-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Little Post-Fed Minutes Follow Through In Asia

EXECUTIVE SUMMARY

- FED EDGED CLOSER TO TAPER TALK IN APRIL MINUTES (MNI)

- BIDEN: U.S. MUST DEFEND SEA LANES IN ARCTIC, SOUTH CHINA SEA (BBG)

- DEMOCRATS MULL WEAKENING BIDEN TAX ON CAPITAL GAINS FOR ESTATES (BBG)

- ECB'S SCHNABEL: EURO ZONE INFLATION SURGE IS TEMPORARY (RTRS)

- HOPES RISE FOR END TO UK LOCKDOWN NEXT MONTH (TIMES)

- ISRAEL AND HAMAS NEAR CEASE-FIRE AMID MOUNTING PRESSURE (WSJ)

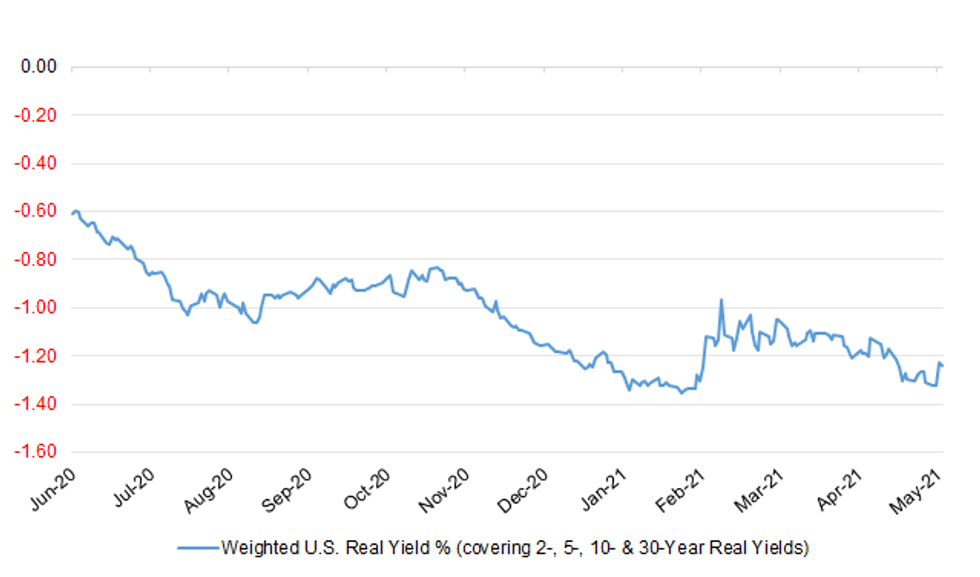

Fig. 1: Weighted U.S. Real Yield % (covering 2-, 5-, 10- & 30-Year Real Yields)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson is increasingly optimistic that coronavirus restrictions can end as planned on June 21 after early data suggested that the Indian variant was not spreading as fast as previously feared. Hospital admissions are "fairly flat" in variant hotspots while initial estimates suggest a smaller increase in transmissibility that would not risk overwhelming the NHS if restrictions end next month. The prime minister said last night that he was "even more cautiously optimistic than I was last Thursday", telling the 1922 Committee of Tory MPs: "I know there are anxieties about new variants. But we can see nothing to suggest that we have to deviate from the road map." (The Times)

CORONAVIRUS: Ministers are considering diluting plans for "freedom day" in England on 21 June and delay the end of all social distancing rules, as new figures showed another sharp increase in the Covid variant first detected in India. (Guardian)

CORONAVIRUS: The vaccine rollout could reach those in their early-20s in the first weeks of next month, The Telegraph understands, with hopes that all over-18s could be offered jabs in June. (Telegraph)

CORONAVIRUS: Surge testing and jabs will be expanded to six new areas of concern in England to combat the spread of the Indian Covid variant, Matt Hancock has said. The areas were identified using new techniques, including analysing wastewater and travel patterns, he told a Downing Street briefing. (BBC)

CORONAVIRUS: Up to 270,000 people will fly to "amber list" countries from the UK by the weekend amid growing confidence among the vaccinated that it is safe to travel. (Telegraph)

ECONOMY: MNI DATA BRIEF: UK Pay Awards At Highest Since Nov 2020

- UK median pay awards rose to the highest level since November 2020 in the three months to April, according to the latest survey from XpertHR. This is giving cause for optimism, with "a noticeable upturn in the data... first clear sign for a year that pay settlement levels are on the up," XpertHR's Sheila Attwood said Thursday. Pay awards rose to 1.9% in the three months to April, up from 1.0% recorded for past four rolling quarters. The report noted April is the most common month for annual reviews and almost 50% of deals recorded by XpertHR are registered in this period. Annual public sector pay awards remained higher than private sector deals, at 2.5% and 1.0%, respectively. However, pay freezes still are still present with almost one in five (19.3%) settlements resulting in no salary increase, Attwood added - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EUROPE

ECB: The surge in euro zone inflation is temporary and consumer prices should fall sharply next year, European Central Bank board member Isabel Schnabel told German broadcaster ARD on Wednesday. "This means we will keep financing conditions favourable in order to support the economy," she said. "There is no reason for an interest rate hike at the moment." (RTRS)

