-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Friday's Equity Block Sales Dominate In Asia

EXECUTIVE SUMMARY

- ECB'S LANE: ECB MUST REMAIN EURO ZONE'S STABILISER (RTRS)

- EU WON'T LET ASTRA EXPORT COVID VACCINES UNTIL PLEDGE MET (BBG)

- INCHCAPE: EVER GIVEN SUCCESSFULLY REFLOATED IN SUEZ CANAL (BBG)

- EX-TIGER ASIA FOUNDER TRIGGERS $30 BILLION IN LARGE STOCKS SALES (WSJ)

- VIACOMCBS HOLDER SAID TO OFFER 45 MILLION SHARES IN BLOCK TRADE (BBG)

- NOMURA WARNS OF 'SIGNIFICANT' LOSS FROM U.S. CLIENT (BBG)

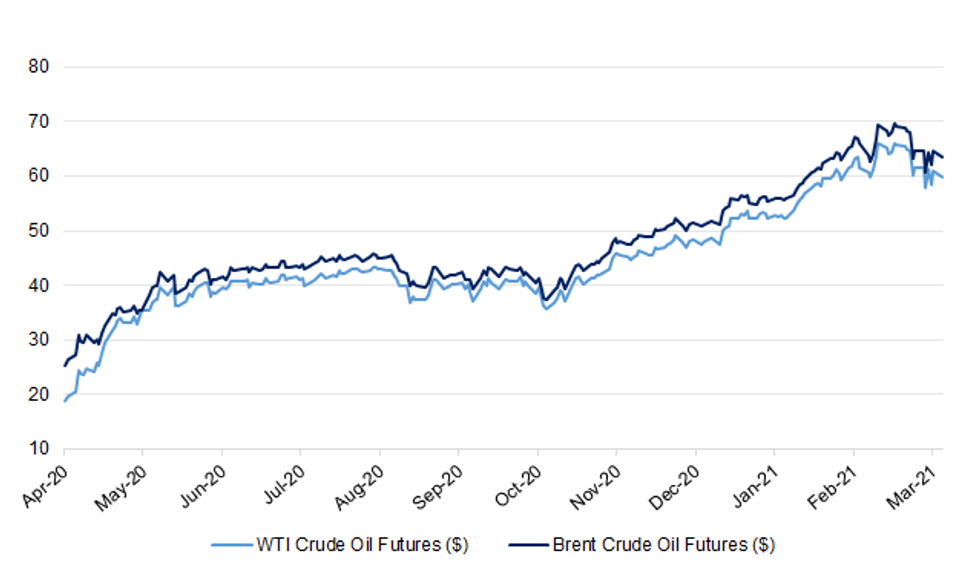

Fig. 1: WTI & Brent Crude Oil Futures $ (Continuation Chart)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Britons are being urged to follow the rules or risk a resurgence of the coronavirus as England takes a much-anticipated step toward exiting restrictions that have pummeled the economy and curtailed civil liberties. Starting Monday, six people, or two households, can gather outdoors and outdoor sports facilities such as tennis and basketball courts will be allowed to reopen. It's the second in a series of steps the government hopes will see all lockdown curbs removed by June 21. (BBG)

CORONAVIRUS: Boris Johnson has said the roadmap for easing England's coronavirus lockdown is still on track, even as a third wave of infections hits Europe. The PM said he will soon "be able to go to the barbers" and eventually "drink a pint... in the pub". (BBC)

CORONAVIRUS: The Moderna coronavirus vaccine is on course to start being used in the UK from next month, it has been confirmed. A first shipment of the jab, which is a messenger RNA vaccine akin to the Pfizer-BioNTech vaccine already in use, is expected in about three weeks. (The Times)

CORONAVIRUS: Over-70s will start to get booster Covid vaccines from September to protect them from new virus variants as the Government drives ahead with its jabs rollout. (Telegraph)

CORONAVIRUS: Vaccine passports could be a "tool in the short term" to reopen theatres and sports stadiums, Culture Secretary Oliver Dowden has said. The government needs to "look at all options" to "make areas of our national life viable", he said, but no decisions have yet been made. And he insisted the roadmap for lifting restrictions in England was on track. Wales' First Minister Mark Drakeford said there were "prizes to be won" with vaccine passports. (BBC)

CORONAVIRUS: Conservative MPs are calling on Boris Johnson to consider lifting "work from home" guidance from next month to help quicken an economic rebound after lockdown. (Telegraph)

CORONAVIRUS: Ministers will discuss whether France should be placed on the "red list" on Tuesday after Oliver Dowden signalled that the "very worrying" third Covid wave in Europe could scupper holidays abroad this summer. (Telegraph)

CORONAVIRUS: Discussions are under way in Whitehall about expanding the travel "red list" of countries as ministers face mounting pressure to prevent coronavirus variants undermining the vaccine programme. The Guardian understands that officials met on Friday to consider the case for taking a tougher approach. British residents and nationals returning from countries on the red list must quarantine in an airport hotel for 10 days at a cost of £1,750, while other arrivals are banned. It remains illegal to go on holiday. (Guardian)

CORONAVIRUS: Summer holidays abroad are unlikely to be allowed until August it has been reported, as a cabinet minister said a traffic light system was being considered to enable overseas trips. Speaking to Sky News, Culture Secretary Oliver Dowden said there were "challenges around international travel" in the face of rising COVID-19 infection rates in Europe, but that "all options" were being looked at as part of a review of foreign breaks. Officials have warned it is unlikely to lead to an early lifting of the coronavirus ban on travel abroad, when it reports on 12 April. (Sky)

CORONAVIRUS: All truckers arriving into England from outside the U.K. will have to take a Covid-19 test within 48 hours, Transport Minister Grant Shapps said on Twitter. The drivers will then have to take additional tests for each 72 hours they remain, he said. The mandatory testing will help "ensure we keep track of any future coronavirus variants of concern," he said. (BBG)

