-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Geopolitics & Commodity Matters Headline Ahead Of FOMC

EXECUTIVE SUMMARY

- U.S. SENATORS WANT COMMERCE DEPT TO LIST TECH TO KEEP AWAY FROM CHINA (RTRS)

- PENTAGON CONSIDERING PERMANENT NAVAL TASK FORCE TO COUNTER CHINA IN THE PACIFIC (POLITICO)

- EU'S DOMBROVSKIS: EU WILLING TO COOPERATE WITH U.S. ON CHINA (BBG)

- SCHUMER TO TRIGGER RECONCILIATION PROCESS ON WEDNESDAY (THE HILL)

- RBNZ EYES ANOTHER TOOL TO BATTLE WORLD'S HOTTEST HOUSING MARKET (BBG)

- CHINA TAKES FURTHER STEPS TO CLAMP DOWN ON COMMODITY PRICES

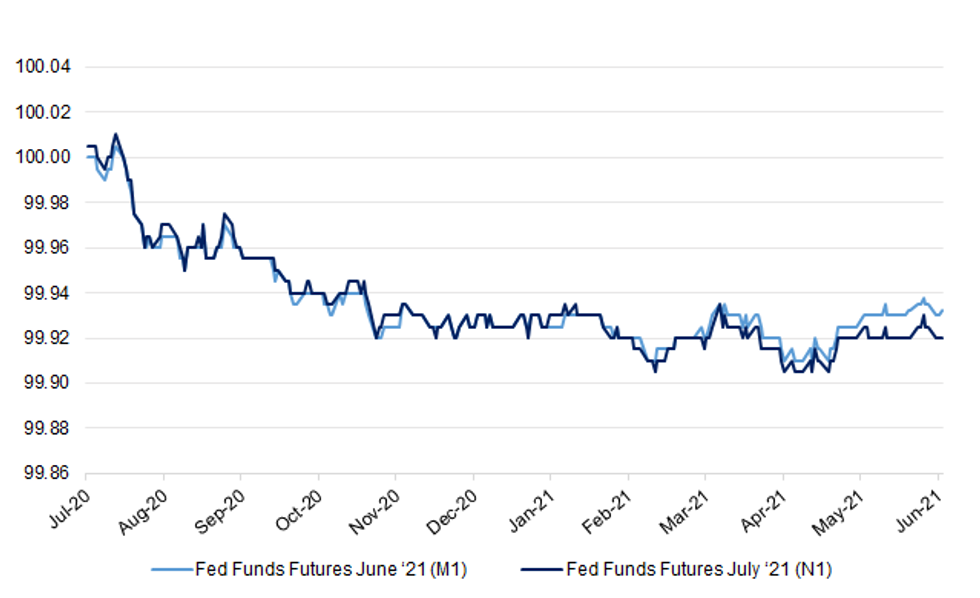

Fig. 1: Fed Funds Futures June '21 (M1) & July '21 (N1) Contracts

UK

CORONAVIRUS: Shortages of the Pfizer vaccine have forced the NHS to slow the rollout of jabs despite ministers promising to use the delay to the ending of Covid restrictions to vaccinate as many people as possible. Supplies of the Pfizer jab to virus hotspots in which Covid case rates are rising among younger groups have been cut, The Telegraph has learned. Boris Johnson said on Monday that delaying the reopening would give the NHS crucial weeks in which to accelerate the vaccination programme. Ministers have brought forward the target to offer all adults a first dose, and said over-40s should receive their second more quickly. But analysis reveals that the rate at which jabs are dispensed is slowing and is set to keep falling further. (Telegraph)

CORONAVIRUS: Ministers will be advised against the mass rollout of Covid vaccinations to children until scientists obtain more data on the risks, The Telegraph understands. Experts on the Joint Committee on Vaccination and Immunisation (JCVI) are expected to make a recommendation against the vaccination of under-18s in the immediate future. The committee is understood to be preparing an "interim" statement for release as soon as the end of the week following a meeting on Tuesday. At a meeting, members are understood to have voiced serious ethical concerns about vaccinating children, given that they rarely suffer serious illness from Covid. The statement is set to say more time is needed to assess studies of vaccine rollouts in other countries where children are being vaccinated – including the US and Israel – before deciding whether such a programme should be launched in the UK. A Whitehall source said: "Nobody is going to green light the mass vaccination of children at this stage. (Telegraph)

CORONAVIRUS/POLITICS: Prime Minister Boris Johnson's decision to prolong England's coronavirus lockdown is the last extension many in his Conservative Party will bear after 15 months of restrictions, people familiar with the matter warned. Johnson said Monday the final stage of reopening the economy planned for June 21 would be pushed back four weeks to allow time for more people to get a second vaccine dose, to counter a surge in cases fueled by the fast-spreading delta variant. The delay is due to be put to a Parliament vote on Wednesday. (BBG)