FRANCE: French President Emmanuel Macron would beat the far-right leader Marine Le Pen in a run-off for the 2022 presidential elections, according to a Harris Interactive poll for Challenges magazine published Wednesday. Macron would beat Le Pen by 53% to 47% in the run-off. Le Pen may get between 27% and 29% of the votes in the first round, 2 percentage points more than Macron. Both would fare better if former European Commissioner Michel Barnier is the candidate for Les Republicains, who'd garner 6% of first-round votes. Xavier Bertrand would fetch 14% if he were to represent Les Republicains. (BBG)

SWEDEN: Swedish residential property prices rose 0.9% on the month in April, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden. (BBG)

U.S.

FED: MNI BRIEF: Fed Edged Closer to Taper Talk in April Minutes

- Several Federal Reserve officials believed it might be appropriate to begin talking about tapering in coming months if economic improvements are sustained, minutes from the central bank's April meeting said Wednesday. "A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," the minutes showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Debated Standing Repo Facility in April

- The Federal Reserve discussed a standing repo facility at the last FOMC meeting, with a a substantial majority of participants seeing potential benefits outweighing the costs, meeting minutes released Wednesday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said he is looking closely at what he expects to be volatile economic data in coming months for signs the economy has made substantial progress toward the Fed's goals of full employment and low inflation - the bar the Fed has set before it will consider reducing its support for the economy. "If we see that substantial, significant progress towards our goals, I'm going to be advocating for us moving policy - now, we are not there right now," Bostic said on Bloomberg TV. He added that "no one" should think he would advocate a change "tomorrow," noting the economy is still 8 million jobs short of where it was before the coronavirus pandemic and that inflation has not been above 2% for a sustained period. "I'm paying attention and, because this is such an unprecedented time, I'm going to try to be as prepared as I can for whatever happens coming down the road," Bostic said. (RTRS)

FED: MNI INTERVIEW: Virus and Jobs May Restrain Prices-Fed's Wright

- Minneapolis Fed Research Director Mark Wright told an MNI webinar Wednesday a recent jump in inflation is likely temporary and the major risks facing the U.S. economy come instead from the failure to reach herd immunity or generate enough employment to accommodate some 10 million workers still out of a job - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: U.S. President Joe Biden will unveil the first detailed budget proposal of his term in office on May 28, a day later than originally planned, the White House said on Wednesday. No reason was given for the delay. (RTRS)

FISCAL: House Republicans introduced a 5-year, $400 billion transportation bill on Wednesday that directs historic levels of funding to highways, bridges and transit systems. The bill comes amid ongoing talks this week between the White House and Senate Republicans over their competing infrastructure plans. The bill unveiled on Wednesday represents a potential third option for infrastructure funding, one that's more narrowly focused than either the White House plan or the Senate Republicans' plan. (CNBC)

FISCAL: The Biden administration's proposal to dramatically expand the inheritance tax bill for wealthy Americans is running into some headwinds with Democrats on Capitol Hill, showcasing nervousness about the scope and size of elements of the White House's ambitious tax plans. President Joe Biden's sweeping expansion of social spending programs would be financed in part by tax hikes on the rich. A key element of that is ending "step-up in basis," which allows heirs to use the market value of assets at the time of inheritance -- rather than the historical purchase price -- as the cost basis for capital gains. Instead of hitting heirs with a hefty tax payment at the time of the death of their benefactor, staff for House Ways and Means Chair Richard Neal have floated allowing the beneficiaries to defer the bill as long as they hang on to the asset, according to people familiar with the matter. (BBG)

CORONAVIRUS: The FDA is holding more than 100 million Johnson & Johnson Covid-19 vaccine doses for further testing after the agency found multiple safety violations at a plant — run by Emergent BioSolutions — that was helping make the shots, Emergent CEO Robert Kramer told lawmakers Wednesday. The U.S. put J&J in charge of the Baltimore plant last month after learning that Emergent, a federal contractor that had been making key ingredients for J&J and AstraZeneca, cross-contaminated the two shots. Kramer is testifying before House lawmakers Wednesday about poor conditions at the plant said to be responsible for ruining millions of J&J Covid-19 shots. (CNBC)

POLITICS: The House vote on Wednesday to approve a Jan. 6 commission is a sugar high about to confront the reality of a Senate comedown. Axios spoke with a series of Republican senators and as of now, it's hard to see a plausible pathway to getting the necessary 10 GOP votes in the Senate to approve a panel. This, despite 35 Republican votes in favor in the House. (Axios)

POLITICS: Former President Donald Trump tore into New York Attorney General Letitia James and other prosecutors Wednesday after James' office said it is pursuing a criminal investigation of the Trump Organization. Trump attacked James, who announced the criminal inquiry Tuesday, and other officials in a long statement that said: "There is nothing more corrupt than an investigation that is in desperate search of a crime. "But, make no mistake, that is exactly what is happening here," he said. "The Attorney General of New York literally campaigned on prosecuting Donald Trump even before she knew anything about me." (NBC)

