-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Continues to Tighten Grip On Fintech

EXECUTIVE SUMMARY

- CHINA WARNS LARGE TECH FIRMS AS INDUSTRY FACES RISING OVERSIGHT (WSJ)

- ASTRAZENECA STRUGGLES WITH DATA NEEDED FOR COVID-19 VACCINE'S APPROVAL (WSJ)

- U.S. TOP DIPLOMAT BLINKEN TO VISIT UKRAINE NEXT WEEK (CBS)

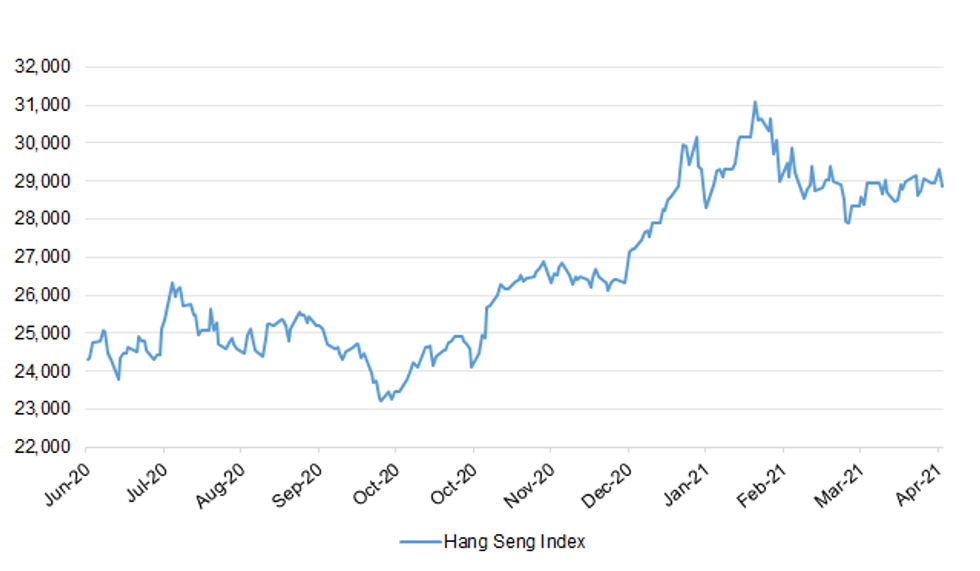

Fig. 1: Hang Seng Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Social distancing for large events can be scrapped from June 21, Boris Johnson will be told next week after initial results from a pilot scheme found no spike in Covid cases among attendees. (Telegraph)

CORONAVIRUS: American tourists may be allowed to travel to Britain next month as part of a plan to gradually reopen the U.K.'s borders, according to the head of London's Heathrow airport. Progress on Covid-19 vaccinations in the two countries could allow the U.S. to be included on the so-called Green List of countries from which people will be able to travel to Britain without quarantine, Heathrow Chief Executive Officer John Holland-Kaye said in an interview Thursday. (BBG)

BREXIT: The UK and Norway have failed to reach a fishing deal for this year, with the industry warning that hundreds of crew members will be left out of work. It means UK fleets will have no access to Norway's sub-Arctic waters, known for their cod catches. The government said its "fair offer" had been rejected in talks. The firm UK Fisheries called it a "disgrace", saying fishermen in Hull would be particularly badly affected by the lack of progress. In 2018, UK fleets landed fish worth £32m in Norwegian waters, according to the government. (BBC)

BREXIT/NORTHERN IRELAND: Ministers are to warn the European Union that failure to compromise on the Northern Ireland protocol risks further damage to the peace process after Arlene Foster's forced resignation. The government is concerned that the departure of Northern Ireland's first minister is likely to result in the Democratic Unionist Party hardening its stance against the protocol before assembly elections next year. (The Times)

POLITICS: The Conservatives have extended their polling lead over Labour before the local elections despite the furore over Boris Johnson's flat refurbishment and allegations of sleaze. A YouGov poll for The Times has found an 11-point gap between the Tories and Labour. The Conservatives are on 44 per cent, the same as a week ago, with Labour down one point on 33. (The Times)

EUROPE

FRANCE: France detected its first cases of contamination with the B.1.617 variant of the novel coronavirus, currently very present in India, the country's Health Ministry said in a statement late on Thursday. (RTRS)

ITALY: Italy's government gave its final approval to a package worth about 260 billion euros ($315 billion) to salvage the economy and address longstanding structural issues, drawing chiefly on European Union funds. A cabinet meeting hosted by Prime Minister Mario Draghi backed the recovery plan, which is due to be sent to Brussels by a Friday deadline, according to officials, who declined to be named on a confidential issue. The blueprint drafted by Draghi draws heavily on Italy's share of grants and loans under the EU's pandemic recovery fund, the largest portion allotted to a single country. The ex-head of the European Central Bank is counting on the funds to jump-start an economy that contracted 9% last year under the weight of the virus outbreak and a series of lockdowns. (BBG)

