-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: FOMC Day

EXECUTIVE SUMMARY

- POWELL TO RESIST PRESSURE TO HONE QE GUIDANCE (MNI)

- EU REGULATOR BACKS ASTRA VACCINE AS SAFETY REVIEW RAMPS UP (BBG)

- FRANCE, ITALY HINT AT ASTRAZENECA U-TURN WITH FOCUS ON REGULATOR (BBG)

- ELDERSON: ECB NOT BOUND BY MARKET NEUTRALITY IF MARKET FAILS (BBG)

- U.S. CAUTIONS MEETING WITH CHINA UNLIKELY TO YIELD BREAKTHROUGH (BBG)

- U.S. BLINKEN SAYS CHINA IS ACTING AGGRESSIVELY AND REPRESSIVELY IN ASIA (RTRS)

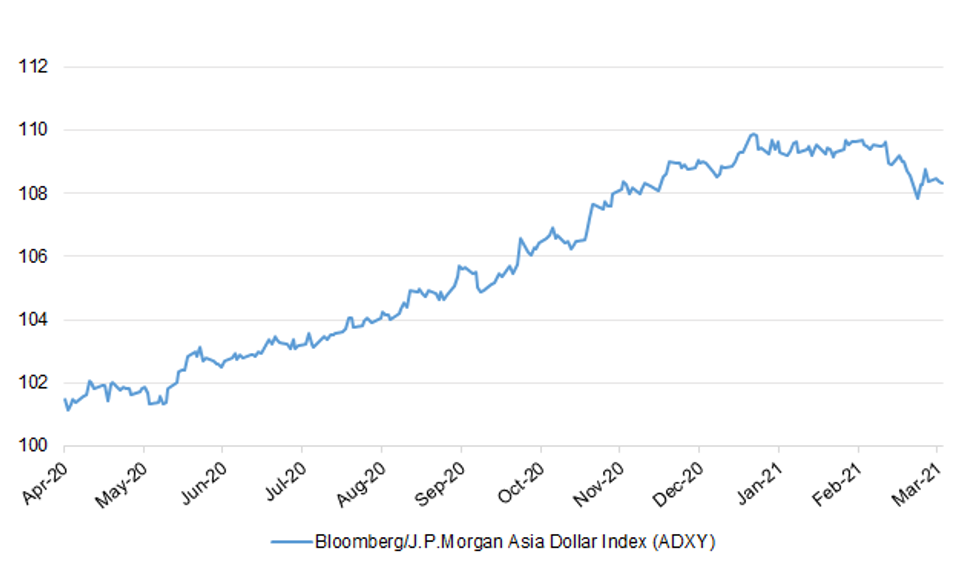

Fig. 1: Bloomberg/J.P.Morgan Asia Dollar Index (ADXY)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Two cases of a new Covid-19 variant of concern, originating from the Philippines, have been identified in England, Public Health England said on Tuesday. The variant, called P.3, was reported by the Philippines on March 9, and includes a number of mutations around the spike protein – which the virus uses to enter human cells – that have been found in other strains of concern. (FT)

BOE: The Bank of England should leave policy unchanged at its meeting this week because the outlook is uncertain, a panel of leading economists has said. All nine members of The Times shadow monetary policy committee recommended waiting for more evidence before taking any action. Markets expect the Bank to hold interest rates at 0.1 per cent and leave quantitative easing as it is at £895 billion tomorrow. Last week the European Central Bank stepped up the pace of its bond buying to reverse a rise in market interest rates since the start of the year. UK sovereign debt has also seen a sharp rise in yields but the Bank is expected to put it down to markets pricing in a recovery. (The Times)

EUROPE

ECB: In case of market failures, the European Central Bank is "not obliged to adhere to market neutrality under all circumstances," Executive Board member Frank Elderson says in Twitter Q&A. "In any case, market neutrality is not a legal concept," Elderson says about the discussion on climate change in the central bank's strategy review. Euro-area central banks are preparing to measure "greenhouse gas emissions and other sustainable and responsible investment-related metrics" of their investment portfolios. Says the ECB looks "at a number of indicators" to analyze financing conditions. (BBG)

ECB: The European Central Bank is shielding the euro-zone economy from higher bond yields partly because the region is rolling out its fiscal stimulus too slowly, according to policy maker Peter Kazimir. While the rise in euro-area government bond yields this year isn't "dramatic for now," the Slovakian central bank governor said the ECB wanted to shore up confidence that the region wouldn't suffer from higher borrowing costs sparked by the $1.9 trillion U.S. fiscal package. (BBG)

CORONAVIRUS: The European Union's drugs regulator reiterated that the benefits of AstraZeneca Plc's Covid vaccine outweigh the risks as it urgently reviews safety data following the suspension of shots by a growing number of countries. The comments were the second from the European Medicines Agency in as many days, and come amid reports of blood clots in some people who received shots. Its intervention follows dramatic measures by several EU member states to halt the use of Astra's vaccine, potentially throwing the region's already slow inoculation campaign further off track. EMA executive director, Emer Cooke, said she was concerned that the government decisions could undermine public support for vaccines. (BBG)

