-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Defensive Tinge Overnight

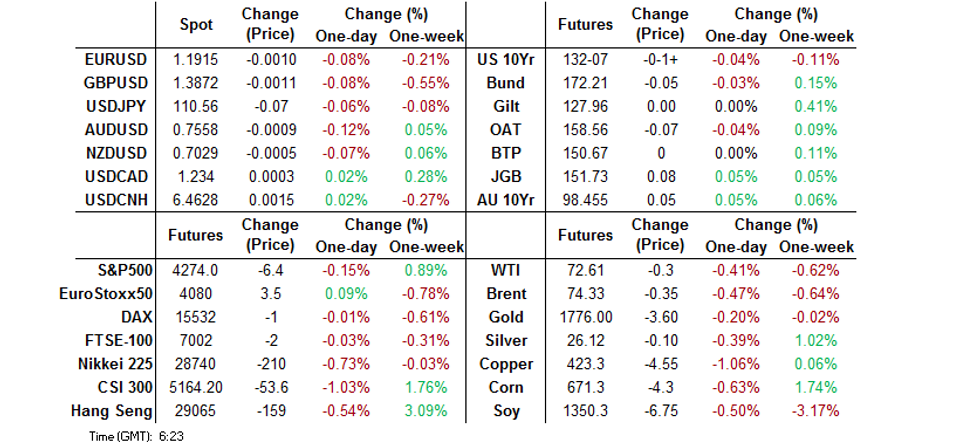

- A defensive feel to Asia-Pac trade sees the JPY atop the G10 FX leaderboard in what has been a limited session, with the major Asia-Pac equity indices and U.S. e-minis a touch softer.

- Headline flow has been light since the NY close, with the COVID situation across the Asia-Pac region still garnering interest.

- Central bank speak headlines Tuesday's docket.

BOND SUMMARY: ACGBs & JGBs Sit Off Best Levels

There has been nothing in the way of Asia-Pac follow through in the wake of Monday's U.S. Tsy rally/curve flattening, which unwound Friday's cheapening/steepening. T-Notes were seemingly happy to operate within the confines of the range witnessed ahead of the NY close, leaving the contract -0-01+ at 132-07 at typing, on meagre volume of ~36K. Yields are little changed across the cash Tsy curve, with nothing in the way of notable headline flow witnessed overnight. Consumer confidence and another round of comments from Richmond Fed President Barkin will headline during NY hours.

- Monday's bid in U.S. Tsys meant that the major cash JGB benchmarks were generally flat to 1.0bp richer during Tokyo dealing, with 7s leading the bid, although futures faded from overnight levels to last deal +7 vs. yesterday's settlement, even as domestic equities came under some modest pressure. The latest round of local retail sales data was loosely in line with broader exp., while there was a 0.2 ppt uptick in the unemployment rate vs. 0.1 ppt exp. A decent enough round of 2-Year JGB supply was seen as the cover ratio nudged higher and low price topped dealer expectations (100.235 per the BBG dealer poll), although the tail did see an incremental widening vs. the previous round of 2-Year supply (it was still limited in nature). The BoJ will outline its July Rinban plan after hours today, with preliminary industrial production data headlining the local docket on Wednesday.

- The Aussie bond space looked through the imposition of tighter COVID restrictions in areas of Queensland over the coming days, leaving YM +1.0 and XM +5.0 at typing. Longer dated ACGBs currently print ~5.5bp richer on the day in cash trade. There has been little to note outside of the early spill over from U.S. Tsys and developments on the local COVID front. On the latter, the NSW Premier outlined the state's business support scheme, which aims to fight off some of the headwinds that companies operating in the state will face. On the SSA issuance front a A$200mn tap of the EIB's Aug '24 line priced. Private sector credit data headlines the local docket on Wednesday.

FOREX: Lingering Caution Keeps Yen Afloat

The yen went bid into the Tokyo fix, as broader coronavirus worry weighed on U.S. e-minis and Asia-Pac equity benchmarks. The defensive feel lent support to the greenback, but the DXY struggled to take out yesterday's high.

- Selling pressure hit AUD as Australia locked down Brisbane, the fourth regional capital to be placed under Covid-19 restrictions. A softer commodity complex provided another headwind for the Aussie, while also wounding the NOK.

- NZD slipped around the time when the RBNZ released their Statement of Intent, even as the document contained little to rock the boat. RBNZ Gov Orr suggested policy settings could normalise over the medium term, provided that the global recovery is sustained.

- The PBOC set its central USD/CNY mid-point at CNY6.4567, just 3 pips below sell-side estimate. Spot USD/CNH blipped higher on the back of general risk aversion.

- Flash German CPI, EZ confidence gauges as well as comments from Fed's Barkin, BoE's Hauser and ECB's Lagarde, Villeroy & Weidmann take focus today.

