-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed's Waller Notes Very Optimistic View, China PMIs Slow In June

EXECUTIVE SUMMARY

- FED'S WALLER DOES NOT RULE OUT 2022 RATE HIKE (RTRS)

- FED'S BARKIN PREFERS SIMPLE, FLEXIBLE TAPER (MNI)

- OPEC+ DELAYS FIRST ROUND OF MINISTER TALKS TO BRIDGE DIVIDE (BBG)

- CHINA'S OFFICIAL PMIS LARGELY IN LINE WITH EXP., SLOWING IN JUNE

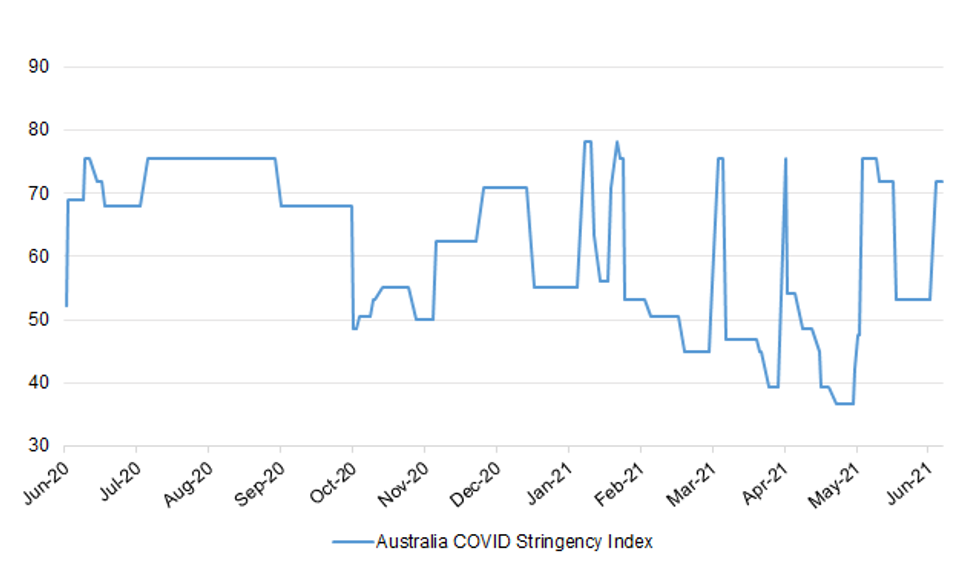

Fig. 1: Australia COVID Stringency Index

Source: MNI - Market News/Bloomberg/Oxford University

Source: MNI - Market News/Bloomberg/Oxford University

UK

CORONAVIRUS: The supply from Pfizer and Moderna is now the main limiting factor in the coronavirus vaccine programme, analysts say, preventing a reduction in the eight-week interval between doses as the race against the Delta variant continues. The government was advised last month under-40s should be offered an alternative to the Oxford-AstraZeneca jab because of a small risk of blood clots, given the low prevalence of the virus and the availability of other shots. Only imported doses of the Pfizer-BioNTech and Modena vaccines are being used for people in their twenties and thirties. "It appears from the data available that Pfizer and Moderna supplies are the pace-limiting factor," Matt Linley, an analyst at Airfinity, a data company tracking the vaccine campaign, said. (The Times)

CORONAVIRUS: Ministers are examining retaining some limited coronavirus measures in England — including offering organisers of large events the option of insisting on certificates for attendees to prove they are virus-free — as infections soared again but hospitalisations continued to lag far behind. Sajid Javid, the new health secretary, told MPs on Monday that the country would have to "learn to live" with the virus as he declined to commit to lifting all remaining restrictions on July 19. Officials close to discussions said that some measures could become a feature of life. These could include giving organisers of events such as festivals and theatres the choice to require a Covid-19 certificate, based on an existing NHS app, so ticket holders can show they have been double-jabbed or have had a recent negative test. "We have to do this to facilitate international travel anyway," said one person briefed on discussions, adding that in the event of a major new variant of the disease emerging certificates could become mandatory. (FT)

CORONAVIRUS: The number of pupils self-isolating at home quadrupled in a fortnight to 375,000, it has been revealed, piling pressure on the government to relax Covid-19 rules. One in 20 children at schools in England were self-isolating last week. Most did not have the virus but when a pupil tests positive all those in their bubble, which could be an entire year group, have to go home. Last night Gavin Williamson, the education secretary, said he was preparing to scrap bubbles in line with the easing of other restrictions. However, this will not be until September and absences are expected to continue to rise in the last weeks of the summer term. (The Times)

CORONAVIRUS: Sajid Javid is set to pave the way for reopening travel to EU countries with a new NHS app that is ready to bypass Angela Merkel's quarantine demands. The app has been updated to serve as a Covid passport that will enable British travellers to prove they are fully vaccinated, show a negative pre-departure test or show that they have had the virus in the past 180 days. It is now ready to be integrated into the EU's identical green pass system, which will allow people to travel freely throughout the bloc by revealing their vaccination or test status at borders. "We are technically ready to be integrated into the EU database that will recognise your digital NHS signature and allow you to demonstrate your Covid status," said a senior industry source. (Telegraph)

CORONAVIRUS: Senior executives who have traveled to England can temporarily leave quarantine if their work is likely to bring major benefits to the U.K. economy, the government announced on Tuesday. The exemption from isolation rules for newly arrived travelers applies to multinational executives who are visiting British branches of their firms. Critics of the decision questioned why it wasn't also extended to smaller businesses. Top executives of foreign companies can also be released from the quarantine requirement if they are looking to make an investment in a British business or set up a new company in the U.K, the government said. (BBG)

