-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Inflation Still Deemed Transitory At The Fed

EXECUTIVE SUMMARY

- FED CHAIR POWELL: STILL 'SOME TIME' BEFORE TAPERING

- BIDEN VOWS 'AMERICA IS ON THE MOVE' (SKY)

- MANCHIN: BIDEN'S FAMILY AID PLAN COST IS 'UNCOMFORTABLE' (BBG)

- U.S. EYES MAJOR ROLLBACK IN IRAN SANCTIONS TO REVIVE NUKE DEAL (AP)

- CHINA READIES TENCENT PENALTY IN ANTITRUST CRACKDOWN (RTRS SOURCES)

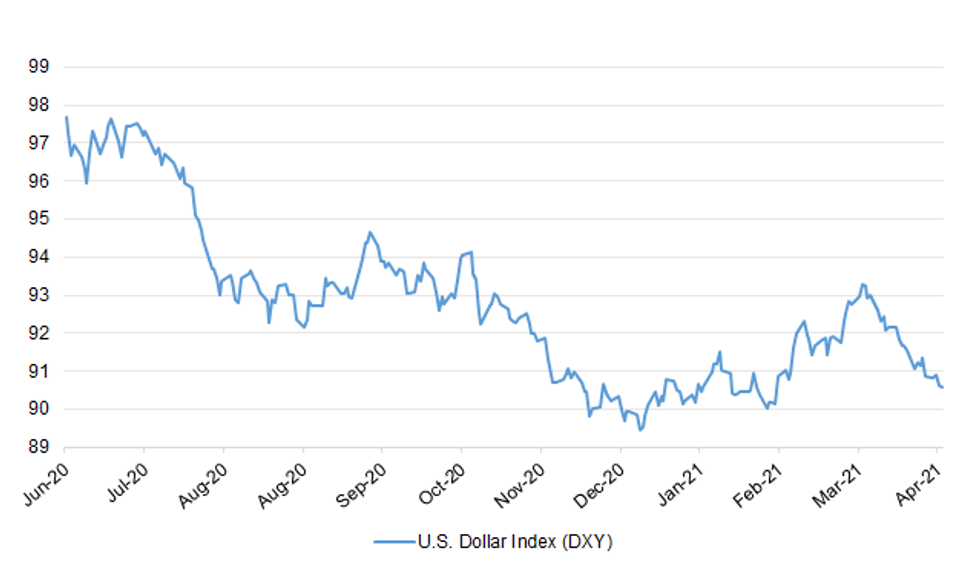

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. government has secured an extra 60 million doses of the vaccine produced by Pfizer Inc. and BioNTech SE to form part of a booster program to protect the most vulnerable people against Covid-19 before winter. Scientists at the Joint Committee on Vaccination and Immunization are deciding which groups of people should get the booster shot later this year, after they have been given their first two doses. (BBG)

CORONAVIRUS: Compulsory Covid status certificates to enter pubs and restaurants are now off the menu and the government's review is likely to recommend that documents are required only for larger events. Michael Gove, the Cabinet Office minister, is expected to set out progress on the review into Covid certification in a written statement to the Commons on Thursday, the Guardian understands. The review is still ongoing and subject to change and will report back next month. Plans for the use of so-called vaccine passports had sparked considerable anger among Conservative MPs, though Boris Johnson had suggested in several interviews that he backed their use. (Guardian)

INFLATION: The British public's expectations for inflation over the next 12 months rose slightly to 2.8% in April from 2.7% in March, but are below a peak of 3.8% seen in December, a monthly survey by YouGov showed on Wednesday. Inflation expectations for the next five to 10 years rose to 3.3% in April from 3.1% in March. "Household inflation expectations remain well anchored in our view. Upside risks that had been evident during the pandemic now appear to have eased," said economists at Citi, which sponsors the survey. (RTRS)

FISCAL: It would cost less than £1bn a year for the UK to adopt a system of earnings insurance, offering unemployed people the same level of support as furlough currently provides, a report by the Resolution Foundation says. The pandemic has exposed two big failings of the pre-crisis welfare system, according to the think-tank: the inadequacy of the basic safety net for families under the universal credit (UC) system and the lack of earnings insurance, linking the level of unemployment benefits to previous earnings. These shortcomings forced the government to make radical changes at the start of the crisis, by raising the basic rate of UC, making it more accessible and introducing generous support for furloughed and self-employed workers — at a cost of £82bn in 2020-21 alone. But on current policy, both the income support schemes and the temporary uplift to UC will end later this year. (FT)

BREXIT: Britain is preparing to grant full diplomatic status to the European Union's ambassador in London, concluding a dispute that has strained relations between the two sides for the past year. João Vale de Almeida took up his post as the EU's first ambassador to London last spring after Britain's exit from the bloc but was denied formal recognition. (The Times)

