-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Back From Post FOMC Minute Extremes

- U.S. Tsy yields and the broader USD a little off of their respective post-FOMC minute peaks.

- Conflicting rumours doing the rounds re: the prospects of a ceasefire in the Israeli-Palestinian conflict.

- Australian labour market data disappoints.

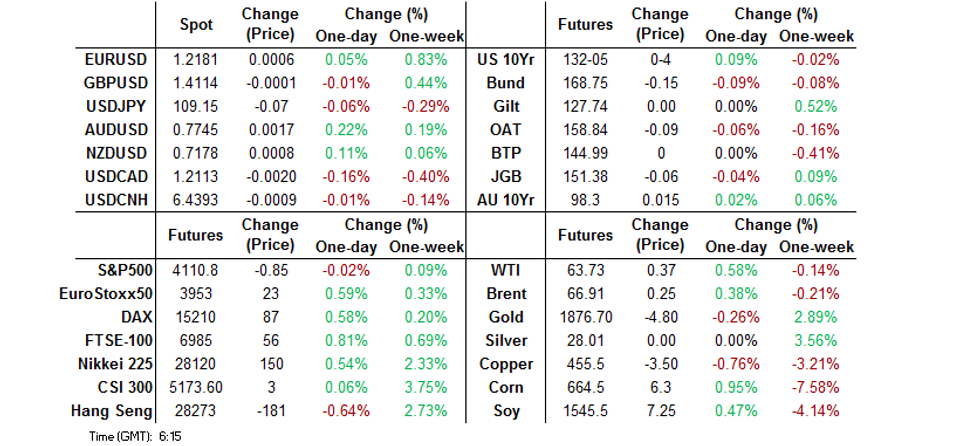

BOND SUMMARY: Core FI Modestly Higher Overnight

T-Notes last +0-05 at 132-06, 0-01 off best levels, while cash Tsys trade unchanged to 1.0bp richer across the curve. There was some light interest to fade Wednesday's cheapening in U.S. Tsys during Asia-Pac hours, as regional participants stepped in after cheapening witnessed in the wake of the release of the FOMC's April meeting meetings (which were a little hawkish vs. most expectations). There was little in the way of overt tier 1 headline news overnight, with conflicting rumours surrounding the future of the Israeli-Palestinian conflict and the usual round of Sino-U.S. tension. Pockets of buying FV & TY futures helped the broader bid.

- JGB futures last -6 after failing to trade back to unchanged levels during Tokyo hours. The space initially benefitted from the uptick in U.S. Tsys and press reports pointing to the impending state of emergency declaration covering Okinawa prefecture (after the region recommended such a move on Wednesday). The majority of the major benchmarks on the cash curve print unchanged to 0.5bp richer on the day. The latest round of BoJ Rinban operations saw the sizes of the purchase buckets in play left unchanged, with marginal, albeit mixed (and inconsequential), moves observed in the offer to cover ratios.

- YM & XM both +1.0 in Australia, with very modest firming seen on the back of the disappointing headline fall in the number employed in the latest Australian labour market report, bringing to an end an impressive run of generally stronger than expected monthly releases. Still, it wasn't all doom and gloom, with no clear signs of any impact from the cessation of the JobKeeper scheme (per the ABS commentary flagged in an earlier bullet). It is interesting to note that the ABS flagged that "like we saw in January, the number of people taking leave over the Easter public and school holidays was also higher than in the past," with April's losses in employment driving solely by a fall in the number of part-time employed, which may be limiting the follow through from the release. Elsewhere, the participation rate edged lower, which actually allowed the unemployment rate to tick lower, even as the number employed dipped. The underemployment rate now sits at levels not witnessed since the middle of '14, while the underutilisation rate hovers around Dec '19 levels. Note, there had been some bearish setup via YM single-day options ahead of the release.

