-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBoC Still Playing A Steady Hand

EXECUTIVE SUMMARY

- LOCKDOWN EASING IN ENGLAND DELAYED TO 19 JULY (BBC)

- YUAN MAY FACE DEPRECIATION PRESSURE IN H221 (FINANCIAL NEWS)

- PBOC MAY INCREASE LIQUIDITY INJECTION IN 2ND HALF OF JUNE (CSJ)

- PBOC ROLLS OVER MATURING MLF PROVISIONS

- BOJ IS SAID TO SEE NO NEED FOR EXTRA BOND-BUYING TWEAKS FOR NOW (BBG)

Fig. 1: Shanghai Shenzhen CSI 300 Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The final stage of easing lockdown restrictions in England is to be delayed until 19 July. It means most remaining curbs on social contact will continue beyond 21 June, when they had been due to be lifted. The limit on wedding guest numbers will be removed but venues will still have to adhere to other rules. Prime Minister Boris Johnson said there would be a review after two weeks and he was "confident" the delay would not need to be longer than four weeks. However, he told a Downing Street press conference he could not rule out the possibility the date could be pushed back further. Scientists advising the government had warned of a "significant resurgence" in people needing hospital treatment for Covid-19 if stage four of easing the lockdown went ahead on 21 June. It comes amid rising cases, driven by the more transmissible Delta variant, which was first identified in India. (BBC)

FISCAL: Rishi Sunak has rejected a call from business leaders to extend furlough, despite the delay in ending lockdown. The scheme, which pays 80 per cent of people's wages, is due to start being wound down at the end of this month. (The Times)

BREXIT: Senior figures at the European Union have clashed over its response to the dispute with the UK over Brexit and Northern Ireland. Hardliners led by President Macron of France and Ursula von der Leyen, the European Commission president, insist that the letter of EU single market law applies, according to Brussels sources. Others, such as Maros Sefcovic, the commission vice-president in charge of negotiations, are pushing for flexibility on EU rules such as medicines approval to achieve a compromise. (The Times)

BREXIT: A UK-Australia free trade deal has been agreed and will be announced on Tuesday morning, a government source has told Sky News. Boris Johnson and Australian Prime Minister Scott Morrison agreed the broad terms of the agreement over dinner in No 10 on Monday evening, the source said. The UK government had been eager to strike a free trade deal with Australia by the end of June to demonstrate its capability of forging new economic opportunities having left the European Union. (Sky)

EUROPE

GERMANY: Germany's conservatives plan to rule out tax hikes in their election manifesto, a draft obtained by Reuters showed, aligning them with their preferred liberal coalition partners and distinguishing them from their main rivals. (RTRS)

GERMANY: The latest INSA poll for Bild newspaper put support for the CDU/CSU at 27.5%, the Greens fell to 19.5% and the left-leaning Social Democrats (SPD) rose to 16.5%. The FDP stood at 13.5%, the far-right AfD at 11% and the far-left Linke on 6%. (RTRS)

SPAIN: Spain is due to receive 19 billion euros ($23 billion) from the European Union's COVID-19 recovery package this year, a government source with knowledge of the matter told Reuters on Monday, confirming a report in El Pais newspaper. Spain would receive 9 billion euros in June, as an early payment, and the EU would disburse a second tranche of 10 billion euros by the end of the year. The Spanish government had originally envisaged an investment of 27 billion euros from the EU recovery funds in the 2021 budget, but delays in the approval of the plan have shifted part of the money to next year. (RTRS)

U.S.

