-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Light Risk-Off In Asia

- Geopolitical tensions and regulatory matters in China weigh on risk to start the week.

- Fed Chair Powell offers little of note in his latest address.

- U.S. Tsy supply eyed, with both 3- & 10-Year auctions scheduled on Monday.

BOND SUMMARY: Core FI Supported By Downtick In Equities

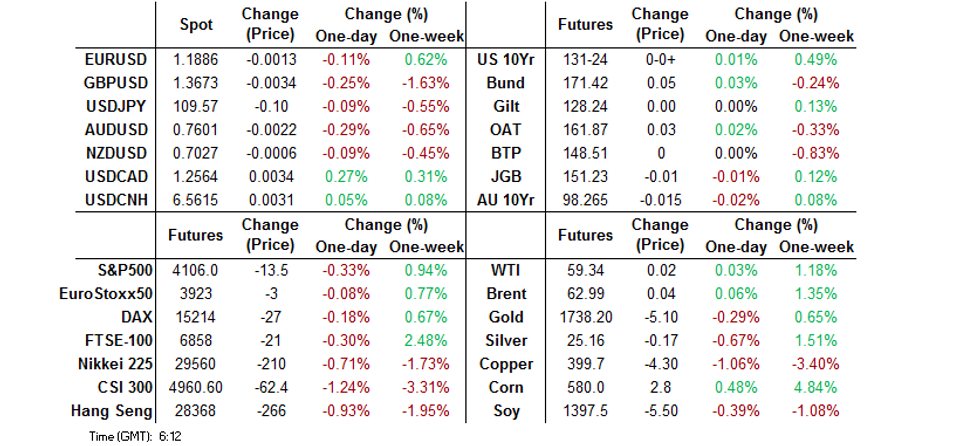

Global core fixed income markets caught a modest bid as we moved through Asia-Pac hours, with the downtick in the majority of the major equity indices (linked to geopolitical tensions and a huge antitrust fine for Alibaba in China, which dented broader sentiment even as the single name rallied) unwound some early supply related weakness. T-Notes last +0-01 at 131-24+, the cash curve seeing some light twist flattening, with almost all of the early, supply related cheapening (which was led by the belly) unwinding. Comments from Fed Chair Powell reflected the usual tinge of cautious optimism, albeit caveated with well-documented COVID-related risks and the need to continue to support the economy until the recovery "is complete." Headline flow was sparse. Market flow was headlined by a FV/US block steepener (+10.0K vs. -2.8K) and ~4.0K screen lift of the TYK1 130.25 puts. 3- & 10-Year Tsy supply headline the local docket on Monday, with an address from Fed's Rosengren also due.

- JGB futures stuck to the confines of the overnight range for almost all of the Tokyo session, last -1. Cash trade has seen the entire curve richen (to varying degrees), with the 3- to 5-Year sector of the curve outperforming, as yields in that zone of the curve fell by 1.5-2.0bp. There is nothing in the way of conventional JGB supply due this week, with liquidity enhancement auctions covering the 5- to 15.5-Year and 15.5- to 39-Year buckets providing the only supply points of note. We also saw Cantor Fitzgerald launch a multi-tranche round of 2-, 3- & 5-Year JPY issuance. On the headline front weekend news flow saw the Governor of Osaka prefecture warn that he may need to request the declaration of a state of emergency if current COVID-19 mitigation measures are deemed "insufficient," which could add to recent declarations in other areas.

- YM -0.5., XM -1.5 at typing, after XM moved off lows alongside U.S. T-Notes. There was little reaction to the official launch of the syndication of ACGB Nov '32, with the initial price guidance generally around the firm to average end of broader market expectations. France's BPCE mandated for new 5- & 7-Year $ paper, while Rabobank Australia mandated for 3-Year issuance and NSW Electricity Networks mandated for a potential round of 8-Year supply. The monthly NAB business survey and weekly payrolls data from the ABS will hit on Tuesday, although it will be the pricing of the aforementioned ACGB Nov '32 that headlines local matters tomorrow.

