-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Dot Plot The Talk Of The Town, Antipodean Positives Also Eyed

EXECUTIVE SUMMARY

- FED TAPERING TALK BEGINS; 2023 HIKES EYED (MNI)

- CHINA TARGETS SPECULATORS AS COMMODITIES CURBS FIND SOME SUCCESS (BBG)

- RBA'S LOWE CONFIRMS MORE QE (MNI)

- STELLAR LABOUR MARKET REPORT OUT OF AUSTRALIA

- NZ GDP COMFORTABLY TOPS EXPECTATIONS

- BANK OF CANADA STICKS WITH VIEW THAT RISING INFLATION IS TEMPORARY (DOW JONES)

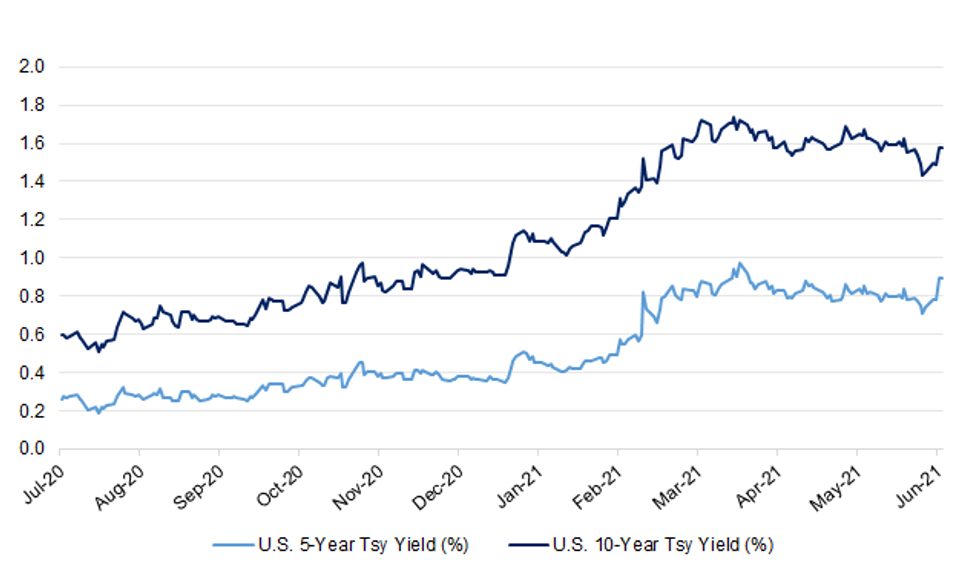

Fig. 1: U.S. 5- & 10-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Lockdown restrictions in England will be extended by up to four weeks after MPs backed the government in a Commons vote by 461 to 60. It means the regulations can stay in place until 19 July, despite a large Tory rebellion against the move. Health Secretary Matt Hancock told MPs ahead of the vote there has been a "significant change" that has given the virus "extra legs". Labour supported the delay but said it did so "with a heavy heart". (BBC)

CORONAVIRUS: Summer holidays abroad will be opened up for vaccinated Britons under plans being considered by the Government, The Telegraph understands. Officials are drawing up proposals that could allow people who have had both Covid jabs to avoid having to quarantine on their return from amber list countries although they will still have to be tested. The change would effectively turn amber countries green for the vaccinated, opening up the possibility of quarantine-free travel to most major holiday destinations in Europe and the US. The proposals to ease the restrictions for vaccinated people are said to be at an early stage. Matt Hancock, the Health Secretary, who has fought for tough border restrictions, is said to be "open" to the change. "They haven't definitely got there yet, but that's the direction of travel," a senior source told The Telegraph. (Telegraph)

INFLATION: Chancellor of the Exchequer Rishi Sunak said rising prices are one of his near-term concerns, as U.K. inflation surged unexpectedly past the Bank of England's target for the first time in almost two years. "Of course that's one of the many risks it's my job to worry about," Sunak said in an interview on GB News, when asked about the spike. "As interest rates and inflation change, that has an impact on our debt." (BBG)

