-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI EUROPEAN OPEN: Geopolitics & Aussie Labour Market Report Headline

EXECUTIVE SUMMARY

- FED'S POWELL: ECONOMY GOING INTO HIGHER GEAR

- FED'S CLARIDA: MAXIMUM EMPLOYMENT ALONE WON'T MOVE FED

- U.S. CDC PANEL DOESN'T VOTE ON J&J PAUSE (BBG)

- U.S. POISED TO IMPOSE RUSSIA SANCTIONS OVER ELECTION & SOLARWINDS (BBG)

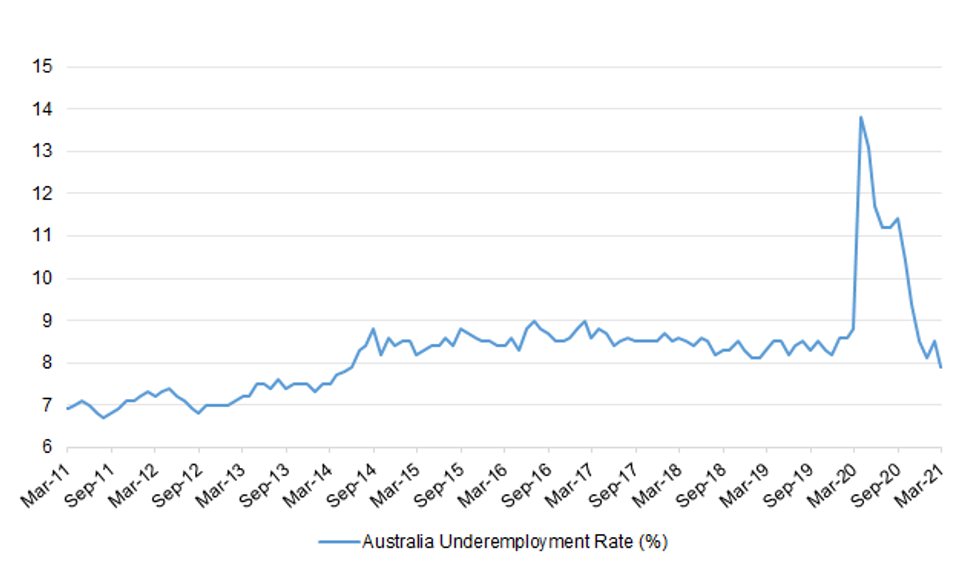

Fig. 1: Australia Underemployment Rate (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

PROPERTY: London new-home sales fell to their lowest level in almost nine years in the first quarter, led by a lack of interest from landlords and a dearth of buyers for central properties. Sales of the homes tumbled 39% to 3,703 compared with the same period last year, according to data compiled by Molior London and seen by Bloomberg News. The researcher calculates the numbers based on transactions at projects with at least 20 units. London's housing market is in flux as a premium on space and greenery causes the value of suburban houses to rise and apartment prices to fall. Sentiment in the new homes market improved in March as Prime Minister Boris Johnson's timetable for easing lockdown restrictions boosted confidence, according to Molior. (BBG)

EUROPE

ECB: The ECB doesn't expect "a sustained rise in inflation" this year, Executive board member Isabel Schnabel says in webinar. Sees chance of temporary increases due to base effects, adjustments to inflation basket. "Can't exclude possibility that inflation will increase more strongly," but doesn't see expectations in financial markets of rampant euro- area inflation. For the U.S. it's "a different story" due to its large fiscal stimulus package. Sees signs of excessive valuation in equity markets, especially in the U.S. (BBG)

SWITZERLAND: As part of its anti-Covid strategy, cultural and sports events will be open to the public under certain conditions, a government statement said. The number of spectators will be limited to 100 outdoors and 50 indoors and strict hygiene rules must be observed. Universities and further education institutions will be allowed to offer regular classes, and certain amateur sports activities are also to resume. However, work-from home rules will remain in place for the time being, Interior Minister Alain Berset told a news conference on Wednesday. (SwissInfo)

U.S.

