-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: No Unwind For U.S. Tsys Ahead Of Event Risk

- Chinese policymakers added little to the broader discussion with comments made on Thursday.

- Chinese & U.S. policymakers hold "frank, practical" phone call, agreed to "promote the healthy development of pragmatic cooperation on trade and investment while properly handle differences."

- U.S. Tsys hold firm ahead of U.S. CPI, 30-Year Tsy supply & ECB decision

BOND SUMMARY: Core FI Firms In Asia, Event Risk Eyed

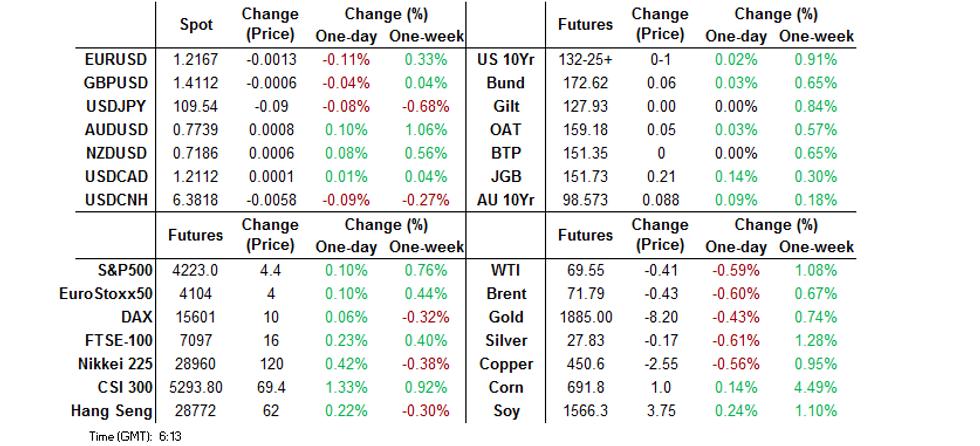

T-Notes stuck to a narrow 0-03+ range overnight, last dealing +0-01 at 132-25+. Cash Tsys trade unchanged to 1.5bp richer across the curve, with bull flattening in play as regional players reacted to Wednesday's bid and looked through any positives surrounding a phone call between the U.S. and Chinese ministers of commerce. Preliminary open interest data pointed to short covering in TU, TY, UXY & US futures on Wednesday, which was touted at the time. Finally, a 3,665 lot block buy of TYU1 futures helped the broader bid during Asia-Pac hours. Participants may be happy to sit on the sidelines ahead of risk events scheduled during Thursday's European & U.S. sessions (the ECB monetary policy decision, U.S. CPI print & 30-Year Tsy supply). Weekly jobless claims and real AHE data pad out the local economic docket.

- Cash JGBs firmed in Tokyo with 7s leading the way, richening by ~2.5p as the cash space played catch up to the U.S. Tsy-driven jump in futures during overnight trade. JBM1 +20, adding to the overnight rally, after an early, limited dip. Super-long dated swap spreads tightened by 1.0-2.0bp A solid enough liquidity enhancement auction for off-the-run 5- to 15.5 Year JGBs was seen, with the cover ratio nudging higher and the difference between the high and average spreads only ever so slightly wider but moving deeper into negative territory when compared to the previous auction. The quarterly BSI survey headlines the local docket on Friday.

- The Aussie bond curve has flattened further in Sydney trade, with spill over from Wednesday's U.S. Tsy move evident. YM +2.0 & XM +9.0 at typing. Roll flow continues to dominate matters, with a bias to selling still evident in both YM & XM rolls. 407K/470K & 147K/258K trading on the respective bids (numbers shown are volume traded on the bid since the Sydney open vs. total volume). In terms of market matters, ANZ moved their call for the first RBA hike of a new cycle to H223. On the local data front, we saw an uptick in consumer inflation expectations. The release of the AOFM's weekly issuance schedule headlines locally on Friday.

