-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Aversion Remains, Vaccine Matters Under Scrutiny

EXECUTIVE SUMMARY

- POWELL EXPECTS BUMP IN INFLATION, SAYS IT WON'T GET OUT OF HAND (BBG)

- YELLEN: TREASURY NOT PLANNING TO LENGTHEN DEBT (MNI)

- EU TO EXTEND VACCINE EXPORT CURBS TO COVER BRITAIN, BACKLOADING (RTRS)

- HONG KONG SUSPENDS BIONTECH VACCINES ON PACKAGING DEFECT (BBG)

- SUEZ CANAL TO DIVERT TRAFFIC TO OLDER ROUTE AFTER GIANT SHIPT BLOCKS CANAL (RTRS)

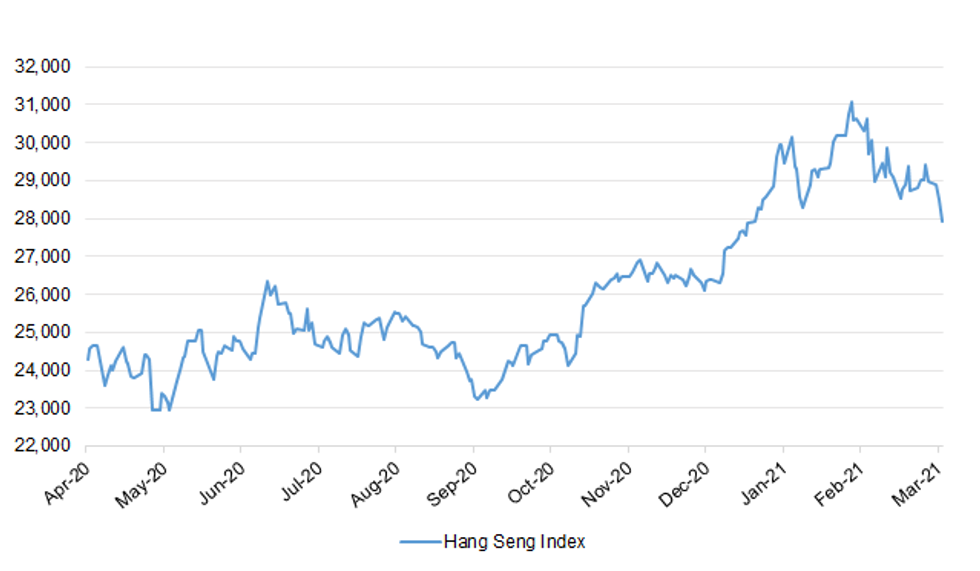

Fig. 1: Hang Seng Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has said that summer holidays abroad "look difficult for the time being" and suggested that the government could impose tougher border controls to stop the import of mutant strains. In a Downing Street press conference to mark the anniversary of the first lockdown, the prime minister said that there was mounting concern over the spread of variant strains on the continent which are more resistant to vaccines. (Times)

CORONAVIRUS: South African and Brazilian variants of the coronavirus that are more resistant to vaccines now account for up to 40 per cent of all new cases in some regions in France, according to data presented to ministers. The Times has been told that Boris Johnson is under mounting pressure from Chris Whitty, the chief medical officer for England, and Jonathan Van-Tam, his deputy, to implement tougher border controls to stop mutant strains being imported. They are said to be "very concerned" because the majority of people travelling from France are exempt from quarantine measures. (Times)

CORONAVIRUS: Children will start getting the Covid vaccine as early as August under provisional government plans to push for maximum immunity from the virus, The Telegraph can reveal. Two sources involved in preparations said that was the soonest point at which Britons under the age of 18 would be given the jabs – months earlier than expected. Safety data on the critical child vaccine study being run by Oxford University – on which ministers are waiting before making their final decisions – is expected shortly, with its conclusions due in June or July. (Telegraph)

CORONAVIRUS: The COVID crisis will cause a "long rain shadow" and there will "definitely" be another surge in infections, according to England's chief medical officer. Professor Chris Whitty, speaking on the anniversary of the UK's first lockdown, warned of "bumps and twists on the road" as the country attempts to recover from the pandemic. Addressing the Public Health Conference 2021, organised by the Local Government Association (LGA) and the Association of Directors of Public Health (ADPH), Prof Whitty told delegates: "The path from here on in does look better than the last year." But, predicting a further spike in infections at some point and possible vaccine supply problems, he added: "There are going to be lots of bumps and twists on the road from here on in. "There will definitely be another surge at some point whether it's before winter or next winter, we don't know. (Sky)

CORONAVIRUS/ECONOMY: Retailers have called on the government to take "all necessary precautions" to prevent a fourth lockdown after 67,000 retail jobs were lost in the past year. The industry, which still employs more than 3 million people, according to the latest data from the Office for National Statistics, warned that further job losses could be on the way if shops were forced to remain closed beyond 12 April. The British Retail Consortium (BRC), which represents hundreds of retail groups from major supermarkets to independent fashion chains, said there were now 600,000 retail workers on furlough, up 200,000 since December, suggesting further jobs were at risk. Helen Dickinson, the chief executive of the BRC, said the situation was "likely to get worse if the third lockdown wears on". (Guardian)

ECONOMY: Boris Johnson has created a cross-government group to attract foreign investment in strategic projects as Downing Street works to bolster the UK's post-Brexit appeal. The Office for Investment will involve public and private sector experts whose job it will be to "unlock" complex schemes seen as crucial for wider government objectives such as infrastructure development and renewable energy. Economists are concerned that the end of the Brexit transition period at the end of the year will hit the level of overseas investment coming into the UK. They fear foreign-owned UK-based manufacturers and service companies may reduce investment here after losing access to key markets in the EU. (FT)

