-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NFPs In View

EXECUTIVE SUMMARY

- BIDEN TEAM LIKELY TO PROCEED ON TRUMP'S CHINA INVESTMENT BAN (BBG)

- CHINA 2021 CONSUMER INFLATION TO BE LOWER THAN 3% TARGET (DAILY)

- CHINA, U.S. TO OFFER CLASHING WORLD VIEWS AT UN EVENT FRIDAY (BBG)

- STRONG CHINESE EXPORTS DELIVER WIDER THAN EXPECTED TRADE SURPLUS IN APR

- UK CONSERVATIVES POSIED TO TAKE HARTLEPOOL MP SEAT

- NEW CONCERNS AS INDIAN COVID VARIANT CLUSTERS FOUND ACROSS ENGLAND (GUARDIAN)

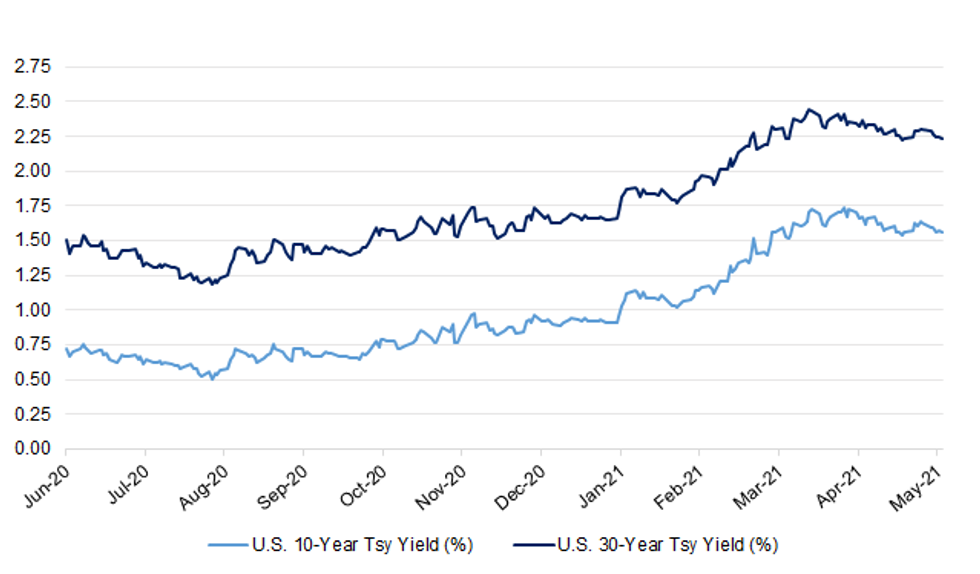

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Clusters of the Indian variants of Covid-19 have been found across England, including in care homes, the Guardian has learned, amid growing fears about the speed with which they are spreading in communities. The latest update of case numbers of these variants was due to be published on Thursday. But leaked emails seen by the Guardian show the announcement was delayed until at least Friday because of the local elections. The documents also suggest officials from Public Health England are poised to escalate one of the variants to one "of concern". (Guardian)

CORONAVIRUS: People under the age of 40 are to be offered an alternative to the AstraZeneca vaccine as evidence grows that younger people are more likely to be affected by rare blood clots linked to the jab, The Independent can reveal. The policy currently applies to the under-30s, but the Joint Committee on Vaccination and Immunisation (JCVI) has recommended that the age threshold be raised after Britain's medicines regulator reported new figures on clots last week. (Independent)

CORONAVIRUS: Boris Johnson will defy trade union pressure and announce on Monday that secondary school children will no longer have to wear face masks in class, The Telegraph understands. (Telegraph)

BREXIT: The EU ambassador to the UK has vowed that the bloc will not be "bureaucratic" as it seeks urgent solutions to the Brexit border issue that has stoked political tensions and civic unrest in Northern Ireland. João Vale de Almeida said the EU was fully aware of the volatile situation in the region and that it had an "emotional" commitment to finding a solution "sooner rather than later". There have been months of growing anger in the pro-UK unionist community in Northern Ireland over post-Brexit checks on trade coming through the "Irish Sea border" between Great Britain and the region. (FT)

BREXIT: Boris Johnson and President Macron will try to restore the "brotherly" relationship between Europe's biggest military allies after yesterday's stand-off over fishing rights in Jersey. Government officials admitted that relations were "not where we want them to be" after the deployment of naval vessels by both countries. The two leaders are expected to speak over the coming days to reset an alliance that has hit a new post-Brexit low after disputes about fishing, vaccines and financial services. A senior government source said that both sides were keen to "dial down the rhetoric" before next month's G7 summit. "We're a bit like a pair of brothers," the source said. "We're the closest allies and there is no fundamental unhappiness but things are bumpy." (The Times)

BREXIT: Brussels rallied behind France in its dispute with Jersey on Thursday as the fishermen behind a seven-hour blockade of the Channel island threatened to return and begin a fresh "scallop war" with Britain. (Telegraph)

