-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Geopolitics & Liquidity

- PBoC tweaks medium-term liquidity at the margins.

- Another generally firm round of Australian labour market data seen, although full-time employment fell.

- U.S. sanctions on Russia eyed.

BOND SUMMARY: Narrow Ranges, But Some Idiosyncratic Matters In Play

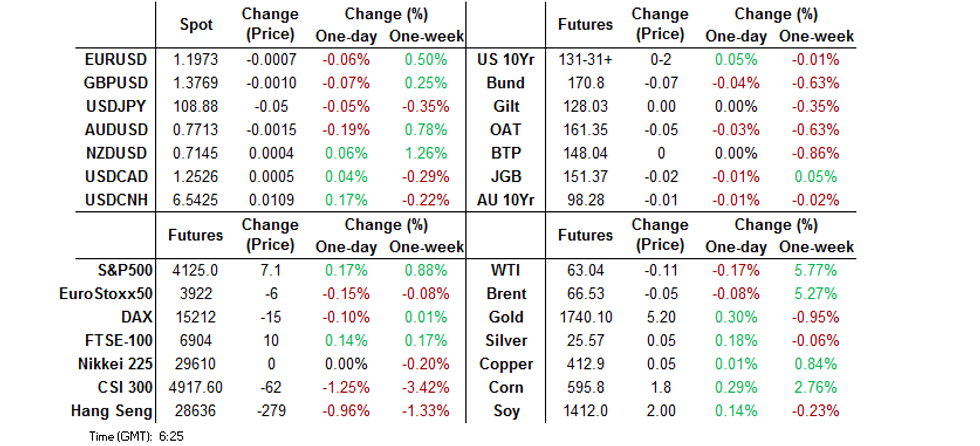

The Tsy space held to a narrow range in Asia, with no tangible reaction to a BBG source piece pointing to a (near enough) imminent round of sanctions that the U.S. is set to impose on Russian individuals and entities. Broader headline flow has been light since the re-open, with T-Notes sticking to a 0-05 range, last +0-01 at 131-31, while cash Tsys print little changed across the curve. Elsewhere, the marketing of Tencent's 4-part US$ issuance, comprising of 10-, 20-, 30- & 40-Year paper, is underway. The deal was flagged earlier this week and could price as early as today. Thursday's local docket is headlined by retail sales & weekly jobless claims data, as well as another deluge of Fedspeak. A note released by Credit Suisse's Zoltan Pozsar late in the NY day on Wednesday pointed to "a relatively muted year-end turn," based on his analysis of the quarterly earnings reports and conference calls from J.P.Morgan & Wells Fargo (and assumed lack of pressure on G-SIB scores). This could have been the trigger behind the EDZ1 buying and EDU1/Z1 spread selling we flagged around the CME re-open. EDZ1 leads the way in terms of volume of the Eurodollar strip, trading 2x as many as any other contract through the reds, with 19K lots trading hands thus far. The strip runs -0.5 to +0.5 through the reds.

- JGB futures unwound their overnight losses during the Tokyo morning, but have nudged lower again in early afternoon trading, to last print -4, while yields are little changed across the cash curve. Participants looked to the potential for wider COVID-related restrictions in regions surrounding Tokyo (per local newswire reports) in what proved to be a relatively light session for news flow. Elsewhere, the latest comments from BoJ Governor Kuroda didn't offer anything new. The latest liquidity enhancement auction, which covered off-the-run 5- to 15.5-Year JGBs, passed smoothly.

- The Aussie bond space edged away from lows in the wake of a much stronger than expected headline employment reading. YM -0.5, XM -2.0 at typing. The uptick from lows came as the headline masked a ~21K fall in the number of full-time employed, meaning the job gains in March were driven solely by part-time jobs. Still, the stronger than expected headline reading outweighed an uptick in the participation rate, allowing the unemployment rate to move lower and continued the run of upside surprises for the headline print (and strong overall rebound in the labour market). The underemployment rate hit levels not seen since '14, with the underutilisation rate moving to within a whisker of late '19 levels. Futures had traded lower into the release as some participants seemingly positioned for a firm reading.