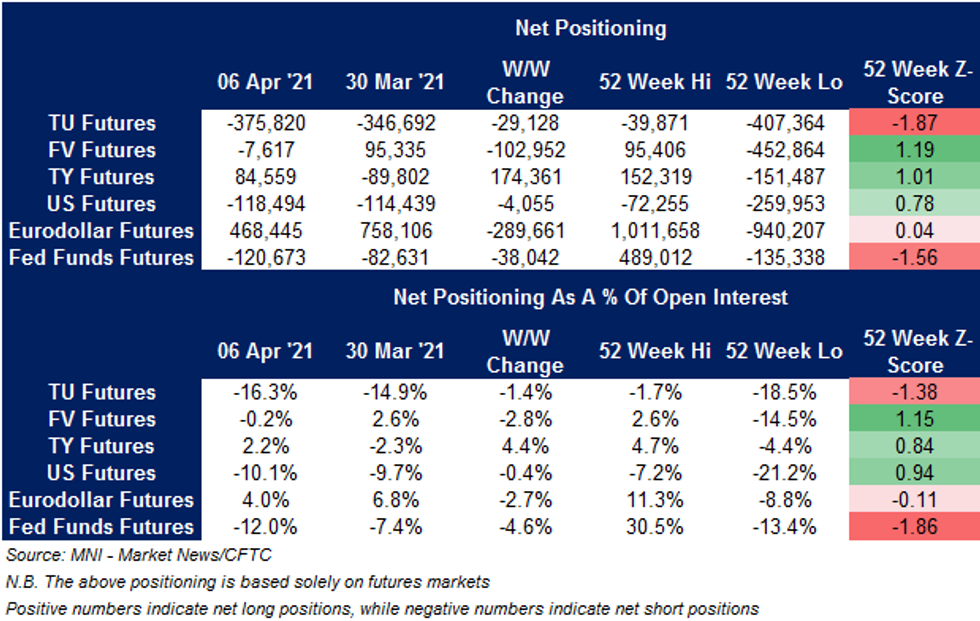

US TSY FUTURES: A Mixed Bag In CFTC Futures Positioning

The latest CFTC CoT report saw TU & US net shorts build, while FV net positioning flipped net short. TY positioning was the exception to the broader rule, flipping back to net long territory. Net positioning across the major bond futures contracts remains off of recent extremes.

- In the short end Eurodollar net longs were trimmed while net short positioning in Fed Funds extended back towards the recent extreme.

ASIA FX: Risk Averse Trade

The greenback squeezed out some gains amid generally risk averse sentiment in Asia.- CNH: Offshore yuan is weaker, but off worst levels. Markets await a raft of data from China this week; trade balance, GDP, industrial production and retail sales are all due.

- SGD: Singapore dollar is lower, late Friday it was announced that Singapore had ratified the Regional Comprehensive Economic Partnership (RCEP) and deposited its ratification instrument, becoming the first participating country to complete the official process.

- TWD: Taiwan dollar is weaker, losing ground as stocks decline. Data late on Friday showed Taiwan's exports rose for the ninth straight month in March, exports increased 27.1%.

- KRW: Won has weakened, data earlier in the session showed exports rose 24.8% Y/Yin the first 10 days of April as shipments of chips and autos remained robust amid an economic recovery from the pandemic. Imports increased 14.8%, resulting in a trade deficit of $1.7 billion in the period.

- MYR: Ringgit is weaker, Malaysian Plantation Industries and Commodities Ministry said that it is in talks to ramp up palm oil exports to Afghanistan. Min Khairuddin suggested that Malaysia wants to open a "golden gateway" to Middle Eastern markets.

- IDR: Rupiah is lower, a magnitude 6.0 earthquake hit Java over the weekend, killing 8 people, hurting dozens more and damaging 1,300 buildings. The event did not create a tsunami risk.

- PHP: Peso has weakened, Pres Duterte announced the loosening of restrictions in Metro Manila and the neighbouring provinces of Bulacan, Rizal, Laguna and Cavite, after hospitals in the region added 3,156 beds for Covid-19 patients.

- THB: Baht is lower, Thailand's daily Covid-19 case count surged to a new record on Sunday, as the country declared 967 new infections. Analysts have expressed concerns that the flare-up in infections could detail Thailand's re-opening plans, which include loosening border restrictions.

ASIA RATES: Bonds Mostly Bid In Cautious Trade

Generally risk averse trade saw safe havens gain.