ECONOMY: Recruitment activity is rebounding at the fastest pace in 23 years as employers respond to what many see as the brighter outlook for the economy. According to the monthly Report on Jobs produced by KPMG and the Recruitment and Employment Confederation, permanent hires rose in April at the fastest rate since records began in 1997 and advertised vacancies grew more rapidly than at any point since 1998. The increase in temporary hires also was close to historic highs, expanding for a ninth straight month. (The Times)

POLITICS: Shadow transport secretary Jim McMahon has conceded defeat in the Hartlepool by-election, telling the BBC that Labour "hasn't got over the line". Speaking at the Hartlepool count, Mr McMahon said: "It's quite clear when we see the ballots landing on the table that we just haven't got over the line on the day… that's clearly very disappointing." (BBC)

POLITICS: Sir Keir Starmer is coming under pressure to reshuffle his shadow cabinet next week as his party braces for a disappointing set of local election results. Labour MPs on the front and back benches believe that the leader must carry out a root-and-branch reshuffle of his top team, which they say lacks political punch. (The Times)

EUROPE

CORONAVIRUS: Germany Thursday opened up the use of the Oxford/AstraZeneca coronavirus vaccine for everyone over the age of 18 in order to speed up immunization efforts, Health Minister Jens Spahn announced. Speaking at a press conference in Berlin following talks with Germany's 16 state-level health ministers, Spahn said the vaccine should become available to all, regardless of their medical history. "We agreed today to completely abolish the prioritization of AstraZeneca's vaccine — this means that when vaccinations are administered in doctors' offices, it is the doctors who decide who is to be vaccinated and when, at their own discretion," he said, adding that "the vaccine can only be administered after the patient has been informed [about potential risks] by the doctor and an individual decision has been made." (POLITICO)

FRANCE: French economic growth will slow in the second quarter as renewed curbs to contain the resurgent pandemic delay the more robust recovery that is expected in other countries, forecasts from the national statistics bureau Insee show. The French economy had proved resilient at the start of the year, growing 0.4% in the first quarter while the euro area as a whole slid into recession. Yet for the current quarter, Insee forecasts the growth rate will decelerate to around 0.25% after the government implemented a strict lockdown in April that will lift only gradually in May and June. (BBG)

ITALY: Italian Prime Minister Mario Draghi has abandoned a project backed by his predecessor to create a single national fiber network controlled by Telecom Italia SpA, in a bid to boost competition among carriers and employ a wider set of technologies including 5G services. The government's project to improve the country's digital services will be structured around competitive tenders in multiple areas and will be designed to grant wholesale access to third parties, a senior government official said. Italy's recovery plan earmarks 6.7 billion euros ($8 billion) to boost investment in ultra-wide broadband to achieve universal coverage across the entire country, the official added, asking not be named discussing the plan. (BBG)

SWEDEN: Swedish apartment prices rose by 10% in April from a year earlier, while house prices increased by 19%, the most in a twelve-month period ever, according to statement from Svensk Maklarstatistik. Apartment prices rose 3% on a 3-month basis and unchanged m/m. House prices rose 8% on a 3-month basis and by 2% m/m. About 11,800 apartments were sold in April, which is 31% more than in April last year. About 5,300 houses were sold in April, which is 2% more than in same month last year. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Stable) & France (current rating: AA; Outlook Negative)

- Moody's on Italy (current rating: Baa3; Outlook Stable)

U.S.

FED: The economic outlook is brightening but more improvements are needed to the labor market and inflation before the Federal Reserve will start to scale back monetary support, Cleveland Fed Bank President Loretta Mester said on Thursday. The U.S. economy is still short more than 8 million jobs from before the pandemic and inflation is expected to trend down next year after a temporary increase, Mester said. "My view is policy is going to have to remain very accommodative for some time because we want that recovery to broaden," Mester said during a virtual conversation organized by the University of California, Santa Barbara. (RTRS)

FED: MNI BRIEF: Fed's Bostic Predicts About 1 Million Jobs Print

- Atlanta Fed President Raphael Bostic said Thursday he foresees a payrolls report coming in Friday in the range of 1 million, but that wouldn't be enough to convince him to start talking about tapering bond buys. "I'm just going to keep my head down," he said, adding that any number tomorrow short of 6 million jobs would not be enough. Bostic spoke to reporters after giving remarks at a Consumer Financial Protection Bureau research conference - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Warns Little Visibility On Hedge Fund Leverage

- Leveraged hedge funds could generate big losses and make the financial system more vulnerable, the Federal Reserve warned Thursday in its semi-annual report on financial stability, as it noted limited data available on risk exposure of nonfinancial investors - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: A Million US Jobs Seen Added In April Surge

- U.S. job growth surged in April as widely available vaccines and stimulus money fueled business confidence, recruiters and industry experts told MNI, though a significant labor shortage threatens to slow the market's recovery. After months of practicing some caution in hiring, employers in April were "just optimistic," said Tom Gimbel, president and CEO of the LaSalle Network, with caution "out the window" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI:US Employers Offer Hiring Bonuses to Combat Labor Shortage