EUROPE

EU: MNI EXCLUSIVE: France Pushes For Covid Exclusion From Debt Pact

- France is arguing for Covid-related debt to be excluded from revamped rules on public borrowing ahead of a review of the eurozone's dormant Stability and Growth Pact, setting up a possible tussle between the bloc's more fiscally hawkish and dovish states in the autumn, Brussels officials said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EU: The European Commission will on Wednesday extend EU powers to potentially block COVID-19 vaccine exports to Britain and other areas with much higher vaccination rates, and to cover instances of companies backloading contracted supplies, an EU official said. The moves, which the EU official said could hit Johnson & Johnson, are designed to avoid even limited shortfalls in deliveries to a region whose inoculation programme has been beset by delays and supply issues. Shipments abroad could also be withheld if vaccine-producing countries, such as Britain and the United States, do not allow exports to the EU, the official said, confirming comments by Commission head Ursula von der Leyen last week. (RTRS)

EU: The EU's current export regime guarantees that supplies to some 90 countries won't be interrupted, and also offers protection to companies like Pfizer Inc. and Moderna Inc. that have met their commitments in Europe. Under stricter restrictions being drafted in Brussels, both of those exemptions could be removed, a senior EU official said. That could hit countries from the Gulf to Canada, as the EU is one of the world's biggest coronavirus vaccine producers. The move marks a fresh escalation in the EU's battle to secure supplies. The bloc's executive arm could potentially block all exports to countries that do not reciprocate, with the U.K a prime target. The new rules won't affect shipments for Covax, a global program to help lower-income nations get vaccines. (BBG)

EU/U.S.: MNI BRIEF: Biden, EU Leaders Set Up Mar 25 Video Summit

- U.S. President Joe Biden will join European leaders on a video summit call Thursday to discuss future cooperation between Brussels and Washington, Barend Leyts, a spokesman for European Council President Charles Michel said Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EU/CHINA: China's ambassador to Germany, Wu Ken, was called in for "urgent talks" on Tuesday with state secretary Miguel Berger, the Foreign Ministry said. Wu was summoned following a move by Beijing to sanction European officials in retaliation for EU measures responding to China's crackdown on the Uyghur Muslim minority. During the discussion, Berger "made clear the German government's view that China's sanctions against European MPs, scientists and political institutions as well as non-governmental organizations represent an inappropriate escalation that unnecessarily strains ties between the EU and China," the Foreign Ministry said. China's ambassadors were also summoned in other European countries over Beijing's retaliatory sanctions. In France, the Foreign Ministry said Chinese ambassador Lu Shaye was called in over the sanctions as well as "unacceptable statements" targeting French lawmakers and researchers, news agency dpa reported. Denmark made a similar move on Tuesday, with Foreign Minister Jeppe Kofod saying China's sanctions were "a clear attack on ... freedom of expression." (Deutsche Welle)

ITALY/CHINA: Italy has summoned the Chinese ambassador over sanctions against the European Union, Italy's Foreign Ministry says in a statement. Deputy minister Marina Sereni will receive the ambassador on Wednesday (BBG)

ITALY/TURKEY: Italy's Premier Mario Draghi, Turkish President Recep Tayyip Erdogan discussed EU-Turkey, the situation in the Eastern Mediterranean and in Libya, "as well as global challenges and priorities of the Italian G20Presidency," according to statement from Draghi's office. (BBG)

FRANCE: France is turning to mass centres to speed up its vaccination campaign amid a "vertiginous" surge in Covid-19 infections. In the Paris region, where inoculations have lagged behind the rest of the country, local officials are calling for the vaccine distribution criteria to be broadened too. For months France's government resisted calls for a new Covid-19 lockdown, before settling for "lockdown light light". Now it has decided to change tack on its under-fire vaccination drive too, embracing the mass inoculation centres it had previously opposed. As hospitals struggle to cope with a third wave of infections, Health Minister Olivier Véran on Monday announced that France would follow the lead of countries like the US and Britain that have turned stadiums into inoculation sites to rapidly dispense vaccines. "The army's health service will work on developing a certain number of large vaccination centres," he said, adding that there would be at least 35 across the country. On Tuesday, his cabinet colleague Agnès Pannier-Runacher, the industry minister, said the supersites would open "in the coming days". (France24)

FRANCE/TURKEY: President Emmanuel Macron expressed concern that Turkey will attempt to influence upcoming French elections. "The threats aren't veiled, so I think that we must be very lucid," Macron said on Tuesday in an interview with France 5 television. The comments come somewhat out of left field. Ties between Macron and Turkish President Recep Tayyip Erdogan have been tense over issues ranging from religion to energy exploration in the eastern Mediterranean, but they exchanged letters in January and agreed to try and mend ties. On March 2 they followed up with a video call. Macron didn't explain how Turkey might attempt to interfere with French elections -- or whether he was referring to regional elections in June, the presidential ballot in 2022, or both. He said only that Turkey would be "playing on public opinion." It was likely a reference to its hold over parts of the Turkish diaspora via schools, mosques and other organizations. (BBG)

NETHERLANDS: The Netherlands kept talking to Russia about gas in secret, even though diplomatic and trade relations were frozen because of the downing of flight MH17, investigative website Follow The Money said on Tuesday. To the outside world, contacts were cut, but behind the scenes the ties were re-established and parliament was not informed, FTM said. 'After several years of diplomatic standstill, the business community revived contacts between the Netherlands and Russia in 2017 through their joint 'energy working party,' FTM said. The working party, which includes ministers from both countries, was established in the early 1990s and meets every 18 to 24 months to discuss current economic issues. (DutchNews.nl)

NETHERLANDS: Ministers are set to start the curfew an hour later at 10pm from next Wednesday, sources have told broadcaster NOS ahead of Tuesday night's press conference. Local mayors had been concerned about the 9pm start time, given the clocks go forward this weekend and the evenings become longer. In addition, some officials called for the curfew to be pushed back because Ramadan starts in mid April and that could also be a complicating factor. (DutchNews.nl)

