-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Policymakers Offer Little New, Brexit Headlines Still Seen

EXECUTIVE SUMMARY

- CHINA & U.S. COMMERCE MINISTERS TALK OVER PHONE ON PRAGMATIC COOPERATION (XINHUA)

- PBOC GOVERNOR EXPECTS INFLATION TO BE BELOW 2% THIS YEAR (RTRS)

- CHINA FX REGULATOR WARNS AGAINST ONE-WAY BET ON YUAN (BBG)

- CHINA WATCHING CHALLENGES EXPORTERS FACE IN PRICES, YUAN RATE (BBG)

- EU-UK TALKS ON NORTHERN IRELAND APPEAR CLOSE TO COLLAPSE ON EVE OF G7 (GUARDIAN)

- KEYSTONE XL PIPELINE HALTED AFTER BIDEN BLOCKS PERMIT (BBC)

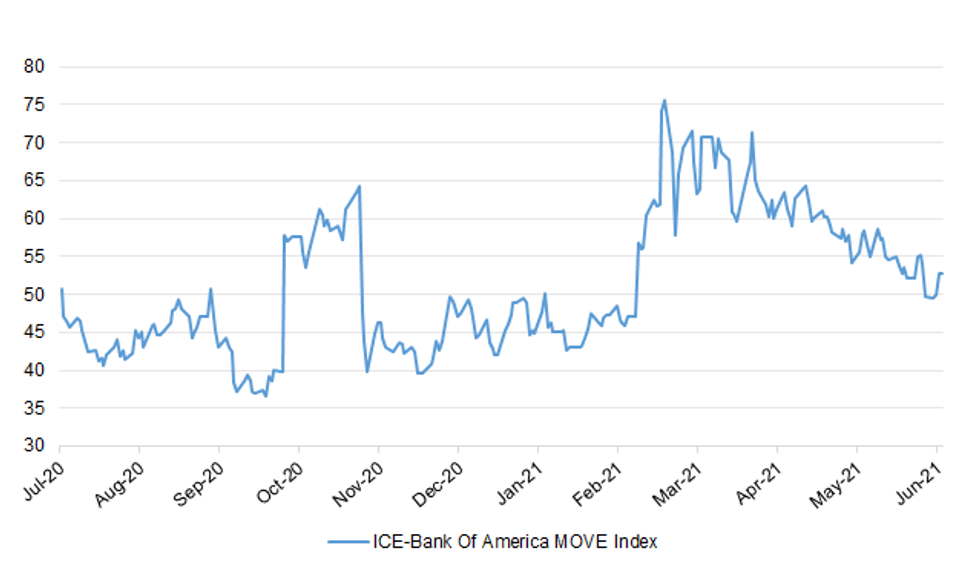

Fig. 1: ICE-Bank Of America MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson is examining a "mix-and-match" approach to easing lockdown restrictions in England on June 21, following a surge in cases of the Delta variant of coronavirus. On Wednesday, another 7,540 cases of Covid-19 were reported, a week-on-week increase of two-thirds and the highest level since February, along with six further deaths. The NHS is braced for a rise in hospital admissions in the coming month. The UK prime minister said the government needed to assess whether "the vaccine rollout . . . has built up enough protection in the population in order to go ahead to the next stage" of easing restrictions. Johnson will make his final decision on Monday. (FT)

CORONAVIRUS: Boris Johnson will lift the 30-person limit on weddings even if the easing of other lockdown restrictions is delayed beyond June 21, The Times has been told. The prime minister, who married Carrie Symonds on May 29, is understood to be determined to relax curbs on weddings and receptions this month. Ministers are considering delaying the easing of lockdown rules for a fortnight amid mounting concern about the spread of the Indian variant of the coronavirus. Many couples have had to postpone their weddings repeatedly since the first lockdown in March last year. At present 30 people are allowed to attend weddings and civil partnership ceremonies in Covid-secure venues. (The Times)

CORONAVIRUS: The health secretary is set to face questions from MPs about his role in the government's response to the coronavirus pandemic. Matt Hancock will field questions from MPs on the Science and Technology and Health and Social Care committees from 9.30am. He is likely to face tough questions on things like coronavirus testing, test and trace and the government's approach to care homes in the early months of the COVID-19 pandemic. (Sky)

BREXIT: Talks between the EU and the UK over Northern Ireland appear on the brink of collapse as London indicated it was still considering unilateral action to keep unhindered supplies flowing from Great Britain into the region. The European commission vice-president, Maroš Šefčovič, said patience was "wearing very, very thin" and described the relationship with the UK as "at a crossroads". Amid fears that the escalating crisis over Northern Ireland would develop into a trade war, David Frost, the Brexit minister, said there had been "no breakthroughs" over the Brexit checks but no "breakdowns" after a two-hour meeting with Šefčovič in London. (Guardian)

BREXIT: Protecting trade flows east-west and north-south across the island of Ireland is "easily doable", the UK PM has said. Speaking ahead of the G7 in Cornwall, Boris Johnson said a "solution" would protect the Northern Ireland peace process, but also guarantee the "economic and territorial integrity of the whole United Kingdom". (BBC)