CORONAVIRUS: Nicola Sturgeon has raised hopes that Scotland's latest coronavirus spike may have passed its peak as new figures reveal younger people to be the greatest casualties of the third wave. Eighty per cent of all cases of Covid-19 in Scotland are among those under the age of 44, it has emerged. So far this week fewer than 20 pensioners in Scotland have tested positive for the coronavirus, compared with almost 400 people aged 25 to 44. The figures were published as Humza Yousaf, the Scottish health secretary, admitted that football fans watching Euro 2020 matches together indoors and fans travelling on coaches to London to see Scotland play England at Wembley were partly behind the rise in cases. (The Times)

INFLATION: The British public's expectations for inflation were broadly steady this month, according to a survey on Tuesday, that will give the Bank of England more confidence that rising prices are not becoming engrained in the popular psyche, Reuters reports. Inflation expectations for the year ahead ticked up to 2.8% in June from 2.7% in May, the survey from U.S. bank Citi and pollsters YouGov showed. Expectations for inflation in the long term were steady at 3.4%. (Guardian)

BREXIT: Voters in Northern Ireland are evenly split over the need for Brexit checks on goods coming in from Great Britain, a new survey has shown just hours before a new deal between the EU and the UK is revealed. (Guardian)

BREXIT: The export of British lawnmowers to Northern Ireland could be prevented under new EU rules, MPs warned as London and Brussels prepared to announce a ceasefire in their sausage war on Wednesday. (Telegraph)

BREXIT/FISCAL: The UK will on Wednesday set out plans for a simpler, more "nimble" post-Brexit system of state subsidies which the government will use to turbo-charge or prop up selected industries. The government said the new UK system would "start from the basis that subsidies are permitted if they follow UK-wide principles — delivering good value for the British taxpayer while being awarded in a timely and effective way". Rows over state aid were a source of friction during the negotiations on the UK-EU trade deal finalised last year, with Brussels pushing for Britain's rules to remain aligned with the bloc in order to ensure a "level-playing field". Prime minister Boris Johnson resisted those demands, arguing the UK could take a faster, less bureaucratic approach to supporting business that would be tailored to the needs of the British economy. "The UK's new bespoke subsidy system will be simple, nimble and based on common sense principles — free from excessive red tape," said Paul Scully, the business minister. (FT)

FISCAL: Firms that benefited from government furlough cash should have their names published, MPs have urged. The Public Accounts Committee called on the Treasury to set out new transparency guidance for government support in the next six months. The committee repeated its earlier warning that fraud and error in government Covid schemes may have cost taxpayers billions of pounds. But the government said it had acted "at speed" to help workers and firms. Fraudsters could have benefited from the government's decision to drop basic checks in paying out Covid loans and furlough support, the committee said. (BBC)

GREEN BONDS: Plans for £15 billion of green savings bonds are expected to be announced by the chancellor this week, allowing people to invest in renewable energy projects such as wind and solar power. Rishi Sunak will use a speech at Mansion House in the City of London to reveal details of the scheme, which is expected to be one of the biggest issues of green bonds in the world. They will be available through NS&I, the Treasury-backed savings organisation that also offers Premium Bonds. Germany and Sweden have similar bonds for retail investors. Sunak's announcement will be part of the government's efforts to enhance its green credentials before the Cop26 climate conference in Glasgow in November. Britain has committed to hitting net-zero emissions by 2050. (The Times)

EUROPE

ECB: ECB President Lagarde tweeted the following on Tuesday: "As the pandemic passes, we need to shift focus from preserving the economy to transforming it. To do that we must redirect investment towards the green and digital sectors." (MNI)

SPAIN: Spain's prime minister met Tuesday with the chief of Catalonia for the first time since his government pardoned nine separatist leaders of the affluent region's separatist movement in an attempt to further mend relations between their governments. Prime Minister Pedro Sánchez sat down with Catalan regional president Pere Aragonès for two and a half hours at the Moncloa palace, the seat of Spain's government. As expected, the meeting was more about getting the sides to talk again than real achievements. Aragonès repeated his demand for an authorized referendum on independence, as well as a complete amnesty for all those facing legal trouble for their roles in the region's illegal 2017 secession bid. Sánchez had previously said that a ballot on independence by a region is unconstitutional and that the way forward is satisfying the Catalans' needs by focusing on social and economic issues. "The first meeting with Pedro Sánchez has shown how far apart our positions remain and the evident differences that exist to resolving the conflict," Aragonès said afterwards. (AP)

U.S.

FED: Federal Reserve Governor Christopher Waller on Tuesday said he is "very optimistic" about the economy, and while he declined to say when he thinks the Fed should start raising interest rates, he said it could be next year. "The unemployment rate would have to drop fairly substantially, or inflation would have to really continue at a very high rate, before we would take seriously a rate hike in 2022, but I'm not ruling it out," Waller told Bloomberg TV in his first public comments since the Fed met earlier this month. With the crisis phase of the pandemic over, Waller said, "we are now in a different phase of economic policy, and so it's appropriate to start thinking about pulling back on some of the stimulus," beginning with how and when to start tapering the Fed's monthly purchases of $40 billion in mortgage-backed securities and $80 billion in Treasuries. Waller said he would be "all in favor" of phasing out MBS purchases first. "Right now the housing markets are on fire; they don't need any other unnecessary support," he said. "And it's an easy sell to the public." (RTRS)