CORONAVIRUS: European Union countries were warned on Tuesday that the slow pace of vaccinations, as well as moves to block the use of some doses, could put the recovery effort at risk and increase the likelihood of prolonged lockdowns. The European Commission on Tuesday pushed back against member states' attempts to dodge any blame over the EU's lackluster vaccination rollout, which has been plagued by slow regulatory approvals and delivery disruptions by AstraZeneca Plc. The bloc's health chief, Stella Kyriakides, told EU ministers in a call that out of the 70 million doses delivered to member states so far, only 51 million have been administered. (BBG)

CORONAVIRUS: Germany postponed a meeting of state and federal leaders over the nation's vaccination strategy to Friday, Der Spiegel reported, citing Malu Dreyer, the Prime Minister of the state of Rhineland-Palatinate. Meeting originally scheduled for Wednesday, but was postponed following the country's decision to temporarily halt vaccinations with AstraZeneca Plc shots. (BBG)

CORONAVIRUS: Italian Prime Minister Mario Draghi and French President Emmanuel Macron are ready to allow the use of AstraZeneca's Covid-19 vaccine again if the European Union's drug regulator advises that it's safe, the Italian government said after the two leaders spoke by telephone. The European Medicines Agency, which is reviewing the shot after several countries suspended it on health concerns, is due to give a definitive assessment Thursday. Draghi's office said the initial guidance from the EMA was encouraging. (BBG)

CORONAVIRUS: In a change of policy, Lithuania suspended use of AstraZeneca's COVID-19 vaccine as "a precaution" until the European Medicines Agency gives a final evaluation of its safety, the country's Health Minister Arturas Dulkys said on Tuesday evening. "We are taking the decision now, because over the previous few hours we have received three reports about serious, unexpected, unwanted thromboembolic cases in patients who were given the AstraZeneca vaccine in Lithuania," the head of the country's medicine authority Gytis Andrulionis told reporters on Tuesday. "We do not have proof whether this is a coincidence or due to the vaccine," he added. (RTRS)

CORONAVIRUS: Brussels is to propose the creation of a Covid-19 certificate to allow EU citizens to travel inside the bloc after a push by tourism-reliant countries devastated by the pandemic. The European Commission on Wednesday will call for a "digital green certificate" to be created that would allow vaccinated and non-vaccinated citizens to travel to other member states and not be forced to quarantine on arrival. (FT)

GERMANY: Angela Merkel's CDU/CSU party bloc, which received a blow in two state elections on Sunday, is also losing support at the national level, according to a new poll. Backing for the group dropped 4 percentage points compared with a week ago, and it would win a 29% share of votes if a national election were held now, according to a poll by Forsa, for broadcaster RTL. The opposition Green party saw its support climb at the expense of the CDU/CSU, up 3 percentage points to 21%, RTL said in a statement. (BBG)

FRANCE: France is considering imposing tougher restrictions in the Paris region to contain the coronavirus. Prime Minister Jean Castex declined to be specific but said on television Tuesday that worsening indicators were pushing the government to work on a potential lockdown during weekends. The government will discuss possible restrictions at a cabinet meeting Wednesday, Castex said. More than 400 people out of every 100,000 people in the Paris region have tested positive over the past week, a threshold Castex has described as alarming. Intensive-care units in and around the capital are almost full, forcing the state to transfer patients to other hospitals around the country. (BBG)

SPAIN: Faced with a possible flood of visitors from Germany later this month, authorities in Spain's Balearic Islands are warning hotel owners that tourists must adhere to coronavirus restrictions the same way residents do. (AP)

NETHERLANDS: The leaders of the top eight parties in the Dutch general election made a final pitch for votes Tuesday night in a televised debate on the eve of the last day of voting in the coronavirus-affected national election. The lead of Prime Minister Mark Rutte's People's Party for Freedom and Democracy in polls has been shrinking in recent weeks but it is still around 10 percentage points ahead of its nearest rival, the anti-immigration Party for Freedom led by anti-Islam firebrand Geert Wilders. The two clashed in the debate, with Rutte casting himself as the leader to guide the Netherlands out of the coronavirus crisis and accusing Wilders of failing to suggest solutions. (AP)

U.S.

FED: MNI EXCLUSIVE: Powell to Resist Pressure to Hone QE Guidance

- Federal Reserve Chairman Jerome Powell will likely resist market pressure to clarify what he means by "substantial progress" in the economy at an interest-rate decision and press conference Wednesday, ex-Fed economists and a current advisor told MNI. "We are nowhere near the labor market of February 2020, so the Fed does not need to define it precisely," said Claudia Sahm, a former Fed board economist. "We will learn so much in the coming months about this recovery" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Millions of Americans are scheduled to receive stimulus checks on March 17, according to reporting from CNBC's Lorie Konish. The funds should be available for withdrawal around 9 a.m. local time. Some Americans have already received their stimulus checks via direct deposit from certain banks and credit unions that made the money available earlier. The majority of the roughly 160 million checks greenlit by the stimulus package passed last week will be issued via direct deposit, according to the IRS. If funds are not transferred via direct deposit, paper checks will be sent instead. (CNBC)