CORONAVIRUS/POLITICS: Boris Johnson was calling wavering MPs yesterday urging them to back an extension of coronavirus restrictions as a cabinet minister insisted: "You can't run society purely to stop the hospitals being full." Internal government discomfort over the postponement of full reopening to July 19 spilled into the open yesterday as Jacob Rees-Mogg, leader of the Commons, said that "the NHS is there to serve the British people not the British people are there to serve the NHS". With discontent spreading beyond the hardcore of lockdown sceptics, Johnson was yesterday attempting to convince moderate MPs to back him in a Commons vote today extending the rules in England for four more weeks. (The Times)

POLICY: Prime Minister Boris Johnson said the U.K. must end "burdensome" red tape built up during almost five decades as a member of the European Union if the country is to reach its full potential outside the bloc. The government will consult across industry and civil society about changes to Britain's regulatory framework, Johnson said in response to a report he commissioned to look at areas where the U.K. can now benefit from setting its own rules. A designated Brexit opportunities unit will also be set up, he said. (BBG)

SCOTLAND: Scottish MPs will be given the right to vote down English legislation in a major constitutional reform being considered by the government to rejuvenate the Union. The Times has learnt that Michael Gove, the Cabinet Office minister, has brought forward proposals to abolish English Votes for English Laws (Evel), the Commons procedure introduced after the Scottish independence referendum. Under the plans, which were put to cabinet ministers last week, the requirement that bills, amendments and clauses of legislation affecting England alone be approved by a majority of English MPs would be abolished to make parliament work "for every part of the UK and every party in the UK". (The Times)

EUROPE

ECB: Austrian central bank Governor Robert Holzmann backs Finance Minister Gernot Bluemel's recommendation to fellow EU member states that they rein in budget spending as the crisis subsides. EU member states should "save in good times in order to be able to spend in bad times," Holzmann says at a briefing in Vienna on Tuesday. "I hope this will be taken up by many of his colleagues." (BBG)

ITALY: Italy has vaccinated more than 50% of its population with at least one Covid-19 vaccine dose, according to Bloomberg calculations based on government data. The country has administered 42.9 million doses, of which about 30 million are first or single-shot doses, according to the latest government data. (BBG)

ITALY/BTPS: Italy will tap the following bonds in a specialist auction Jun 16, with a maximum total offered of EUR1.5bn:

- 3.00% Aug-29 BTP

- 5.25% Nov-29 BTP

AUSTRIA/RATINGS: The credit profile of Austria (Aa1 stable) reflects its wealthy and highly competitive economy, as well as its moderate private-sector leverage, Moody's Investors Service said in an annual report today. Other credit strengths include its high quality institutions and high debt affordability metrics, despite comparatively elevated debt levels. The country's main credit challenges include relatively weak trend growth and slow progress in implementing structural reforms to tackle rising costs relating to an ageing population. Despite entering a technical recession during the winter, government support measures in response to the pandemic have kept the economy's supply-side mostly intact. "Our stable outlook on Austria's sovereign credit rating reflects our view that the pandemic-related contraction will not significantly affect Austria's medium-term growth outlook, and that the debt burden will resume its downward trajectory after peaking this year," said Heiko Peters, a Moody's Vice President - Senior Analyst and the report's author. Moody's expects Austria's debt to peak at 87.1% of GDP in 2021 before resuming its downward trajectory in 2022, falling to 85.8% by the end of 2024. (Moody's)

SNB: MNI BRIEF: Call For SNB to Boost Payouts From Strong Profits

- The Swiss National Bank should re-evaluate the "excessive" level at which it currently holds central bank equity and ensure that all profits are distributed to the Swiss Confederation and cantons over the year, a new report by the SNB Observatory group argues. The strong growth in the SNB's profits from its foreign investments over the past 10 years has corresponded with a fall in the share passed on to the public purse, authors Stefan Gerlach, Yvan Lengwiler and Charles Wyplosz write, making distributions "impossible in the long-run" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SWEDEN: Sweden's government refused to back down after the left-wing opposition threatened to try to unseat Prime Minister Stefan Lofven over plans to deregulate the country's rental housing market. Minister for Justice Morgan Johansson said the Cabinet will continue to prepare a formal bill, after the Left Party demanded it to drop the intention to allow landlords charge market rates for new rental apartments. The government expects to come back with a final proposal late this fall, Johansson said. "I don't think there is any support among the Swedish public for causing a government crisis over a proposal that hasn't even been tabled," Johansson said at a press conference. "This is not a game. If they force the government's resignation we are facing a large political and constitutional crisis." (BBG)

U.S.