FED: MNI BRIEF: Powell: Economy Going Into Higher Gear

- Federal Reserve Chairman Jerome Powell said Wednesday the economy is entering a "period of faster growth and higher job creation" as vaccinations take hold despite lingering risks from the gradually fading Covid pandemic - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Clarida: Maximum Employment Alone Won't Move Fed

- Federal Reserve Vice Chair Richard Clarida Wednesday reiterated his view the U.S. central bank should have a one year look-back period on inflation and emphasized that meeting one side of the dual mandate won't be enough to raise interest rates. "Policy will not tighten solely because the unemployment rate has fallen below any particular econometric estimate of its long-run natural level," he said. "In our new framework, when in a business cycle expansion labor market indicators return to a range that in the Committee's judgment is broadly consistent with its maximum-employment mandate, it will be data on inflation itself that policy will react to" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Williams: Economy Coming Back 'Strong'

- Federal Reserve Bank of New York President John Williams said Wednesday the economy is "coming back pretty strong right now" but promised the Fed won't overreact to a temporary burst of inflation due to supply bottlenecks or base effects - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: U.S. Economy Has Picked Up, Fed's Beige Book Says

- The U.S. economy "accelerated to a moderate pace" from late February to early April, according to the Federal Reserve's Beige Book published Wednesday. "Consumer spending strengthened. Reports on tourism were more upbeat, bolstered by a pickup in demand for leisure activities and travel which contacts attributed to spring break, an easing of pandemic-related restrictions, increased vaccinations, and recent stimulus payments among other factors," the report said. "Auto sales grew, even as new-vehicle inventories remained constrained by microchip shortages" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: Bounce On The Cards For US Retail Sales

- U.S. March retail sales should get a boost from fresh stimulus and job growth through the month, industry experts told MNI, although some of that improvement came from pent up demand after winter storm disruptions depressed sales in February and isn't necessarily indicative of the coming months' sales pace. March saw a "perfect alignment" of positive factors like fresh stimulus, strong employment growth, and increased household mobility as vaccines became more widely available and state economies continued to reopen, said Jack Kleinhenz, chief economist at the National Retail Federation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: A group of moderate Senate Republicans on Wednesday signaled they are preparing to offer their own proposal to reform the nation's infrastructure, as GOP lawmakers seek to significantly pare back the roughly $2 trillion in new spending endorsed by President Biden. The Republican alternative is expected to be less than half the size of the White House's plan, according to party lawmakers, who in recent days have suggested its total price tag could ultimately cost between $600 billion and $800 billion. Moderate GOP members of Congress also have pledged to narrow their focus to include only the elements they consider traditional infrastructure, such as roads and bridges, while jettisoning the corporate tax increases that Biden has endorsed in favor of other ways of financing the overall package. (Washington Post)

FISCAL: A Senate bill introduced Wednesday would broadly reform the U.S. unemployment system, seeking to plug gaps in the safety net for jobless Americans in response to the Covid pandemic and put states on a more equal footing. The legislation would raise the amount and duration of unemployment benefits, and expand the pool of workers who qualify for aid. It's sponsored by Sens. Ron Wyden, D-Ore., chair of the Finance Committee, and Michael Bennet, D-Colo. (CNBC)

CORONAVIRUS: A Centers for Disease Control and Prevention panel ended discussion about the Johnson & Johnson vaccine without taking a vote, leaving it unclear how long the distribution of the shot will remain paused in the U.S. Some panel members advocated for a monthlong pause, while others were concerned about the effects of not having the J&J vaccine available, especially to the communities it was being targeted toward. As a result, distribution of the vaccine will remain halted at least until the panel meets next, perhaps in a week to 10 days. (BBG)

CORONAVIRUS: The House coronavirus subcommittee will hear Thursday from three top Biden administration health officials about the United States' efforts to ramp up vaccinations as Covid cases, including those from dangerous variants, are on the rise. The hearing, which will also focus on the enduring need for people to wear masks and follow social distancing measures, is scheduled to begin at 10:30 a.m. ET. It will be livestreamed. (CNBC)

CORONAVIRUS: The Biden administration is working to accelerate doses of the Pfizer-BioNTech and Moderna Covid-19 vaccines after U.S. health officials advised states to hold off on using Johnson & Johnson's shot while regulators investigate a rare blood-clotting issue, a top U.S. official said Wednesday. Jeff Zients, the White House's Covid-19 coordinator, said the Food and Drug Administration's recommended pause on J&J's vaccine would not have a "significant impact" on the administration's vaccination program. On Tuesday, the FDA asked states to temporarily halt using J&J's vaccine "out of an abundance of caution" after six women developed a rare, but serious, blood-clotting disorder that left one dead and another in critical condition. (CNBC)