POLITICS: Downing Street is concerned that the involvement of a Tory donor in funding Boris Johnson's flat renovation has left a damaging paper trail at Conservative Party headquarters. The Electoral Commission launched an investigation yesterday of the party's role in funding the redecoration of the home that he shares with his fiancée and son above 11 Downing Street. (The Times)

AUTOS: Car production in the UK rose in March for the first time after 18 consecutive months of decline, according to the latest vehicle manufacturing figures published today. Outputs were up by almost 50 per cent compared to the same month a year ago, when factories were forced to close down operations as a result of the pandemic. The Society of Motor Manufacturers and Traders described the growth as a 'major step in the right direction' but warned that manufacturers face a fresh challenge in the shape of the worldwide shortage of semi-conductors. (This Is Money)

EUROPE

FISCAL: MNI SOURCES: EU Finance Ministers To Keep Focus On Stimulus

- June's meeting of eurozone finance ministers is being billed as the year's most significant decision point for the bloc, but looming German elections look set to stall progress on completing Banking Union and a review of national fiscal policies is unlikely to prompt any withdrawal of fiscal stimulus in the near term, European officials said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUTOS: Production at Oxford's Mini plant will be suspended for three working days due a shortage of computer chips. BMW said its Cowley factory will not manufacture cars on Friday or on Tuesday and Wednesday after the bank holiday weekend. A spokeswoman said the company had taken steps to minimise further disruption and was monitoring the situation on a daily basis. Other companies are also being hit by a global shortage of computer chips. (BBC)

U.S.

FED: MNI STATE OF PLAY: Powell: Still 'Some Time' Before Tapering

- Federal Reserve Chair Jay Powell on Wednesday said even with signs inflation has started to pick up in the start of a strong economic rebound, he's in no rush to dial back bond purchases or raise interest rates. While the Covid comeback has progressed faster than expected, the recovery is uneven with 8.5 million more people out of work due to the pandemic, Powell said. Supply bottlenecks driving inflation higher will also resolve themselves eventually, he said. "It will take some time before we see substantial further progress," he said, referring to the Fed's bar for starting to taper its asset purchases from the current level of USD120 billion a month. "We've said we would let the public know when it is time to have that conversation. We said we would do that well in advance to the decision of tapering" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: The U.S. Treasury noted the following on Wednesday: "Earlier today, Secretary Janet L. Yellen met virtually with CEOs and CFOs of the biggest retail companies in the U.S. who are members of the Retail Industry Leaders Association (RILA), the trade association for U.S.-based leading retail companies. The Secretary discussed the positive impact of the Administration's American Rescue Plan and the merits of the American Jobs and American Families Plans. The Secretary highlighted the ways in which the Administration is working to build back better, including addressing the U.S.'s long history of underinvestment in our public goods like airports, roads, bridges, broadband, R&D, job training, and the challenges faced by families including soaring costs of childcare and health care; insufficient paid leave; lack of affordable education. Secretary Yellen also discussed how addressing these underinvestments and challenges will benefit the retail sector. The Secretary and retail executives also discussed climate finance, corporate tax rates, trade, supply chains including the labor supply, how the pandemic has affected the retail sector and how the industry has responded. The Secretary relayed that she is increasingly optimistic that the retail sector will witness a strong rebound over 2021, and affirmed her commitment to helping Americans and businesses make it to the other side of the pandemic and be met there by a robust recovery." (MNI)

ECONOMY: MNI INTERVIEW: Higher US Auto Prices Expected On Chip Shortage

- The semiconductor shortage that has capped new vehicle production in the U.S. should push prices higher into 2022, driving the price of both new and used cars out of range for many consumers, industry experts told MNI, though demand remains high - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: US President Joe Biden says America is "on the move" and that, despite the pain of the past year, the country can "turn peril into possibility". Mr Biden was marking his 100th day in office with an address to Congress, using the speech to promote a $1.8trn spending package. The plan would provide universal preschool, two years of free community college, $225bn for child care, and monthly payments of at least $250 for parents. (Sky)

FISCAL: U.S. Treasury Secretary Yellen noted: "Tonight, President Biden placed education and caregiving squarely where they should be in our national discussion – as core elements of a strong economy. Historically, childcare and other social programs to help families haven't been seen as crucial investments underpinning American growth and productivity. But this is a failure of perspective. A healthy U.S. economy requires a vibrant labor market with high rates of participation. Raising U.S. rates of participation to levels comparable to those of other advanced nations requires widespread change in our labor policies. Indeed, there are many reasons for why U.S. labor force participation lags, but an undeniable one is the lack of support for people as they raise children and care for older relatives. Funding policies that help children and families will boost labor force participation and productivity, resulting in an improvement in the standard of living. This is the President's vision: To recognize that our work lives – and our family lives – are inextricably linked, and if we want to improve one, then we must improve the other. The President pays for these investments by addressing another historic challenge: the country's unfair tax code. Over the next decade, the American people are expected to lose out on $7 trillion in revenue, in large part because some of the highest earners aren't reporting their actual income. In addition to strengthening compliance, the plan will also close capital gains loopholes and treat investment earnings the same as wages for high-income taxpayers. A fairer tax code in exchange for a higher quality of life for most American families? There are some economic trade-offs that are tough calls. This is not one of them." (MNI)