CORONAVIRUS: Rishi Sunak is calling on Britain's employers to end working from home and allow staff back in the office - or risk them voting with their feet and quitting. Looking beyond the pandemic, the chancellor says working in an office is crucial for young people to get to know colleagues and seek out mentors to help their career. "I'm probably in the camp of saying that it's good that people are in offices together," he said, as he appealed to bosses to start investing and hiring when coronavirus lockdown rules are lifted. (Sky)

CORONAVIRUS: Boris Johnson has sparked new controversy over when employees should return to their workplaces by suggesting people have had enough "days off" at home during the pandemic, and should try to go back to their offices. The prime minister's comments – which followed remarks from the chancellor, Rishi Sunak, urging companies to reopen offices when the pandemic eases or risk losing staff – caused alarm among scientists, and were branded by Labour as "irresponsible" and "glaringly inconsistent" with the government's own route out of lockdown. (Observer)

BREXIT: The EU says it expects to receive a UK "road map" on implementing the Northern Ireland Protocol in the coming days. It follows a meeting of senior officials who are overseeing the Northern Ireland deal. A UK government statement does not mention a roadmap, instead referring to an "agreed work programme". (BBC)

BREXIT: More than a quarter of small exporters have stopped selling to European Union customers three months on from the Brexit transition, a study has found. The Federation of Small Businesses warned that what might have been dismissed as "teething problems" in the first weeks of January were now looking more like permanent "systemic problems". A survey of nearly 1,500 small companies conducted by the employers' group found that 23 per cent had temporarily stopped selling to the EU and 4 per cent had halted sales permanently. Eleven per cent of exporters were said to be considering a permanent halt. Small importers have been hit hard by new paperwork, with 17 per cent temporarily suspending purchases from the EU. The majority — 70 per cent — of importers and exporters said that they had suffered shipment delays when moving goods around the EU in recent weeks. (The Times)

BREXIT: The Bank of England is demanding that lenders seek its approval before relocating UK jobs or operations to the EU, after becoming concerned that European regulators are asking for more to move than is necessary for financial stability after Brexit. The BoE has taken this stance — described by one senior banker as "increasingly curmudgeonly" — after hearing of several requests from the European Central Bank that it considers excessive and beyond what is required from a prudential supervisory perspective, according to people familiar with the move. Governor Andrew Bailey has taken a personal interest in the issue, they added. (FT)

ECONOMY: Retailers will be allowed to open until 10pm when they reopen next month as the Government seeks to bolster the high street and ensure compliance with social distancing rules. Robert Jenrick, the Communities Secretary, on Friday announced the temporary measures enabling non-essential stores to stay open for longer, ahead of the planned reopening on April 12. (Telegraph)

FISCAL: Reports of possible furlough fraud have topped 26,000, raising fears that chancellor Rishi Sunak's job protection scheme has been abused. HM Revenue & Customs said it had received 26,232 reports by the beginning of last week, up from 23,500 at the start of last month and double the 13,114 in October. A total of 11.4 million jobs have been protected by the scheme — which has paid 80 per cent of private sector wages at its most generous — since it was launched a year ago. Furlough has cost taxpayers £57 billion — a big chunk of Sunak's total bailout bill of about £352 billion. (Sunday Times)

BOE: MNI BRIEF: BOE Tenreyro: Some Scenarios Need Looser Policy

- Bank of England Monetary Policy Committee member Silvana Tenreyro made clear Friday that she could support further policy easing if downside risks materialize, putting her on teh same page as other independents on the policy setting committee. Speaking at a San Francisco Fed event she said that a likely rise in near-term inflation, due to higher energy prices and supply bottlenecks, may prove unsustainable but that a rise in unemployment, slow Covid vaccine roll-out in key UK export markets and the risk of Covid vaccine defying mutations could all require "looser policy later this year" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Sir Keir Starmer is preparing to replace his shadow chancellor, Anneliese Dodds, in a shake-up of his frontbench team. Starmer, who will mark his first anniversary as Labour leader next Sunday, is due to demote several underperforming shadow ministers after the local elections in an attempt to get on the front foot and challenge Boris Johnson. (Sunday Times)

POLITICS: Senior Labour MPs want Keir Starmer to bring in a "big figure" to provide greater direction to his leadership, amid concerns within the party that caution and a lack of ambition are holding back his performance. Shadow cabinet ministers are understood to be among those who have concerns that Starmer is losing crucial momentum at the end of his first year in office, with several MPs calling for more experience to be injected into his team to spell out "what Keir is for". (Guardian)

SCOTLAND: Neale Hanvey has become the second MP to defect from the SNP and join Alex Salmond's new pro-independence party. On Saturday, former justice secretary Kenny MacAskill said he would stand as a candidate for the Alba Party. Mr Hanvey, who holds the Kirkcaldy and Cowdenbeath seat, said the new party provided "a tonic for our movement". Alex Salmond launched Alba on Friday with the aim of building "a supermajority for independence" at Holyrood after the election in May. (BBC)

WALES: Cabinet ministers fear that the Cardiff government will insist on holding a Welsh independence referendum if Labour loses power in May's elections. The most likely outcome of the May 6 poll is a three-way split between Labour, the Tories and Plaid Cymru, with no party getting close enough to a majority of 60 seats. Plaid Cymru disclosed on Times Radio yesterday that a referendum for Wales to split away from the UK will be central to its election campaign. Adam Price, the Welsh nationalist party's leader, ruled out governing with the Tories in Wales. He is expected to insist on a vote for independence as his price to prop up a minority Labour government in Cardiff. (The Times)

EUROPE

ECB: The European Central Bank must remain a key stabilizer of the euro zone economy as the bloc is at risk of suffering longer-term damage from its pandemic-induced double-dip recession, ECB chief economist Philip Lane said on Saturday. A sustained period of low activity reduces labour productivity, weakens corporate balance sheets and saps confidence, leading to a potential downward spiral, Lane said in a speech to the Spring workshop of The European House - Ambrosetti. (RTRS)