- A labor shortage threatening to derail the job market recovery is driving employers to offer greater benefits like hiring bonuses to coax workers back to the market, industry experts told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden on Thursday said he wants to see a corporate tax rate "between 25 and 28" percent, setting down a new marker in the ongoing negotiations over how to fund a major infrastructure bill. "The way I can pay for this, is making sure that the largest companies don't pay zero, and reducing the [2017 corporate] tax cut to between 25 and 28," Biden said at an event in Louisiana. "That's a couple hundred billion dollars, and we can pay for these things." (CNBC)

FISCAL: Senate Minority Leader Mitch McConnell said Thursday that there is a "real chance" some Democrats and the White House could work with Republicans to pass a "bipartisan" infrastructure bill, a shift from other comments he made this week that Republicans are "100%" focused on stopping President Biden. (FOX)

CORONAVIRUS: Illinois is on track to fully reopen without capacity limits as soon as June 11, Governor J.B. Pritzker said. The state will move to the bridge phase of the reopening on May 14, he said, though plans could change if the metrics worsen. (BBG)

CORONAVIRUS: Los Angeles County is easing restrictions on capacity limits from theme parks to restaurants starting Thursday after meeting the threshold to move to the least restrictive yellow tier. The county's test positivity rate on Wednesday was 0.7%. Theme parks will now be able to boost their capacity to 35% and open their doors for fully-vaccinated out-of-state visitors. Bars will be able to operate indoors at a 25% cap, with that limit rising to 50% for breweries and wineries. The capacity limit for restaurants, gyms and movies theaters will also increase to 50%. (BBG)

CORONAVIRUS: Minnesota will lift almost all restrictions by Memorial Day on May 31 and a statewide mask mandate will end by July 1, Governor Tim Walz said. "We're going to have a summer where just the simple pleasures will be back," the Democratic governor said at a news conference. (BBG)

MARKETS: In a hearing focused on the frenzied trading of GameStop stock, the new S.E.C. chairman suggests more disclosure is needed. Gary Gensler is putting transparency in the markets and the need to understand the impact of new technology at the top of his priority list as the new chairman of the Securities and Exchange Commission. "I think transparency is at the heart of efficient markets," Mr. Gensler said during his first testimony on Capitol Hill as the nation's top securities cop. (New York Times)

OTHER

U.S./CHINA: The Biden administration is likely to maintain pressure on China by preserving limits on U.S. investments in certain Chinese companies imposed under former President Donald Trump, six people familiar with the matter said, bucking entreaties from Wall Street to ease the restrictions. Biden officials are still in preliminary discussions about Trump's investment bans on companies linked to China's military, which included three of the country's biggest telecommunications firms, the people said. No decision has been made. (BBG)

U.S./CHINA: President Joe Biden warned Thursday that Congress needs to adopt his multi-trillion dollar spending plans to renew the US economy because China is "eating our lunch." (AFP)

U.S./CHINA: China should be responsible for warning and protecting people in the path of its falling rocket, according to Jim Cooper, chair of a House subcommittee that oversees U.S. space programs. "The Chinese Communist Party has repeatedly shown a blatant disregard for space safety, this time by not even predicting where the Long March 5 rocket body could land, much less helping those below," Cooper, a Tennessee Democrat, said in an emailed statement. Cooper helped lead a joint hearing on Wednesday between two U.S. House subcommittees about what kinds of international agreements could help regulate behavior in space.

EU/CHINA: The EU should not risk the Comprehensive Agreement on Investment with China and be "hoodwinked" by the U.S. into joining its campaign containing China, the China Daily said in an editorial. China won't yield if the EU is holding the deal hostage to compel China to lift sanctions on its lawmakers, which were countermeasures to EU sanctions of Chinese individuals for "alleged human rights violations" in Xinjiang, the official English-language newspaper said. The agreement was reached after seven years of negotiation and not a gift to China, the daily said. (MNI)

GEOPOLITICS: The top diplomats from China and the U.S. will showcase their diverging views on how to address regional and global crises at a United Nations Security Council event on Friday. U.S. Secretary of State Antony Blinken and China's Foreign Minister Wang Yi will be joined at the virtual session by several other foreign ministers as they debate how to strengthen the international system. The meeting will be led by China, which holds the rotating presidency of the Security Council this month and has criticized U.S. efforts to rally regional blocs in Asia and Europe against Beijing. Blinken plans to use his speech to make clear that the U.S. wants to defend a rules-based, international system which it sees as increasingly under threat by Beijing's actions in places like the South China Sea, Hong Kong & Xinjiang region, senior state department officials said. (BBG)

CORONAVIRUS: Germany on Thursday rejected a U.S. proposal to waive patent protection for COVID-19 vaccines, saying the greatest constraints on production were not intellectual property but increasing capacity and ensuring quality. (RTRS)