ECONOMY: MNI BRIEF: 31% of Small Firms to Raise Prices in Next 6M - ADP

- Just under a third of small businesses plan to raise prices in the next six months, ADP Chief Economist Nela Richardson said Tuesday, driven by higher import and production costs and firms' efforts to recover revenue lost during the pandemic. "Firms are not shy about raising prices in the next six months," Richardson said during a webinar following the release of ADP's inaugural quarterly Small Business@Work Survey, conducted between May 10 - 25. Richardson expects price increases to be temporary as supply shortages wane. Roughly 13% of the 2,000 businesses surveyed by ADP cited increases in input prices or production costs as a key challenge to growth - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Charles Schumer (D-N.Y.) says he will convene a meeting with all 11 Democratic members of the Senate Budget Committee on Wednesday to begin the process for passing a budget resolution, paving the way for Democrats to pass a major infrastructure bill on a party-line vote. Schumer said he hopes to pass the budget resolution for fiscal 2022 in July. "Tomorrow I'm convening a meeting with all 11 Democratic members of the Senate Budget Committee regarding a fiscal year '22 budget resolution," Schumer said. (The Hill)

FISCAL: Senate Finance Committee Chairman Ron Wyden plans to propose changes to a business deduction established in the 2017 tax law that would limit the break for the wealthy while making it more broadly available. Wyden's legislation, which is still being drafted, will take aim at a temporary deduction of up to 20% that is available under Section 199A for partnerships, LLCs, and other entities taxed only at the individual owner level. Wyden (D-Ore.), a vocal critic of the Trump-era tax code overhaul, will likely aim to start phasing out the deduction for individuals making above $400,000 in annual business income, with the perk unavailable for people making over $500,000. (BBG)

FISCAL: Senator Mitt Romney says he is "very optimistic" that at least 10 fellow Republicans will support a bipartisan infrastructure plan he is helping to negotiate. (BBG)

CORONAVIRUS: New York will lift most of its Covid-19 restrictions now that 70% of all adults in the state have been vaccinated with at least one dose, Gov. Andrew Cuomo announced Tuesday. Cuomo said all state-mandated restrictions on commercial businesses, social settings, sports and recreation events, construction, manufacturing and retail that were put in place beginning in March 2020 were being rolled back, "effective immediately." (CNBC)

CORONAVIRUS: California Governor Gavin Newsom marked the full reopening of the world's fifth-largest economy Tuesday with a lottery awarding 10 vaccinated residents $1.5 million each. Speaking at Universal Studios near Los Angeles, he touted the most-populous U.S. state's virus progress while saying he is taking variants seriously and "won't let our guard down." The state -- the first to shut down, in March 2020 -- is lifting capacity limits and social distancing requirements, and removing most mask mandates for vaccinated individuals. After recording almost 3.7 million virus cases, the most in the U.S., California's outbreak has substantially improved and it now boasts one of the lowest test-positivity rates in the country. (BBG)

POLITICS: Following a series of speeches to Republican conservatives over the past five months, former President Donald Trump will head to Ohio and Florida over the next two-and-a-half weeks to hold the kinds of mass rallies with rank-and-file supporters that fueled his White House campaigns. Trump is expected to stage his first post-presidential rally in the Cleveland area on June 26, and follow up with an event in the Tampa area on July 3, said two aides familiar with the planning. (USA Today)

MARKETS: Citigroup Inc. dropped after Chief Financial Officer Mark Mason signaled that revenue from the bank's trading operations will probably fall by around 30% from a year ago -- as Wall Street braces for a pandemic-driven boom to run out of steam. Revenue from the business could drop by a percentage in the low thirties in the second quarter, Mason said Tuesday at a Morgan Stanley virtual conference. That's a bigger decline than analysts in a Bloomberg survey were anticipating and comes as investment-banking fees could also fall by a percentage in the mid-to-high single digits, he said. The current quarter is "a very different place than we were a year ago," Mason said, noting strength in the firm's equities trading business would be offset by a weaker performance in the fixed income unit. (BBG)

EQUITIES: Cboe Global Markets, Inc. (Cboe: CBOE), a market operator and global trading solutions provider, today announced it plans to extend global trading hours (GTH) for its S&P 500 Index (SPX) options and Cboe Volatility Index (VIX) options to nearly 24 hours each business day on Cboe Options Exchange, beginning Sunday, November 21, 2021, subject to regulatory review. (PRNewswire)

