Britain as it plunged into a third national lockdown will end with a spending spree when restrictions are lifted. In an interview with the Observer, the Bank's governor, Andrew Bailey, said there was a chance after being cooped up for so long people would "go for it" once the vaccine programme allowed the economy to reopen. (Observer)

BOE: The Bank of England could shy away from buying the bonds of fossil fuel companies as it attempts to make its balance sheet greener, Governor Andrew Bailey said in an interview published by the Observer newspaper on Saturday. Asked if the BoE's plans to overhaul its bond-buying programmes would mean moving away from fossil fuel companies, Bailey said: "Yes, it could. We are serious about this issue." (RTRS)

ECONOMY: Accounting group BDO's measure of the UK's output fell in January to a seven-month low. Its Output Index fell by 5.38 points to 70.44. Services drove the decline, with output dropping for a third consecutive month in January. (FT)

ECONOMY: British companies made net borrowings of £35.5bn last year, £25bn more than the average in the previous five years, according to a study. EY, the accounting and consulting group, said its research indicated that companies would borrow a further £26bn by the end of 2021. (FT)

ECONOMY: Losses at the 100 largest UK restaurant groups increased 112 per cent to an aggregate £571m last year, an accounting group's research has found. (FT)

POLITICS: Sir Keir Starmer will seek to reset his faltering leadership with a pledge to make the Labour Party "unashamedly pro-business". (Sunday Times)

EUROPE

ECB: European Central Bank President Christine Lagarde predicted the euro-area recovery will pick up in the summer, while stressing that public authorities will have a difficult job weaning the economy off of emergency support. In an interview with French newspaper Le Journal du Dimanche, Lagarde expressed confidence in the region's ability to emerge from the coronavirus crisis stronger, with a more digital and greener future. She also urged governments to speed up work on their spending plans, so the European Commission can start issuing joint debt. (BBG)

ECB: "Effective fiscal and monetary policy support should be continued until the recovery of economic activity is firmly underway," European Central Bank Governing Council member Olli Rehn says. "Faced with an unprecedented blow to the global economy, monetary and fiscal policy makers have had to join forces to deliver a crisis response commensurate with the shock. Forceful policy measures have been justified to limit persistent damage to our economies," Rehn says in text of speech. (BBG)

ECB: European Central Bank Governing Council member Robert Holzmann says he sees "the onus on the future Italian government to provide the programs which are able to provide finally productivity in Italy." "Without productivity growth, I don't think a number of the problems can be solved." "In order to really get the best out of it now, fiscal policy, structural policy have to deliver and I wish Mario Draghi all the best." "We all love Italy, but we all hope they finally get their act together. When this happens, we're able to be much more optimistic." (BBG)

CORONAVIRUS: AstraZeneca Plc's coronavirus vaccine is finally arriving in European Union countries as the bloc tries to speed up its inoculation campaign and put a crisis-ridden period behind it. (BBG)

GERMANY: Germany is likely to extend its Covid-19 lockdown for another two weeks when Chancellor Angela Merkel and state government leaders meet next week, people familiar with the discussions said. (BBG)

GERMANY: Germany will have to extend its lockdown when state and federal leaders meet on Wednesday to discuss Covid-19 strategy, Bavarian state premier Markus Soeder said. Soeder, whose CSU party is part of Chancellor Angela Merkel's governing bloc, told broadcaster ARD "it makes no sense to just call it off now" and risk a resurgence of the virus by easing restrictions prematurely. (BBG)

GERMANY: German Finance Minister Olaf Scholz stepped up his bid to return the Social Democrats to the chancellery after Angela Merkel leaves this fall, presenting a fiscally expansive platform to finance a sweeping shift to clean energy and better digital infrastructure. Scholz, the SPD's candidate for chancellor in Germany's Sept. 26 election, and his party are betting on a spending stance that contrasts with Merkel's Christian Democrat-led bloc, which wants to restore constitutional limits on borrowing that have been suspended to deal with the economic slump caused by Covid-19. (BBG)

FRANCE: France's Covid measures are failing to control the virus, and the country faces a new wave of infections at a time when pandemic activity is already at a high level, Bruno Riou, medical crisis director at Paris hospital operator AP-HP, said in a press briefing on Friday. "It's clear that we're going to live very difficult times in the coming weeks," Riou said, adding that the government has been slow to implement previous lockdowns, and he expects the same situation for a potential third lockdown. (BBG)

ITALY: Italy's centre-right Forza Italia party said on Friday it will give its full backing to the efforts of Prime Minister designate Mario Draghi to form a government. (RTRS)

ITALY: Mario Draghi's prospects of forming a government in Italy were boosted on Saturday when the two largest parties in parliament, the anti-establishment 5-Star Movement and the rightist League, both gave him their conditional backing. However, Draghi's route to power is still not clear. Both parties said his policy proposals would be the key to securing their support, and it may be some time before he is able to put together a coalition able to muster a parliamentary majority. (RTRS)

ITALY: The Bank of Italy sees an increase in economic output in the Spring even as continued fears over coronavirus infections weigh on a recovery in consumer spending, governor Ignazio Visco said in a speech. A spring recovery "hinges crucially upon the progressive attenuation of the epidemic over the course of the coming months," Visco, who is also a member of the European Central Bank's governing council, said at the annual Assiom-Forex event. "The surveys conducted by the Bank of Italy at the end of November suggest that consumption expenditure is being held back by fears of infection, besides the precautionary motive based on economic and financial considerations." (BBG)