ECONOMY: MNI REALITY CHECK: US Retail Spending Seen Strong Through May

- Retail sales likely strengthened in May as mobility increased and consumers were mostly undeterred by higher prices, industry experts told MNI, painting a rosier picture than most forecasts suggest. Retail spending growth through May was "solid," said Jack Kleinhenz, Chief Economist at the National Retail Federation, driven by pent up demand as restrictions on business, travel, and in-person activities eased. Consumers were also still "flushed with cash" from stimulus checks and tax returns, he added - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: U.S. Senate Republicans are due to hear details on Tuesday about a bipartisan proposal to revitalize America's roads and bridges, which lawmakers believe could win support from the caucus as a part of President Joe Biden's sweeping infrastructure plan. Members of a bipartisan Senate group will discuss the proposal with Republican senators at their weekly policy lunch, Republican lawmakers and aides said on Monday evening. "We'll be discussing it," Senator Bill Cassidy, a member of the group, told reporters. "It won't be a formal sort of 'OK - now we need your vote.' It'll be more kind of 'OK - here's more information for you.'" The bloc of Senate moderates, five Republicans and five Democrats, said last Thursday that it had reached an agreement after negotiations between Republican Senator Shelley Moore Capito and Biden broke down. (RTRS)

FISCAL: Senate Budget Committee Chairman Bernie Sanders (I-Vt.) says he won't support a bipartisan infrastructure spending proposal unveiled last week because he believes it doesn't do enough to address the needs of the country and shields the wealthy from tax increases. Sanders's opposition means the proposal would need to garner at least 11 Republican votes in the 50-50 Senate if Senate Majority Leader Charles Schumer (D-N.Y.) puts it on the floor and the rest of the Democratic caucus votes for it. "I wouldn't vote for it," he told reporters Monday evening. "The bottom line is there are needs facing this country. Now is the time to address those needs and it has to be paid for in a progressive way given the fact that we have massive income, wealth inequality in America." (The Hill)

OTHER

GLOBAL TRADE: The EU and US are poised to resolve a 17-year dispute over aircraft subsidies, lifting the threat of billions of dollars in punitive tariffs from their economies in a boost to transatlantic relations. Diplomats and officials confirmed on Monday night that two days of intensive negotiations in Brussels had left the EU and the Biden administration on the cusp of confirming a deal on subsidy rules for Airbus and Boeing. The breakthrough is set to be finalised on Tuesday at US president Joe Biden's first EU-US summit meeting in Brussels. People close to the talks said on Monday night that the governments of Airbus's three home countries in the EU — Germany, France, and Spain — were being consulted on an agreement that could then be confirmed on Tuesday morning if there were no last-minute obstacles. (FT)

U.S./CHINA: A U.S. aircraft carrier group led by the USS Ronald Reagan has entered the South China Sea as part of a routine mission, the U.S. Navy said on Tuesday, at a time of rising tensions between Washington and Beijing, which claims most the disputed waterway. China frequently objects to U.S. military missions in the South China Sea saying they do not help promote peace or stability, and the announcement follows China blasting the Group of Seven nations for a statement scolding Beijing over a range of issues. "While in the South China Sea, the strike group is conducting maritime security operations, which include flight operations with fixed and rotary wing aircraft, maritime strike exercises, and coordinated tactical training between surface and air units," the U.S. Navy said. (RTRS)

GEOPOLITICS: U.S. President Joe Biden will intensify his post-Trump push to renew transatlantic relations on Tuesday, meeting with European Union leaders to cool trade tensions and join forces to beat COVID-19, uphold democracy and hold back climate change. (RTRS)

GEOPOLITICS: China warned the North Atlantic Treaty Organization it won't "sit back" in the face of any challenges, illustrating the potential for tensions to escalate while the U.S. tries to convince its allies to take a tougher approach to the Asian nation. Beijing doesn't pose a "systemic challenge" to any countries, according to a statement posted Tuesday on the website of its mission to the European Union that added NATO should not exaggerate China's military power. The statement also urged NATO to push forward with dialogue and cooperation, and said the bloc should work to safeguard international and regional stability. (BBG)