JAPAN: Weekly International Security Flows Pick Up After Turn Of Japanese FY

The latest round of weekly international security flow data revealed that Japanese investors lodged the largest round of net weekly purchases of bonds witnessed since November in the week ending 9 April. Some of this likely reflected continued recycling of offshore equity holdings (which Japanese investors were net sellers of for a 5th consecutive week), although the net purchases of foreign bonds far outweighed the net sales of foreign equities, which suggests that Japanese investors started to put money to work after the turn of the Japanese FY (we have outlined the attractiveness of both Aussie & U.S. FX-hedged yields at a sovereign level from the perspective of a Japanese investor in recent bullets and analysis pieces).

- The other side of the ledger revealed the largest round of weekly net foreign purchases of Japanese bonds since February 2020, in a week which saw longer dated JGBs find a (short-term) base.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1714.4 | 375.1 | 2845.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -623.3 | -199.0 | -1464.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1229.5 | 568.6 | -1533.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 640.9 | 977.6 | 687.1 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: AUD Takes Hit Despite Continued Fall In Unemployment

Price action across the G10 FX space painted a mixed picture, with most currency pairs sticking to relatively tight ranges. AUD blipped higher upon the release of the Australian jobs report, but retreated as the data received some more scrutiny. The main parameters were strong, as the downtick in unemployment was larger than expected, the participation rate climbed to a record high and employment growth topped forecasts. However, the latter was driven solely by part-time positions, while almost 21k full-time jobs were shed. AUD/USD printed a fresh three-week high before pulling back under the 50-DMA and approaching the $0.7700 figure.

- NZD outperformed the rest of the G10 pack. CAD also fared well, while NOK went offered.

- JPY held firm, although it is a Gotobi day today. Its safe haven peer CHF lost ground.

- The DXY extended yesterday's losses, but rejected support from its 50-DMA.

- The PBoC set its central USD/CNY mid-point at CNY6.5297, 5 pips shy of sell-side estimate. Nonetheless, USD/CNH chewed into yesterday's losses, eventually returning above the CNH6.54 mark.

- KRW softened after the BoK left interest rates unchanged.