BREXIT: Boris Johnson will on Thursday face pressure from Joe Biden to work with the EU to end a bitter stand-off over a settlement in Northern Ireland, as post-Brexit talks ended in stalemate and threats. The US leader, who meets his British counterpart in Cornwall ahead of a G7 summit, would not welcome any steps that imperilled or undermined the Good Friday Agreement or peace in the region, said Jake Sullivan, his national security adviser. Johnson will also face pressure from European leaders at the summit, as the EU repeated its threat to retaliate with trade sanctions if Britain unilaterally suspends parts of the so-called Northern Ireland protocol, which aims to avoid a hard border on the island of Ireland. (FT)

BOE: Central bankers are at their most dangerous moment in decades, with the risk of a "bad mistake" if they don't act to quell accelerating inflation, according to Bank of England chief economist Andy Haldane. Haldane, who is leaving the role this month, wrote in the New Statesman that the balance of risks have "shifted decisively" on inflation in recent months, and a rapid resurgence was now the central scenario for many businesses. With demand booming as the world emerges from lockdown, consumers eager to spend the savings built up during the pandemic, and companies running into supply issues, price pressures are mounting. While most central bankers say this phase will be temporary, Haldane said it may feed into wage demands and become entrenched. (BBG)

EUROPE

GERMANY: German finance minister Olaf Scholz has played down the surge in inflation in Germany in May, calling it a "temporary phenomenon". The annual pace of price growth in Germany rose to 2.4 per cent last month, its highest rate in more than two years; the country's central bank forecasts that it could hit 4 per cent later this year. Scholz blamed the rise on "adjustment effects", singling out the recovery from the coronavirus pandemic in certain sectors of the economy, which has disrupted supply chains and pushed up demand for everything from raw materials to semiconductors. (FT)

U.S.

FED: MNI: Fed Price Patience May Jolt Expectations Too Far- Ex-Staff

- The Fed's downplaying of faster inflation may send price expectations lurching higher than policy makers want and force a messy rethink of their stance, ex-staffers and advisers told MNI. "My chief concern is that the Fed will repeatedly state that its long-run target is 2% but that its actions will prove inconsistent with that rate, and then people's expectations will jump suddenly, leaving the Fed in the lurch," said Dean Cruoshore, a former long-time economist at the Philadelphia Fed. Inflation could quicken to as fast as 5% next year, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: NRF Revises US 2021 Retail Sales Forecast Higher

- Retail sales this year should grow between 10.5% and 13.5% to more than USD4.44 trillion, National Retail Federation Chief Economist Jack Kleinhenz said Wednesday. That's up significantly from the 6.5% to 8.2% range forecast in March as fiscal and monetary policy intervention has created an "overabundance" of purchasing power, he said at the NRF's inaugural State of Retail and the Consumer conference. "It's prudent to update our forecast for retail sales in 2021 given the brightening picture," he said, noting that economic activity has been "more frontloaded than expected" and real GDP growth should approach 7% this year, up from the 4% to 5% range forecast in February. The NRF expects real PCE growth of roughly 7.5% compared to 4.5% at the end of January and inflation across 2021 at 2.4%, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: House Budget Committee Chairman Yarmuth: Bipartisan infrastructure deal looks unrealistic. (BBG)

FISCAL: Brian Deese, director of the National Economic Council, told Axios at a virtual event on Wednesday that President Biden "is not going to stop reaching out" to Republicans to negotiate his American Jobs Plan. Biden is aiming to strike a deal with a separate, bipartisan group of senators after infrastructure talks — led by Sen. Shelley Moore Capito (R-W.Va.) — officially broke down on Tuesday. (Axios)

FISCAL: The infrastructure proposal from a new bipartisan group of senators wouldn't raise corporate or income taxes, according to a senator involved in the discussions. (BBG)

FISCAL: More than 2.3 million new stimulus checks have been sent, representing over $4.2 billion in payments to Americans, the government announced on Wednesday. In total, more than 169 million payments worth about $395 billion have been issued since Congress passed the American Rescue Plan Act in March. (CNBC)

FISCAL: The Labor Department determined it can't legally stop states from opting out of pandemic-era unemployment programs supporting millions of Americans, according to an agency official. The labor bureau also can't keep federal unemployment benefits flowing to affected individuals via an alternative mechanism, the official said. "We don't have the legal authority," according to the official, who spoke on condition of anonymity. (CNBC)

FISCAL: U.S. Treasury Secretary Yellen to appear at Senate Finance hearing on Budget on June 16. (BBG)

EQUITIES: The Securities and Exchange Commission is considering changing rules that govern how U.S. stocks are traded, including pricing incentives that exchanges and high-speed traders use to attract orders, Chairman Gary Gensler said Wednesday. Speaking to an industry conference, Mr. Gensler outlined a broader examination of market structure than he had previously described. (WSJ)

EQUITIES: Drafts of bills about tech competition and antitrust, likely to be introduced by leaders of the U.S. House Judiciary antitrust subcommittee soon, are circulating among Washington policy circles. When the bills are formally introduced, it will be the next step in the subcommittee's antitrust investigation, which last year resulted in a sweeping report (along with a separate report from ranking antitrust member Rep. Ken Buck of Colorado) recommending changes to antitrust law to better keep up with the digital age. (Axios)