FISCAL: The U.S. House approved a two-month extension of a popular U.S. small-business rescue program that still has almost $93 billion left to distribute, giving companies until the end of May to apply for the forgivable loans. The Paycheck Protection Program was initially set up a year ago as lockdowns stemming from the coronavirus paralyzed the American economy. Lawmakers expanded and extended it as the Covid-19 crisis continued. The House voted 415-3 on a bill extending the PPP for two months from its current expiration date of March 31. The Senate is expected to also approve it, with Majority Leader Chuck Schumer saying Tuesday Democrats "want it to pass as quickly as possible." (BBG)

FISCAL: President Joe Biden's tax plan will feature higher levies on corporations and wealthy Americans, with relief eyed for middle-class households, including those in the $110,000-a-year income range, a White House economic aide said Tuesday. "The key here is that the president believes strongly that the biggest corporations and those folks who have done extremely well over the last several decades should pay a bit more," Bharat Ramamurti, deputy director of the National Economic Council, said Tuesday in an interview with Bloomberg Television. (BBG)

FISCAL: Senate Minority Leader Mitch McConnell said there was no chance that Republicans would back any tax increases to pay for President Joe Biden's infrastructure plan, leaving Democrats to try to force through a package on their own. "I don't think there's going to be any enthusiasm on our side for a tax increase," the Kentucky Republican said. He predicted Democrats would have to employ the same budgetary maneuver, known as reconciliation, that they used to pass Biden's $1.9 trillion stimulus package with a simple majority vote. He said he expected a massive package with infrastructure would be a "Trojan horse" that also includes tax hikes and other Democratic priorities. (BBG)

CORONAVIRUS: The US has administered more than 110m doses of coronavirus vaccines, bringing shots to nearly 65 per cent of the senior population. The Centers for Disease Control and Prevention said on Tuesday that 72.1m Americans have received at least one dose so far – equal to 21.7 per cent of the total population. More than 39m people, or 11.8 per cent of the country, are fully vaccinated. Residents over the age of 65 account for roughly half of the number of people who have received a shot. The data showed that 36.6 per cent of seniors have completed the vaccination process. (FT)

CORONAVIRUS: Andy Slavitt, White House senior advisor for Covid response, predicted that a growing number of Americans will continue to take the Covid vaccine due to messaging and evidence from trusted sources. "In Israel where they're a little bit ahead of us, 89% of seniors have chosen to take the vaccine," Slavitt said. "We think we can get up to those kinds of numbers, if we just continue to reliably answer people's questions, because these are very good, safe, effective vaccines." Roughly 37% of people in the U.S. over the age of 65 have been fully vaccinated, according to the latest data from the Centers for Disease Control and Prevention. States administered about 17 million shots in the last week alone. (CNBC)

CORONAVIRUS: Anthony Fauci, the nation's top infectious-disease expert, said the U.S. is on a march toward more normalcy from the coronavirus pandemic but that a surge in cases similar to what is occurring in Europe is possible if the country relaxes public-health precautions prematurely. High-school-age children could get vaccinated in fall, Dr. Fauci said Tuesday at The Wall Street Journal's Executive Membership Series. Both summer and fall would bring greater flexibility that feels more like normalcy, he predicted. (WSJ)

CORONAVIRUS: The list of states releasing plans to quickly expand vaccine access is growing by the day. Montana Gov. Greg Gianforte announced Tuesday the expansion of vaccine eligibility to residents 16 years and older starting April 1. (CNBC)

CORONAVIRUS: Covid-19 infections and hospitalizations have plateaued in Colorado although tests indicate an increased prevalence of variants, Rachel Herlihy, state epidemiologist, said at a Tuesday news conference in Denver. A total of about 600 cases of the UK, South Africa, California and New York City variants have been identified in the state, Herlihy said, including 11 cases of the South Africa variant tied to a state prison in a rural county. (BBG)

CORONAVIRUS: Former President Trump recommended that Americans, and specifically those who voted for him, get vaccinated against COVID-19 during an interview with Fox News on Tuesday. (Axios)

POLITICS: President Biden will give the first formal press conference of his presidency on March 25, White House press secretary Jen Psaki informed pool reporters on Tuesday. Biden has largely avoided taking direct questions from reporters while handling several major crises since taking office. Biden is slated to do a one-on-one interview with George Stephanopoulos this week. (Axios)

POLITICS: President Biden told ABC News Tuesday he supports reforming the Senate's filibuster rule to require lawmakers to talk on the Senate floor to delay a bill's passage. (Axios)

RATINGS: S&P affirmed the U.S.A. at AA+; Outlook Stable

OTHER

U.S./CHINA: Senior U.S. officials sought to set a low bar on expectations for the Biden administration's first face-to-face meeting with Chinese officials later this week, saying it will be more about the two sides discussing their priorities -- and differences -- rather than trying to craft agreements. "We expect there are parts of the conversation that could be difficult," Press Secretary Jen Psaki told reporters Tuesday aboard Air Force One en route to Pennsylvania. "There are issues that the president has not held back on voicing concerns about, whether it's human rights, whether it's economic or technology issues." National Security Adviser Jake Sullivan and Secretary of State Antony Blinken are scheduled to meet with Yang Jiechi, a member of the ruling Politburo, and Wang Yi, China's foreign minister, on Thursday evening and Friday in Anchorage, Alaska, following Blinken's visits with allies in Japan and South Korea. (BBG)

