-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI EUROPEAN OPEN: NFPs Front & Centre

EXECUTIVE SUMMARY

- FOCUS ON NFPS, WITH MARKETS LACKING A CLEAR CATALYST IN ASIA

- DUTCH PM RUTTE CLINGS ON AFTER POLITICAL BATTLE (AFP)

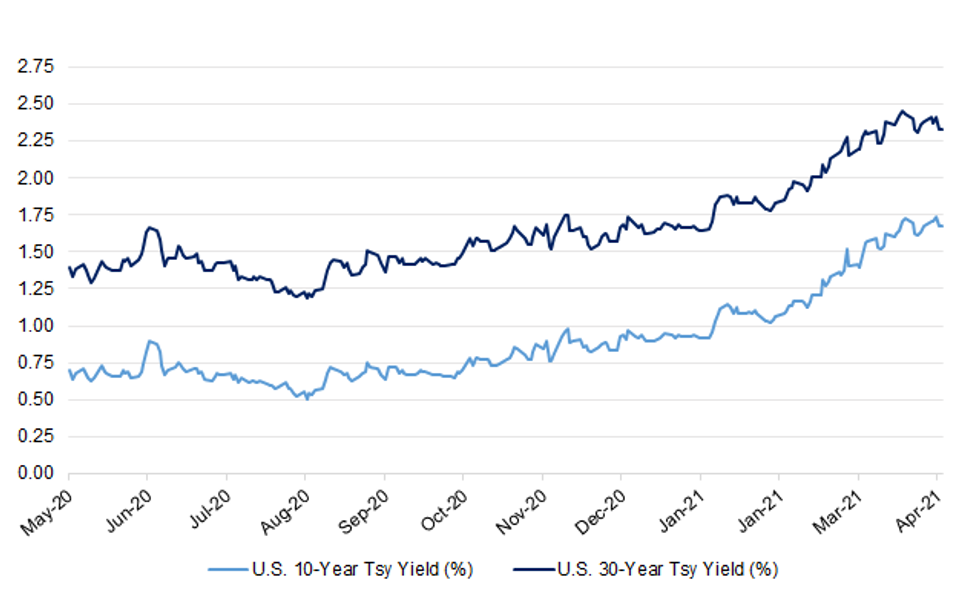

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Covid passports are set to be trialled at events in Britain within weeks, The Telegraph can reveal, as the Government pushes ahead with the idea despite a growing rebellion by MPs. (Telegraph)

CORONAVIRUS: More than 70 MPs - including more than 40 Conservatives - have sent a warning shot to Boris Johnson by forming a major cross-party campaign against the use of vaccine passports within the UK. The prime minister has said there will "definitely" be a role for vaccine passports for Britons heading abroad, with it reported ministers are discussing a new traffic-light scheme for prioritising travel to countries with high vaccination rates. (Sky)

CORONAVIRUS: British officials are drawing up plans for the tentative return of international travel, allowing families to book holidays and offering a desperately needed lifeline to the aviation industry. But the resurgence of the coronavirus in Europe is forcing Boris Johnson's government to consider whether to push back the reopening of overseas travel beyond the proposed start date of May 17, people familiar with the matter said. The prime minister is due to set out the blueprint on April 5. (BBG)

CORONAVIRUS: The United States, Maldives, Israel and Malta could become the first overseas destinations to be opened up for British holidaymakers this summer under plans to prioritise countries with high coronavirus vaccination rates. Ministers discussed a new traffic-light scheme last night for resuming international travel in advance of an announcement by Boris Johnson on Monday when he will set out how the system will work. Countries will be graded red, amber or green. (The Times)

EUROPE

CORONAVIRUS: Austria, Slovenia, and the Czech Republic have been excluded from an EU move to provide millions of extra vaccines to hard-hit member countries, ending bitter negotiations over jab supply that have divided governments. A coalition of 24 EU countries on Thursday decided on a "solidarity" mechanism that will provide 2.85m additional doses of the BioNTech/Pfizer jab to five member states: Estonia, Latvia, Croatia, Slovakia, and Bulgaria. The decision will not give additional jabs to a trio led by Austria after they blocked proposals for redistribution in protest after seeking a higher share. The negotiations end weeks of divisive horse-trading over how to distribute 10m jabs bought forward from the third quarter to help ease supply shortages as the virus forces new lockdown measures across the EU. (FT)

