-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Conflicting Views Re: The Future Of Fed Policy Remain Evident

EXECUTIVE SUMMARY

- FED COULD LIFT RATES TO 4% OR MORE, DUDLEY SAYS (MNI)

- U.S. TREASURY'S YELLEN TAMPS DOWN INFLATION FEARS OVER BIDEN SPENDING PLAN (RTRS)

- U.S. SEC STATE BLINKEN: CHINA ACTING 'MORE AGGRESSIVELY ABROAD' (CBS)

- WHITE HOUSE: 'NO DEAL' REACHED YET WITH IRAN TO LIFT ECONOMIC SANCTIONS (CNN)

- UK POLITICAL WINDS CONTINUE TO SWIRL

- GREENS KEEP POLL LEAD IN RACE FOR MERKEL'S CHANCELLERY (BBG)

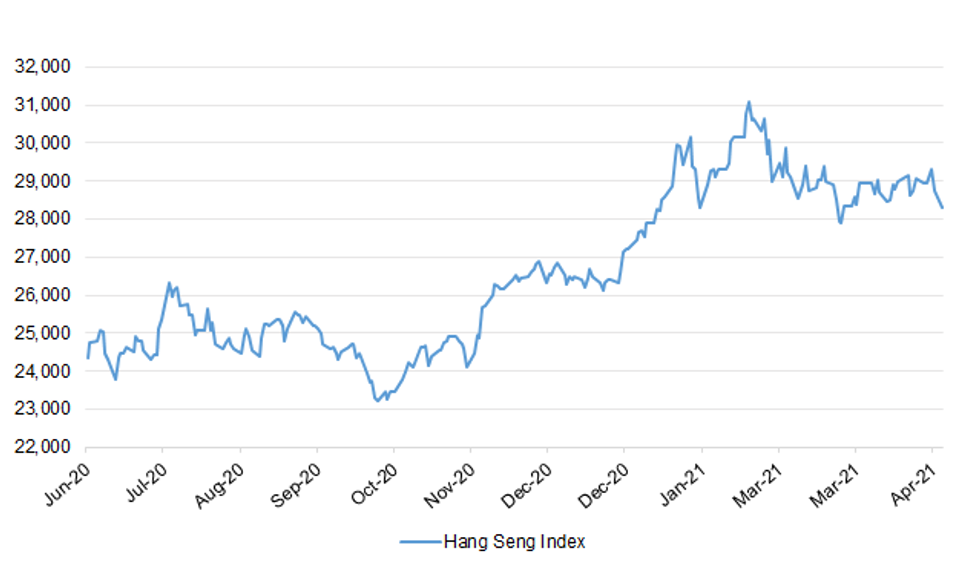

Fig. 1: Hang Seng Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The "one metre-plus" social distancing rule will be scrapped from June 21 under plans to ensure that all restaurants, pubs, theatres and cinemas can reopen fully, The Times understands. Masks will have to be worn in some cases to mitigate the risks but it will mean venues can reopen at full capacity for the first time in 15 months. Dominic Raab, the foreign secretary, confirmed yesterday that some coronavirus restrictions would remain beyond June 21, causing concern in hospitality. He said "conditions, counteracts and safeguards" would have to stay, adding: "They'll be something around masks." (The Times)

CORONAVIRUS: Foreign Secretary Dominic Raab suggested only a few restrictions will remain in the U.K. by mid-year, but warned people will need to be careful about social contacts in an interview with Sky News on Sunday. "We are very close now to really turning the corner and I think we still need to be careful as we go," Raab said. In a separate BBC interview, he said that "maybe there'll be something around masks" even after June 21, the date set by the government for lifting all restrictions. (BBG)

CORONAVIRUS: The 10-day "stay at home" rule for people contacted by NHS Test and Trace could soon be lifted if a major new government trial proves daily coronavirus tests are a suitable alternative. (Telegraph)

CORONAVIRUS: New modelling to be presented to ministers ahead of stage three of reopening on May 17 will show the risk of a "third wave" of Covid cases in the UK has diminished dramatically and may not happen at all, according to experts. The last set of projections, published by Sage on March 31, presented ministers with a difficult dilemma because they suggested a third wave of infections could be expected to kill another 15,000 to 20,000 people in the late summer if steps three and four of the exit roadmap were implemented as planned. (Telegraph)

CORONAVIRUS: Health officials are drawing up plans to offer the Pfizer vaccine to secondary school pupils from September. "Core planning scenario" documents compiled by NHS officials include the offer of a single dose to children aged 12 and over when the new school year starts. The plans, which have been confirmed by sources within the government and the NHS, depend on advice due this summer from scientists on the joint committee on vaccination and immunisation. But officials are preparing for a rollout in schools. A source said: "No decision has been made yet but we are drawing up planning materials for the different scenarios." (Sunday Times)

CORONAVIRUS: Boris Johnson faces a cabinet rift as ministers argue over how many holiday destinations should be on the government's "green list" for international travel, The Times understands. Cabinet ministers have privately urged the prime minister to overrule Matt Hancock, the health secretary, and Chris Whitty, England's chief medical officer, who are said to be pushing for only a "tiny" group of countries to be exempt from quarantine restrictions from May 17. (The Times)

CORONAVIRUS: Holidaymakers and airlines could get as little as one week's notice of the rules to allow overseas travel from England this month, as government sources insisted they would err on the side of caution when easing restrictions. Ministers are likely to announce on Friday that the ban on non-essential foreign travel will be lifted from 17 May, but it may not release the "traffic light" list of countries to which travel will be permitted until 10 May. (Guardian)