OTHER

GLOBAL TRADE: In an interview with Bloomberg Television, EU trade chief Valdis Dombrovskis listed a whole series of flaws in the global trading system that the U.S. and the EU want to attack together, including opaque subsidy regimes, unfair competition from state-owned companies and "forced technology transfers." "Many of those elements stem from the structural model of China," he said. "The EU is definitely very much willing to discuss and cooperate with the U.S. specifically on China -- that's not an issue here." (BBG)

GLOBAL TRADE: The UK competition watchdog has launched an investigation into the dominance by Apple and Google of mobile platforms in its latest move to address concerns that the giant technology groups have too much power. The Competition & Markets Authority said that it would carry out a study into whether the two companies' "effective duopoly" over mobile operating systems, app stores and web browsers was stifling competition or harming consumers and other businesses, including app developers. Consumers could be missing out because of Apple and Google controlling the "gateways" used to access a range of online services, such as music, television and video streaming, as well as fitness tracking, shopping and banking, the regulator said. (The Times)

U.S./CHINA: A group of 10 Republican U.S. senators on Tuesday urged Commerce Secretary Gina Raimondo to quickly identify American technologies that could be misused by the Chinese government. The letter led by Senator Tom Cotton and seen by Reuters urged the department to identify "emerging and foundational technologies" as required under a nearly three-year-old law. "We remain concerned that U.S. businesses export sensitive technologies to ostensibly civilian Chinese firms or accept investment from them only for these Chinese firms to promptly hand over this technology to the Chinese military or intelligence services," said the letter. The department did not immediately comment. (RTRS)

U.S./CHINA: The Pentagon is considering establishing a permanent naval task force in the Pacific region as a counter to China's growing military might, according to two people familiar with internal discussions. The plan would also involve creating a named military operation for the Pacific that would enable the defense secretary to allocate additional dollars and resources to the China problem, said the people, who requested anonymity to discuss pre-decisional plans. (POLITICO)

U.S./CHINA: The U.S. attempt to rely on administrative means to create its own supply chain goes against market principles and cannot lead to a sustainable impact on global supply chains, the Global Times said in a commentary. The U.S. eagerness to establish its own manufacturing chain is a reflection of its anxiety over the hollowing out of its industries, and it no longer possesses the fundamentals required for mass manufacturing, with the tertiary sector already accounting for more than 80 percent of its GDP, the newspaper said. The U.S., at the top of the supply chain, has never been cut off supplies of any materials by any party, it said. The hype about its industrial chain vulnerabilities is the same as the conspiracy theory about global dependence on Chinese manufacturing, the newspaper said. (MNI)

TAIWAN: China flew 28 military aircraft into Taiwan's air defence buffer zone on Tuesday in its largest such incursion so far, according to Taipei officials, a move that came as Beijing continues to express anger over warnings from western countries and their allies about its military pressure on the island. The flights involved 20 fighter jets and four nuclear-capable bombers alongside anti-submarine warfare and early-warning aircraft, the Taiwanese air force said in a statement. Previously, the largest incursion had featured 25 Chinese military aircraft on a single day in April. The operation came after the G7 group of developed economies issued a final communiqué on Sunday following its UK summit, in which it highlighted "the importance of peace and stability across the Taiwan Strait" and called for a peaceful resolution of issues between China and Taiwan. (FT)

TAIWAN: Taiwan's ruling DPP is the root cause of problems, says Ma Xiaoguang, spokesman for the Beijing office that handles matters related to the democratically ruled island. (BBG)

TAIWAN: Government is happy to see key democratic partners, such as the U.S. and European Union, continue to pay close attention to the fact that peace and stability in the Taiwan Strait are being unilaterally, purposely sabotaged, Taiwan's Ministry of Foreign Affairs says in statement. (BBG)

JAPAN: Japan to discuss easing event capacity restrictions. (Nikkei)

JAPAN: Japanese Prime Minister Yoshihide Suga is considering calling a snap election in Sept. after the Tokyo Olympic and Paralympic Games, the Mainichi newspaper reports, citing an unidentified senior official. Suga mulls convening an extra parliament session after the Paralympics and dissolve the lower house during that period. Detailed election schedule will be determined considering the pace of Covid-19 vaccine rollout. (BBG)

RBNZ: New Zealand Finance Minister Grant Robertson has given the central bank access to another tool to rein in the country's rampant housing market. Robertson has agreed to add debt serviceability restrictions to the list of potential macro-prudential tools available to the Reserve Bank, Governor Adrian Orr said in a statement Wednesday in Wellington. This would allow the bank to impose debt-to-income limits if it deemed them necessary to support more sustainable house prices, he said. New Zealand policy makers are battling the hottest property market in the world, according to the Bloomberg Economics global bubble ranking, with median prices surging more than 30% in the year through May. (BBG)