EU: Three populist leaders called for a "renaissance" in the European Union to realign it along traditional family values but failed to overcome divisions toward establishing a new party to vie for influence at the highest EU levels. The prime ministers of Hungary and Poland, Viktor Orban and Mateusz Morawiecki, and Italian Deputy Premier Matteo Salvini agreed in Budapest on Thursday to continue talks on an EU-wide platform aimed at uniting the continent's populist and far-right forces. No breakthrough was announced, underscoring divisions that hinder their efforts to subvert the political mainstream, despite the leaders' rhetoric. (BBG)

GERMANY: Germany's vaccine commission, known as STIKO, recommended on Thursday that people under 60-years old who have had a first shot of AstraZeneca's COVID-19 vaccine should receive a different product for their second dose. Earlier in the week, Germany said only people aged 60 and over should be administered the AstraZeneca vaccine due to the rare but severe occurrence of thromboembolic side effects. It said it would make a separate recommendation later on younger people who had already received a first shot. In an updated recommendation on its website, STIKO said there was no scientific evidence on the safety of a mixed series of vaccines. (RTRS)

PORTUGAL: Portugal will continue to gradually ease confinement measures as planned, with smaller stores reopening from Monday and outdoor seating allowed at restaurants and cafes. Controls on the land border with Spain remain in place for now, Prime Minister Antonio Costa said. The number of daily infections in Portugal eased in February and March after the country faced one of the world's worst outbreaks in January. (BBG)

NETHERLANDS: Dutch Prime Minister Mark Rutte survived one of the biggest political fights of his decade in power Friday, narrowly winning a no-confidence vote over claims he lied about coalition talks. Dubbed the "Teflon premier" for his ability to dodge scandal, Rutte will however remain under pressure after every party except his own supported a separate motion in parliament condemning his behaviour. Rutte, whose VVD party won the most seats in elections last month based on his handling of the coronavirus pandemic, was accused of covering up efforts to rein in an outspoken MP during coalition negotiations. "I will continue as prime minister, I will work terribly hard to regain trust," Rutte told parliament after the no-confidence vote. (AFP)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on France (current rating: AA; Outlook Stable) & Poland (current rating: A-; Outlook Stable)

U.S.

FED: San Francisco Federal Reserve Bank President Mary Daly on Thursday said the U.S. central bank will keep monetary policy easy despite what she said will be an increase this year in prices as the economy reopens more fully and households spend more. "As policymakers we have to look through these temporary increases; we're really looking for sustained improvements in inflation so we can average 2% and meet our price stability goals," Daly said in an interview with Fox Business Network. "We still have almost 10 million people on the sidelines looking for jobs... we really aren't projecting achieving either side of our dual mandate in 2021 and that's why policy is remaining accommodative." (RTRS)

ECONOMY: MNI REALITY CHECK: US March Jobs Seen Up on Vaccines, Stimulus

- U.S. payrolls growth in March should nearly double the gains seen in February, and that momentum isn't expected to slow down anytime soon as the country's immunization push picks up speed and the latest fiscal stimulus keeps businesses' and consumers' heads above water, recruiters and industry experts told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: Fed Jobs Model Sees Nearly 2M Jobs in March

- U.S. payrolls from mid-February to mid-March may have increased by as much as 1.67 million, St. Louis Fed economist Max Dvorkin told MNI. That's despite a "modest slowdown in the evolution of employment in mid-March, most likely related to spring break." On the lower end, Dvorkin's model, which synthesizes high frequency data from employee scheduling software companies Homebase and Kronos, predicts a monthly payrolls gain of 843,000, which would still be the largest one-month gain since August - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Wires have noted that U.S. President Biden will give comments on the jobs report at 11:00 NY time on Friday (16:00 London). (MNI)

ECONOMY: MNI INTERVIEW: US Factory Prices Seen +3% Amid Best ISM in 38Y

- U.S. manufacturers are holding back on massive price increases amid the strongest backdrop in nearly four decades, Institute for Supply Management chair Tim Fiore told MNI Thursday. "I don't want to call it inflation yet," Fiore said in an interview. "I'm not overly concerned about it. It's just a healthy indication of supply and strong demand" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The U.S. Treasury noted the following on Thursday: "Today, the U.S. Department of the Treasury, the Internal Revenue Service, and the Bureau of the Fiscal Service announced they are disbursing several million more payments in the third batch of Economic Impact Payments from the American Rescue Plan. This brings the total disbursed so far to more than 130 million payments worth approximately $335 billion." (MNI)