JAPAN: Some Movement In Weekly International Security Flow Data

Some notable flips in terms of the direction of net flows in the latest round of Japanese weekly international security flow data, with Japanese net purchases of foreign bonds resuming after a 2 week hiatus, while the same held true for foreign net flows surrounding Japanese paper. Elsewhere, foreigners were net sellers of Japanese equities after 6 consecutive weeks of net purchases.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 600.2 | -72.2 | -770.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 189.7 | 114.1 | -218.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 878.4 | -372.9 | -81.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -471.4 | 144.7 | 224.7 |

FOREX: USD Loses Shine, AUD Shows Limited Reaction To Local Jobs Data

The USD went offered and gave away some of yesterday's gains as the dust settled after the release of FOMC minutes, which suggested that some policymakers were ready to debate a tapering of bond purchases if rapid progress in economic recovery continued. The DXY ground lower, but remained way off yesterday's low in a generally headline-light Asia-Pac trade.

- AUD knee-jerked lower upon the release of Australian monthly jobs data. An unexpected downtick in the unemployment rate was underpinned by lower participation and coupled with an upward revision to the prior reading. Although consensus forecast was a 20.k increase in employment, 30.6k jobs were shed, albeit headline figure fell solely on the back of losses in part-time jobs. The Aussie's reaction was short-lived and the currency firmed a tad during the remainder of the session.

- Sterling softened as participants assessed press reports on whether the UK will be able to go ahead with its reopening plans as scheduled.

- The PBOC set its central USD/CNY mid-point at CNY6.4464, just 3 pips shy of sell-side estimates, while leaving 1-Year & 5-Year LPRs unchanged. USD/CNH stuck to a tight range.