ITALY: Italy is targeting to reach herd immunity by the end of September, when about 80% of its population will have received a full vaccine, General Francesco Figliuolo, who's heading the country's vaccination campaign, said in remarks quoted by Ansa. Figliuolo said that Italy seeks to vaccinate about 60% of people by mid-July and that the nation can potentially administer 600,000 to 700,000 shots a day. (BBG)

ITALY: Italy's state lender Cassa Depositi e Prestiti has agreed to revise its offer for a controlling stake in Autostrade per l'Italia ahead of Atlantia's board meeting Friday, according to people familiar with the matter. (BBG)

SPAIN: Spain has finalised its landmark plan to spend €140bn from the EU coronavirus recovery fund as Pedro Sánchez's government seeks to respond to criticism that it has centralised control over the money and that the immediate economic impact may be less than hoped. The Socialist prime minister argues that the plan, set to be formally submitted for EU approval on Friday, will transform the country's economy in the same way that Spain's entry into the European Community did in 1986. In addition to the €70bn of grants that Madrid plans to tap between 2021 and 2023, the government intends to take out an equivalent amount of loans from 2024 to 2026. It has also proposed over 100 accompanying reforms. (FT)

PORTUGAL: Portugal will continue to gradually ease confinement measures as planned, with restaurants and stores allowed to have customers until later in the evening. From Saturday, shops can stay open until 7 p.m. on weekends and 9 p.m. during the week, Prime Minister Antonio Costa said at a press conference in Lisbon on Thursday night. Controls on the land border with Spain will be lifted. The number of daily coronavirus infections in Portugal eased in February and March after the country faced one of the world's worst outbreaks in January. The government said on Jan. 21 that the Covid-19 variant that emerged in the U.K. was spreading quickly, forcing it to implement strict confinement measures such as closing schools. (BBG)

IRELAND: Ireland will reopen swathes of its economy next month, Prime Minister Micheal Martin said, as the country's four-month lockdown comes to an end. Hair dressers and so-called click-and-collect retail will reopen on May 10, with non-essential stores to open fully a week later. The government will also ease restrictions on household gatherings and religious services, while some sporting activities can resume. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Germany (current rating: AAA; Outlook Stable) & Slovakia (current rating: A; Outlook Negative)

- Moody's on Norway (current rating: Aaa; Outlook Stable) & Poland (current rating: A2; Outlook Stable)

- S&P on the Czech Republic (current rating: AA-; Outlook Stable)

- DBRS Morningstar on Italy (current rating: BBB (high), Trend Negative)

U.S.

FED: Fed to release semi-annual financial stability report on May 6. (MNI)

FISCAL: Sen. Joe Manchin, the powerful West Virginia Democrat, made clear Thursday that the aggressive vision for the federal government that President Joe Biden laid out to the nation must first face scrutiny in Congress, signaling the long slog ahead facing the White House's sweeping domestic agenda. "Oh, most certainly," Manchin told CNN in a one-on-one interview when asked if he had concerns about Biden's push for a more expansive role of government. Manchin, who is a pivotal swing vote in the 50-50 Senate, said that with signs of a growing economy, on top of the trillions in spending already approved by Congress, lawmakers must be judicious in deciding where to pump additional resources. As he raised concerns about the price tag along with the proposed tax increases, Manchin reiterated his demand for Senate Democrats to work with Republicans and warned that he would oppose efforts by members of his party if they try to go it alone prematurely. (CNN)

FISCAL: Republican Senator Susan Collins says President Biden's infrastructure and family aid proposals "appears to be $4 trillion in spending and I am worried it would ignite inflation, which is very harmful to our economy and American families." Collins tells reporters she is now waiting for more details and "to see what we can do." (BBG)

CORONAVIRUS: New York City is moving to fully reopen by July 1 with arenas, gyms, stores, restaurants and hair salons returning, Mayor Bill de Blasio said. "This is going to be the summer of New York City," de Blasio said Thursday during a press briefing. "We're all going to get to enjoy this city again, and people are going to flock here from all over the country." Governor Andrew Cuomo, who has ultimate reopening authority, said he hopes the city can fully reopen before de Blasio's July 1 target, but isn't going to make projections. "I don't want to wait that long," he said. (BBG)

CORONAVIRUS: Chicago is broadly easing restrictions across industries to allow for higher capacity at restaurants, bars and large indoor venues as Covid-19 vaccinations increase, city officials said Thursday. (BBG)

CORONAVIRUS: Utah Governor Spencer Cox said that "any type of organization," from employers to churches to community groups, can request a mobile clinic to administer vaccines. Vaccine supply is outstripping demand in Utah, as is in the case in many places around the U.S. (BBG)