FED: MNI INTERVIEW: Fed's Barkin Prefers Simple, Flexible Taper

- Federal Reserve Bank of Richmond President Tom Barkin told an MNI webcast on Tuesday he prefers a simple, flexible approach to winding down the central bank's bond purchases and for the process to begin after millions more people return to work. He would be "open minded" about phasing out mortgage bond purchases faster or sooner than Treasuries, and would ideally like to complete tapering before raising interest rates, he added. "I recognize and appreciate the arguments of folks who say the housing market is pretty hot right now," he said, but "making the case you want to try to differentiate the kind of liquidity" the Fed is providing markets "feels complicated." Simplicity in approach is a priority, he said. "I also have some preference for the least-drama way of moving back to normal," he said. A flexible model that gives the Fed "optionality" to respond to the economic outlook is key, Barkin said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Fed President Daly tweeted the followong in Tuesday: "The strength of the American economy depends on jobs—not just inflation. People without jobs can't buy anything, no matter what the price. #FullEmployment #PriceStability" (MNI)

FISCAL: President Joe Biden traveled to La Crosse, Wisconsin on Tuesday to promote his recently announced $1.2 trillion bipartisan infrastructure framework. There, Biden toured the city's Municipal Transit Utility, and he delivered remarks focused on how the massive infrastructure package would benefit Wisconsin residents. "It's going to make the world a difference for families here in Wisconsin," Biden said. "More than a thousand bridges here in Wisconsin are rated as structurally deficient by engineers," he said. "A thousand, just in Wisconsin." The framework includes $579 billion in new spending on roads, bridges, railways, public transit, electric vehicle systems, power, broadband and water. Biden also touted the rural high-speed broadband expansion that the deal would fund if Congress passes it. (CNBC)

FISCAL: Speaker Nancy Pelosi (D-Calif.) on Tuesday amplified her plans to link a bipartisan infrastructure agreement to a second package of Democratic economic priorities, rebuffing an appeal from Senate Minority Leader Mitch McConnell (R-Ky.) to decouple the two bills. In a closed-door meeting with her caucus in the Capitol, Pelosi said her initial strategy — to withhold a House infrastructure vote until the Senate passes a larger, partisan families plan — remains unchanged, according to lawmakers in attendance. "What the Speaker has said, and I totally agree with her, is that we're not going to vote on one until the Senate sends us both," Rep. John Yarmuth (D-Ky.), chairman of the House Budget Committee, told reporters after the meeting. "That's not changed." (The Hill)

CORONAVIRUS: Washington D.C. Mayor Muriel Bowser says now is a good time to visit because the city has fully reopened. (BBG)

HOUSING: White House: U.S. looking into supply issues related to housing market. (BBG)

POLITICS: The campaign to become New York City's next mayor has come in for another twist. On Tuesday, the City Board of Elections released new numbers that suggested Brooklyn Borough President Eric Adams' lead in the Democratic primary had narrowed in the first set of tabulated ranked-choice voting results. Former Sanitation Commissioner Kathryn Garcia, in this preliminary count, had nearly closed the gap, giving Adams a two-point lead. But within hours of the new figures coming online, the board backtracked -- following questions from the Adams campaign and others -- and acknowledged a "discrepancy" in its counting process. It subsequently removed the data from its website. Late Tuesday night, the body put out another statement, this time revealing it had mistakenly included 135,000 test vote records in the initial tally. The count will be re-run once the slate is cleared. (CNN)

POLITICS: Matthew Calamari, Trump Organization's COO, won't face charges from Manhattan District Attorney Cyrus Vance Jr. this week, Insider reports, citing Nicholas Gravante Jr., Calamari's lawyer. Gravante said he doesn't expect Calamari and his son, Matthew Calamari Jr., the head of security at Trump Organization, to be charged soon. Representative of the DA's office declined Insider's request for comment. (BBG)

MARKETS: The Securities and Exchange Commission on Tuesday named New Jersey Attorney General Gurbir Grewal as the next leader of the agency's enforcement division, putting in place a well-known public sector figure to police Wall Street misdeeds. Grewal, 48, will take the helm of SEC enforcement on July 26, after serving as New Jersey's top law enforcement official since 2018. Grewal is one of the state's longest-serving attorneys general and made history as the first Sikh American to hold the position. (POLITICO)

OTHER

GLOBAL TRADE: The Biden administration should take a different approach to trade than that of its predecessor to help improve the U.S. economy, a key European Commission trade official said. The new U.S. government should "distance themselves clearly from the previous administration, which tried to negotiate rules bilaterally and enforce them unilaterally at great cost to the U.S. economy," Director General for Trade Sabine Weyand said in a virtual discussion Tuesday. "I think this recognition of economic reality would already be a good starting point." (BBG)

GLOBAL TRADE: Negotiators in Paris are battling to persuade holdout nations to sign up to a global deal on corporate taxation this week as they become increasingly concerned that the compromises needed to get countries on board will water down the final agreement. China, India, eastern European countries and developing nations have all raised objections to the deal struck by the G7 group of leading economies this month. The talks at the OECD are seeking to find carve-outs to bring them on board. (FT)