FISCAL: Democratic Senator Joe Manchin says President Biden's $1.8 trillion family aid proposal is a significant amount of money and he wants to find out more information about how to pay for it. "It's a lot of money. A lot of money. That makes you very uncomfortable," the West Virginia Democrat tells reporters, adding that he has not seen the plan. (BBG)

FISCAL: President Biden's proposed tax hikes on the wealthy could apply to at least some 2021 earnings, White House economic adviser Heather Boushey told the Axios Re:Cap podcast on Wednesday. The administration has said it wants to raise income and capital gains rates on the richest Americans to offset new spending, but has not yet specified when it wants those increases to go into effect. (Axios)

FISCAL: The U.S. Treasury said on Wednesday that President Joe Biden's "American Families Plan" tax overhaul would invest about $80 billion into the Internal Revenue Service over a decade to boost enforcement, generating some $700 billion in net new tax revenue over the same period. The Treasury said in a statement the investments would upgrade IRS technology and allow for it to expand and train its auditing staff to keep up with increasingly sophisticated tax evasion efforts. (RTRS)

CORONAVIRUS: New York Gov. Andrew Cuomo announced Wednesday that the state will lift dining curfews statewide and a ban on bar seating in New York City in a major milestone for the recovery of an industry hit hard by pandemic lockdowns. Seating at bars will be allowed in New York City starting May 3, more than one year after restrictions first went into place at the height of the coronavirus pandemic. (CNBC)

CORONAVIRUS: New York's legislature plans to repeal several of Governor Andrew Cuomo's coronavirus-related executive orders, nearly two months after stripping him of pandemic-era emergency powers. The Senate and Assembly on Wednesday will reverse a Cuomo directive that required customers to order food with alcohol in bars and restaurants, according to a Senate Majority news release. (BBG)

CORONAVIRUS: Maryland is dropping most outdoor mask requirements effective immediately and loosening other restrictions that were in place to stem the spread of Covid-19. Masks will still be required at all large venues, such as stadiums and concerts and indoors at all private and public businesses, Kata D. Hall, a spokeswoman for Governor Larry Hogan, said on Twitter. (BBG)

EQUITIES: Apple reported a blowout quarter on Wednesday, announcing companywide sales up 54% higher than last year, and significantly stronger profits than Wall Street expected. Apple stock rose over 4% at one point in extended trading. Apple reported double-digit growth in every single one of its product categories, and its most important product line, the iPhone, was up 65.5% from last year. Its Mac and iPad sales did better, with its computers up 70.1% and iPad sales growing nearly 79% on an annual basis. (CNBC)

OTHER

U.S./CHINA: President Joe Biden proposed a sweeping new $1.8 trillion plan in a speech to a joint session of Congress on Wednesday, pleading with Republican lawmakers to work with him on divisive issues and to meet the stiff competition posed by China. (RTRS)

U.S./CHINA: The Biden administration has mobilized allies to jointly exert pressure on China and has made some progress in attempts to smear governance in China's Xinjiang Region as "genocide," the Global Times said in an editorial. The process of technological decoupling will only speed up in the future even as economic cooperation may expand, the state-run newspaper said. Catching up with the strength of the U.S. should be the decisive factor that will crush the U.S. illusion of containing China, it said. (MNI)

GLOBAL TRADE: The Biden administration is in talks with the European Union to avoid an escalation in a dispute over tariffs on European metals exports as the transatlantic alliance tries to repair their economic counterweight against China, people familiar with the matter said. Commerce Secretary Gina Raimondo, on a call with EU trade chief Valdis Dombrovskis last week, inquired about what could be done to avoid a looming escalation of European tariffs, according to the people, who asked not to be named discussing private talks. (BBG)

GEOPOLITICS: As India battles a resurgence in coronavirus cases, China is shoring up ties with South Asia through cooperation on the pandemic. Chinese Foreign Minister Wang Yi and his counterparts from Afghanistan, Pakistan, Nepal, Sri Lanka, and Bangladesh agreed on Tuesday to set up an emergency supplies reserve and a cooperation centre on poverty alleviation, among other initiatives. India did not take part in the online meeting to discuss ways to counter Covid-19, an absence that observers said reflected the tense relations between China and India over their border stand-off in the Himalayas. (SCMP)