GERMANY: German Chancellor Angela Merkel threatened to assert federal control over measures to stem the Covid-19 pandemic, picking a legal fight that reflects the gravity of the latest surge in infections. In an unexpected turn of events, Merkel said she may seek to use federal law to regain the initiative after rescinding a wide-ranging lockdown for the Easter holidays amid a storm of criticism. She expressed exasperation with what she described as broken commitments by the leaders of Germany's 16 states, who have direct authority to deploy health and safety rules under the country's federal system. She singled out two state premiers of her Christian Democratic Union who are personal allies. (BBG)

GERMANY: Germany must bring down coronavirus infections in the next few weeks or risk new virus mutations that are resistant to vaccines, Chancellor Angela Merkel's chief of staff Helge Braun told the Bild am Sonntag newspaper. "We are in the most dangerous phase of the pandemic," he added. "The next few weeks will determine whether we can foreseeably get the pandemic under control." If the number of infections rises rapidly again, there is a growing danger that the next virus mutation will become resistant to the vaccine, Braun said. "Then we would need new vaccines, then we would have to start vaccinating all over again," he pointed out. To curb the virus' spread, Braun called for the imposition of stricter measures and night-time curfews in regions with high numbers of new infections. (Deutsche Welle)

GERMANY: Support for German Chancellor Angela Merkel's party has fallen further, a poll released on Sunday indicated, with the ecologist Greens closing in to just two points behind them ahead of a national election September. With popular frustration growing over Merkel's government's management of the coronavirus pandemic, support for Merkel's Christian Democrats (CDU) and their Bavarian CSU sister party - together dubbed the 'Union' - dropped to 25%, the Kantar poll showed. The fall of two percentage points from the previous week was the fourth consecutive decline in support for the conservative alliance to a level not seen since early March last year. (RTRS)

FRANCE: Critical care doctors in Paris say surging coronavirus infections could soon overwhelm their ability to care for the sick in the French capital's hospitals, possibly forcing them to choose which patients to treat. The sobering warning of "catastrophic medicine" was delivered Sunday in a newspaper opinion piece signed by 41 Paris-region doctors. Published by Le Journal du Dimanche newspaper, it comes as President Emmanuel Macron has been vigorously defending his decision not to completely lockdown France again as he did last year. (AP)

FRANCE: The French government is close to finalizing a recapitalization plan for Air France after addressing some antitrust concerns raised by the European Commission, according to people familiar with the matter. The multi-billion-euro package could be announced in coming days following final approval from Brussels and the board of parent Air France-KLM, said the people, who asked not to be named because the information isn't public. (BBG)

ITALY: As Italy seeks to speed up its vaccination campaign, Health Minister Roberto Speranza said he is confident that the country will see restrictions easing during the summer, according to an interview published by Messaggero. Current three-tiered restrictions are expected to remain in place until the end of April, Speranza added. Italy will be able to administer 300,000 Covid-19 vaccine doses per day by next week, Repubblica reported. (BBG)

ITALY: Italy reported 19,611 new cases and 297 deaths on Sunday, reflecting a 7.2% positive test rate. New cases in the country remain stable as some regions, including the one around Rome, are set to slightly ease restrictions starting Tuesday. (BBG)

RATINGS: Rating reviews of note from Friday include:

- Fitch affirmed Belgium at AA-; Outlook Negative

- Fitch affirmed Cyprus at BBB-; Outlook Stable

- S&P affirmed Germany at AAA; Outlook Stable

- DBRS Morningstar confirmed the European Union at AAA, Stable Trend

- DBRS Morningstar confirmed Sweden at AAA, Stable Trend

MONEY MARKETS: The EU's top financial regulator has proposed sweeping reforms to safeguard the continent's €1.4tn money market fund sector, which only narrowly avoided a crisis at the height of the pandemic last year. Huge withdrawals were made from European money market funds in March 2020 as companies made a dash for cash in response to the announcement of lockdown measures by governments across Europe. Acute problems also erupted at US money market funds, threatening to trigger a destabilising spiral across the world's financial system, which was averted only by central banks introducing aggressive emergency liquidity measures. (FT)

U.S.

FISCAL: Democrats in Congress and White House officials are increasingly confident that they can pass an economic recovery package worth more than $3tn in the coming months, even in the absence of Republican support. Joe Biden, the US president, this week said that his next "major initiative" after enacting this month's $1.9tn fiscal stimulus bill would be a multibillion-dollar plan to fund long-term infrastructure, education and childcare spending — partially funded by tax increases. (FT)

FISCAL: President Biden plans to split up his next big government-spending push into two programs and will lay out his vision for an infrastructure-focused first proposal, including green-energy programs, at an event in Pittsburgh this week, a top administration official said Sunday. The second proposal, which the administration plans to release in April, would focus more on child care and healthcare programs, among other priorities for the administration, White House press secretary Jen Psaki said on "Fox News Sunday." (WSJ)

CORONAVIRUS: The latest rise in new Covid-19 infections can't be pinned on highly transmissible variants alone as more Americans travel for spring break and states lift restrictions, including mask mandates, intended to slow the virus' spread, White House Chief Medical Advisor Dr. Anthony Fauci said on Sunday. (CNBC)

POLITICS: Donald Trump's planned social media platform "will debut in three to four months," the former president's one-time campaign manager and senior adviser said. "We're going to have a platform where the president's message of America First is going to be able to be put out to everybody," Corey Lewandowski said on the conservative Newsmax TV network's "Saturday Agenda." (BBG)

EQUITIES: One mystery in a dramatic year on Wall Street has been the identity of a trader whose persistent purchases have sent shares in ViacomCBS Inc., Discovery Inc. and a handful of other companies surging even when the broader market was down. People familiar with the transactions say the answer is former Tiger Asia manager Bill Hwang. Late last week Morgan Stanley, Goldman Sachs Group Inc. and Deutsche Bank AG swiftly unloaded large blocks of shares in those companies and others, part of the liquidation of positions at Mr. Hwang's Archegos Capital Management. The sales approached $30 billion in value, some of the people said, and fueled a 27% plunge Friday in shares of ViacomCBS—an unusually large decline in a widely held, large-capitalization stock on a day with no significant company specific news. Billions of market value in other companies were wiped out as the sales continued, surprising market participants who called the size and speed of these stock sales unprecedented. The liquidations appear to have left Archegos, which managed an estimated $10 billion of personal wealth for Mr. Hwang and his family, under extreme pressure following heavy losses. People close to the stock sales said that the bulk of the selling has been completed. (WSJ)