FISCAL/POLICY: Boris Johnson has approved a new legislative programme of more than 25 bills that will implement planning reform and a new state-aid regime, as he seeks to flesh out his post-pandemic economic recovery plan. The UK prime minister wants the programme, to be outlined in the Queen's Speech on May 11, to deliver the meat of the Conservative party's 2019 election manifesto and signal the start of a return to "normality" after Covid-19, according to people briefed on the plans. The Queen is expected to confirm in her speech — to be delivered by the monarch in person in a Covid-secure ceremony at Westminster — Johnson's ambition to reform the cash-starved social care sector. (FT)

BOE: The Treasury has come under pressure to appoint a woman to the Bank of England's ratesetting committee amid broader changes at the top of the central bank. Interviews with candidates to replace Gertjan Vlieghe, whose term on the monetary policy committee ends on August 31, have been completed and an announcement is expected soon.The Bank is separately hiring a new chief economist, who will also sit on the MPC, and a new executive director for financial stability. It has been pushing hard to improve gender diversity but has fallen short. Less than a third of senior staff were women at the end of last year and there is only one woman among the nine members of its key interest rate-setting committee. (The Times)

POLITICS: Conservative figures fear officials in the party's central office will be forced to "take the bullet" over the Downing Street flat refurbishment, as staff were told on Friday night that they could be jailed if they tried to cover up the paper trail. (Telegraph)

POLITICS: Labour has slashed the Tories' poll lead in half as more voters conclude that Boris Johnson is corrupt and dishonest ahead of this week's bumper set of local and devolved elections. The latest Opinium poll for the Observer shows the Conservative lead has fallen from 11 points to five points after a week in which the prime minister was at the centre of allegations over the refurbishment of his Downing Street flat, and criticised for reportedly saying he would rather see "bodies pile high" than order another Covid-19 lockdown. (Observer)

POLITICS: YouGov can reveal that current voting intention figures among those who plan to vote (or have already voted via postal ballot) in the upcoming local authority elections suggest that Keir Starmer's Labour party could be in for yet another tough night in their former heartlands. Across the councils included in our analysis, the last time these particular seats were contested the combined headline vote was: Conservatives 24%, Labour 42%, Lib Dems 10%, Greens 5% UKIP 12% and others 7%. From our fieldwork carried out from 16-28 April, we estimate that the current vote intention for the council elections on 6 May is: Conservatives 37%, Labour 38%, Lib Dems 6%, Greens 9%, Reform UK 3%, and others 6%. (YouGov)

POLITICS: Labour will fail to seize any councils from the Tories in this week's local elections as Keir Starmer struggles to capitalise on Boris Johnson's troubles over sleaze allegations, an exclusive poll reveals. (Telegraph)

POLITICS: Boris Johnson should resign if he is found to have broken government rules over his flat renovations, the Scottish Conservative leader has said. Douglas Ross told the BBC that people expected the highest standards of those in the highest office of the land. But the foreign secretary, Dominic Raab, insisted the prime minister had followed the rules and the newspaper stories were "gossip". (BBC)

SCOTLAND: Nicola Sturgeon is on course to win a majority at the Holyrood election on Thursday, a new poll for The Herald has found. The exclusive poll by BMG Research suggests the SNP is set to win 68 seats, while the independence question is neck and neck. (Scottish Herald)

SCOTLAND: The Scottish National Party is heading for a fourth term in office in Thursday's Holyrood election. But the SNP's hopes of winning a majority, which could be central to its independence hopes, are on a knife edge, according to a new poll. The latest Panelbase survey for The Sunday Times indicates that Nicola Sturgeon will win in Scotland, perhaps with a majority of only one. The Conservatives are set to remain as the official opposition in second place. The once dominant Scottish Labour, which was voted out of power in 2007, is further away than ever from returning to government. Despite high personal approval ratings for its new leader, Anas Sarwar, it is on course for its worst Holyrood election result. (Sunday Times)

SCOTLAND: Boris Johnson is planning to spend billions of pounds on new road and rail links and treating Scottish patients on English NHS beds in a desperate counter-offensive against Nicola Sturgeon. (Telegraph)

SCOTLAND: Boris Johnson is prepared to take the SNP to the Supreme Court to stop the party unilaterally holding a second Scottish independence referendum should it win next week's Holyrood elections. (Telegraph)

NORTHERN IRELAND: Northern Irish voters continue to oppose uniting the two sides of the island, a poll shows. Some 44% of Northern Irish voters are against unification and 35% are in favor, according to a survey for the Irish Independent, which polled 2,250 people across the island. While a majority in the south back the unification, both sides need to agree. (BBG)

EUROPE

ECB: European Central Bank policy maker Jens Weidmann said officials must be prepared to tighten monetary policy when needed to curb inflation, even if that increases the strain on heavily indebted governments. "We central bankers must clearly say that we will rein in monetary policy again when the price outlook demands it," the Bundesbank president said in an interview with Berliner Zeitung published Friday. "And irrespective of whether the financing costs for governments rise." Weidman said the institution risks becoming too entangled with fiscal policy through its massive bond purchases, which have been deployed repeatedly to calm markets and to boost inflation, and which were ramped up during the pandemic. (BBG)

GERMANY: Germany's Greens have cemented a robust advantage in the early stages of the election campaign, boosting their chances of capturing the chancellery in September and pushing through a heavily environmentalist reform agenda. Bolstered by a youthful image and strong climate credentials, the Greens surged past Angela Merkel's center-right bloc in three polls in the past week, with one putting them six points ahead at 28%. A new survey published Sunday confirmed the trend with Merkel's bloc falling to a 14-month low of 24%. The Greens lost 1 percentage point to 27%, still close to their biggest mark in about two years. The polls offer the first gauges of voter intent following the nomination of the parties' candidates, and the Greens' early momentum gives the former fringe party a realistic shot at leading a ruling coalition for the first time. (BBG)

NETHERLANDS: The Dutch government is postponing the lifting of some lockdown measures originally scheduled on May 11, according to local media citing a cabinet statement. Zoos, amusement parks and gyms will not open for the time being, with a review of the restrictions expected next week. (BBG)

AUTOS: Volkswagen AG's main car brand expects the global chip shortage to curb production of vehicles in the coming months, but the output of electric cars currently isn't affected by supply bottlenecks. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Slovakia at A; Outlook Negative

- Moody's affirmed Poland at A2; Outlook Stable

- DBRS Morningstar confirmed Italy at BBB (high); Trend Negative

U.S.