NORTH KOREA: North Korea's leader Kim Jong Un says the country's food situation is "getting tense" as the agricultural sector didn't reach its grain production plan due to typhoon damage last year, state media KCNA reports. Presiding over a plenary meeting of the ruling Workers' Party of Korea, Kim says steps should be taken to address food issue Kim also says North Korea's industrial output has improved from last year. (BBG)

CANADA: MNI REALITY CHECK: Canada May CPI Seen Going to Decade High

- Canadian industry leaders told MNI that whether inflation keeps accelerating beyond the highest pace in a decade depends on whether supply chain congestion turns around, because demand will remain solid as the economy re-opens and more people are vaccinated. Consumer price inflation will likely to reach the fastest since May 2011 at 3.5% year over year growth, according to economists surveyed by MNI, in a Statistics Canada report due at 830am EST on Wednesday. Most of the gain is driven by the base effect as current prices are compared with weakness last year during the first wave of the pandemic - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

TURKEY: An enlarged swap agreement with China has been recorded on the accounts of Turkey's central bank, the bank said on Tuesday, in line with an announcement made two days earlier by President Tayyip Erdogan. In a statement, the central bank said its swap agreement with China had been increased by 35.1 billion lira ($4.10 billion) and 23 billion Chinese yuan, to facilitate bilateral trade and to support financial stability. On Sunday, Erdogan announced that Turkey's central bank had agreed with China to increase the currency swap facility to $6 billion from $2.4 billion. (RTRS)

MEXICO/RATINGS: S&P affirmed Mexico at BBB; Outlook Negative

SOUTH AFRICA: Confronted with a rapid surge of COVID-19 cases and hospitalizations, South Africa has returned to tighter restrictions on public gatherings and liquor sales, President Cyril Ramaphosa announced Tuesday night. The new infections threaten the health systems in several parts of the country, said Ramaphosa in a nationally televised address. (AP)

ISRAEL: Israel says it has launched air strikes against Hamas targets in the Gaza Strip, after incendiary balloons were launched from the territory. Explosions were heard in Gaza City in the early hours of Wednesday. Several balloons, designed to cause fires, were sent from Gaza into Israel earlier on Tuesday. It is the first major flare-up since a ceasefire on 21 May ended 11 days of fighting between the two sides. In a statement, the Israel Defense Forces (IDF) said its fighter jets had hit military compounds operated by Hamas in Khan Yunis and Gaza City. It said "terrorist activity" took place in the compound, and that the IDF was "prepared for all scenarios, including the resumption of hostilities, in the face of continued terror acts from the Gaza Strip." (BBC)

METALS: China is expanding its oversight of domestic firms' commodities trading to include positions taken on overseas markets, the latest step in the government's campaign to exercise control over soaring raw materials prices. The State-owned Assets Supervision and Administration Commission has ordered state enterprises to control risk and limit exposure to overseas commodities markets, according to people with knowledge of the matter. The companies have been asked to report their futures positions for Sasac to review, said the people, who asked not to be identified because the information is confidential. (BBG)

METALS: China will soon release some base metals from state stockpiles, as it keeps up a campaign to rein in surging commodities prices. The government will sell some copper, aluminum and zinc in batches to metal fabricators and manufacturers, the National Food and Strategic Reserves Administration said in a statement on its website. (BBG)

OIL: The Biden administration's suspension of new oil and gas leases on federal land and water was blocked Tuesday by a federal judge in Louisiana. U.S. District Judge Terry Doughty's ruling came in a lawsuit filed in March by Louisiana's Republican attorney general, Jeff Landry and officials in 12 other states. Doughty's ruling granting a preliminary injunction to those states said his order applies nationwide. The 13 states said the administration bypassed comment periods and other bureaucratic steps required before such delays can be undertaken. Doughty heard arguments in the case last week in Lafayette. The moratorium was imposed after Democratic President Joe Biden on Jan. 27 signed executive orders to fight climate change. The suit was filed in March. The states opposing the suspension said it was undertaken without the required comment periods and other bureaucratic steps. (AP)

CHINA

YUAN: China should beware of the impact of one-way appreciation of the yuan on exporters, as it could dampen the job market with small exporters hurt by reduced profits even as the overall exports remain strong, wrote Guan Tao, a former forex regulatory official and global chief economist at the BOC International in an article published on Yicai.com. A 4% appreciation of yuan against the U.S. dollar would already have made exporters unprofitable, and the yuan has already gained 12% in the past year, said Guan. As the economy is still recovering, the importance of stabilizing foreign trade is not in earning foreign exchange, but protecting exporters that create jobs, according to Guan. (MNI)