EQUITIES: Morgan Stanley was shopping a large block of ViacomCBS Inc. shares on Sunday, according to people familiar with the matter, the latest in a flurry of block trades that began before the weekend. About 45 million shares were offered Sunday on behalf of an undisclosed holder, the people said. The shares were being offered at $46 to $47 each, one of the people said, a maximum discount of 4.6% to Friday's closing price. Morgan Stanley representatives declined to comment. The U.S. media giant was also the subject of at least one large block trade on Friday through Goldman Sachs, a person familiar with the matter told Bloomberg at the time. (BBG)

EQUITIES: Nomura Holdings Inc.'s warning of a "significant" potential loss from an unnamed U.S. client is related to the unwinding of trades by Bill Hwang's Archegos Capital Management, according to people familiar with the matter. The family office founded by Hwang, a former Tiger Management trader, was one of Nomura's prime brokerage clients, one of the people said, without providing further details. They asked not to be identified discussing private information. Nomura said in a statement on Monday that the estimated amount of the claim against the U.S. client was about $2 billion. (BBG)

OTHER

U.S./CHINA: The U.S. isn't ready to lift tariffs on Chinese imports in the near future, but might be open to trade negotiations with Beijing, according to U.S. Trade Representative Katherine Tai. In her first interview since Senate confirmation, Ms. Tai said she recognized that the tariffs can exact a toll on U.S. businesses and consumers, though proponents have said they also help shield companies from subsidized foreign competition. (WSJ)

U.S./CHINA: Secretary of State Antony Blinken evaded questions about whether the U.S. would seek retaliatory actions against China for its handling of the coronavirus outbreak during an interview on CNN's "State of the Union" Sunday, instead saying that the focus should be on preventing another pandemic in the future. The diplomat said there should be "accountability for the past," positioning himself in contrast to his predecessor Mike Pompeo, who had called for China to be punished, per CNN. (Axios)

U.S./CHINA/TAIWAN: The US is concerned that China is flirting with the idea of seizing control of Taiwan as President Xi Jinping becomes more willing to take risks to boost his legacy. "China appears to be moving from a period of being content with the status quo over Taiwan to a period in which they are more impatient and more prepared to test the limits and flirt with the idea of unification," a senior US official told the Financial Times. The official said the Biden administration had reached the conclusion after assessing Chinese behaviour during the past two months. (FT)

U.S./CHINA/CANADA: China has imposed sanctions against two U.S. religious rights officials, a Canadian member of parliament and a subcommittee on human rights in Canada's House of Commons, according to a Chinese Foreign Ministry statement released Saturday. The sanctions are the latest escalation in a growing dispute between Western nations and Beijing over the treatment of ethnic and religious minorities in China, particularly the province of Xinjiang. (CNBC)

U.S./CHINA/CANADA: The United States on Saturday condemned China's sanctions against two American religious-rights officials and a Canadian lawmaker in a dispute over Beijing's treatment of Uighur Muslims and other minorities. China's moves "only contribute to the growing international scrutiny of the ongoing genocide and crimes against humanity in Xinjiang. We stand in solidarity with Canada, the UK, the EU, and other partners and allies around the world in calling on the (China) to end the human rights violations and abuses," U.S. Secretary of State Anthony Blinken said in a statement. (RTRS)

UK/CHINA: On Friday afternoon, the Foreign Office (FCDO) said the minister for Asia, Nigel Adams, had summoned Yang Xiaoguang, the Chinese embassy in London's chargé d'affaires, over Beijing's actions. An FCDO spokesperson said Mr Adams had made it clear that China's decision to impose sanctions on Britons and UK entities was "unwarranted and unacceptable". Mr Adams also noted that China's decision to target those "seeking to shine a light on human rights violations" would "not distract attention away from those very violations taking place in Xinjiang". (BBC)

UK/CHINA: Five UK parliamentarians sanctioned by China have released a joint statement vowing to "redouble" their efforts to campaign against human rights abuses. (BBC)

GEOPOLITICS: Boris Johnson and Joe Biden, the US president, have vowed to create a global coalition to combat China, in retaliation for its imposition of sanctions on British MPs and peers. The two leaders have discussed plans for an infrastructure project to rival the Belt and Road strategy used by Beijing to expand its economic and political influence. (Sunday Times)

GEOPOLITICS: China and Europe must stay alert and not fall into the "battlefield" laid by the U.S. to consolidate its hegemony using the Xinjiang issue as a flash point, the government-run Global Times said in an editorial. The U.S. intends to divide the world again and cause China to lose the strategic opportunity to open up to the world. Europe would then lose much of the Chinese market and follow the U.S. lead, the newspaper said. China hoped the tit-for-tat sanctions by China and the West stay symbolic and ideological, and do not cross into economic and trade areas, it said. (MNI)

GEOPOLITICS: President Joe Biden included Russia's Vladimir Putin and China's Xi Jinping among 40 world leaders he invited to a White House climate summit next month, showing he plans to include friends and foes in his administration's first major international gathering. The virtual summit will bring together 17 countries responsible for 80% of global emissions and gross domestic product, the White House said in a statement. It will be open to the public through a webstream, the White House said. (BBG)

GEOPOLITICS: China and Iran signed an overarching deal aimed at charting the course of their economic, political and trade relations over the next 25 years, Iranian state TV reported, in a challenge to the Biden administration. The "Comprehensive Strategic Partnership" agreement, signed in Tehran on Saturday by Iranian Foreign Minister Mohammad Javad Zarif and his Chinese counterpart, Wang Yi, has been in the works since 2016, when President Xi Jinping became the first Chinese leader to visit the Iranian capital in over a decade. (BBG)

