-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsy Yields & USD Back From Extremes, Still Comfortably Higher In Wake Of FOMC

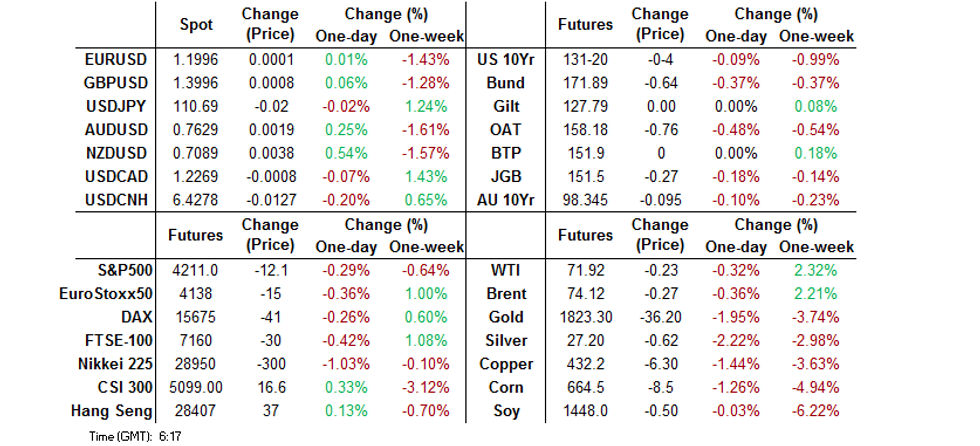

- U.S. Tsy yields & the USD off of early Asia highs, but still comfortably above pre-FOMC levels on dot plot dynamics.

- Antipodean data in the form of the Australian labour market report & NZ GDP comfortably top expectations.