CORONAVIRUS: Vaccine hesitancy in the U.S. is shrinking, though 1 in 7 residents remain wary about getting a Covid-19 vaccine, largely because of concerns about side effects. That segment is younger and less educated than average, according to a tracker released Wednesday by the U.S. Census Bureau that uses Household Pulse Survey data. Residents were surveyed before U.S. regulators on Tuesday recommended pausing Johnson & Johnson vaccines because of concerns about rare blood clots. (BBG)

CORONAVIRUS: New York Governor Andrew Cuomo moved the curfew on bars and restaurants to midnight from 11 p.m. The closing time for catered events will shift to 1 a.m. from midnight, he said in a briefing Wednesday. The changes will take effect Monday. (BBG)

CORONAVIRUS: Michigan health officials won't issue new orders shutting down parts of the state economy in an attempt to combat the state's surging Covid-19 cases, Governor Gretchen Whitmer announced Wednesday. Health officials in the state are concerned tighter restrictions might just lead to more noncompliance. The Michigan Department of Health and Human Services reported 7,955 new cases Wednesday as roughly two dozen Michigan hospitals neared in-patient capacity. About 18% of Michigan hospital beds are occupied by people with the virus, state officials said Wednesday. (BBG)

CORONAVIRUS: Denver ended its outdoor mask mandate but will continue to require masks on public transit and indoor events, Mayor Michael Hancock announced Wednesday. (BBG)

POLITICS: Democratic lawmakers plan to introduce legislation on Thursday that would add four seats to the Supreme Court, an initiative that has slim hopes of passage but reflects progressives' impatience with President Biden's cautious approach toward overhauling a court that turned to the right during the Trump administration. (WSJ)

AIRLINES: American Airlines is expanding its summer schedule in a bet that the resurgence of travel demand will continue as more people get vaccinated. American plans to fly more than 90% of its summer 2019 U.S. capacity and 80% of its international summer capacity from that year, adding 150 new routes for the peak vacation season. American said its first quarter capacity was down more than 43% compared with the same period of 2019. (CNBC)

MARKETS: Gary Gensler will lead the Securities and Exchange Commission after the Senate voted 53-45 on Wednesday to confirm his nomination to head the nation's top financial regulator. Gensler, chosen for the role by President Joe Biden, will now play a key part in enforcing and drafting the rules that govern Wall Street, investors and a wide range of other financial entities. Now, with the SEC commissioners possessing a 3-2 Democratic majority, Gensler will likely have a long to-do list after he settles in to his new job. Progressives expect the 63-year-old to follow through on his promises to look into a range of topics, including digital currencies, the GameStop trading mania and how corporate America prioritizes environmental, social and governance issues. (CNBC)

OTHER

U.S./CHINA/HONG KONG: Beijing's top representative in Hong Kong said on Thursday that any foreign powers that try to use the global financial centre as a pawn will face counter measures, amid escalating tensions between the city and Western governments. Luo Huining, the director at China's Hong Kong Liaison Office, was speaking at a ceremony to mark National Security Education Day. Beijing imposed a national security law on Hong Kong last June that Western governments have condemned as an effort to crush dissent in the former British colony. (RTRS)

U.S./CHINA/TAIWAN: Taiwan President Tsai Ing-wen on Thursday told emissaries visiting at U.S. President Joe Biden's request that the island would work with the United States to deter 'adventurous manoeuvres and provocations' amid threats from Chinese military activities. Former senior U.S. officials, including former U.S. Senator Chris Dodd and former Deputy Secretaries of State Richard Armitage and James Steinberg, are visiting Taipei in a trip to signal Biden's commitment to Taiwan and its democracy. Tsai told the U.S. delegation in a meeting at the Presidential Office that Chinese military activities in the region have threatened regional peace and stability. (RTRS)

CORONAVIRUS: Biotechnology company Novavax, Inc. on Wednesday said its NVX-CoV2373 is one of four Covid-19 vaccines that will be studied in a Phase 2 trial conduced by the University of Oxford "to evaluate the potential for combined regimens that mix vaccines from different manufacturers to achieve immune protection against Covid-19." The Comparing COVID-19 Vaccine Schedule Combinations - Stage 2, or Com-COV2, clinical trial will include 1,050 participants, aged 50 or older, who got their first vaccination eight to 12 weeks prior, the company said. "Volunteer study participants will receive one of four different vaccines as a second dose, 350 of whom will be administered NVX-CoV2373," Novavax said. "The research will compare the immune system responses from those who receive a heterologous regimen to those who receive a homologous regimen." (Dow Jones)