FISCAL: President Joe Biden would like to see the jobs and infrastructure proposal he rolled out this week approved by Congress by summertime, White House press secretary Jen Psaki said on Thursday. (RTRS)

FISCAL: Any hopes that Washington could scrape together a bipartisan infrastructure package took a hit Thursday. Senate Minority Leader Mitch McConnell, R-Ky., told reporters the more than $2 trillion plan the White House unveiled Wednesday "is not going to get support from our side." The proposal would invest in roads, bridges, airports, broadband, water systems, electric vehicles and job training programs, and raise the corporate tax rate to 28% to offset the spending. The Republican also vowed to oppose the broader Democratic agenda under President Joe Biden, who passed his first major initiative last month in the $1.9 trillion coronavirus relief package. (CNBC)

FISCAL: President Biden is unlikely to propose reinstating state and local tax deductions in his second tax-and-spending package despite pressure from several fellow Democrats, according to people with direct knowledge of the planning. That stance could complicate his goals of passing a multitrillion-dollar infrastructure proposal. (Axios)

FISCAL: President Joe Biden has requested that Education Secretary Miguel Cardona prepare a report on the president's legal authority to cancel up to $50,000 in student debt per borrower, White House chief of staff Ron Klain said in an interview on Thursday with Politico. "Hopefully we'll see that in the next few weeks," Klain said of the memo. "And then he'll look at that legal authority, he'll look at the policy issues around that and he'll make a decision." (CNBC)

CORONAVIRUS: President Joe Biden's administration is "assured" that Johnson & Johnson will meet its U.S. vaccine delivery targets despite a setback at a Baltimore site, White House Press Secretary Jen Psaki said. Psaki spoke Thursday at the White House after J&J and one of its subcontractors, Emergent BioSolutions Inc., acknowledged that a batch of drug substance had been spoiled. She said the U.S. doesn't expect J&J to miss any delivery targets, and alluded to having some room with a larger supply of Pfizer Inc. and Moderna Inc. The U.S. has said it will have enough vaccine doses for all American adults in May from those companies. (BBG)

CORONAVIRUS: The Food and Drug Administration is investigating what caused a batch of the active ingredient for Johnson & Johnson's Covid-19 vaccine to be scrapped for failing to meet quality standards at a contract manufacturing plant, according to a person familiar with the matter. The FDA may send an inspection team to assess the situation at the Baltimore plant operated by contractor Emergent BioSolutions Inc., the person said. (Dow Jones)

CORONAVIRUS: The Food and Drug Administration (FDA) adjusted Moderna's emergency use authorization on Thursday to permit more COVID-19 vaccine doses in each vial – a move expected to speed up deliveries and shipments. The FDA announced late Thursday that it will allow Moderna to include up to 50 percent more extractable doses in its vials in an amendment to its authorization. The increase would permit Moderna to put up to 15 doses per vial, instead of the previous 10 doses per vial. The federal agency also boosted the maximum number of doses allowed to be extracted from the already existing 10-dose vials to 11 doses, noting that the extra dose may only be available depending on the syringes and needles used. (The Hill)

CORONAVIRUS: The United States may not need AstraZeneca's COVID-19 vaccine, even if it wins U.S. regulatory approval, Anthony Fauci, the nation's top infectious disease doctor told Reuters on Thursday. The vaccine, once hailed as another milestone in the fight against the COVID-19 pandemic, has been dogged by questions since late last year, even as it has been authorized for use by dozens of countries, not including United States. Fauci, director of the National Institute of Allergy and Infectious Diseases and chief medical adviser to the White House, said the United States has enough contracts with other vaccine makers to vaccinate its entire population, and possibly enough for booster shots in the fall. (RTRS)

CORONAVIRUS: Maine will open vaccines up to everyone 16 years and older starting Wednesday, moving the original date forward from April 19. "With the Federal government significantly increasing our supply of vaccines, it is appropriate to accelerate our timeframe, " Governor Janet Mills said in a statement. (BBG)