REGULATORY: Financial Stability Oversight council meeting moved to June 11. (BBG)

EQUITIES: Boeing Co resumed deliveries of its best-selling 737 MAX on Wednesday, following approval of a fix for an electrical grounding issue that sidelined dozens of jets, a person familiar with the matter told Reuters. (RTRS)

OTHER

U.S./CHINA: President Joe Biden said Wednesday that the U.S. must defend open and safe sea lanes in the Arctic and South China Sea as nations including Russia and China seek to assert greater control over the maritime regions. "It's of vital interest to America's foreign policy to secure unimpeded flow of global commerce," Biden said at the Coast Guard Academy in New London, Connecticut, in his first commencement address as president. "And it won't happen without us taking an active role to set the norms of conduct, to shape them around democratic values, not those of autocrats." (BBG)

U.S./CHINA: Chinese military warned USS Curtis Wilbur to leave after it entered Chinese waters surrounding the Paracel Islands May 20 without permission from Chinese government, Tian Junli, spokesperson of Southern Theater Command says in a statement. (BBG)

GEOPOLITICS: China plans funding and other measures to support Africa at Forum on China-Africa Co-operation in fourth quarter of year, Wu Peng, director general of Foreign Ministry's African Affairs Department, tells briefing Thursday in Beijing. (BBG)

CORONAVIRUS: The U.S. Food and Drug Administration has authorized storage of thawed, undiluted Pfizer Covid-19 vaccine in the refrigerator for as long as one month, according to a statement from the regulators. When initially authorized late last year, the shot had to be kept at ultracold temperatures, which limited its use in some areas that didn't have access to the required storage technology. Previously, the shot could only be kept in a refrigerator for as long as five days. Regulators in Canada have issued a similar clearance. (BBG)

CORONAVIRUS: Data indicate mRNA vaccines are better at stopping people from becoming contagious, helping reduce onward transmission -- an unexpected extra benefit as the first wave of Covid vaccines were intended to stop people from becoming very sick. Other vaccines, while effective in preventing acute illness or death from Covid, appear not to have this extra perk to the same degree. (BBG)

JAPAN: Japan's target of balancing its budget by fiscal 2025 is essentially out of reach and pushing for it too hard would derail the pandemic- hit economy, according to Ayako Fujita, a member of the finance ministry's debt-management panel. "It's pretty much impossible," Fujita said of the goal to balance the government's budget excluding debt-servicing payments by the year ending March 2026. Measures such as spending cuts or tax increases to meet the goal would shave 1% off the economy each year and are therefore unlikely, Fujita, a senior economist at JPMorgan Securities, said in an interview. (BBG)

JAPAN: Japan plans to boost defense spending without worrying about sticking to its long-standing limit of 1% of gross domestic product, Defense Minister Nobuo Kishi told Nikkei on Wednesday. (Nikkei)

JAPAN: Japan is likely to approve COVID-19 vaccines by both AstraZeneca and Moderna Inc, with an official announcement expected from the country's health minister on Friday, public broadcaster NHK reported on Thursday. (RTRS)

JAPAN: The Japanese government is planning to declare a coronavirus state of emergency in Okinawa prefecture, broadcaster FNN reports, citing an unidentified government official. (BBG)

JAPAN: NHK has learned that preparations are ongoing to ensure that the number of foreign officials visiting this summer's Olympic and Paralympic Games is less than half the previous estimate. Government sources say initially more than 200,000 athletes and foreign delegates were expected to visit Japan. But work is reportedly in progress to see that the figure is reduced to about 94,000 as part of anti-infection measures. (NHK)

JAPAN: International Olympic Committee President Thomas Bach plans to visit Japan on July 12, Kyodo reports, citing a letter addressed to Olympic officials by IOC Vice President John Coates. The games are scheduled to start on July 23. (BBG)

JAPAN: IOC member Dick Pound says a decision on holding the Tokyo Olympics scheduled this summer should come before the end of June, Jiji reports. (BBG)

BOJ: MNI INTERVIEW: Ex-BOJ Hayakawa: BOJ Policy Normalization Done

- The Bank of Japan is finished with policy normalization moves for now with recent steps to prepare for a push deeper into negative territory largely done to keep the reflationist wing of the Policy Board on side, a former BOJ executive director and chief economist told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA/CHINA: The federal Trade Minister says the government is trying to understand why China has delayed importing table grapes at a cost the Australian industry estimates to be worth millions of dollars a week. Dan Tehan says he "won't jump to any conclusions" about the possibility that the $300 million a year table grape trade to China is the latest casualty in the trade war with the superpower. (ABC)

AUSTRALIA/CHINA: The Morrison government's choice of pandering to the U.S. at the expense of its ties with China will harm Australia as China further diversifies away from Australian commodities, the government-run Global Times said. The booming iron ore exports to China have so far allowed the Morrison administration to claim an ongoing trade relationship with China, ignoring that other domestic industries have suffered badly from deteriorating political ties, the newspaper said. China's suspension of economic dialogues this month in response to Canberra's undermining mutual trust points to a further downward spiral, the newspaper said. (MNI)