OTHER

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen joins Mexico Finance Minister Arturo Herrera, Indonesia Finance Minister Sri Mulyani Indrawati, South Africa Finance Minister Tito Mboweni and Germany Vice Chancellor and Minister of Finance Olaf Scholz in a Washington Post opinion piece supporting a global minimum tax. "We call on all countries in the international negotiations to come together in a political agreement in line with the agreed timeline and ahead of the G-20 finance ministers meeting next month," officials write. (BBG)

GLOBAL TRADE: Rishi Sunak has won support from Brussels to exempt the City from G7 tax proposals amid fears that global banks based in London will be caught up in the measures. EU officials said other countries support his plans, with one saying: "Rumour has it that la douce France is also in favour of the carve-out." Another did not rule out the idea, adding that "technicalities are still being discussed". The Chancellor is said to be pushing "for an exemption on UK financial services" just days after declaring victory on tax avoidance aimed at ensuring the world's largest companies do not shift their earnings to havens around the world. (Telegraph)

U.S./CHINA: China's Minister of Commerce Wang Wentao and U.S. Secretary of Commerce Gina M. Raimondo talked over phone Thursday and exchanged views on relative issues and concerns in a frank and practical way. During the talks at the invitation of the U.S. side, Wang and Raimondo stressed the importance of dialogue and communication between China and the United States in the business field, and agreed to promote the healthy development of pragmatic cooperation on trade and investment while properly handle differences. The two sides also agreed to maintain communication in their working relationship. (Xinhua)

U.S./CHINA: Defense Secretary Lloyd Austin on Wednesday directed the Pentagon to place China and its military buildup at the center of American defense policy. The classified Pentagon-wide directive comes on the heels of recommendations from a 23-member task force aimed at assessing the U.S. military's China strategy. (CNBC)

U.S./CHINA: China speeded up plans for an anti-sanctions law after Joe Biden dashed Beijing's hopes that he would adopt a softer policy stance towards China, sources and observers have said. They said discussions about the law started last year during Donald Trump's presidency but China was looking for signs that Washington would adopt a different approach under a new administration. The law, which will provide a legal framework for retaliation and allow Chinese firms to seek compensation over foreign sanctions, is expected to be passed by the National People's Congress Standing Committee on Thursday. (SCMP)

U.S./CHINA: The U.S. is unable to choke the continuous growth of the Chinese economy given China's production capability, market potential and status as the top trading nation, the Global Times said commenting on U.S. President Joe Biden's European trip. The containment strategy of the U.S. against China must be supported by huge dividends and renewed high growth to build the confidence of its allies, the newspaper said. Most U.S. allies benefit from cooperating with China more than their strategic fears, and their interests determine that they will keep a distance from a U.S. comprehensive containment strategy, the newspaper said. (MNI)

U.S./CHINA: The Global Times tweeted the following on Thursday: "The US's "Indo-Pacific Strategy" is of Cold War mentality and aims to provoke group confrontation. As friendly neighbors and strategic partners, China & South Korea should not be biased into the rhythm, State Councilor and FM Wang Yi said in phone call with Chung Eui-yong." (MNI)

U.S./CHINA/TAIWAN: U.S. Trade Representative Katherine Tai plans to speak with her Taiwanese counterpart as early as Thursday as the two governments move to restart trade and investment talks that were suspended during the Trump administration, people familiar with the discussion said Wednesday. (WSJ)

U.S./CHINA/UK: Boris Johnson and Joe Biden will on Thursday attempt to bury their differences by signing a 21st century "Atlantic charter", committing Britain and the US to working together to tackle global challenges including the rise of an authoritarian China. At their first face-to-face meeting, the UK prime minister and US president are expected to announce a task force charged with reopening transatlantic travel and agree in principle a deal to jointly develop technology, including artificial intelligence. (FT)

CORONAVIRUS: Experts at the Wuhan Institute of Virology reiterated that no one at the lab has contracted the virus that causes Covid-19, in an interview with state media, the latest pushback from China against the theory that it leaked from there that has gained renewed traction. The experts, who requested anonymity, called on individuals from the West to present their proof and dismissed U.S. intelligence report saying three researchers were hospitalized in November 2019 with symptoms consistent with that of the flu and Covid, according to the interview with state-backed English-language newspaper China Daily. China has repeatedly denied that the virus leaked from the lab. The Group of Seven leaders are set to call for a fresh, transparent, World Health Organization-convened study into the origins of the coronavirus, according to a draft statement seen by Bloomberg News. (BBG)

CORONAVIRUS: The Group of Seven leaders is set to vow to deliver at least 1 billion extra doses of vaccines over the next year to help cover 80% of the world's adult population, according to a draft communique seen by Bloomberg News. Ahead of the G-7 summit in the U.K., officials are putting together a document that outlines a plan to end the pandemic by December 2022. The document has yet to be finalized but will form the basis of final-stage talks at the summit of leaders in Cornwall, southwestern England, starting Friday. (BBG)

CORONAVIRUS: The Biden administration will buy 500 million doses of the Pfizer-BioNTech coronavirus vaccine to share with countries around the world, with the option to buy an additional 200 million, two sources familiar with the deal tell Axios. (Axios)