JAPAN: The Japanese government will consider designating Tokyo's neighboring prefectures Saitama and Kanagawa as areas needing stricter coronavirus measures if their governors seek application of a quasi-state of emergency, public broadcaster NHK reports, without attribution. The government also considers adding Aichi prefecture, central Japan, to the status. (BBG)

BOJ: Japan's economy was picking up but any recovery was likely to be modest due to lingering caution over the coronavirus pandemic, Bank of Japan Governor Haruhiko Kuroda warned on Thursday. The world's third-largest economy is confronting a resurgence in COVID-19 infections with record cases reported in the western region of Osaka, which has prompted authorities to enforce targeted lockdown measures. (RTRS)

AUSTRALIA: Australia will likely find Covid-19 has a lingering effect on the economy and the sheer scale of stimulus means it will probably be a couple of years before it's clear how much has changed, former Reserve Bank board member Heather Ridout said. "People are operating differently, companies are having to operate differently and it's going to take a long time before supply chains get back to what they were before," Ridout said in an interview with Bloomberg News Wednesday. "There will be a new normal and I think worrying about pandemics and all of this will become part of the new normal." (BBG)

AUSTRALIA: Australia is "rapidly being left behind" by much of the rest of the world when it comes to cutting greenhouse gas emissions. It has made so little progress on climate change it now has to do more than most other nations just to keep up. But far from Australia's fossil fuel-based economic bedrock being at risk if we moved to a greener economy, a scathing new report has predicted the opposite could be true. Other nations could begin to slap "carbon tariffs" on Aussie exports and the country could miss out on being a world leader in clean energy as it stubbornly stands behind fossil fuel industries. "The federal government is behind the momentum that's building elsewhere in the world," said ANU climate scientist Professor Will Steffen at the launch of the Aim High, Go Fast climate report. (News Au)

NEW ZEALAND: New Zealand medicines regulator Medsafe said it has requested additional information from Janssen ahead of making a decision about whether to approve the company's Covid-19 vaccine. (BBG)

BOK: MNI STATE OF PLAY: BOK Holds Rates; Flags Higher Growth, Prices

- The Bank of Korea on Thursday kept policy rates unchanged at a record low citing uncertainties about Covid-19 and modest inflationary pressures on the demand side although it now expects growth for the year to exceed its earlier forecast. The bank maintained the base rate at 0.5%, as widely expected.

CANADA: MNI INTERVIEW: Canada Heads for Rate Trap on Unanchored Budget

- Canada will likely present a budget Monday without a strong deficit restraint plan, leaving the economy vulnerable to a trap of slow growth and rising interest costs, former associate deputy finance minister Don Drummond told MNI. Rock-bottom interest rates are bound to rise and could eventually drive up Canada's debt service costs toward an uncomfortable 15% of revenue according to Drummond, who now teaches at Queen's University and works with the C.D. Howe Institute on fiscal policy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Health Canada, working with provinces and territories and other partners, has established a Critical Drug Reserve to help bolster Canada's supply of drugs used to treat COVID-19 patients. The reserve will help avoid shortages and support Canada's pandemic response. (Health Canada)

MEXICO: Mexican President Andres Manuel Lopez Obrador's controversial proposal to tighten control over the country's fuel market has cleared the lower house of congress, another step in his long-sought goal of resuming the state's energy monopoly. With 292 lawmakers in favor, 153 opposed, and 11 abstaining, the chamber approved in general terms the president's proposal to give national oil company Petroleos Mexicanos greater control over the recently liberalized fuel market that lured investments from Royal Dutch Shell Plc, BP Plc, Chevron Corp. and Exxon Mobil Corp. After debate on certain articles, the bill will be taken up by the senate, where the ruling Morena party and its allies have a majority. (Mexico)

BRAZIL: Brazil Supreme Court will resume the session on Thursday, Justice Luiz Fux said. Before discussing the annulment of former President Lula's convictions, Fux accepted a request made by the defense attorney to leave the decision to the second panel of the Supreme Court, which is in charge of the Carwash investigation. (BBG)

BRAZIL: A federal court in Brazil has reconsidered its own decision that had prohibited state-run oil company Petrobras from discussing dividends and healthcare plan reform at its annual ordinary shareholders' meeting, scheduled for Wednesday afternoon, the company said in a securities filing. In the filing, the company formally known as Petroleo Brasileiro SA said it had taken notice of the earlier decision. However, the court's re-consideration meant it had no practical effect. (RTRS)