CORONAVIRUS: Colleges and universities should require all on-campus students to be vaccinated for the Covid-19 virus this fall, the American College Health Association said. (BBG)

POLITICS: More than half of Americans approve of President Joe Biden after nearly 100 days on the job, according to Reuters/Ipsos polling, a level of support that his Republican predecessor Donald Trump never achieved and one that should help Democrats push for infrastructure spending and other big-ticket items on Biden's agenda. (RTRS)

POLITICS: Donald Trump revealed on Thursday that he is "100%" thinking about running for president again in 2024 and would "certainly" consider Florida Gov. Ron DeSantis as his running mate. The former president made the comments during an exclusive interview on "Mornings with Maria" on Thursday, the morning after President Biden's address to a joint session of Congress during his most high-profile speech to the nation yet, on the eve of his 100th day in office. Trump noted that DeSantis is "a friend of mine" and "a great guy." (Fox)

EQUITIES: U.S. air-safety regulators have launched an audit into how a Boeing Co. factory tweak led to a safety problem with the plane maker's 737 MAX, according to people familiar with the matter, two years after a pair of fatal crashes prompted other fixes to the jet. As part of its audit, the Federal Aviation Administration is investigating why Boeing missed that a minor production change involving drilled holes wound up the root of potential electrical problems, these people said. (WSJ)

OTHER

CORONAVIRUS: AstraZeneca PLC executives have struggled to pull together the full data necessary to apply for U.S. approval of its Covid-19 shot, according to people familiar with the matter, further delaying its efforts to secure the Food and Drug Administration's go-ahead. (WSJ)

CORONAVIRUS: Japan is prepared to provide 300 respirators and 300 oxygen concentrators to India once talks are finalized, Japan's chief cabinet secretary Katsunobu Kato said on Friday. Kato did not specify when the respirators and concentrators would be delivered, saying that he hoped they would be provided "swiftly" once discussions with India were finalised. India is struggling to secure hospital beds and medical oxygen as it battles a surge in coronavirus cases. The death toll in India from the pandemic topped 200,000 on Wednesday. (RTRS)

CORONAVIRUS: Pfizer Inc's shipment of COVID-19 vaccine to Mexico this week includes doses made in its U.S. plant, the first of what are expected to be ongoing exports of its shots from the United States, a source familiar with the matter told Reuters on Thursday. (RTRS)

JAPAN: Japan's cabinet said on Friday it would spend 500 billion yen ($4.59 billion) from emergency reserves to support pandemic-hit businesses. (RTRS)

JAPAN: Japan should seek to maintain market trust in the country's stance of improving its fiscal health, Finance Minister Taro Aso says. Ramped-up government spending due to Covid-19 has worsened the nation's finances, but Japan should still seek to balance its primary balance by around fiscal year 2025, Aso tells reporters Friday. Currency markets and bond yields have generally remained stable due to market trust in the government's fiscal stance. Need to get the economy expanding steadily first to recover fiscal health. 500 billion yen ($4.6 billion) of reserve funds will be used to support regional governments in their coronavirus response; 4.5 trillion yen will remain in the virus reserve fund. (BBG)

BOJ: MNI INTERVIEW: BOJ Framework Set In Stone Until Kuroda Gone

- The Bank of Japan will be limited to policy fine-tuning until Governor Haruhiko Kuroda steps down in April 2023, with no great shift in the wider framework unless the economy takes off, a former Board member has told MNI. "Small fine-tuning may be possible but the framework of monetary policy will not change under Governor Kuroda unless the pace of economic recovery accelerates sharply," according to Makoto Sakurai, who stepped down from the BOJ's board on March 31 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI INTERVIEW: New BOJ Loan Facility If Needed - Ex-Official

- The Bank of Japan will consider a new lending facility to support banks if prolonged low interest rates start to impact financial intermediation, according to a former board member. The BOJ's statement that it will act swiftly to ease further if necessary and "without hesitation" means that the bank would if needed consider a temporary emergency new facility as, Makoto Sakurai, who stepped down from the BOJ board on March 31, told MNI on Wednesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NEW ZEALAND: Fonterra raises forecast 2020-21 NZ milk collection to 1,535m kg milksolids, from 1,525m. (BBG)

SOUTH KOREA: South Korea has decided to extend the current social distancing measures and the ban on gatherings of more than five people for another three weeks. Currently, Level 2 is in place in Seoul and surrounding regions, and Level 1.5 in other parts of the country. Acting Prime Minister Hong Nam-ki said Friday at a meeting of the Central Disaster and Safety Countermeasures Headquarters, "We cannot relax, with 661 confirmed cases of COVID-19 coming out the previous day." "In May, there will be Children's Day, Parents' Day, and Buddha's Birthday, which could increase the risk of spreading the infection," he said, adding that he decided to extend the special quarantine week for another week. (Korea Herald)