INFLATION: China's state planner urged pig farmers on Wednesday to keep pig production capacity at a reasonable level, after a closely watched indicator of production costs last week fell below the point at which farmers make money. The average hog-to-grain ratio fell to below 6:1 last week, said the National Development and Reform Commission, triggering a level-3 warning that requires action by the government to stabilize prices. The pricing division at NDRC "will closely monitor live pig production and market price trends...carry out reserve adjustments in a timely manner, and promote the smooth operation of the live pig market," it said in a statement. Live hog prices have plunged by almost 60% since the start of the year due to farmers sending heavy pigs to slaughter, an increase in pork imports and weak seasonal demand, the NDRC said. (RTRS)

COMMODITIES: Prices of some commodities in China will gradually return to a reasonable range in the second half amid stricter supervision, helping cool soaring PPI, Yicai.com reported citing analysts. The China Commodity Index decreased 3.1% to 100.2% in May from April, falling for the first time in three months to a five-month low, the newspaper said. Commodity prices (excluding crude oil) may peak this quarter before falling as the imbalance between supply and demand has eased amid supply recovery, the newspaper said citing Wu Xianghong, senior economist of China at JPMorgan Chase. (MNI)

OVERNIGHT DATA

JAPAN MAY TRADE BALANCE -Y187.1BN; MEDIAN -Y77.0BN; APR +Y253.1BN

JAPAN MAY TRADE BALANCE ADJ +Y43.1BN; MEDIAN +Y241.8BN; APR +84.4BN

JAPAN MAY EXPORTS +49.6% Y/Y; MEDIAN +50.8%; APR +38.0%

JAPAN MAY IMPORTS +27.9% Y/Y; MEDIAN +26.6%; APR +12.8%

JAPAN APR CORE MACHINE ORDERS +6.5% Y/Y; MEDIAN +8.0%; MAR -2.0%

JAPAN APR CORE MACHINE ORDERS +0.6% M/M; MEDIAN +2.5%; MAR +3.7%

AUSTRALIA MAY WESTPAC LEADING INDEX -0.06% M/M; APR +0.19%

The growth rate in the Leading Index has normalised significantly over the last six months to signal a more sustainable above trend growth rate through the remainder of 2021 and 2022. The March quarter national accounts showed that GDP growth had slowed from an annualised pace of 14% over the second half of 2020 to an annualised pace in the first quarter of 2021 of 7.3%. Over the second half of 2021 Westpac expects that annualised pace to slow further to 4.5% while growth in 2022 is forecast at a more normal but still healthy 3.2%. That forecast second half growth pace is still well above trend but more in line with the six month annualised growth rate of 1.47% which the Leading Index has printed for May. (Westpac)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 111.0; PREV. 110.7

Consumer confidence increased 0.3% last week as the two-week lockdown in Melbourne came to an end, although restrictions such as mandatory wearing of masks in public places and other travel and gathering restrictions remained. This probably explains why confidence in Melbourne fell a further 0.9%, while it rose by 4.8% in regional Victoria. We see the rapid recovery in confidence in regional Victoria as evidence that consumer sentiment remains resilient in the face of temporary lock-downs and so don't expect the more prolonged period of restrictions in Melbourne to have a long-term scarring effect. (ANZ)

NEW ZEALAND Q1 BOP CURRENT ACCOUNT BALANCE -NZ$2.895BN; MEDIAN -NZ$2.470BN; Q4 -NZ$2.590BN

NEW ZEALAND Q1 CURRENT ACCOUNT GDP RATIO YTD -2.2%; MEDIAN -2.1%; Q4 -0.8%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

PBOC SETS YUAN CENTRAL PARITY AT 6.4078 WEDS VS 6.4070

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4078 on Wednesday, compared with the 6.4070 set on Tuesday.