CORONAVIRUS: At least 3.01 billion doses of Covid vaccine have been administered around the world, according to the latest data from Bloomberg, as the pace of the global rollout continues to accelerate. Of the about 43 million doses now being administered every day, according to Bloomberg's Vaccine Tracker, almost half are being performed in China. China's pace of vaccinations is enough to cover 75% of the population there with a two-dose vaccine in about a month from now, a remarkably rapid rollout that has eclipsed similar efforts in the U.S., the European Union and India. The pace of the global vaccine effort continues to accelerate. It took 143 days to perform the first billion doses, and another 40 days for the second billion. The third billion doses were performed in 26 days, according to Bloomberg's data. (BBG)

CORONAVIRUS: NIH: Immune response to J&J vaccine robust against COVID variants. (BBG)

GEOPOLITICS: The U.S. Transportation Department on Tuesday issued an order to ban ticket sales for air travel between the United States and Belarus, acting after Minsk forced a Ryanair flight to land and arrested a dissident journalist who was aboard. In issuing the order, the Transportation Department said the U.S. State Department had determined that limiting travel between the United States and Belarus was in Washington's foreign policy interest in light of the diversion of the Ryanair flight. It said the order would extend to "interline" travel in which tickets are purchased through one airline that contain flights operated by multiple airlines. (RTRS)

GEOPOLITICS: Huawei says CFO Meng Wanzhou seeks to introduce various HSBC documents into evidence before the British Columbia Supreme Court Tuesday and Wednesday. The documents show "the false and misleading nature" of the U.S.'s record of the case. If Meng succeeds in introducing them into evidence, she will be able to rely on them at the committal stage of her extradition hearings, scheduled for August. The documents consist of emails and other HSBC records showing there is no evidence of fraud on HSBC. (BBG)

GEOPOLITICS: India should not enter into a border standoff and pursue competition with China while pushed by the West, the Global Times said commenting on media reports that India has redirected more than 50,000 additional troops to its border with China. India is strategically controlled by the U.S., fighting for its Indo-Pacific strategy and starting a contest with China that cannot be supported by India's strength, the newspaper said. China is India's largest trading partner, but India is economically acting "rashly" against China and calculating "decoupling" with China, the state-owned newspaper said. It is impossible for India to reap benefits from the border confrontation with China, as India cannot match China in military capabilities, the newspaper said. (MNI)

JAPAN: Japan's tax revenues likely exceeded 60 trillion yen ($540 billion) to a record high in the year that ended in March despite the blow to the economy from the COVID-19 pandemic, two government sources told Reuters. The bumper tax revenue could ease concerns about the coronavirus-hit to state coffers, possibly fuelling calls for further fiscal stimulus even though massive COVID-19 spending rolled out last year has added to the industrial world's heaviest public debt burden. The amount was bigger than the government's initial estimate of 55.1 trillion yen and due largely to the boost to corporate profits from solid U.S. and Chinese economic recoveries, the officials said on condition of anonymity as they were not authorised to speak publicly. (RTRS)

AUSTRALIA: Health officials have approved a nationwide COVID-19 pharmacy vaccination program to accelerate inoculations. It will commence in the Northern Territory and Western Australia on July 12 and in NSW, Victoria and South Australia a week later. (The Australian)

AUSTRALIA: Alice Springs will enter a 72-hour lockdown after a man who health authorities expect will test positive for coronavirus visited the town's airport last Friday. Despite no new cases of coronavirus being recorded in the NT overnight, Chief Minister Michael Gunner said Alice Springs would be sent into lockdown as an "extreme precautionary measure". Mr Gunner said health authorities were operating under the assumption that the man, who worked at the Tanami Desert mine at the centre of a COVID-19 outbreak that has grown to 10 people, would test positive for coronavirus. He said the man arrived at Alice Springs airport via a charter flight on Friday morning and remained at the airport between 9:00am and 3.50pm. He did not leave the airport. On Saturday, after returning to Adelaide, he returned a negative COVID test. However, Mr Gunner said the man had since developed COVID symptoms while isolating in Adelaide, and four of his household contacts had tested positive. (ABC)

AUSTRALIA: South Australia has confirmed five new cases of coronavirus but the state will be spared a snap lockdown. Premier Steven Marshall confirmed the first case was a miner who worked at the Northern Territory mine linked to an outbreak and had previously tested negative but has since returned a positive test at home in Adelaide. His wife and three of his four children have also tested positive. (9 News)

SOUTH KOREA: South Korea's Finance Minister Hong Nam-ki says BOK's recent comment on possible rate hike will slow liquidity inflows into housing markets. Hong comments in weekly meeting to review housing markets. Hong asks home buyers to make rational judgment in deciding purchases, not led by excessive expectation on price gain. (BBG)

NORTH KOREA: North Korean leader Kim Jong-un said a "grave incident" has happened that could threaten the safety of his people and country in nationwide anti-epidemic efforts, state media reported Wednesday. Kim made the remarks as he presided over an extended politburo meeting of the ruling Workers' Party on Tuesday, accusing senior officials of neglecting their duties in carrying out measures needed to fight the global pandemic, according to the Korean Central News Agency. "By neglecting important decisions of the party in its national emergency antivirus fight in preparations for a global health crisis, officials in charge have caused a grave incident that poses a huge crisis to the safety of the nation and its people," the KCNA said. The KCNA did not elaborate on what the grave incident was. (Yonhap)