SOUTH KOREA: Vice Finance Minister Lee Eog-won says April CPI, which will be announced next week, is expected to gain more than 2% on base effect. Chance that annual inflation would exceed 2% target is limited. (BBG)

CANADA: Ontario's latest Covid-19 wave appears to be peaking, albeit at a very high level, as sweeping restrictions introduced earlier this month start to have an impact, along with efforts to vaccinate more people in virus hot spots. Officials cautioned, however, that because of an earlier swell in infections, intensive care units are still seeing fresh records in the number of virus patients. That's putting the hospital system under incredible pressure, according to data from the Ontario Covid-19 Science Advisory Table. "We still have a long journey in front of us and please know that the way down will be slower than the way up, particularly for our hospitals," Adalsteinn Brown, a doctor who is co-chair of the group, said in a news briefing Thursday. "So while we've had a good start, it's nothing more than that. We cannot afford a fourth wave." (BBG)

CANADA: Alberta will adopt new "targeted" public-health measures in an attempt to slow the spread of COVID-19, Premier Jason Kenney says. The province reported 2,048 new cases on Thursday, the highest single-day total since the pandemic began in March 2020. "Effective tomorrow, we are implementing targeted public-health measures for hot spots across the province," Kenney said at a news conference. "These are communities or regions where there are more than 350 active cases per 100,000 people and that have a floor of at least 250 total active cases. (CBC)

BOC: MNI INTERVIEW: BOC Will Taper to Avoid Market Squeeze - Dodge

- The Bank of Canada will keep paring back weekly government bond purchases to avoid amassing a stockpile that distorts market pricing, former Governor David Dodge told MNI, adding policy makers can manage 3% inflation through most of next year without seeking a deliberate overshoot like the Fed's - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexican Deputy Finance Minister Gabriel Yorio on Thursday told a news conference on public finances that a recent rise in inflation due to the coronavirus pandemic does not seem to be permanent. Speaking at the the same event, another finance ministry official said the Mexican central bank had room to hike interest rates without pressuring public finances. (RTRS)

MEXICO/RATINGS: Moody's affirmed Mexico at Baa1; Outlook Negative

BRAZIL: Brazil's Senate on Thursday approved a bill to suspend patent protection for COVID-19 vaccines, tests and medications during the pandemic, sending the proposal to the lower house of Congress for consideration and possible amendments. It remains unclear if lower house lawmakers will pass the bill, with implications for pharmaceutical firms such as AstraZeneca and China's Sinovac Biotech, which have arranged local production of their COVID-19 vaccines. U.S. firm Pfizer also made its first delivery of coronavirus vaccines to Brazil on Thursday evening. The government of President Jair Bolsonaro has publicly opposed proposals to suspend patent protections, arguing that such a move could endanger talks with vaccine producers. Brazil on Thursday saw its death toll from the pandemic pass 400,000, the second-highest tally in the world after the United States. Experts say that Brazil's slow vaccine rollout is likely to keep the daily death toll high for months. "We can't remain passively watching, day after day, 3,000 to 5,000 deaths. The opportunity is there, we must do our part," said Senator Nelsinho Trad, one of the backers of the bill. (RTRS)

BRAZIL: Brazil's govt is firmly committed to use safe, effective and approved vaccines, Health Minister Marcelo Queiroga said in Sao Paulo. Queiroga's remarks were made at the arrival of Pfizer's first batch of vaccines to Brazil. Brazil is capable of vaccinating 2.4m people a day 16.8m doses will be delivered over the next 6 days. Brazil will be self-sufficient in vaccines production, according to Communications Minister Fabio Faria. (BBG)

RUSSIA: U.S. Secretary of State Antony Blinken will visit Ukraine next week, CBS News reported on Thursday, with tensionsigh between Ukraine and Russia. (RTRS)

SOUTH AFRICA: The resurgence of the Covid-19 pandemic in India has prompted the South African government to consider introducing additional measures in order to stave off a third wave. Health Minister Zweli Mkhize told an online conference that a close eye was being kept on India, which has now the highest Covid-19 infection rate in the world. "The challenges we have seen in India are very serious," Mkhize said. "We have received an advisory from the ministerial advisory council that we have to consider some restrictions and we are now going through that," he said, without giving details. (BBG)

IRAN: The US said on Thursday that some progress has been made in negotiations on reviving the Iranian nuclear agreement in Vienna. World powers have been meeting in the Austrian capital over the last two weeks in a bid to get Tehran to return to compliance with a landmark 2015 nuclear accord. "We are now in the third round of what promises to be a multi-round exercise and it continues to be a venue where we have been able to engage indirectly with the Iranian delegation in largely thoughtful, businesslike, instructive dialogue, but there's still a great distance to travel," said State Department Spokesman Ned Price. (Arab News)