GEOPOLITICS: The G7 and its communique about China are far more symbolic than practical, and the Chinese do not need to take them seriously, the Global Times said in a commentary, following the group's statement that criticized China over issues including human rights in Xinjiang, Hong Kong autonomy and Taiwan. China should concentrate on doing its own affairs well, which will be the most powerful response against G7 interventions, although tactically it needs to pay some attention to them to protect China's global standing, the newspaper said. China must ensure that global affairs not be determined by a small number of Western powers, which can sacrifice other nations' interests, the Times said. (MNI)

CORONAVIRUS: The global spread of Covid-19 is moving faster than the global distribution of vaccines, World Health Organization officials said Monday. They attributed transmission rates to new variants, such as Alpha and Delta, which have been shown to be more contagious. "That means the risks have increased for people who are not protected, which is most of the world's population," Tedros Adhanom Ghebreyesus, director-general of the WHO, said during a press briefing. (CNBC)

CORONAVIRUS: Covid-19 vaccines from Pfizer Inc. and AstraZeneca Plc are highly effective after two doses at preventing hospitalization of those infected with the delta variant, underscoring the urgency in getting people fully protected, according to health authorities in England. The Pfizer and BioNTech SE shot is 96% effective against hospitalization after two doses, while the AstraZeneca and University of Oxford Covid inoculation is 92% effective, according to an analysis announced Monday by Public Health England. Those results are comparable with the protection offered against the alpha variant, which first emerged in Britain, the data show. (BBG)

CORONAVIRUS: Pfizer Inc. will examine cases of fully vaccinated people who contracted Covid-19 to determine whether and when a booster shot is necessary. "We will be looking at real world data to help us understand when we might see a change in vaccine effectiveness," David Swerdlow, clinical epidemiology lead for Pfizer Vaccines, said at the Precision Medicine World Conference. More than 10,200 Covid-19 vaccine breakthrough cases have been reported in the U.S. as of April 30, although it's rare for fully vaccinated people to get infected. (BBG)

BOJ: The Bank of Japan remains convinced it doesn't need to take any further measures to improve the functioning of the government debt market for now after offering more clarity on its bond-buying operations, according to people familiar with the matter. Ahead of a policy meeting later this week, central bank officials said it is still too early to judge whether tweaks made to the central bank's policy framework in March have been ineffective in improving the functioning of the Japanese government bond market. The officials see the greater transparency on its operations helping ensure yields are more closely aligned with market conditions by limiting investors' reactions to its own purchases, the people added. (BBG)

BOJ: MNI BRIEF: BOJ Hopes For Upward Capex Revision in June Tankan

- Bank of Japan economists await the upcoming June Tankan to gauge whether capital investment plans are revised revised up from March, as normally happens, to gauge whether a virtuous cycle is still in place in the corporate sector, MNI understands. Capex plans by major firms are expected to rise 3.0% this fiscal year, above the historical average - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: An expert panel of Okinawa prefecture, southern Japan, is seeing the need to extend a coronavirus state of emergency that's due to expire on June 20, broadcaster TV Asahi reports, without attribution. Although the number of daily infections is declining in the prefecture, the panel considers the emergency needs to be extended by ~2 weeks because medical system is still strained. The government of Okinawa prefecture will decide "soon" whether to ask the central government to extend the emergency. (BBG)

JAPAN: Japan's defense ministry has decided to expand the age group of vaccinations at large sites from Thursday, public broadcaster NHK reports, without attribution. Those aged 18 and above from across the nation will be eligible but require vouchers from local authorities. The ministry will officially decide Tuesday on the expansion. (BBG)

JAPAN: Japan's opposition has submitted a no-confidence motion against Prime Minister Yoshihide Suga's cabinet, just over a month before the Tokyo Olympics are due to start. However, Suga's Liberal Democratic Party and its smaller coalition partner Komeito have a majority in the lower house of parliament and are expected to shoot the vote down on Tuesday. The fractured opposition camp had earlier called on the cabinet to extend the current parliamentary session due to end on Wednesday, but their demand was rejected. Among the criticisms of Suga from the opposition are his plans to forge ahead with the Tokyo Olympics, due to start on July 23, despite the coronavirus pandemic. (DPA)

