-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBNZ Policy Settings Unchanged, Familiar Risk Evident Elsewhere

- No curve balls from the RBNZ as the Bank reaffirms its willingness to stay the course.

- Sino-U.S. tensions simmer, with eyes on Taiwan.

- Another raft of Fedspeak is set to hit today.

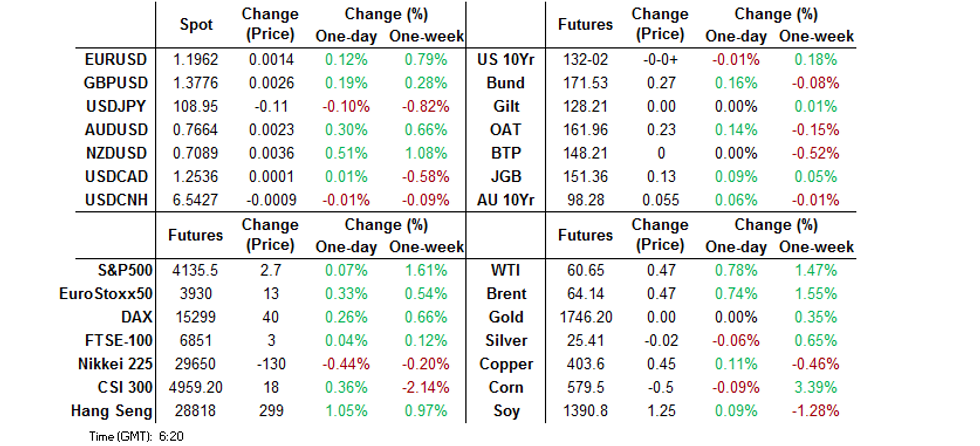

BOND SUMMARY: Narrow Ranges

Core FI markets sit little changed to a touch firmer in Asia-Pac hours, with the recent supply burden in U.S. Tsys & ACGBs now in the rear-view mirror. A couple of pockets of TYM1 screen buying helped support the broader U.S. Tsy space in early Asia dealing, although T-Notes have moved away from best levels to last print unchanged on the day, sitting at 132-02+ (operating in a 0-04 range), while cash Tsys sit within ~0.5bp of settlement levels, running marginally cheaper across the curve into European hours. Wednesday presents another slew of Fedpseak, headline by comments from Chair Powell.

- JGB futures consolidated overnight gains during the Tokyo session, last +14. The cash JGB curve initially drew support from the overnight move in futures/U.S. Tsys, with the super-long end richening further in the afternoon, longer dated yields print 2.0-2.5bp lower on the day at typing. There has been little in the way of notable headline flow to flag during Tokyo hours. The latest round of BoJ Rinban operations covering 1- to 10-Year JGBs saw some light upticks in the offer/cover ratios. An enhanced liquidity auction for off-the-run 5- to 15.5-Year JGBS headlines the local docket on Thursday.

- Aussie bond futures held onto their overnight gains and traded a touch firmer in Sydney hours, YM last +1.0, XM +6.0. The space has looked through the strongest headline Westpac consumer confidence reading in over a decade, while there was no knock-on from the latest RBNZ monetary policy decision across the Tasman. Participants look to tomorrow's monthly labour market report, given the fact that the labour market recovery has outstripped the baseline expectations at the RBA.

FOREX: NZD Bid After Uninspiring RBNZ Decision, USD Extends Losses

The RBNZ's Monetary Policy Review was expectedly uninspiring and thus smoothly digested, albeit NZD/USD implied vols fell after the decision, with 1-month tenor printing lowest levels in more than a year. Spot NZD/USD pierced resistance from Apr 5 high of $0.7070 and accelerated gains thereafter, with BBG trader source flagging interbank purchases to cover buy stops above that level. The kiwi showed at its strongest levels in three weeks vs. both USD and AUD.

- NZD strength spilled over into AUD, to a degree. The Aussie had earlier ignored a strong Westpac Consumer Confidence print, with headline index surging to levels not seen since 2010.

- The DXY extended Tuesday's losses as participants assessed familiar developments. The greenback's weakness allowed USD/JPY to penetrate support from Apr 8 low/round figure at Y109.00.

- The PBoC set its central USD/CNY mid-point at CNY6.5362, just 2 pips below sell-side estimates and the sixth lower fix in a row.

- KRW led gains in Asia as South Korea's unemployment fell for the second month, while export prices recorded the fourth straight monthly gain.

