-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: ECB Members Debate Housing's Impact On Inflation

EXECUTIVE SUMMARY

- FED'S DALY: APPROPRIATE TO CONSIDER TAPERING LATER THIS YEAR (RTRS)

- ECB'S SCHNABEL: TEMPORARY INFLATION OVERSHOOT NECESSARY (BBG)

- ECB'S KNOT WARNS CENTRAL BANK COULD BE UNDERESTIMATING INFLATION (BBG)

- XI, TOP EUROPEAN LEADERS SAID TO PLAN CALL AS TENSIONS FLARE (BBG)

- GERMANY'S ALTMAIER SPURNS FRENCH PUSH FOR PERMANENT EU DEBT (BBG)

- OPEC+ CRISIS DEEPENS AS SAUDI ARABIA REFUSES TO BUDGE (BBG)

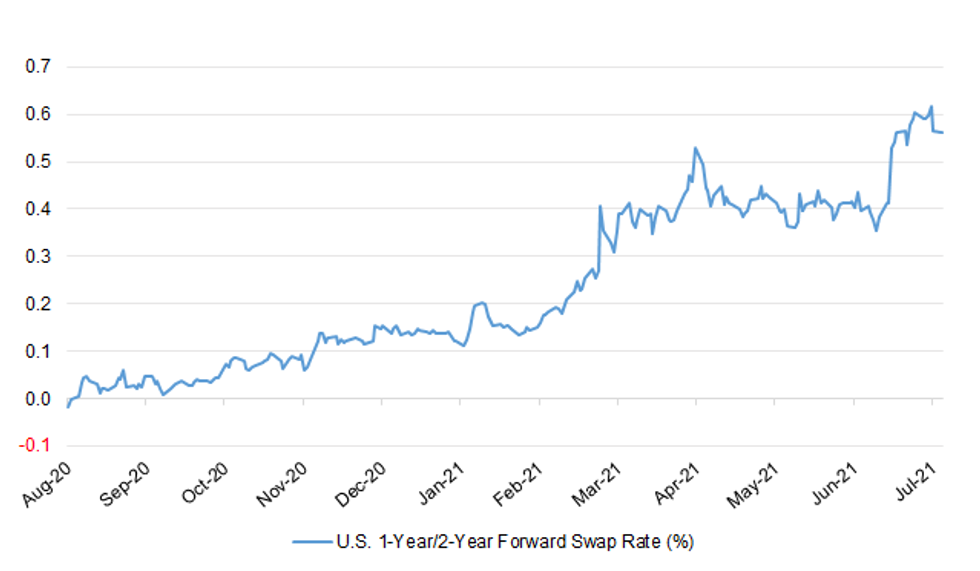

Fig. 1: U.S. 1-Year/2-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson will announce his intention today to lift remaining lockdown restrictions on July 19 while warning that the public must "exercise judgment when going about our lives". At a press conference, the prime minister will push ahead with plans to return to normality and "restore people's freedoms" in two weeks' time, with social distancing rules scrapped, a return to large events and an end to compulsory masks in shops and on public transport. A cabinet minister said yesterday that the government would now "move away from the state telling you what to do" and confirmed face coverings would become voluntary. The policy requiring pupils to stay at home if a child in their bubble tests positive for coronavirus will also end, it was confirmed. (The Times)

CORONAVIRUS: Chris Whitty has privately predicted that people will still need to take precautions like wearing facemasks in confined spaces after July 19, as six in ten Britons back the end of restrictions on that date. Voters, however, remain wary of a resurgence of coronavirus and overwhelmingly back the return of lockdown measures if another wave risks significant numbers of deaths. Boris Johnson and Sajid Javid, the new health secretary, have both insisted that England is on track to be free of coronavirus laws in little more than two weeks, citing the success of vaccination in ensuring low hospital admissions even as cases of Covid-19 double every nine days. Polling for The Times finds that a majority of voters back this position. (The Times)

CORONAVIRUS: Leading doctors in the U.K. urged the government to keep some pandemic restrictions in place in England, pushing back against Downing Street's plans to relax measures from July 19. "The idea that on the 19th of July we can return to a pre-Covid world of having no restrictions, we think is not sensible in light of what are spiraling infection rates," Chaand Nagpaul, chair of the British Medical Association Council said in an interview with the BBC. While the link between cases and hospitalizations has weakened, it hasn't been broken, he added. The U.K. should avoid putting further strain on the nation's health care system and instead focus on bringing down the infection rate, particularly with so many cases of long-Covid, Nagpaul said. (BBG)

CORONAVIRUS: Workers will not be told to return to offices en masse on July 19 even if the Government's official work from home guidance is lifted, The Telegraph understands. (Telegraph)

CORONAVIRUS: Fewer than two-thirds of staff are expected to return to the workplace when restrictions are lifted as a new era of hybrid working takes hold after the pandemic, an exclusive Telegraph poll shows. (Telegraph)

CORONAVIRUS: Children are being vaccinated against Covid before an official decision on whether youngsters should be given the jab, The Telegraph can disclose. (Telegraph)

FISCAL: The chancellor must extend the "vital" weekly £20 increase in universal credit, six former Tory welfare secretaries have said. Rishi Sunak is under growing pressure to make permanent the increase, which was introduced as an emergency measure. A letter to Sunak was signed by Amber Rudd, Esther McVey, Damian Green, Stephen Crabb, Sir Iain Duncan Smith and David Gauke. The former welfare secretaries said that the increase had been "vital for protecting the incomes of many families and providing support to the economy". (The Times)