IRELAND: After months of delay, Ireland will begin quarantining passengers on arrival deemed at high risk of spreading the coronavirus — a plan that critics call arbitrary and dangerous for unvaccinated police officers. Starting Friday, any travelers who arrive in Ireland without a negative coronavirus test result in hand will be escorted to a hotel near Dublin Airport. So will any passengers who are from, or have recently traveled through, any of 33 countries on a list of high-risk destinations, which includes Austria, Dubai, 17 African nations and all of South America. (Politico)

SLOVAKIA: Slovak President Zuzana Čaputová called on the country's prime minister, Igor Matovič, to resign Tuesday and put an end to a political crisis sparked by his unilateral decision to purchase the Russian-developed Sputnik V coronavirus vaccine. "It is essential that the prime minister resign and enable the completion of a coalition agreement on the reconstruction of the government. No individual person's position is … more important than the interests of the country and its citizens," Čaputová said after she had accepted the resignation of the country's justice minister, Mária Kolíková. Matovič had said Sunday he would step down to resolve the crisis, but he made his resignation contingent on a number of conditions. They included him remaining in government as a minister and his Ordinary People party leading an additional ministry, breaking the agreement hammered out a year ago when the four-party coalition took power. (Politico)

CZECHIA: MNI CNB Preview - March 2021: To Steer Clear of Further CZK Strength

- The Czech National Bank is expected to keep their benchmark rate, the discount rate and the Lombard rate steady at 0.25%, 0.05% and 1%, respectively. Even though the progress in the vaccination campaign in many developed countries has increased hopes for a recovery in H2 2021, restrictions remain elevated in many core European nations and are expected to be lifted very gradually. Therefore, raising interest rates too soon could weigh on growth expectations - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

U.S.

FED: Federal Reserve Chairman Jerome Powell said prices would rise this year as the pandemic recedes and Americans are able to go out and spend, but he played down the risk that this would spur unwanted inflation. "We do expect that inflation will move up over the course of this year," Powell told the House Financial Services Committee on Tuesday, citing pent-up demand, supply-chain bottlenecks and the comparison with very weak price pressures last year. "Our best view is that the effect on inflation will be neither particularly large nor persistent." (BBG)

FED: MNI BRIEF: Fed's Bullard Sees Rates Near Zero Through 2023

- St. Louis Fed President James Bullard said Tuesday his "dot plot" forecast for interest rates does not foresee the first increase until 2023 despite his own estimates for robust economic growth - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- Federal Reserve Governor Lael Brainard on Tuesday stressed patience on removing monetary policy support as the Covid recovery speeds up this year, citing labor slack and "entrenched inflation dynamics "that will likely keep prices low after a temporary blip higher - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- Treasury Secretary Janet Yellen said Tuesday the U.S.has no plans to lengthen the maturity of government debt before interest rates rise - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: The Senate on Tuesday confirmed Shalanda Young as the White House's deputy budget director, even as plans to fill the top spot remain on hold. Young, a former staff director for the House Appropriations Committee, was confirmed by a vote of 63-37. Many Republicans who initially supported Young's confirmation as the No. 2 at the Office of Management and Budget withdrew their support after an initial round of confirmation hearings, citing objections to her support for repealing the Hyde Amendment in her written responses. (Hill)

POLITICS: President Biden on Tuesday urged Congress to pass gun control legislation, including two House-approved bills to expand background checks, and renew bans on assault weapons and high-capacity magazines. Why it matters: They were some of Biden's most forceful comments on gun control since he was elected, and they came in the wake of a mass shooting in Boulder, Colorado, on Monday and a series of shootings in Georgia last week. (Axios)

POLITICS: President Biden is considering executive action on gun control in the wake of two mass shootings in less than a week, White House press secretary Jen Psaki said Tuesday. Psaki did not specify what action Biden might take. "We are considering a range of levers, including working through legislation, including executive action," Psaki told reporters. "That has been under discussion and will continue to be under discussion." (Fox)

POLITICS: Senate Majority Leader Chuck Schumer (D-N.Y.) on Tuesday said the Senate will take up two bills focused on hate crimes, including one that addresses anti-Asian hate crimes and another focused on the threat of domestic terrorism and white supremacy. (Axios)

POLITICS: Two Democratic senators of Asian American and Pacific Islander heritage confronted a senior White House official Monday night over the absence of AAPI representation in President Biden's Cabinet, four Senate aides familiar with the call tell Axios. Behind the scenes: Sen. Tammy Duckworth (D-Ill.), backed up by Sen. Mazie Hirono (D-Hawaii), leveled the complaint to deputy chief of staff Jen O'Malley Dillon during a Zoom call between the White House and the Senate Democratic Caucus. (Axios)

OTHER

GLOBAL TRADE: The EU's trade policy chief has warned that China's decision to escalate a sanctions row risks imperilling a market-access deal meant to be the cornerstone of future relations between Brussels and Beijing. Valdis Dombrovskis, the EU's trade commissioner, said that the fate of the freshly negotiated EU-China Comprehensive Agreement on Investment — or CAI — was tied up with the diplomatic dispute, which erupted this week. "China's retaliatory sanctions are regrettable and unacceptable," Dombrovskis said. "The prospects for the CAI's ratification will depend on how the situation evolves," he explained. "The ratification process cannot be separated from the evolving dynamics of the wider EU-China relationship." (FT)

GLOBAL TRADE: China is well behind on the two-year targets set in its trade deal with the U.S., having purchased only about a third of the goods it said it would buy so far. Total purchases of U.S. agricultural, manufactured, and energy goods were $123 billion in the 14 months since the trade deal was signed in January 2020, according to Bloomberg analysis of official Chinese data. That was 32.6% of the target of $378 billion for 2020-21. (BBG)

GLOBAL TRADE: U.S. Trade Representative Katherine Tai spoke on Tuesday with top officials in Japan, South Korea, Mexico and France about shared interests ranging from concerns about China's trading practices and human rights to World Trade Organization reforms, USTR said. Continuing a series of calls with her international counterparts, Tai spoke with Japanese Foreign Minister Toshimitsu Motegi and Hiroshi Kajiyama, the country's economy and trade minister, as well as South Korean Trade Minister Yoo Myung-hee. She met with Mexican Secretary of Economy Tatiana Clouthier, French Finance Minister Bruno Le Maire and Franck Riester, France's minister delegate for trade. In her call with Motegi, Tai voiced the Biden administration's support for engagement on digital trade issues and participating in international forums, including the Asia Pacific Economic Cooperation (APEC) and the Organization for Economic Cooperation and Development (OECD). (RTRS)