ECONOMY: The U.K. extended its ban on evictions of commercial tenants by nine months to protect Covid 19-hit businesses from losing their premises while pandemic restrictions are still in place. The ban had been due to end on June 30, but Chief Secretary to the Treasury Steve Barclay on Wednesday told the House of Commons the government would extend it until March 25 next year. In the meantime, he said, the government plans to establish a binding arbitration protest for tenants and landlords who are unable to reach agreement on repayment programs. (BBG)

BREXIT: Liz Truss will hold talks with New Zealand negotiators on Thursday as she seeks to pave the way for a trade deal with the country in a matter of weeks. The Trade Secretary's Kiwi counterpart, Damien O'Connor, flew to Britain on Wednesday and the pair had dinner, ahead of direct talks due to be held in the Locarno Room of the Foreign Office. It is the first time they have met in person. A deal with New Zealand is seen as a clear next step after Britain and Australia announced the outline of an agreement on Tuesday. The tie-up with Wellington is expected to follow similar broad strokes to the Australian deal – prising open the country for UK goods and services, but opening up British markets to exports sent by New Zealand farmers. (Telegraph)

EUROPE

SPAIN: Spain will receive 19 billion euros ($23 billion) by the end of this year from the European Union's pandemic recovery fund, Prime Minister Pedro Sanchez said. Those funds will be an initial disbursement from the 69.5 billion euros that Spain is set to receive during the next six years. Madrid is also in line for about 70 billion euros in cheap EU loans to fuel the economic recovery. (BBG)

BONDS/BANKS: The European Commission will make an assessment of banks it banned from EU Recovery Fund bond issuance very soon, which could see lenders re-admitted to the process, sources familiar with the situation told Reuters on Wednesday. The European Union has excluded some of the biggest investment banks with past involvement in breaches of antitrust rules from syndicated debt sales backing its up to 800 billion euro ($969 billion) COVID-19 recovery fund. According to sources familiar with the ban, the banks were aware of the situation and a number of banks have submitted information to steps taken to address the issues and alleviate the EU Commission's concerns. (RTRS)

U.S.

FED: MNI STATE OF PLAY: Fed Tapering Talk Begins; 2023 Hikes Eyed

- Federal Reserve Chair Jay Powell on Wednesday kicked off discussions that will lead to a winding down of the central bank's USD120 billion a month in asset purchases as officials advanced their timeline for a first interest-rate increase following the pandemic, noting conditions in the FOMC's forward guidance may be met sooner than previously anticipated.

FISCAL: Efforts to strike a bipartisan agreement on infrastructure gained traction in Congress on Wednesday, as a group of 10 moderate senators announced that support had doubled for a framework they have not yet made public. (New York Times)

OTHER

U.S./CHINA: The U.S. military should maintain a "combat-credible" posture in the Indo-Pacific to help deter potential Chinese aggression, President Joe Biden's nominee to be assistant secretary of defense for the region told senators. Such an approach would include the "forward" positioning of U.S. forces in order to "deter, and, if necessary, deny a fait accompli scenario" where China tries to quickly overwhelm Taiwan, Ely Ratner told the Senate Armed Services Committee in written answers to questions for his confirmation hearing Wednesday. (BBG)

U.S./CHINA: U.S. Treasury Secretary Janet Yellen on Wednesday said she expects the United States to decouple in some areas from China to protect its national security, but she would worry about a complete severing of ties on the technological front. "We are looking at full range of tools that we have to push back and to redress practices that harm us (and our) national security and our broader economic interests," Yellen told the Senate Finance Committee, citing curbs on potentially harmful Chinese investments in the United States. "I would worry somewhat about complete technological decoupling," she said, adding that many U.S. allies would be reluctant to sharply reduce their business activities in China. (RTRS)

CORONAVIRUS: The delta Covid variant, first detected in India, has now spread to more than 80 countries and it continues to mutate as it spreads across the globe, World Health Organization officials said Wednesday. The variant now makes up 10% of all new cases in the United States, up from 6% last week. Studies have shown the variant is even more transmissible than other variants. WHO officials said some reports have found that it also causes more severe symptoms, but more research is needed to confirm those conclusions. (CNBC)