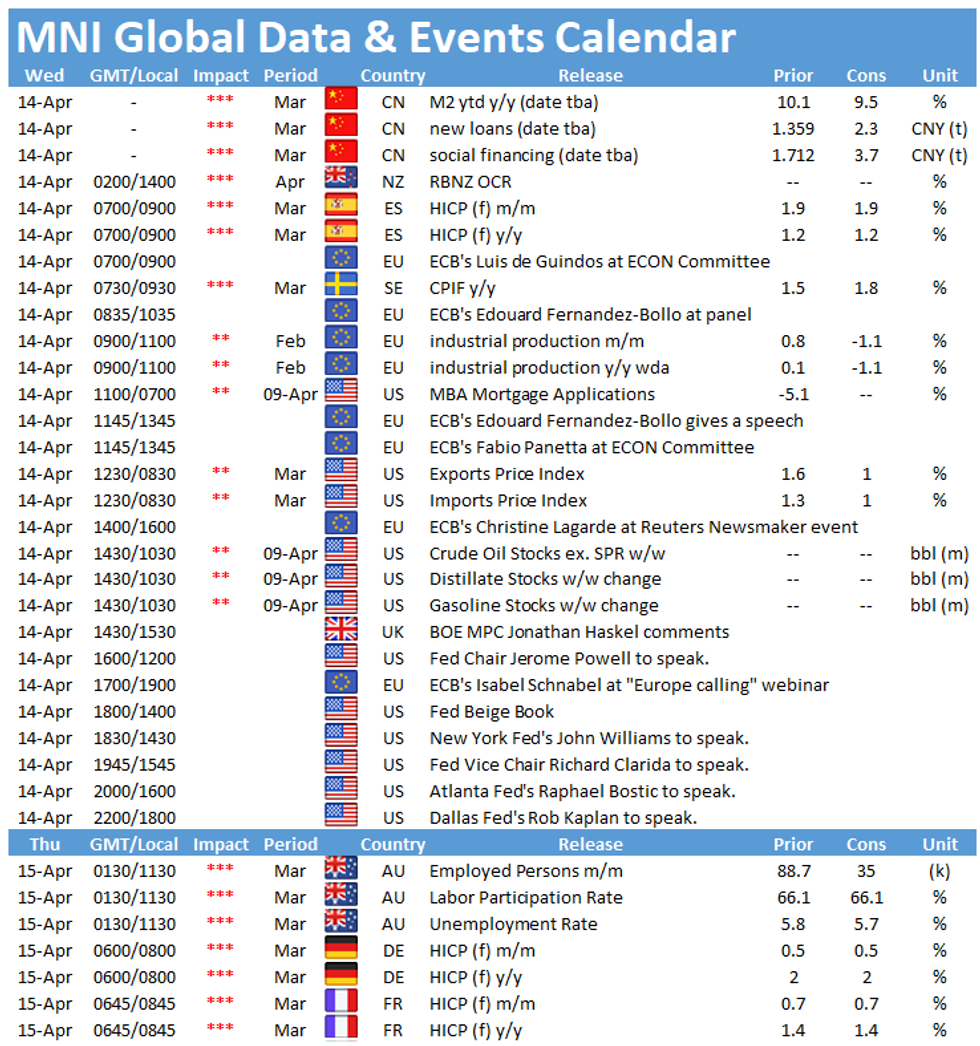

- Coming up today we have EZ industrial output, Swedish CPI and comments from Fed's Powell, Clarida, Williams, Bostic & Kaplan, BoE's Haskel as well as ECB's Lagarde, Schnabel, de Guindos & Panetta.

FOREX OPTIONS: Expiries for Apr14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E855mln), $1.1900(E1.1bln-EUR puts), $1.1925(E1.3bln-EUR puts), $1.1945-60(E1.46bln-EUR puts), $1.1975-80(E430mln-EUR puts)

- USD/JPY: Y108.00($831mln), Y108.50($525mln), Y108.75-80($477mln), Y108.95-00($868mln)

- GBP/USD: $1.3840-50(Gbp792mln-GBP puts), $1.4050(Gbp762mln)

- EUR/GBP: Gbp0.8600-15(E1.1bln)

- AUD/USD: $0.7700(A$700mln-AUD puts)

- USD/CAD: C$1.2465-70($750mln), C$1.2500($1.2bln-USD puts)

ASIA FX: Most USD/Asia EM Crosses Lower For Third Day

Safe haven assets sagged as US President Biden's inauguration went without any hiccups and markets hope the administration will place a greater emphasis in pushing through fiscal stimulus, and in tackling the pandemic situation including faster vaccine roll outs. As a result Asia EM FX gained, with equity markets in the region also hitting records.