IMF: The staff of the International Monetary Fund has recommended a new allocation of $650 billion in the Fund's emergency reserves, or Special Drawing Rights, given a new assessment of global reserve needs, sources briefed on the issue said on Tuesday. (RTRS)

CORONAVIRUS: Pfizer on Tuesday said it has begun early stage U.S. clinical trials of an investigational, oral antiviral drug for COVID-19. According to the company, the candidate "has demonstrated potent in vitro antiviral activity" against the virus that causes COVID-19, as well as activity against other coronaviruses, suggesting the potential for use to address future threats. The candidate is a class of drug known as a protease inhibitor, which has been long used used to treat HIV and hepatitis C. The drugs work by blocking a critical enzyme, a protease, that the virus needs to replicate. (Hill)

CORONAVIRUS: Regeneron Pharmaceuticals announced Tuesday that its COVID-19 antibody treatment has proven in a clinical study to sharply reduce the risk of hospitalization or death among patients who test positive for the virus. The company announced on its website that a trial involving more than 4,500 patients indicated that Regeneron's treatment reduced both risks by 70 percent. The drug cocktail was also effective in shortening recovery time from two weeks to 10 days, according to the company's findings. (Hill)

CORONAVIRUS: AstraZeneca will publish up-to-date results from its major U.S. COVID-19 vaccine trial within 48 hours after health officials publicly criticized the drugmaker for using "outdated information" to show how well the immunization worked. The rare public rebuke marks the latest setback for the vaccine once hailed as a milestone in the fight against the COVID-19 pandemic but has since been dogged by questions over its effectiveness and possible side effects. AstraZeneca said results it published on Monday in which the vaccine had demonstrated 79% efficacy were based on an interim analysis of data through Feb. 17, and it would now "immediately engage" with the independent panel monitoring the trial to share its full analysis. The British-based drugmaker on Tuesday said it had reviewed the preliminary assessment of its full, or primary, analysis and found it to be consistent with the interim report. (RTRS)

ASIA: China has reclaimed land to extend a reef in the Spratly Islands, in the disputed South China Sea, satellite images show. Photographs taken by American space technology company Maxar showed that Subi Reef – which is also claimed by the Philippines and Vietnam – had new land added to it that had not been visible in a satellite photo taken on February 20. (SCMP)

BOJ: MNI POLICY: BOJ To Be Pre-Emptive If Intermediation Stalls

- The Bank of Japan board will consider pre-emptive policy adjustments to prevent any further deterioration in financial intermediation asa result of its easy stance as such a development could delay achieving the 2%price target, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI BRIEF: BOJ Mulls Wait For Long-End JGB Ops If Yields Dip

- The Bank of Japan could skip operations preventing any sharp declines in yields at the longer-end of the JGB curve for now, leaving price movements to the markets as ensuring low yields across the curve through the pandemic period, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

HONG KONG: Secretary for Food and Health Sophia Chan, Secretary for the Civil Service Patrick Nip and Director of Health Constance Chan will hold a briefing on the Covid-19 vaccination program at 2:30pm local time, according to a Hong Kong government statement. (BBG)

RBA: Australia's economic recovery is running ahead of even the most optimistic forecasts, but there's still a very long road ahead before a rise in interest rates will be called for, Ian Harper, a board member of the Reserve Bank of Australia, told The Wall Street Journal. "No serious forecaster was saying the recovery was going to be flat bottomed. Everybody was predicting a V-shape of some sort, but what is appearing is that it is sharper than even the most optimistic forecasts, and that's clearly to be welcomed," said Mr. Harper, who wasn't speaking on behalf of the RBA. The Australian economy is on track to recapture its output level of late 2019 by the middle of this year, or possibly even earlier, he said. Still, there's no need for a major rewriting of the RBA's forecasts, added Mr. Harper, who is also dean of Melbourne Business School. "We are always revising the outlook. We don't need to change the tenor of our forecasts because we were always forecasting a recovery. If it's faster than that, then all to the good," he said. Mr. Harper said that while it is clear unemployment has peaked and is falling quickly, conditions in the job market are still short of anything that would generate strong wage growth and inflation. Wage growth of 3% to 4% or more is needed to create and keep inflation within the desired 2%-3% target band, he said. Current data shows "we are way off" numbers like that, he said. In a wide-ranging interview, Mr. Harper also said there's no urgency yet to clamp down on strong house-price growth as there is no evidence that lending standards are fraying or that the financial system is at risk. (WSJ)

AUSTRALIA: The federal government's $4 billion JobMaker program could be scaled back in the May budget given the rapid speed of the labour market recovery. Minister for Finance Simon Birmingham has told a Senate hearing the scale of the scheme which was expected to create 450,000 jobs may be reduced. "If employment growth continues to exceed expectations and that employment program translates into a small deficit in youth employment, as we had anticipated, then it may not ultimately be needed if the continued growth in recovery is strong or may not be needed to the scale at which early forecasts were outlined," Mr Birmingham said. (AFR)

AUSTRALIA: A man's body was found in a car trapped by floodwaters on Wednesday, the first death linked to wild weather across Australia in recent days that has submerged houses, swept away cars and livestock and cut off entire towns. (RTRS)

BOC: The Bank of Canada provided the greatest guidance yet into how it plans to slow purchases of government bonds as the economic recovery accelerates, fueling expectations it could begin doing so as soon as April. In a speech on Tuesday, Deputy Governor Toni Gravelle said the central bank is winding down emergency liquidity programs it deployed to grease markets when the coronavirus hit last year, including programs to buy provincial and corporate debt. He also provided insight into how the central bank plans to pare back its main government bond purchasing program -- including a pledge that any tapering will be gradual. (BBG)