FED: MNI INTERVIEW: Fed Could Lift Rates To 4% Or More, Dudley Says

- The Federal Reserve may need to raise interest rates to at least 3.5% and perhaps even above 4% because its new framework will generate lags in responding to inflation that require more aggressive tightening later, former New York Fed President William Dudley told MNI. "The chances of a soft landing in this regime is virtually nil," Dudley said. "They're going to be late and that's by design. So when they start tightening they're going to have to go relatively quickly." When the Fed does eventually begin to raise interest rates it will have to keep doing so for some time Dudley said, much like during the "considerable period" phase under Alan Greenspan from 2004-2006. Dudley is surprised markets are only pricing in a rise in the federal funds rate to 2% because "that's lower than what the Fed says is neutral" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: U.S. Treasury Secretary Janet Yellen on Sunday tamped down concerns that President Joe Biden's plans for infrastructure, jobs and families will cause inflation, saying the spending will be phased in over a decade. "It's spread out quite evenly over eight to 10 years," Yellen, former Federal Reserve chair, said in an interview with NBC's "Meet the Press." She said the Federal Reserve will monitor inflation carefully and has the tools to address it if necessary. (RTRS)

CORONAVIRUS: The Biden administration said on Friday it is extending face mask requirements across all U.S. transportation networks through Sept. 13 to address the spread of COVID-19. The U.S. Transportation Security Administration (TSA) requirements that took effect on Feb. 1 were to set to expire on May 11. They cover workers and travelers at airports, on board commercial aircraft, on over-the-road buses, and on commuter bus and rail systems through Sept. 13. The Centers for Disease Control and Prevention (CDC) issued the federal mask mandate in nearly all transportation modes in late January, including on ride-share vehicles. The order does not apply to private cars or commercial trucks being driven by a sole operator. (RTRS)

CORONAVIRUS: New York City restaurants can expand their indoor dining capacity to 75% on May 7, New York Governor Andrew Cuomo announced on Friday. The announcement aligns New York City with the rest of the state, Cuomo said in a news release. Hair salons, barber shops and other personal care services also can open at 75% capacity on May 7, and gyms and fitness centers in the city can open at 50% capacity on May 15, Cuomo said. The easing of restrictions comes as new cases continue to fall in the state. (BBG)

CORONAVIRUS: Florida's surgeon general issued guidance saying that fully vaccinated people "should no longer be advised to wear face coverings or avoid social and recreational gatherings" except in undefined "limited circumstances." The guidance appeared to allow vaccinated Floridians to drop mask wearing indoors. Earlier this week the U.S. Centers for Disease Control and Prevention said fully vaccinated people were freer to not wear masks outdoors. (BBG)

CORONAVIRUS: Governor Kate Brown put 15 of Oregon's counties, about 80% of the population, under more severe restrictions as a new viral surge sweeps through a partially vaccinated population. The Democratic governor said hospitalizations have doubled in the last week. The restrictions prohibit indoor dining, put limits on religious gatherings and sharply curb capacity at gyms, movie theaters and other public venues. (BBG)

POLITICS: Top Republicans are turning on Rep. Liz Cheney, the party's highest-ranking woman in Congress, with one conservative leader suggesting she could be ousted from her GOP post within a month. The comments by Reps. Steve Scalise, the minority whip, and Jim Banks, chairman of the Republican Study Committee, carry weight because of their close relationship with House Minority Leader Kevin McCarthy (R-Calif.) — who is openly feuding with Chesney. (Axios)

EQUITIES: Warren Buffett's capital-deployment machine pulled back on several fronts at the start of the year as the billionaire took a more cautious stance on stocks. Berkshire Hathaway Inc.'s net stock sales in the first quarter were the second-highest in almost five years and the conglomerate, where the billionaire is chief executive officer, slowed its buyback pace, according to a regulatory filing Saturday. That helped push Berkshire's cash pile up 5.2% from three months earlier to a near-record $145.4 billion at the end of March. (BBG)

OTHER

U.S./CHINA: U.S. Secretary of State Antony Blinken said in an interview that aired on Sunday that China had recently acted "more aggressively abroad" and was behaving "increasingly in adversarial ways." Asked by CBS News' "60 Minutes" if Washington was heading toward a military confrontation with Beijing, Blinken said: "It's profoundly against the interests of both China and the United States to, to get to that point, or even to head in that direction." He added: "What we've witnessed over the last several years is China acting more repressively at home and more aggressively abroad. That is a fact." (RTRS)

U.S./CHINA: China has fallen short on its commitments to protect American intellectual property in the 'Phase 1' U.S.-China trade deal signed last year, the Biden administration's trade office said on Friday. The U.S. Trade Representative's "Special 301" report on intellectual property said that China had made amended its Patent Law, Copyright Law and Criminal Law last year and published several draft regulatory measures on IP. (RTRS)

U.S./CHINA: China's newly commissioned nuclear-powered submarine is armed with the country's most powerful submarine-launched ballistic missile (SLBM) capable of hitting the US mainland, according to a military source and analysts. (SCMP)