- INDIA: Yields lower with equity markets seeing heavy selling, while a record number of daily coronavirus cases at over 168k calls for further caution. Friday's auction was weak again, despite the advent of a new purchase programme from the RBI. Primary dealers were left to salvage the sale again, the seventh time in 2021. Underwriters bought INR 109.3bn of the INR 110bn of new 2026 bonds on offer.

- SOUTH KOREA: Futures ground higher from the open and have retraced around half of Friday's drop. Positive news in the form of lower coronavirus cases and robust exports couldn't derail the bid for safe haven assets. The 3-year auction from the MOF was well received.

- CHINA: The PBOC matched maturities with injections again today, the twenty fourth straight session of matching maturities, while the bank hasn't injected funds since February 25. The overnight repo rate is has dropped having risen at the open, last down 1.75bps at 1.7825%, while the 7-day repo rate has risen 15bps at 2.0038%, still below the PBOC's 2.20% rate. Futures are higher alongside other regional bonds, 10-year future up 0.18 at 97.385. Markets await a raft of data from China this week; trade balance, GDP, industrial production and retail sales are all due.

- INDONESIA: Yields higher across the curve as bonds sell off, bucking the regional trend. Late doors on Friday, Bank Indonesia said they see CPI at +1.37% Y/Y in the first two weeks of Apr, with inflation driven by certain food commodities. Elsewhere, PT Bio Farma Pres Basyir suggested that the private sector has secured 40mn doses of Covid-19 vaccines from China and Russia, with deliveries expected later this month.

FOREX: Risk Aversion Materialises

Lingering geopolitical tensions inspired a degree of risk aversion overnight, amid the absence of headlines that would affect broader sentiment. JPY led gains in the G10 basket, while AUD brought up the rear, with a BBG trader source flagging AUD/JPY sales by Japanese exporters and AUD/USD selling by funds.

- The greenback fared well, outperforming most of its G10 peers, but the DXY failed to take out the prior trading day's peak. Fed Chair Powell said that the economy is at an "inflection point" and is "about to start growing much more quickly," but warned against the principal risk of a renewed spread of Covid-19.

- The PBoC set its central USD/CNY mid-point at CNY6.5578, virtually matching sell-side estimates. USD/CNH hovered above neutral levels ahead of this week's Chinese data deluge.