CORONAVIRUS: Michigan reported its first case of the variant that is helping drive the outbreak in Brazil. The state already has the U.S.'s highest number of cases of the variant first found in the U.K. after Florida, according to the Centers for Disease Control and Prevention. It is also among the hardest-hit U.S. states in the latest wave of infection, with the most cases per capita over the last seven days, CDC data shows. (BBG)

CORONAVIRUS: Kansas legislative leaders Thursday revoked an order of Gov. Laura Kelly's urging counties to keep their mask mandates hours after she issued it. State law gives eight leaders in the state legislature the power to overturn an order of the governor issued because of a pandemic or an emergency. They immediately did so after Kelly issued an order that would have required people to wear masks indoors and socially distance, unless county officials voted to opt out. (BBG)

CORONAVIRUS: Montana Governor Greg Gianforte is resisting a White House request to states to restore mask mandates as Covid-19 infections increase nationally. "I don't think one size fits all," Gianforte said Wednesday, according to the Billings Gazette. "I said that from the beginning." Gianforte, a Republican, said the number of cases and hospitalization is falling in Montana. (BBG)

OTHER

GEOPOLITICS: Japan, U.S. Summit to agree on Indopacific development. (Yomiuri)

CORONAVIRUS: The UK has received 30 reports of the rare blood clotting events that have been linked to the Oxford/AstraZeneca Covid-19 vaccine in recent weeks and have caused precautionary restrictions to be placed on its use in many European countries. On Thursday evening, the Medicines and Healthcare products Regulatory Agency released information about 25 new cases of severe and very rare blood clotting events, on top of five it had reported earlier this month. The MHRA also clarified that it had not seen any of the same reactions in individuals that had received the BioNTech/Pfizer vaccine. (FT)

CORONAVIRUS: The Covid-19 origin report published earlier this week included many recommendations for next steps made by the international team of scientists, and the World Health Organization expects there will be follow-up assessments, Director-General Tedros Adhanom Ghebreyesus said at a briefing. More than a dozen nations have criticized the report, saying the mission "lacked access to complete, original data and samples," and calling for more transparency and timeliness in response to future outbreaks. The WHO hasn't yet discussed follow-ups with China yet because the report was just released, Tedros said, adding the WHO will start engagements as soon as possible. (BBG)

GLOBAL TRADE: U.S. Deputy Treasury Secretary Wally Adeyemo on Thursday kicked off a review of U.S. economic and financial sanctions, underscoring the need to use them as a strong, viable policy tool, the Treasury Department said in a statement. Adeyemo met with academics and other experts on sanctions, who affirmed the role of U.S. sanctions as a key instrument of U.S. national security and foreign policy, the statement said. "Deputy Secretary Adeyemo noted that sanctions remain a potent and valuable tool for policymakers and as programs are evaluated, it is critical to keep an eye toward ensuring they remain a strong, viable option in years to come," it said. (RTRS)

GLOBAL TRADE: As part of an ongoing review into critical supply chains, the Biden administration is considering requesting that supply chains undergo "stress tests" of hypothetical scenarios and suggesting that companies stockpile certain critical inventory, according to two senior administration officials and two people familiar with the review. "The idea of making sure that companies have a better sense of their own supply chain vulnerabilities is clearly one of the things involved in the process," said a senior administration official who declined to be identified because the review was neither complete nor public. (CNBC)

GLOBAL TRADE: President Joe Biden's top national security and economic advisers plan to meet April 12 with semiconductor and auto companies to discuss the global shortage of microprocessors, according to people familiar with the matter. National Security Adviser Jake Sullivan and National Economic Council director Brian Deese will discuss the impacts of the shortage and a path forward with industry leaders, an administration official said. The official added that the White House is also engaged with Congress and allies abroad on the issue. (BBG)

NORTH KOREA: White House National Security Adviser Jake Sullivan will lay out the emerging U.S. strategy toward North Korea in a meeting with his Japanese and South Korean counterparts on Friday at the U.S. Naval Academy, a senior administration official said. Sullivan will host National Security Secretariat Secretary General Shigeru Kitamura of Japan and South Korean National Security Adviser Suh Hoon at the academy in Annapolis, Maryland, the official said in a briefing for reporters. (BBG)