U.S./CHINA: United States Secretary of State Antony Blinken told a roundtable of Japanese journalists on Wednesday that China is acting more aggressively and repressively, including in the East and South China Seas. (RTRS)

U.S./CHINA: Chinese camera and touch module supplier O-Film Group will lose a substantial purchase order from an unidentified overseas client, the company reported Tuesday evening, a customer believed to be Apple given the size of the order at stake. The customer recently notified Shenzhen-listed O-Film that its procurement relationship with the group was about to be terminated, the supplier said in a filing on the stock exchange's website. The exact schedule for the cutoff from the supply chain was not revealed, but O-Film said business with this client produced nearly 11.7 billion yuan ($1.8 billion at current rates) in 2019, or 22.51% of total revenue that year. O-Film was one of 11 Chinese companies added to the U.S. Commerce Department's Entity List in July over allegations of human rights abuses involving China's Uyghur Muslim minority. In the blacklisting, Washington named the company's subsidiary in Nanchang, alleging forced labor of Uyghurs and others in the western Chinese region of Xinjiang. (Nikkei)

U.S./CHINA/HONG KONG: U.S. Secretary of State Anthony Blinken said the release of the latest update to the Hong Kong Autonomy Act report showed that China's National People's Congress had unilaterally undermined Hong Kong's electoral system in its March 11 decision. Blinken said the report identified 24 China and Hong Kong officials whose actions have reduced Hong Kong's autonomy. He added that foreign financial institutions which knowingly conduct significant transactions with these officials would be subject to sanctions. (RTRS)

U.S./CHINA/TAIWAN: Taiwan affairs are China's internal affairs, and not allowing intervention from U.S., China's Taiwan Affairs Office spokeswoman Zhu Fenglian says at a press conference. (BBG)

U.S./EU: U.S. Treasury Secretary Janet Yellen discussed the importance of close transatlantic financial regulatory cooperation in a phone call with the European Union's finance services chief, Mairead McGuinness, on Tuesday, Treasury said in a statement. In the call, Yellen emphasized the importance of the transatlantic partnership and conveyed her intention to deepen U.S.-European cooperation on issues such as ending the COVID-19 pandemic, supporting a strong global economic recovery, fighting income inequality, and combating climate change, Treasury said. She also discussed the importance of "close transatlantic financial regulatory cooperation in promoting the safety and soundness of our respective financial systems and reducing regulatory frictions," the statement said. (RTRS)

GLOBAL TRADE: Katherine Tai, President Joe Biden's nominee for U.S. Trade Representative, won unanimous support in a U.S. Senate procedural vote on Tuesday and appeared set for confirmation on Wednesday. The rare 98-0 vote on the motion to end debate on the nomination means Tai, 47, will easily win bipartisan confirmation. Plans for a Wednesday vote on her nomination were confirmed by a spokeswoman for Senate Majority Leader Charles Schumer. (RTRS)

GLOBAL TRADE: Japan will raise tariffs on U.S. beef imports for 30 days, the Ministry of Finance announces Wednesday after shipments from America exceeded an agreed upon quota. (BBG)

GLOBAL TRADE: Samsung Electronics Co. warned it's grappling with the fallout from a "serious imbalance" in semiconductors globally, becoming the largest tech giant to voice concerns about chip shortages spreading beyond the automaking industry. Samsung, one of the world's largest makers of chips and consumer electronics, expects the crunch to pose a problem to its business next quarter, co-Chief Executive Officer Koh Dong-jin said during an annual shareholders meeting in Seoul. The company is also considering skipping the introduction of a new Galaxy Note -- one of its best-selling models -- this year, though Koh said that was geared toward streamlining its lineup. (BBG)

GEOPOLITICS: Russian President Vladimir Putin knew of and likely directed a Russian effort to manipulate the 2020 U.S. presidential campaign to benefit former President Donald Trump with "misleading or unsubstantiated allegations" against challenger Joe Biden, U.S. intelligence officials said on Tuesday. The assessment was made in a 15-page report into election interference released by the Office of the Director of National Intelligence. It underscored allegations that Trump's allies played into Moscow's hands by amplifying claims made against Biden by Russian-linked Ukrainian figures in the run-up to the Nov. 3 election. Biden, a Democrat, defeated Trump, a Republican, and became president on Jan. 20. U.S. intelligence agencies found other attempts to sway voters, including a "multi-pronged covert influence campaign" by Iran intended to undercut Trump's support. Trump pulled the United States out of an international nuclear deal with Iran and imposed fresh sanctions. (RTRS)

GEOPOLITICS: The Biden administration is expected to announce sanctions related to election interference as soon as next week, three US State Department officials told CNN. The officials did not disclose any details related to the expected sanctions but said that they will target multiple countries including Russia, China and Iran. (XNN)