CORONAVIRUS: BioNTech chief executive has said he is confident the Covid-19 vaccine his company pioneered with Pfizer will work against a new variant circulating in India, where health officials are recording hundreds of thousands of new coronavirus cases a day. Ugur Sahin, who founded the German biotech with his wife Ozlem Tureci, said BioNTech had developed the vaccine with variants in mind. "[It] will hold, I'm confident of that," he said, adding that BioNTech's early experience developing cancer therapies meant that the company had been prepared for the virus to mutate. "We come out of cancer medicine and [there] the tumour is constantly changing and mutating . . . So we have experience with these escape mechanisms," he said, at an online meeting with reporters. (FT)

CORONAVIRUS: U.S. Trade Representative Katherine Tai on Wednesday met virtually with the top executive of drugmaker Moderna to discuss a proposed waiver of certain intellectual property rights in response to the COVID-19 pandemic, Tai's office said. Tai and Moderna Chief Executive Stephane Bancel also discussed increasing vaccine production and global health issues, Tai's office said in a statement. (RTRS)

CORONAVIRUS: U.S. President Joe Biden's top trade adviser met virtually with Microsoft co-founder and philanthropist Bill Gates on Tuesday about increasing COVID-19 vaccine production and the proposed waiver of intellectual property rights protections for vaccines. (RTRS)

CORONAVIRUS: U.S. assistance flights will start arriving in India on Thursday, April 29 and will continue into next week, White House says. U.S. is sending 1 million rapid diagnostic tests, the first tranche of a planned 20,000 treatment courses of the antiviral drug remdesivir. U.S. re-directed its own order of AstraZeneca manufacturing supplies to India, allowing India to make over 20 million doses of COVID-19 vaccine. (BBG)

CORONAVIRUS: Health secretary Matt Hancock reiterated the UK's support for India as it battles its latest wave of Covid-19, but said that the country was not in a position to offer surplus vaccines. Speaking at the Downing Street briefing, Hancock said the fight against coronavirus was "global" and that the situation within India was a "stark reminder" the pandemic is not yet over. (FT)

CORONAVIRUS: Countries in Africa, Asia and Latin America must engage the international human rights movement to ensure equitable access to coronavirus vaccines, particularly for poor countries, says South African Finance Minister Tito Mboweni. "All of us should be committed to opposing what we refer to as 'vaccine narrow nationalism', the tendency by rich countries to want to accumulate the vaccines unto themselves and by so doing making vulnerable, poor countries to be unable to access the vaccine," Mboweni says at a virtual event hosted by the South African Jewish Report newspaper Wednesday. (BBG)

JAPAN: Japan will consider making vaccines and medical treatments that have yet to be domestically approved available for emergency use in order to reduce regulatory delays to Covid-19 vaccination as cases spike, the Nikkei reports. (BBG)

AUSTRALIA: Australian Treasurer Josh Frydenberg said the jobless rate will "need to have a four in front of it" to generate the faster wage growth and higher inflation needed to repair the economy, signaling a willingness to keep the fiscal spigot open in his May 11 budget. In doing so, the government is aligning with the Reserve Bank of Australia in trying to drive unemployment down to very low levels. Treasury estimates full employment is now 4.5%-5%, Frydenberg said in a speech Thursday, or higher than the central bank's estimate of low 4s or high 3s needed to generate pay gains and lift consumer prices."In effect, both the RBA and Treasury's best estimate is that the unemployment rate will now need to have a four in front of it to deliver this outcome," Frydenberg said. Wage growth and annual core inflation are currently hovering around record lows, underscoring the scale of the task. "The best way to repair the budget is to repair the economy," he said. (RTRS)

AUSTRALIA/CHINA: Australian exports of wine to mainland China have almost completely dried up after the Chinese government imposed tariffs of more than 200% last year in an escalating trade spat. Shipments in the three months ended March 31 plummeted to just A$12 million ($9.4 million) from A$325 million in the same period a year earlier, Wine Australia said Thursday. China used to be Australia's biggest wine export market. China last month formalized tariffs of more than 200% on Australian wine for five years, though the higher duties had been in place since November. The tariffs followed a raft of measures barring Australian imports from coal and copper to barley last year. (BBG)

RBNZ: The Reserve Bank of New Zealand's Monetary Policy Committee has never needed to vote on a decision in its two years of operation because of a unique process that is conducive to consensus, according to external member Peter Harris. The committee, which first met in May 2019, was created to bring a greater diversity of views to the decision-making process, but it considers a vote to be "the last resort," Harris said in an interview Wednesday in Wellington. "The committee has developed a process that increases the chances of consensus emerging, and increases the chances of early divergences of opinion being reconciled," he said. "So far it's moved to decisions that everyone can live with. I wouldn't say 100% agreement on every dimension, every sentence of every statement, but broadly speaking we develop what is an effective consensus. I don't think that would happen without the time and the staging of the deliberative process." (BBG)