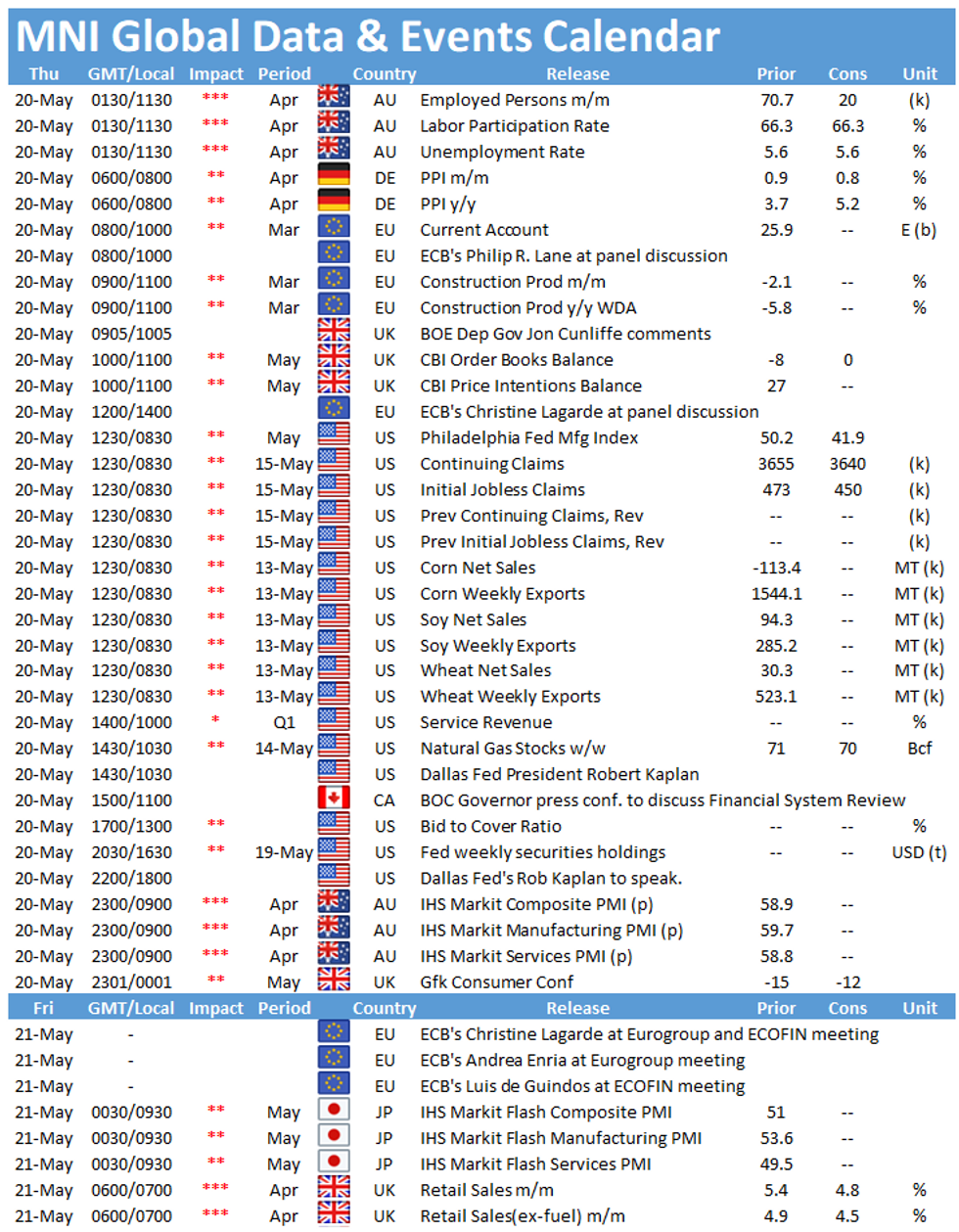

- U.S. initial jobless claims & plenty of central bank speak from ECB's Lagarde, Lane, Villeroy & Holzmann, Riksbank's Skinsgsley & Breman, BoE's Cunliffe, Fed's Kaplan & BoC's Macklem take focus from here.

FOREX OPTIONS: Expiries for May20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2045-55(E1.1bln-EUR puts), $1.2100-10(E594mln), $1.2160-75(E1.8bln-EUR puts), $1.2215-35(E668mln-EUR puts)

- USD/JPY: Y108.00-11($1.2bln-USD puts), Y108.65-75($718mln-USD puts), Y109.00-10($636mln), Y110.00($522mln)

- GBP/USD: $1.3990-1.4020(Gbp1.1bln)

- USD/CHF: Chf0.9000($607mln-USD puts), Chf0.9034-35($646mln-USD puts), Chf0.9160($500mln-USD puts), Chf0.9295-0.9300($952mln-USD puts)

- AUD/USD: $0.7760-70(A$1.0bln-AUD puts), $0.7775-85(A$973mln)

- USD/MXN: Mxn19.88($980mln)

ASIA FX: Baht Best Performer, Rupiah Bottom Of The Pile

The greenback dropped slightly after its rise on Wednesday, still performance was mixed across Asia EM FX with a surge in coronavirus cases in several countries affecting sentiment.

- CNH: Offshore yuan is higher, reversing its earlier move. The PBOC fixed USD/CNY at 6.4464, 3 pips below sell side estimates, indicating a slight preference for a stronger yuan. Just the second fix below estimates in the previous 10 sessions. A PBOC researcher has said that the yuan will continue to appreciate against the greenback in the medium and long term

- SGD: Singapore dollar is stronger, reversing some of its move lower on Wednesday. On the coronavirus front officials have pushed back on the assertion from a minister in New Delhi that a new variant was discovered in Singapore, saying it was actually the Indian strain affecting Singapore.

- TWD: Taiwan dollar has firmed, USD/TWD has seen highs of 28.085 and lows of 27.8445 this week, USD/TWD 3-month option volatility is up 19bps so far this week. Gains reverse late losses yesterday, Taiwan extended its soft lockdown to the whole island after the number of new cases outside of the capital rose.

- KRW: Won is weaker, South Korean President Moon is in the US for a a five-day trip, he will hold summit talks with US President Biden on issues such as North Korea, COVID-19 vaccines and bilateral economic cooperation.

- MYR: Ringgit is weaker, Malaysia declared a record surge in new Covid-19 cases Wednesday, with 6,075 officially confirmed infections. Malaysia's richest state & economic powerhouse Selangor remained the main contributor to the nationwide tally.

- IDR: Rupiah is lower, data showed the trade surplus widened as exports rose above estimates. Econ Min Hartarto revealed that Pres Widodo has submitted a letter to lawmakers to begin debate on revisions to tax law. Proposed changes could include a carbon tax & possible tax amnesty.