CORONAVIRUS: CureVac said its Covid-19 vaccine was 47% effective, falling well short of the high bar set by other messenger RNA shots in a preliminary analysis of a large study muddied by the spread of virus variants. The interim analysis of data from about 40,000 volunteers included 134 Covid cases, the German company said in a statement. CureVac declined to say how many who got the shot got sick or how many received a placebo. But the results suggest the vaccine works less well for older people than in a younger population, Chief Technology Officer Mariola Fotin-Mleczek said in an interview Wednesday. Though preliminary, the results throw the future of the vaccine into question as wealthy nations around the world move swiftly to inoculate their populations with shots already available. Still, CureVac will finish its trial and plans to gain approval, Chief Executive Officer Franz-Werner Haas said. (BBG)

HONG KONG: Hong Kong's national security police arrested five executives of the pro-democracy Apple Daily newspaper for suspected breaches of the national security law, local news outlets reported Thursday, as the government escalated its campaign against well-known activist and media tycoon Jimmy Lai. (BBG)

JAPAN: Japanese Economy Minister Yasutoshi Nishimura said on Thursday that a panel of government-appointed experts had approved a plan to downgrade the state of emergency in seven prefectures including Tokyo, which will host the Olympics from July 23. Speaking at the end of the meeting, Nishimura, who oversees Japan's coronavirus response, said the latter half of the discussions centred on the wisdom of lifting the emergency state in Tokyo. With the pace of decline in new infections slowing in recent days, some warned of a likely rebound and stressed the need to respond without hesitation through further curbs or even the reinstatement of a state of emergency, Nishimura said. (RTRS)

JAPAN: The Japanese government is planning to start issuing Covid-19 "vaccine passport" as soon as mid-July, public broadcaster NHK reports, without attribution. The certificates will initially be paper based and be issued at local municipalities. The government will later consider digitalized certificates. (BBG)

JAPAN: Members of an expert panel that advises Japan on virus measures will say they see holding the Olympics without spectators as the least risky scenario in preventing the spread of the coronavirus, NHK reports, citing a draft of the report. If spectators are allowed, they should be subject to stricter measures than other sporting events. (BBG)

JAPAN: Japan to extend employment subsidy program through August. (Nikkei)

RBA: MNI BRIEF: RBA's Lowe Confirms More QE

- Reserve Bank of Australia Governor Philip Lowe has confirmed that the central bank will continue with its program of Quantitative Easing and will make a decision on the size and duration of more bond purchases at its July meeting.

NEW ZEALAND: Prime Minister Jacinda Ardern says New Zealand's vaccine rollout to the general population will begin in late July, in comments at news conference. Will organize the rollout by age cohort. Starting with those 60 or older from July 28, then those 55 or older from Aug 11. (BBG)

RBNZ: RBNZ has published new Banking Prudential Requirements documents that implement the decisions made during the Capital Review, Deputy Governor Geoff Bascand says in emailed statement. Reiterates that increases in bank capital will be phased in over a seven-year period, starting from July 2022. Says has improved the way the rules are structured, presenting them as a series of Banking Prudential Requirements, rather than changing a 'Handbook' which will ensure the rules are more transparent and easier to follow. (BBG)

BOK: Bank of Korea plans to take measures to stabilize markets if necessary as volatility may rise due to changes in policy expectations over economic and inflation situations in major economies like the U.S., Senior Deputy Governor Lee Seung-heon says in meeting. FOMC comments overnight were more hawkish than expected. (BBG)

BOC: Bank of Canada Gov. Tiff Macklem is sticking with the central bank's projection that the recent rise in the country's inflation rate is temporary, even after Statistics Canada data showed the consumer-price index accelerated to a 3.6% annual rate in May. Speaking before a Senate committee Wednesday evening, Macklem said the bank expects inflation to remain near the top of the 1%-3% target range through the summer, largely because of the effects of last year's shutdowns and much stronger gasoline prices. "As these base-year effects fade, Governing Council expects the ongoing excess supply in the economy to pull inflation back down," he said. (Dow Jones)