FOREX OPTIONS: Expiries for Jun29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-10(E623mln)

- USD/JPY: Y109.30-45($1.4bln), Y110.00-15($1.1bln-USD puts), Y110.85-90($515mln), Y111.00-10($526mln), Y112.00($1.25bln-USD calls)

- NZD/USD: $0.7260(N$705mln)

- USD/CAD: C$1.2300-10($570mln)

- USD/CNY: Cny6.4000($510mln)

- USD/MXN: Mxn19.88($890mln)

ASIA FX: Coronavirus Resurgence Engenders Negative Sentiment

Risk sentiment soured on a resurgence in coronavirus cases, most Asia EM currencies lost ground.

- CNH: Offshore yuan is weaker but within yesterday's range and moving a tight band through the session. The PBOC fixed the yuan at 6.4567, in line with sell side estimates. Elsewhere China's GDP growth is projected to reach 12.3% in the first half of the year and 8.8% for full-year 2021 according to Securities Times editorial.

- SGD: Singapore dollar is slightly weaker. On the coronavirus front new cases have dropped, four new cases were found in the past 24 hours which denotes the lowest since June 11. The vaccination drive is accelerating which officials have said is helping contain the number of cases.

- KRW: The won is broadly flat, hugging a narrow range through the session. Late on Monday President Moon said the economy is expected to grow 4% this year, well above the previous estimate of 3.2%. He noted the recovery will be driven by exports and also pointed to a healthy fiscal position thanks to the recovery and cited a surplus of over KRW 30tn in tax revenue.

- TWD: Taiwan dollar is stronger, reversing Monday's decline. On the coronavirus front there were 60 new cases in the past 24 hours, there were reports from the health minister that more doses of the Moderna vaccine will arrive on Wednesday.

- MYR: Ringgit is weaker, PM Muhyiddin announced a MYR150bn economic assistance package, which includes MYR10bn to be disbursed in direct cash aid by the end of the year. The gov't has also unveiled a six-month debt moratorium for all borrowers regardless of income group.

- IDR: Rupiah is weaker, The Straits Times ran a source report suggesting that Indonesia is preparing to implement a "hard lockdown" from tomorrow.

- PHP: Peso bucked the trend and squeezed out some gains. The gov't announced that General Community Quarantine restrictions in Metro Manila and adjacent provinces will be extended through Jul 15, with less stringent rules in the rest of the country left unchanged. Vaccine czar Galvez suggested that the Philippines will intensify vaccination efforts to 8mn jabs a month.

- THB: Baht is weaker, USD/THB has pierced the psychological THB32.000 figure amid a broader baht rout, printing best levels since mid-May 2020. The combination of tighter restrictions in Bangkok and the spectre of continued political unrest in the country has been cited as a factor sapping strength from the baht.