U.S./CHINA/TAIWAN: A comprehensive American strategy on China under President Joe Biden's administration is still in the works, but Washington has promised to approach the Taiwan issue with "steadiness and clarity and resolve." "The American position on this is quite straightforward," U.S. national security adviser Jake Sullivan said Friday at a virtual forum held by the Aspen Institute. "We believe in the 'One China' policy, the full implementation of the Taiwan Relations Act, the six assurances ... and we oppose unilateral changes to the status quo." (Nikkei)

UK/CHINA: Chinese investors have amassed a portfolio of UK businesses, infrastructure, property and other assets worth nearly £135 billion, almost twice as much as was previously suspected, an investigation reveals today. The swift and largely unnoticed buying spree includes at least £44 billion of purchases by Chinese state-owned entities. More than 80 of the 200 investments uncovered by The Sunday Times have taken place since 2019 as relations between Britain and China have grown increasingly tense. (Sunday Times)

GEOPOLITICS: China's Shandong aircraft carrier task group recently conducted an exercise in the South China Sea, the country's People's Liberation Army (PLA) said on Sunday. China has repeatedly complained about United States Navy ships getting close to islands it occupies in the South China Sea, where Vietnam, Malaysia, the Philippines, Brunei and Taiwan all also have competing claims. (RTRS)

GLOBAL TRADE: The global semiconductor shortage roiling a wide range of industries likely won't be resolved for a few more years, according to Intel Corp.'s new Chief Executive Officer Pat Gelsinger. The company is reworking some of its factories to increase production and address the chip shortage in the auto industry, he said in an interview with CBS News. (BBG)

GLOBAL TRADE: German Finance Minister Olaf Scholz said a global deal on minimum corporate taxes is possible within months, citing signals of support by President Joe Biden's administration. "I'm convinced we'll finish up a global minimum tax on corporate profits this summer," Scholz, the Social Democratic Party's candidate for chancellor in Germany's September election, told Funke Media Group in an interview. "The American administration is on board with it now." (BBG)

CORONAVIRUS: With the resumption of global travel on the horizon, some people are discovering that their choice of vaccine could determine where they're allowed to go. Already, the European Union is planning to allow Americans vaccinated with shots approved by their drug agency to enter over the summer, European Commission president Ursula von der Leyen suggested in a New York Times interview Sunday. This means that those who have shots by Chinese makers like Sinovac Biotech Ltd. and Sinopharm Group Co. Ltd. are likely to be barred from entry for the foreseeable future, with stark consequences for global business activity and the revival of international tourism. As inoculation efforts ramp up around the world, a patchwork of approvals across countries and regions is laying the groundwork for a global vaccine bifurcation, where the shot you get could determine which countries you can enter and work in. (BBG)

CORONAVIRUS: The World Health Organization cleared Moderna's Covid-19 shot for emergency use, making it the fifth vaccine to receive its green light. The WHO's expert group recommended the inoculation for all age groups 18 and above in its interim assessment in January. The WHO has also listed the Pfizer shot, the AstraZeneca vaccines made by SK Bio and the Serum Institute of India, as well as the Johnson & Johnson shot. (BBG)

CORONAVIRUS: People who haven't fought off Covid-19 before are still vulnerable to infection from variants after getting the first dose of Pfizer Inc. and BioNTech SE's vaccine, underscoring the need for fast and full inoculation regimens, according to a U.K. study published Friday. Among those who previously had mild or asymptomatic cases of Covid, the protection was "significantly enhanced" after a single dose against the variants first seen in the U.K. and South Africa, researchers said in the study, published Friday in the journal Science. (BBG)

CORONAVIRUS: Talks starting this week between the U.S. and World Trade Organization over expanding access to vaccines will focus on how to get them "widely distributed, more widely licensed, more widely shared," according to White House Chief of Staff Ron Klain. "We're going to have more to say about that in the days to come," he said. Trade Representative Katherine Tai is leading the U.S. side, Klein said on CBS's "Face the Nation" on Sunday. "Intellectual property rights is part of the problem, but really, manufacturing is the biggest problem," he added. India, South Africa and other countries are seeking a WTO waiver to more ease intellectual property protections for Covid-19 vaccines. The U.S. administration is reluctant to let countries force drug makers to turn over proprietary know-how. (BBG)

CORONAVIRUS: President Joe Biden will restrict travel from India starting Tuesday on the advice of the Centers for Disease Control and Prevention as India battles a deadly second wave of coronavirus infections. The policy will not apply to American citizens, lawful permanent residents or other exempted individuals, according to a White House official. People in those categories will still have to test negative prior to travel, quarantine if unvaccinated and retest as negative upon entering the U.S., as is required for all international travelers. "The policy will be implemented in light of extraordinarily high COVID-19 caseloads and multiple variants circulating in the India," White House press secretary Jen Psaki said in a statement. (NBC)

CORONAVIRUS: Foreign Secretary Dominic Raab said the U.K. will be sending 1,000 ventilators "very shortly" to India to help the country cope with a surge of coronavirus cases that's overwhelming hospitals. "We've said that will do whatever we can, whatever they ask for," Raab told Sky News on Sunday. "We have also looked at these oxygen generators like mini-factories. That's the thing they need right now." (BBG)

CORONAVIRUS: Mexico's president said on Friday that he's seeking another 5 million Covid-19 vaccine doses from the U.S., his latest appeal to countries including Russia and China to help the nation speed up its vaccination pace. The U.S. already lent Mexico over 2.7 million vaccines in March and April, and declined to comment about whether it plans to share more shots with its southern neighbor. (BBG)