GEOPOLITICS: Secretary of State Antony Blinken suggested U.S. options for stopping Nord Stream 2 are limited but that differences over the Russian gas pipeline to Germany shouldn't burden relations between the two allies. While "we think it's a bad idea," Germany "is one our closest allies and partners anywhere in the world," Blinken said on CNN's "State of the Union" in an interview recorded after a NATO summit in Brussels last week. "And the fact that we have a difference over this pipeline is not going to change that." (BBG)

GEOPOLITICS: The Philippine military is sending light fighter aircraft to fly over hundreds of Chinese vessels in disputed waters in the South China Sea, its defence minister said, as he repeated his demand the flotilla be withdrawn immediately. International concern is growing over what the Philippines has described as a "swarming and threatening presence" of more than 200 Chinese vessels that Manila believes were manned by maritime militia. The boats were moored at the Whitsun Reef within Manila's 200-mile exclusive economic zone. (RTRS)

GEOPOLITICS: Dozens of Myanmar protesters were killed in clashes with the military and police in the deadliest weekend since the February coup, sparking condemnation from governments around the world. At least 114 people died on Saturday, including civilians who weren't taking part in demonstrations, according to rights group Assistance Association for Political Prisoners. Another nine deaths were reported on Sunday, it said. The death toll will likely rise in coming days as more are verified and documented, the group said. (BBG)

GLOBAL TRADE: Salvage teams freed the Ever Given in the Suez Canal, according to maritime services provider Inchcape, almost a week after the giant vessel ran aground in one of the world's most important trade paths. While the ship is floating again, it wasn't immediately clear how soon the waterway would be open to traffic, or how long it will take to clear the logjam of more than 450 ships stuck, waiting and en route to the Suez that have identified it as their next destination. (BBG)

GLOBAL TRADE: U.S. Trade Representative Katherine Tai on Friday said she was maintaining the threat of U.S. tariffs on goods from Austria, Britain, India, Italy, Spain and Turkey in retaliation for their digital services taxes. In a statement, Tai announced that her office would proceed with steps to impose potential tariffs, including filing public notices and collecting public comments as part of investigations launched originally by the Trump administration into the taxes aimed largely at American internet companies and e-commerce platforms. The taxes target in-country revenues of digital services platforms, such as Facebook, Google, and Amazon.com. (RTRS)

GLOBAL TRADE: The U.K. and the U.S. are unlikely to be ready to strike a trade deal before 2023, in a blow to British hopes of a quick win from Brexit, according to people familiar with the matter. President Joe Biden's administration is focused on other priorities such as China and investing in domestic programs to boost the U.S. economy, and his legal power to fast-track a trade accord through Congress is due to expire on July 1. (BBG)

CORONAVIRUS: The European Union will block exports of AstraZeneca Plc coronavirus vaccines if the company fails to deliver the doses bought by the region on time, according to the EU commissioner in charge of fixing the bloc's vaccination drive. "As long as AstraZeneca doesn't make good on its obligations, everything that's produced on European soil is distributed to Europeans," Thierry Breton, the EU's internal markets commissioner, said on RTL radio and LCI television Sunday. "If there are surpluses, they will go elsewhere." (BBG)

CORONAVIRUS: Britain is close to striking a vaccine deal with the European Union that will remove the threat of the bloc cutting off supplies. After a week of frantic behind-the-scenes diplomacy the two sides are expected to seal an agreement as soon as this weekend under which the EU will remove its threat to ban the export of Pfizer-BioNTech jabs to Britain. In return the government will agree to forgo some long-term supplies of the Oxford-AstraZeneca vaccine that had been due to be exported from Holland. Senior diplomatic sources said the secret talks, which began last Saturday conducted by the former EU ambassador Sir Tim Barrow, had helped restore trust despite the public rhetoric. (The Times)

CORONAVIRUS: Dublin has said it is unaware of any offer of spare COVID jabs from the UK following reports Britain planned to share millions of doses, partly to help Northern Ireland exit lockdown. Speaking to Sky News, cabinet minister Oliver Dowden also pointed out the UK does not "currently have a surplus" of coronavirus doses and said the first priority was vaccinating its own population. However, Northern Ireland's First Minister Arlene Foster insisted the proposed sharing of excess COVID-19 vaccines was "a runner" and revealed she had raised it with Prime Minister Boris Johnson in recent conversations. (Sky)

CORONAVIRUS: Britain will this week tell the European Union that it must take into account the millions of pounds spent by British taxpayers on creating the AstraZeneca vaccine as the threat of its export being blocked remains. (Telegraph)

CORONAVIRUS: The White House is weighing whether to suspend intellectual property protections for Covid-19 vaccines and treatments, in response to pressure from developing nations and subsequent support from progressive lawmakers, according to three sources familiar with the matter. A temporary suspension of intellectual property protections would apply to all medical technologies to treat or prevent Covid-19. South Africa and India made a formal request to the World Trade Organization to waive the protections until the pandemic is over, but the issue was tabled without a resolution. (CNBC)

CORONAVIRUS: The U.S. has "real concerns about the methodology and the process" of a draft World Health Organization report on the origins of the Covid-19 virus, including that the Chinese government "apparently helped to write it," Secretary of State Antony Blinken said. The politically contentious report, based on findings by international scientists convened by WHO and China, is expected shortly. While there needs to be "accountability for the past," the focus should be on building "a stronger system for the future," Blinken said on CNN's "State of the Union." (BBG)

CORONAVIRUS: French Industry Minister Agnes Pannier-Runacher urged countries with large vaccination capacities to join the EU in shipping vaccines to the rest of the world to limit the spread of new variants. France is aiming to inoculate 30 million citizens by the end of June. (BBG)

BOJ: MNI BRIEF: BOJ Policy Framework Set For Next Few Yrs

- A Bank of Japan board member said the central bank's new policy framework will be the basic guideline for the BOJ's monetary policy for the next few years, according to the summary of opinions from the March 18-19 meeting released on Monday. The board member said: "The analyses of the policy effects made in the assessment show that the current monetary easing should be continued for a long time. The BOJ's policy actions decided at this meeting have significance, in that they have ensured the sustainability and nimbleness of policy measures that are necessary to achieve the price stability target - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Osaka Governor to ask government for virus measures. (JiJi)