ITALY/BTP: Italy plans to sell 7 billion euros ($8.4 billion) of bills due Feb 14, 2022 in an auction on Feb 10. (BBG)

SPAIN: Spain is limiting use of the Covid-19 vaccine from AstraZeneca Plc to people age 55 and younger, based on "scientific evidence," the Health Ministry said in a statement. Spain is the latest European Union country to set an upper age limit for recommended use of the shot. Countries including Germany, France and Italy have also set limits. (BBG)

GREECE: The Greek government tightened restrictions on movement by citizens to prevent the spread of the coronavirus as the number of new cases and people hospitalized increased in the last days. (BBG)

GREECE: Greek Prime Minister Kyriakos Mitsotakis has come under fire again for apparently disregarding his own government's coronavirus lockdown rules. (POLITICO)

NORWAY: Norway's second-largest city, Bergen, will go into lockdown after transmission of the South African virus variant was detected at construction sites. Shops, cafes, restaurants, gyms and museums will close, and all events will be banned in the city and two nearby municipalities for one week from 6 p.m. on Sunday. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Moody's affirmed the Czech Republic at Aa3; outlook stable

U.S.

ECONOMY: Treasury Secretary Janet Yellen said the U.S. can return to full employment in 2022 if it enacts a robust enough coronavirus stimulus package, but otherwise risks a slower rebound in jobs and the economy. "I'm afraid that the job market is stalling," she said on CBS's "Face the Nation," in one of two Sunday-morning interviews. (BBG)

FISCAL: As Washington lawmakers work to come to an agreement on a new coronavirus relief package, one key question has emerged: Will the next stimulus checks be $1,400? President Joe Biden sought to end that debate in a press conference on Friday by re-affirming his commitment to $1,400. "I'm not cutting the size of the checks," Biden said. "They're going to be $1,400. Period. "That's what the American people were promised." (CNBC)

FISCAL: President Joe Biden gave his strongest indication yet that he'll push for swift action on coronavirus relief for the U.S. economy without Republican support, as House lawmakers cleared the way for passing his $1.9 trillion stimulus plan with only Democratic votes. Highlighting his emphasis on speed, Biden signaled he was resigned to his minimum-wage hike not being a part of the bill. "Apparently, that's not going to occur because of the rules of the United States Senate," he said in a CBS interview. The $15 an hour proposal was panned by Republicans, who sought to block it in the Senate. (BBG)

FISCAL: President Joe Biden and his Democratic allies in Congress forged ahead with their $1.9 trillion COVID-19 relief package on Friday as lawmakers approved a budget outline that will allow them to muscle Biden's plan through in the coming weeks without Republican support. By a party line vote of 219-209, the House of Representatives passed the budget plan, after the Senate approved it in a pre-dawn vote. Vice President Kamala Harris cast the tie-breaking vote in the Senate for the first time. (RTRS)

FISCAL: Majority Leader Steny Hoyer says he thinks the House will vote on a stimulus package the week of February 22. Hoyer says there is a "chance" lawmakers would come back early to consider the legislation. (BBG)

FISCAL: U.S. House Speaker Nancy Pelosi told reporters after a White House meeting with President Joe Biden on Friday she hopes the House can send a coronavirus relief package to the Senate within two weeks. (RTRS)

FISCAL: A senior U.S. House lawmaker told reporters that a COVID-19 relief package would include a new round of payroll assistance for U.S. airline workers. Representative Peter DeFazio, who chairs the House Transportation and Infrastructure Committee, told reporters at the White House the new round of airline government assistance would extend restrictions on executive compensation and stock buybacks. (RTRS)

FISCAL: Senior Democrats on Monday will unveil legislation to provide $3,000 per child to tens of millions of American families, aiming to make a major dent in child poverty as part of President Biden's $1.9 trillion economic relief package. (Washington Post)

CORONAVIRUS: US states on Sunday reported fewer than 100,000 cases for the first time in more than three months, a key database showed. The Covid Tracking Project identified about 96,000 new cases, the lowest level since November 2 2020. However, Sunday's data is missing updates from several states, some of which regularly do not report on the weekend and others having technical difficulties. There were 81,439 people in hospital being treated for Covid-19, the lowest number since November 19 2020. "The number of people currently hospitalised continues to decrease," CTP noted in its analysis. "We are still far above the peak hospitalisation numbers [of about] 60,000 during the April and July 2020 surges," it added. (FT)

CORONAVIRUS: The highly contagious coronavirus variant first detected in the U.K. is doubling in the U.S. nearly every 10 days, according to a new study released on Sunday. The preprint study from MedRxiv, which has not been peer-reviewed, comes after the CDC and top infectious disease experts have warned that the highly transmissible COVID-19 variant could become the dominant U.S. strain. (Axios)

CORONAVIRUS: President Joe Biden said it's unlikely the U.S. will reach herd immunity for the coronavirus before the end of the summer due to a shortfall in vaccine availability. "The idea that this can be done and we can get to herd immunity much before the end of this summer is very difficult," Biden said in an interview with CBS News that aired on Sunday. In the U.S., logistical delays and vaccine shortages have meant only a small fraction of the population has received shots since two different vaccines became available in December. (BBG)

CORONAVIRUS: Dr. Anthony Fauci warned Americans not to delay their second dose of the coronavirus vaccine, after other health experts suggested recently there may be a benefit to pushing more people to get a first shot and possible delaying the follow-ups a bit. (BBG)