JAPAN: Japan's government will approve the use of Moderna Inc.'s Covid-19 vaccine as soon as May 21, the Yomiuri newspaper reported Saturday without attribution. The Moderna vaccine would be the second to get approved in Japan and will be used in the nation's large inoculation centers that will open in Tokyo and Osaka from May 24, the paper said. Currently, only the Pfizer Inc. vaccine is cleared for use in Japan. (BBG)

JAPAN: VLP Therapeutics, a U.S.-based company, will apply for Japanese approval for its coronavirus vaccine by next month and aims to start clinical trials there by summer, the Nikkei reported on Saturday, without saying where it got the information. (BBG)

NEW ZEALAND/CHINA: New Zealand's differences with China are becoming "harder to reconcile," the prime minister Jacinda Ardern has said, as she called on China "to act in the world in ways that are consistent with its responsibilities as a growing power". Ardern's comments were made as New Zealand's government comes under increasing pressure, both internally and from international allies, to take a firmer stance on concerns over human rights abuses of Uyghur people in China's Xinjiang province. Last week, the Act party presented a motion for New Zealand's parliament to debate whether the treatment of Uyghurs in Xinjiang constitutes genocide – a motion that Labour will discuss this week. "Managing the relationship is not always going to be easy and there can be no guarantees," Ardern said in her speech to the China Business Summit on Monday. "We need to acknowledge that there are some things on which China and New Zealand do not, cannot, and will not agree." (Guardian)

SOUTH KOREA: Retail traders who drove record gains in South Korean stocks during the darkest days of the pandemic are bracing for a new threat -- the return of institutional players betting on share-price declines. The world's longest ban on short-selling stocks came to an end on Monday. Stocks fluctuated between gains and losses. Nevertheless, the end of the ban has individual investors scrambling for strategies to protect their portfolios. Some have cashed out large chunks of their holdings over recent weeks, while others are toying with the idea of trying short selling themselves. One influential group, the Korea Stockholders Alliance, has even vowed to gather day traders into a force to fight short sellers -- much the same way their U.S. peers took on Wall Street over GameStop Corp. -- if equities begin to tumble. (BBG)

NORTH KOREA: North Korea is pushing back at President Joe Biden's comment labeling the country a serious threat, and issued new warnings to South Korea for not stopping activists from sending anti-Pyongyang leaflets across the border. (BBG)

NORTH KOREA: The Biden administration's policy toward North Korea "is not aimed at hostility" but at "achieving the complete denuclearization of the Korean peninsula," a top aide said. National Security Adviser Jake Sullivan spoke hours after North Korea labelled President Joe Biden's recent comment that the country's nuclear program is a threat as "intolerable". (BBG)

ASIA: The top economic policymakers of South Korea, China and Japan on Monday called for vigilance against uneven economic recovery across the countries and increased downside risks amid the pandemic. The finance ministers and central bank governors of the three nations virtually held their annual trilateral meeting to discuss ways to promote economic cooperation amid the COVID-19 pandemic. The financial chiefs said the economic outlook for the Northeast Asian countries has improved on the back of continued policy support and the vaccine rollout. "However, we should remain vigilant as the economic recovery has been uneven across and within member economies, uncertain and subject to elevated downside risks," said a joint statement issued after the trilateral meeting. (Yonhap)

BOC: In line with its objectives to support core funding markets and to foster the well-functioning of the Government of Canada securities market, the Bank of Canada is announcing changes to securities repo operations (SROs). The maximum total bidding amount across all securities in the SRO will increase to $4,000 million for each eligible participant effective Monday, May 3, 2021. The maximum bid rate will remain at 15bps. The terms and conditions of the SRO provide operational details. (Bank of Canada)

MEXICO: Petroleos Mexicanos said on Friday its net loss narrowed 93% to $1.8 billion in the first quarter after higher sales, lower imports and tax cuts eased pressure on Mexico's highly indebted state oil company. The loss of 37.3 billion pesos was down from 562.1 billion pesos in the year-ago quarter, said Pemex, as the company is known, in a filing with the Mexican stock exchange. Foreign exchange movements, financing costs and derivatives all racked up losses that offset its total income of 317.6 billion pesos ($15.7 billion). Even so, income was up 12% from the year-ago quarter as sales in Mexico and to other countries grew, and prices recovered. (RTRS)

BRAZIL: Brazilian Economy Minister Paulo Guedes will not leave his post while the coronavirus pandemic continues, he told O Globo newspaper. Guedes added that Brazil's economy will grow 3% in 2022, the next electoral year. Guedes estimated that President Jair Bolsonaro supported about 65% of his liberal agenda, though he said the Brazilian leader was completely on board when he was elected in 2018. Now, he said, that agenda has less political urgency. (BBG)

BRAZIL: Brazil reached a self-imposed daily Covid-19 vaccination goal, but a shortage of shots poses a risk to the immunization plan going forward. The seven-day moving average of shots given rose to 1 million for the first time since applications started in mid-January. (BBG)

BRAZIL: Rio de Janeiro suspended the administration of the second dose of Sinovac vaccine for 10 days because of shortages, O Globo reported citing the city hall. Vaccine stock in the city has run out, as in other municipalities in Rio de Janeiro state. (BBG)

BRAZIL: Brazilian oil workers union FUP is planning a strike on Monday to force Petrobras to adopt new measures to contain the spread of coronavirus at the Campos Basin, according to a statement. The union is demanding additional COVID-19 tests and N95 masks, as FUP said more than 500 workers have been infected in April. (RTRS)

RUSSIA: Talks are in the works for a summit between President Biden and Russian President Vladimir Putin this summer, National Security Advisor Jake Sullivan said Friday. The meeting is likely to occur in a third country, but it is not yet clear where. (Fox)