NEW ZEALAND: The economy is expected to grow at a healthy clip and unemployment to fall close to 4 per cent in the coming years, with a big increase in infrastructure spending driving rosy forecasts from the Treasury. Finance Minister Grant Robertson's 2021 Budget includes $57.3 billion in infrastructure spending between 2021 to 2025, increasing what was already a large increase in the 2020 Budget. As well as further boost in funding for rail, including $85 million for carriage assembly at Hillside in Dunedin, more than $630m for school property, $300m for Scott Base and another $300m for the Green Investment Fund. After a severe recession in 2020, the economy is expected to expand by 2.9 per cent this year, accelerating to 4.4 per cent in 2023, growing at an average of around 3 per cent over the next four years. Treasury predicts unemployment will fall to 4.2 per cent by 2025, only marginally above what it was before Covid-19. "New Zealand has been through a health and economic shock," Finance Minister Grant Robertson told a Budget lockup at Parliament, ahead of the official release. "The economy will grow strongly from here." A stronger overall economy means that while spending climbs, the forecasts are stronger than in the last update in December. The Crown is expected to continue to run a deficit until at least 2027, debt levels are lower than the last forecast. Strong spending mean the Crown accounts are expected to show a deficit of $15.1 billion in 2021, rising to $18.4b in 2020, before gradually falling. (NZ Herald)

NORTH KOREA: South Korean President Moon Jae-in is set to make a last-ditch attempt to bring the U.S. and North Korea together under his watch when he meets Joe Biden at the White House on Friday, trying to revive dormant nuclear talks in his final year in office. But Pyongyang, which has displayed disdain for both leaders, has shown no interest in their diplomacy. That raises the stakes for the Friday summit as Moon tries to find fresh enticements to bring his neighbor back to table and the Biden administration undertakes a new strategy to end a nuclear program it sees as a serious threat to America and the world. (BBG)

TURKEY: Turkey's Treasury is working on a framework that will allow it to sell bonds abroad for the first time with pricing tied to environmental and social goals. The Treasury aims to finalize the legal requirements by the end of this year to be able to issue sustainability-linked social and green bonds, according to a Treasury official, who asked not to be named because they're not authorized to speak publicly on the issue. The country may tap markets before the end of the year, depending on market conditions, the official said. The framework will allow the Treasury to sell a variety of ESG bonds in different currencies, especially social and "dark green" securities, the latter linked to projects that promote a low-carbon future such as wind farms. (BBG)

BRAZIL: A Brazilian congressional probe into the federal government's handling of the pandemic was suspended when former Health Minister Eduardo Pazuello suffered a sudden drop in blood pressure after about six hours of hard questioning by senators. Pazuello, an Army general who led the Health Ministry between September and March, was questioned Wednesday about the federal government's slow purchase of vaccines, as well as his role in the crisis that left the Amazonian city of Manaus's without oxygen to care for all of its Covid patients earlier this year. (BBG)

BRAZIL: Brazil's federal police are targeting Environment Minister Ricardo Salles and other government authorities in an investigation of alleged irregularities in timber exports. (BBG)

BRAZIL: Brazil's lower house approved the main text of a bill that paves the way for the privatization of state utility Eletrobras. (BBG)

BRAZIL: Brazilian foreign trade chamber Camex extended until December the tax exemption to import 628 products, including medicine vaccines and other hygiene items, considered essential to fight the pandemic, according to a statement disclosed late on Wednesday. (BBG)

RUSSIA: Top diplomats from the Biden administration and Russia in their first in-person meeting on Wednesday stressed that the former Cold War foes have serious differences in how they view world affairs but struck an optimistic tone for the talks, saying the two sides can still find ways to work together. (RTRS)

RUSSIA: The State Department cited the parent company and chief executive of a Russian natural-gas pipeline for sanctions but waived the penalties, clearing a hurdle for the completion of a project that U.S. officials say will increase Moscow's influence in Europe. In a report released Wednesday, the State Department named Nord Stream 2 AG, the Swiss-registered Russian firm behind the project, as well as its chief executive officer, Matthias Warnig, as having knowingly engaged in sanctionable activity but waived the application of these sanctions on national-security grounds. Nord Stream 2 has rankled a bipartisan majority on Capitol Hill and tested U.S. relations with Germany, a chief customer for the pipeline. U.S. lawmakers and some officials worry that Nord Stream 2 will strengthen Russia's grip on the European energy market and weaken U.S. partner Ukraine, which hosts a gas-transit network and is trying to resist Russian aggression. (WSJ)

RUSSIA: The Biden administration said stopping Nord Stream 2 is a long shot now that the gas pipeline from Russia to Germany is more than 90% complete, a shift in tone that came as the U.S. held off on sanctioning the company overseeing its construction. In a report to Congress on Wednesday, the State Department said that Nord Stream 2 AG and its chief executive Matthias Warnig are engaged in sanctionable activity under U.S. law but that the administration will waive penalties for national security reasons. An administration official who briefed reporters said the chances of stopping the pipeline's completion are increasingly remote and suggested that President Joe Biden wants to avoid a confrontation with Germany and other European Union allies that back the project. (BBG)