CORONAVIRUS: U.S. President Joe Biden said on Tuesday the United States is in talks with several countries about who will get any extra doses of COVID-19 vaccines. "We're talking with several countries already," Biden told reporters as he left the White House to promote his coronavirus stimulus package in Pennsylvania. "I'll let you know that very shortly." Biden has promised to make sure every American has access to a vaccine before giving any to other nations. He did not identify the countries. (RTRS) Vaccine nationalism in countries including the U.S. and India is likely to derail efforts by the World Health Organization to deliver 2 billion doses to poorer and middle- income nations by the end of the year, according to the head of the world's biggest vaccine maker. Countries are holding tight to their supplies and restricting access to materials needed to make more, said Adar Poonawalla, chief executive officer of the Serum Institute of India Ltd. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga is set to lift the coronavirus state of emergency for the Tokyo area when it expires on March 21, local media including the Sankei newspaper reported. The country first imposed a state of emergency for Tokyo and nearby areas in early January, before later expanding it to other parts of the country. While it has since been lifted in other areas, the emergency was extended in the Tokyo region as cases plateaued despite early success in reducing new infections. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga will meet Olympics Minister Tamayo Marukawa this afternoon and confirm plans to hold the Olympic games without foreign spectators, broadcaster FNN reports, without attribution. (BBG)

BOJ: The Bank of Japan could change its yield target to five-year government debt from the current 10-year maturity if it is looking to surprise markets, according to former BOJ policy board member Takahide Kiuchi. "We can't rule out the possibility that the BOJ will try to come up with some kind of surprise," said Kiuchi, currently executive economist at Nomura Research Institute. "Having made such a big deal about giving advanced notice, the BOJ must have been considering policy revisions that weren't necessarily minor," said Kiuchi, who was a consistent dissenter during his time on Governor Haruhiko Kuroda's board. (BBG)

AUSTRALIA: Australian Prime Minister Scott Morrison expressed concern over a resurgence of a Covid-19 outbreak in Papua New Guinea, saying it raises risks for his country. Australia suspended passenger flights from Papua New Guinea to Cairns. Morrison also said Australia would provide more aid to Papua New Guinea, including the donation of 8,000 vaccine doses to the country's health care workers. (BBG)

RBA: Reserve Bank of Australia Assistant Governor Christopher Kent said monetary policy shouldn't try to control asset prices, and regulators have alternative mechanisms to deal with deteriorating lending standards if needed. Responding to a question after a speech Wednesday on whether stimulus might be pulled back quicker if asset prices over-inflate, Kent said rising prices are an important part of policy transmission, but the Council of Financial Regulators is closely monitoring the issue. If prices rise "on the back of deteriorating lending standards and a rise in financial risk, that would be of concern to the council," Kent said. "We're not at that point currently, but those responses would not be first and foremost from monetary policy. In fact, I think there are a lot of other avenues that they would pursue." (BBG)

NEW ZEALAND: Fonterra's first-half profit fell as the previous year's earnings were inflated by one-off asset sales, however an improvement in its underlying performance means it has resumed paying dividends. The cooperative posted a 22 per cent fall in net profit to $391 million in the six months to the end of January, with the previous period's profits boosted by the sale of its half share in pharmaceutical supplier DFE Pharma and nutrition business Foodspring. "While down on this time last year at a headline level, the 2020 financial year benefited significantly from the divestments of DFE Pharma and Foodspring," said chief executive Miles Hurrell. (Stuff NZ)

SOUTH KOREA: South Korea said it will keep using AstraZeneca vaccine as scheduled, with around 570,000 people in the country have received the vaccine so far. Yonhap subsequently reported that one case of a blood clot was found after receiving an AstraZeneca shot. (BBG)

SOUTH KOREA: South Korea's capital city of Seoul, where about half of the country's population lives, is requiring foreign workers to get tested for Covid-19 as sporadic cluster outbreaks among migrants have stymied efforts to lower the number of daily new coronavirus patients. Seoul's mandate follows that of adjoining Gyeonggi Province which last week required testing of foreign workers and their employers, a move that some foreigners have decried as xenophobic. South Korea's daily new cases have hovered around 400 for the past two weeks despite strict social distancing measures and vaccine roll out. (BBG)

NORTH KOREA: US intelligence has assessed that North Korea could be preparing to carry out their first weapons test since President Joe Biden came into office, according to several US officials speaking to CNN on condition of anonymity. The US officials are on alert as the US and South Korea conduct scaled-down, simulated military exercises and US Secretary of State Tony Blinken and Defense Secretary Lloyd Austin are in Asia for meetings with their Japanese and South Korean counterparts. (CNN)

MEXICO: Mexico expects an answer from Washington on Friday about whether the US will share some of its stock of Oxford/AstraZeneca vaccines. "We're getting a reply on Friday and we will announce the details then, but I'd say things are progressing well," Marcelo Ebrard, foreign minister, told a daily government news conference. (FT)

BRAZIL: Eletrobras privatization has potential revenue of 60b reais, special secretary of Investment Partnerships Program Martha Seillier said in a virtual press conference. Govt authorized inclusion of Eletrobras, post office Correios and Empresa Brasileira de Comunicacao in National Privatization Plan. Best format for postal service privatization is to sell the whole company, according to a BNDES study. Bill that paves the way for post office privatization should be approved by Aug. 2021, Seillier said. There's no need to talk about post office shutdown, she said. (BBG)