MARKETS

SNAPSHOT: Geopolitics & Commodity Matters Headline Ahead Of FOMC

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 146.55 points at 29290.74

- ASX 200 down 2.771 points at 7376.7

- Shanghai Comp. down 27.446 points at 3529.113

- JGB 10-Yr future down 5 ticks at 151.76, yield down 0bp at 0.051%

- Aussie 10-Yr future down 3.4 ticks at 98.455, yield up 3.1bp at 1.529%

- U.S. 10-Yr future unch. at 132-17, yield up 0.34bp at 1.496%

- WTI crude up $0.58 at $72.71, Gold up $0.93 at $1859.94

- USD/JPY down 2 pips at Y110.06

- U.S. SENATORS WANT COMMERCE DEPT TO LIST TECH TO KEEP AWAY FROM CHINA (RTRS)

- PENTAGON CONSIDERING PERMANENT NAVAL TASK FORCE TO COUNTER CHINA IN THE PACIFIC (POLITICO)

- EU'S DOMBROVSKIS: EU WILLING TO COOPERATE WITH U.S. ON CHINA (BBG)

- SCHUMER TO TRIGGER RECONCILIATION PROCESS ON WEDNESDAY (THE HILL)

- RBNZ EYES ANOTHER TOOL TO BATTLE WORLD'S HOTTEST HOUSING MARKET (BBG)

- CHINA TAKES FURTHER STEPS TO CLAMP DOWN ON COMMODITY PRICES

BOND SUMMARY: FOMC Awaits

T-Notes deal unchanged at 132-17 at typing with the contract holding to a narrow 0-03 range overnight. Cash Tsys print unchanged to 1.0bp cheaper across the curve. Participants remain focused on Wednesday's FOMC decision, while the release of the monthly Chinese economic activity datapoints will provide some interest in the interim. There was nothing in the way of tangible reaction to the latest moves by Chinese policymakers re: stemming the rally in commodity prices.

- The Tokyo morning saw some weakness in the longer end of the JGB curve, which was perhaps linked to growing speculation surrounding a snap election and linked fresh fiscal support package, with local press reports pointing to such matters perhaps playing out in September. The long end has now retraced some of the early weakness. Futures stuck to the confines of the overnight session's range, last -4 on the day. The latest round of BoJ Rinban operations revealed a moderation in the offer to cover ratios for the 1- to 3- and 3- to 5-Year buckets (vs. prev. operations), while the 5- to 10-Year bucket saw an uptick in the cover ratio.

- Aussie bond futures struggled for any fresh traction, consolidating above their respective overnight lows within tight ranges, leaving YM -0.9 & XM -3.4 The cash ACGB curve has steepened, playing catch up to the overnight moves in futures, with longer end bonds running as much as ~4.0bp cheaper at typing.

JGBS AUCTION: Japanese MOF sells Y2.8575tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8575tn 1-Year Bills:- Average Yield -0.1161% (prev. -0.1218%)

- Average Price 100.116 (prev. 100.122)

- High Yield: -0.1091% (prev. -0.1198%)

- Low Price 100.109 (prev. 100.120)

- % Allotted At High Yield: 30.1993% (prev. 98.7853%)

- Bid/Cover: 3.005x (prev. 3.446x)

EQUITIES: China Stocks Struggle Again

Another mixed day for equity markets in the Asia time zone; markets in China are lower again, on track for the third straight day of declines. The PBOC refrained from injecting liquidity again but repo rates dropped after rising for three straight days. In Japan the Nikkei 225 is has lost some ground, data showed the trade deficit widened more than expected, exports rose below consensus while imports beat forecasts. Core machinery orders rose below consensus and a sharp drop in the pace of increase from last month. In South Korea markets are slightly higher as the won weakened, markets digest a hawkish set of BoK minutes. Futures in the US are mostly lower, though the Nasdaq is just keeping above water after a heavy sell off yesterday, markets await the FOMC rate announcement later today.

OIL: Rally Rolls On

Oil continues its march higher; WTI is up $0.62 from settlement levels at $72.74/bbl, Brent is up $0.69 at $74.68/bbl. Bulls now look to resistance at $73.50 a 3.236 projection of Mar 23/30 /Apr 5 price swing. Data after market yesterday from the US API showed headline crude stocks fell 8.54m bbls last week, markets will look to US DOE inventory figures later today to confirm the draw which would be the biggest since January. Demand cues from the US remain positive, California opened up its economy yesterday while New York has now lifted all remaining restrictions.

GOLD: Respecting The Range

Bullion finished lower again on Tuesday but failed to challenge the extremes of Monday's ranges as participants looked ahead to the latest FOMC decision (please see our full preview for more colour on that specific matter). Spot has settled into a narrow range during Asia-Pac hours given the impending event risk, last trading a handful of dollars softer, just above $1,855/oz. The previously outlined technical picture remains intact.

FOREX: Antipodeans Gain, Markets In Waiting Mode

Most major USD crosses tread water in Asia-Pac hours, as participants were preparing for the upcoming monetary policy decision from the FOMC & China's monthly economic activity data. The DXY was happy to hold its yesterday's range.

- The Antipodeans were slightly firmer, despite light regional news flow. A BBG trader source flagged demand for the Aussie from local exporters.