SOUTH AFRICA: Pfizer has committed to sending 4.5 million doses of its COVID-19 vaccine to South Africa by June, with some 300,000 set to arrive Sunday, Health Minister Zweli Mkhize has announced. (Axios)

IRAN: White House officials on Sunday denied Iranian state media reports that the US has reached an agreement with Iran to lift economic sanctions against the country, saying that there is still much to be negotiated over the coming weeks. US and Iranian officials held talks in Vienna last month aimed at bringing the United States back to the 2015 nuclear deal and Iran back into compliance with it. "There is no deal now," national security adviser Jake Sullivan said Sunday on ABC News' "This Week," adding that "there's still fair distance to travel to close the remaining gaps." (CNN)

IRAN: Iranian Supreme Leader Ayatollah Ali Khamenei publicly rebuked the country's foreign minister for parroting the "words of the enemy" after a leaked tape emerged where the top diplomat disagreed with the strategies of a revered Iranian general. Khamenei said the comments by Mohammad Javad Zarif in an interview published by a dissident, London-based news channel last week were "shocking," and that they shouldn't be repeated. The leader added in his statement on state TV on Sunday that Iran's Foreign Ministry was mostly responsible for executing diplomatic policy, rather than designing it. (BBG)

MIDDLE EAST: The Saudi air defenses destroyed an explosive-laden drone that was launched towards the kingdom's southern region, Saudi state TV said late on Sunday, citing a statement by the Saudi-led coalition fighting in Yemen. (RTRS)

OIL: Iran expects to export as much as 2.5 million b/d of crude after the removal of US sanctions as the third round of talks between Tehran and some signatories to the nuclear agreement concluded in Vienna amid hopes of Washington removing oil sanctions on Tehran. "Oil sales have dropped much. But the conditions are better now and we are more in control of the situation," Vice President Eshaq Jahangiri was quoted as saying May 1 by oil ministry news service Shana. "We have the possibility to increase oil exports up to 2.5 million barrels of oil after removal of the sanctions." (Platts)

OIL: Russia increased its oil production in April thanks to a more generous OPEC+ quota. The nation pumped 42.81 million tons of crude and condensate last month, according to preliminary data from the Energy Ministry's CDU-TEK unit. That equates to 10.46 million barrels a day, or 1.9% more than in March. (BBG)

OIL: Iraq's federal oil exports, excluding those from the semi-autonomous Kurdish region, were little changed in April, the oil ministry said May 2, signaling that OPEC's second-biggest producer was still struggling to adhere to its OPEC+ quota. Exports were 2.947 million b/d in April compared with 2.945 million b/d in March, the ministry said in a statement. (Platts)

OVERNIGHT DATA

AUSTRALIA APR, F MARKIT M'FING PMI 59.7; FLASH 59.6

The manufacturing PMI surging to the highest on record is an encouraging sign for the recovery of the Australian economy from COVID-19 restrictions. Despite evidence of an increase in new COVID-19 cases globally, demand rose both domestically and externally, reflecting resilient economic conditions. Supply constraints however continued to propel a surge in input cost inflation, even as lockdowns eased, which may be worth continued scrutiny moving forward. Broadly, however, the improvements in the outlook and hiring suggest that business confidence continues to pick up in the Australian economy. (IHS Markit)

AUSTRALIA APR AIG M'FING PMI 61.7; MAR 59.9

The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) increased by a further 1.8 points to 61.7 points in April 2021 (seasonally adjusted), indicating a stronger pace of expansion. This was the highest monthly result for the Australian PMI® since March 2018 and a seventh consecutive month of recovery from the severe disruptions of COVID-19 in Q2 of 2020. This month's strong result was the third highest rate of growth since the Australian PMI® moved to a monthly format in May 2001 and the fifth highest since the Australian PMI® commenced (as a quarterly series) in 1992. Results above 50 points indicate expansion, with higher results indicating a faster rate of expansion. All six manufacturing sectors in the Australian PMI® expanded in April 2021, as did all seven activity indicators. The Australian PMI® capacity utilisation index hit a record high for this series, which suggests employment and/or investment may need to step up in order to facilitate further growth from here. Indeed, many respondents said they plan to invest in facilities, equipment, staff and/or overall capacity over the next three to six months. (AiG)

AUSTRALIA APR ANZ JOB ADVERTISEMENTS +4.7% M/M; MAR +7.8%

ANZ Australian Job Ads rose 4.7% m/m in April, its 11th straight monthly gain, signalling strong labour demand growth has continued post-JobKeeper. Job Ads is now up 27.8% on its pre-pandemic level. ANZ Job Ads has been a good indicator of the speed of the labour market recovery so far. It has risen for 11 months straight to be equivalent to 1.4% of the labour force (highest since late-2011), while the unemployment rate has dropped almost 2ppt since July 2020 to 5.6% in March. It is not surprising that ANZ Job Ads has continued to rise post-JobKeeper. Businesses looking to hire new workers are, on the whole, unlikely to be those that were heavily dependent on the JobKeeper payment. We estimate 100,000-150,000 people will have lost or will lose employment in the months following the end of JobKeeper. But we've also seen almost 160,000 additional people employed over the past two months. Strong labour demand should mean that many (but not all) will be able to find work elsewhere relatively quickly. ANZ Job Ads is still signalling ongoing declines in the unemployment rate. In the May SoMP due on Friday, we think the RBA may upgrade its outlook to forecast an unemployment rate of around 5% by the end of this year. This would still be above the likely rate of full employment (NAIRU). While Treasury now estimates NAIRU at 4.5-5%, RBA Governor Lowe has said that he was sure it was below 5% and it was "entirely possible" that it could be in the 3s. So the unemployment rate may need to fall a lot further to generate enough wage growth and inflation. But something that garners less attention is the influence of underemployment on wages growth. In March, the under-employment rate fell below 8% for the first time since mid-2014, which was encouraging, but we think it will need to fall a lot further. (ANZ)