CANADA: MNI REALITY CHECK: Rocky Canada Re-Opening on Supply Shortages

- Canada's economic restart may not be quick or smooth as firms struggle to hire back workers and face supply shortages that drive up costs, dimming optimism around the accelerating vaccine rollout, industry sources tell MNI. Gross domestic product likely declined 0.8% in April according to an economist consensus ahead of a report due Wednesday at 830am EST from Statistics Canada. The agency may also give a flash estimate for May that also shows a decline, reflecting major shutdowns in the third wave of the pandemic that disrupted manufacturing and retail sales. There is a fair amount of uncertainty around the April figure with estimates ranging from -0.6% to -1.1%. Output is expected to pick up in June as provinces such as Ontario and Quebec re-opened and vaccination rates rose well above 50%, but a full economic rebound still needs to be propped up by government support - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's foreign minister Marcelo Ebrard said on Tuesday the Mexican government had suggested to U.S. counterparts that travel restrictions on the shared border between the countries should change as vaccination programs advance near the frontier. Ebrard, speaking as foreign ministers from the Group of 20 major economies met face-to-face on Tuesday for the first time in two years, also said five vaccine producing countries could decide to make the COVAX facility work better by releasing more doses. (RTRS)

MEXICO: Mexico is looking at new ways to carry out the worker contract votes that are required under a recent labor reform, officials said on Tuesday, after a disputed vote at a General Motors plant drew U.S. scrutiny over possible worker rights violations. Mexican authorities found "serious irregularities" in the April vote at GM's pick-up plant in Silao, in which workers voted on whether to keep their current collective contract. (RTRS)

MEXICO/RATINGS: Ratings agency Moody's Investors Service said on Tuesday that a credit upgrade of Mexican state oil company Petroleos Mexicanos is unlikely given its consistent negative free cash flow generation, despite a recovery in oil prices. Moody's said that its Ba2 credit rating for Pemex, as the company is known, includes the assumption of "very high government support in case of need and very high default correlation between Pemex and the government of Mexico." "An upgrade is unlikely given the negative outlook for Mexico's Baa1 rating and Moody's expectations for continued negative free cash flow for Pemex," Moody's said in a statement.

BRAZIL: Brazil will suspend a $324 million Indian COVID-19 vaccine contract that has mired President Jair Bolsonaro in accusations of irregularities, the health minister said on Tuesday, following the guidance of the federal comptroller, the CGU. The deal to buy 20 million doses of Bharat Biotech's Covaxin shot has become a headache for Bolsonaro after whistleblowers went public with alleged irregularities. One Health Ministry official said he alerted the president about his concerns. Bolsonaro, whose popularity has faded as Brazil's COVID-19 death toll climbed past 500,000, has denied any wrongdoing, saying on Monday he was not aware of any irregularities. But thorny questions refuse to go away, and may pose problems for him ahead of next year's presidential vote. Brazil Health Minister Marcelo Queiroga said at a news conference his team would probe the allegations during the suspension. (RTRS)

BRAZIL: A member of Brazil's Health Ministry asked for a bribe when negotiating with Davati Medical Supply the acquisition of 400m doses of the AstraZeneca vaccine against Covid-19, Brazilian newspaper Folha de S. Paulo reports, citing a representative from the company. Bribe request of US$ 1 per dose would have been made during a dinner in Brasilia on February 25. Brazil's presidency, Health Ministry and Davati Medical Supply did not immediately respond to Bloomberg's request for comment outside business hours. (BBG)

MIDDLE EAST: The top U.S. military commander in Afghanistan said security across the country is deteriorating just weeks before the last American forces withdraw. Gen. Scott Miller, in a rare briefing on Tuesday, said that recent gains by the Taliban are highly concerning, even if not unexpected. "The security situation is not good right now," he told a small group of reporters at the fast-emptying coalition headquarters in Kabul. "Civil war is certainly a path that can be visualized if this continues on the trajectory it's on right now. That should be a concern to the world." (WSJ)

OIL: The meeting of the OPEC+ Joint Technical Committee ended on Tuesday without any discussion of possible output increases nor a policy recommendation, delegates said. (BBG)

OIL: OPEC and its allies delayed preliminary talks between ministers by one day to allow countries more time to resolve differences before a critical meeting, according to two delegates. The coalition led by Saudi Arabia and Russia is considering whether to continue reviving more halted crude supplies as global demand bounces back from the pandemic. Moscow is weighing a proposal to hike output, but Riyadh has signaled it prefers a gradual approach. The 23-nation alliance had been due to convene its advisory body, the Joint Ministerial Monitoring Committee, on Wednesday. That session will now take place on Thursday, the same day as the main policy meeting. Delegates said it was to allow more time for talks. According to an official letter, Russia's Alexander Novak sought the delay because of "presidential commitments." (BBG)

CHINA

INFLATION: A surge in China's producer price index may begin to slow in June from May's nearly 13-year high of 9%, as commodity prices may ease amid the government's increased interventions, the China Securities Journal reported citing analysts. The actual production and inventory of industrial products are sufficient to meet demand, which has been weakening, so the rallying product prices cannot be supported in the near future, the newspaper said citing CICC analysts. PPI may decelerate to 8% in June, the newspaper said citing analysts. CPI gains may be moderate in H2 as pork prices weaken, the journal cited CICC analysts as saying. (MNI)

PBOC: The PBOC is seen largely maintaining a neutral monetary policy stance even though it conducted reverse repos to meet a surge in mid-year demand, the 21st Century Business Herald reported citing analysts. The central bank has increased the size of injection to CNY30 billion for three trading days from CNY10 billion previously, the newspaper said. This increased injection may also aim to make room for a possible reduction in H2 in case the U.S. proceeds to tighten, the newspaper said citing analysts. The PBOC may continue to keep liquidity stable in July when CNY400 billion MLF and CNY60 billion reverse repos mature, but further easing is unlikely, the newspaper said citing analyst Zhou Yue with Sinolink Securities. (MNI)