IRAN: Iran has started enriching uranium at its underground Natanz plant with a second type of advanced centrifuge, the IR-4, the U.N. nuclear watchdog said in a report reviewed by Reuters on Tuesday, in a further breach of Tehran's deal with major powers. Iran has recently accelerated its breaches of the deal's restrictions on its nuclear activities in an apparent bid to pressure U.S. President Joe Biden as both sides are locked in a standoff over who should move first to save the deal. (RTRS)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen said on Tuesday it had destroyed an explosive-laden boat before an imminent attack off the Yemeni port of Salif, Saudi state media reported. The coalition added that Yemen's Iran-aligned Houthi group "continue to threaten maritime traffic and international trade." (RTRS)

OIL: Indian state refiners are planning to cut oil imports from Saudi Arabia by about a quarter in May, in an escalating stand-off with Riyadh following OPEC's decision to ignore calls from New Delhi to help the global economy with higher supply. Two sources familiar with the discussions said the move was part of the government's drive to cut dependence on crude from the Middle East. Indian Oil Corp, Bharat Petroleum Corp., Hindustan Petroleum Corp and Mangalore Refinery and Petrochemicals Ltd are preparing to lift about 10.8 million barrels in May, the sources said on condition of anonymity. (RTRS)

OIL: Russia sees its compliance with OPEC+ deal at 100.7% in February, Deputy Energy Minister Pavel Sorokin says in a statement. Russia keeps raising domestic oil supplies to meet growing fuel demand as the Russian economy is recovering from the pandemic. (BBG)

CHINA

CORONAVIRUS: Chinese embassies in at least 20 countries have offered to facilitate visa applications by people who have received China- developed Covid-19 vaccines, the Global Times reported. Chinese foreign ministry spokesman Zhao Lijian called the move an exploratory action aimed at easing travel restrictions, according to the report. Applicants who have completed vaccinations are still required to present negative coronavirus test results. The facilitation applies to those coming to China for work, family members of Chinese citizens or permanent residents in countries ranging from Australia and South Korea to India and Pakistan, according to Global Times. (BBG)

PBOC: China will risk "huge economic losses" if it tries to curb asset bubbles through monetary policy tightening, a former central bank official warned, adding to a debate that's roiled financial markets this year. Sheng Songcheng, a former director of the People's Bank of China's statistics and analysis department, said closer market supervision would be better than policy tightening measures to reduce speculation in financial assets. (BBG)

YUAN: The yuan will show no clear advantage this year as the recovering global economy makes other nations' assets more attractive, Guan Tao, an economist at Bank of China Securities and a former official at State Administration of Foreign Exchange, wrote in a commentary by Netease Research. The yuan's valuation is also affected by China's rate of Covid inoculation, which is slower than some of its competitors, Guan said. The PBOC has also refrained from significant tightening, said Guan. On inflation, Guan said China's CPI may be moderately capped at 3%, given rising pork supplies and stable industrial production. (MNI)

ECONOMY: China's tourism and entertainment industries are expected to surge as authorities loosen pandemic restrictions, the Securities Times said in a frontpage commentary. Beijing has removed requirements for nucleic acid tests on inbound travelers and nearby commuters. Entertainment performances around the countries are no longer restricted, benefiting hotels and transportation, the newspaper said. The economy is expected to fully recover with a nationwide inoculation push underway, the Times said. (MNI)

IP: China should enhance laws on data property rights to protect personal and commercial data and rein in the unregulated expansion of platform companies, many of which take advantages of loopholes to abuse rights of consumers, said the 21st Century Business Herald in the editorial. MNI noted that a chorus of state media has criticized the ecommerce industry after President Xi Jinping this week signaled further crackdown on privately owned online giants such as Alibaba Group and Meituan Inc., whose sprawling businesses provide essential services such as delivery and online shopping. Large so-called platform companies have expanded into multiple industries and overwhelmed smaller businesses, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN FEB TRADE BALANCE +Y217.4BN; MEDIAN +Y420.0BN; JAN -Y325.4BN

JAPAN FEB TRADE BALANCE ADJ -Y38.7BN; MEDIAN -Y119.0BN; JAN +Y551.1BN

JAPAN FEB EXPORTS -4.5% Y/Y; MEDIAN -0.2%; JAN +6.4%

JAPAN FEB IMPORTS +11.8% Y/Y; MEDIAN +12.0%; JAN -9.5%

AUSTRALIA FEB WESTPAC LEADING INDEX +0.01% M/M; JAN -0.09%

The growth rate in the Index continues to hold comfortably in positive territory indicating that growth through much of 2021 will be above trend. That outlook is consistent with Westpac's views. Indeed, we recently lifted our growth forecast for 2021 to 4.5% from 4.0% – well above trend. From our perspective the key driver of growth in 2021 will be the household sector as a sharp fall in the currently elevated savings rate will free up considerable funds to support strong consumer spending. (Westpac)

NEW ZEALAND Q4 BOP CURRENT ACCOUNT BALANCE -NZ$2.695BN; MEDIAN -NZ$2.675BN; Q3 -NZ$3.620BN

NEW ZEALAND Q4 CURRENT ACCOUNT GDP RATIO YTD -0.8%; MEDIAN -0.8%; Q3 -0.8%

SOUTH KOREA FEB UNEMPLOYMENT 4.0%; MEDIAN 5.0%; JAN 5.4%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1912% at 09:24 am local time from the close of 2.2198% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 37 on Tuesday vs 36 on Monday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4978 WEDS VS 6.5029

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4978 on Wednesday, compared with the 6.5029 set on Tuesday.