NORTH KOREA: Denuclearization will remain at the center of U.S. policy toward North Korea and any approach to Pyongyang will have to be done in "lockstep" with close allies, including Japan and South Korea, U.S. State Department spokesman Ned Price said on Thursday. (RTRS)

CANADA: The Ontario government is imposing a province-wide "emergency brake" starting Saturday, but stopped short of a stay-at-home order, despite modelling showing such a measure could significantly curb the surge in COVID-19 case numbers and hospitalizations. The measure comes into effect as of 12:01 a.m. on April 3, the province said in a news release, and will be in place for at least four weeks. "We are facing a serious situation and drastic measures are required to contain the rapid spread of the virus, especially the new variants of concern," Premier Doug Ford said in a statement. (CBC)

BRAZIL: Brazil's President Jair Bolsonaro said on Thursday he is not politicizing the armed forces, after he appointed his chief of staff as the new defense minister earlier this week, resulting in the heads of all military branches being replaced. During a weekly live internet broadcast, Bolsonaro added that the military would not be used to enforce state and local COVID-19 lockdowns. (RTRS)

BRAZIL: Nine Brazilian states have filed a request for exceptional authorization to import doses of the Russian vaccine Sputnik V, the regulatory agency known as Anvisa said in a statement. (BBG)

RUSSIA: Turkey fined 10 securities firms for up to 7.8 million lira ($1 million) in relation to irregularities in short-selling transactions, the country's Capital Markets Board said in its weekly bulletin on Thursday. Fines of various amounts were imposed on firms including Merrill Lynch International, JP Morgan Securities, Goldman Sachs International, Credit Suisse Securities Europe and Barclays Capital Securities, the statement said. Last July, Turkey's Borsa Istanbul applied a temporary short selling ban on various foreign institutions because they failed to notify authorities about short- selling transactions. (RTRS)

RUSSIA: The United States is concerned by Russia's recent escalations of aggressive and provocative actions in eastern Ukraine, U.S. State Department spokesman Ned Price told reporters on Thursday. Unverified social media footage has suggested Russia has been moving large quantities of tanks, armoured personnel carriers and other equipment to regions that border Ukraine as well as to Crimea, which Moscow annexed from Ukraine in 2014. (RTRS)

RUSSIA: The European Union said on Thursday that Russia had launched a conscription campaign in the Crimea peninsula and that the move broke international law. "Today, the Russian Federation has launched yet another conscription campaign in the illegally-annexed Autonomous Republic of Crimea and the city of Sevastopol to draft residents of the peninsula in the Russian Federation Armed Forces," the EU said in a statement. "This is another violation of international humanitarian law. The Russian Federation is bound by international law, and obliged to ensure the protection of human rights on the peninsula," the EU statement said. (RTRS)

IRAN: Iran and the remaining world powers in the 2015 nuclear deal will hold a virtual meeting on Friday to discuss the U.S.'s return to the accord, the European Union said in a statement. The discussion, which will involve officials from Iran, Russia, China, Germany, France and the U.K., will be chaired by the EU's top foreign envoy Josep Borrell and address how the landmark agreement can be fully implemented by all sides, according to the statement. (BBG)

IMF: A $650 billion increase in International Monetary Fund reserves could be distributed to member countries in August, but only a small portion is likely to be converted to hard currency by poor countries, U.S. Treasury officials said on Thursday. The Treasury has formally notified Congress of its plans for the new allocation of IMF Special Drawing Rights, starting a 90-day consultation process that will be completed in early July, officials told reporters on a conference call. The $650 billion SDR allocation must then be approved by the IMF's Board of Governors, made up of the institution's 190 member countries. (RTRS)

IMF: The No. 2 official of the International Monetary Fund is optimistic that the Group of 20 largest economies next week will agree to extend debt relief to low-income nations through the end of this year. The G-20's Debt Service Suspension Initiative, which took effect last May, has delivered$5 billion in relief for more than 40 countries, according to the World Bank. The G-20 last October extended the program, originally set to expire in December 2020, through June, and agreed to consider a further six-month extension later. (BBG)