CORONAVIRUS: The Biden administration is exploring every option for increasing manufacturing of Johnson & Johnson's COVID-19 vaccine, which is under regulatory review, and said on Friday that currently expected levels of early doses were less than hoped. (RTRS)

CORONAVIRUS: The White House has turned to the US military to help with its vaccine rollout. More than a thousand active-duty troops will help inoculate Americans against Covid-19 at five centres nationwide. (FT)

CORONAVIRUS: New York state plans to take unused Covid-19 vaccine doses from hospitals and give them to city and county health departments to distribute to people with underlying health conditions beginning Feb. 15, Gov. Andrew Cuomo said on Friday. (CNBC)

CORONAVIRUS: Chicago Public Schools reached a "tentative agreement" with its teachers to resume in-person learning later this week, but union members still need to review its framework to make a deal final. (BBG)

CORONAVIRUS: Dozens of states and cities are clawing back thousands of extra doses of Covid-19 vaccine that were meant to be used by CVS and Walgreens to immunize residents of nursing homes through a federal partnership set up by the Trump administration. (CNBC)

CORONAVIRUS: As the NFL season draws to a close, the league offered to make all its stadiums available as mass vaccination sites, in a letter from Commissioner Roger Goodell to President Joe Biden. Goodell noted that several stadiums are already in use and that "we can expand our efforts to stadiums across the nation." Seven clubs are already using their facilities as vaccine sites. "We look forward to further discussions with your administration as well as your partners in state and local government to advance this effort," Goodell wrote in the letter dated Tuesday. (BBG)

OTHER

U.S./CHINA: President Joe Biden said his administration was ready for "extreme competition" with China but that his approach would be different than his predecessor. "I'm not going to do it the way Trump did. We are going to focus on the international rules of the road," Biden told in a CBS interview clip published Sunday. "We need not have a conflict but there is going to be extreme competition," he added. In his interview with CBS, Biden said that he had not yet spoken to China's Xi Jinping since ascending to the nation's highest office last month. "I know him pretty well," Biden said, explaining that as vice president he spent more time with Xi than any world leader has. "He's very bright and he's very tough and – I don't mean it as a criticism it's just a reality – he doesn't have a democratic...bone in his body." (CNBC)

U.S./CHINA: U.S. Secretary of State Antony Blinken told top Chinese diplomat Yang Jiechi in a phone call on Friday the United States will stand up for human rights and democratic values in Xinjiang, Tibet and Hong Kong, the State Department said. Blinken also pressed China to condemn the military coup in Myanmar, and he reaffirmed that Washington will work with allies to hold China accountable for efforts to threaten stability of Indo-Pacific, including across the Taiwan Strait, the department said in a statement. Yang told Blinken that the United States should "correct" its recent mistakes and that both sides must respect each other's political systems and development paths, according to a statement from the Chinese foreign ministry. (RTRS)

U.S./CHINA: The relationship between China and the United States now stands "at an important juncture," Chinese State Councilor and Foreign Minister Wang Yi noted, calling for bringing the bilateral ties back on the track of sound and steady development. Wang made the remarks in his Lunar New Year message to members of the diplomatic corps in China ahead of Spring Festival, the Year of the Ox, which falls on February 12 this year. (CGTN)

U.S./CHINA: China and the U.S. can form better relations if the U.S. wants to pursue common interests, deepen economic and trade cooperation despite tough rhetoric, the China Daily said in an editorial following a phone call between the two nations' top diplomats. The official newspaper noted that President Biden had said he would work with Beijing when it is in the U.S. interest, a marked difference from the Trump administration's "maximum pressure" approach, the Daily said. This is notable despite Secretary of the State Anthony Blinken signaling the administration would continue its predecessor's policies of "stirring up trouble" in China's regions, including Xinjiang and Hong Kong, the Daily said. (MNI)

U.S./CHINA: Objectively speaking, the US' strategy of containing China has shown its tendency toward a serious failure. It is obvious to the world that China's development is unstoppable. It is wishful thinking for the US to try and rope in its allies to oppose China. European countries have made it clear that they do not wish to blindly follow Washington in fighting against Beijing because doing so is not in line with their core interests. The same goes for most countries in the Asia-Pacific. If the Biden administration really wants to handle the US' domestic affairs well first, maybe their only option is to reduce the current tension between China and the US and ease the two countries' conflicts. Otherwise, the Biden administration might find itself falling into the holes dug by Donald Trump and Mike Pompeo during their final "frenzy." The Biden administration is well versed in terms of strategy. We believe that they can distinguish the pros from the cons. No matter what they say to the American people, we hope their actual actions can bring the US' China policy from the cloud of fantasy back down to pragmatic ground. (Global Times)

U.S./CHINA: MNI EXCLUSIVE: US Stance Damps China's Tariff Hopes

- Recent statements by the U.S. on its stance towards China have tempered optimism among Beijing advisors, who now expect calls for more domestic reform to precede discussions on trade and a revival of the unfinished bilateral investment proposal as a replacement for the phase two trade deal - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

U.S./CHINA: A once low-profile post in the commerce department has emerged as a key battleground for China hawks in Washington who want to push Joe Biden to take a hard line on technology exports to Beijing. Biden has yet to name his choice to head the department's Bureau of Industry and Security but some critics are already targeting Kevin Wolf, an Obama administration export control lawyer now at Akin Gump, a law firm, who is seen as the frontrunner. (FT)