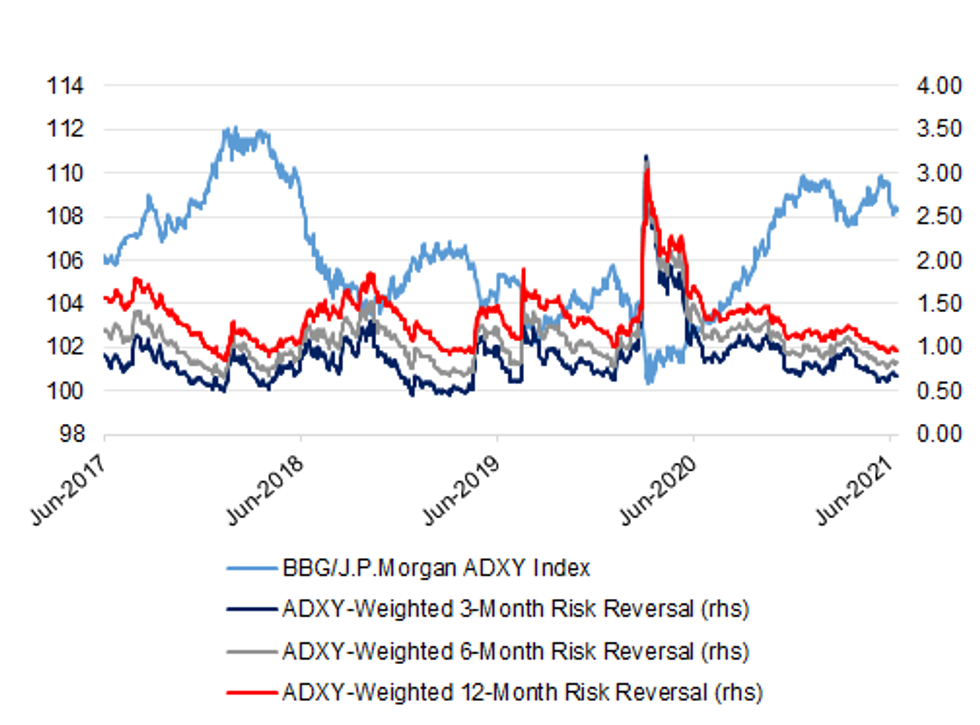

ASIA FX: Lack Of Upside USD/Asia Hedging Evident In Recent ADXY Sell Off

Our ADXY-weighted risk reversal metrics (covering 3-, 6- & 12-month risk reversals) haven't shown much in the way of upside hedging demand across the major USD/Asia FX crosses (in broad terms) during the June downtick in the BBG/J.P.Morgan ADXY Index. The Fed's June decision saw the risk reversals record an uptick from the YtD lows registered earlier this month (after the 6- and 12-month measures tested the '19 lows), although the measures have edged lower again in recent days with the ADXY off lows. Still, the historical preference to hold broader USD/Asia FX calls over puts (evidenced by positive risk reversals) remains intact across the tenors that we monitor.

- N.B. we use USD/CNH risk reversals for the Chinese yuan.

| Last | 3-Month Low | 3-Month High | 12-Month Low | 12-Month High | 3-Year Low | 3-Year High | |

|---|---|---|---|---|---|---|---|

| BBG/J.P.Morgan ADXY Index | 108.30 | 107.63 | 109.89 | 102.84 | 109.89 | 100.33 | 109.89 |

| ADXY-Weighted 3-Month Risk Reversal (rhs) | 0.6824 | 0.6036 | 0.9660 | 0.6036 | 1.1739 | 0.4459 | 3.2052 |

| ADXY-Weighted 6-Month Risk Reversal (rhs) | 0.8191 | 0.7703 | 1.1058 | 0.7703 | 1.3160 | 0.6732 | 3.1266 |

| ADXY-Weighted 12-Month Risk Reversal (rhs) | 0.9594 | 0.9427 | 1.2302 | 0.9427 | 1.5164 | 0.9296 | 3.0486 |

Fig. 1: ADXY- Weighted 3-, 6- & 12-Month Risk Reversals

Source: MNI - Market News/Bloomberg

ASIA RATES: PBOC Injects Liquidity For Fourth Session

- INDIA: Yields lower in early trade, bonds moving in tandem with US tsys and boosted a decline in crude oil prices. Yesterday India announced an expansion of support measures for the economy, including an additional 50% in its emergency credit program to INR 4.5tn and widening its scope to the tourism sector alongside healthcare and airlines. While the total package is INR 6.3tn analysis from Deutsche Bank note that most of the measures announced are in the form of credit guarantee schemes and contingent liabilities, which speaks to the limited fiscal headroom available to India. This could weigh on bonds as it implies that India could be forced to increase bond issuance in order to further support the recovery.

- SOUTH KOREA: Futures rose in South Korea, tracking a move in US tsys. The move higher comes despite an upgrade in growth forecasts by President Moon to 4% from 3.2% previously. There were also reports that a KRW 33tn supplementary budget would be voted on July 2.

- CHINA: The PBOC injected CNY 20bn into the financial system, the fourth straight day of injections and bringing net additions in the last four sessions to CNY 80bn. Repo rates are higher in early trade, the overnight repo rate up 25 bps at 1.8213% but well below last week's highs above 2.36%. The 7-day repo rate is down 45bps after jumping into the close yesterday. There were reports in the Financial News that the PBOC is likely to continue small liquidity injections via reverse repos heading into month and quarter-end.

- INDONESIA: Yields higher across the curve. The Straits Times ran a source report suggesting that Indonesia is preparing to implement a "hard lockdown" from tomorrow. The report noted that top officials will hold an internal meeting to discuss the details today. Meanwhile, Central Java, the country's third-biggest province, has tightened Covid-19 restrictions. FinMin Indrawati revealed that the gov't is discussing tax reform plan with lawmakers. Among the proposed changes are a VAT hike (to 12% from 10% on most goods and services) and a new income bracket (35% tax on people with an annual salary above IDR5bn).

EQUITIES: Negative Day In Asia On Coronavirus Concerns

A broadly negative day for equities in the Asia-Pac region with risk sentiment soured by a resurgence in coronavirus cases and fears over the delta variant, markets in mainland China lead the way lower with losses of over 1% in the CSI 300. The US House passed two bills on Monday that are expected to form the basis of the US-China competitiveness bill. Markets in Japan in the red, the latest round of local retail sales data was loosely in line with broader exp., while there was a 0.2 ppt uptick in the unemployment rate vs. 0.1 ppt expected. Markets in Australia came under pressure with losses in the commodity complex. In the US futures are lower, losses led by the Nasdaq after gains yesterday took US indices to a record highs.