CANADA: Finance Minister Chrystia Freeland said her debut budget lays out a "reasonable and sustainable" debt track that maintains Canada's reputation as a fiscal stalwart. The fiscal plan forecasts a declining debt ratio in coming years once Covid-related spending is no longer needed, Prime Minister Justin Trudeau's finance chief said Wednesday. The nation's deficit, meanwhile, will also drop to pre-pandemic levels. "Canada being Canada, we are proud of our reputation for fiscal prudence and that's something I would say is built into Canada's institutional DNA," Freeland said in an interview for Bloomberg Markets magazine. (BBG)

TURKEY: US Secretary of State Antony Blinken voiced hope Wednesday for better relations with Turkey despite US recognition of the Armenian genocide, but renewed warnings of sanctions if Ankara keeps a Russian air defense system. President Joe Biden on Saturday defied decades of Turkish pressure and recognized the mass killings of Armenians by the Ottoman Empire as genocide, leading Ankara to summon the US ambassador. Blinken noted that Biden told Turkish President Recep Tayyip Erdogan by telephone of the decision so there would be "no surprises" and agreed to meet him in June on the sidelines of a NATO summit. (AFP)

TURKEY: Turkey reached a deal to acquire 50m doses of Russia's Sputnik V vaccine as it grapples with delayed shipments of other drugs and new variants of the coronavirus, the health minister said. Turkey has detected its first cases of a strain of the virus first identified in India, the minister, Fahrettin Koca, said in a televised message. "Mutations have made the fight against the virus arduous," he said. (FT)

BRAZIL: Brazil's government increased its emergency cash buffer in March to cover future debt obligations and other due payments to more than 1 trillion reais, Treasury figures showed on Wednesday, as public debt also rose to a new all-time high. The Treasury swelled its liquidity cushion, essentially an emergency cash buffer, by 20% in nominal terms from the previous month to a new high of 1.12 trillion reais ($207 billion), it said in a monthly report. The amount is enough to cover more than seven months of debt maturities, the Treasury said, adding that some 435 billion reais of debt was scheduled to mature in April and May alone. (RTRS)

RUSSIA: Senators from both parties tell Axios they generally approve the idea of a summit between President Biden and Russian leader Vladimir Putin but oppose any reset of relations between Washington and Moscow. (Axios)

SOUTH AFRICA: South Africa is not doing enough to tackle corruption and must fight to prevent it from being embedded into its systems, Finance Minister Tito Mboweni said. "Major infrastructural developments have taken place but there have also been major problems, corruption has been one of those and as a country we have to deal with that," Mboweni said during a virtual panel discussion at the event hosted by the South African Jewish Report newspaper. "At times, I feel that we are not doing enough to fight against corruption." (BBG)

IRAN: The Biden administration is considering a near wholesale rollback of some of the most stringent Trump-era sanctions imposed on Iran in a bid to get the Islamic Republic to return to compliance with a landmark 2015 nuclear accord, according to current and former U.S. officials and others familiar with the matter. As indirect talks continue this week in Vienna to explore the possibility of reviving the nuclear deal, American officials have become increasingly expansive about what they might be prepared to offer Iran, which has been driving a hard line on sanctions relief, demanding that all U.S. penalties be removed, according to these people. (AP)

IRAN: Iranian President Hassan Rouhani said the leaking of an audio recording that has triggered calls for the impeachment of his top diplomat was intended to derail nuclear talks with world powers as they near a breakthrough. A dissident Iranian news channel on Sunday aired parts of an interview in which Foreign Minister Mohammad Javad Zarif complains that some unilateral decisions by a widely revered general, Qassem Soleimani, had undermined his diplomatic efforts, including forging a critical 2015 international agreement. The deal removed sanctions on Iran in return for capping its atomic program, and Zarif said the Islamic Revolutionary Guard Corps had opposed it. (BBG)

MIDDLE EAST: U.S. Special Envoy for Yemen Tim Lenderking will travel to Saudi Arabia and Oman on Thursday for talks with government officials about efforts to end Yemen's civil war, the U.S. State Department said in a statement. (RTRS)

EQUITIES: Samsung Electronics Co. beat analyst estimates for profit in the first quarter, but warned of continued fallout from semiconductor shortages as the global economy recovers from the Covid-19 pandemic. South Korea's largest company reported net income of 7.1 trillion won ($6.4 billion) for the three months ended March, beating the 6.7 trillion won average of estimates compiled by Bloomberg. Revenue rose 18% for the period. (BBG)

METALS: Fortescue Metals Group Ltd., the world's no. 4 iron ore exporter, reported a 9% dip in March quarter shipments at a time when tightening global supplies are adding to upward pressure on prices. Exports in the three months to March 31 were 42.3 million tons, down from 46.4 million tons the previous quarter, the Perth-based company said Thursday in a statement. That compares with a median estimate of 41.9 million tons among 4 analysts. "Significant rainfall" hampered its Pilbara port and mine operations during the period, while the company said annual exports remain on track to be between 178-182 million tons for the year ending June 30. (BBG)