CANADA: Canadian Finance Minister Chrystia Freeland on Tuesday said she would present the government's first budget in two years on April 19, a document she has said will include more pandemic support in addition to stimulus to help the economy rebound. "The government will continue to do whatever it takes to help businesses" get through the pandemic, Freeland said when she announced the date during Question Period in the House of Commons on Tuesday. (RTRS)

BRAZIL: Brazil reported more than 3,000 Covid-19 deaths for the first time in a 24-hour period, as the pandemic spreads unchecked across Latin America's biggest economy and overruns its health system. Most of Brazil's states have ICU occupancy rates above 80% with some at full capacity while the vaccine rollout has seen just 6% of the population receive a first dose. Large states like Sao Paulo and Rio de Janeiro only closed restaurants and bars in the past few weeks, and governors are scrambling to prevent a total collapse of hospitals with beaches cordoned off and holidays brought forward to keep people home. (BBG)

BOK: MNI BRIEF: BOK Sees Faster Recovery; No Policy Unwind Yet

- South Korea's current economic conditions don't warrant any adjustments in monetary policy settings, Bank of Korea Chairman Lee Juyeol said on Wednesday, indicating the central bank will stand pat when it meets on April 15. This year's recovery will be faster than expected but the bank is in no hurry to unwind its easy policy, Lee said in response to reporters questions - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NORTH KOREA: North Korea fired two cruise missiles off the west coast Sunday, sources said Wednesday, Pyongyang's first missile test in about a year seen as aimed at testing the administration of U.S. President Joe Biden without being too provocative. "What they fired were cruise missiles, not ballistic missiles, and they were detected by our assets," a source said on condition of anonymity, without providing further details, including their exact type and where they were fired from. The launches mark the North's first known missile test since it launched multiple short-range cruise missiles into the East Sea in April last year. Unlike ballistic missiles, cruise missiles are not sanctioned by U.N. Security Council resolutions. The North has maintained a self-imposed moratorium on nuclear and long-range missile testing since late 2017. (Yonhap)

INDIA/PAKISTAN: Pakistani Prime Minister Imran Khan received a letter of goodwill from his Indian counterpart Narendra Modi on Tuesday, a Pakistani senior Cabinet minister said, as relations thaw between the two nuclear-armed neighbours. Asad Umar, a senior Pakistani minister, in a post on Twitter welcomed Modi's letter, calling it a "message of goodwill". He added that Khan had already expressed a desire for a peaceful South Asia. (RTRS)

ISRAEL: Prime Minister Benjamin Netanyahu failed to secure a solid parliamentary majority in Israel's election on Tuesday but a potential deal with a rival rightist could make him the eventual winner, TV exit polls showed. Prime Minister Benjamin Netanyahu failed to secure a solid parliamentary majority in Israel's election on Tuesday but a potential deal with a rival rightist could make him the eventual winner, TV exit polls showed. (RTRS)

RUSSIA: Russian President Vladimir Putin was vaccinated against COVID-19 Tuesday out of sight of the cameras, his spokesman said, prompting questions about whether the gesture will boost comparatively low immunization rates in Russia. Dmitry Peskov said Putin is feeling fine after getting the shot and is planning a regular workday Wednesday. He explained earlier Tuesday that the president would get the vaccine out of the public eye because "when it comes to getting vaccinated on camera, he has never supported that, he doesn't like that." (AP)

THAILAND: MNI BoT Preview - March 2021: Frugal BoT To Let Fiscal Do The Job

- The Bank of Thailand are expected to leave their key interest rate unchanged at the record low after holding fire for six straight meetings. The responsibility for stimulating economic recovery has clearly shifted to fiscal authorities, at the time when limited monetary policy space forces the BoT to take extra care in choosing appropriate timing - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MALAYSIA: Umno president Ahmad Zahid Hamidi said his party will not work with Malaysia's opposition Parti Keadilan Rakyat (PKR) in the next general election and dismissed claims that both parties have discussed such cooperation. (Straits Times)

AFGHANISTAN: Afghan President Ashraf Ghani will propose a new presidential election within six months under a peace plan he will put forward as a counter-offer to a U.S. proposal that he rejects, two senior government officials told Reuters. Ghani will unveil his proposal at an international gathering in Turkey next month, signalling his refusal to accept Washington's plan for his elected government to be replaced by an interim administration, the officials said. But he will participate only if Taliban leader Haibatullah Akhunzada, or Mullah Yaqub, the son of the militants' late founder, Mullah Omar, attends, one of the officials said. (RTRS)

LIBYA: France will reopen its embassy in the Libyan capital Tripoli next Monday to show its support for the North African country's new authorities, President Emmanuel Macron said on Tuesday. Libya's new unity government took office on March 16 from two warring administrations that had ruled eastern and western regions, completing a smooth transition of power after a decade of violent chaos. "We will do everything that is in our power to defend this sovereignty and stability agenda," Macron said alongside Mohammed al-Menfi, the head of the Libyan presidency council. (RTRS)

COMMODITIES: The blockage of the Suez Canal by a giant container vessel is likely to send a ripple of disruption through the global energy supply chain. European and U.S. refiners that rely on the vital waterway for cargoes of Mideast oil may be forced to look for replacement supplies should the blockage persist, potentially boosting prices of alternative grades. At the same time, flows of crude from North Sea fields destined for Asia will be held up. The world's busiest maritime trade route has been thrown into turmoil after the container ship ran aground on Tuesday, blocking traffic in both directions. While the vessel is only likely to remain stuck for a couple of days, that'll be long enough to scramble some energy flows, creating an extra headache for refiners, traders and producers already coping with the pandemic's fallout. (BBG)

COMMODITIES: Egypt's Suez Canal Authority will on Wednesday divert traffic to the canal's older branch after a container ship ran aground in the new one due to bad weather, two senior marine sources told Reuters. The canal is the fastest shipping route between Europe and Asia and one of the Egyptian government's main sources of foreign currency. (RTRS)