MIDDLE EAST: Iran on Thursday welcomed what it called a change of tone from Saudi Arabia and said it hoped they could work together to secure peace, amid moves to ease tensions between the regional rivals. (RTRS)

OIL: Libya's oil production target of 1.5 million barrels per day (bpd) by the end of 2021 depends on parliament approving the national budget quickly, Oil Minister Mohamed Oun told Reuters on Thursday. (RTRS)

OIL: The Dakota Access oil pipeline's operators plan to ask the U.S. Supreme Court to intervene in its ongoing legal battle to keep the line out of North Dakota open, according to a court filing on Thursday. The operators of the 570,000 barrel-per-day line, led by Energy Transfer LP, sought a stay from the U.S. Court of Appeals for the District of Columbia, saying it would allow the Dakota Access Pipeline (DAPL) to continue running. The U.S. District Court for the District of Columbia earlier this week ordered the U.S. Army Corps of Engineers to provide an update by May 3 on when it plans to complete an environmental review of the pipeline and whether it recommends the line should shut during the process. (RTRS)

CHINA

CORONAVIRUS: China must boost the production of vaccines and increase inoculation efforts to create a domestic line of defense against the Covid-19 virus, the People's Daily said citing Vice Premier Sun Chunlan. China has administered 244 million shots of vaccines and established 50,000 vaccination locations through the campaign, the country's largest in history, it said citing Sun. (MNI)

CORONAVIRUS: China has reached the "final stage" in approving the use of BioNTech's mRNA COVID-19 vaccine in cooption with Shanghai-based Fosun Pharma, the Global Times reported citing an interview with the German company's CEO Ugur Şahin. The developer is evaluating combining mRNA vaccines with inactivated and adenovirus vector jabs as booster shots to stabilize antibody levels against the coronavirus, Sahin was cited as saying. BioNTech is expected to be the first foreign-developed Covid-19 vaccine that China will import to pave the way for mixed shots in sequential inoculation, the newspaper said citing Shao Yiming, leading physician-scientist and immunologist serving at the Chinese Center for Disease Control and Prevention. (MNI)

FINTECH: China showed its resolve to tighten the supervision of fintech companies' activities and limit their operations within legal scopes, China News Service said in a commentary on its WeChat account after the People's Bank of China and three other top financial regulators on Thursday summoned 13 tech firms including Tencent and ByteDance for talks. The move, which came 17 days after the Ant Group was called in by the regulators, further reminded financial business to focus on serving the real economy and consumers and keep their financial risks in check, China News said. (MNI)

FINTECH: China is reining in the ability of the country's internet giants to use big data for lending, money-management and similar businesses, ending an era of rapid growth that authorities said posed dangers for the financial system. On Thursday, China's central bank and other regulators ordered 13 firms, including many of the biggest names in the technology sector, to adhere to much tighter regulation of their data and lending practices. Their aim, say analysts, is to curb a revolutionary business model that let China's Big Tech develop and use powerful payment apps and other information about hundreds of millions of users. (WSJ)

OVERNIGHT DATA

CHINA APR M'FING PMI 51.1; MEDIAN 51.8; MAR 51.9

CHINA APR NON-M'FING PMI 54.9; MEDIAN 56.1; MAR 56.3

CHINA APR COMPOSITE PMI 53.8; MAR 55.3

MNI DATA IMPACT: China April PMI Weakens To 51.1

- China's manufacturing activity as measured by the Purchasing Manager Index (PMI) fell to 51.1 in April from 51.9 in March, weakening slightly from the previous strong rebound but still higher than for the same period in 2019 and 2020, the National Bureau of Statistics said on Friday. The PMI registered a 14th-month expansion above the breakeven 50.0 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA APR CAIXIN M'FING PMI 51.9; MEDIAN 50.9; MAR 50.6

The Caixin China General Manufacturing PMI came in at 51.9 in April, its 12th straight month of expansion. The reading was the highest this year, indicating an accelerated recovery of manufacturing activity. To sum up, manufacturing demand and supply expanded significantly in April. Overseas demand remained solid and the job market recovered. Manufacturing growth remained strong as the post-epidemic economic recovery kept its momentum. Manufacturers stayed confident about the economic recovery and keeping Covid-19 under control as the gauge for future output expectations was still higher than the long-term average. In the future, the focus will be on inflation as the price gauges have maintained an upward trend for several months. Policymakers have expressed concerns about rising commodity prices on several occasions and urged adjusting raw material markets and easing businesses' cost pressure. In the coming months, rising raw material prices and imported inflation are expected to limit policy choices and become a major obstacle to the sustained economic recovery. (Caixin)