JAPAN: Japan will issue digital health certificates to citizens who have been inoculated against coronavirus, joining China, the European Union and other countries that have embraced vaccine passports aimed at opening up overseas travel, Nikkei has learned. (Nikkei)

AUSTRALIA: Brisbane, Australia's third most-populous city, will enter a three-day lockdown from 5 p.m. local time Monday due to an outbreak of the U.K. strain of the coronavirus. Residents will only be able to leave their homes for food, exercise, essential work and medical reasons, Queensland state Premier Annastacia Palaszczuktold reporters. Mask wearing in public will become compulsory for people in the rest of the state and home gatherings limited to 30 people, the premier said, after announcing 4 new cases of community transmission. (BBG)

AUSTRALIA: The prudential regulator has reminded Parliament that its primary responsibility is financial stability, not soaring house prices, and it is not seeing activity right now that would compel it to intervene. Soaring home prices, including 2.1 per cent growth in February, have raised pressure on regulators to think about applying the brakes. New Zealand's prudential regulator has already intervened twice this year. Australian Prudential Regulation Authority chairman Wayne Byres said it was watching lending standards but had seen nothing that warranted immediate action. "It's not our job to solve house prices and it's not our job to solve house pricing affordability. The extent to which there is dynamic emerging of increased risk taking by the community … at this stage it's not evident," Mr Byres told a federal parliamentary committee on Monday. Liberal MP Tim Wilson had asked at the live-streamed House of Economics Standing Committee on Economics hearing if the regulator had any concern about young people being priced out of the housing market. (Australian Financial Review)

AUSTRALIA: Prime Minister Scott Morrison has launched a bid to recover from weeks of political damage over the treatment of women by naming a new cabinet team, shifting problem ministers and punishing a disgraced Liberal MP. Mr Morrison named Peter Dutton as the country's next Defence Minister and leader of the government in the House of Representatives and Michaelia Cash as the new Attorney-General and Industrial Relations Minister in the two biggest appointments in the changes. (Sydney Morning Herald)

AUSTRALIA/CHINA: Australia's trade minister threatened to take China to the World Trade Organisation on Saturday over its "unjustifiable" decision to hike duties on Australian wine imports for up to five years. In the latest salvo between Beijing and Canberra, China's commerce ministry announced levies ranging from 116.2 percent to 218.4 percent would be slapped on Australian wine imports from Sunday. (SBS)

AUSTRALIA/CHINA: The federal government has hit a roadblock in its bid to haul China over the coals at the World Trade Organisation for Beijing's ban on Australian barley exports, after the push became collateral damage in a spat between the US and Venezuela. The WTO's dispute settlement body (DSB) was due to hold a meeting on Friday, at which Australia was scheduled to formally lodge its complaint against China for imposing anti-dumping measures against Australian barley imports. But the meeting was unexpectedly thrown into limbo after Venezuela reheated a two-year-old feud with Washington over US trade sanctions against President Nicolas Maduro's regime. Venezuela's attempt to launch a dispute "panel" over the US sanctions prompted American diplomats in Geneva to block the whole DSB meeting from taking place. Last time Venezuela and the US clashed at the WTO within the DSB, its meetings were suspended for a month. (Australian Financial Review)

NEW ZEALAND: Filled jobs were unchanged in February and were down slightly on a year ago. Westpac says jobs have held up better than expected through the tourist-less summer, but still suggest an uptick in unemployment in the near term. Wellington and the mid North Island are making jobs gains on government projects; the rest of the country, including Auckland, is soft on a weakening private sector. (Interest NZ)

SOUTH KOREA: resident Moon Jae-in replaced Kim Sang-jo, his top Cheong Wa Dae aide on policy, Monday, Moon's office announced amid a controversy over the leasing of his apartment in southern Seoul. Moon promoted Lee Ho-seung, senior secretary for economic affairs, to the post of handling policy at the presidential office, according to You Young-min, presidential chief of staff. (Yonhap)

NORTH KOREA: North Korea said on Saturday that the administration of U.S. President Joe Biden had taken a wrong first step and revealed "deep-seated hostility" by criticising its self-defensive missile test. (RTRS)

NORTH KOREA: U.S. efforts to develop a new approach toward North Korea are in their final stages that include consultations with U.S. allies, a White House spokeswoman said Friday, calling consultations an important part of the process. (Yonhap)

MEXICO: Andres Manuel Lopez Obrador is doubling down on a promise that helped launch him to Mexico's highest office in a landslide victory. The Mexican president is trying to scrap a policy that opened the nation's energy sector, and he's made it the center of his strategy to keep control of congress in midterm elections just two months away. Late Friday, Lopez Obrador sent a bill to congress that would reform the country's hydrocarbon law and give state oil company Petroleos Mexicanos greater control over the domestic fuel market. The legislation is the latest bid by the president to protect Mexico's aging state companies, which he pledged during his campaign to restore to their former glory. (BBG)

RUSSIA: Russian President Vladimir Putin hopes that Russia will reach herd immunity by the end of the summer as it ramps up its vaccine rollout, he said in interview to state television on Sunday. This will pave the way for a significant easing of restrictions, he said. (BBG)

SOUTH AFRICA: South Africa is targeting vaccinating about 200,000 people a day from mid-May as the government seeks to scale-up inoculations to tackle the pandemic, according to Health Minister Zweli Mkhize. The government has set up 2,000 centers where the doses would be administered, Mkhize told the Sunday Times newspaper. Shortages of doses threaten to upend South Africa's plans to vaccinate two-thirds of a population of about 60 million people this year, though the country is set to take delivery of 2.8 million Johnson & Johnson vaccines at the end of April. South Africa has been slow to secure vaccines, with just over 230,000 people inoculated so far. (BBG)