CHINA

CORONAVIRUS: Macau suspended vaccines manufactured by BioNTech SE from Wednesday, citing packaging defects related to vial caps of the shots. The move came as Hong Kong halted vaccinations at at least two centers administering the BioNTech shots on Wednesday morning, according to officials at the sites. A Hong Kong government spokesperson declined to comment on any reason for the closures. The financial hub has suspended BioNTech shots as of Wednesday, HK01 reported. Macau said it had received written notice about the defects in a batch of vaccines from Shanghai Fosun Pharmaceutical Group Co., which has the rights to develop and market the shots across mainland China, Hong Kong, Macau and Taiwan. Some BioNTech vaccine doses administered in Hong Kong have the same batch number, 210102, as those delivered to Macau. BioNTech and Fosun Pharma have initiated an investigation into the issue and say there is no reason to believe product safety is at risk, according to the Macau government statement. (BBG)

PBOC: The PBOC is unlikely to raise rates and tighten policies to manage imported inflation, despite some emerging economies including Turkey using rate hikes to stop their plunging currencies, the 21st Century Business Herald reported citing analysts. Imported inflation may drive up China's PPI more significantly than CPI, but PPI growth is expected to decelerate in H2 on the base effect, the newspaper said citing Chi Guangsheng, an analyst at Essence Securities. China is unlikely to experience large-scale capital outflows as its economy strengthens further, and China's opening of financial markets is giving investors more confidence, Chi said. (MNI)

ECONOMY: China's fiscal and monetary policies will continue to favor growth this year to ensure the economy fully recovers from the pandemic, the 21st Century Business Herald reported citing Guan Tao, the chief economist at BOC International and a former official at SAFE. While the government restated the need to control macro leverage and debt risks it isn't this year's top priority, and the budget deficit was also targeted above the usual 3%-GDP level, Guan told the newspaper. China's opening up means it is likely to tolerate a wider movement of the yuan, which will be decided by a host of factors including the dollar, U.S. policies and both domestic and global economies, he said. (MNI)

ECONOMY: China must stop property speculation and earn wealth by boosting supply and strictly verifying that intended purchases have legitimate intent, the Economic Information Daily said in a front page commentary, citing February home price data that showed increases in 56 monitored cities. Authorities should increase taxation and punish the illicit use of capital to buy properties, it said. Larger cities must also develop policy-supported housing and enhance the rental market, the Daily said. (MNI)

EQUITIES: Pony Ma, the reticent founder of Tencent Holdings, China's biggest social media and video games company, met with China's antitrust watchdog officials this month to discuss compliance at his group, two people with direct knowledge said. The meeting is the most concrete indication yet that China's unprecedented antitrust crackdown, which started late last year with billionaire Jack Ma's Alibaba business empire, could soon target other internet behemoths. Beijing has vowed to strengthen oversight of its big tech firms, which rank among the world's largest and most valuable, citing concerns that they have built market power that stifles competition, misused consumer data and violated consumer rights. (RTRS)

OVERNIGHT DATA

JAPAN MAR, P JIBUN BANK M'FING PMI 52.0; FEB 51.4

JAPAN MAR, P JIBUN BANK SERVICES PMI 46.5; FEB 46.3

JAPAN MAR, P JIBUN BANK COMPOSITE PMI 48.3; FEB 48.2

Activity at Japanese private sector businesses remained subdued at the end of the first quarter of 2021, as flash PMI data pointed to a sustained deterioration in business activity. New orders also reduced, however the pace of contraction was the softest in the current 14-month sequence of decline. That said, one positive note was private sector firms in Japan recording the strongest increase in employment levels since January 2020. This came as service providers noted the fastest pace of job creation since May 2019. Despite disruption to short-term activity caused by an ongoing third wave of coronavirus disease 2019 (COVID-19) infections, Japanese private sector companies were optimistic that business conditions would improve in the year ahead, albeit to a lesser extent than in February. Positive sentiment stemmed from the expectation that the lifting of state of emergency measures and broader restrictions as vaccinations roll out would trigger a recovery in demand in both domestic and external markets. (IHS Markit)

JAPAN FEB SERVICES PPI -0.1% Y/Y; MEDIAN -0.5%; JAN -0.4%

AUSTRALIA FEB, P TRADE BALANCE +A$8.1000BN; JAN +A$1.0142BN

AUSTRALIA FEB, P EXPORTS +2% Y/Y; JAN +6%

AUSTRALIA FEB, P IMPORTS +2% Y/Y; JAN -2%

AUSTRALIA MAR, P MARKIT M'FING PMI 57.0; FEB 56.9

AUSTRALIA MAR, P MARKIT SERVICES PMI 56.2; FEB 53.4

AUSTRALIA MAR, P MARKIT COMPOSITE PMI 56.2; FEB 53.7

Private sector companies benefited from strong gains in new work during March, which prompted them to lift output and continue with their hiring efforts. In particular, there were notable accelerations in growth rates for new orders and business activity across the service sector. The latest results rounded off a strong quarter for the private sector, the best since the second quarter of 2017, suggesting that the economic rebound through the second half of 2020 reported by the official statistics office will have extended into 2021. Inflation remains an area of concern, with March data showing the strongest rise in input costs in the survey history. While companies opted to pass on to their clients only part of their additional cost burdens, future upward adjustments to charges could restrict demand. Supply-chain disruption was cited by panellists as the main driver of inflation, a factor that also restricted business optimism towards growth prospects. (IHS Markit)

NEW ZEALAND FEB TRADE BALANCE +NZ$181MN; MEDIAN +NZ$181MN; JAN -NZ$626MN

NEW ZEALAND FEB TRADE BALANCE 12 MONTHS YTD +NZ$2.364BN; JAN +NZ$2.745BN

NEW ZEALAND FEB EXPORTS NZ$4.47BN; JAN NZ$4.19BN

NEW ZEALAND FEB IMPORTS NZ$4.29BN; JAN NZ$4.82BN

SOUTH KOREA FEB PPI +2.0% Y/Y; JAN +0.9%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0454% at 09:40 am local time from the close of 2.0985% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 3 on Monday vs 37 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5228 WEDS VS 6.5036

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5228 on Wednesday, compared with the 6.5036 set on Tuesday.