HONG KONG: Hong Kong health authorities are expected on Friday afternoon to announce plans to shorten the city's mandatory three-week quarantine period for fully vaccinated inbound travellers as well as close contacts of Covid-19 patients, the Post has learned. A revision of the existing 21-day quarantine arrangements for more than a thousand residents of Royalton I in Pok Fu Lam and a block at Caribbean Coast in Tung Chung – where a coronavirus variant was discovered – was also to be announced, according to a source familiar with the decision-making process. (SCMP)

JAPAN: Japanese Prime Minister Yoshihide Suga is set to extend a virus state of emergency that includes Tokyo to the end of May and expand it to cover two more regions hit by rising case numbers, public broadcaster NHK said Friday. The move, which comes less than three months before the capital is set to host the Olympics, will add the industrial region of Aichi and the southern prefecture of Fukuoka to areas subject to restrictions. (BBG)

RBA: MNI BRIEF: RBA Upgrades Forecasts, Key Targets Still Distant

- The Australian economy is transitioning to expansion phase "earlier and with more momentum than anticipated," but even though the Reserve Bank of Australia has upgraded its growth, employment and wages forecasts it would still be around three years before key targets were met - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: New South Wales has reported no new locally acquired coronavirus cases on the first full day of new restrictions in the state, but contact tracers are still working to find the source of an infection in a man who had no links to overseas travel or hotel quarantine. No new locally acquired cases of Covid-19 were detected in the 24 hours between 8pm Wednesday and 8pm Thursday, out of 13,339 tests. There were five new cases in hotel quarantine. (Guardian)

AUSTRALIA: Australia's international borders may not completely open until the middle or the second half of 2022, the Australian Financial Review said, citing reported comments Friday by Trade Minister Dan Tehan. (BBG)

NORTH KOREA: Unification Minister Lee In-young said Friday that North Korea is not likely to carry out major provocations ahead of summit talks between the United States and South Korea slated for later this month. "We cannot rule out all possibilities of North Korea raising tensions but many experts say that the chances of the North heightening military tensions ahead of the South Korea-U.S. summit remain relatively low," Lee told a local radio show. (Yonhap)

TURKEY: Turkey's finance minister said on Thursday gross domestic product (GDP) will grow at a more than 5 percent rate this year, helped along by export growth of between 16% to 20% after a pandemic-hit 2020. (RTRS)

TURKEY: Turkey's finance minister said on Thursday that the central bank has maintained its tight monetary policy stance "at the moment", after the bank held its key interest rate steady at 19% earlier in the day as expected. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said he wanted to be at the at Senate Inquiry Committee that investigates federal govt action during the pandemic, he said during a live broadcast on social media this Thursday. Inquiry committee was too harsh on Health Minister Marcelo Queiroga. Bolsonaro said he never saw anyone dying due to use of hydroxy-chloroquine There is nothing for the government to be accused of, he said. (BBG)

SOUTH AFRICA/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on South Africa (current rating: Ba2; Outlook Negative)

IRAN: The U.S. and Iran could revive their nuclear agreement with world powers as early as this month if the government in Tehran proves its willingness to rein in its atomic work in exchange for sanctions relief, according to a U.S. official. Diplomats will enter a fourth round of indirect nuclear talks in Vienna on Friday with sides closing in on an agreement that could restore the accord struck in 2015 and abandoned by the Trump administration three years later. A decision to rejoin the deal would arguably be President Joe Biden's riskiest foreign policy move a little more than 100 days into office. The agreement with Iran has riven the U.S. from some Middle East allies and deeply divided domestic politics. (BBG)

IRAN: There are still big gaps between the U.S. and Iranian positions on what a mutual return to the 2015 nuclear deal looks like, a senior State Department official told reporters on Thursday ahead of the next round of talks in Vienna. The talks are at a critical stage as key deadlines approach, after which a deal could be much harder to reach. The official said an agreement could be reached within a few weeks, but that the Iranian position will have to change significantly to make that happen. (Axios)

COPPER: Chile's lower house approved introducing progressive taxes on copper sales in what could become one of the heaviest levies in global mining, potentially stalling investments and boosting prices. Lawmakers, who had already approved a bill to introduce a flat 3% on sales of both copper and lithium, on Thursday voted 78 to 55 to add a mechanism of marginal rates as copper prices rise, with the highest bracket set at 75%. In doing so, the world's biggest copper industry now moves closer to what the local mining society describes as an "almost expropriatory" system. Its proponents, including Communist Party representative Daniel Nunez, said the new mechanism would reap $7 billion a year at a time when Chile is looking to resolve lingering inequalities. Opposed by the government, the bill now goes to senate. (BBG)

OIL: OPEC and its allies have overproduced their quotas by a cumulative 3.316 million b/d through the end of March, with Russia and Iraq the most egregious offenders, according to an internal document seen by S&P Global Platts. Under the terms of the OPEC+ agreement, each country must compensate for any excess production with cuts of equivalent volume below its quota by the end of September. The extra cuts, if fulfilled, could go a long way towards speeding the market's rebalancing, or provide the OPEC + alliance some breathing room to relax quotas for the rest of its members, though the figures show scant progress has been made on this compensation over the past few months. (Platts)