OIL: Major Chinese investors are in talks to buy a stake in Saudi Aramco, several sources told Reuters on Wednesday, as Saudi Arabia's state oil firm prepares to sell another slice of its business to international investors. (RTRS)

CHINA

POLICY: China should initiate top-down planning to respond to declining birth rates and the accelerating aging population, including letting more farmers join the urban job markets, the 21st Century Business Herald said in an editorial. China should seek to keep migrant workers in cities, promote agricultural modernization and strengthen investment in education, the newspaper said. China should also encourage consumption and address expensive housing which prevents young people from marrying and childbirth, the Herald said. (MNI)

LGFVS: MNI EXCLUSIVE: China To Restrict, Not End, Support For LGFVs

- China will continue to help local government financing vehicles through short-term liquidity crunches despite an official statement seemingly withdrawing implicit guarantees for their debt as any dent in the bonds' safety record could have major ramifications for the regional economy, policy advisors told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

PBOC: MNI INTERVIEW: Ex-PBOC Advisor: Prepare For Fed Tightening

- Chinese regulators should brace for possible large capital outflows when the Federal Reserve eventually indicates it will move to tighten monetary policy, a prominent policy advisor told MNI in an interview - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FINTECH: China is preparing a substantial fine for Tencent Holdings as part of its sweeping antitrust clampdown on the country's internet giants, but it is likely to be less than the record $2.75 billion penalty imposed on Alibaba earlier this month, two people with direct knowledge of the matter said. (RTRS)

OVERNIGHT DATA

AUSTRALIA Q1 EXPORT PRICE INDEX +11.2% Q/Q; MEDIAN +9.0%; Q4 +5.5%

AUSTRALIA Q1 IMPORT PRICE INDEX +0.2% Q/Q; MEDIAN -1.6%; Q4 -1.0%

NEW ZEALAND MAR TRADE BALANCE +NZ$33MN; FEB +NZ$181MN

NEW ZEALAND MAR TRADE BALANCE 12 MTH YTD +NZ$1.688BN; +NZ$2.364BN

NEW ZEALAND MAR EXPORTS NZ$5.68BN; FEB NZ$4.47BN

NEW ZEALAND MAR IMPORTS NZ$5.65BN; FEB NZ$4.29BN

NEW ZEALAND APR, F ANZ BUSINESS CONFIDENCE -2.0; FLASH -8.4

NEW ZEALAND APR, F ANZ ACTIVITY OUTLOOK 22.2; FLASH 16.4

Business sentiment and activity indicators were much higher in the late-month April sample, seeing nearly all indicators higher than the previous month. The jump relative to the early-April read was likely influenced by a fading of the initial reaction to the new housing policies, plus the announcement of the trans-Tasman bubble, a welcome step back towards normality. (ANZ)

SOUTH KOREA MAY BUSINESS SURVEY M'FING 98; APR 91

SOUTH KOREA MAY BUSINESS SURVEY NON-M'FING 82; APR 78

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2125% at 09:25 am local time from the close of 2.1600% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 37 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUQN CENTRAL PARITY AT 6.4715 THURS VS 6.4853

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4715 on Thursday, compared with the 6.4853 set on Wednesday.

MARKETS

SNAPSHOT: Inflation Still Deemed Transitory At The Fed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 17.231 points at 7081.9

- Shanghai Comp. up 6.028 points at 3463.096

- JGBs are closed

- Aussie 10-Yr future up 2.0 ticks at 98.345, yield down 3.5bp at 1.695%

- U.S. 10-Yr future -0-01+ at 132-01+, cash Tsys are closed

- WTI crude up $0.19 at $64.05, Gold up $2.74 at $1784.42

- USD/JPY up 1 pip at Y108.61

- FED CHAIR POWELL: STILL 'SOME TIME' BEFORE TAPERING

- BIDEN VOWS 'AMERICA IS ON THE MOVE' (SKY)

- MANCHIN: BIDEN'S FAMILY AID PLAN COST IS 'UNCOMFORTABLE' (BBG)

- U.S. EYES MAJOR ROLLBACK IN IRAN SANCTIONS TO REVIVE NUKE DEAL (AP)

- CHINA READIES TENCENT PENALTY IN ANTITRUST CRACKDOWN (RTRS SOURCES)

BOND SUMMARY: Fresh Highs For S&P E-Minis Apply Light Pressure

A bid in the equity space in the wake of quarterly earnings releases from some of the U.S. tech giants (Apple & Facebook) was evident in Asia-Pac hours, resulting in the S&P 500 e-mini contract hitting a fresh all-time high, with the NASDAQ 100 outperforming (the Fed's insistence surrounding the path of future policy i.e. inflation matters are deemed transient, still some time until substantial progress is seen and now is not the time to discuss tapering also supported equities). The uptick in equities applied some light pressure to T-Notes, with nothing in the way of surprises seen provided in President Biden's latest address. T-Notes last -0-02 at 132-01, 0-00+ off lows, operating on ~40K lots, with liquidity thinned and cash Tsys closed until London hours on the back of a Japanese holiday.