GOLD: Russia's Finance Ministry has allowed the National Wealth Fund (NWF) to diversify its assets by investing part of the funds into precious metals, including gold. The share of gold, which is seen as one of the most "protective" assets, has been significantly boosted in Russia's foreign exchange reserves, the ministry said. The step is aimed at diversifying the assets allocated by the NWF for ensuring the safety of the funds, as well as for increasing the yields, according to the ministry which will make the draft public in the near future. (RT)

OIL: Syria's oil ministry said on Saturday its fuel shipments would face delays due to a giant container ship that has been grounded, impeding traffic, in the Suez Canal since Tuesday. (RTRS)

OIL: Libya's National Oil Corporation (NOC) said early on Sunday that an oil spill near Dahra field has been fixed, NOC said on its page on Facebook. The technical teams were able to complete repairing the leak in a short time earlier on Saturday without affecting the production processes, NOC added. (RTRS)

CHINA

CORONAVIRUS: China had administered more than 100 million doses of Covid-19 vaccines as of March 27, Mi Feng, a spokesman for the National Health Commission, said at a press conference on Sunday. (BBG)

YUAN: MNI INTERVIEW: Yuan To Firm, Fed On Hold -Ex PBOC Official

- China's yuan should strengthen moderately against the dollar by the end of the year, driven by capital inflows as the Federal Reserve keeps rates on hold to keep U.S. government borrowing costs low, a former high-ranking People's Bank of China official told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC/RATINGS: China's credit rating industry is likely to see a round of mergers and acquisitions as the PBOC prepares a plan to overhaul the industry following a number of defaults by firms, Yicai.com reported. Rating agencies are required to build a rating mechanism centered on default rates and track their ratings timely, according to the PBOC's draft posted on its website Sunday. Credit ratings in the Chinese bond market are often criticized for inaccuracies and lacking distinctions, the newspaper said. (MNI)

PBOC: China should try and prevent any premature de-industrialization and be wary of a continued decline in the importance of manufacturing in the economy, according to a central bank adviser. "Manufacturing has always been the most important and most basic part of China's real economy, but also a worrying part right now," said Cai Fang, a member of the People's Bank of China's monetary policy committee. "The share of China's manufacturing industry has been on a downward trend since first dropping in 2006, so we need to stabilize the real economy and the manufacturing sector." Manufacturing's share of GDP was 27% in 2019, down from a peak of about 32.5% in 2006, Cai said at a forum on Saturday. Cai joined the policy committee recently and was previously deputy head of the Chinese Academy of Social Sciences. (BBG)

PROPERTY: China is cracking down on the misuse of loans for investment into the property market, with three ministries issuing statements to probe nationwide banking systems, the Xinhua News Agency's Economic Information Daily said. Investors have been channeling funds borrowed for normal business activities into the housing market, which pushed up levels of business and personal debt and heightened risks of a debt crisis, the newspaper said citing Dong Ximiao, an analyst with China Merchant Bank. Authorities are posting the names of businesses and individuals being punished into credit-rating systems to halt the illegal practice at its source, the Daily's report said. (MNI)

OVERNIGHT DATA

CHINA FEB INDUSTRIAL PROFITS YTD +178.9% Y/Y

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1957% at 09:28 am local time from the close of 2.2192% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday, flat from the close of Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5416 MON VS 6.5376

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a fourth day at 6.5416 on Monday, compared with the 6.5376 set on Friday.

MARKETS

SNAPSHOT: Friday's Equity Block Sales Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 335.35 points at 29509.94

- ASX 200 down 13.627 points at 6810.6

- Shanghai Comp. up 27.076 points at 3445.403

- JGB 10-Yr future down 5 ticks at 151.31, yield down 0.3bp at 0.080%

- Aussie 10-Yr future down 3.5 ticks at 98.280, yield up 3.1bp at 1.686%

- U.S. 10-Yr future +0-01+ at 131-26, yield down 2.48bp at 1.651%

- WTI crude down $0.97 at $60.00, Gold down $3.39 at $1729.15

- USD/JPY down 12 pips at Y109.52

- ECB'S LANE: ECB MUST REMAIN EURO ZONE'S STABILISER (RTRS)

- EU WON'T LET ASTRA EXPORT COVID VACCINES UNTIL PLEDGE MET (BBG)

- INCHCAPE: EVER GIVEN SUCCESSFULLY REFLOATED IN SUEZ CANAL (BBG)

- EX-TIGER ASIA FOUNDER TRIGGERS $30 BILLION IN LARGE STOCKS SALES (WSJ)

- VIACOMCBS HOLDER SAID TO OFFER 45 MILLION SHARES IN BLOCK TRADE (BBG)

- NOMURA WARNS OF 'SIGNIFICANT' LOSS FROM U.S. CLIENT (BBG)

BOND SUMMARY: Core FI Off Worst Levels

T-Notes last +0-01+ at 131-26, just shy of Asia highs (holding to a 0-06 range since the re-open, working away from late Friday lows on limited volume of ~88K), the cash curve has bull flattened, with 30s sitting ~2.5bp richer on the day. Continued focus on the knock-on impact of Friday's block sale frenzy in the equity space & talk of continued potential flow on that front (see earlier bullets for more details on that matter) provided modest support for core FI early this week, although there has been little in the way of broader market spill over, even as banks start to outline potential losses (which were seemingly driven by one, or maybe two, funds). A downtick for crude oil on the back of the refloating of the well-documented stranded ship in the Suez Canal provided another source of support for core global FI as we moved through overnight trade. Elsewhere, a 4,600 block buyer of FVM1 was seen ahead of European hours.

- JGB futures -5 vs. Friday's settlement after briefly unwinding overnight losses during the Tokyo morning. Cash JGBs were marginally mixed out to 7-Years, firming further out, with 30s leading the way, richening by ~2.5bp, as the longer end benefitted from the bid in Tsys. The summary of opinions from the BoJ's March meeting revealed little in the way of fresh information (as expected), while the JPY supply pipeline built as Berkshire Hathaway mandated for a round of benchmark bond issuance.