LGFVS: Onshore bond issuance by China's local government financing vehicles (LGFV) will slow during the second half (H2) of the year because of tightening policy measures and investor risk aversion, says Moody's Investors Service in a new report. Investor sentiment in the offshore market is likely to stay fluid because of risk stemming from increasing funding difficulties for weak LGFVs amid tightening funding conditions and government measures in the onshore market. "The slowdown will likely reduce LGFVs' net financing and constrain some LGFVs' refinancing ability, particularly those owned by regional local governments (RLGs) with high leverage and weak economic fundamentals," says Ivan Chung, a Moody's Associate Managing Director. "Moreover, we expect the geographic divergence in LGFVs' access to funding to widen in onshore and offshore markets, given China's uneven economic development and investors' greater awareness of differences in RLGs' capacity to support and manage LGFVs." Total LGFV onshore bond issuance fell 47% in May compared with May 2020, leading to a record negative net financing amount of RMB108 billion. The fall was driven largely by more stringent government measures in March to contain RLGs' contingent liabilities through strengthening debt management for local SOEs. In addition, the Shanghai and Shenzhen stock exchanges raised the threshold for LGFVs to issue bonds for purposes other than refinancing, amid investors' increased risk aversion toward LGFVs owned by weaker RLGs. Still, Moody's does not expect full-year issuance to be significantly lower than in 2020 given the large amount of RMB1.9 trillion LGFV bonds due for refinancing in H2. The likely slowdown in H2 follows three consecutive full years of record issuance volume. (Moody's)

CREDIT: Auditors will need more information and time to complete the necessary audit procedures of the financial reports of China Huarong Asset Management and its notes and securities guarantor, China Huarong International Holdings, according to statement to Hong Kong stock exchange. Under the terms and conditions of the notes, failure by the guarantor and co. to provide the audited financial reports doesn't constitute an event of default. There is also no event of default under the terms and conditions of the perpetual securities. (BBG)

OVERNIGHT DATA

CHINA JUN M'FING PMI 50.9; MEDIAN 50.8; MAY 51.0

CHINA JUN NON-M'FING PMI 53.5; MEDIAN 55.3; MAY 55.2

CHINA JUN COMPOSITE PMI 52.9; MAY 54.2

JAPAN MAY, P INDUSTRIAL OUTPUT +22.0% Y/Y; MEDIAN +27.0%; APR +15.8%

JAPAN MAY, P INDUSTRIAL OUTPUT -5.9% M/M; MEDIAN -2.1%; APR +2.9%

JAPAN MAY HOUSING STARTS +9.9% Y/Y; MEDIAN +8.4%; APR +7.1%

JAPAN MAY ANNUALIZED HOUSING STARTS 0.875MN; MEDIAN 0.865MN; APR 0.883MN

JAPAN JUN CONSUMER CONFIDENCE INDEX 37.4; MEDIAN 35.0; MAY 34.1

AUSTRALIA MAY PRIVATE SECTOR CREDIT +1.9% Y/Y; MEDIAN +1.6%; APR +1.3%

AUSTRALIA MAY PRIVATE SECTOR CREDIT +0.4% M/M; MEDIAN +0.3%; APR +0.3%

NEW ZEALAND JUN, F ANZ BUSINESS CONFIDENCE -0.6; FLASH -0.4

NEW ZEALAND JUN, F ANZ ACTIVITY OUTLOOK 31.6; FLASH 29.1

Compared to the preliminary June results, activity indicators were little changed at robust levels, with the exception of the "own activity" measure, which rose another 3 points. Inflation expectations at 2.41% (2.53% in the late-month sample) can no longer be said to be "close to" the RBNZ's target range midpoint of 2%. Retailers' pricing intentions soared to an unheard-of 84%. The risks around upcoming CPI outturns are all to the upside, and the RBNZ needs to get a wriggle on regarding raising the Official Cash Rate. Expected costs hit the maximum possible 100% for agriculture, and are in the 90s for manufacturing and construction. Even in the laggard services sector, a net 79% of firms expect higher costs (and 54% are intending to raise their prices). Our usual heat map of levels and changes on a standardised basis shows the early leaders of construction and manufacturing falling back into the pack somewhat in terms of activity indicators. It shows capacity pressures in agriculture have abruptly intensified (reflecting well-publicised labour shortages), and that export intentions remain a weak point. It also shows that costs and pricing intentions are historically extremely elevated. (ANZ)

SOUTH KOREA MAY INDUSTRIAL OUTPUT +15.6% Y/Y; MEDIAN +18.3%; APR +12.6%

SOUTH KOREA MAY INDUSTRIAL OUTPUT -0.7% M/M; MEDIAN +0.7%; APR -1.6%

SOUTH KOREA MAY CYCLICAL LEADING INDEX CHANGE +0.4; APR +0.5

UK JUN LLOYDS BUSINESS BAROMETER 33; MAY 33

UK JUN BRC SHOP PRICE INDEX -0.7% Y/Y; MAY -0.6%

CHINA MARKETS

PBOC INJECTS NET CNY20BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY30 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation resulted in a net injection of CNY20 billion given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at half-year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:24 am local time from the close of 2.5219% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 57 on Tuesday vs 54 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4601 WEDS VS 6.4567

People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4601 on Wednesday, compared with the 6.4567 set on Tuesday.