- JGBs were closed as Japan observed the aforementioned national holiday.

- YM +0.5, XM +2.0 in what has been relatively sedate trade. Very light pressure crept into XM on the back of the previously flagged uptick in U.S. equity index futures, although the negative RBA-adjusted net supply, month-end index extensions and spill over from yesterday's softer domestic CPI data seemingly continue to provide an underlying level of support. In local news, Treasurer Frydenberg noted that the country's jobless rate will "need to have a four in front of it" to generate the required level of wage growth and inflation, with the Treasury's estimate of NAIRU now between 4.5-5.0% (remember that RBA Governor Lowe couldn't discount the suggestion that NAIRU may start with a 3 when questioned on the matter during a recent appearance).

EQUITIES: Fed Guidance & Strong Earnings Support Equities

Equity markets have benefitted from the Fed's reiteration of guidance surrounding its future policy path and stronger than expected earnings from the likes of Apple, Facebook, Ford & Samsung. The NASDAQ outperformed given the tech focus of 2/3 of the aforementioned U.S. equity names. The S&P 500 e-mini contract registered another fresh all-time high, while the major Asia-Pac equity indices also ticked higher, with the Hang Seng leading. A reminder that Japanese markets were closed for the observance of a national holiday.

OIL: Crude A Touch Firmer Alongside Equities

The uptick in global equity indices supported crude in Asia-Pac trade, although WTI & Brent moved back from best levels of the day as the DXY recovered from worst levels, leaving the benchmarks $0.20 to $0.25 above their respective settlement levels at typing. The broader global COVID trends remain key re: the demand side of the equation. Elsewhere, Wednesday saw the release of the latest round of weekly DoE inventory data from the U.S., with crude and gasoline stocks registering surprise, albeit modest, builds while distillate stocks experienced a much sharper than expected drawdown.

GOLD: Firming Post FOMC

Gold has drawn support from the post-FOMC downtick in U.S. Tsy yields & USD weakness, after a brief showing below the 50-day EMA on Wednesday. Spot last deals $5/oz or so firmer, just above $1,785/oz with the bullish impetus still intact from a technical perspective. Bulls need to take out well defined resistance in the form of the April 22 high (1,797.9/oz) before turning their focus higher.

FOREX: Moving On After FOMC

Familiar dynamics were in play in the early part of the Asia-Pac session, but started to peter out in the second half. Headline flow failed to provide any notable catalysts, while regional activity was limited by a market holiday in Japan. The latest speech from U.S. Pres Biden generated no tangible market reaction, as most details had been outlined/leaked earlier. The greenback continued its post-FOMC slide and the DXY printed two-month lows as a result, but trimmed the bulk of initial losses thereafter, even as the U.S. dollar remained among the worst G10 performers.

- USD/CNH went offered despite a marginally softer than expected PBOC fix. China's central bank set its USD/CNY mid-point at CNY6.4715, 8 pips above sell side estimates, but USD/CNH slipped through yesterday's low to its worst levels since the early days of March.

- The Antipodeans gave away their initial gains, which made NZD/USD fail to consolidate above broken resistance from Mar 18 high of $0.7269. Both AUD/USD & NZD/USD returned to respective opening levels.

- NOK remained resilient and topped the G10 pile, with SEK & GBP also holding up well.

- USD/CAD slipped to a fresh cycle low of C$1.2288, even though some suggested that C$1.2300 may have held some barrier options. The rate moved away from that trough as USD started chewing into its post-FOMC losses.