- The downtick in e-minis and local COVID-related lockdown in the city of Brisbane have provided support to the Aussie bond space, although the bid can't be described as particularly firm, with Aussie 10s still printing 1.0bp or so wider vs. U.S. 10s in cash trade. Meanwhile, futures have failed to unwind their overnight session losses, YM -1.0, XM -4.0.

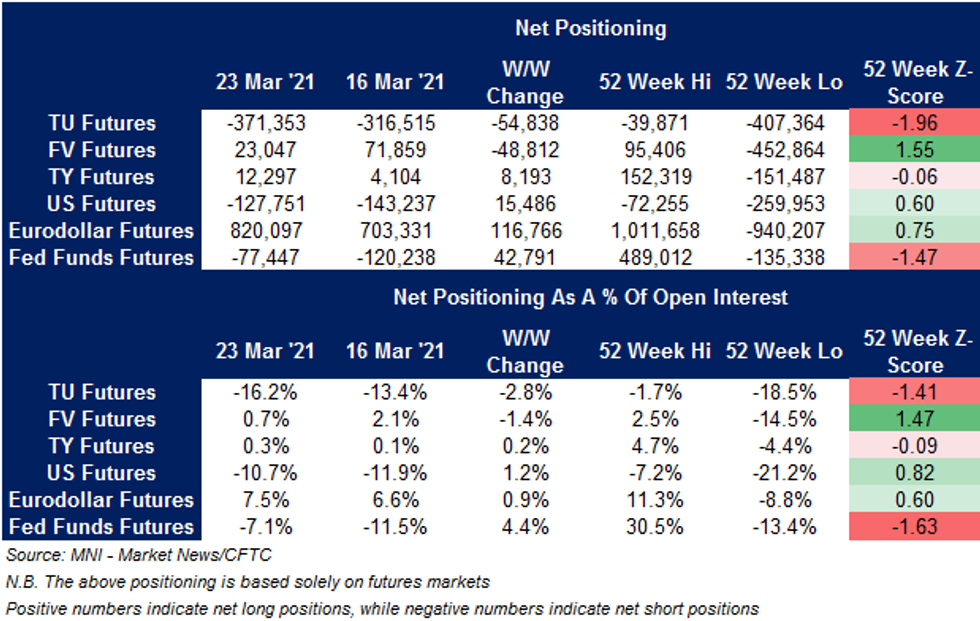

US TSY FUTURES: Twist Flattening Seen In CFTC CoT Positioning

Some modest twist flattening-like positioning swings were seen across the benchmark U.S. Tsy futures contracts in the latest CFTC commitment of traders report (covering the week ending 23 Mar '21). Positioning remains off of recent extremes across those contracts.

EQUITIES: Block Trade Reports Weigh On US Futures

Most markets in the Asia-Pac region are in the green, Australia's ASX 200 is the laggard at the time of writing, down around 0.25%. Most markets are taking a positive lead from a record close in the US, markets in Japan are around 1% higher, shrugging off a loss warning from Nomura. Markets in mainland China and Hong Kong rebound from early losses as markets shrug off concerns about stock dumping. US futures couldn't manage to do the same though, and are currently in negative territory, grinding lower through the session. Archegos Capital are said to be behind the block trades seen on Friday which totalled over $20bn in value, with the liquidations forced upon the fund as existing positions moved against them.

OIL: Renewed Lockdown Concerns Weigh

Crude futures are slightly lower to start the week; WTI & Brent sit ~$0.70 and ~$0.55 below their respective settlement levels at typing.

- The major crude benchmarks knee jerked lower on the previously flagged BBG story which noted that the Ever Given has been refloated in the Suez canal, per reports from maritime service providers. A reminder that timing re: the clearing of the waterway still remains up in the air.

- Market participants will also look to Abu Dhabi where futures contracts for its oil will be available, the country will then ship the barrels from Fujairah. This is the first move in creating a new regional benchmark and will challenge pricing for around 20% of the world's crude supply.

- Elsewhere, Indonesia's Pertamina said that an incident has caused a fire at its 125k Balongan refinery but its fuel supply was not affected.

GOLD: As You Were

Bullion continues to coil within the confines of the recently observed range, spot last dealing little changed around the $1,730/oz mark, with slightly lower nominal and real U.S. yields observed during Asia-Pac hours, while the broad USD (proxied by the DXY) trades little changed.

FOREX: Caution Prevails In Asia

JPY led the way in thin Asia-Pac trade, as caution prevailed after Friday's well-documented stock market developments, with Nomura seen issuing a warning against "significant" potential loss from a U.S. name (which BBG sources linked to the unwinding of trades by Archegos). USD/JPY ticked away from multi-month highs registered last Friday, even as the greenback fared well against its other G10 peers.

- The Antipodeans paid little attention to local headlines, with AUD/NZD narrowing in on Mar 23 cycle high. Brisbane was placed under a three-day lockdown to curb the spread of the UK coronavirus variant, while NZ gov't said it will monitor the rental market's reaction to its housing policy package.

- CAD and NOK posted marginal downticks in sync with a dip in crude oil, as Inchcape said the Ever Given was successfully refloated.

- The PBOC fixed its USD/CNY mid-point at CNY6.5416, just 3 pips below sell side estimates. USD/CNH edged higher as geopolitical tensions between China and its Western adversaries continued to simmer.

- Speeches from Fed's Waller & ECB's de Cos headline today's uninspiring economic docket.

FOREX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-15(E610mln), $1.1800(E367mln-EUR puts), $1.1935(E1.1bln), $1.1950(E728mln), $1.2000(E910mln)

- USD/JPY: Y107.00($841mln), Y107.80($708mln), Y108.70-75($1.9bln), Y108.95-109.10($671mln)

- EUR/GBP: Gbp0.8585-90(E1.2bln-EUR puts), Gbp0.8595-0.8600(E835mln-EUR puts), Gbp0.8605-10(E840mln-EUR puts)

- AUD/USD: $0.7700-05(A$519mln)

- USD/CNY: Cny6.51($645mln), Cny6.55($880mln)

- USD/ZAR: Zar15.40($538mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.