CORONAVIRUS: Moderna Inc. is interested in partnering with the U.S. government on possibly providing additional doses of it Covid-19 vaccine to help address the pandemic in low- and middle-income countries, the company said. Spokesman Ray Jordan said in an email that the company wouldn't provide additional details about any particular talks. Moderna is in the process of expanding its manufacturing capacity so it can produce up to 3 billion vaccine doses next year, compared with its goal of up to 1 billion this year. The talks between Moderna and the U.S. were reported earlier by CNBC. (BBG)

CORONAVIRUS: Travel industry figures have dismissed the latest moves by the US and UK to reopen travel. A new taskforce will be set up to make recommendations on easing restrictions as part of an "Atlantic Charter", set to be agreed on Thursday. A Number 10 statement said the prime minister and president would "work to relaunch UK-US travel as soon as possible". But the boss of Virgin Atlantic said the announcement "falls short". Chief executive Shai Weiss said: "The creation of the Atlantic Taskforce is positive recognition of the importance of the UK-US travel corridor and a first step towards reopening the skies." (BBC)

JAPAN: The lower house of the Japanese parliament is likely to be dissolved in September, with the first general election under Prime Minister Yoshihide Suga following soon thereafter. After a slow start, the government is accelerating its COVID-19 vaccination rollout ahead of the Tokyo Olympics and Paralympics, which start in July. The government and the ruling Liberal Democratic Party are increasingly confident that the coronavirus pandemic will have dissipated to the point where it will be possible to hold an election in the fall. Suga is expected to direct ministries to consider a major economic stimulus package as early as this summer, and the LDP will try to highlight to voters Suga's commitment to bolstering the economy and repairing the damage caused by the pandemic. (Nikkei)

JAPAN: The Japanese government will allow anyone 65 and above to be vaccinated at large-scale sites run by the defense ministry after previously restricting use to residents of neighboring prefectures, Nikkei reports, without attribution. Tokyo site is currently limited to those residing in the capital and its surrounding 3 prefectures, while Osaka site is limited to those in the prefecture and 2 neighbors. The government will make an announcement soon and be ready to take reservations as soon as this week. The government will also accept phone reservations for the sites after initially limiting use to people who booked online. (BBG)

JAPAN: Japan to allow under 65s to get vaccinated at SDF site. (Sankei)

JAPAN: More than 80% of the athletes participating in the Tokyo Olympics next month have been vaccinated, according to the International Olympic Committee. "We are over and above the 80% mark," Olympic Games Executive Director Christophe Dubi said during a virtual press conference Wednesday in Lausanne. (BBG)

BOJ: The Bank of Japan is seen standing pat on its main policies at next week's meeting, while tinkering on the margins of its toolkit by extending aid for pandemic-hit businesses as the country's fight against the virus drags on. Some 89% of 44 economists surveyed by Bloomberg see the BOJ keeping in place its negative interest rate and asset purchase settings, with most seeing no change for the foreseeable future. Around 60% said they expect the bank to prolong its Covid-era lending measures past the current expiration in September. Another 39% said they see the bank making the move next month, instead. (BBG)

AUSTRALIA/CHINA: Australian Prime Minister Scott Morrison said his government will ask the World Trade Organization to resolve its wine-tariff trade dispute with China. "Barley producers in Australia, wine growers in Australia, have been targeted with trade sanctions that we believe are completely unconscionable," Morrison said in a radio interview on Thursday. "We are seeking to take those up to the World Trade Organization and see them resolved there." (BBG)

NEW ZEALAND: New builds will be exempt from planned changes to the tax treatment of residential investment property, Finance Minister Grant Robertson confirms in emailed statement. (BBG)

BOK: South Korea's central bank said Thursday it will make efforts to achieve its inflation target of 2 percent for this year in the medium term, as it hinted an exit from record-low interest rates amid signs of a strong recovery from the COVID-19 pandemic. In a regular monetary report, however, the Bank of Korea (BOK) said it will maintain the current easing of monetary policy "for the time being" to support an economy recovery. "Monetary policy will stay accommodative for the time being," the BOK said in the report, adding that it will work to stabilize consumer prices at a target of 2 percent this year. (Yonhap)

NORTH KOREA: Kim Jong Un has placed the North Korean people first and foremost under revisions to the all-important governing party rulebook, according to reports that began surfacing this month, indicating that the leader is setting out to create an identity that is starkly different from his revered grandfather and father. (Nikkei)

CANADA: By early July, fully vaccinated Canadians and permanent residents who return home after travelling will be subject to a far shorter quarantine – measured in days, not weeks – as long as they test negative for COVID-19, the federal government announced Wednesday. Travellers who are fully vaccinated and arriving in Canada more than two weeks after their last shot will only need to self-isolate until the COVID-19 test they take on arrival into the country comes back negative, Health Minister Patty Hajdu said. The change is based on rising vaccination rates and lower case counts. Dominic LeBlanc, Minster of Intergovernmental Affairs, cautioned these changes will only be implemented if new COVID-19 case counts keep dropping and the vaccination effort "continues to go well." (Globe & Mail)