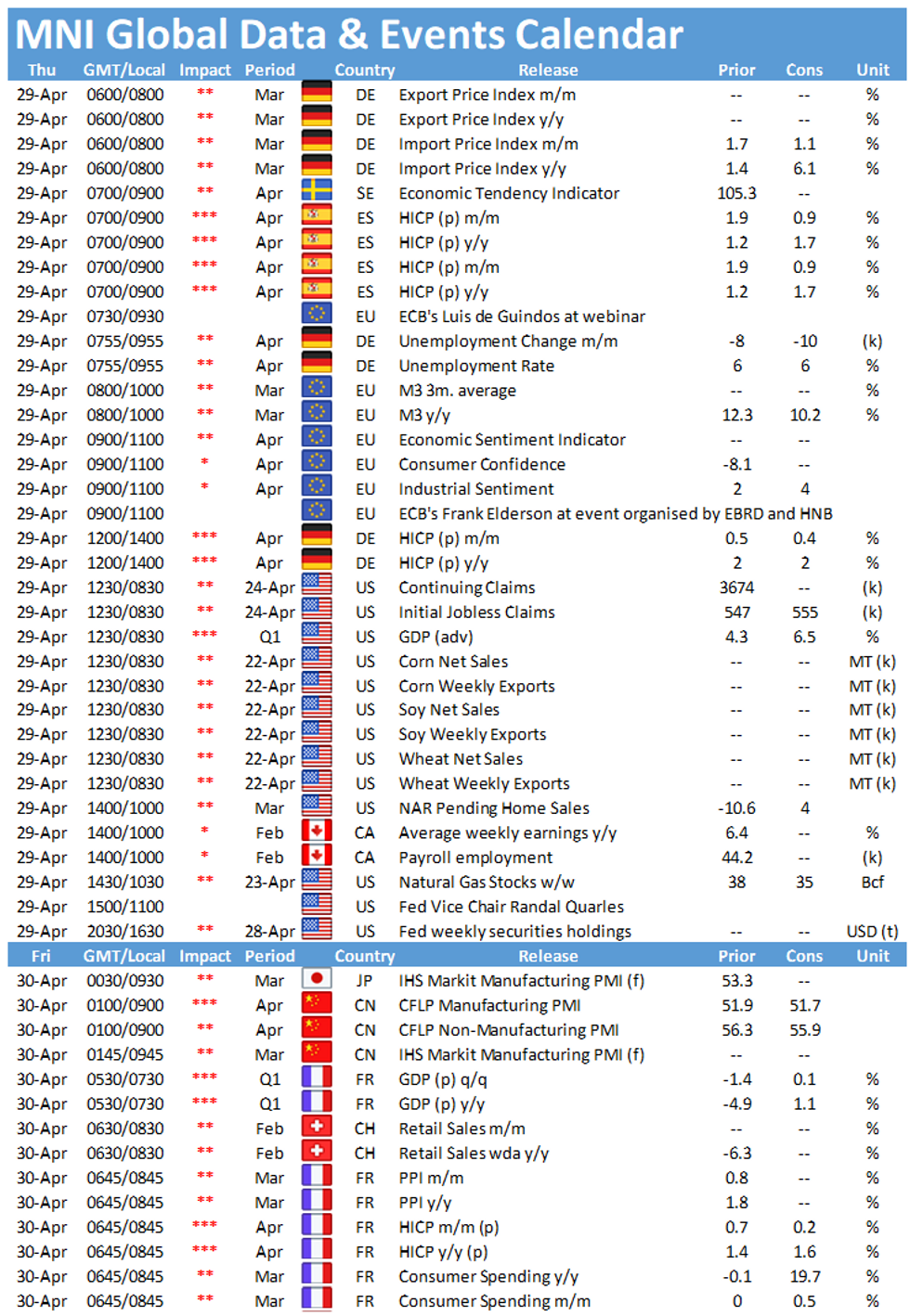

- The global data docket features U.S. GDP & initial jobless claims, German unemployment & flash CPI. Speeches are due from Fed's Quarles as well as ECB's de Guindos, Elderson, Weidmann & Holzmann.

FOREX OPTIONS: Expiries for Apr29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-1.1905(E1.4bln-EUR puts), $1.1940-50(E589mln), $1.2095-1.2110(E1.3bln), $1.2135-40(E562mln), $1.2200(E625mln)

- USD/JPY: Y106.25($1.3bln), Y106.60-70($1.5bln-USD puts), Y106.85-107.00($1.5bln), Y108.00-15($822mln), Y108.45-50($1.2bln-USD puts), Y108.65-75($526mln), Y108.95-109.00($1.4bln-USD puts)

- EUR/JPY: Y129.85-95(E1.1bln-EUR puts)

- GBP/USD: $1.3500(Gbp613mln)

- EUR/GBP: Gbp0.8500-20(E777mln)

- USD/CHF: Chf0.9200($1.1bln-USD puts)

- EUR/CHF: Chf1.0950(E602mln-EUR puts)

- AUD/USD: $0.7600(A$925mln-AUD puts), $0.7650-60(A$842mln-AUD puts), $0.7740-50(A$514mln)

- AUD/JPY: Y81.00(A$1.1bln-AUD calls)

- EUR/AUD: A$1.5385-1.5400(E830mln-EUR puts)

- USD/CAD: C$1.2220-30($815mln), C$1.2400($615mln), C$1.2450($815mln-USD puts), C$1.2550($1.15bln-USD puts)

- USD/CNY: Cny6.4500($570mln)

- USD/MXN: Mxn9.80($470mln), Mxn20.00($505mln)USD/ZAR: Zar14.20($1.1bln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.