RBA: MNI BRIEF: RBA Likely To Continue QE, Says Board Minutes

- The Reserve Bank of Australia is likely to continue buying government bonds when the current program concludes in September, with the bank saying in the latest minutes that it "would be premature to consider ceasing the program," an indication it believes that accommodative policy is still required for the economy to meet targets around inflation and full employment - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBNZ: New Zealand Finance Minister Grant Robertson added house prices to the central bank's monetary policy remit despite both the bank and the Treasury Department advising it would have little impact. Emails released to Bloomberg under the Official Information Act show Treasury considered the change useful only as a signal, and did not expect it to significantly influence monetary policy or house prices. Correspondence between senior Treasury and Reserve Bank officials also reveals the central bank fought a running battle over the language used in the new remit, insisting that it note the government's desire for "sustainable" rather then "affordable" house prices. (BBG)

RBNZ: Treasury Dept. publishes advice on potential amendments to the Reserve Bank of New Zealand Bill, currently being scrutinized by parliament. Says the bill introduces a new governance model, including a new non-executive board responsible for monitoring RBNZ management and the Monetary Policy Committee. Says potential issues have arisen -- in particular the risk of conflict between the MPC and the board about the use of the balance sheet. (BBG)

CANADA: U.S. and Canadian officials are set to meet Tuesday to discuss how to eventually lift pandemic-related border restrictions between the two countries, but no immediate action is expected, sources briefed on the matter told Reuters on Monday. (RTRS)

TURKEY: Turkish President Tayyip Erdogan sounded upbeat after his first face-to-face talks with Joe Biden, though he announced no major breakthroughs in the awkward relationship between the two allies, at odds over Russian weapons, Syria, Libya and other issues. Erdogan characterized his talks with the new U.S. president on the sidelines of a NATO summit in Brussels as "productive and sincere." "We think that there are no issues within U.S.-Turkey ties, and that areas of cooperation for us are richer and larger than problems," he said. (RTRS)

BRAZIL: A large overhaul of Brazil's public sector has a good chance of being approved by congress before the end of the year, according to the lawmaker handling the bill. Fernando Monteiro, the head of the congressional committee analyzing the government's proposal, said in an interview that since the window to discuss politically sensitive matters closes in December before the 2022 presidential election, the next six months will be the last chance to push through the changes, which include lowering starting wages and ending job security for several public careers. He estimates the amendment will pass the lower house by September and the Senate by December, and plans to speed up the process by debating the reform in both houses simultaneously, as was done during the successful pension reform. (BBG)

BRAZIL: Delivery of 3 million doses of Janssen vaccines against the new coronavirus, scheduled for Tuesday, will no longer occur, BandNews TV reports citing confirmation by Brazil Health Ministry. Reason for cancellation was not informed by the company or government. There is also no new delivery date. Vaccine produced by Janssen, the pharmaceutical arm of Johnson & Johnson, is applied in a single dose. The shots would arrive in the country close to the expiration date, on June 27. (BBG)

BRAZIL: Facing its worst drought in almost a century, Brazil's government is preparing a temporary decree that could lead to electricity rationing, according to a draft of the measure seen by Reuters on Monday. (RTRS)

RUSSIA: U.S. President Joe Biden said his Wednesday meeting with Russian President Vladimir Putin would be "critical" and that he'd offer to Moscow to cooperate on areas of common intrest if the Kremlin so choses. Biden characterized Putin as "an adversary, or someone who could be an adversary," as bright and tough. "I will make clear to President Putin that there are areas where we can cooperate if he choses," Biden said after a NATO summit in Brussels. "If he choses not to cooperate and acts in the way he has in the past related to cyber seurity and some other activies, we will respond, we will respond in kind," the U.S. leader said, adding he would "make clear where the red lines are" to Putin as well. (RTRS)