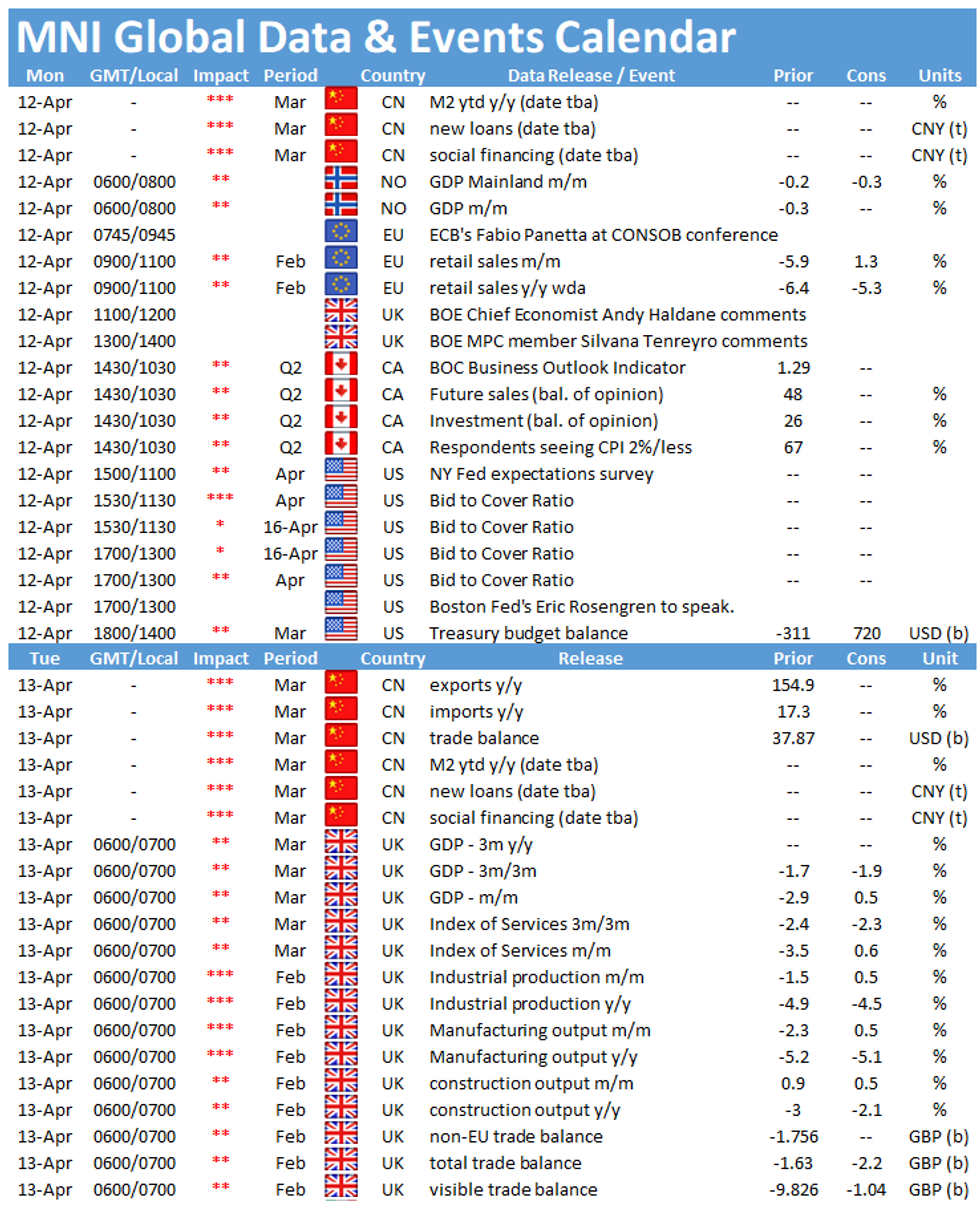

- Today's economic docket is rather uninspiring, with EZ retail sales and comments from ECB's Panetta & de Cos, Fed's Rosengren, BoE's Tenreyro & Riksbank's Ohlsson providing the main highlights.

FOREX OPTIONS: Expiries for Apr12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1915-30(E1.45bln, E1.4bln EUR puts)

- EUR/GBP: Gbp0.8600-05(E530mln)

- USD/CAD: C$1.2600-15($600mln-USD puts)

- USD/CNY: Cny6.4925($500mln), Cny6.5500-15($500mln)

EQUITIES: Lower To Start The Week

A broadly negative day for stocks in the Asia-Pac time zone, markets in mainland China and Hong Kong were the subject of heavy selling which put pressure on other indices in the region. China's antitrust regulator imposed a record fine on Alibaba following a long investigation, Alibaba managed to rally despite the fine and even as the broader market declined. Markets in South Korea proved resilient, buoyed by shipmakers after another large order and the National Pension Service increases upper limit of strategic investment weighting of local stocks to 19.8% from the current 18.8%. Japan came under pressure as markets assess a rise in coronavirus infections and reports the Osaka may declare a state of emergency. US futures are lower after rallying into the end of last week, Fed chair Powell was on the wires earlier, he said that while the outlook had brightened substantially there were still risks. He also reiterated that the Fed would keep supporting the economy until the recovery was complete.

GOLD: Off Recent Highs

Bullion trades little changed early this week, with spot last printing around the $1,740/oz mark. This comes after an uptick in U.S. real yields and the DXY provided some pressure on Friday, pulling gold away from recent highs and leaving the previously flagged technical backdrop intact.

OIL: Crude Treads Water

Crude futures are broadly flat. Oil market specific commentary was sparse, but a few comments from Fed's Powell crossed the wires, he noted that while the outlook had brightened substantially there were still risks. He also reiterated that the Fed would keep supporting the economy until the recovery was complete.

- Elsewhere, there were reports on Saturday that initial talks in Vienna between the US and Iran wee rea good first step, but officials said that Iran still needs to take further steps to come back into compliance with the terms of the nuclear deal, meaning Iranian supply will not be returning to market in the near term.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.