OIL: Indian state refiners on Thursday placed orders for regular supplies from Saudi Aramco for June, after reducing purchases this month, drawn by lower prices by the world's top oil exporter, four sources said on Thursday. (RTRS)

CHINA

INFLATION: Rise in China's consumer prices in 2021 will be significantly lower than the target of about 3%, state-run Economic Daily reports, citing an interview with Sheng Laiyun, vice head of the National Bureau of Statistics. Impact of industrial product price rise on consumer prices is limited as supply of many products exceeds demand. Quarterly Y/y GDP growth will slow this year due to the base effect, report says, without giving specific forecast. (BBG)

ECONOMY: A marginal slowdown in China's growth is to be expected as the post-pandemic recovery approaches the potential of 5.8%, said Sheng Laiyun, a deputy director of the Nation Bureau of Statistics, who commented on Q1 0.6% m/m growth being the second-slowest on record, the Economic Daily reported. China's economy won't be weakening even as GDP growth may slow quarter by quarter, as shown by "relatively strong" indicators including March PMI of 51.9 and April's 51.1, while retail sales and manufacturing investment will improve with the domestic spread of the coronavirus contained and supporting policies take hold, Sheng was reported as saying. (MNI)

PROPERTY: Larger banks in China's southern city Shenzhen are likely to raise mortgage rates following moves by China Construction Bank, which raised 15bp for first-time home buyers and 35bp for those buying second or more properties, the 21st Century Business Herald reported. The rate hike by CCB happened on the same day when the Shenzhen government published a report enforcing curbs on property speculation, the newspaper said. Lenders are also reducing mortgage loan sums available while applications are more stringent with longer process periods, it said. (MNI)

OVERNIGHT DATA

CHINA APR TRADE BALANCE +$42.85BN; MEDIAN +$27.70BN; MAR +$13.80BN

CHINA APR TRADE BALANCE +CNY276.50BN; MEDIAN +CNY129.50BN; MAR +CNY87.98BN

CHINA APR EXPORTS +32.3% Y/Y; MEDIAN +24.1%; MAR +30.6%

CHINA APR EXPORTS CNY +22.2% Y/Y; MEDIAN +12.5%; MAR +20.7%

CHINA APR IMPORTS +43.1% Y/Y; MEDIAN +44.0%; MAR +38.1%

CHINA APR IMPORTS CNY +32.2% Y/Y; MEDIAN +33.6%; MAR +27.7%

MNI DATA IMPACT: China April Foreign Trade Shows Strong Growth

- China's foreign trade reported another strong month in April, with exports of labour intensive products and mechanical and electrical products and imports of commodities showing rapid growth, data from the General Administration of Customs showed on Friday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA APR CAIXIN SERVICES PMI 56.3; MEDIAN 54.2; MAR 54.3

CHINA APR CAIXIN COMPOSITE PMI 54.7; MAR 53.1

The Caixin China General Services Business Activity Index rose to 56.3 in April, up from 54.3 the previous month and staying in expansionary territory for 12 months in a row. The reading hit the highest level this year, signalling an accelerated recovery of the services sector. Services supply and demand both expanded at a faster pace than the previous month and continued the upward trend for the 12th consecutive month. Both gauges hit this year's highest levels. Overseas demand recovered fast despite resurgence of Covid-19 cases in some countries. The measure for new export orders bounced sharply back to positive territory in April. The job market continued improving along with market recovery. Service companies added staff gradually to meet market demand. The gauge for employment has stayed in expansionary territory in eight out of the past nine months, reflecting the continuity of services recovery. Outstanding orders declined slightly as an increased number of staff finished part of orders. Price gauges remained at a high level and inflationary pressure heightened. Input costs increased faster last month than the previous one, maintaining expansion for the 10th month in a row, amid rising raw material prices and demand-driven higher labor costs. Prices set by service providers rose along with costs. Surveyed enterprises said strong market demand provided some room for them to raise prices. Entrepreneurs remained confident. Although the gauge for business expectations slightly declined from the previous month, it stayed significantly above the long-term average. Surveyed service providers were confident about the control of the epidemic and the economic recovery. (Caixin)

JAPAN MAR LABOUR CASH EARNINGS +0.2% Y/Y; MEDIAN -0.2%; FEB -0.4%

JAPAN MAR REAL CASH EARNINGS +0.5% Y/Y; MEDIAN 0.0%; FEB +0.1%

MNI DATA IMPACT: Japan March Wages Up; Real Pay Positive

- Average wages in Japan rose 0.2% y/y in March, recording the first rise in 12 months following a 0.4% drop in February. Real wages remained in positive territory, up 0.5% in March, according to preliminary data released Friday by the Ministry of Health, Labour and Welfare - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN APR, F JIBUN BANK SERVICES PMI 49.5; FLASH 48.3