BOC: The Bank of Canada is starting to see signs that the country's red hot housing market is cooling down, although a return to a normality will take time, Governor Tiff Macklem said on Wednesday. The sector surged in late 2020 and early 2021, with home prices escalating sharply amid investor activity and fear of missing out. The national average selling price fell 1.1% in May from April but was still up 38.4% from May 2020. You are starting to see some early signs of some slowing in the housing market. We are expecting supply to improve and demand to slow down, so we are expecting the housing market to come into better balance," Macklem said. "But we do think it is going to take some time and it is something that we are watching closely," he told the Canadian Senate's banking committee. (RTRS)

MEXICO: Mexican central bank Governor Alejandro Diaz de Leon has a "close relationship" and talks "widely" with his recently-designated successor Arturo Herrera, the governor said Wednesday. Diaz has a "good dialogue" relationship with Finance Minister Herrera, whom he has known for three years, he said at a press conference in response to a question by Bloomberg News. The board believes keeping institutional continuity is most important. (BBG)

MEXICO: Mexico's central bank announces agreement to extend its swap line with the Fed to Dec. 31, 2021, according to a statement. Swap line established March 19, 2020, as part of measures to deal with instability in financial markets due to Covid-19 pandemic. (BBG)

BRAZIL: Health Ministry negotiated with Pfizer to bring forward the delivery of 7m vaccine doses, according to a message sent by the ministry's press office. As a result, Pfizer will deliver 15m doses in July compared to 8m doses initially expected. By year-end, 200m doses of Pfizer's vaccine will be delivered, the ministry said. (BBG)

BRAZIL: A bill allowing the privatization of state-owned energy giant Eletrobras will be put to the vote on Thursday starting at 10 a.m. local time (1300 GMT), the head of Brazil's Senate Rodrigo Pacheco said on Monday. The bill has passed the lower chamber but has been changed in the Senate in its present form, which means it would have to return to the house and could run out of time. The bill is a temporary decree issued by the government and must be approved in Congress by June 22 or it will expire. The privatization of Latin America's biggest power utility will be done by floating 60% of its shares on the stock market, up from 40% at present. That would dilute the state's stake in the company, a plan that has met with opposition from politicians, mainly from the left. The federal government would retain a golden share to veto hostile takeovers and other strategic threats. The government expects to raise roughly 25 billion reais ($4.95 billion) from the sale of shares, of which half will go to the Treasury and the other half to mitigating household energy costs in coming years. (RTRS)

RUSSIA: The presidents of the US and Russia have praised their talks in Geneva but have made little concrete progress at the first such meeting since 2018. Disagreements were stated, said US President Joe Biden, but not in a hyperbolic way, and he said Russia did not want a new Cold War. Russian President Vladimir Putin said Mr Biden was an experienced statesman and the two "spoke the same language". The talks lasted four hours, less time than was scheduled. Mr Biden said they did not need to spend more time talking and there was now a genuine prospect to improve relations with Russia. The two sides agreed to begin a dialogue on nuclear arms control. They also said they would return ambassadors to each other's capitals - the envoys were mutually withdrawn for consultations in March, after the US accused Russia of meddling in the 2020 presidential election. However, there was little sign of agreement on other issues, including cyber-security, Ukraine and the fate of Russian opposition leader Alexei Navalny, who is currently serving a two-and-a-half-year sentence in a penal colony. Mr Biden said there would be "devastating consequences" for Russia if Navalny died in prison. (BBC)

SOUTH AFRICA: South Africa, which is battling a third coronavirus wave, recorded 13,246 new cases over the past 24 hours, according to data released by the Health Ministry. That's the highest daily increase since January. (BBG)

IRAN: Russian President Vladimir Putin and his U.S. counterpart Joe Biden agreed to work to prevent Iran from obtaining nuclear weapons when they met in Geneva on Wednesday, Biden said after the meeting. Putin meanwhile said that Moscow and Washington had agreed to launch nuclear arms control talks to build on the New START treaty, a cornerstone of global arms control. Putin said the two sides were aware of their special responsibility for global strategic stability and the important role of the treaty, extended by the two countries at the eleventh hour earlier this year. (Haaretz)