- USD/CNH is lower, some of this can be attributed to a weaker USD, but some CNH strength has stemmed from China's decision to sanction outgoing secretary of state Mike Pompeo and 27 other officials from the Trump administration.

- USD/TWD lower on the session, last down 0.248 at 27.958, retreating from the 28.00 handle after gravitating higher towards the level yesterday. Data yesterday showed export orders rose over 10% to an all time high in 2020, boosted by demand for chips and smartphones.

- USD/KRW lower as the won strengthens on positive trade data. Exports continued to rise in January, up 11% in the first 20 days of the year. The won continues to benefit from foreign equity flows.

- USD/MYR consolidates after Wednesday's monetary policy decision from BNM. The rate operates -0.125 at MYR4.0325. The board left its OPR unchanged at a record low 1.75%

- USD/PHP sits at 48.046 marginally below neutral levels. BSP said in a statement that Gov Diokno was discharged from the hospital Wednesday and will be ready to chair the Monetary Board meetings from next week.

- USD/IDR trades flat at 14,035 ahead of Bank Indonesia's announcement. The rate has faded its modest opening losses, with bulls looking for further gains past the 50-DMA, intersecting at 14,093

- USD/SGD last down 9 pips at 1.3238, USD/HKD last flat at 7.7517, still flirting with lower barrier of the policy band at 7.75.

ASIA RATES: Upward Impetus

Most bonds higher on upward impetus from US Tsys, some caution in domestic markets and local incentives also supporting the space.

- INDIA: Markets in India are closed for a local holiday.

- SOUTH KOREA: Futures opened higher, pushed upwards by the move in US T-notes, in the cash space yields are lower, flattening on the curve seen, 2-/20-year yield 1.5bps tighter. Some caution over COVID-19 infections. South Korea reported 731 daily new coronavirus cases in the past 24 hours, rebounding to over 700, the most in over three months. Strong unemployment data kept a lid on bonds.

- CHINA: Repo rates climbed for a third day, on track for the longest run of increases since February, demand for liquidity is on the rise with lenders helping corporates pay tax. Bonds marginally higher, up for the fifth straight session but stalling around these levels, in the cash space yields hover near the lowest since January. The MOF sold 2-,5-year debt to similar demand to previous auctions. There is some speculation that the state linked sector is close to seeing its first defaults on public bonds, doubts over bad-debt manager Huarong's future continues to cause consternation for credit markets.

- INDONESIA: Yields lower for the first time in three days following a successful auction yesterday. The government sold IDR 21.68tn, the most debt in two months, compared to just IDR 3.75tn at the last sale. There was some concern over demand, with bid/cover at 1.86. Also boosting demand today are reports that Indonesia will offer a record-low tax on interest earned from holding bonds cutting the final income tax to 10%, starting in August, from the current 20%.

EQUITIES: Mixed As Coronavirus Headlines Return To The Fore

A mixed day for equities in the Asia-Pac region. Taiwanese and Japanese indices struggled on idiosyncratic issues, but are off lows. Gains are led by Hong Kong, taking a positive lead from the US, while tech leads the way higher after China ordered its leading tech companies to self-inspect and rectify business practices that limit competition in a bid to avoid further punitive action. US futures are little changed after making record highs yesterday, while there is some scepticism that the US vaccine rollout will continue as planned after suspension of the Johnson & Johnson inoculation.

GOLD: Still Coiling

Bullion continues to stick to the confines of the recent range, with the latest richening of U.S. Tsys/downtick in U.S. real yields and DXY softness supporting gold over the last 24 hours, although bulls haven't been able to force a test of resistance in the form of the April 8 high & 50-day EMA. Spot last deals little changed around the $1,745/oz mark.

OIL: Crude Futures Creep Higher

Another small bump higher for oil prices in Asia-Pac trade on Wednesday, with the major benchmarks a little under $0.50 firmer on the day into European hours. Since mid-March WTI has moved in a range between approximately $62/bbl and $57/bbl with the price coiling in previous sessions.

- Yesterday OPEC's monthly report upgraded the groups demand forecasts and asserted that the market is capable of absorbing extra supply. "Reductions in surplus inventories as well as an expected pick-up in product demand will pave the way for a cautious recovery of oil market balance in the summer months," the report said.

- Data from the API yesterday showed headline crude stocks fell 3.61m bbls, the third consecutive draw. A mixed report for downstream products with gasoline stocks rising 5.57m bbls, while distillates fell 3m bbls. Cushing stocks rose 917k bbls. Markets look ahead to US DOE inventory figures in the US session, also on the docket today is the IEA monthly report where markets will assess the agencies outlook for demand and supply.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.