JAPAN MAR, P INDUSTRIAL OUTPUT +4.0% Y/Y; MEDIAN -0.6%; FEB -2.0%

JAPAN MAR, P INDUSTRIAL OUTPUT +2.2% M/M; MEDIAN -2.0%; FEB -1.3%

JAPAN MAR UNEMPLOYMENT 2.6%; MEDIAN 2.9%; FEB 2.9%

JAPAN MAR JOB-TO-APPLICANT RATIO 1.10; MEDIAN 1.09; FEB 1.09

JAPAN APR TOKYO CPI -0.6% Y/Y; MEDIAN -0.2%; MAR -0.2%

JAPAN APR TOKYO CORE CPI -0.2% Y/Y; MEDIAN 0.0%; MAR -0.1%

JAPAN APR TOKYO CORE-CORE CPI 0.0% Y/Y; MEDIAN +0.3%; MAR +0.3%

JAPAN APR, F JIBUN BANK M'FING PMI 53.6; FLASH 53.3

Latest PMI data pointed to a sustained expansion in the Japanese manufacturing sector at the start of the second quarter of 2021. Firms reported the quickest rates growth in both production and new orders since early-2018. Overall, the headline Manufacturing PMI was pushed to the highest level for three years. Improved operating conditions buoyed Japanese manufacturers to increase staffing levels for the first time since December. The pace of job creation was the quickest for 14 months, despite being only marginal overall. Japanese manufacturers continued to report a positive outlook for activity in the medium term. Close to 36% of panellists estimated that output levels would rise over the coming year. This was in line with the current IHS Markit forecast for industrial production to grow 7.7% in 2021, although this does not fully recover the output lost to the pandemic in 2020. Moreover, further disruption to the manufacturing sector cannot be ruled out as COVID-19 restrictions are reintroduced as infections rise once again. (IHS Markit)

JAPAN APR CONSUMER CONFIDENCE INDEX 34.7; MEDIAN 34.2; MAR 36.1

AUSTRALIA Q1 PPI +0.2% Y/Y; Q4 -0.1%

AUSTRALIA Q1 PPI +0.4% Q/Q; Q4 +0.5%

AUSTRALIA MAR PRIVATE SECTOR CREDIT +1.0% Y/Y; MEDIAN +0.8%; FEB +1.6%

AUSTRALIA MAR PRIVATE SECTOR CREDIT +0.4% M/M; MEDIAN +0.3%; FEB +0.2%

NEW ZEALAND APR ANZ CONSUMER CONFIDENCE INDEX 115.4; MAR 110.8

NEW ZEALAND APR ANZ CONSUMER CONFIDENCE +4.2% M/M; MAR -2.0%

SOUTH KOREA MAR INDUSTRIAL OUTPUT +4.7% Y/Y; MEDIAN +4.2%; FEB +0.9%

SOUTH KOREA MAR INDUSTRIAL OUTPUT -0.8% M/M; MEDIAN -0.5%; FEB +4.4%

SOUTH KOREA MAR CYCLICAL LEADING INDEX CHANGE +0.2; FEB +0.2

UK APR LLOYDS BUSINESS BAROMETER 29; MAR 15

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2779% at 09:28 am local time from the close of 2.2716% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 39 on Thursday vs 44 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4672 FRI VS 6.4715

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4672 on Friday, compared with the 6.4715 set on Thursday.

MARKETS

SNAPSHOT: China Continues to Tighten Grip On Fintech

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 218.13 points at 28839.34

- ASX 200 down 57.382 points at 7024.9

- Shanghai Comp. down 17.809 points at 3457.092

- JGB 10-Yr future up 3 ticks at 151.35, yield down 0.8bp at 0.090%

- Aussie 10-Yr future down 3 ticks at 98.300, yield up 2.6bp at 1.741%

- U.S. 10-Yr future -0-02 at 131-29+, yield up 0.72bp at 1.642%

- WTI crude down $0.38 at $64.63, Gold down $3.09 at $1769.22

- USD/JPY down 12 pips at Y108.81

- CHINA WARNS LARGE TECH FIRMS AS INDUSTRY FACES RISING OVERSIGHT (WSJ)

- ASTRAZENECA STRUGGLES WITH DATA NEEDED FOR COVID-19 VACCINE'S APPROVAL (WSJ)

- U.S. TOP DIPLOMAT BLINKEN TO VISIT UKRAINE NEXT WEEK (CBS)

BOND SUMMARY: Off Worst Levels In Lackluster Trade

T-Notes have edged away from lows. Regional participants were happy to sell Tsys at the cash re-open even as e-minis ticked lower (ESM1 back below 4,200), before softer than expected official Chinese PMI data helped the space form a base. The cash Tsy market was closed during yesterday's Asia-Pac session, owing to a Japanese holiday, with the same story in play Monday through Wednesday of next week (with a Chinese market holiday also set to sap liquidity over that period). T-Notes last -0-02 at 131-29+, operating in a 0-05+ range, with recent trade seeing a 3,750 lot block seller at the current market price. The cash space trades little changed to 1.0bp cheaper across the curve.