OIL: Saudi Arabia's cautious approach to reviving OPEC+ oil output has been proved correct, said Energy Minister Prince Abdulaziz bin Salman. After a year of oil market turmoil due to the coronavirus pandemic, fuel consumption is seeing robust growth and the International Energy Agency is calling for the cartel to boost supplies. Yet, in the minister's view "we still are not out of the woods." "Many claim that I'm excessively cautious," Prince Abdulaziz told the Robin Hood Investors Conference on Wednesday, according to people familiar with his comments. "Well, it is paying off." (BBG)

OIL: About 1,100 workers on floating rigs off Norway's coast were set to strike from Thursday if a wage deal wasn't settled between unions and the Norwegian Shipowners' Association, but the parties agreed after overtime mediation, Industri Energi union says in a statement. Industri Energi union had prepared 605 workers to strike; SAFE prepared 460 workers DSO union also threatened to strike All three unions agreed on the deal with the employer organization, Industri Energi says. (BBG)

CHINA

YUAN: The Chinese yuan's future movement is uncertain and companies should adapt to the norm of two-way fluctuations and hedge risks for both ways instead of betting on either appreciation or devaluation, said the PBOC-run newspaper Financial News citing a statement by the China FX Market Self-Regulatory Framework. The yuan could depreciate in the future on the Federal Reserve's withdrawal from quantitative easing, U.S. dollar rally driven by the strong recovery, rebounding overseas supply pressuring China's exports and the rise of global risk aversion following the bursting of U.S. asset bubble, the newspaper said citing the body. (MNI)

PBOC: The PBOC may respond to inflation by continuing the operation since Q1 controlling credit and liquidity, especially through scaling back credit extended to overheating industrial sectors and redirecting resources to industries not yet recovered, said the 21st Century Business Herald in a commentary. The PBOC is unlikely to hike interest rates as the current PPI remains under control, and that the recovery is unbalanced, the newspaper said. The current inflationary pressure can only be ultimately eased by the industry and not by monetary policy, the newspaper said. (MNI)

FISCAL: China should not increase the money supply through buying government bonds, something done by western countries, as excess money entails a series of problems including faster inflation and capital outflow, He Qiong, a member of the Bank of China's yuan trading division in Shanghai, wrote in a commentary published by the PBOC-run Financial News. The Ministry of Finance should instead increase the frequencies of selling bonds and ensure weekly issuances and control rates through limiting the sizes of the issuances, He wrote. Financial authorities should increase coordination and communication with the central bank to minimize funds' negative impact on bond issuances and control the costs of selling bonds, He wrote. Authorities should also help stabilize bond yield curves through greater and more frequent purchases and help those holders of government bonds manage their positions, the newspaper said. (MNI)

COMMODITIES: Headwinds are building to any further gains in commodities as China continues to blunt speculative interest in markets. Speculation has cooled in the wake of the government's stepped-up campaign to rein in raw materials prices, a dynamic noted by the National Development and Reform Commission at a briefing on Thursday. Indicators of real demand, like the record low Yangshan port premium for copper imports, suggest waning appetite even after the drop in prices from their May peaks. Moreover, the government's release of state metals reserves, one of the pillars of its controls, will be dictated by market conditions, according to the NDRC. That uncertainty over when the hammer might drop will only deter traders further from bidding up prices. (BBG)

MARKETS: Banks and insurance companies are not allowed to offer guarantee for or make purchase in their major shareholder's bond issuance, according to draft rules issued by China Banking and Insurance Regulatory Commission, seeking public feedback. Major shareholders shouldn't use entrusted funds, debt funds and other non-self owned funds to buy shares in banks and insurers. (BBG)