JAPAN/CHINA: Chinese coast guard vessels on Saturday entered Japan's territorial waters near the China-claimed Senkaku Islands for the first time since its new coast guard law took effect this month, Japanese officials said. (Nikkei)

JAPAN/CHINA: Legislators from Japan's ruling party called for a new law on Friday similar to the Taiwan Relations Act in the U.S., looking to help Taipei defend itself amid Beijing's repeated incursions into Taiwan's airspace. (Nikkei)

UK/CHINA: Almost 200 British academics are being investigated on suspicion of unwittingly helping the Chinese government build weapons of mass destruction, The Times can reveal. They are suspected of violating strict export laws intended to prevent intellectual property in highly sensitive subjects being handed to hostile states. (The Times)

GEOPOLITICS: Chinese President Xi Jinping called for the Chinese military to enhance its combat readiness during the upcoming Spring Festival holidays when he recently inspected an aviation division of the People's Liberation Army (PLA) Air Force. Experts said other militaries should not have the illusion that they can make provocative moves during the holidays without meeting PLA's countermeasures. (Global Times)

GEOPOLITICS: The United States, Japan, Australia and India are working to arrange the first meeting of their leaders under the so-called Quad framework amid China's growing clout in the region, a source from one of the countries involved said. (Kyodo)

GLOBAL TRADE: The United States' European Union trade tariff policy is under review, the White House said on Friday. The European Union's ambassador to the United States on Jan. 27 called on U.S. President Joe Biden's administration to immediately lift tariffs on steel and aluminum imports and to work to settle a longstanding dispute over aircraft subsidies. "I know there's a lot of interest in trade tariffs and that's also under review now," White House press secretary Jen Psaki said at a news briefing. (RTRS)

GLOBAL TRADE: Amazon and other companies who have cashed in on the coronavirus crisis are facing a double tax raid under plans being drawn up by the government to plug the black hole in Britain's finances. Treasury officials have summoned tech firms and retailers to a meeting this month ahead of the budget to discuss how an online sales tax would work, according to leaked emails. (Sunday Times)

CORONAVIRUS: South Africa will suspend use of AstraZeneca's COVID-19 shot in its vaccination programme after data showed it gave minimal protection against mild to moderate infection caused by the country's dominant coronavirus variant. (RTRS)

CORONAVIRUS: South Africa plans to fast-track the rollout of Johnson & Johnson's vaccine after it showed more efficacy against a new variant that's prevalent in more than 90% of new cases in the country, according to Glenda Gray, president of the South African Medical Research Council. (BBG)

CORONAVIRUS: AstraZeneca Plc's vaccine is about as effective against the new strain of the virus that emerged in the U.K. as against the initial version, according to a study by the shot's co-developer, the University of Oxford. (BBG)

CORONAVIRUS: There's "a reasonable chance" that vaccines will stay ahead of virus mutations, said Scott Gottlieb, a former head of the U.S. Food and Drug Administration. "I think there's a rule of thumb we can assume that the vaccines are probably going to be about 20% less effective against these new variants from Brazil and South Africa," Gottlieb said on CBS's "Face the Nation." (BBG)

CORONAVIRUS: Countries should share their vaccine doses once they've inoculated their health staff and elderly, World Health Organization Director-General Tedros Adhanom Ghebreyesus said at a briefing. He also called on companies to partner up to boost manufacturing and to share full dossiers with the WHO for emergency use listings. (BBG)

CORONAVIRUS: Israel, with the highest proportion of citizens vaccinated against Covid-19 in the world, found it took three weeks for the Pfizer Inc.-BioNTech SE shot to start curbing new cases and hospitalizations. (BBG)

CORONAVIRUS: British doctors who spent 102 days treating a cancer survivor for Covid-19 documented how the virus mutated after the man was treated with convalescent plasma. The case study suggests the use of blood plasma donated from Covid-19 survivors may have put enough pressure on the virus to force it to evolve. The result: Less susceptibility to immune system antibodies that normally fight off infection, according to the report published Friday in the journal Nature. (BBG)

HONG KONG: Hong Kong health officials expressed worries about large family gatherings and celebratory public markets ahead of the Lunar New Year festival in the coming days as it reported 27 new coronavirus cases on Sunday. "It's a source of worry for us because with all the festivities we know people will want to come together, meet up with relatives or spend time at new years markets," Chuang Shuk-kwan, the head of the Health Department's communicable disease branch, told reporters. (BBG)

JAPAN: Japan will consider lifting its coronavirus state of emergency in some prefectures ahead of the new deadline, based on the law that takes effect Saturday allowing for fines against social distancing violators. (Nikkei)

JAPAN/RATINGS: Fitch affirmed Japan at A; Outlook Negative

AUSTRALIA: Health officials in Australia's largest state said on Monday they are investigating how a woman who tested negative and was released from 14 days quarantine tested positive two days later. (FT)

AUSTRALIA: A hotel quarantine worker in Melbourne has tested positive, sending more than 100 people into isolation on Monday as the Australian state of Victoria battles another leak in its coronavirus containment system. State health minister Martin Foley said the woman had tested negative after her shift on February 4 but developed symptoms after working on Sunday. She was tested and subsequently returned a positive result. (FT)

AUSTRALIA: Australia's most-populous state tightened Covid-19 quarantine testing rules in a bid to stop the virus leaking into the community. Returned overseas travelers in New South Wales must now be tested two days after they complete 14-day hotel quarantines, NSW Health said in a statement. (BBG)