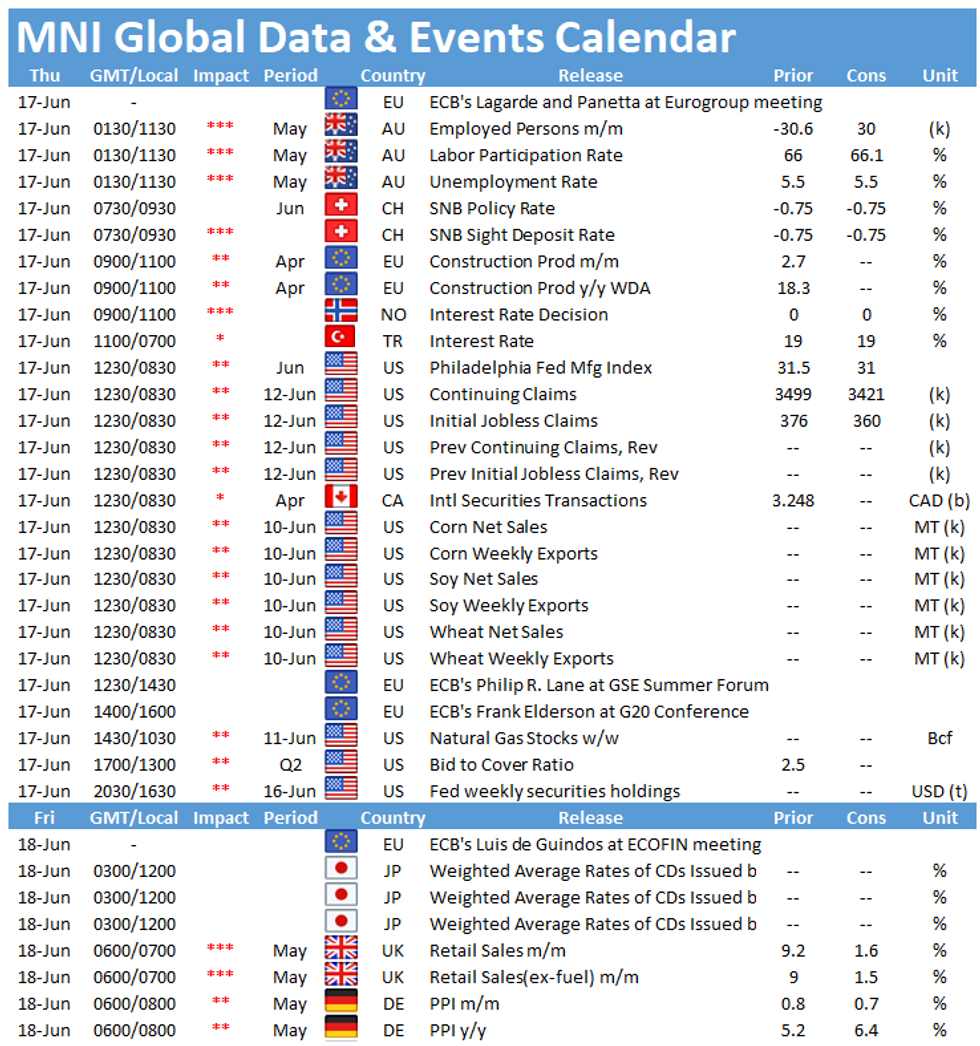

- A slimmer docket in play on Thursday, headlined by ECB speak and central bank decisions from the Norges Bank & CBRT.

BOND SUMMARY: Tsys Off Lows, JGBs Soft, Plenty For ACGBs To Digest

T-Notes have recovered from worst levels of Asia-Pac trade after an early extension through Wednesday's post-FOMC trough, to last trade -0-04 at 131-20, although the contract is nowhere near unwinding anything like the bulk of its post-FOMC losses. There has been nothing in the way of an overt catalyst to trigger the recovery from lows. The major cash Tsy benchmarks are little changed across the curve. Asia-Pac flow was headlined by a 30K screen seller of FFQ1. Weekly jobless claims data and the latest Philly Fed survey headline the local docket on Thursday, with the latest round of 5-Year TIPS supply and end-of-month Tsy auction announcement also scheduled.

- The belly has led the way lower in the cash JGB space (much like what has been witnessed in the remainder of the global core FI markets post-FOMC), with 7s cheapening by ~2.0bp. Futures last -27, adding to the post-FOMC losses witnessed in overnight trade. Local headline flow has been light, with confirmation of the previously outlined speculation re: the evolution of Japan's broader COVID restrictions (rollbacks of some restrictions in Tokyo & 6 prefectures through July 11, although restrictions in Okinawa look set to be rolled over to cover the same horizon). PM Suga is set to give an address on COVID matters this evening. National CPI data and the latest BoJ monetary policy decision headline locally on Friday (expect our preview re: the latter to be published during the London morning).

- Aussie bonds have recovered from worst levels of the day alongside U.S. Tsys, but YM & XM still sit 9.5 lower vs. yesterday's settlement levels. A stellar domestic labour market report pushed the space to worst levels of the day after some modest pressure for YM in the wake of RBA Governor Lowe's latest address (the spill over from the FOMC decision and a strong NZ GDP report had applied pressure before then). The labour market report, coupled with no real pushback from RBA Governor Lowe re: market pricing surrounding the chances of the Bank rolling its yield curve control measure to ACGB Nov '24 from ACGB Apr '24, saw multi-month wides in the ACGB Apr '24/Nov '24 yield spread. To recap, the labour market report saw headline job growth top exp. by nearly 4x the BBG median, driven by full-time job growth. This allowed the unemployment rate to fall to 5.1% even as the participation rate nudged higher. Elsewhere, underutilisation and underemployment cratered to multi-year lows. The release of the AOFM's weekly issuance slate and A$1.0bn of ACGB 1.75% 21 November 2032 supply headline locally on Friday.