OVERNIGHT DATA

CHINA MAY NEW HOME PRICES +0.52% M/M; APR +0.48%

CHINA MAY SWIFT GLOBAL PAYMENTS CNY 1.90%; APR 1.95%

JAPAN MAY TOKYO CONDOMINIUMS FOR SALE +556.0% Y/Y; APR +204.5%

AUSTRALIA MAY UNEMPLOYMENT RATE 5.1%; MEDIAN 5.5%; APR 5.5%

AUSTRALIA MAY EMPLOYMENT CHANGE +115.2K; MEDIAN +30.0K; APR -30.7K

AUSTRALIA MAY FULL-TIME EMPLOYMENT CHANGE +97.5K; APR +33.5K

AUSTRALIA MAY PART-TIME EMPLOYMENT CHANGE +17.7K; APR -64.2K

AUSTRALIA MAY PARTICIPATION RATE 66.2%; MEDIAN 66.1%; APR 65.9%

AUSTRALIA MAY RBA FX TRANSACTIONS GOV'T -A$826MN; APR -A$522MN

AUSTRALIA MAY RBA FX TRANSACTIONS MARKET +A$809MN; APR +A$491MN

AUSTRALIA MAY RBA FX TRANSACTIONS OTHER -A$379MN; APR -A$1,346MN

NEW ZEALAND Q1 GDP +2.4% Y/Y; MEDIAN +0.9%; Q4 -0.8%

NEW ZEALAND Q1 GDP +1.6% Q/Q; MEDIAN +0.5%; Q4 -1.0%

NEW ZEALAND MAY NON-RESIDENT BOND HOLDINGS 50.3%; APR 50.1%

CHINA MARKETS

PBOC NET DRAINS CNY70BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This resulted in a net drain of CNY70 billion given the maturity of CNY10 billion reverse repos and CNY70billion of treasury's deposit in commercial banks on the same day, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1681% at 09:33 am local time from the close of 2.1893% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 38 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4298 THURS VS 6.4078

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a third day at 6.4298 on Thursday, compared with the 6.4078 set on Wednesday.

MARKETS

SNAPSHOT: Fed Dot Plot The Talk Of The Town, Antipodean Positives Also Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 309.98 points at 28976.19

- ASX 200 down 20.276 points at 7365.5

- Shanghai Comp. up 5.984 points at 3524.313

- JGB 10-Yr future down 26 ticks at 151.51, yield up 1.4bp at 0.065%

- Aussie 10-Yr future down 9 ticks at 98.35, yield up 8.6bp at 1.634%

- U.S. 10-Yr future -0-03+ at 131-20+, yield down 0.17bp at 1.574%

- WTI crude down $0.36 at $71.75, Gold up $9.6 at $1821.23

- USD/JPY down 5 pips at Y110.66

- FED TAPERING TALK BEGINS; 2023 HIKES EYED (MNI)

- CHINA TARGETS SPECULATORS AS COMMODITIES CURBS FIND SOME SUCCESS (BBG)

- RBA'S LOWE CONFIRMS MORE QE (MNI)

- STELLAR LABOUR MARKET REPORT OUT OF AUSTRALIA

- NZ GDP COMFORTABLY TOPS EXPECTATIONS

- BANK OF CANADA STICKS WITH VIEW THAT RISING INFLATION IS TEMPORARY (DOW JONES)

BOND SUMMARY: Tsys Off Lows, JGBs Soft, Plenty For ACGBs To Digest

T-Notes have recovered from worst levels of Asia-Pac trade after an early extension through Wednesday's post-FOMC trough, to last trade -0-04 at 131-20, although the contract is nowhere near unwinding anything like the bulk of its post-FOMC losses. There has been nothing in the way of an overt catalyst to trigger the recovery from lows. The major cash Tsy benchmarks are little changed across the curve. Asia-Pac flow was headlined by a 30K screen seller of FFQ1.

- The belly has led the way lower in the cash JGB space (much like what has been witnessed in the remainder of the global core FI markets post-FOMC), with 7s cheapening by ~2.0bp. Futures last -25, adding to the post-FOMC losses witnessed in overnight trade. Local headline flow has been light, with confirmation of the previously outlined speculation re: the evolution of Japan's broader COVID restrictions. PM Suga is set to give an address on COVID matters this evening.

- Aussie bonds have recovered from worst levels of the day alongside U.S. Tsys, but YM & XM still sit 9.0 lower vs. yesterday's settlement levels. A stellar domestic labour market report pushed the space to worst levels of the day after some modest pressure for YM in the wake of RBA Governor Lowe's latest address (the spill over from the FOMC decision and a strong NZ GDP report had applied pressure before then). The labour market report, coupled with no real pushback from RBA Governor Lowe re: market pricing surrounding the chances of the Bank rolling its yield curve control measure to ACGB Nov '24 from ACGB Apr '24, saw multi-month wides in the ACGB Apr '24/Nov '24 yield spread.