- The PBOC set its central USD/CNY mid-point at CNY6.4078, 7 pips above the sell-side estimate. Spot USD/CNH held a very tight range, close to neutral levels.

- Apart from the aforementioned FOMC decision & Chinese data, focus turns to inflation figures from the UK & Canada, U.S. housing starts/building permits, as well as ECB & BoC speak.

FOREX OPTIONS: Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2115-20(E1.2bln-EUR puts), $1.2130(E428mln-EUR puts), $1.2200(E551mln)

- USD/JPY: Y109.15-25($660mln), Y109.70-75($965mln-USD puts), Y110.00-05($775mln-USD puts),Y110.25-31($656mln-USD puts)

- AUD/USD: $0.7740-45(A$589mln-AUD puts)

- USD/CNY: Cny6.40($726mln-USD puts)

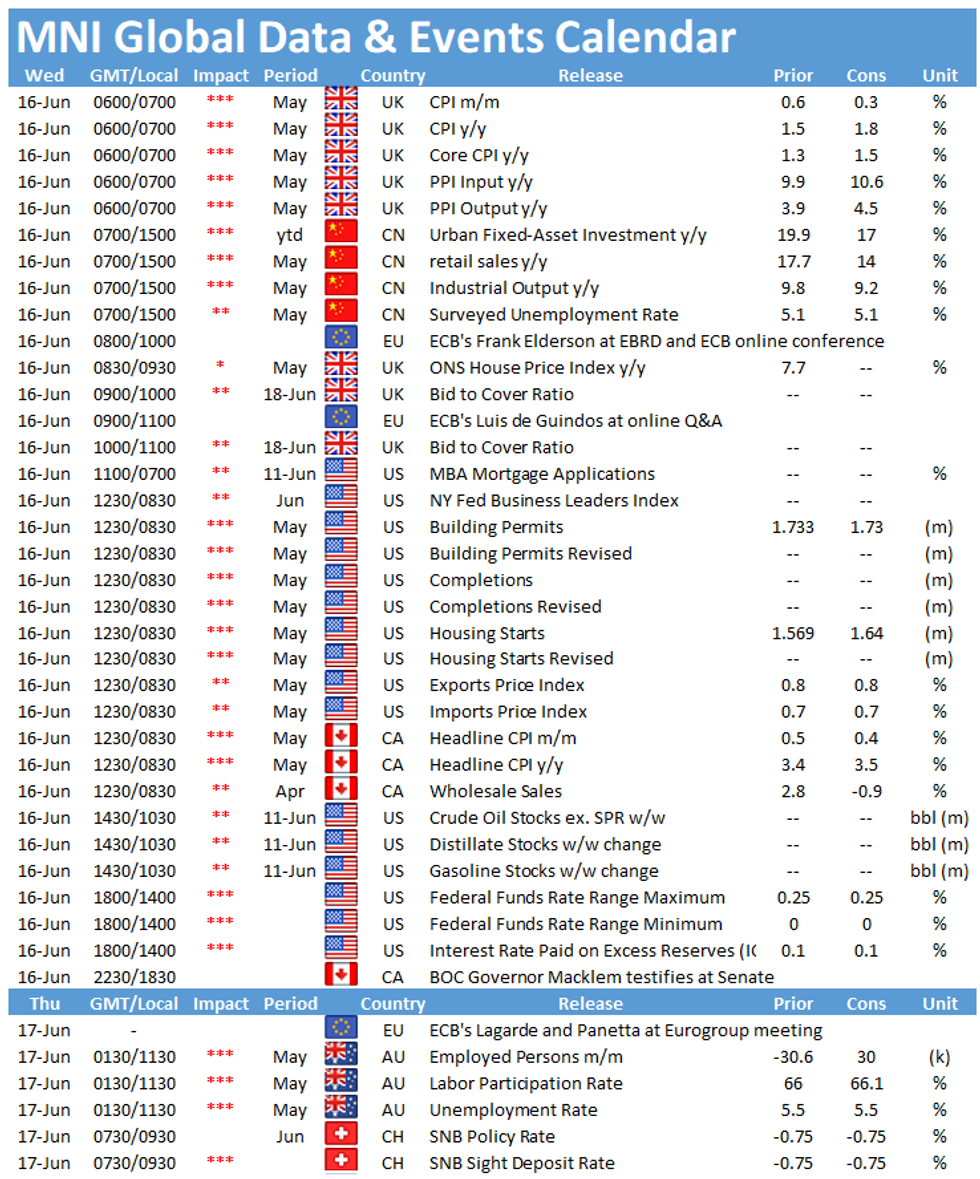

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.