SOUTH AFRICA: A judge is set to rule after the first ever case filed against the government over its alleged failure to crack down on air pollution emitted by power plants operated by Eskom Holdings SOC Ltd. and refineries owned by Sasol Ltd. The case was filed in the Pretoria High Court by groundWork, an environmental- rights organization, and the Vukani Environmental Justice Movement in Action in 2019 and was heard by Judge Colleen Collis this week. The respondents in the case include President Cyril Ramaphosa, Environment Minister Barbara Creecy and provincial officials. (BBG)

IRAN: British, French and German senior diplomats said on Wednesday that there had been tangible progress in nuclear talks with Iran but that success was not guaranteed with very difficult issues still to be resolved. The diplomats also said it was vital that Iran and the UN atomic agency find a way to ensure continuity in the agency's monitoring of Iran's activities given that a technical understanding was due to end shortly. "IAEA access will of course be essential to our efforts to restore the JCPoA (Joint Comprehensive Plan of Action) as a deal cannot be implemented without it," the E3 diplomats said in a statement. (Al Arabiya)

IRAN: Iranian Deputy Foreign Minister Abbas Araghchi says important issues have yet to be resolved in negotiations with the U.S. held through European diplomats to return to the 2015 nuclear deal, Japanese public broadcaster NHK reports. (BBG)

ISRAEL: As the international community ramped up pressure for a ceasefire deal, senior Hamas officials laid out their conditions on Wednesday for a truce with Israel to end the current cycle of bloodshed in the Mideast. But as Israel's leader stressed that the airstrikes on Gaza would continue until Hamas stops firing rockets, the militant group's terms seemed unlikely to bring a breakthrough. (CBS)

ISRAEL: After 10 days of standing behind Israel's military campaign in the Gaza Strip, President Biden made clear that he is running out of patience. Biden told Netanyahu he expects "significant de-escalation today on the path to a ceasefire," per the White House readout of their call. 219 Palestinians have been killed in the fighting, at least half of them civilians, according to the Gaza Health Ministry. Israel is under growing international pressure to end its operation — though Prime Minister Benjamin Netanyahu insisted earlier on Wednesday that Israel wouldn't "stand with a timer" and needed additional time to complete its objectives. Biden was "firm" on the call and sent a clear message that he's "done kidding around and Israel needs to finish it," a source briefed on the call tells Axios. It was their fourth call since the beginning of the crisis. But Netanyahu has elected not to convene the Security Cabinet on Wednesday, meaning a decision on a ceasefire is not imminent because that would require Cabinet approval, Israeli officials say. Netanyahu said in a statement that he appreciated Biden's support for Israel's right to self-defense but was "determined to continue the operation in Gaza until it achieves the goal of restoring calm." (Axios)

ISRAEL: Israeli Foreign Minister Gabi Ashkenazi told U.S. Secretary of State Antony Blinken on Wednesday that Israel needs another few days to complete its Gaza operation, but Blinken stressed that the U.S. expects the operation to end soon, an Israeli official tells Axios (Axios)

ISRAEL: Several Republican senators slammed Democrats during a press conference Wednesday for not fully standing behind Israel in the current conflict with Hamas. (Newsmax)

ISRAEL: "Secretary of Defense Lloyd Austin spoke with Israeli Defense Minister Benny Gantz and again urged de-escalation in the conflict between Israel and Hamas," Pentagon Press Secretary John F. Kirby tells reporters. (Times Of Israel)

ISRAEL: A cease-fire in the fighting between Israel and the Palestinian militant group Hamas could come as early as Friday, according to people involved in the discussions, as pressure mounts from Washington and other foreign capitals to bring an end to airstrikes and rocket fire that have claimed a rising number of civilian casualties. (WSJ)

COPPER: The union representing workers at Chile's Escondida copper mine, the world's largest, said on Wednesday it was preparing for a lengthy strike if owner BHP did not drop a historically "awful" attitude towards its labour force to reach a "fair and equitable" deal in looming contract talks. (RTRS)

OIL: The Opec+ coalition reached 113pc conformity with its output restraint obligations in April, unchanged from March and February, according to two Opec+ delegates. The alliance's 10 Opec members also struck 124pc conformity with their April commitments, again steady from the previous two months. The compliance of non-Opec members weakened further, to 91pc in April from 93pc in March. Opec+ reach their compliance figures by averaging the estimates of six secondary sources, including Argus. An Argus survey found Opec+ conformity at 114pc in April, with Opec and non-Opec members reaching respective compliance rates of 125pc and 92pc last month. Recent Opec conformity levels have benefitted from Saudi Arabia's unilateral decision to keep its output a further 1mn b/d below its official 9.119mn b/d quota under the Opec+ agreement over the February-April period. This cut is scheduled to gradually ease to just 750,000 b/d in May and 400,000 b/d in June. (Argus Media)