JGBS AUCTION: Japanese MOF sells Y4.8984tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.8984tn 3-Month Bills:- Average Yield -0.1011% (prev. -0.1022%)

- Average Price 100.0255 (prev. 100.0255)

- High Yield: -0.0991% (prev. -0.0982%)

- Low Price 100.0250 (prev. 100.0245)

- % Allotted At High Yield: 33.0790% (prev. 6.5779%)

- Bid/Cover: 3.605x (prev. 3.771x)

EQUITIES: Mostly Lower, China Bucks Trend

Most markets in the red in Asia on Thursday, sliding after a negative lead from the US in the wake of a hawkish FOMC. Markets in China buck the regional trend, posting gains after four straight days of decline, data yesterday showed activity slowed in May which buoyed investors hopes that the PBOC will refrain from tightening policy in the near term. Markets in Japan lead the way lower with tech shares selling off. In Australia the ASX200 is flat, recovering from opening losses after strong labour market data. Futures lower in the US, tech shares enduring the worst of the selling with the Nasdaq the laggard among its peers.

OIL: Crude Futures Slip

Oil fell in Asia-Pac trade on Thursday after posting declines on Wednesday, WTI rose as high at $73/bbl before retreating in the US session. WTI last trades down $0.63 from settlement at $71.51/bbl, Brent is down $0.67 at $73.52/bbl. A stronger greenback post-FOMC is a drag on oil, offsetting a larger than expected draw in US crude stocks. Despite weakness into the close, WTI managed to extend the recent winning streak, with Wednesday marking the 15th consecutive session of higher highs -a sequence that hasn't occurred in the contract's history. The second longest winning streak was 13 sessions in 1987. Elsewhere the Saudi Energy Min spoke at the end of yesterday's European session and said that the cautious approach adopted by OPEC+ was paying off, but said the market is not out of the woods yet.

GOLD: Support Pierced

The post-FOMC USD strength and push higher in U.S. real yields has weighed on bullion, with spot last dealing around $1,820/oz vs. ~$1,860/oz pre-FOMC. Current levels represent a ~$15/oz bounce from Wednesday's low after bears failed to launch a real challenge of $1,800/oz. Still, with trend support pierced, bears look to force a break of $1,800/oz which would expose the May 6 low ($1,785.1/oz).

FOREX: Antipodean Data Surprise On The Upside, Bolstering Local Currencies

Strong economic data released out of the Antipodes provided support to regional currencies, helping G10 FX space move on after FOMC monetary policy decision. A firm beat in New Zealand's Q1 GDP pushed the NZD higher, with another bout of purchases seen as bets for the next OCR hike were brought forward. NZD/USD roughly halved its post-FOMC losses and briefly showed above the $0.7100 mark, with the Kiwi comfortably outperforming its G10 peers.

- AUD bounced after the release of Australia's monthly labour market report, which saw an unexpected dip in the unemployment rate, largely driven by faster than forecast employment growth. Strong jobs data outweighed the impact of an earlier speech from RBA Gov Lowe, who noted that "the conditions for an increase in the cash rate could be met during 2024, while in others these conditions are not met".

- AUD/NZD went offered a day after its 50-DMA crossed below the 100-DMA. The rate descended past yesterday's low, trimming losses after the ABS published its jobs report.

- DXY stabilised around two-month highs, following Wednesday's surge driven by the latest FOMC policy announcement.

- The PBOC set its central USD/CNY mid-point at CNY6.4298, 30 pips above sell-side estimate. The redback was unfazed by the softer than expected fixing and USD/CNH ebbed lower.