OIL: After months of preaching caution and saying the time was not right to raise oil production, OPEC and its partners abruptly agreed April 1 to loosen their quotas and add more than 2 million b/d into the market by July. The move is a bet that the OPEC+ alliance can gradually reclaim some of its lost market share, even as the global economy faces an uneven recovery from the pandemic. The increases will be phased in each month, and the alliance reserves the right to U-turn if market conditions deteriorate, Saudi energy minister Prince Abdulaziz bin Salman said. In fact, OPEC+ ministers are planning to meet again April 28 to review their decision, before the first increment goes into effect in May. "The decision today is nothing more than to be willing to test our guts and test our system of tweaking and attending to the situation," Prince Abdulaziz told reporters after the OPEC+ meeting. (Platts)

OIL: Russian Deputy Prime Minister Alexander Novak said on Thursday he hoped global oil inventories, a key parameter for the oil industry, would return to their normal level in 2-3 months. He also said Russia will gradually raise its oil output in May - July in accordance with the decision of the OPEC+ group of leading oil producers. Novak added that Russia's cumulative increase is seen at 114,000 barrels per day during that period. (RTRS)

OIL: Iraq exported 2.945 million barrels a day of crude oil in March from fields under the central government's control, the oil ministry said in a statement. Nation exported total 91.3 million barrels last month. Iraq generated $5.78 billion from March oil sales; sold at an average of $63.33/bbl Figures exclude shipments from northern fields controlled by the semi-autonomous Kurdistan Regional Government. (BBG)

FOREX: U.S. Trade Representative Katherine Tai, in a call on Thursday with Vietnam's minister of industry and trade, highlighted U.S. concerns about Vietnam's currency practices, a USTR statement said. Tai and the Vietnamese minister Tran Tuan Anh also "discussed U.S. concerns on illegal timber practices, digital trade and agriculture," the statement said. The U.S. Treasury Department in December labeled Vietnam a "currency manipulator" due to its growing trade surplus with the United States, its large global current account surplus and heavy foreign exchange market intervention to hold down the value of its dong currency. (RTRS)

CHINA

CORONAVIRUS: Chinese vaccine producers should steadily expand production capacity and increase output when ensuring quality, Minister of Industry and Information Technology Xiao Yaqing says during a visit to Sinovac. (BBG)

CREDIT: New credit and lending by Chinese banks this year will be close to that of 2020 given the government's emphasis on a stable monetary policy, the Economic Information Daily said citing Wang Yifeng, chief analyst of finance industry at Everbright Securities. New RMB loans in 2020 was CNY19.63 trillion, CNY2.82 trillion higher than 2019, MNI noted. Supporting SMEs will remain the priority of banks this year and growth of loans to real estate sector will drop significantly, the newspaper said citing Zeng Gang, the director of Shanghai Institute for Financial and Development. (MNI)

ECONOMY: Chinese spending on travel and leisure is set to surge in the three-day Tomb Sweeping holiday starting April 3 with 100 million people forecast to travel, a level seen before last year's pandemic, the Shanghai Securities News said citing analyst Fang Zexi at CTrip. There has been a 25% rise in ticket bookings for the three holidays from last year, Fang was cited saying. (MNI)

BONDS: Shanghai Stock Exchange started on-site inspection for some bond issuance projects, Shanghai Securities News reports, citing the bourse. It includes on-site inquiry, reading draft of due diligence, checking relevant materials and asking agencies to supplement materials. (BBG)

OVERNIGHT DATA

JAPAN MAR MONETARY BASE Y643.6TN; FEB Y614.7TN

SOUTH KOREA MAR CPI +1.5% Y/Y; MEDIAN +1.5%; FEB

SOUTH KOREA MAR CORE CPI +1% Y/Y; MEDIAN +0.9%; FEB

SOUTH KOREA MAR CPI +0.1% M/M; MEDIAN -0.1%; FEB

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS FRI, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

CHINA SETS YUAN CENTRAL PARITY AT 6.5649 FRI VS 6.5584 THURS

MARKETS

SNAPSHOT: NFPs Front & Centre

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 411.67 points at 29801.37

- ASX 200 is closed

- Shanghai Comp. up 15.057 points at 3481.389

- JGB 10-Yr future up 8 ticks at 151.02, JGB 10-Yr yield up 0.7bp at 0.12%

- Aussie bonds are closed

- U.S. 10-Yr future down 0-02+ at 131-11, cash Tsys are closed

- WTI crude is closed, Gold up $2.82 at $1732.13

- USD/JPY unch. at Y110.62

- FOCUS ON NFPS, WITH MARKETS LACKING A CLEAR CATALYST IN ASIA

- DUTCH PM RUTTE CLINGS ON AFTER POLITICAL BATTLE (AFP)