MARKETS

SNAPSHOT: Risk Aversion Remains, Vaccine Matters Under Scrutiny

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 553.48 points at 28442.94

- ASX 200 up 33.401 points at 6778.8

- Shanghai Comp. down 44.804 points at 3366.185

- JGB 10-Yr future up 19 ticks at 151.45, yield down 1.2bp at 0.070%

- Aussie 10-Yr future up 8 ticks at 98.315, yield down 7.7bp at 1.655%

- U.S. 10-Yr future +0-11 at 132-08+, yield down 3.15bp at 1.589%

- WTI crude down $0.03 at $57.72, Gold up $5.43 at $1732.48

- USD/JPY down 8 pips at Y108.51

- POWELL EXPECTS BUMP IN INFLATION, SAYS IT WON'T GET OUT OF HAND (BBG)

- YELLEN: TREASURY NOT PLANNING TO LENGTHEN DEBT (MNI)

- EU TO EXTEND VACCINE EXPORT CURBS TO COVER BRITAIN, BACKLOADING (RTRS)

- HONG KONG SUSPENDS BIONTECH VACCINES ON PACKAGING DEFECT (BBG)

BOND SUMMARY: Lingering Caution Underpins Core FI, NZGB Dynamics Still In Focus

Lingering risk aversion continued to fuel a rally in T-Notes, as Asia-Pac players digested Fed Chair Powell's attempt to downplay unwanted inflation risk & tighter lockdown measures imposed in several European countries. Hong Kong's and Macau's move to suspend vaccinations with a faulty batch of BioNTech Covid-19 jabs & North Korea's latest missile test added to existing worries. Meanwhile, NZGB dynamics continued to lend support to broader core FI space, to a degree. T-Notes last sit +0-10+ at 132-08, testing session highs. Cash Tsy curve bull flattened, with yields last seen 0.2-3.2bp lower. Eurodollar futures run 0.5-2.0 ticks higher through the reds. 5-Year Note supply, Powell/Yellen Senate testimony, flash durable goods orders & Markit PMIs as well as more Fedspeak are the main points of note in the U.S. today.

- Fluctuations in JGB futures were directionless, the contract last trades at 151.43, 17 ticks above prior settlement. Cash JGB yields trade lower across the marginally flatter curve, with 40s outperforming ahead of tomorrow's auction of 40-Year JGBs. The slightly outdated minutes from the BoJ's Jan MonPol meeting provided little in the way of market-moving insight.

- Bull flattening evident also in cash ACGB space, with yields last seen 0.3-8.5bp lower. YM trades +3.0 & XM +8.0, both just a touch below their respective highs. Bills are unch. to +2 ticks through the reds. The downsized (A$1.2bn) offering of ACGB 1.25% 21 May '32 was smoothly digested, as was the RBA's proposal to buy semi-gov't bonds. There is some more RBA speak from Debelle & Bullock coming up today, after their colleague Harper said that the economic recovery is faster than expected. NZ bond market remained in focus, as the RBNZ missed the purchase target in today's LSAP ops, while the collapse in NZGB yields/paring of RBNZ rate-hike wagers continued.

JGBS AUCTION: Japanese MOF sells Y2.7789tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7789tn 6-Month Bills:- Average Yield -0.1117% (prev. -0.1070%)

- Average Price 100.057 (prev. 100.054)

- High Yield: -0.1098% (prev. -0.1030%)

- Low Price 100.056 (prev. 100.052)

- % Allotted At High Yield: 98.2904% (prev. 57.8540%)

- Bid/Cover: 3.838x (prev. 5.013x)

AUSSIE BONDS: The AOFM sells A$1.2bn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.2bn of the 1.25% 21 May 2032 Bond, issue #TB158:- Average Yield: 1.7834% (prev. 1.6900%)

- High Yield: 1.7850% (prev. 1.6950%)

- Bid/Cover: 4.2167x (prev. 2.5825x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 76.5% (prev. 26.1%)

- bidders 47 (prev. 47), successful 20 (prev. 27), allocated in full 11 (prev. 21)

EQUITIES: Further Losses

Another day of declines in Asia, most major bourses losing over 1% as bond yields decline. Hong Kong leads the way lower as the risk-off tone of Tuesday's NY session spilled over into Asia, while Hong Kong authorities suspended vaccinations with the BioNTech Covid-19 jab, citing packaging defects in a single batch of doses. Japanese stocks lost ground for a third day, while markets in China are on track for a fourth daily loss. In Taiwan TSMC weighs after Intel announced plans for two new factories. Markets in New Zealand and Australia were supported by lower domestic currencies.

- Futures in Europe are lower as markets contemplate fresh lockdowns, while in the US e-mini Dow and S&P are flat, but Nasdaq futures are higher as QQQ, the Invesco QQQ Trust Series 1 ETF which tracks the Nasdaq 100, saw inflows of almost $5bn earlier this week.

OIL: Holding Losses

Crude prices are essentially flat in Asia, holding yesterday's declines. WTI is last $0.07 higher at $57.83/bbl, while Brent is $0.06 lower at $60.85/bbl.

- Markets are digesting reports that a large shipping container has run aground the Suez Canal, blocking off traffic in both directions. Ever Given, a 400m long container ship wedged itself lengthways and caused a build up of around 100 ships. Still, worries over the global recovery amid fresh lockdowns in Europe have tempered any upside for crude. API inventory data yesterday was bearish, headline crude stocks rose 2.93m bbls, though stocks at Cushing, OK fell 2.28m bbls and gasoline stocks fell 3.73m bbls. Markets now look to DoE figures later today.