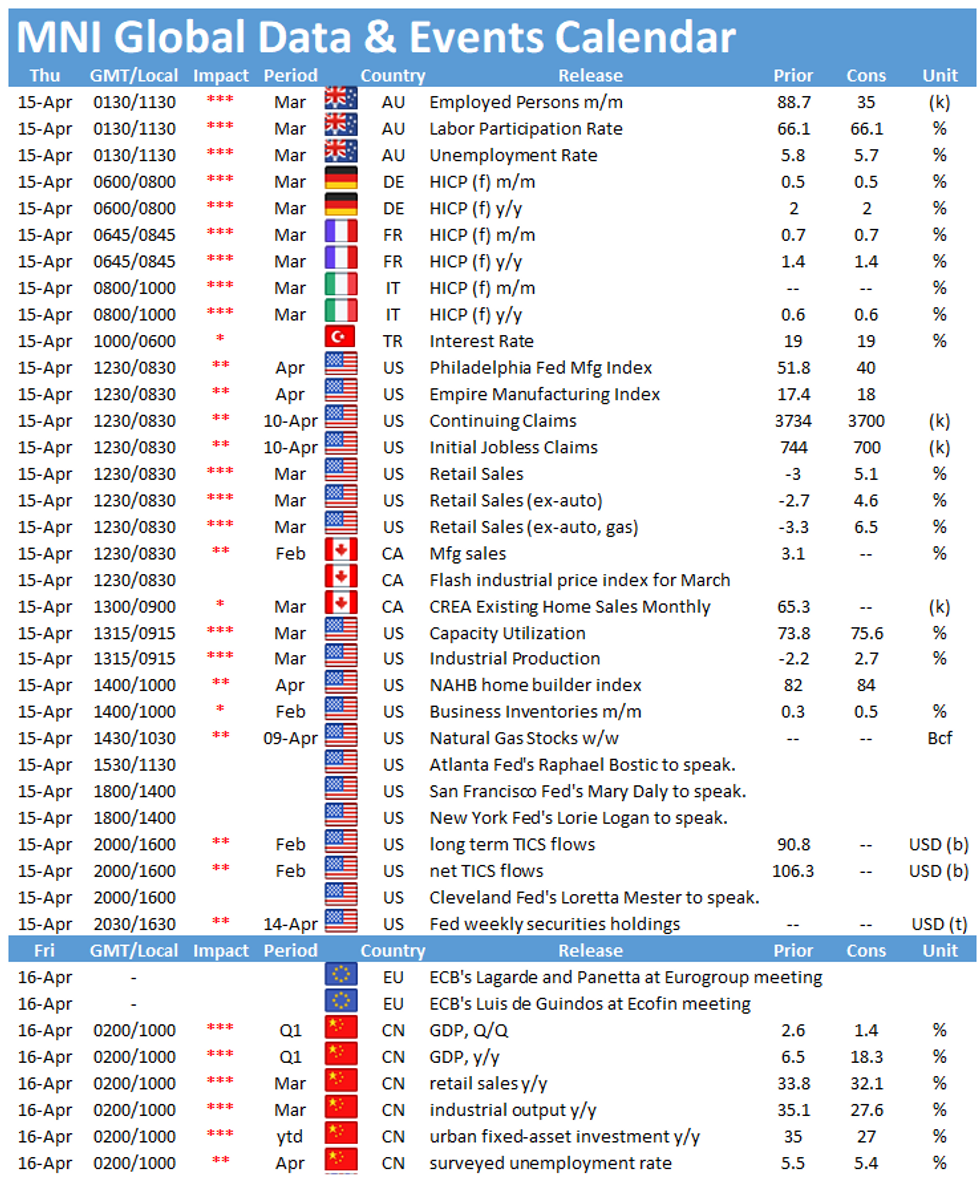

- Focus turns to U.S. initial jobless claims, industrial output & retail sales, final German, French & Italian CPIs as well as comments from Fed's Mester, Daly & Bostic and Riksbank's Ingves.

FOREX OPTIONS: Expiries for Apr15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-65(E1.2bln), $1.1800(E694mln), $1.1820-25(E544mln), $1.1898-1.1900(E2.3bln, E1.85bln EUR puts), $1.1910-25(E719mln-EUR puts), $1.1960(E563mln-EUR puts)$1.1970-75(E1.3bln-EUR puts), $1.1990(E450mln-EUR puts)

- USD/JPY: Y105.90-106.00($1.1bln), Y108.85-95($627mln-USD puts), Y109.00-10($1.7bln-USD puts), Y109.15-25($993mln), Y109.40-50($715mln), Y110.00($691mln), Y110.50-60($1.3bln-USD puts)

- EUR/NOK: Nok10.08-10.09(E526mln-EUR puts)

- AUD/USD: $0.7700(A$592mln), $0.7750-60(A$1.0bln-AUD puts)

- AUD/NZD: N$1.0850(A$668mln)

- EUR/AUD: A$1.5450-52(E565mln-EUR puts)

- USD/CAD: C$1.2645-50($765mln), C$1.2680($837mln)

- USD/CNY: Cny6.50($775mln), Cny6.5415($630mln)

ASIA FX: Early Moves Reversed

Safe havens caught a small bid after the PBOC drained liquidity from the system at the MLF operations, this saw the greenback higher and reversed EM FX gains, most USD/Asia EM crosses higher as a result.

- CNH: Offshore yuan is weaker, USD/CNH rising sharply after the aforementioned MLF operation inspired caution.