AUSTRALIA APR CORELOGIC HOUSE PRICE INDEX +1.8% M/M; MAR +2.8%

AUSTRALIA APR MELBOURNE INSTITUTE INFLATION +2.3% Y/Y; MAR +1.8%

AUSTRALIA APR MELBOURNE INSTITUTE INFLATION +0.4% M/M; MAR +0.4%

SOUTH KOREA APR TRADE BALANCE +$388MN; MEDIAN +$3.105BN; MAR +$4.132BN

SOUTH KOREA APR EXPORTS +41.1% Y/Y; MEDIAN +42.0%; MAR +16.5%

SOUTH KOREA APR IMPORTS +33.9% Y/Y; MEDIAN +29.6%; MAR +18.8%

SOUTH KOREA APR M'FING PMI 54.6; MAR 55.3

April data marked a sustained improvement in the health of the South Korean manufacturing sector, as the latest Manufacturing PMI painted a different picture to 12 months ago. A continued recovery from pandemic-related disruption carried on at the start of the second quarter of 2021. South Korean firms recorded further increases in both output and new orders in the latest survey period, as businesses reported improved demand, particularly in the technology sector. External demand also rose at a solid pace in April, driven by recoveries in Asia and North America. Outstanding business rose at the fastest pace for 11 years in April, with the additional pressure on capacity encouraging firms to expand workforce numbers for the second month running. South Korean goods producers remained optimistic in their outlook for activity over the coming year. Firms were hopeful that a wider economic recovery would drive demand for newly launched products in both domestic and external markets. IHS Markit currently estimates industrial production will expand by 5.5% in 2021. (IHS Markit)

MARKETS

SNAPSHOT: Conflicting Views Re: The Future Of Fed Policy Remain Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 2.419 points at 7023.4

- Shanghai Comp. is closed

- JGBs are closed

- Aussie 10-Yr future down 0.5 ticks at 98.295, yield up 0.8bp at 1.754%

- U.S. 10-Yr future unch. at 132-01, cash Tsys are closed

- WTI crude down $0.25 at $63.33, Gold up $5.03 at $1774.16

- USD/JPY up 28 pips at Y109.59

- FED COULD LIFT RATES TO 4% OR MORE, DUDLEY SAYS (MNI)

- U.S. TREASURY'S YELLEN TAMPS DOWN INFLATION FEARS OVER BIDEN SPENDING PLAN (RTRS)

- U.S. SEC STATE BLINKEN: CHINA ACTING 'MORE AGGRESSIVELY ABROAD' (CBS)

- WHITE HOUSE: 'NO DEAL' REACHED YET WITH IRAN TO LIFT ECONOMIC SANCTIONS (CNN)

- UK POLITICAL WINDS CONTINUE TO SWIRL

- GREENS KEEP POLL LEAD IN RACE FOR MERKEL'S CHANCELLERY (BBG)

BOND SUMMARY: Marching To The Beat Of The Equity Drum

T-Notes have traded either side of unchanged but haven't threatened to close the opening gap lower from Friday's late NY highs. As a reminder, cash Tsys are closed until NY hours owing to the observance of Japanese & UK holidays, which limited broader activity, with just over 50K T-Notes changing hands as of typing. The early dip, facilitated by a bid in e-minis, was perhaps countered by the move lower in the Hang Seng/e-minis pulling back from best levels. It is worth noting that the weekend saw U.S. Tsy Secretary Yellen again play down the inflationary impulse stemming from President Biden's fiscal support schemes, once again highlighting the idea that the Fed has the capability and tools to deal with those sort of issues if they develop. Elsewhere, Iran sent out positive overtures re: the U.S. lifting sanctions, although the U.S. was quick to note that a deal is yet to be struck.

- Sydney trade was relatively narrow, leaving YM +0.5 & XM -0.5 at typing, with the curve holding steeper vs. settlement throughout Sydney trade, perhaps aided by the presence of the RBA purchasing ACGBs maturing in '25 to '28. On the semi front, SAFA is considering tapping its 2.75% May '30 select line bond.