BOND SUMMARY: Core FI Off Best Levels In Asia

T-Notes have drifted marginally lower as we grind towards European hours, -0-02+ at 131-11, holding to a 0-05+ range during overnight trade, with under 40K lots trading thus far. The Easter period and associated holidays are clearly sapping liquidity, while there has been nothing in the way of notable headline flow apparent. Cash Tsys are closed until NY hours (which are themselves shortened). A reminder that the Tsy complex experienced a firm start to the month of April as the curve bull flattened on Thursday, with the longer end richening by ~8.0bp vs. Wednesday's closing levels. This came alongside/despite strong local data, which, when combined with the lower yield environment, allowed the equity space to firm. The S&P 500 index (and ES futures) traded and closed above 4,000 for the first time. The latest ISM m'fing survey revealed the fastest headline rate of expansion seen since the early 80s, but didn't create anything in the way of lasting selling pressure for Tsys as it came on the heels of a strong round of regional PMI prints. Elsewhere, block flow in FVM1 futures dominated with just under 32K lots trading via block throughout the NY session, a mixture of buying and selling observed (~13.4K bought vs. 18.5K sold). The NFP release headlines on Friday, with thinner liquidity having the potential to amplify any post-data swings in the space. The release will be followed an address from President Biden (which is seemingly linked to the jobs report), with the President set to speak from 11:00 Eastern time (16:00 London). Widespread market holidays and a lack of tier 1 data may limit activity ahead of NY hours.

- The cash JGB space firmed a little during the Tokyo morning, drawing support from Thursday's bid in U.S. Tsys and the overnight move in JGB futures. The space has retraced from best levels during the afternoon, alongside Tsys. Futures last printing 8 ticks above Tokyo settlement levels.

EQUITIES: April Kicks Off With A Bang

Asia-Pac indices are in the green, making April a good month so far with two consecutive days of gains. Several markets were closed for holidays, which meant light news flow and thin volumes. Markets took a positive lead from the US, while higher oil prices post OPEC+ also helped support sentiment. Markets in South Korea were buoyed by reports that US officials was planning to meet with semiconductor firms to address the global shortage of microprocessors. Markets in China are on track for their best week since February. US equity futures are higher, buoyed by a record close on the S&P above the 4,000 level, tech shares were the outperformer.

GOLD: Drawing Support From The DXY & U.S. Yields

Spot bullion has added a couple of dollars to last trade at $1,731/oz in holiday-limited Asia-Pac dealing, just above yesterday's high. A softer DXY and downtick in U.S. real yields has supported bullion over the last 24 hours or so, allowing bulls to switch focus to key resistance in the form of the Mar 18 high ($1,755.5/oz). The NFP print is set to dominate during Friday's holiday-thinned session, with thinner markets having the potential to exacerbate volatility.

FOREX: Greenback Declines As Markets Hop Towards Easter Break

Thin volumes and news flow with several markets closed for holidays, while the usual pre-NFP lull is also expected to engender a subdued session.

- AUD and NZD both gained as the greenback gives some more ground, oil closed at its highs following the conclusion of the OPEC+ meeting, which is helped support high beta currencies.

- JPY slightly stronger, USD/JPY shedding around 2 pips. Data earlier showed March monetary base rose 22.8% Y/Y, the release did not have any effect on JPY.

- Offshore yuan is stronger, USD/CNH down 32 pips at 6.5736, still well within yesterday's range, sources note bids at 6.5716. Sino-US tensions continued to summer, in the latest development US Senate minority leader McConnell said the US must work with partners to impose consequences on China over Hong Kong. The PBOC fixed USD/CNY at 6.5649, 3 pips below sell-side estimates. The last time the PBOC fixed above sell-side estimates, indicating a preference for a weaker yuan, was 10 sessions ago.

- EUR struggled to gain despite losses in the greenback as markets focused on fresh lockdowns in several European nations starting this weekend.

FOREX OPTIONS: Expiries for Apr02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.00($585mln)

- USD/CNY: Cny6.58($1.4bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.