- SGD: Singapore dollar is weaker, reversing earlier gains after the greenback went bid.

- TWD: Taiwan dollar bucking the regional trend, there have been some developments on the COVID-19 front, Taiwan announced late yesterday it would ease quarantine rules for air crews from April 15, while it plans to widen the vaccination programme from April 21.

- KRW: Won weakened after the BoK held rates at 0.50%, the bank noted its policy stance remained accommodative but noted the potential for higher growth and inflation.

- MYR: Ringgit is weaker, dropping from the highest level in a week. Malaysian epidemiological experts warned against the impending fourth wave of infections. PM Muhyiddin called upon Ramadan bazaar visitors to observe existing Covid-19 restrictions.

- IDR: Rupiah is weaker, an official at the Energy and Mineral Resources Ministry told Antara that the gov't could save IDR22.12tn in spending if it scraps power subsidies for 15.2mn users. The gov't is currently drafting its electricity subsidy scheme for 2022. Markets await trade data.

- PHP: Peso is stronger, another to buck the trend. Overseas remittances rose 5.1% Y/Y in Feb, beating BBG est. of a 2.0% increase, after a 1.7% decline recorded in Jan. Philippine workers sent $2.48bn home, boosting the YtD sum of foreign remittances to $5.08bn.

- THB: Thai market are closed for a holiday.

ASIA RATES: Mixed Bag

- INDIA: Yields higher in early trade, despite the RBI scheduled to conduct its first purchase under its newly announced GSAP (Government Securities Acquisition Programme). RBI is to purchase a total INR 250bn. Further coronavirus caution with India reporting over 200k single day infections for the first time.

- SOUTH KOREA: BoK held rates at 0.50%, said it would maintain its accommodative stance but noted the potential for above forecast growth and inflation. Lee also touched on the bond market, he noted timing of the bank's bond buying is dependent on market conditions, and that there was no change in the previously announced plan for bond buying. The BoK will adjust liquidity via MSB's and other tools, and will proceed with preparation for 3-Year MSB issuance. Bond markets are indifferent to the comments though, 10-year future at session lows.

- CHINA: The PBOC drained liquidity from the system at the MLF operations against expectations for a neutral position or an injection. Bond futures lower on the perceived tightening move, but repo rates took the announcement in stride.

- INDONESIA: Yields mostly higher as bonds come under pressure after finance ministry data showed global funds sold $282m of Indonesian bonds earlier this week, ending an eight session run of inflows. Data in the session showed exports rose 30.47% against estimates of a 12.23% rise. Elsewhere the finance ministry sold IDR 5.77tn of bonds in a greenshoe option yesterday, with bid/cover around 1.57.

EQUITIES: PBOC's Lack Of Liquidity Drags China Lower

Another mixed day for equity markets in the Asia-Pac time zone. Markets in mainland China and Hong Kong are lower, the PBOC drained liquidity from the system at the MLF operations, which was interpreted by the market as implied tightening and put downward pressure on equity markets. In Japan markets are seeing slight gains, helped higher by Softbank after reports the Vision Fund could hit profit of $30bn in Q1. US futures fluctuated with the Nasdaq struggling to move higher after Coinbase reversed initial gains on its trading debut, while bank stocks helped support S&P 500 and Dow futures.

GOLD: As You Were

Bullion continues to coil, with spot operating in a tight range in recent sessions, last dealing little changed around $1,740/oz, with participants awaiting a fresh catalyst. The technical backdrop remains unchanged.

OIL: Crude Futures Little Changed

WTI & Brent sit around $0.10 softer on the day.

- Crude rallied sharply on Wednesday after US DOE data showed inventories fell the most in two months, oil is now on track for a fourth higher session, the longest run of gains since early-March. Headline crude stocks dell 5.89m bbls last week, against estimates of a 2.58m bbl decline. The data also showed that implied gasoline demand rose for the seventh consecutive week, on the back of improved demand forecasts from the IEA and OPEC.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.