- JGB yields traded either side of unchanged in Tokyo, with little in the way of definitive direction observed across the curve, in a session that plugs a gap between 2 holiday periods. Futures last +2 vs. the previous settlement level. Local data was mixed, with Tokyo CPI missing, while the labour market report and industrial production reading proved to be firmer than expected.

- YM -1.0, XM -3.0, a little off their respective Sydney lows, in what has been fairly limited trade. Softer than expected official Chinese PMI data helped the space find a bit of a base after what seemed to be a case of offshore-related pressure (stemming from U.S. Tsys and heavy offers in the latest RBNZ LSAP operation). Next week's AOFM issuance slate proved to be relatively vanilla. Elsewhere, The latest round of ACGB Jun '31 supply saw the weighted average yield stop 0.73bp through prevailing mids at the time of supply (per Yieldbroker pricing), meanwhile, local private sector credit growth topped exp. Month-end extension flows are eyed, given the upcoming maturity of ACGB 5.75% 15 May 2021.

JAPAN: Muted International Security Flows Seen

The latest round of weekly international security flows data revealed a moderation in 3 of the 4 categories, in what was a muted week (ending 23 April) for the dataset.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 132.8 | 1006.3 | 3229.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -318.6 | -1145.2 | -2285.2 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 123.2 | 352.7 | 2271.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 492.2 | 288.3 | 2399.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.50% 21 Jun '31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:- Average Yield: 1.6882% (prev. 1.7161%)

- High Yield: 1.6900% (prev. 1.7175%)

- Bid/Cover: 3.3260x (prev. 2.8200x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 75.0% (prev. 82.4%)

- bidders 42 (prev. 39), successful 12 (prev. 15), allocated in full 4 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 5 May it plans to sell A$1.2bn of the 1.00% 21 November 2031 Bond.

- On Thursday 6 May it plans to sell A$1.0bn of the 27 August 2021 Note.

- On Friday 7 May it plans to sell A$800mn of the 0.25% 21 November 2024 Bond.

EQUITIES: China Fintech Pressure Weighs On Broader Equities

Equities traded on the defensive in Asia-Pac hours, although losses were generally modest. The Hang Seng was the exception to the "modest" rule, leading the way lower, shedding 1.5% as of typing, after the WSJ noted that "China is reining in the ability of the country's internet giants to use big data for lending, money-management and similar businesses, ending an era of rapid growth that authorities said posed dangers for the financial system. On Thursday, China's central bank and other regulators ordered 13 firms, including many of the biggest names in the technology sector, to adhere to much tighter regulation of their data and lending practices." U.S. e-minis also ticked lower. Participants eyed the potential for equity negative month-end rebalancing flows from funds, given the general outperformance for equities vs. bonds in the month of April (although most calculations point to fairly modest rebalancing flows, at least from a historical perspective). Softer than expected official Chinese PMI data (although still expansionary) also provided some headwinds, although the SME-focused Caixin m'fing PMI survey, also out of China, topped expectations.

OIL: Iran Talks & Equity Downtick Apply Weight

The previously flagged downtick in the major equity indices and suggestions of progress in the U.S.-Iran talks applied light pressure to crude oil in overnight trade. WTI & Brent both print ~$0.40 lower on the day, with no let up on the demand side given the ongoing COVID issues for India.

GOLD: A Touch Softer

Thursday's swings in U.S. yields drove gold prices, which ultimately softened, but finished off of worst levels. Spot has nudged lower again during Asia-Pac hours, but remains comfortably away from yesterday's low, to last trade -$5/oz, just above $1,765/oz, with bears needing to force a break through key support in the form of the April 5 low ($1,721.4/oz) to turn the technical tide.

FOREX: Chinese PMIs Provide Highlights Of Quiet Asia-Pac Session

The yuan faced some temporary headwinds as China's official PMI readings missed forecasts, but it regained poise ahead of the release of Caixin M'fing PMI, which topped expectations. USD/CNH tested yesterday's low in afternoon trade after a fresh round of sales. The PBOC set its central USD/CNY mid-point at CNY6.4672, 7 pips above sell-side estimates, with little in the way of market reaction seen after the fix.

- G10 crosses were happy to hug familiar ranges, with AUD outperforming at the margin. SEK lagged all of its peers from the basket, after bringing up the rear on Thursday.