MARKETS

SNAPSHOT: FOMC Day

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 60.87 points at 29860

- ASX 200 down 32.738 points at 6794.4

- Shanghai Comp. down 10.774 points at 3435.959

- JGB 10-Yr future up 2 ticks at 151.21, yield down 1.0bp at 0.095%

- Aussie 10-Yr future down 3.5 ticks at 98.235, yield up 3.5bp at 1.727%

- U.S. 10-Yr future -0-01+ at 131-29, yield unch. at 1.618%

- WTI crude up $0.04 at $64.84, Gold up $5.61 at $1737.20

- USD/JPY up 11 pips at Y109.11

- POWELL TO RESIST PRESSURE TO HONE QE GUIDANCE (MNI)

- EU REGULATOR BACKS ASTRA VACCINE AS SAFETY REVIEW RAMPS UP (BBG)

- FRANCE, ITALY HINT AT ASTRAZENECA U-TURN WITH FOCUS ON REGULATOR (BBG)

- ELDERSON: ECB NOT BOUND BY MARKET NEUTRALITY IF MARKET FAILS (BBG)

- U.S. CAUTIONS MEETING WITH CHINA UNLIKELY TO YIELD BREAKTHROUGH (BBG)

- U.S. BLINKEN SAYS CHINA IS ACTING AGGRESSIVELY AND REPRESSIVELY IN ASIA (RTRS)

BOND SUMMARY: U.S. Market Flow Dominates In Asia

A lack of tier 1 headline flow made for a relatively limited round of pre-FOMC Asia-Pac trade, at least range-wise, with block flow in the Tsy options space and screen-based flow in Eurodollar futures catching the eye (see earlier bullets for full details on those matters). Central bank meetings are at the fore this week, with the aforementioned FOMC decision headlining on Wednesday, while the upcoming Sino-U.S. summit in Alaska is set to bring about little in the way of tangible progress re: any of the well-defined areas of dispute. T-Notes held to a narrow 0-04+ range overnight, last -0-01+ at 131-29, while cash Tsys print unchanged to 1.0bp richer across the curve vs. closing levels, with some light bull flattening in play.

- JGB futures stuck to a tight range during the Tokyo morning, last +3. Local headline flow was light, with the latest round of BoJ Rinban operations seeing no change to the size of the purchases witnessed in each bucket.The 1-10 Year purchases saw upticks in offer/ratio vs. their prev. rounds of buying, although the moves in the respective metrics were minor, while the offer/cover ratio for the ops covering 10-25 Year JGBs moderated. The super long end of the curve unwound its early underperformance in the afternoon against this backdrop (even though the BoJ Rinban ops didn't go past the 25-Year tenor), with the curve a touch flatter at typing as a result.

- Aussie bond futures stuck to narrow ranges, YM -2.0, XM -3.0. The Q&A portion of RBA Assistant Governor Kent's latest appearance reaffirmed the Bank's well-known views on several key areas of monetary policy. Elsewhere, A$1.0bn of ACGB Jun '31 supply saw the average yield price ~0.6bp through prevailing mids at the time of supply, representing a smooth passage.

JGBS AUCTION: Japanese MOF sells Y2.8537tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8537tn 1-Year Bills:- Average Yield -0.1298% (prev. -0.1221%)

- Average Price 100.130 (prev. 100.122)

- High Yield: -0.1288% (prev. -0.1221%)

- Low Price 100.129 (prev. 100.122)

- % Allotted At High Yield: 56.6320% (prev. 96.2593%)

- Bid/Cover: 3.435x (prev. 4.173x)

BOJ: 1-25 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.31tn of JGB's from the market, sizes unchanged from previous operations.

- Y400bn worth of JGBs with 1-3 Years until maturity

- Y370bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.50% 21 Jun '31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:- Average Yield: 1.7161% (prev. 1.8378%)

- High Yield: 1.7175% (prev. 1.8425%)

- Bid/Cover: 2.8200x (prev. 3.3850x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 82.4% (prev. 8.8%)

- bidders 39 (prev. 54), successful 15 (prev. 25), allocated in full 8 (prev. 18)

EQUITIES: Struggle For Clear Direction

Most indices in Asia-Pac have sustained minor losses, even those in positive territory have struggled to make any significant gains. A mixed picture in China, the CSI 300 currently flat, having retreated from highs and recovered from lows. The PBOC refrained from injecting liquidity for the eighth day, this saw equities pressured initially before repo rates actually declined and saw a bid in markets. Markets in South Korea sustained heavy losses, led lower by Samsung who warned over production delays due to a global chip shortage, while markets in Japan are pressured by disappointing trade data. Futures in the US are slightly lower, markets look ahead to the FOMC rate announcement later today.