AUSTRALIA/CHINA: Just about one year after Scott Morrison's government decided to further sour China-Australia ties by calling for a weapons-inspector style investigation into COVID-19's origins while China was in the midst of containing the novel coronavirus, Chinese ports are beginning to receive hundreds of thousands of tons of coal and a full shipload of iron ore from Sierra Leone, a sign that does not bode well for Australia, as it shows how easy China could replace Australia with alternative import sources, even for iron ore and coal, a Chinese observer told the Global Times on Saturday. (Global Times)

AUSTRALIA/CHINA: China is set to allow some stranded Australian coal cargoes to unload, although its unclear if the deliveries will be cleared by customs, according to a person familiar with the situation. The measure doesn't mean China is loosening its ban on Australian coal, said the person, who asked not to be identified because the information is private. (BBG)

AUSTRALIA/CHINA: Foreign Minister Marise Payne says the Australian journalist Cheng Lei has been formally arrested in China on suspicion of illegally supplying state secrets overseas. Cheng Lei was detained in August last year, but Senator Payne says China's decision to arrest her means that an official investigation into her conduct will now begin. The journalist was working as a high profile anchor for China's state-run English language news service, CGTN. (ABC)

NEW ZEALAND: New Zealand has reported a case who tested positive for coronavirus after 14 days of quarantine and five days of self-isolation, despite returning three previous negative tests. The Ministry of Health said the person had been a guest at the managed isolation facility at the Pullman Hotel in Auckland and has been isolating at home in Hamilton since January 30. (FT)

SINGAPORE: Singapore's efforts to open its borders are stalling, with a plan to allow business travelers to avoid quarantine and stay in a dedicated facility near the airport still not materializing. The Connect@Singapore pilot program for businesspeople and so-called high-economic value travelers was due to get going in January, yet the tourism board hasn't selected operators for the facilities where the visitors would stay, the Business Times reported Monday. (BBG)

CANADA: Prime Minister Trudeau: Canada is looking at ways of strengthening Covid-19 measures at its land border with the United States, announcement to be made soon. (RTRS)

CANADA: Justin Trudeau defended Canada's decision to take doses from a global vaccine alliance meant to support developing nations, as delivery delays cast doubt on his government's inoculation timeline. (BBG)

TURKEY: Turkish President Recep Tayyip Erdogan is doubling down on protests against perceived political interference at the country's top university, issuing a midnight order to open new faculties. A presidential decree published in the early hours of Saturday announced the establishment of new faculties for law and communication at Bogazici University in Istanbul. Erdogan's communications director, Fahrettin Altun, said the new faculties were part of the "quality-focused growth, development and internationalization" of Turkish higher education. (BBG)

RUSSIA: Russia said Friday it was expelling diplomats from Sweden, Poland and Germany, accusing them of attending a rally in support of opposition leader Alexei Navalny, as international tensions grew over the jailing of the Kremlin's most prominent foe. The announcement came as the European Union's foreign affairs chief Josep Borrell told Russian Foreign Minister Sergey Lavrov that the treatment of Navalny represents "a low point" in relations between Brussels and Moscow. (AP)

RUSSIA: The consortium behind the Russia-led Nord Stream 2 natural gas pipeline has resumed laying pipes in the waters of Denmark, it said on Saturday, despite mounting pressure on the project from Washington. (RTRS)

RUSSIA: Germany should not drop support for the planned Nord Stream 2 pipeline from Russia over the crackdown on Kremlin critic Alexei Navalny, as "feel-good moralising" is not foreign policy, the man best placed to be the next German chancellor told Reuters. Pointing to U.S. purchases of crude oil from Russia, Armin Laschet described himself as a political realist - or "Realpolitiker" - and said: "We have to take the world as it is in order to make it better." (RTRS)

RUSSIA: The controversial Nord Stream 2 natural gas pipeline is "in the interests of many European Union countries" and the bloc shouldn't jeopardize the project over opposition to Russia's imprisonment of Alexey Navalny, Austria's Chancellor Sebastian Kurz said. (BBG)

RUSSIA/RATINGS: RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Russia at BBB; Outlook Stable

ARGENTINA: The International Monetary Fund is working constructively with Argentina on structuring a future lending program, with a broad aim of balancing financial stability and support for the most vulnerable, Managing Director Kristalina Georgieva said Friday. (RTRS)

IRAN: The Biden administration is weighing ways to ease Iran's financial pain without lifting crushing economic sanctions -- including on oil sales -- as a step toward reviving the 2015 nuclear deal abandoned by former President Donald Trump. (BBG)

IRAN: France's foreign minister said on Friday he held in-depth talks with his American, British and German counterparts on Iran and how to handle nuclear and regional security challenges. (RTRS)

IRAN: Iran's Supreme Leader said the U.S. must effectively remove all sanctions on his country's economy before the Islamic Republic will agree to scale back its atomic work and help revive the beleaguered multinational nuclear deal. In comments reported on state TV news and published on Twitter using the hashtag "the final word," Ayatollah Ali Khamenei said that if "all sanctions are removed in practice, not just in words or on paper," then Iran will return to full compliance to the 2015 nuclear accord -- once it's verified for itself that the penalties have "properly" gone. (BBG)