- JPY ignored the local data deluge, despite a solid beat in flash industrial output. USD/JPY slipped over the Tokyo fix, as Gotobi Day flows failed to dictate price action, but the pair recouped most losses thereafter.

- Focus turns to GDP reports from Canada, Germany, Italy, France & EZ as well as U.S., PCE data & MNI Chicago PMI. Fed's Kaplan is due to speak.

FOREX OPTIONS: Expiries for Apr30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-60(E687mln), $1.2030(E734mln), $1.2050-65(E749mln), $1.2075(E676mln), $1.2100(E1.9bln-EUR puts), $1.2125(E546mln), $1.2150(E937mln)

- USD/JPY: Y108.50($837mln), Y109.25-30($715mln)

- GBP/USD: $1.3900(Gbp671mln)

- EUR/GBP: Gbp0.8600(E776mln)

- USD/CAD: C$1.2400($990mln-USD puts)

- USD/MXN: Mxn19.50($1.46bln)

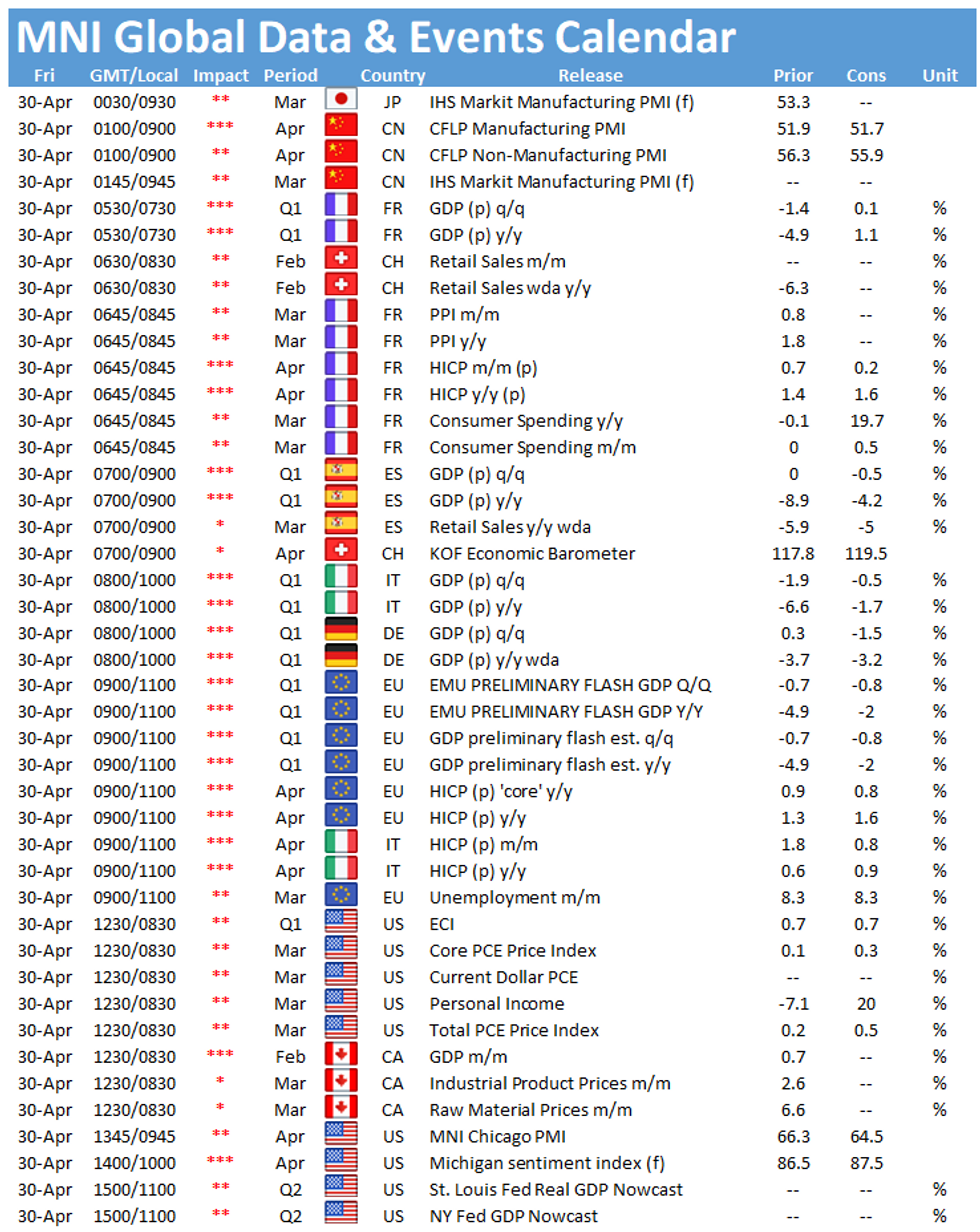

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.