MARKETS

SNAPSHOT: Fed's Waller Notes Very Optimistic View, China PMIs Slow In June

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 1.5 points at 28810.86

- ASX 200 up 42.063 points at 7343.3

- Shanghai Comp. up 8.539 points at 3581.717

- JGB 10-Yr future down 2 ticks at 151.67, yield down 0.2bp at 0.060%

- Aussie 10-Yr future down 1.0 tick at 98.440, yield up 0.7bp at 1.545%

- U.S. 10-Yr future -0-00+ at 132-08, yield up 0.68bp at 1.477%

- WTI crude up $0.47 at $73.45, Gold down $2.89 at $1758.42

- USD/JPY down 3 pips at Y110.49

- FED'S WALLER DOES NOT RULE OUT 2022 RATE HIKE (RTRS)

- FED'S BARKIN PREFERS SIMPLE, FLEXIBLE TAPER (MNI)

- OPEC+ DELAYS FIRST ROUND OF MINISTER TALKS TO BRIDGE DIVIDE (BBG)

- CHINA'S OFFICIAL PMIS LARGELY IN LINE WITH EXP., SLOWING IN JUNE

BOND SUMMARY: Tight Ranges Evident In Core FI

T-Notes stuck to a 0-02 range overnight, last dealing -0-00+ at 132-08, while cash Tsys are little changed to ~1.0bp cheaper across the curve. Fed Governor Waller outlined his "very positive outlook," telling BBG that "the unemployment rate would have to drop fairly substantially, or inflation would have to really continue at a very high rate, before we would take seriously a rate hike in 2022, but I'm not ruling it out." On the corporate issuance front both Softbank & Qatar Petroleum launched $-denominated multi-tranche rounds of issuance.

- There was not much in the way of local follow through in the wake of Tuesday's tweaks to the BoJ's Rinban purchases for thew coming quarter, with most of the cash JGB curve sitting flat to a touch firmer on the day. 20s & 40s are the only major benchmarks that sit cheaper vs. Tuesday's closing levels at typing (to the tune of ~0.5bp). A reminder that most view the tweaks to the Rinban operations (including the release of a quarterly schedule) as a way of promoting the functioning of the JGB market, as opposed to a policy signal. Futures have held to a tight range, last printing -2 vs. yesterday's settlement level, gradually unwinding the overnight downtick as we moved through the day.

- Aussie bond futures are back from their early Sydney highs in what has been a limited session, YM-0.5., XM -0.5. The cash ACGB curve has seen some light twist flattening, with the long end sitting ~1.0bp richer on the day at typing. Alice Springs, NT was the latest area to enter a "precautionary" lockdown, while more broadly, the new local COVID case count numbers remain limited in the grander scheme of things, although that hasn't stopped some of the sell-side names with hawkish calls re: next week's RBA decision from tempering their calls a little (or at least warning on the prospects of an RBA taper). Month-end index extension projections are light (AusBond Composite at a mere +0.034 Years), with desks flagging expectations for a lack of support on that front.

EQUITIES: Struggling To Make Gains

A mixed day for equity markets in the Asia-Pac region with major bourses moving in narrow ranges despite a positive lead from the US where indices hit fresh record highs. In China markets are just managing to keep their heads above water, the PBOC injected liquidity into the system again but repo rates still rose to multi-month highs. In Australia the ASX 200 is higher, shrugging off the announcement of further lockdowns, gains also seen in Singapore after the MAS upgraded growth and inflation forecasts while the number of coronavirus cases remains subdued. Bourses in Japan are flat as industrial production saw the first decline in three months. In the US futures are higher; Fed's Waller spoke late yesterday, he was positive on the economy but noted that while the taper could come earlier than expected he did not move his "dot" forward at the June meeting.

OIL: On Track For Best Half-Year Since 2009

Oil is higher in Asia-Pac trade; WTI is up $0.49 from settlement at $73.47/bbl while Brent is up $0.43 at $75.19/bbl. Heading into month and quarter-end WTI is up some 11% on the month and 25% on the quarter, on track for its best half year since 2009. Data late yesterday showed an 8.153m bbl draw in headline crude stocks, if confirmed by DOE figures later today it would be the biggest decline since January.

- Markets await this week's OPEC+ meeting, at which the group are expected to further ease their output curbs and boost supply by 550,000bpd. The JTC met ahead of this week's full videoconference, and ended without any specific discussion of an output hike, however the JMMC meeting was moved to Thursday from Wednesday in order to allow for more protracted talks -possibly a sign that a production boost is in the offing.

GOLD: Technicals Pointing Lower

Spot deals little changed around the $1,762/oz mark at typing. To recap, gold breached technical support located at the Jun 18 low ($1,761.1/oz) on Tuesday, with the DXY trading on the front foot, although the level was not breached on a closing basis after a retrace from session lows of $1,750.8/oz. Technically, the break below the aforementioned support level confirmed a resumption of the downtrend that started on Jun 1, on the confirmation of the bear flag that developed during the most recent consolidation phase. This now opens the way to $1,733.5/oz, a Fibonacci retracement level. On the upside, initial resistance has been defined at the Jun 23 high ($1,795.00/oz). There was a lack of net movement in our weighted U.S. real yield measure on Tuesday, with that particular metric consolidating in recent sessions.

FOREX: AUD Gains Into FY-End Amid Better Sentiment

Antipodean FX edged higher in muted Asia-Pac trade amid a mild recovery in risk appetite. Sentiment firmed as participants digested the news that Moderna's Covid-19 vaccine is effective against the Delta variant, while a BBG trader source flagged demand for the AUD into the end of the fiscal year.