IRAN: President Biden said the U.S. won't make the first move to restart negotiations with Tehran over the 2015 nuclear accord, indicating he would only lift sanctions if Iran stops enriching uranium beyond the limits of the nuclear deal. Mr. Biden made his comments in a CBS News interview. A clip of the interview was released Sunday morning. The full interview will run Sunday afternoon. (WSJ)

IRAN: United Nations inspectors have found new evidence of undeclared nuclear activities in Iran, according to three diplomats briefed on the discovery, raising new questions about the scope of the country's atomic ambitions. Samples taken from two sites during inspections in the fall by the U.N.'s International Atomic Energy Agency contained traces of radioactive material, the diplomats said, that could indicate Iran has undertaken work on nuclear weapons, based on where it was found. (WSJ)

IMF: Rich countries are poised to recover from the global pandemic much faster than poor ones based on better vaccine access -- and policy makers need to act to avoid deepening inequality between nations, the head of the International Monetary Fund said. Governments and multilateral organizations must help developing nations accompany advanced ones in transitioning to a more inclusive, digitalized, green economy, IMF Managing Director Kristalina Georgieva said in a round-table with reporters on Friday. Countries need to revitalize international cooperation, Georgieva said -- a goal that President Joe Biden's administration also has identified for the U.S., the fund's largest shareholder. (BBG)

OIL: Is China piling into the crude oil market again? A snapshot of where the world's supertankers are headed suggests it may well be. The number the vessels sailing toward the shores of world's largest importer jumped to a six-month high of 127 on Friday. Fully laden, they would deliver in excess of 250 million barrels. The last time the number was higher was in the aftermath of oil's plunge below zero, when China binged on ultra-cheap crude to bolster domestic stockpiles. (BBG)

OIL: The oil market could absorb more crude oil from Iran if US sanctions are eased, according to Iran's governor to OPEC. (Platts)

OIL: Iran said it knew nothing about a cargo of oil that the U.S. is trying to seize and claims was exported covertly by the Islamic Republic. "I don't know anything about it," Deputy Oil Minister Amir Hossein Zamaninia told reporters in Tehran on Sunday, when asked about the 2 million barrels of crude aboard the Greek-owned Achilleas tanker. (BBG)

CHINA

CORONAVIRUS: Health authorities reported no new local Covid-19 cases in China for the first time in 2021, following strict efforts to contain outbreaks ahead of the lunar new year. China has reported more than 2,100 Covid-19 infections since the start of 2021, recording its largest outbreaks since early last year. The country reported one local case of Covid-19 on Sunday. (FT)

CORONAVIRUS: Sinovac Biotech said on Saturday that its unit's COVID-19 vaccine has been approved for use by the general public by China's medical products regulator. It marks the second COVID-19 vaccine approved for public use in China, after a shot developed by a Beijing institute affiliated to state-owned China National Pharmaceutical Group (Sinopharm) was approved in December. (RTRS)

PBOC: The People's Bank of China is likely to maintain ample liquidity during the Chinse New Year beginning this week as fiscal spending and liquidity controls ease, the China Securities Journal wrote in a commentary. Interbank liquidity conditions should also improve as pre-holiday injections mature, the newspaper wrote. The PBOC is likely to refrain from raising OMO rates in H1 to support the credit bond market after nearly CNY50 billion in planned issuances of credit bonds were canceled, wrote the newspaper. Short-term market rates may still rise due to rising asset prices, the weakening dollar and higher consumer demand, the Journal said. (MNI)

YUAN: China's foreign exchange reserves are likely to rise given the weakening U.S. dollar index and a stronger yuan, the Securities Times reported citing Zheng Houcheng, head of research at Yingda Securities. The dollar index may weaken given the Federal Reserve's low-rate policies and record high U.S. trade and fiscal deficits, while China-U.S. interest rate spreads and China's robust trade surplus favor the yuan, Zheng was cited saying. China's FX reserves stood at USD3.21 trillion at the end-Jan, down USD5.9 billion from end-Dec, the newspaper said. (MNI)

DIGITAL YUAN: China unveiled the official version of rules intended to root out monopolistic practices in the internet industry on Sunday, after first seeking feedback on the draft guidelines since November last year. The rules will take effect immediately, according to a statement from the State Administration for Market Regulation, the nation's antitrust watchdog. (BBG)

FINTECH: China's market regulator released new anti-monopoly guidelines on Sunday that target internet platforms, tightening existing restrictions faced by the country's tech giants. The new rules formalise an earlier anti-monopoly draft law released in November and clarify a series of monopolistic practices that regulators plan to crack down on. (RTRS)

OVERNIGHT DATA

CHINA JAN FOREIGN RESERVES $3.2107TN; MEDIAN $3.2220TN; DEC $3.2165TN

JAPAN JAN ECO WATCHERS SURVEY CURRENT 31.2; MEDIAN 30.0; DEC 35.5

JAPAN JAN ECO WATCHERS SURVEY OUTLOOK 39.9; MEDIAN 35.0; DEC 37.1

MNI DATA IMPACT: Japan Jan Sentiment Posts 3rd Straight Drop

- Japan's sentiment index fell for the third straight month in January hit by weaker retail sales and services following the emergency, prompting the Cabinet Office to lower its overall economic assessment yet again - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN DEC BOP CURRENT A/C BALANCE +Y1.1656TN; MEDIAN +Y1.0830TN; NOV +Y1.8784TN

JAPAN DEC BOP CURRENT A/C ADJ +Y2.2784TN; MEDIAN +Y2.2017TN; NOV +Y2.3393TN

JAPAN DEC TRADE BALANCE BOP BASIS +Y965.1BN; MEDIAN +Y947.5BN; NOV +Y616.1BN

JAPAN JAN BANKRUPTCIES -38.68% Y/Y; DEC -20.73%

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY110 billion via 7-dayreverse repos with the rate unchanged on Monday. This resulted in a net injection of CNY10 billion after the maturity of CNY100 billion reverse repos today, according to Wind Information.