RUSSIA: The Biden administration is poised to take action against Russian individuals and entities in retaliation for alleged misconduct including the SolarWinds hack and efforts to disrupt the U.S. election, according to people familiar with the matter. As part of the moves, which could be announced as soon as Thursday, the U.S. plans to sanction about a dozen individuals, including government and intelligence officials, and roughly 20 entities, according to one of the people, who asked not to be identified because the matter was sensitive. The U.S. is also expected to expel as many as 10 Russian officials and diplomats from the country, the person said. (BBG)

RUSSIA: The United States has cancelled the deployment of two warships to the Black Sea, Turkish diplomatic sources said on Wednesday, amid concerns over a Russian military build-up on Ukraine's borders. Washington and NATO have been alarmed by the build-up near Ukraine and in Crimea, the peninsula that Moscow annexed from Ukraine in 2014. Last week, Turkey said Washington would send two warships to the Black Sea, in a decision Russia called an unfriendly provocation. The U.S. Embassy in Ankara had notified Turkey's foreign ministry of the decision, the sources said, but did not provide a reason for the decision. U.S. officials were not immediately available for comment. (RTRS)

SOUTH AFRICA: South African President Cyril Ramaphosa is considering changing the ministries responsible for some of its biggest state-owned companies, including Eskom Holdings SOC Ltd., to better align them with their functions, people familiar with the matter said. Eskom, arms manufacturer Denel SOC Ltd., South African Airways Ltd. and other entities are currently the responsibility of the Department of Public Enterprises, headed by Pravin Gordhan. Eskom may be transfered to the minerals and energy ministry, under Gwede Mantashe, the people said. Denel may move to the defense ministry and SAA could shift to transport, they said, asking not to be identified as an announcement has not been made. (BBG)

IRAN: The United States and Iran will reconvene indirect talks aimed at reviving the 2015 Iranian nuclear deal on Thursday in Vienna, White House press secretary Jen Psaki said. There have been doubts about whether the indirect talks, which began last week, might resume this week following an explosion at Iran's key nuclear site on Sunday, which Tehran blamed on Israel, as well as Iran's decision to enrich uranium to 60%, bringing the fissile material closer to bomb-grade. "We don't have any additional speculation to add to the cause or the origin of the attacks over the weekend," Psaki told reporters. "The diplomatic conversations, though they will be indirect, will reconvene tomorrow in Vienna. We know this will be a long process but we certainly see that as a positive sign." (RTRS)

MIDDLE EAST: Saudi Arabia intercepted 5 ballistic missiles and 4 drones aimed at Jazan, state-run SPA reports, citing coalition spokesman Turki al- Maliki. Houthi rebel armed forces spokesman Yahya Saree claimed that the group attacked an Aramco facility and other key targets in Jazan, south of Saudi Arabia, with missiles and explosive-laden drones. (BBG)

CHINA

ECONOMY: China's Q1 growth may jump by 19.4% y/y, supported by active production, strong exports, a surge in housing-related purchases and a rebound in real estate investment, the Economic Information Daily reported citing economist Li Chao of Zheshang Securities. Li's double-digit growth predictions are shared by other economists, the Daily said. Macro policies are likely to be maintained as the recovery is fragile, with government providing strong fiscal support, abundant liquidity and continued support to SMEs, the newspaper said citing Wang Yiming, a member of the PBOC monetary policy committee. (MNI)

ECONOMY: China's consumption should continue to rise in the 2nd quarter as more pandemic restrictions over services are loosened and travel rebounds, while prices of raw materials and demand for electronics and cars are all rising, the China Securities Journal said citing Li Zhan, Chief economist of Zhongshan Securities. Rising wages and salaries and export demand also supported consumption, the newspaper said citing Fu Yifu, director of the Suning Financial Research Institute. Government promotion of international trade and expanding rural ecommerce also helped lift consumption, said the Journal. (MNI)

CORONAVIRUS: China should speed up the vaccination process or risk being shut out of a re-opening world and also risk its ability to host the Winter Olympics next year, the Securities Times said citing Peng Wensheng, the chief economist with China International Capital Corp. Peng, who said he submitted his views in a recent group meeting with Premier Li Keqiang, suggested the government should assume more public-sector debt to cope with the pandemic, as letting the private sector rack up debt is unsustainable. Peng also told the Premier that annual growth may reach 9%, the Times reported. (MNI)