- Official Chinese PMIs were closely watched, with a miss in Non-M'fing PMI coupled with a virtually in-line reading of M'fing PMI provoking little material reaction. The PBOC set their USD/CNY mid-point at CNY6.4601, marginally above sell-side estimate. USD/CNH shed ~30 pips, leaving yesterday's trough intact.

- The DXY wavered around neutral levels through the Asia-Pac session. Fed's Waller struck an optimistic note re: economic recovery, noting that solid performance of U.S. economy warrants "puling back on some of the stimulus" earlier than expected.

- U.S. ADP employment data & MNI Chicago PMI, UK & Canadian GDP reports, German unemployment & flash EZ CPI take focus on the data front. Comments are due from Fed's Bostic & Barkin, ECB's Panetta & BoE's Haldane.

FOREX OPTIONS: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2010-25(E829mln), $1.2064(E522mln-EUR calls)

- USD/JPY: Y109.45-50($1.4bln), Y110.20-25($1.5bln), Y110.50($1.9bln-$1.3bln USD puts), Y110.70-75($1.5bln), Y110.95-111.00($738mln), Y111.50($600mln-USD calls)

- EUR/GBP: Gbp0.8500-05(E505mln-EUR puts)

- AUD/USD: $0.7505-10(A$722mln-AUD puts)

- USD/CAD: C$1.2105($560mln)

- USD/CNY: Cny6.39($1.8bln)

- USD/MXN: Mxn19.75($1.0bln-USD puts)

- USD/ZAR: Zar14.00($801mln)

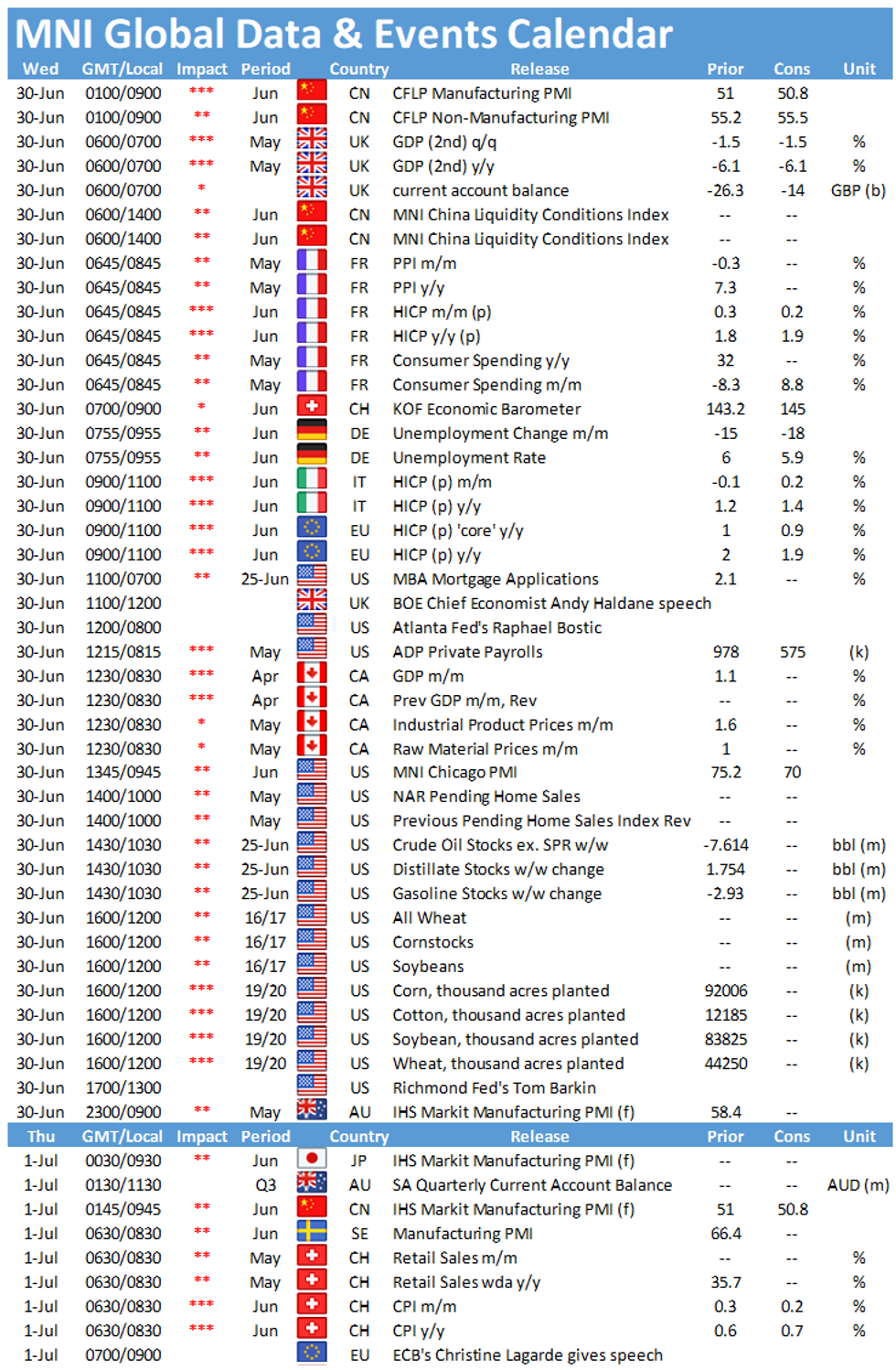

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.