JAPAN APR, F JIBUN BANK COMPOSITE PMI 51.0; FLASH 50.2

Japanese service sector businesses signalled a further step towards stability in April, with activity falling at the softest pace since January 2020. The loosening of COVID-19 restrictions at the end of March also led to a broad stabilisation in incoming business as firms continued to adjust to operating under softer containment measures. At the same time, tentative signs of improving demand conditions buoyed business to take on additional staff, as businesses remained confident that service sector ac Overall private sector activity expanded for the first time in 15 months in April as manufacturers posted the sharpest rise in output for three years. Private sector firms also noted the strongest uptick in incoming business since May 2019. Confidence about the outlook for private sector activity remained strong in April, although the risks are inherently skewed to the downside. A renewed spike in COVID-19 infections has led to the reintroduction of state of emergency restrictions in several prefectures, including Tokyo. Although infection rates have been rising, businesses were optimistic that the Olympic Games and a successful vaccination programme would stimulate a broad economic recovery. IHS Markit estimates that the Japanese economy will grow 2.6% in 2021, a rate which fails to fully recover output lost to the pandemic in 2020. (IHS Markit)

JAPAN APR MONETARY BASE +24.3% Y/Y; MAR +20.8%

JAPAN APR MONETARY BASE END OF PERIOD Y655.5TN; Y643.6TN

AUSTRALIA APR AIG SERVICES PMI 61.0; MAR 58.7

The Australian Industry Group and HIA Australian Performance of Construction Index (Australian PCI®) fell by 2.7 points to 59.1 points in April 2021 (seasonally adjusted) after hitting a record high in March 2021 (highest since this survey commenced in 2005). The Australian PCI® continues to indicate a strong pace of recovery following 2020's recession and the successful HomeBuilder program (results above 50 points indicate expansion, with higher results indicating a stronger pace of expansion). All four components of activity expanded strongly in April 2021 (results well above 50 points, seasonally adjusted). The activity index jumped 5.1 points to a record high of 62.8 points, as home builders nationwide scrambled to commence new projects ahead of the HomeBuilder grant deadlines. The indexes for new orders, employment and supplier deliveries all eased from their record highs in March but remained elevated. Capacity utilisation inched up again, with many home builders reporting shortages of skilled labour, materials and inputs. The selling prices index hit a new record high, as more builders passed on the cost of input price increases and delivery delays to their customers.(AiG)

NEW ZEALAND Q2 2-YEAR INFLATION EXPECTATION +2.05% Y/Y; Q1 +1.89%

SOUTH KOREA MAR BOP CURRENT ACCOUNT BALANCE +$7.8160BN; FEB +$7.9421BN

SOUTH KOREA MAR BOP GOODS BALANCE +$7.9204BN; FEB +$5.9739BN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.1191% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 38 on Thursday, flat from the close of April 30.

PBOC SETS YUAN CENTRAL PARITY AT 6.4678 FRI VS 6.4895

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4678 on Friday, compared with the 6.4895 set on Thursday.

MARKETS

SNAPSHOT: NFPs In View

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 45.36 points at 29376.54

- ASX 200 up 23.705 points at 7085.4

- Shanghai Comp. up 14.502 points at 3455.785

- JGB 10-Yr future up 3 ticks at 151.45, yield down 0.5bp at 0.085%

- Aussie 10-Yr future up 1.0 tick at 98.360, yield down 1.3bp at 1.686%

- U.S. 10-Yr future -0-01+ at 132-20, yield down 0.35bp at 1.566%

- WTI crude up $0.45 at $65.17, Gold up $4.50 at $1819.69

- USD/JPY down 1 pip at Y109.08

- BIDEN TEAM LIKELY TO PROCEED ON TRUMP'S CHINA INVESTMENT BAN (BBG)

- CHINA 2021 CONSUMER INFLATION TO BE LOWER THAN 3% TARGET (DAILY)

- CHINA, U.S. TO OFFER CLASHING WORLD VIEWS AT UN EVENT FRIDAY (BBG)

- STRONG CHINESE EXPORTS DELIVER WIDER THAN EXPECTED TRADE SURPLUS IN APR

- UK CONSERVATIVES POSIED TO TAKE HARTLEPOOL MP SEAT

- NEW CONCERNS AS INDIAN COVID VARIANT CLUSTERS FOUND ACROSS ENGLAND (GUARDIAN)

BOND SUMMARY: Swings In Aussie 3s

A generally muted overnight session for core global FI markets left T-Notes in a narrow 0-02+ range, last -0-01+ at 132-20, with benchmark yields little changed across the curve, in what was a typical pre-NFP session for the Asia-Pac region. T-Notes operate on light volume of ~44K at typing. The major cash benchmarks generally trade little changed to a touch richer on the day. The aforementioned NFP release headlines the local docket on Friday, with Fedspeak from Barkin also due.