TURKEY: "As long as the problems persist, it is not easy for us to cooperate sincerely in many fields," Turkey's Foreign Minister Mevlut Cavusoglu says in interview with state-run TRT television ahead of Monday's meeting between Presidents Joe Biden and Recep Tayyip Erdogan. "We see that the U.S. administration has a desire to work with Turkey in many strategic areas," Cavusoglu says. (BBG)

TURKEY: Differences between Turkey and France over the conflict in Libya have eased since the new Libyan government was sworn in, Turkish Foreign Minister Mevlut Cavusoglu said, adding that ties between the NATO allies were on a positive trend after months of tension. (RTRS)

MEXICO: Mexican President Andres Manuel Lopez Obrador said Wednesday he's named long-time economic adviser and ally Rogelio Ramirez de la O as his finance minister, three days after the government lost congressional support in midterm elections. Ramirez de la O will replace Arturo Herrera, who will be nominated to head the country's central bank, known as Banxico, Lopez Obrador said on his Twitter account. The current Banxico governor, Alejandro Diaz de Leon, will leave in December. (BBG)

MEXICO: The U.S. has asked Mexico to review whether workers at the Tridonex automotive parts facility in Matamoros, Tamaulipas, are being denied the rights of free association and collective bargaining, the office of the U.S. Trade Representative says in a statement. Request is second time ever, and the second time in the past month, that the U.S. has requested Mexico's review of collective bargaining rights issues under the Rapid Response Labor Mechanism in the United States-Mexico-Canada Agreement, or USMCA. (BBG)

BRAZIL: Data in Brazil shows the virus continues to be transmitted at a high speed across the country, the Fiocruz health foundation warned. The combination of rising cases, despite a slight drop in deaths, and high levels of ICU bed occupancy is worrisome, Fiocruz said. The nation has 12 states where ICUs are 90% full or more, it added. (BBG)

BRAZIL: Brazilian inflation will peak in June or July before coming down toward the central bank's target range, thanks to firm efforts by monetary policymakers and the government, an Economy Ministry senior official said on Wednesday. In an online event hosted by the Brazil-Florida Business Council, special secretary to the ministry Adolfo Sachsida said the government's firm commitment to fiscal consolidation will help lower inflation expectations, while the central bank "is going to do its part." (RTRS)

RUSSIA: President Joe Biden on Wednesday began his first trip abroad since taking office by hailing America's unwavering commitment to the NATO alliance and warning Russia it faced "robust and meaningful" consequences if it engaged in harmful activities. Biden, speaking to about 1,000 troops and their families at a British air base, said he would deliver a clear message to Russian President Vladimir Putin when they meet next week after separate summits with NATO, G7 and European leaders. "We're not seeking conflict with Russia," the Democratic president said at the start of his eight-day visit to Europe. "We want a stable and predictable relationship ... but I've been clear: The United States will respond in a robust and meaningful way if the Russian government engages in harmful activities." (RTRS)

RUSSIA: The U.S. and the European Union plan to launch a framework next week to harmonize policy on Russia, a country that's drawn increasing western criticism for flouting international norms and a deteriorating record on human rights. At a June 15 meeting in Brussels, President Joe Biden and the EU's 27 leaders will say that "to coordinate our policies and actions we will establish an EU-U.S. high-level dialogue on Russia," according to a draft of the summit conclusions seen by Bloomberg. (BBG)

RUSSIA: US President Joe Biden is expected to bring up the issue of the Nord Stream 2 pipeline with German leadership during upcoming bilateral discussions, White House National Security Adviser Jake Sullivan said on Tuesday. "I expect Nord Stream 2 will come up in conversations with the Germans. Again, I don't want to negotiate publicly on this issue, they understand well our concerns, but we do want to talk to them about what the implications of this pipeline are for energy security in Europe and for Ukraine," Sullivan told reporters. (Sputnik News)

RUSSIA: A Moscow court on Wednesday night outlawed the organizations founded by Russian opposition leader Alexei Navalny by labeling them extremist, the latest move in a campaign to silence dissent and bar Kremlin critics from running for parliament in September. The Moscow City Court's ruling, effective immediately, prevents people associated with Navalny's Foundation for Fighting Corruption and his sprawling regional network from seeking public office. Many of Navalny's allies had hoped to run for parliamentary seats in the Sept. 19 election. (AP)

SOUTH AFRICA: The number of new confirmed cases in South Africa surged to 8,881, with a positivity rate of 16.5% on tests conducted. "The increased number of tests and cases, and increased positivity are all evidence of the predicted third surge in Covid-19 cases," the National Institute of Communicable Diseases said in a statement on Wednesday. The commercial hub of Gauteng accounted for 58% of the new cases. South Africa is the worst- affected nation on the continent, with over 57,000 deaths and 1.7 million confirmed infections. (BBG)

SOUTH AFRICA: South Africa's Eskom says loadshedding will be increased to Stage 3 at 8am on Thursday until 10pm when it will revert to Stage 2, the company said in a tweet, citing breakdowns at several power stations. (BBG)

IRAN: Negotiations between Iran and the world powers on how to revive the 2015 nuclear accord will resume this weekend, U.S. Deputy Secretary of State Wendy Sherman said on Wednesday, adding that Iran's June 18 presidential election was a complicating factor. "I know that the negotiation will start again over this coming weekend," Sherman said during a virtual event organized by the German Marshall Fund think tank. (RTRS)