FOREX: Antipodean Data Surprise On The Upside, Bolstering Local Currencies

Strong economic data released out of the Antipodes provided support to regional currencies, helping G10 FX space move on after FOMC monetary policy decision. A firm beat in New Zealand's Q1 GDP pushed the NZD higher, with another bout of purchases seen as bets for the next OCR hike were brought forward. NZD/USD roughly halved its post-FOMC losses and briefly showed above the $0.7100 mark, with the Kiwi comfortably outperforming its G10 peers.

- AUD bounced after the release of Australia's monthly labour market report, which saw an unexpected dip in the unemployment rate, largely driven by faster than forecast employment growth. Strong jobs data outweighed the impact of an earlier speech from RBA Gov Lowe, who noted that "the conditions for an increase in the cash rate could be met during 2024, while in others these conditions are not met".

- AUD/NZD went offered a day after its 50-DMA crossed below the 100-DMA. The rate descended past yesterday's low, trimming losses after the ABS published its jobs report.

- DXY stabilised around two-month highs, following Wednesday's surge driven by the latest FOMC policy announcement.

- The PBOC set its central USD/CNY mid-point at CNY6.4298, 30 pips above sell-side estimate. The redback was unfazed by the softer than expected fixing and USD/CNH ebbed lower.

- U.S. initial jobless claims, final EZ CPI, Norges Bank & CBRT MonPol decisions as well as speeches from ECB's Villeroy, Lane, Elderson & Visco take focus today.

FOREX OPTIONS: Expiries for Jun17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1985-90(E841mln), $1.2000-05(E1.1bln), $1.2045-50(E1.3bln), $1.2085-00(E1.2bln-EUR puts), $1.2185-00(E1.3bln-EUR puts), $1.2220-35(E3.6bln-EUR puts), $1.2300(E1.9bln-EUR puts)

- USD/JPY: Y108.65-75($886mln-USD puts), Y109.10-20($878mln), Y109.35-50($586mln-USD puts), Y110.20-25($1.6bln-USD puts), Y110.50($985mln-USD puts), Y110.95-111.00($600mln-USD puts)

- AUD/USD: $0.7715-30(A$630mln-AUD puts), $0.7800(A$521mln), $0.7850(A$614mln)

- NZD/USD: $0.7250(N$920mln)

- USD/CAD: C$1.2065-70($1.0bln-USD puts)

ASIA FX: FOMC Puts The Cat Among The Pigeons

Most Asia EM FX weaker after a jump in the greenback post-FOMC.

- CNH: Offshore yuan I stronger, retracing some of the losses sustained after the FOMC. Data showed fiscal spending in the Jan-May period rose 3.6%, while fiscal revenue rose 24.2%. Elsewhere the NDRC said commodity speculation was cooling after controls.

- SGD: Singapore dollar is slightly stronger but is holding most of its losses. There were reports that the government of Singapore is considering the timing of the removing some lockdown restrictions as case numbers rise again.

- TWD: Taiwan dollar is weaker, markets await the CBC rate announcement later today, the bank is expected to remain on hold at record low 1.125%.

- KRW: Won is the worst performer, hitting the lowest level since May. Losses were tempered after BoK Senior Deputy Gov Lee said the BoK plans to take measures to stabilise markets if necessary.

- MYR: Ringgit is weaker, Malaysia's King called for the parliament to be reconvened as soon as possible. The Conference of Rulers also said that there is no need to extend the state of emergency in Malaysia beyond Aug 1.

- IDR: Rupiah is lower, Bank Indonesia are set to announce their latest monetary policy decision later today, virtually all analysts expect benchmark rates to remain on hold after just tightening mobility restrictions.

- PHP: Peso weakened, Pres Duterte called running for Vice Pres once his tenure expires in 2022 a "good idea," despite earlier showing some reservations. Duterte's party passed a resolution last month, asking him to run for vice presidency.