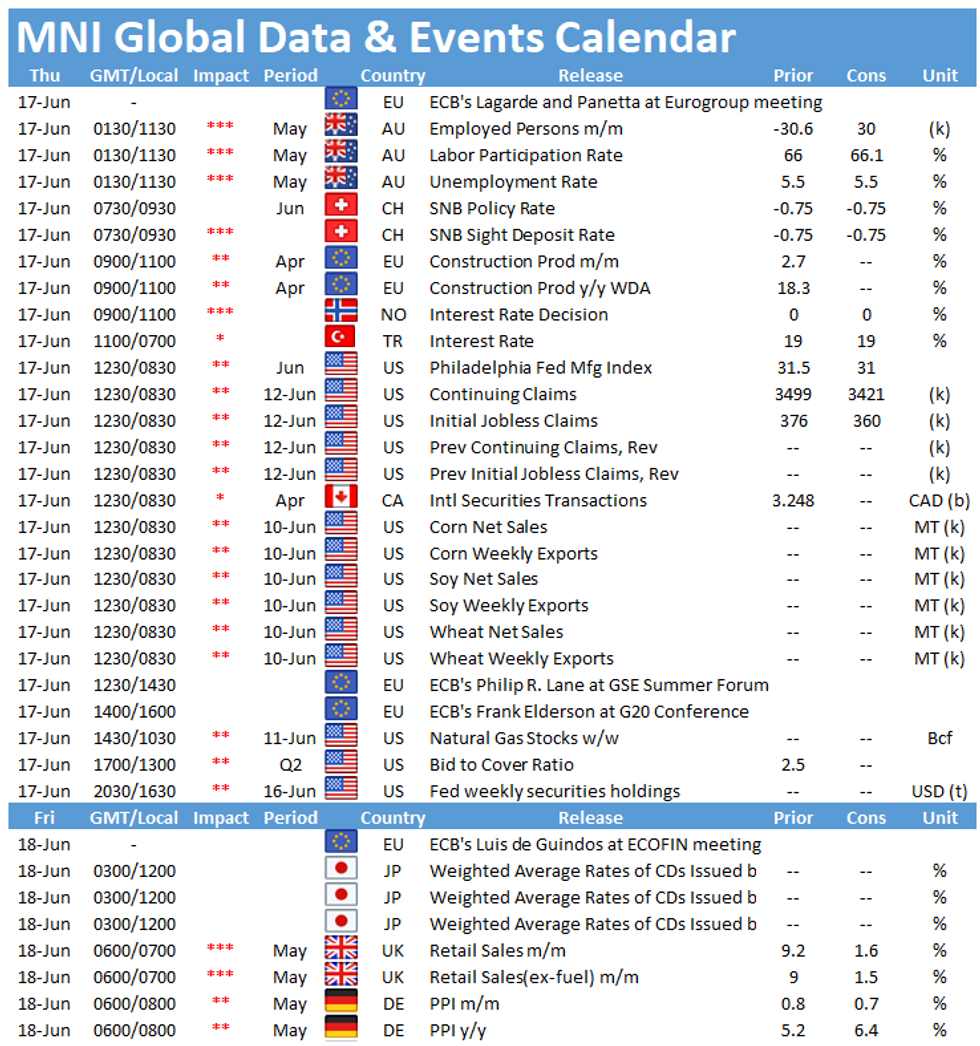

- U.S. initial jobless claims, final EZ CPI, Norges Bank & CBRT MonPol decisions as well as speeches from ECB's Villeroy, Lane, Elderson & Visco take focus today.

FOREX OPTIONS: Expiries for Jun17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1985-90(E841mln), $1.2000-05(E1.1bln), $1.2045-50(E1.3bln), $1.2085-00(E1.2bln-EUR puts), $1.2185-00(E1.3bln-EUR puts), $1.2220-35(E3.6bln-EUR puts), $1.2300(E1.9bln-EUR puts)

- USD/JPY: Y108.65-75($886mln-USD puts), Y109.10-20($878mln), Y109.35-50($586mln-USD puts), Y110.20-25($1.6bln-USD puts), Y110.50($985mln-USD puts), Y110.95-111.00($600mln-USD puts)

- AUD/USD: $0.7715-30(A$630mln-AUD puts), $0.7800(A$521mln), $0.7850(A$614mln)

- NZD/USD: $0.7250(N$920mln)

- USD/CAD: C$1.2065-70($1.0bln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.