CHINA

YUAN: Value of the Chinese yuan is approaching a turning point and may face depreciation pressure in the 2nd half of 2021, according to a Monday report by Financial News citing analysts. The appreciation risks of dollar is one of the main reasons behind a weakening yuan, says the report. Factors such as global immunization, economic recovery, rising inflation, and tightening monetary policies all point to a strengthening dollar. (BBG)

PBOC: China's central bank is expected to offer more MLF than the amount due this month, China Securities Journal says in a front-page article, citing analysts. China will keep its monetary policy stable and won't take sharp turn despite impact on global financial market from Fed's possible scaling back in debt purchases. PBOC almost always increased short to medium term liquidity via means including reverse repo operations every June, and there will be no exception this year. (BBG)

OVERNIGHT DATA

AUSTRALIA Q1 HOUSE PRICE INDEX +7.5% Y/Y; MEDIAN +7.6%; Q4 +3.6%

AUSTRALIA Q1 HOUSE PRICE INDEX +5.4% Q/Q; MEDIAN +5.3%; Q4 +3.0%

NEW ZEALAND MAY REINZ HOUSE SALES +81.4% Y/Y; APR +419.7%

NEW ZEALAND MAY FOOD PRICE INDEX +0.4% M/M; APR +1.1%

SOUTH KOREA APR MONEY SUPPLY L +1.8% M/M; MAR +1.5%

SOUTH KOREA APR MONEY SUPPLY M2 +1.5% M/M; MAR +1.2%

CHINA MARKETS

PBOC NET DRAINS CNY10BN BY MLF AND REPOS TUESDAY

The People's Bank of China (PBOC) injected CNY200 billion through one-year medium-term lending facility (MLF) with the rate unchanged at 2.95% on Tuesday. The operation was intended to roll over CNY200 billion MLF maturing today and keep the liquidity reasonable and ample, the PBOC said on its website. The PBOC also injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.20%. In total, the central bank net drained CNY10 billion as CNY20 billion reverse repos matured today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:29 local time from the close of 2.1516% on June 11, the last working day before the holiday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 42 last Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4070 TUES VS 6.3856

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4070 on Tuesday, compared with the 6.3856 set on Friday.

MARKETS

SNAPSHOT: PBoC Still Playing A Steady Hand

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 277.85 points at 29439.93

- ASX 200 up 74.366 points at 7386.7

- Shanghai Comp. down 32.415 points at 3557.333

- JGB 10-Yr future down 7 ticks at 151.8, yield up 0.4bp at 0.045%

- Aussie 10-Yr future up 0.8 ticks at 98.551, yield up 0.7bp at 1.495%

- U.S. 10-Yr future +0-03 at 132-19+, yield down 1.02bp at 1.484%

- WTI crude up $0.22 at $71.1, Gold down $0.52 at $1865.67

- USD/JPY unch. at Y110.07

- LOCKDOWN EASING IN ENGLAND DELAYED TO 19 JULY (BBC)

- YUAN MAY FACE DEPRECIATION PRESSURE IN H221 (FINANCIAL NEWS)

- PBOC MAY INCREASE LIQUIDITY INJECTION IN 2ND HALF OF JUNE (CSJ)

- PBOC ROLLS OVER MATURING MLF PROVISIONS

- BOJ IS SAID TO SEE NO NEED FOR EXTRA BOND-BUYING TWEAKS FOR NOW (BBG)

BOND SUMMARY: Mixed Performance For Core FI

T-Notes held to a very narrow 0-03 range overnight, last +0-03 at 132-19+. Cash Tsys trade unchanged to 1.0bp richer across the curve. Headline flow remains light, with ongoing bi-partisan Senator level meetings re: fiscal matters confirmed for this week, although certain, high-ranking quarters of the Democratic party continue to point towards the need for reconciliation measures. Elsewhere, the latest U.S. naval incursions into the South China Sea had little impact on broader sentiment.