GOLD: Lines In The Sand Remain Untouched

Bullion has nudged lower over the last 24 hours or so, as the DXY has firmed a little, which seems to have outweighed the downtick in our weighted U.S. real yield measure. Spot last deals little changed at $1,778/oz. Still, the well-defined technical lines in the sand are untouched. It is also worth noting that known ETF holdings of gold have stabilised in recent weeks, and last print ~9.5% shy of the all-time high registered at the backend of last year.

OIL: On Track For Second Day Of Declines

Oil is lower in Asia-Pac trade, on track for a second day of declines. WTI & Brent sit ~$0.20 below their respective settlement levels at typing. Markets continue to assess the chances of an output boost at this week's OPEC+ meeting, a global resurgence in coronavirus cases due to the delta variant has also cast some doubt over short term demand. Ahead of the meeting of the technical committee today data indicates that the market will likely remain in deficit this year if output is kept steady.

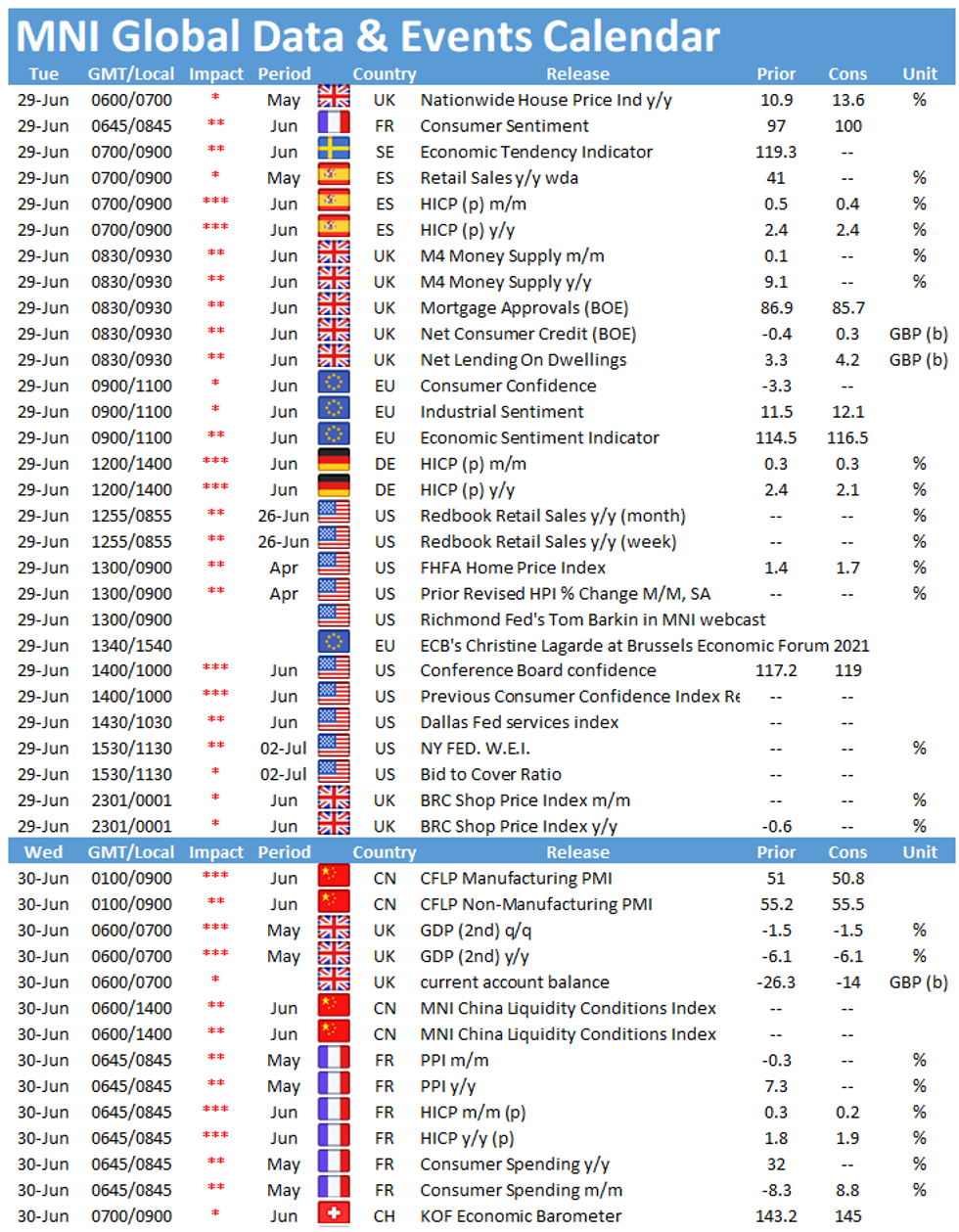

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.