IRAN: The Biden administration is privately urging the governments of Venezuela and Cuba to turn away two Iranian naval ships believed to be carrying arms intended for transfer to Caracas, as the vessels make their way across the Atlantic Ocean this week, according to three people briefed on the situation. (POLITICO)

MIDDLE EAST: Rockets hit near U.S. forces and contractors in Iraq on Wednesday, including an air base north of Baghdad and a military base at Baghdad International Airport, the Iraqi army and security officials said. (RTRS)

OIL: The Keystone XL pipeline's developer has halted all construction on the project months after its permit was revoked by the Biden administration. The pipeline was set to carry oil 1,200 miles (1,900km) from the Canadian province of Alberta down to Nebraska. Environmentalists and Native American groups had fought against the project for more than a decade. President Donald Trump revived the pipeline in 2017, two years after it was rejected by President Barack Obama. In a statement on Wednesday, Calgary-based TC Energy said it would work with regional regulators to dismantle their equipment and "ensure a safe termination of and exit from" areas where construction had been planned. (BBC)

OIL: Libya's Waha Oil Co aims to return to normal output operations on Thursday after fixing a leak on a pipeline that more than halved the company's oil production, an oil source at the Es Sider crude export terminal said. (RTRS)

CHINA

INFLATION/YUAN: The Ministry of Commerce is watching closely challenges that exporters face in raw material prices, exchange rate fluctuations and shipping fees, according to a ministry statement analyzing May trade data. The ministry will work with local governments and other departments to take "comprehensive measures" in order to help exporters solve the problems, the statement says, without giving details. China's trade still faces complex and severe external environment due to the spreading global pandemic. (BBG)

YUAN: Companies should avoid one-way bet on yuan exchange rate, Pan Gongsheng, head of State Administration of Foreign Exchange, says at Lujiazui Forum. Two-way fluctuation of yuan exchange rate will become the norm. China plans to expand QDLP (Qualified Domestic Limited Partnership) trial and boost size of the program. China also plans to start QFLP (Qualified Foreign Limited Partner) trial in Lingang area in Shanghai's free trade zone. China will use ESG as a long-term investment target for China's forex Reserves. (BBG)

PBOC: China's central bank governor Yi Gang said he expects the country's annual average inflation to be below 2% this year, while cautioning against both inflationary and deflationary pressure amid economic and macro policy uncertainty. China will stick with implementing normal monetary policy, and will focus on the impact from structural changes on prices, Yi told a financial forum in Shanghai. China will also actively use structural monetary policy tools to support green transformation of the economy, Yi said. (RTRS)

PBOC: China may see less need to raise interest rates as the PPI is likely to slow in Q2 and Q3 after surging 9% y/y in May, which was the highest in almost 13 years, while CPI may only rise moderately, the Securities Times reported citing analysts. Rising raw material prices, driven by higher prices of crude oil, iron ore and non-ferrous metals, have contributed six percentage points to the PPI surge. However, higher prices of upstream products have failed to transmit to the consumer markets due to weak demand, which may discourage investment in expanding production, the Times said citing Wu Chaoming, chief economist of Chasing Securities. Policymakers should stabilize inflation expectation by ensuring commodity supplies, the newspaper said. (MNI)

RISKS: Investors who bet property prices will never fall will end up paying a heavy price, China Banking and Insurance Regulatory Commission Chairman Guo Shuqing says at the Lujiazui Forum in Shanghai. Guo also urged prevention of financial derivative risks. China will actively deal with a rebound in non-performing assets, Guo says, adding that he expects certain amounts of loans from small and medium-sized companies will turn into bad assets. Property bubbles are becoming more severe in some regions, with a number of government financing platforms faced with big debt repayment pressure. China to speed up restructuring of its financial system, and a key task is to boost share of direct financing. (BBG)

LGFVS: China should discourage local officials from raising excessive debt for development or evading debt obligations so as to better resolve hidden debt risks, Sina Finance reported citing former Finance Minister Lou Jiwei, who spoke at a forum. Currently, some local governments still insist on borrowing to stimulate investments and growth, while some officials wrongfully believe that the central government will bail out high-risk local government financing vehicles, said Lou. LGFV debts should be managed in standardized ways, Lou was reported as saying. (MNI)

OVERNIGHT DATA

JAPAN MAY PPI +4.9% Y/Y; MEDIAN +4.5%; APR +3.8%

JAPAN MAY PPI +0.7% M/M; MEDIAN +0.5%; APR +0.9%

JAPAN MAY TOKYO AVG OFFICE VACANCIES 5.90; APR 5.65

AUSTRALIA JUN CONSUMER INFLATION EXPECTATIONS +4.4%; MAY +3.5%

NEW ZEALAND MAY CARD SPENDING RETAIL +1.7% M/M; APR +4.4%

NEW ZEALAND MAY CARD SPENDING TOTAL +2.3% M/M; APR +4.4%

SOUTH KOREA MAY BANK LENDING TO HOUSEHOLDS KRW1,024.1TN; APR KRW1,025.7TN

UK MAY RICS HOUSE PRICE BALANCE 83%; MEDIAN 77%; APR 76%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2182% at 09:25 am local time from the close of 2.2716% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 37 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3972 THURS VS 6.3956

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3972 on Thursday, compared with the 6.3956 set on Wednesday.