- JGB futures held to a narrow range, last +3, with the local COVID issues and stronger than expected local wage data having no real impact on the space. There may have been some incremental support from a solid liquidity enhancement auction for off-the-run JGBs with 1- to 5-Years until maturity, with the major benchmarks generally trading unchanged to a touch firmer across the cash curve.

- YM unchanged with XM +1.0 in Sydney. There were no surprises provided in the release of the RBA's latest SoMP given the guidance already seen earlier this week. The A$800mn auction of ACGB Nov '24 went well, with the cover ratio moving higher vs. the prev round of supply for the line, while the weighted average yield printed 0.74bp through prevailing mids at the time of supply (per Yieldbroker pricing). There were some interesting swings in ACGB Apr '24 (the bond targeted by the RBA under its 3-Year yield targeting mechanism), which forms part of the YMM1 basket. The line traded as low as 0.055% in yield terms (comfortably through the Bank's 0.10% target) before backing off to trade at 0.09% at typing. The retracement came as the RBA noted that it "is currently accepting requests to borrow the Apr '23 and Apr '24 bonds via its own facility only. The indicative fee to borrow these bonds is currently 25 bps, subject to change." Back in March the RBA lifted the cost of borrowing of these lines to 100bp, as it looked to limit short selling that was testing the implementation of its 3-Year yield targeting mechanism. Shorts in the line were squeezed in the early goings as they seemingly looked to secure bonds for settlement of existing positions. The weekly RBA issuance slate was vanilla.

JGBS AUCTION: Japanese MOF sells Y5.3088tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.3088tn 3-Month Bills:- Average Yield -0.1043% (prev. -0.1035%)

- Average Price 100.0263 (prev. 100.0278)

- High Yield: -0.1011% (prev. -0.1023%)

- Low Price 100.0255 (prev. 100.0275)

- % Allotted At High Yield: 56.7777% (prev. 67.8670%)

- Bid/Cover: 3.332x (prev. 4.266x)

JGBS AUCTION: Japanese MOF sells Y397.7bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y397.7bn of 1-5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.005% (prev. -0.003%)

- High Spread: -0.004% (prev. -0.002%)

- % Allotted At High Spread: 93.2832% (prev. 73.4497%)

- Bid/Cover: 4.533x (prev. 3.999x)

AUSSIE BONDS: The AOFM sells A$800mn of the 0.25% 21 Nov '24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 0.25% 21 November 2024 Bond, issue #TB159:- Average Yield: 0.2971% (prev. 0.2523%)

- High Yield: 0.3000% (prev. 0.2525%)

- Bid/Cover: 4.7875x (prev. 4.3312x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 6.8% (prev. 97.4%)

- bidders 44 (prev. 45), successful 15 (prev. 8), allocated in full 7 (prev. 1)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Monday 10 May it plans to sell A$1.0bn of the 1.00% 21 December 2030 Bond.

- On Tuesday 11 May it plans to sell A$100mn of the 1.00% 21 February 2050 Indexed Bond.

- On Thursday 13 May it plans to sell A$500mn of the 27 August 2021 Note & A$500mn of the 22 October 2021 Note.

- On Friday 14 May it plans to sell A$1.0bn of the 4.25% 21 April 2026 Bond.

EQUITIES: In The Green

A positive day for Asia-Pac equity indices, supported by a positive lead from the US and further gains across the commodity complex. All major bourses are in the green at the time of writing, Taiwan leads the way higher ahead of what is expected to be positive trade data today, while markets in South Korea also saw strong gains after an upbeat economic assessment from the Vice FinMin. China added to gains after trade data showed a wider than expected trade surplus with soaring exports and import growth broadly in line with expectations. In the US futures are higher, markets await the April payrolls report which will be dissected for clues as to the Fed's timetable for tapering.

OIL: Crude Futures On Track For Consecutive Weekly Gain

Crude futures are higher in Asia, WTI is $0.19 higher from settlement levels at $64.90/bbl, while Brent is up $0.14 at $68.23/bbl. The move higher today has been supported by a slight pullback in the greenback and improved risk appetite. For the week the benchmarks are up over 2%, the second straight weekly gain.

- If the move higher can continue WTI looks to the March 15 high at $66.15 which has been probed but not convincingly broken. A clear break would pave the way for a test of the key hurdle for bulls at $67.29, Mar 8 high.

GOLD: Support Still Evident In Asia

The DXY saw a small extension through yesterday's lows in Asia, which, when coupled with a steady U.S. yield environment, allowed bulls to add a handful of dollars to yesterday's gains. Spot last deals at ~$1,820/oz after yesterday's convincing break through $1,800/oz. Bulls now target the Feb 12 high at $1,830.8/oz, with today's U.S. NFP print providing the headline risk event ahead of the weekend.

FOREX: Commodity FX Lose Ground, Redback Firms On Chinese Trade Data

Commodity FX faltered in quiet Asia-Pac trade even as BBG Commodity Index extended gains to fresh multi-year highs, with little in the way of notable headline flow crossing the wires. JPY struggled for momentum despite aversion to high-betas, as Japanese gov't confirmed they will seek the extension & expansion of Covid-19 state of emergency.