- PHP: Peso has declined. The Health Dept said that the number of active Covid-19 cases dropped to the lowest number in over two months.

- THB: Baht has gained, Thailand imposed restrictions on movement of workers at construction sites and dormitories in Bangkok, after these locations have been identified as Covid-19 hotspots.

ASIA RATES: RBI Ops Help Lift Fixed Income Space

China bucking the regional trend again is no surprise, fixed income space mostly pressured lower by a move down in UST's post-FOMC, while in India focus turns to GSAP ops later in the session.

- INDIA: Yields lower in early trade. Participants await the latest round of GSAP operations from the RBI today, the bank will purchase INR 350bn of debt in a range of maturities from 2024 to 2035. When this operation was announced last week there was some disappointment in the market. There was an expectation that RBI would look to buy back some of the liquid papers, but the absence of 5-year paper in the choice of eligible issues is conspicuous, while other other papers are relatively illiquid.

- SOUTH KOREA: Futures in South Korea are lower, playing catch up with a move in UST's after the FOMC minutes indicated some members were willing to discuss a future taper. 10-year contract is down 21 ticks having gapped lower at the open. The contract is off session lows at 125.49. Elsewhere, the BoK sold KRW 2.2tn of 2-year MSB's, yield 0.92%, cover 1.0818x.

- CHINA: The PBOC matched injections with maturities, the overnight repo rate rose 5bps to 2.0808% while the seven-day repo rate rose 2.2bps to 2.1619%. Both rates are well below this week's highs. Futures gapped higher at the open and held gains. China's 1- & 5-Year Loan Prime Rates were kept on hold at 3.85% and 4.65% respectively. The decision was in line with expectations. LPR rates have been unchanged since April 2020 when the PBOC cut rates to help cope with the impact of the pandemic. The MLF, which is linked to the LPR, was unchanged for the 14th month earlier this week. While there was speculation that the PBOC could increase the LPR's to help reign in rising producer prices, the bank said in its Q1 Monetary Policy report that the pickup in inflation is expected to be transitory and the bank could look through the readings.

- INDONESIA: Yields higher across the curve with bear flattening seen. Econ Min Hartarto revealed that Pres Widodo has submitted a letter to lawmakers to begin debate on revisions to tax law. Proposed changes could include a carbon tax & possible tax amnesty.

EQUITIES: Mostly Negative, Losses Modest

Another negative for indices in the Asia-Pac region, taking cues from losses in the US as the prospect of tapering rears its head post-FOMC minutes. Most major markets are in the red, though losses are more contained than earlier in the week. The Hang Seng leads the way lower with losses of around 1%, while in mainland China the CSI 300 is down around 0.25% Markets in Japan are hovering around neutral, Japanese media earlier reported a state of emergency is planned to be declared in Okinawa. Australia is a bright spot, the ASX 200 rising around 0.9% as financials gained despite a miss in labour market data and a sell off in iron ore. Futures in the US are lower, Nasdaq is faring slightly better than its counterparts following late gains for tech stocks yesterday.

GOLD: Bulls Still In Command

Spot gold has edged higher in Asia-Pac hours, with very modest firming in U.S. Tsys and a downtick in the DXY lending some light support. Spot last deals a handful of dollars higher on the day, just above $1,877/oz, well within the confines of Wednesday's range. Yesterday's move higher in the DXY and U.S. real yields, which accelerated in the wake of the release of the minutes from the FOMC's April meeting (the release came across a little more hawkish vs. some expectations) saw bullion back from highs of the day, although bulls still remain focused on the 76.4% retracement of the Jan 6 to Mar 8 sell off ($1,892.7/oz).

OIL: Crude Futures Hug Narrow Range

Oil moved in a narrow range in Asia on Thursday, WTI & Brent last print ~$0.15 above their respective settlement levels. Crude declined on Wednesday as markets assessed the impact of additional supply from Iran as nuclear deal negotiations continue, while the prospect of additional supply from OPEC+ in coming months also weighed.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.