OVERNIGHT DATA

AUSTRALIA MAR UNEMPLOYMENT RATE 5.6%; MEDIAN 5.7%; FEB 5.8%

AUSTRALIA MAR EMPLOYMENT CHANGE +70.7K; MEDIAN +35.0K; FEB +88.7K

AUSTRALIA MAR FULL-TIME EMPLOYMENT CHANGE -20.8K; FEB +89.1K

AUSTRALIA MAR PART-TIME EMPLOYMENT CHANGE +91.5K; FEB -0.5K

AUSTRALIA MAR PARTICIPATION RATE 66.3%; MEDIAN 66.1%; FEB 66.1%

AUSTRALIA APR CONSUMER INFLATION EXPECTATIONS +3.2%; MAR +4.1%

AUSTRALIA MAR FX TRANSACTIONS MARKET +A$1.332BN; FEB +A$878MN

AUSTRALIA MAR FX TRANSACTIONS GOV'T -A$1.390BN; FEB -A$882MN

AUSTRALIA MAR FX TRANSACTIONS OTHER +A$4.014BN; FEB +A$988MN

NEW ZEALAND MAR REINZ HOUSE SALES +31.2% Y/Y; FEB +14.6%

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA MLF AND REPOS THURS

The People's Bank of China (PBOC) injected CNY150 billion via one-year medium-term lending facilities (MLF) with the rate unchanged at2.95% on Thursday. This aims to roll over the CNY100 billion of MLFs maturing today and CNY56.1 billion in targetted medium-term lending facilities (TMLF) maturing on April 25, the PBOC said on its website.

The PBOC also injected CNY10 billion via 7-day reverse repos. In total, the central bank net injected CNY40 billion given CNY10 billion repos mature today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1442% at 09:35 local time from the close of 2.0349% on Wednesday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 42 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5297 THURS VS 6.5362

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a third day at 6.5297 on Thursday, compared with the 6.5362 set on Wednesday.

MARKETS

SNAPSHOT: Geopolitics & Aussie Labour Market Report Headline

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 6.9 points at 29627.89

- ASX 200 up 45.003 points at 7068.1

- Shanghai Comp. down 40.421 points at 3376.3

- JGB 10-Yr future down 4 ticks at 151.35, yield down 0.3bp at 0.090%

- Aussie 10-Yr future down 2.0 ticks at 98.270, yield up 1.6bp at 1.765%

- U.S. 10-Yr future +0-01+ at 131-31, yield down 0.17bp at 1.631%

- WTI crude down $0.13 at $63.02, Gold up $3.84 at $1740.28

- USD/JPY down 6 pips at Y108.87

- FED'S POWELL: ECONOMY GOING INTO HIGHER GEAR

- FED'S CLARIDA: MAXIMUM EMPLOYMENT ALONE WON'T MOVE FED

- U.S. CDC PANEL DOESN'T VOTE ON J&J PAUSE (BBG)

- U.S. POISED TO IMPOSE RUSSIA SANCTIONS OVER ELECTION & SOLARWINDS (BBG)

- BOK LEAVES POLICY UNCHANGED

BOND SUMMARY: Narrow Ranges, But Some Idiosyncratic Matters In Play

The Tsy space held to a narrow range in Asia, with no tangible reaction to a BBG source piece pointing to a (near enough) imminent round of sanctions that the U.S. is set to impose on Russian individuals and entities. Broader headline flow has been light since the re-open, with T-Notes sticking to a 0-05 range, last +0-01 at 131-31, while cash Tsys print little changed across the curve. Elsewhere, the marketing of Tencent's 4-part US$ issuance, comprising of 10-, 20-, 30- & 40-Year paper, is underway. The deal was flagged earlier this week and could price as early as today. Thursday's local docket is headlined by retail sales & weekly jobless claims data, as well as another deluge of Fedspeak. A note released by Credit Suisse's Zoltan Pozsar late in the NY day on Wednesday pointed to "a relatively muted year-end turn," based on his analysis of the quarterly earnings reports and conference calls from J.P.Morgan & Wells Fargo (and assumed lack of pressure on G-SIB scores). This could have been the trigger behind the EDZ1 buying and EDU1/Z1 spread selling we flagged around the CME re-open. EDZ1 leads the way in terms of volume of the Eurodollar strip, trading 2x as many as any other contract through the reds, with 19K lots trading hands thus far. The strip runs -0.5 to +0.5 through the reds.