- USD/CNH knee-jerked to a session low as a surge in exports underpinned the much wider than expected Chinese trade surplus. This allowed the pair to extend its earlier losses and print worst levels since late Feb. The PBOC set its central USD/CNY mid-point at CNY6.4678, 27 pips above sell-side estimates, but the redback was unfazed.

- Sterling outperformed in G10 FX space as polling stations closed after the "Super Thursday" elections. Labour MP McMahon effectively conceded defeat in Hartlepool by-election, where a "red wall" stronghold looked set to turn blue.

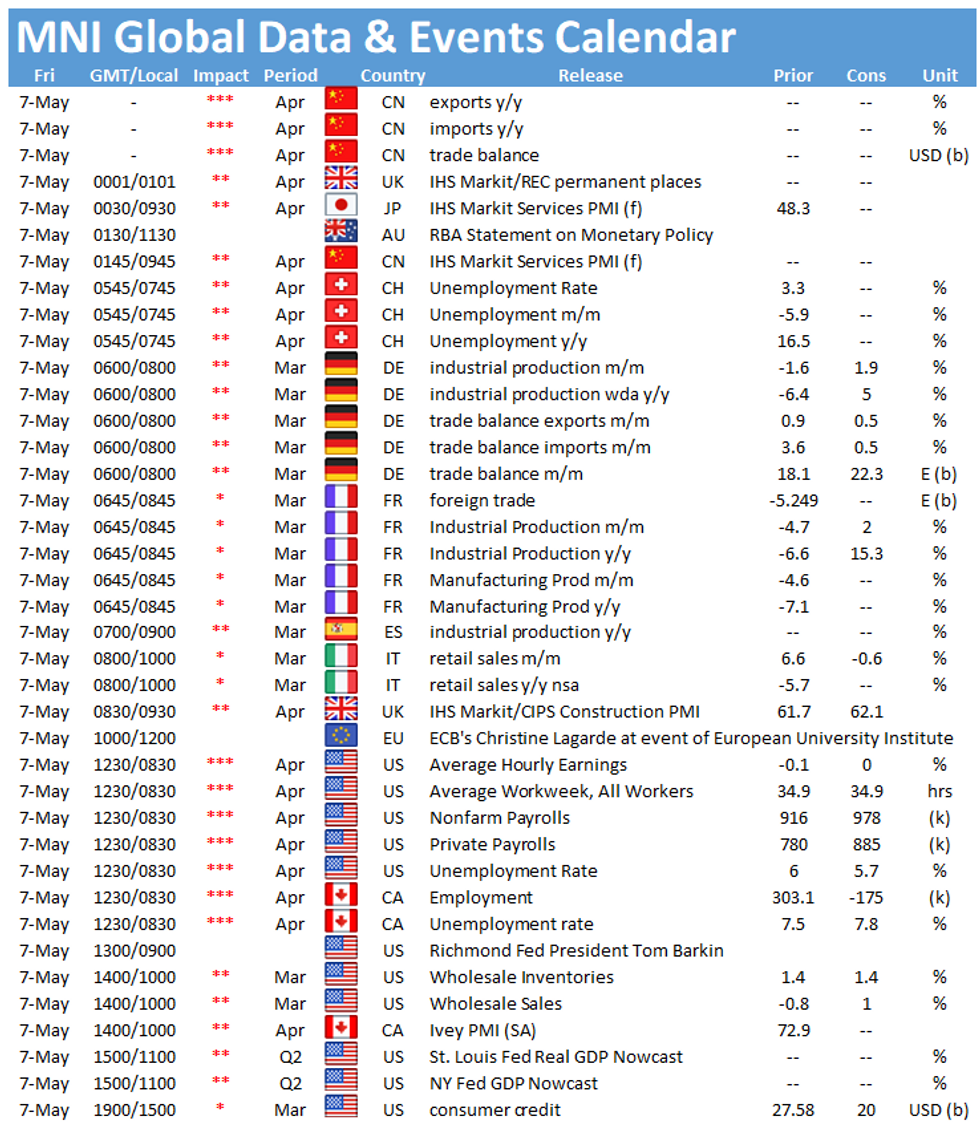

- U.S. NFP report provides takes centre stage today, with German industrial output, Canadian unemployment & comments from Fed's Barkin, ECB's Lagarde, Riksbank's Floden and BoE's Broadbent & Haldane also due.

FOREX OPTIONS: Expiries for May07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1895-10(E1.2bln), $1.2025-40(E2.3bln), $1.2100(E749mln)

- USD/JPY: Y106.60($500mln), Y109.00-10($988mln)

- GBP/USD: $1.3900(Gbp842mln)

- EUR/GBP: Gbp0.8650-60(E625mln)

- AUD/USD: $0.7800(A$1.1bln)

- USD/CAD: C$1.2400-20($938mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.