- The operation aims to maintain stable liquidity before the Chinese New Year holiday, as residents' demand for cash withdrawals before the holiday this year was significantly lower than in previous years, and fiscal expenditures before the holiday largely increased, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.3515% at 09:33 am local time from 2.3518% at Friday's close.

- The CFETS-NEX money-market sentiment index closed at 32 on Friday vs 36 on Monday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4678 MON VS 6.4710

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4678 on Monday. This compares with the 6.4710 set on Friday.

MARKETS

SNAPSHOT: U.S. Fiscal Matters Support Equites, Weigh On Bonds

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 544.09 points at 29323.7

- ASX 200 up 51.668 points at 6892.2

- Shanghai Comp. up 37.047 points at 3533.38

- JGB 10-Yr future down 16 ticks at 151.48, yield up 0.5bp at 0.065%

- Aussie 10-Yr future down 7.0 ticks at 98.730, yield up 6.9bp at 1.261%

- U.S. 10-Yr future -0-04 at 136-18, yield up 2.42bp at 1.186%

- WTI crude up $0.61 at $57.46, Gold down $2.65 at $1811.81

- USD/JPY up 11 pips at Y105.50

- BIDEN: WILL BE 'EXTREME COMPETITION' WITH CHINA, WON'T TAKE TRUMP APPROACH (CNBC)

- DEMOCRATS CLEAR PATH FOR APPROVAL OF BIDEN'S $1.9 TRILLION COVID PACKAGE (RTRS)

- ASTRA VACCINE SHOWS LESS EFFECT AGAINST SOUTH AFRICA VARIANT (BBG)

- ITALY'S 5-STAR, LEAGUE OPEN UP TO DRAGHI GOVERNMENT, AWAIT POLICY PLANS (RTRS)

- PBOC SEES LESS CASH WITHDRAWAL DEMAND BEFORE HOLIDAY THIS YEAR (BBG)

BOND SUMMARY: U.S. Fiscal Matters Dominate Sources Of Risk

The start of the week has been dominated by broader focus on the prospects of a sizeable fiscal support package in the U.S., with Treasury Secretary Yellen and President Biden continuing to push home the need for notable assistance for the economy (although it looks like minimum wage hikes will have to wait, at least for now). The continued moderation in U.S. COVID cases is also helping risk-positive flows, although worry re: the spread of the UK strain of the virus around the U.S., in addition to issues pertaining to the efficacy of the Oxford/AstraZeneca vaccine in combatting the South African strain of the virus may be limiting broader follow through. Elsewhere, Sino-U.S. tensions are not expected to ease any time soon, especially on the back of the rhetoric provided by U.S. President Biden & Secretary of State Blinken over the weekend, although they will likely be on a more predictable and less spontaneous trajectory than what was seen during Donald Trump's term. Ultimately, the U.S. Tsy curve has been subjected to some bear steepening on the aforementioned fiscal matters, with 30-Year yields threatening to break above 2.00%, while S&P 500 e-minis had a very brief, and very limited look above the 3,900 mark, tagging a fresh all-time high in the process. T-Notes last -0-03+ at 136-18+, hovering just off worst levels of the day.

- Aussie bond futures were pressured by the broader dynamic witnessed in core FI, as well as some local semi issuance and reports from BBG which pointed to China allowing some stranded Australian coal cargoes onshore (although the broader import ban is set to remain in place). This leaves YM unchanged, with XM -7.0.

- JGB futures also fell afoul of the broader dynamic, with fresh cycle highs for 10-Year Japanese breakevens and super-long swap paying adding some local sources of pressure. JGB futures -16 ticks at typing.

JGBS AUCTION: Japanese MOF sells Y199.8bn 10-Year JGBi's:

The Japanese Ministry of Finance (MOF) sells Y199.8bn 10-Year JGBi's:- High Yield: -0.121% (prev. 0.033%)

- Low Price 102.95 (prev. 101.55)

- % Allotted At High Yield: 51.0638% (prev. 93.0348%)

- Bid/Cover: 3.070x (prev. 3.314x)

AUSSIE BONDS: The AOFM sells A$500mn of the 4.50% 21 Apr '33 Bond, issue #TB140:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 4.50% 21 April 2033 Bond, issue #TB140:- Average Yield: 1.3503% (prev. 0.9832%)

- High Yield: 1.3525% (prev. 0.9850%)

- Bid/Cover: 4.8700x (prev. 4.1500x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 82.8% (prev. 39.7%)

- bidders 38 (prev. 32), successful 10 (prev. 11), allocated in full 5 (prev. 5)

EQUITIES: Positive Sentiment Spills Over From US

Asia-Pac equities are in positive territory to start the week, most major indices are in the green led by indices in Japan where the Nikkei 225 has gained over 2%.