OIL: Lower For Fourth Day

Crude futures are marginally lower in Asia on Wednesday; WTI is down $0.03 from settlement levels, while Brent is around $0.11 lower. If the benchmarks do record declines, it will be the fourth straight day of drops, though the benchmarks are holding the majority of the ~70% gain seen since November 2020. Data after market yesterday showed a surprise 1m bbl draw in US crude inventories compared to a massive 12.80m bbl build in the previous week. Downstream product data was less bullish, gasoline inventories fell by a less than expected 926k bls, and distillate inventories increasing by 904k bbls. For more comprehensive inventory data, the market will now be looking towards the DOE report due later today, if the DOE figures confirm the API report it would be the first headline draw since February.

GOLD: Range Intact Ahead Of FOMC

Spot has added $4/oz since settlement to last deal at ~$1,736/oz, sticking to the confines of yesterday's range, as bulls look to force a technical break above the 20-day EMA to open up the next leg higher. Wednesday's FOMC decision presents the immediate risk event for U.S. Tsys & the USD, and as a result, bullion.

FOREX: Greenback Outperforms With FX Space In Pre-FOMC Waiting Mode

The greenback ground higher ahead of today's monetary policy decision from the Fed, with G10 crosses treading water through the tight Asia-Pac session. The DXY failed to threaten yesterday's extremes, while e-minis & most regional equity benchmarks lost altitude.

- AUD was the worst performer in G10 FX space as a degree of caution crept in. RBA Asst Gov Kent stuck to the familiar script, reaffirming some key aspects of the Reserve Bank's policy stance.

- USD/JPY resumed gains after the recent formation of the "golden cross" pattern, despite today's expiry of $1.2bn worth of options with strikes at Y108.50-55. USD/JPY overnight ATM implied volatility rose to 13.29%, a level not seen since the U.S. presidential election.

- The PBOC fixed its USD/CNY mid-point at CNY6.4978, virtually in line with sell side estimates. USD/CNH was rangebound.

- Apart from the FOMC meeting, today's highlights include Canadian and final EZ CPIs, U.S. housing starts & building permits as well as comments from ECB's Elderson.

FOREX OPTIONS: Expiries for Mar17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E1.65bln-EUR puts), $1.1940-50(E603mln), $1.2000(E1.2bln), $1.2040-55(E1.6bln), $1.2065-75(E671mln)

- USD/JPY: Y108.30($630mln), Y108.50-55($1.3bln)

- GBP/USD: $1.3885-90(Gbp614mln-GBP puts)

- EUR/GBP: Gbp0.8600(E1.2bln), Gbp0.8750(E621mln)

- USD/CHF: Chf0.9200($660mln)

- AUD/USD: $0.7745-50(A$540mln), $0.7765(A$550mln)

- USD/CAD: C$1.2685($793mln)

- USD/CNY: Cny6.40($884mln), Cny6.46($895mln), Cny6.57($500mln)

- USD/ZAR: Zar15.00($531mln)

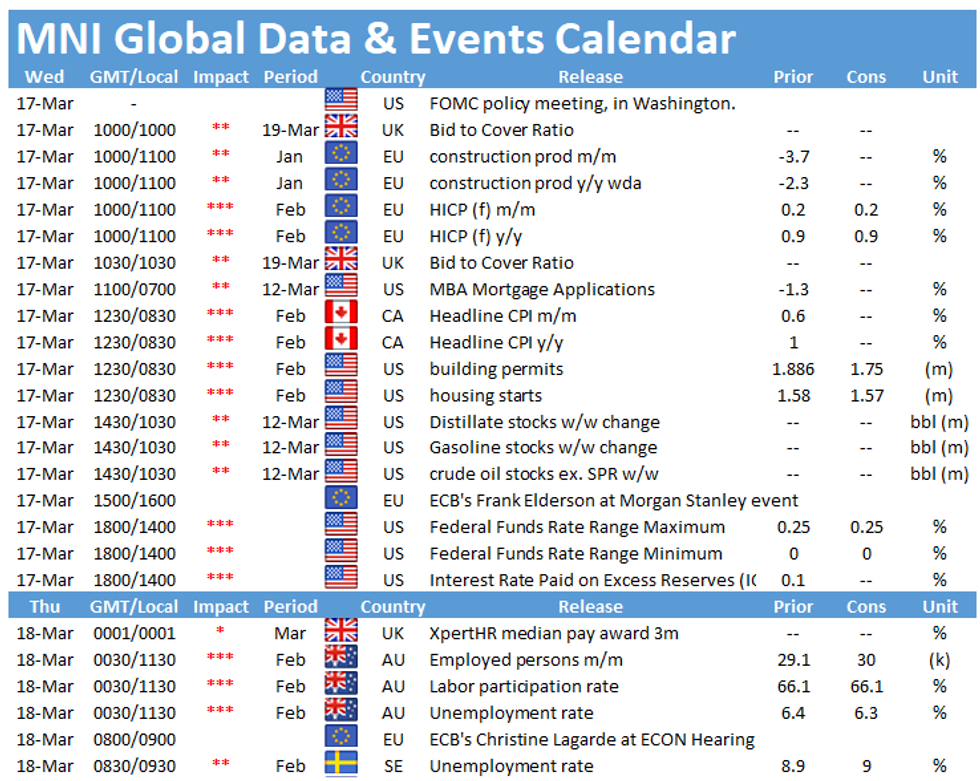

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.