JAPAN: Limited Weekly International Security Flows

The latest round of weekly international security flow data revealed that net flows were relatively subdued across all 4 major categories, with the highlight being net weekly foreign purchases of foreign bonds by Japanese investors, bringing an end to 2 straight weeks of net selling in that category.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 665.9 | -1089.9 | -374.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 67.5 | 129.4 | 298.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 489.2 | -30.1 | 2526.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 94.5 | 181.4 | -418.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Yuan Gains On U.S.-China Talks, JPY Outperforms In G10 FX Space

China stole the limelight again, as offshore yuan gained on the back of reports that Commerce Mins from the U.S. and China have agreed to improve bilateral trade and investment ties. Separately, PBOC Gov Yi told the audience of the Lujiazui Forum in Shanghai that he sees China's consumer-price inflation below 2% this year, adding that the yuan exchange rate will remain stable.

- Headlines from China failed to elicit much volatility in G10 FX space, which saw another quiet Asia-Pac session. The yen resisted any potential impact of Gotobi Day flows and outperformed at the margin, as USD/JPY slipped over the Tokyo fix.

- The latest monetary policy decision from the ECB and much awaited U.S. inflation data are set to take centre stage today. Speeches are due from ECB Pres Lagarde, BoC Dep Gov Lane & BoE Chief Economist Haldane.

FOREX OPTIONS: Expiries for Jun10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2080-1.2100(E1.9bln-EUR puts), $1.2140(E597mln-EUR puts), $1.2175-90(E2.2bln), $1.2200-10(E950mln-EUR puts), $1.2280-00(E1.1bln)

- USD/JPY: Y108.50-60($921mln), Y108.95-10($1.5bln-USD puts), Y109.55-65($2.5bln-USD puts), Y109.70-75($775mln), Y110.00($981mln-USD puts)

- EUR/GBP: Gbp0.8600-05(E1.4bln-EUR puts)

- AUD/USD: $0.7750(A$537mln-AUD puts)

- EUR/AUD: A$1.5630(E937mln-EUR puts)

- USD/MXN: Mxn19.60($545mln-USD puts)

ASIA FX: Beijing Holds Talks With DC, PBOC's Yi Expects Sub-2% CPI This Year

Most Asia EM currencies posted marginal gains vs the greenback, while respecting relatively tight ranges. Sino-U.S. trade matters and PBOC speak took focus.

- CNH: Offshore yuan firmed as newswire headlines flagged that China's Commerce Min Wang has held a phone conversation with his U.S. counterpart, during which off'ls agreed to develop bilateral trade and investment relations. Separately, PBOC Gov Yi noted that that consumer-price inflation is expected to average below 2% in 2021, i.e. below the central bank's target. Spot USD/CNH shed ~70 pips, printing worst levels in a week.

- KRW: The won hugged a tight range. The BOK released their quarterly monetary policy report, noting that inflation may accelerate faster than expected and warning against financial imbalances.

- IDR: The rupiah was broadly higher, despite little of note in the way of local news flow. Spot USD/IDR fell to its lowest point since May 17.

- MYR: The ringgit was steady, as the local Covid-19 situation remained front and centre.

- PHP: The peso was stable after the BSP reported that FDI net inflow into the Philippines rose 139.5% Y/Y in March.

- THB: The baht was marginally firmer, even as Thailand's consumer sentiment dropped to the worst since the University of the Thai Chamber of Commerce's survey began in 1998.

- SGD: USD/SGD hovered around unchanged levels, with local news flow offering nothing of much note.

- TWD: USD/TWD slipped alongside most USD/Asia crosses. The WSJ reported that U.S. & Taiwanese trade reps will get in touch this week to restart trade and investment talks.

EQUITIES: Ticking Higher, China Outperforms

The major regional equity indices nudged higher during Thursday's Asia-Pac session, with the major Chinese mainland indices leading the way higher. That outperformance came on the back of a call between the U.S. & Chinese commerce ministers, with Chinese state media noting that the two "agreed to promote the healthy development of pragmatic cooperation on trade and investment while properly handle differences. The two sides also agreed to maintain communication in their working relationship." Chinese equities also benefitted from U.S. President Biden's move to revoke Trump era executive orders targeting TikTok & WeChat, moving to a new order requiring security reviews of these apps (and others) in the jurisdiction of foreign adversaries. U.S. equity index futures have nudged higher after the S&P 500 & DJIA ticked lower on Wednesday.