- Markets took a positive lead from the US on Friday where the S&P 500 hit fresh record highs. Markets are also digesting comments from US Treasury Secretary Yellen who advocated for an accelerated stimulus package, saying the US could reach full employment next year if stimulus is passed. Also providing oil with tailwinds are expectations of stimulus from the US. The senate approved a fast track budget measure on Friday that could facilitate the passing of the stimulus package even without Republican support.

- Bourses in South Korea are the exception, currently trading with minor losses. South Korea's Hyundai Motor said on its talks with Apple over autonomous electric cars ended without a deal, just a month after it confirmed early-stage talks with the tech giant. Kia, an affiliate of Hyundai and the firm touted to actually carry out the work, also dropped.

- Futures in the US are higher, gaining around 0.5% at the time of writing.

OIL: Rally Extends

The rally continues, crude futures are higher in Asia to kick off the week; WTI and Brent both around $0.50 at $57.39 and $58.85 respectively.

- Crude markets are supported by strong demand from China. The number of vessels sailing toward China hit a six-month high of 127 on Friday, equating to approximately 250m/bbls.

- Also providing oil with tailwinds are expectations of stimulus from the US. The senate approved a fast track budget measure on Friday that could facilitate the passing of the stimulus package even without Republican support. US Tsy Sec Yellen weighed in saying that US could reach full employment next year if stimulus is passed.

- Elsewhere Vitol, the world's largest independent oil trader, echoed sentiments of its rival Gunvor and said the market is getting ahead of itself.

GOLD: Holding Back Above $1,800/oz

A softer USD (as measured by the broader DXY) has supported bullion since the final Asia-Pac session of last week, even with longer dated U.S. real yields ticking higher, although the stabilisation/marginal uptick for the DXY during the early rounds of a new week of trade have kept a lid on bullion over the last few hours. Spot last deals little changed, just above $1,810/oz.

FOREX: U.S. Stimulus Optimism Dominates Quiet Asia-Pac Session

Cautious optimism took hold in early trade this week as participants scrutinised weekend comments from U.S. Tsy Sec Yellen, who kept pushing for a sizeable Covid-19 stimulus package. The Antipodeans caught a light bid, even though a lack of major headlines kept G10 crosses rangebound. New Zealand observed a public holiday. AUD/JPY topped Y81.00 for the first time since 2018. Meanwhile, AUD/USD trades at $0.7674 at typing, ahead of the expiry of $1.0bn worth of options with strikes at $0.7650.

- USD/JPY resumed gains after snapping its seven-day winning streak on Friday, but failed to test the nearby 200-DMA. Japanese news flow revolved around potential for the early lifting of the state of emergency introduced in 10 prefectures. BBG reported that the UK's Dialog Semiconductor is in talks to sell the company to Japan's Renesas Electronics for ~EUR4.9bn.

- The DXY edged higher, moving away from Friday's lows.

- The PBoC fix fell roughly in line with expectations. The bank injected CNY 10bn, a still small injection by historical standards but the PBOC seem to be comfortable with liquidity in the system heading into LNY.

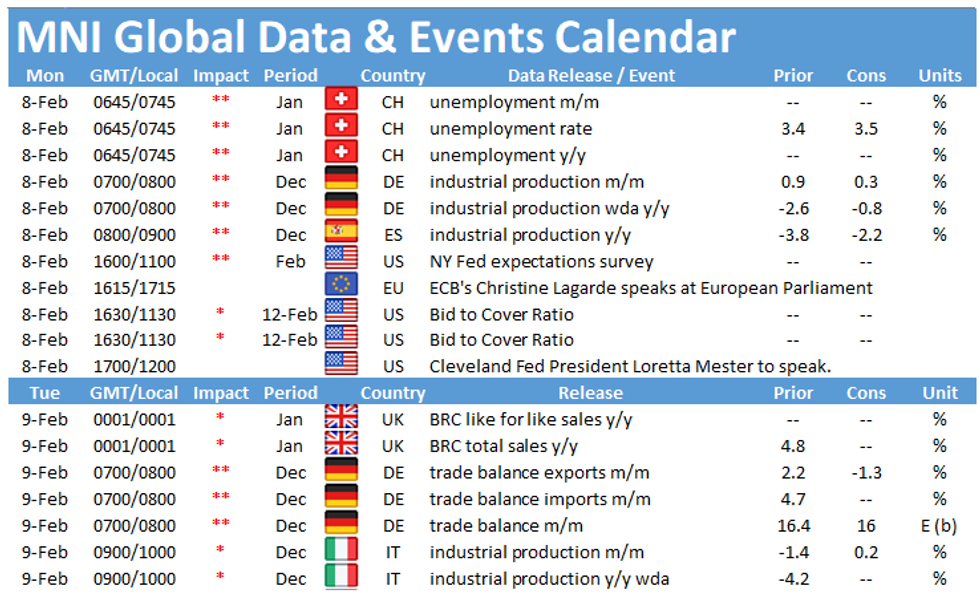

- German industrial output as well as comments from BoE Gov Bailey, Fed's Mester and ECB's Lagarde & Villeroy headline today's economic docket.

FOREX OPTIONS: Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-10(E613mln), $1.2000-05(E1.2bln), $1.2035-50(E1.1bln), $1.2090-00(E606mln)

- USD/JPY: Y103.00-20($838mln)

- AUD/USD: $0.7600-05(A$1.1bln), $0.7650(A$1.0bln), $0.7815-30(A$1.1bln)

- USD/CAD: C$1.2790-00($541mln)

- USD/CNY: Cny6.45($1.6bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.