MARKETS

SNAPSHOT: Chinese Policymakers Offer Little New, Brexit Headlines Still Seen

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 109.36 points at 28966.5

- ASX 200 up 35.196 points at 7305.5

- Shanghai Comp. up 29.322 points at 3620.718

- JGB 10-Yr future up 19 ticks at 151.90, yield down 1.9bp at 0.050%

- Aussie 10-Yr future up 9.0 ticks at 98.575, yield down 9.1bp at 1.481%

- U.S. 10-Yr future +0-01 at 132-25+, yield down 1.35bp at 1.477%

- WTI crude down $0.50 at $69.46, Gold down $2.92 at $1885.53

- USD/JPY down 8 pips at Y109.55

- CHINA & U.S. COMMERCE MINISTERS TALK OVER PHONE ON PRAGMATIC COOPERATION (XINHUA)

- PBOC GOVERNOR EXPECTS INFLATION TO BE BELOW 2% THIS YEAR (RTRS)

- CHINA FX REGULATOR WARNS AGAINST ONE-WAY BET ON YUAN (BBG)

- CHINA WATCHING CHALLENGES EXPORTERS FACE IN PRICES, YUAN RATE (BBG)

- EU-UK TALKS ON NORTHERN IRELAND APPEAR CLOSE TO COLLAPSE ON EVE OF G7 (GUARDIAN)

- KEYSTONE XL PIPELINE HALTED AFTER BIDEN BLOCKS PERMIT (BBC)

BOND SUMMARY: Core FI Firms In Asia, Event Risk Eyed

T-Notes stuck to a narrow 0-03+ range overnight, last dealing +0-01 at 132-25+. Cash Tsys trade unchanged to 1.5bp richer across the curve, with bull flattening in play, as regional players reacted to Wednesday's bid and looked through any positives surrounding a phone call between the U.S. and Chinese ministers of commerce. Preliminary open interest data pointed to short covering in TU, TY, UXY & US futures on Wednesday, which was touted at the time. A 3,665 lot block buy of TYU1 futures helped the broader bid during Asia-Pac hours. Participants may be happy to sit on the sidelines ahead of risk events scheduled during Thursday's European & U.S. sessions (the ECB monetary policy decision, U.S. CPI print & 30-Year Tsy supply).

- Cash JGBs firmed with the 7- to 10-Year sector leading the way, richening by ~2.0bp as the cash space played catch up to the U.S. Tsy-driven jump in futures during overnight trade. JBM1 +17, incrementally adding to the overnight rally, after an early, limited dip. Super-long dated swap spreads tightened by 0.5-1.0bp. A solid enough liquidity enhancement auction was seen, with the cover ratio nudging higher and the difference between the high and average spreads only ever so slightly wider but moving deeper into negative territory when compared to the previous auction.

- The Aussie bond curve has flattened further in Sydney trade, with spill over from Wednesday's U.S. Tsy move evident. YM +1.8 & XM +8.0 at typing. Roll flow continues to dominate matters, with a bias to selling still evident in both YM & XM rolls.

JGBS AUCTION: Japanese MOF sells Y497.7bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.7bn of 5-15.5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.017% (prev. -0.003%)

- High Spread: -0.016% (prev. -0.003%)

- % Allotted At High Spread: 21.7695% (prev. 49.2781%)

- Bid/Cover: 4.424x (prev. 4.282x)

JAPAN: Limited Weekly International Security Flows

The latest round of weekly international security flow data revealed that net flows were relatively subdued across all 4 major categories, with the highlight being net weekly foreign purchases of foreign bonds by Japanese investors, bringing an end to 2 straight weeks of net selling in that category.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 665.9 | -1089.9 | -374.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 67.5 | 129.4 | 298.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 489.2 | -30.1 | 2526.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 94.5 | 181.4 | -418.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Ticking Higher, China Outperforms

The major regional equity indices nudged higher during Thursday's Asia-Pac session, with the major Chinese mainland indices leading the way higher. That outperformance came on the back of a call between the U.S. & Chinese commerce ministers, with Chinese state media noting that the two "agreed to promote the healthy development of pragmatic cooperation on trade and investment while properly handle differences. The two sides also agreed to maintain communication in their working relationship." Chinese equities also benefitted from U.S. President Biden's move to revoke Trump era executive orders targeting TikTok & WeChat, moving to a new order requiring security reviews of these apps (and others) in the jurisdiction of foreign adversaries. U.S. equity index futures have nudged higher after the S&P 500 & DJIA ticked lower on Wednesday.

OIL: A Touch Softer

WTI & Brent sit ~$0.50 below their respective settlement levels after finishing around neutral levels on Wednesday.

- A reminder that Wednesday's headline DoE crude inventory data revealed a larger than expected drawdown in headline crude stocks, alongside larger than expected builds in both gasoline and distillate stocks (with all 3 readings providing wider drawdowns/builds than the weekly API equivalents, while also printing in the same direction as those equivalents). The build in the product stocks comfortably outweighed the drawdown in headline crude. Finally, stocks at the Cushing hub saw an incremental build vs. a small draw in the weekly API reading.