- THB: Baht fell, PM Prayuth said late Wednesday that Thailand is planning to welcome foreign visitors in 120 days and expects that most Thai residents will be offered at least one Covid-19 jab by Oct.

ASIA RATES: Bonds Pressured Post-FOMC

Bonds in the region pressured after a more hawkish than expected FOMC saw UST's sell off.

- INDIA: Yields higher in early trade. Market participants will focus on the final operation under the RBI's GSAP 1.0 today, the Bank will purchase INR 400bn of debt from the market, including INR 100bn of state debt. Eligible sovereign issues: 6.97% 2026, 6.79% 2027, 7.17% 2028, 7.59% 2029, 5.85% 2030 and 6.64% 2035. Markets will also pay attention to the RBI monthly bulletin that asserted the 10-year yield could fall further in the coming quarter. The bulletin notes evolving yield curve dynamics and scope for OMO's to shape the yield curve. They note the 5-year yield to be fairly valued and the 10-year yield converging to fair value in Q2. The bank's model indicates yields to adjust upwards by 1-23bps in the 2-3 years maturity, and decline by 39-56 bps in the 6-9 years segment.

- SOUTH KOREA: Futures gapped lower at the open in tandem with the move in UST's, but have recovered from early lows. BoK Senior Deputy Gov Lee said the BoK plans to take measures to stabilise markets if necessary, predicting volatility may rise due to changes in policy expectations over economic and inflation situations around the world, especially the US. Looking ahead the MOF will sell KRW 100bn of 10-year linkers tomorrow

- CHINA: Repo rates mixed today, the overnight rate slightly higher and the 7-day repo rate slightly higher – both are within recent ranges. The head of the NDRC spoke and said that commodity controls were working and would be continued, this combined with a data showing a slowdown in activity yesterday eased concerns the PBOC could tighten rates in the near term. Futures are flat having recovered from opening losses.

- INDONESIA: Yields higher across the curve as bonds sell-off alongside regional/global bond markets. Bank Indonesia are set to announce their latest monetary policy decision later today, virtually all analysts expect benchmark rates to remain on hold at a record low of 3.50%, Indonesia recently tightened mobility restrictions.

EQUITIES: Mostly Lower, China Bucks Trend

Most markets in the red in Asia on Thursday, sliding after a negative lead from the US in the wake of a hawkish FOMC. Markets in China buck the regional trend, posting gains after four straight days of decline, data yesterday showed activity slowed in May which buoyed investors hopes that the PBOC will refrain from tightening policy in the near term. Markets in Japan lead the way lower with tech shares selling off. In Australia the ASX200 is flat, recovering from opening losses after strong labour market data. Futures lower in the US, tech shares enduring the worst of the selling with the Nasdaq the laggard among its peers.

GOLD: Support Pierced

The post-FOMC USD strength and push higher in U.S. real yields has weighed on bullion, with spot last dealing around $1,820/oz vs. ~$1,860/oz pre-FOMC. Current levels represent a ~$15/oz bounce from Wednesday's low after bears failed to launch a real challenge of $1,800/oz. Still, with trend support pierced, bears look to force a break of $1,800/oz which would expose the May 6 low ($1,785.1/oz).

OIL: Crude Futures Slip

Oil fell in Asia-Pac trade on Thursday after posting declines on Wednesday, WTI rose as high at $73/bbl before retreating in the US session. WTI & Brent futures last sit ~$0.20 or so softer, comfortably off worst levels. A stronger greenback post-FOMC is a drag on oil, offsetting a larger than expected draw in US crude stocks. Despite weakness into the close, WTI managed to extend the recent winning streak, with Wednesday marking the 15th consecutive session of higher highs -a sequence that hasn't occurred in the contract's history. The second longest winning streak was 13 sessions in 1987. Elsewhere the Saudi Energy Min spoke at the end of yesterday's European session and said that the cautious approach adopted by OPEC+ was paying off, but said the market is not out of the woods yet.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.