CHINA

YUAN: The following lists highlights from Chinese press reports on ThursdayThe Chinese yuan may remain in the range of 6.3 to 6.7 against the dollar for 2021 with the central point around 6.4 to 6.5, the Economic Daily said citing Tang Jianwei, an analyst at the Bank of Communications. The recent appreciation of the yuan can be attributed to the strong domestic recovery and the Federal Reserve's dovish stance which held down the dollar index, the daily said citing Zhou Maohua, an analyst with Everbright Bank. The yuan closed at 6.4383 against the dollar on Wednesday. (MNI)

ECONOMY: China's economy has yet to return to normal growth even as the April data released this week showed the recovery is on course, said the Economic Daily in a commentary. Consumption recovery still lags behind the production, while investment in manufacturing is also not at the pre-pandemic level, the daily said. China should boost domestic demand by stimulating auto and home appliance purchases, increasing investment in the manufacturing industry, and stepping up the income of residents, it said. Still, the daily cited two international forecasts that projected 8% growth this year. (MNI)

PBOC: MNI BRIEF: PBOC Maintains Loan Prime Rates for 13th Month

- China's central bank on Thursday left its key loan rates unchanged for the 13th month even as the factory-gate price last month jumped to a more-than-3-year high - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OVERNIGHT DATA

CHINA APR SWIFT GLOBAL PAYMENTS CNY 1.95%; MAR 2.49%

JAPAN APR TRADE BALANCE +Y255.3BN; MEDAN +Y147.7BN; MAR +Y662.2BN

JAPAN APR TRADE BALANCE ADJ +Y65.2BN; MEDIAN +Y70.4BN; MAR +Y371.9BN

JAPAN APR EXPORTS +38.0% Y/Y; MEDIAN +30.8%; MAR +16.1%

JAPAN APR IMPORTS +12.8% Y/Y; MEDIAN +9.0%; MAR +5.8%

JAPAN MAR CORE MACHINE ORDERS -2.0% Y/Y; MEDIAN -3.3%; FEB -7.1%

JAPAN MAR CORE MACHINE ORDERS +3.7% M/M; MEDIAN +5.0%; FEB -8.5%

JAPAN APR TOKYO CONDOMINIUMS FOR SALE +204.5% Y/Y; MAR +44.9%

AUSTRALIA APR UNEMPLOYMENT RATE 5.5%; MEDIAN 5.6%; MAR 5.7%

AUSTRALIA APR EMPLOYMENT CHANGE -30.6K; MEDIAN +20.0K; MAR +77.0K

AUSTRALIA APR FULL-TIME EMPLOYMENT CHANGE +33.8K; MAR -21.1K

AUSTRALIA APR PART-TIME EMPLOYMENT CHANGE -64.4K; MAR +98.1K

AUSTRALIA APR PARTICIPATION RATE 66.0%; MEDIAN 66.3%; MAR 66.3%

AUSTRALIA MAY CONSUMER INFLATION EXPECTATIONS +3.5%; APR +3.2%

AUSTRALIA APR RBA FX TRANSACTIONS GOV'T -A$522MN; MAR -A$1.390BN

AUSTRALIA APR RBA FX TRANSACTIONS MARKET +A$491MN; MAR +A$1.332BN

AUSTRALIA APR RBA FX TRANSACTIONS OTHER -A$1.346BN; MAR +A$4.014BN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THU; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4464 on Thursday, compared with the 6.4255 set on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4464 THU VS 6.4255

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1794% at 09:24 am local time from the close of 2.1455% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 37 on Tuesday. A higher index indicates stronger expectations for tightening liquidity.

MARKETS

SNAPSHOT: Little Post-Fed Minutes Follow Through In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 96.66 points at 28141.11

- ASX 200 up 90.736 points at 7022.4

- Shanghai Comp. down 10.102 points at 3500.863

- JGB 10-Yr future down 7 ticks at 151.37, yield down 0.2bp at 0.080%

- Aussie 10-Yr future up 1.5 ticks at 98.300, yield down 1.4bp at 1.758%

- U.S. 10-Yr future +0-04 at 132-05, yield down 0.68bp at 1.664%

- WTI crude up $0.25 at $63.61, Gold up $5.87 at $1875.49

- USD/JPY down 6 pips at Y109.16

- FED EDGED CLOSER TO TAPER TALK IN APRIL MINUTES (MNI)

- BIDEN: U.S. MUST DEFEND SEA LANES IN ARCTIC, SOUTH CHINA SEA (BBG)

- DEMOCRATS MULL WEAKENING BIDEN TAX ON CAPITAL GAINS FOR ESTATES (BBG)

- ECB'S SCHNABEL: EURO ZONE INFLATION SURGE IS TEMPORARY (RTRS)

- HOPES RISE FOR END TO UK LOCKDOWN NEXT MONTH (TIMES)

- ISRAEL AND HAMAS NEAR CEASE-FIRE AMID MOUNTING PRESSURE (WSJ)

BOND SUMMARY: Core FI Modestly Higher Overnight

T-Notes last +0-05 at 132-06, 0-01 off best levels, while cash Tsys trade unchanged to 1.0bp richer across the curve. There was some light interest to fade Wednesday's cheapening in U.S. Tsys during Asia-Pac hours, as regional participants stepped in after cheapening witnessed in the wake of the release of the FOMC's April meeting meetings (which were a little hawkish vs. most expectations). There was little in the way of overt tier 1 headline news overnight, with conflicting rumours surrounding the future of the Israeli-Palestinian conflict and the usual round of Sino-U.S. tension. Pockets of buying FV & TY futures helped the broader bid.