- Elsewhere, Libya seem to have provided a quick fix to a leaking pipeline at the ~350K bpd Waha oilfield.

- Finally, we should flag that the Keystone XL pipeline's developer halted all construction on the project months after its permit was revoked by the Biden admin.

GOLD: $1,900/oz Proving A Tough Nut To Crack

Gold bulls haven't managed to force a sustained re-test of the $1,900/oz marker over the last 24 hours. Our weighted U.S. real yield measure is a touch higher over that horizon, after recovering from intraday lows on Wednesday, with the broader DXY tracing out a similar pattern, both of which would have played into bullion's pullback from its Wednesday peak. Spot last deals little changed just shy of $1,890/oz, with the 20-day EMA providing the initial line of support.

FOREX: Yuan Gains On U.S.-China Talks, JPY Outperforms In G10 FX Space

China stole the limelight again, as offshore yuan gained on the back of reports that Commerce Mins from the U.S. and China have agreed to improve bilateral trade and investment ties. Separately, PBOC Gov Yi told the audience of the Lujiazui Forum in Shanghai that he sees China's consumer-price inflation below 2% this year, adding that the yuan exchange rate will remain stable.

- Headlines from China failed to elicit much volatility in G10 FX space, which saw another quiet Asia-Pac session. The yen resisted any potential impact of Gotobi Day flows and outperformed at the margin, as USD/JPY slipped over the Tokyo fix.

- The latest monetary policy decision from the ECB and much awaited U.S. inflation data are set to take centre stage today. Speeches are due from ECB Pres Lagarde, BoC Dep Gov Lane & BoE Chief Economist Haldane.

FOREX OPTIONS: Expiries for Jun10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2080-1.2100(E1.9bln-EUR puts), $1.2140(E597mln-EUR puts), $1.2175-90(E2.2bln), $1.2200-10(E950mln-EUR puts), $1.2280-00(E1.1bln)

- USD/JPY: Y108.50-60($921mln), Y108.95-10($1.5bln-USD puts), Y109.55-65($2.5bln-USD puts), Y109.70-75($775mln), Y110.00($981mln-USD puts)

- EUR/GBP: Gbp0.8600-05(E1.4bln-EUR puts)

- AUD/USD: $0.7750(A$537mln-AUD puts)

- EUR/AUD: A$1.5630(E937mln-EUR puts)

- USD/MXN: Mxn19.60($545mln-USD puts)

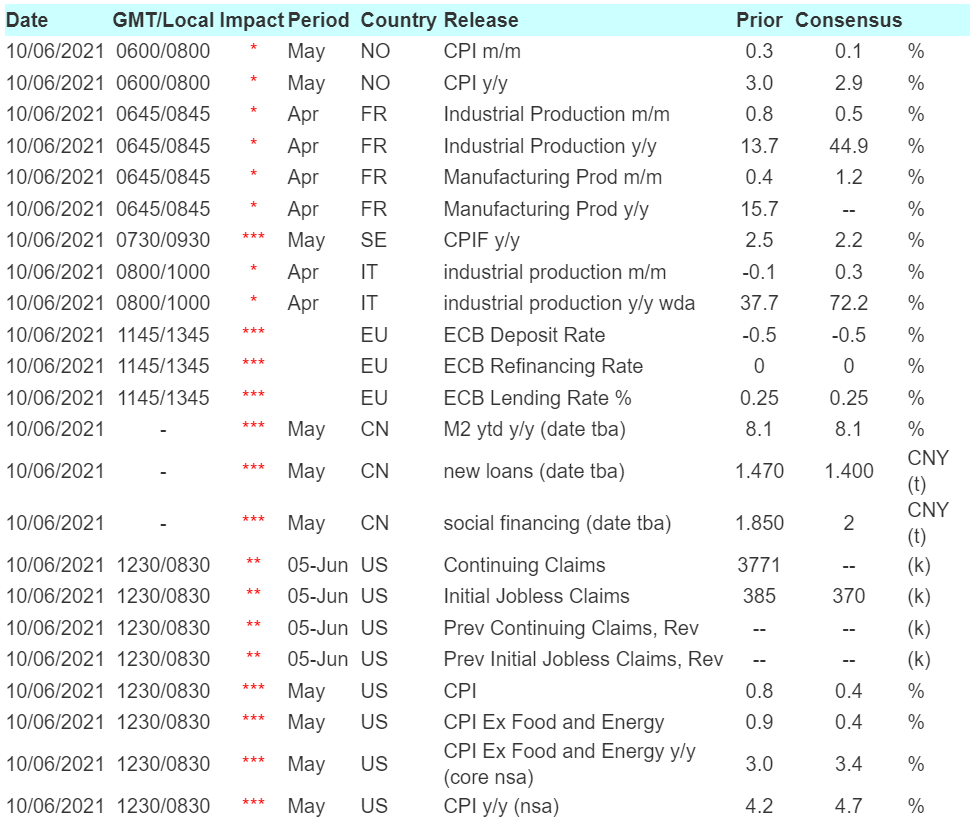

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.