GOLD: $1,900/oz Proving A Tough Nut To Crack

Gold bulls haven't managed to force a sustained re-test of the $1,900/oz marker over the last 24 hours. Our weighted U.S. real yield measure is a touch higher over that horizon, after recovering from intraday lows on Wednesday, with the broader DXY tracing out a similar pattern, both of which would have played into bullion's pullback from its Wednesday peak. Spot last deals a few dollars softer around $1,885/oz, with the 20-day EMA providing the initial line of support.

OIL: A Touch Softer

WTI & Brent sit ~$0.40 below their respective settlement levels after finishing around neutral levels on Wednesday.

- A reminder that Wednesday's headline DoE crude inventory data revealed a larger than expected drawdown in headline crude stocks, alongside larger than expected builds in both gasoline and distillate stocks (with all 3 readings providing wider drawdowns/builds than the weekly API equivalents, while also printing in the same direction as those equivalents). The build in the product stocks comfortably outweighed the drawdown in headline crude. Finally, stocks at the Cushing hub saw an incremental build vs. a small draw in the weekly API reading.

- Elsewhere, Libya seem to have provided a quick fix to a leaking pipeline at the ~350K bpd Waha oilfield.

- Finally, we should flag that the Keystone XL pipeline's developer halted all construction on the project months after its permit was revoked by the Biden admin.

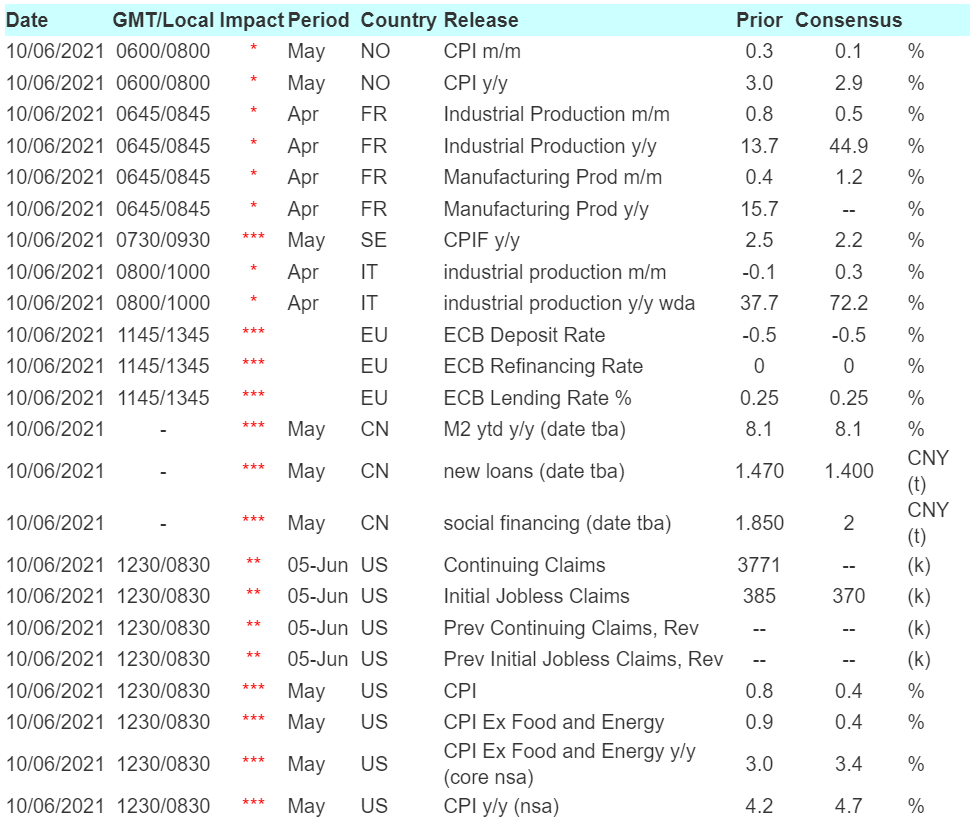

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.