- The JGB curve runs steeper on the day, while futures have recovered from their overnight lows to last print -6. There has been little to really move the market, at least meaningfully, with the previously outlined BoJ, COVID and political headlines offering little new on net. The latest liquidity enhancement auction for off-the- run JGBs with 15.5- to 39-Years until maturity was on the softer side, in terms of both cover ratio and spread dynamics.

- Aussie bond futures are a little flatter, YM -1.4, XM +1.2. The minutes from the RBA's June meeting pointed to an extension of the Bank's broader bond buying scheme, with a variety of scenarios re: the future shape of purchases sketched out (including a straight rollover of the existing scheme, scaling back the amount purchased or spreading the purchases over a longer period, or moving to an approach where the pace of the bond purchases is reviewed more frequently, based on the flow of data and the economic outlook). Re: the potential extension of the Bank's yield targeting measure to ACGB Nov '24, the board noted that it "had previously stated that it would not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. A key consideration for the decision regarding the yield target would be an assessment of the prospect of this condition being met some time in 2024." It also noted that market pricing indicated that bond market participants "did not, on balance, expect the yield target to be extended."

JGBS AUCTION: Japanese MOF sells Y2.7762tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7762tn 6-Month Bills:- Average Yield -0.1036% (prev. -0.1016%)

- Average Price 100.052 (prev. 100.051)

- High Yield: -0.0996% (prev. -0.0996%)

- Low Price 100.050 (prev. 100.050)

- % Allotted At High Yield: 10.7480% (prev. 92.3390%)

- Bid/Cover: 4.664x (prev. 4.098x)

JGBS AUCTION: Japanese MOF sells Y498.8bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:- Average Spread: +0.005% (prev. -0.008%)

- High Spread: +0.008% (prev. -0.007%)

- % Allotted At High Spread: 72.7804% (prev. 46.6121%)

- Bid/Cover: 2.184x (prev. 3.104x)

EQUITIES: Mixed After Return From Holiday

Mixed performance for equity markets in Asia on Tuesday; bourses in mainland China return from yesterday's holiday and have come under pressure with major indices down over 1%. The PBOC's OMO and MLF operations resulted in a net drain of CNY 10bn despite chatter of additional liquidity on its way in June. Markets in Japan, Australia are higher, the latter supported by a dovish set of RBA minutes. Futures are higher in the US after a late rally took the S&P 500 to a fresh record high yesterday.

OIL: Flat For Second Day

Oil is flat in Asia-Pac trade on Tuesday, giving back early gains after a flat finish on Monday. WTI last trading at $70.90/bbl while Brent last at $72.88/bbl. In terms of technical levels holding above $70/bbl targets $72.06 next, a Fibonacci projection. Key trend support has been defined at $61.56, May 21 low.

GOLD: Off Monday's Lows

U.S. real yield dynamics were in the driving seat on Monday driving gold lower early on, before bullion rebounded from worst levels to last trade around the $1,865/oz mark as participants await the latest FOMC decision on Wednesday. The 50-day EMA provides the next area of technical support, while resistance isn't seen until the June 8 high ($1,903.8/oz).

FOREX: AUD Softens, USD Crosses Rangebound

Commodity FX felt some mild selling pressure as caution emerged ahead of Thursday's announcement of the FOMC's latest monetary policy decision. AUD led losses in G10 FX space, as minutes from the RBA's June policy meeting noted that "monetary policy would be likely to need to remain highly accommodative for some time yet."

- Most major USD crosses stuck to tight ranges, even as markets in Australia, China, Hong Kong and Taiwan reopened after a long weekend. The DXY remained within the confines of the prior day's range.

- The first yuan fixing this week fell roughly in line with expectations, as the PBOC set its central USD/CNY mid-point at CNY6.4070 (against sell-side est. of CNY6.4074).