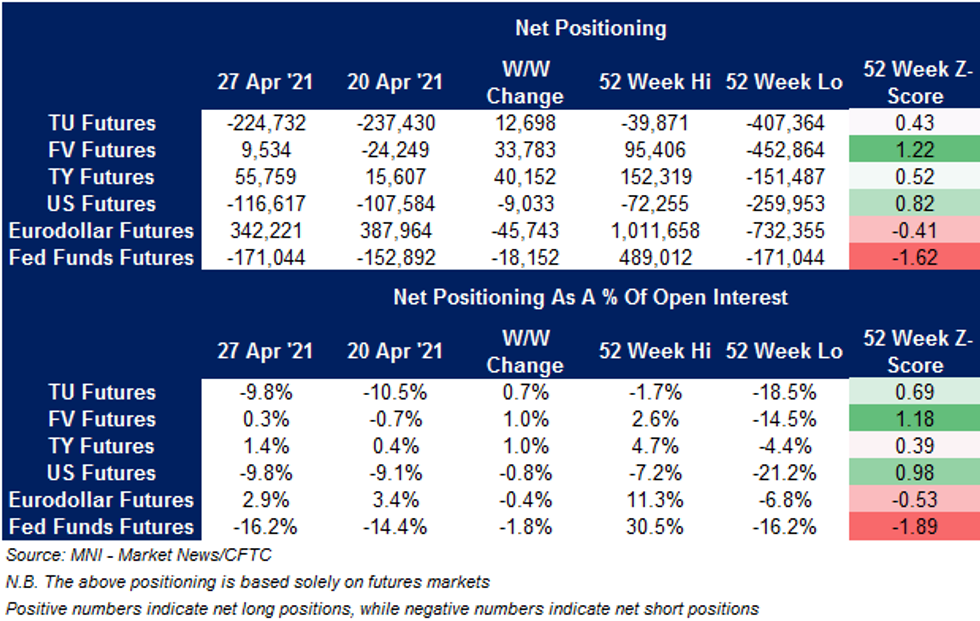

US TSY FUTURES: STIR Positions Provide The Highlight In The Weekly CFTC Report

The latest weekly CFTC CoT report saw non-commercial TU net shorts trimmed, while non-commercial FV net positioning flipped back into long territory and non-commercial TY net length extended. Non-commercial positioning in US futures was the exception among the major Tsy futures contracts, with the net short position there extending. Positioning remained shy of the recent respective extremes across all 4 contracts.

- Non-commercial net length in Eurodollar futures pulled back to the lowest level witnessed since July '20, as the recent run in reduction of net length extended.

- Non-commercial net shorts in Fed Funds futures continued to extend, edging closer to the extremes that were last witnessed in '19.

EQUITIES: Hang Seng Struggles Again

The Hang Seng has provided the most notable move in the Asia-Pac region, shedding ~1.5% on Monday, adding to Friday's losses which were linked to a Chinese clampdown on the fintech space, with broader trade thinned by holidays in both Japan & China (both will return on Thursday). Elsewhere, the remaining major indices in the region were little changed to lower on the day. U.S. equity index futures were a little more resilient, unwinding some of their Friday losses, with U.S. Tsy secretary Yellen once again trying to play down any fears re: inflation surrounding the U.S. fiscal impulse.

OIL: A Few Cents Lower

WTI & Brent sit ~$0.10 lower on the day, with the talks surrounding Iranian sanctions initially showing some promise over the weekend, although the U.S. was quick to enforce the notion that no deal had been made re: the rollback of sanctions on the Middle Eastern state. There was little else to go off, with a lack of fresh developments on the broader COVID front.

GOLD: As You Were

Holiday-thinned trade made for a tight range in Asia-Pac hours, with spot bullion last dealing a handful of dollars higher, just above $1,770/oz, comfortably within the confines of the well-documented technical parameters that we flagged at the backend of last week.

FOREX: Risk Appetite Recovers, Holidays Limit Activity

Participants abandoned safe havens in holiday-thinned Asia-Pac trade as e-minis inched higher, suggesting that Friday's Wall Street rout may have run its course. The yen led losses in G10 FX space, with USD/JPY extending its rally to a three-week high.

- Antipodean currencies outperformed, with NZD taking the lead, drawing support from positive risk sentiment & firmer iron ore prices. NOK also traded on a firmer footing, even as crude oil futures gave away their initial upticks.

- USD/CNH caught a light bid, extending its move away from recent two-month lows. There was no PBOC fix, with the next one coming up when onshore Chinese markets re-open on Thurday.

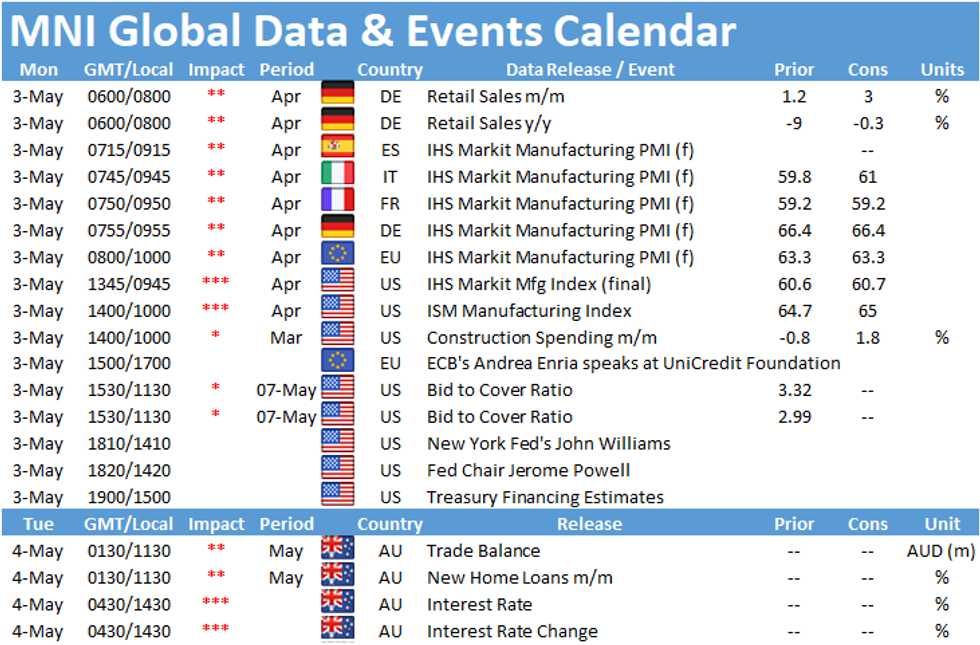

- Market closures in China, Japan, UK & Australia's Queensland/Northern Territory limit liquidity today. Global economic docket features a suite of M'fing PMI readings & comments from Fed Chair Powell.

FOREX OPTIONS: Expiries for May03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E881mln), $1.1950(E653mln), $1.2045-50(E765mln)

- USD/JPY: Y108.50($580mln), Y108.80($600mln)

- GBP/USD: $1.3700(Gbp1.3bln), $1.4300(Gbp1.1bln)

- AUD/USD: $0.7790-00(A$824mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.