- JGB futures last -6 after failing to trade back to unchanged levels during Tokyo hours. The space initially benefitted from the uptick in U.S. Tsys and press reports pointing to the impending state of emergency declaration covering Okinawa prefecture (after the region recommended such a move on Wednesday). The majority of the major benchmarks on the cash curve print unchanged to 0.5bp richer on the day. The latest round of BoJ Rinban operations saw the sizes of the purchase buckets in play left unchanged, with marginal, albeit mixed (and inconsequential), moves observed in the offer to cover ratios.

- YM & XM both +1.0 in Australia, with very modest firming seen on the back of the disappointing headline fall in the number employed in the latest Australian labour market report, bringing to an end an impressive run of generally stronger than expected monthly releases. Still, it wasn't all doom and gloom, with no clear signs of any impact from the cessation of the JobKeeper scheme (per the ABS commentary flagged in an earlier bullet). It is interesting to note that the ABS flagged that "like we saw in January, the number of people taking leave over the Easter public and school holidays was also higher than in the past," with April's losses in employment driving solely by a fall in the number of part-time employed, which may be limiting the follow through from the release. Elsewhere, the participation rate edged lower, which actually allowed the unemployment rate to tick lower, even as the number employed dipped. The underemployment rate now sits at levels not witnessed since the middle of '14, while the underutilisation rate hovers around Dec '19 levels. Note, there had been some bearish setup via YM single-day options ahead of the release.

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y975bn of JGB's from the market, all sizes unchanged from previous operations:

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

JAPAN: Some Movement In Weekly International Security Flow Data

Some notable flips in terms of the direction of net flows in the latest round of Japanese weekly international security flow data, with Japanese net purchases of foreign bonds resuming after a 2 week hiatus, while the same held true for foreign net flows surrounding Japanese paper. Elsewhere, foreigners were net sellers of Japanese equities after 6 consecutive weeks of net purchases.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 600.2 | -72.2 | -770.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 189.7 | 114.1 | -218.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 878.4 | -372.9 | -81.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -471.4 | 144.7 | 224.7 |

EQUITIES: Mostly Negative, Losses Modest

Another negative for indices in the Asia-Pac region, taking cues from losses in the US as the prospect of tapering rears its head post-FOMC minutes. Most major markets are in the red, though losses are more contained than earlier in the week. The Hang Seng leads the way lower with losses of around 1%, while in mainland China the CSI 300 is down around 0.25% Markets in Japan are hovering around neutral, Japanese media earlier reported a state of emergency is planned to be declared in Okinawa. Australia is a bright spot, the ASX 200 rising around 0.9% as financials gained despite a miss in labour market data and a sell off in iron ore. Futures in the US are lower, Nasdaq is faring slightly better than its counterparts following late gains for tech stocks yesterday.

OIL: Crude Futures Hug Narrow Range

Oil moved in a narrow range in Asia on Thursday, WTI is up $0.13 from settlement levels at $63.49/bbl, Brent is down $0.01 at $66.45. Crude declined on Wednesday as markets assessed the impact of additional supply from Iran as nuclear deal negotiations continue, while the prospect of additional supply from OPEC+ in coming months also weighed.

GOLD: Bulls Still In Command

Spot gold has edged higher in Asia-Pac hours, with very modest firming in U.S. Tsys and a downtick in the DXY lending some light support. Spot last deals a handful of dollars higher on the day, just above $1,877/oz, well within the confines of Wednesday's range. Yesterday's move higher in the DXY and U.S. real yields, which accelerated in the wake of the release of the minutes from the FOMC's April meeting (the release came across a little more hawkish vs. some expectations) saw bullion back from highs of the day, although bulls still remain focused on the 76.4% retracement of the Jan 6 to Mar 8 sell off ($1,892.7/oz).

FOREX: USD Loses Shine, AUD Shows Limited Reaction To Local Jobs Data

The USD went offered and gave away some of yesterday's gains as the dust settled after the release of FOMC minutes, which suggested that some policymakers were ready to debate a tapering of bond purchases if rapid progress in economic recovery continued. The DXY ground lower, but remained way off yesterday's low in a generally headline-light Asia-Pac trade.

- AUD knee-jerked lower upon the release of Australian monthly jobs data. An unexpected downtick in the unemployment rate was underpinned by lower participation and coupled with an upward revision to the prior reading. Although consensus forecast was a 20.k increase in employment, 30.6k jobs were shed, albeit headline figure fell solely on the back of losses in part-time jobs. The Aussie's reaction was short-lived and the currency firmed a tad during the remainder of the session.

- Sterling softened as participants assessed press reports on whether the UK will be able to go ahead with its reopening plans as scheduled.