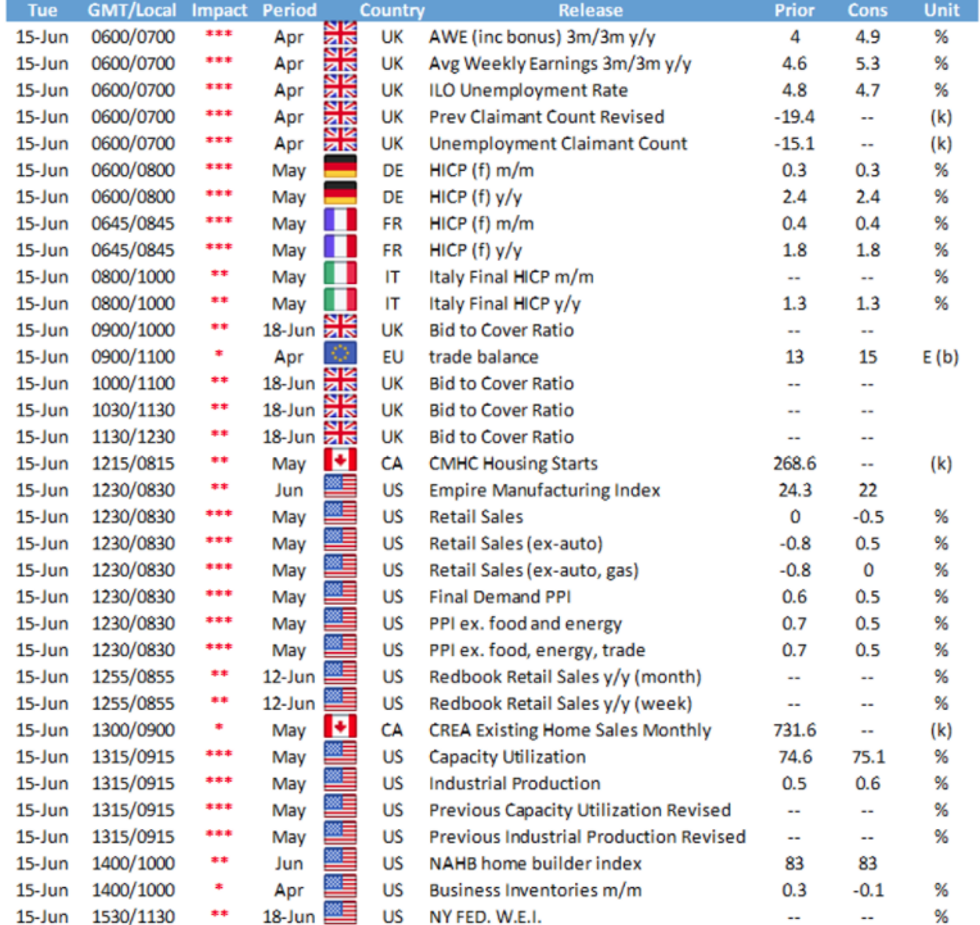

- Coming up today we have U.S. retail sales, industrial output & Empire M'fing, final German CPI, UK unemployment & Canadian housing starts. Speeches are due from BoE's Bailey as well as ECB's Lane, Rehn, de Cos, Panetta & Holzmann.

FOREX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-55(E552mln), $1.2075-80(E646mln-EUR puts), $1.2150-60(E590mln), $1.2200(E706mln), $1.2240-50(E870mln-EUR puts), $1.2300(E584mln-EUR puts)

- USD/JPY: Y109.00-15($620mln-USD puts), Y109.50-60($665mln-USD puts), Y110.00-11($1.45bln-USD puts), Y111.50($799mln)

- EUR/GBP: Gbp0.8600-10(E1.1bln-EUR puts)

- USD/NOK: Nok7.99($500mln), Nok8.15($400mln)

- AUD/USD: $0.7700-15(A$880mln, A$724mln-AUD puts), $0.7725-40(A$1.4bln-AUD puts), $0.7940-50(A$574mln)

- USD/MXN: Mxn19.82($635mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.