- JGB futures unwound their overnight losses during the Tokyo morning, but have nudged lower again in early afternoon trading, to last print -4, while yields are little changed across the cash curve. Participants looked to the potential for wider COVID-related restrictions in regions surrounding Tokyo (per local newswire reports) in what proved to be a relatively light session for news flow. Elsewhere, the latest comments from BoJ Governor Kuroda didn't offer anything new. The latest liquidity enhancement auction, which covered off-the-run 5- to 15.5-Year JGBs, passed smoothly.

- The Aussie bond space edged away from lows in the wake of a much stronger than expected headline employment reading. YM -0.5, XM -2.0 at typing. The uptick from lows came as the headline masked a ~21K fall in the number of full-time employed, meaning the job gains in March were driven solely by part-time jobs. Still, the stronger than expected headline reading outweighed an uptick in the participation rate, allowing the unemployment rate to move lower and continued the run of upside surprises for the headline print (and strong overall rebound in the labour market). The underemployment rate hit levels not seen since '14, with the underutilisation rate moving to within a whisker of late '19 levels. Futures had traded lower into the release as some participants seemingly positioned for a firm reading.

JGBS AUCTION: Japanese MOF sells Y496.7bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y496.7bn of 5-15.5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.004% (prev. -0.008%)

- High Spread: -0.003% (prev. -0.007%)

- % Allotted At High Spread: 47.1379% (prev. 67.5905%)

- Bid/Cover: 4.703x (prev. 3.664x)

EQUITIES: PBOC's Lack Of Liquidity Drags China Lower

Another mixed day for equity markets in the Asia-Pac time zone. Markets in mainland China and Hong Kong are lower, the PBOC drained liquidity from the system at the MLF operations, which was interpreted by the market as implied tightening and put downward pressure on equity markets. In Japan markets are seeing slight gains, helped higher by Softbank after reports the Vision Fund could hit profit of $30bn in Q1. US futures fluctuated with the Nasdaq struggling to move higher after Coinbase reversed initial gains on its trading debut, while bank stocks helped support S&P 500 and Dow futures.

OIL: Crude Futures Holding Gains

Oil is holding its gains in Asia-Pac trade on Thursday; WTI is up $0.07 from settlement levels at $63.22/bbl, Brent is up $0.14 at $66.70.

- Crude rallied sharply on Wednesday after US DOE data showed inventories fell the most in two months, oil is now on track for a fourth higher session, the longest run of gains since early-March. Headline crude stocks dell 5.89m bbls last week, against estimates of a 2.58m bbl decline. The data also showed that implied gasoline demand rose for the seventh consecutive week, on the back of improved demand forecasts from the IEA and OPEC.

GOLD: As You Were

Bullion continues to coil, with spot operating in a tight range in recent sessions, last dealing little changed just shy of $1,740/oz, with participants awaiting a fresh catalyst. The technical backdrop remains unchanged.

FOREX: AUD Takes Hit Despite Continued Fall In Unemployment

Price action across the G10 FX space painted a mixed picture, with most currency pairs sticking to relatively tight ranges. AUD blipped higher upon the release of the Australian jobs report, but retreated as the data received some more scrutiny. The main parameters were strong, as the downtick in unemployment was larger than expected, the participation rate climbed to a record high and employment growth topped forecasts. However, the latter was driven solely by part-time positions, while almost 21k full-time jobs were shed. AUD/USD printed a fresh three-week high before pulling back under the 50-DMA and approaching the $0.7700 figure.

- NZD outperformed the rest of the G10 pack. CAD also fared well, while NOK went offered.

- JPY held firm, although it is a Gotobi day today. Its safe haven peer CHF lost ground.

- The DXY extended yesterday's losses, but rejected support from its 50-DMA.

- The PBoC set its central USD/CNY mid-point at CNY6.5297, 5 pips shy of sell-side estimate. Nonetheless, USD/CNH chewed into yesterday's losses, eventually returning above the CNH6.54 mark.

- KRW softened after the BoK left interest rates unchanged.

- Focus turns to U.S. initial jobless claims, industrial output & retail sales, final German, French & Italian CPIs as well as comments from Fed's Mester, Daly & Bostic and Riksbank's Ingves.