- The PBOC set its central USD/CNY mid-point at CNY6.4464, just 3 pips shy of sell-side estimates, while leaving 1-Year & 5-Year LPRs unchanged. USD/CNH stuck to a tight range.

- U.S. initial jobless claims & plenty of central bank speak from ECB's Lagarde, Lane, Villeroy & Holzmann, Riksbank's Skinsgsley & Breman, BoE's Cunliffe, Fed's Kaplan & BoC's Macklem take focus from here.

FOREX OPTIONS: Expiries for May20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2045-55(E1.1bln-EUR puts), $1.2100-10(E594mln), $1.2160-75(E1.8bln-EUR puts), $1.2215-35(E668mln-EUR puts)

- USD/JPY: Y108.00-11($1.2bln-USD puts), Y108.65-75($718mln-USD puts), Y109.00-10($636mln), Y110.00($522mln)

- GBP/USD: $1.3990-1.4020(Gbp1.1bln)

- USD/CHF: Chf0.9000($607mln-USD puts), Chf0.9034-35($646mln-USD puts), Chf0.9160($500mln-USD puts), Chf0.9295-0.9300($952mln-USD puts)

- AUD/USD: $0.7760-70(A$1.0bln-AUD puts), $0.7775-85(A$973mln)

- USD/MXN: Mxn19.88($980mln)

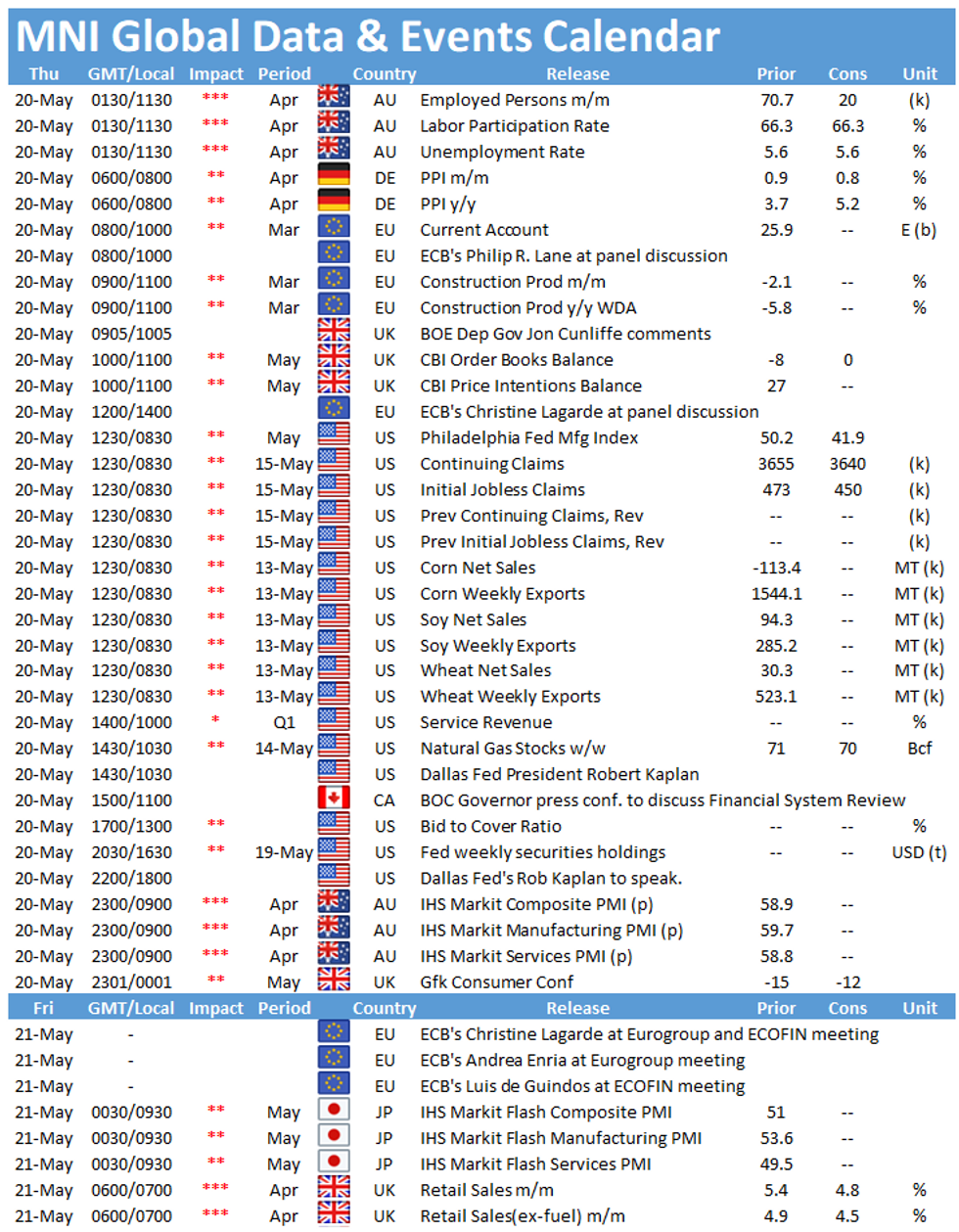

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.