GOLD: Higher As Yields Drop

The yellow metal has gained in Asia on Wednesday, the rate bottomed out at $1723.94 before bouncing to session highs just below $1735, last trades up $4.69 at $1731.81.

- Broad risk off trade has seen bonds bid, pressuring yields lower and allowing gold to rally, even as the greenback consolidates its recent gains. Markets are still digesting comments from Fed Governor Powell yesterday where he played down the risk of inflation overshoots. Markets await further comments from Powell and US Treasury Secretary Yellen at the Senate Banking Committee.

FOREX: Risk Aversion Carries Over Into Asia

FX price action in the Asia-Pac session was largely driven by familiar factors, as the region absorbed a risk-off impetus from NY trade. The impact of tighter lockdown measures imposed across Europe & the latest address from Fed Chair Powell remained in play. The Antipodeans lagged the G10 pack as lingering risk aversion coincided with the continued unwinding of RBNZ tightening bets. NZD/USD ground through yesterday's trough to levels not seen since Nov 25 as NZ 5-Year IRS printed fresh multi-month lows.

- The yen outperformed at the margin amid demand for safe havens. USD/JPY shed a handful of pips ahead of today's expiry of $1.3bn of USD puts with strikes at Y108.00.

- The PBOC fixed its USD/CNY mid-point at CNY6.5228, 13 pips below sell side estimates. USD/CNH climbed to two-week highs as the greenback edged higher.

- Focus turns to the Senate testimony from Fed Chair Powell & Tsy Sec Yellen, a flurry of PMI readings from across the world, UK inflation data, U.S. flash durable goods orders and comments from ECB's Lagarde, RBA's Debelle & Bullock, Fed's Barkin, Williams, Daly & Evans.

FOREX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E320mln), $1.1960-75(E732mln), $1.2000-10(E615mln)

- USD/JPY: Y108.00($1.4bln-USD puts), Y108.45-50($586mln)

- EUR/NOK: Nok10.20(E844mln-EUR puts)

- AUD/USD: $0.7710-12(A$533mln)

- USD/CNY: Cny6.50($631mln-USD puts)

- USD/MXN: Mxn20.50($1.1bln-USD puts), Mxn21.25($583mln), Mxn21.48($675mln)

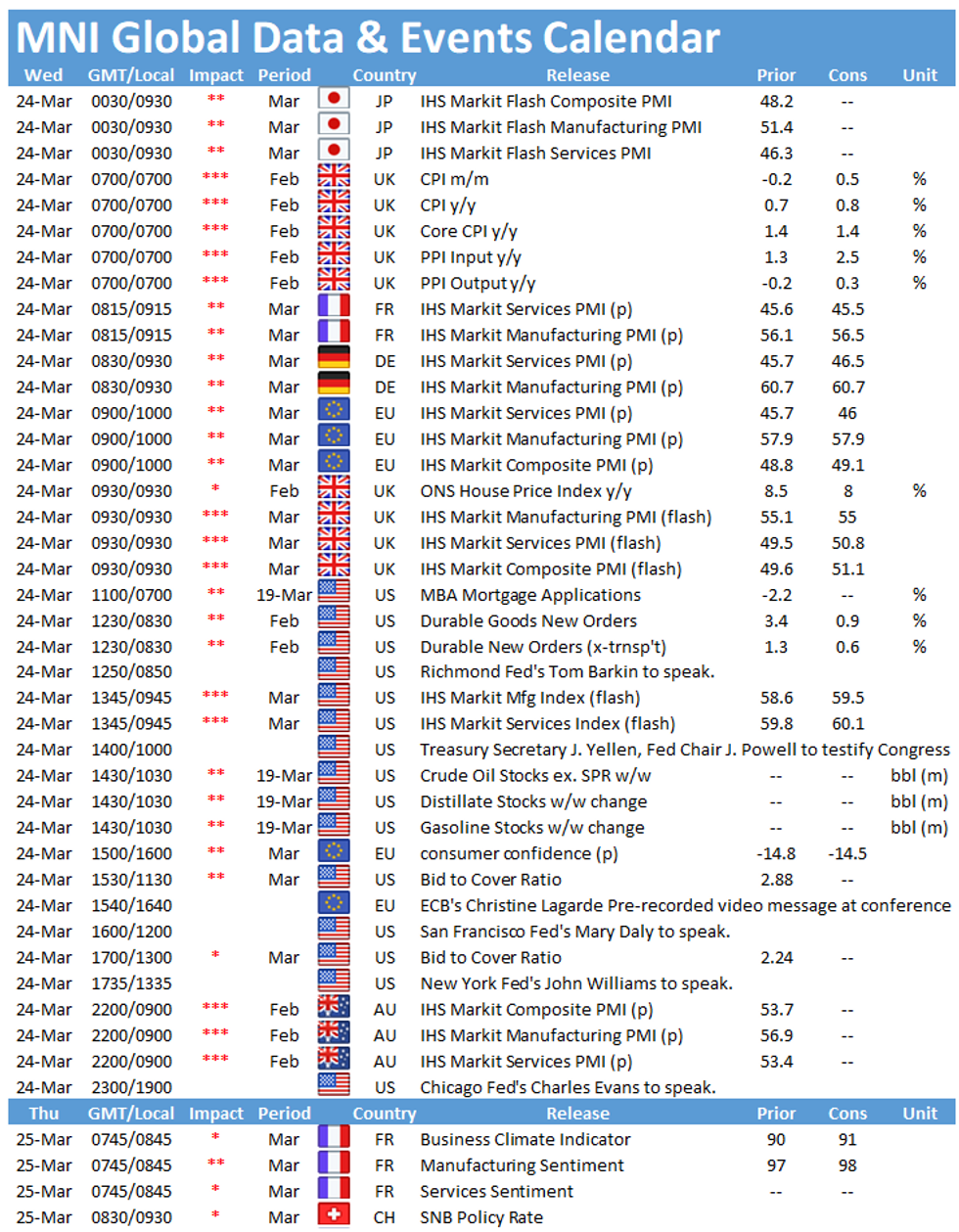

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.