FOREX OPTIONS: Expiries for Apr15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-65(E1.2bln), $1.1800(E694mln), $1.1820-25(E544mln), $1.1898-1.1900(E2.3bln, E1.85bln EUR puts), $1.1910-25(E719mln-EUR puts), $1.1960(E563mln-EUR puts)$1.1970-75(E1.3bln-EUR puts), $1.1990(E450mln-EUR puts)

- USD/JPY: Y105.90-106.00($1.1bln), Y108.85-95($627mln-USD puts), Y109.00-10($1.7bln-USD puts), Y109.15-25($993mln), Y109.40-50($715mln), Y110.00($691mln), Y110.50-60($1.3bln-USD puts)

- EUR/NOK: Nok10.08-10.09(E526mln-EUR puts)

- AUD/USD: $0.7700(A$592mln), $0.7750-60(A$1.0bln-AUD puts)

- AUD/NZD: N$1.0850(A$668mln)

- EUR/AUD: A$1.5450-52(E565mln-EUR puts)

- USD/CAD: C$1.2645-50($765mln), C$1.2680($837mln)

- USD/CNY: Cny6.50($775mln), Cny6.5415($630mln)

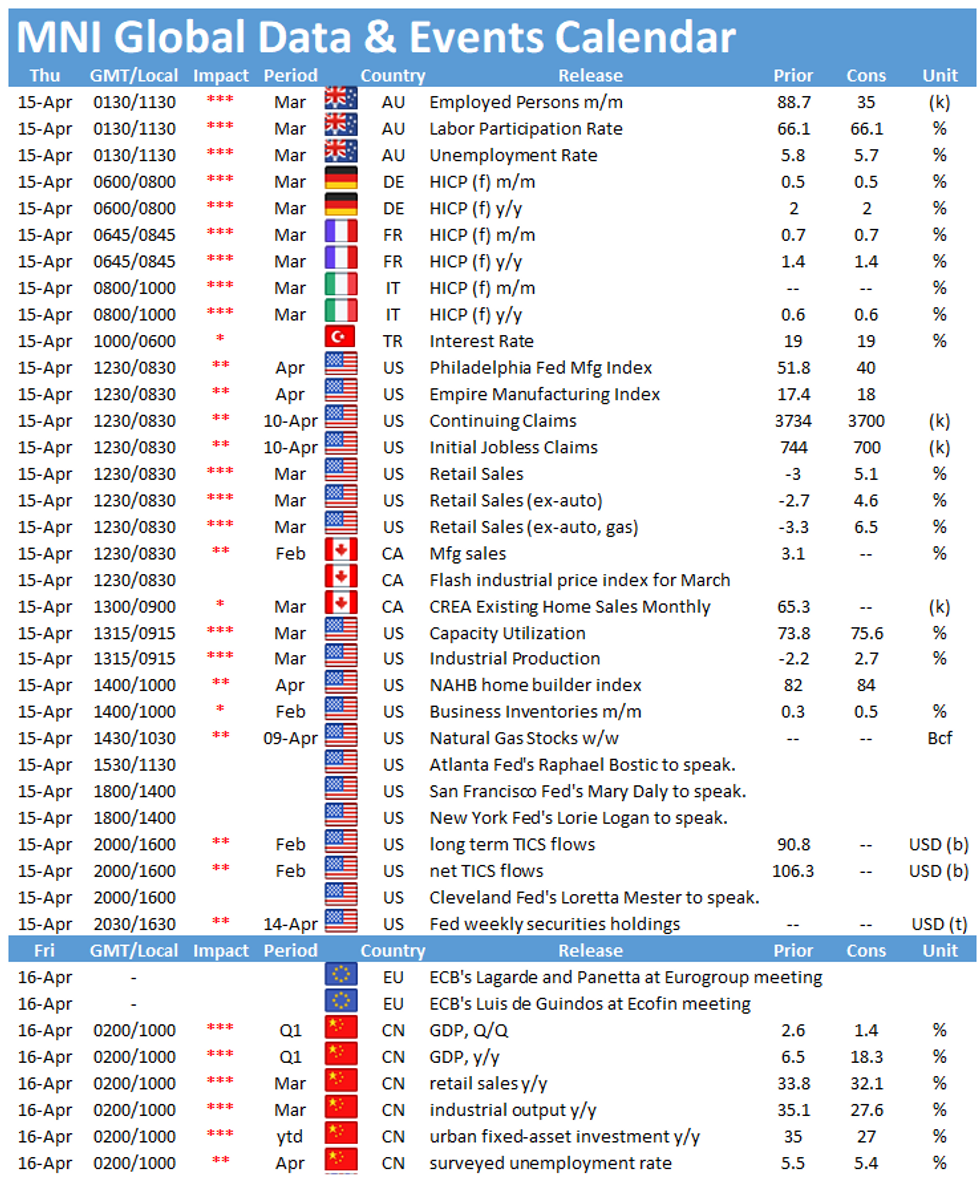

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.