FISCAL: Sajid Javid is open to supporting a tax rise to pay for major social care reform, according to allies, as he joined the Treasury in a push to find a "sustainable" funding solution. (Telegraph)

BREXIT: European Union leaders need to engage in "constructive and ambitious" discussions to resolve a lingering Brexit dispute over the Irish border, the U.K.'s chief Brexit negotiator and its secretary of state for Northern Ireland wrote in the Irish Times. Goods must be able to move "as freely as possible" within the customs territory of the U.K., and products important to Northern Irish consumers that come from Great Britain must continue to be available, David Frost and Brandon Lewis wrote in the opinion article. (BBG)

BREXIT: The new DUP leader says Northern Ireland risks losing out on economic opportunities because of the Brexit border in the Irish Sea. In his first television interview since taking up the post, Sir Jeffrey Donaldson told Sky News the prime minister needs to restore Northern Ireland's place in the UK, both economically and constitutionally. (Sky)

BREXIT: The EU fears that Boris Johnson wants to "dismantle" the Northern Ireland protocol, the Irish foreign minister has said, as relations between Brussels and London deteriorated again after remarks by the Brexit minister David Frost in the past 24 hours. Simon Coveney told RTÉ on Sunday that EU leaders feared the worst after what he felt was a provocative article written by Lord Frost and the Northern Ireland secretary, Brandon Lewis, in the Irish Times on Saturday. "Many in the EU are interpreting the UK's response as essentially saying: 'Look, concessions don't matter. What is required now is to dismantle elements of the protocol piece by piece,'" he said, adding. "That is going to cause huge problems." (Guardian)

BREXIT: The Irish taoiseach, Micheál Martin, has called on Downing Street to "reciprocate the generosity of spirit" shown by EU leaders on the Northern Ireland protocol after they extended the grace period allowing chilled meats to be shipped to the nation from Britain. On Saturday, Martin said "warning each other is over" and called for engagement to find solutions through the withdrawal agreement. (Guardian)

POLITICS: As Boris Johnson travelled to Chequers in the wake of the Conservatives' defeat in Batley & Spen he was feeling sanguine. Allies say that the prime minister did not expect to win the seat and, while disappointed, believes it brings politics more into line with where they should be midway through the parliament. In Conservative Campaign Headquarters and No 10 the finger of blame is being pointed firmly at Matt Hancock, the former health secretary, and his affair with a senior aide. "We're naturally gutted; it was a missed opportunity for us," one Downing Street source said. "But I think we should reflect on the fact Matt Hancock brought the reputation of the government down; it had enormous cut-through." (The Times)

EUROPE

ECB: European Central Bank policy maker Isabel Schnabel said it is "necessary and proportionate" that inflation overshoots the institution's goal for a while as the economy recovers, remarks that may spark a pushback by some colleagues in the Governing Council. The Executive Board member said on Saturday that she sees "growing evidence" inflation expectations are finally starting to align with the ECB's target of just-under 2%, but that continued monetary and fiscal stimulus is needed to ensure that happens. (BBG)

ECB: Speaking on Sunday at the conference, Bank of France Governor Francois Villeroy de Galhau raised another difficulty with inflation: measuring it. He noted that while changes in prices are often overestimated by households, the ECB hasn't taken into account the pressure from housing costs. "Better accounting for housing costs is very important," Villeroy said. "It's one of the things that we must change in the strategic review of monetary policy that we are in the process of concluding." (BBG)

ECB: European Central Bank policy maker Klaas Knot warned that policy makers may be underestimating the potential for accelerating inflation to become entrenched, and that emergency monetary stimulus should end around March 2022. While the ECB predicts that current elevated inflation rates are temporary -- driven by rebounding energy prices and supply shortages as the economy reopens -- the Dutch central bank governor said the outcome may be different. "We should not overestimate our capacity to determine in advance what is temporary inflation and what is not," he said in an interview with Dutch newspaper NRC. "There are other scenarios conceivable than our base case of persistently low inflation. Inflation is not dead." (BBG)

INFLATION: European companies are pushing up prices as supply disruptions lift costs and hamper their ability to match surging demand, said executives gathered for a conference this weekend in southern France. The bosses of industrial firms including tire company Michelin and construction materials producer Saint-Gobain say they're facing scarce supplies, transport bottlenecks and staff shortages in the wake of the pandemic, and that they expect consumer-price inflation to pick up as a result. "We usually have one or two operational crises to handle at a time on supplies -- right now we have 23," said Florent Menegaux, CEO of Michelin, told Bloomberg TV. "The entire supply chain has been disturbed." (BBG)

FISCAL: German Economy Minister Peter Altmaier poured cold water on a French proposal to give the European Union a lasting tool to raise common debt. France intends to push for a permanent mechanism on joint EU debt issuance to drive investment in innovation that member countries can't finance on their own, according to Finance Minister Bruno Le Maire. The comments came ahead of a meeting between the ministers of Europe's biggest economies on Sunday at an annual conference in Aix-en-Provence, southern France. Asked about the initiative, the German official expressed reluctance. (BBG)

CORONAVIRUS: The spread in Europe of a more contagious form of Covid-19 is dashing hopes of recovery in air travel, with the head of a major airports operator warning that it could cut short any rebound. "The delta variant is creating such uncertainty that we can't be sure what's going to happen in three weeks," said Augustin de Romanet, chief executive officer of operator ADP, which also manages dozens of other hubs worldwide. (BBG)

GERMANY: Chancellor Angela Merkel's conservative bloc widened its lead over the Green party to 10 percentage points in a weekly poll ahead of Germany's election on Sept. 26. The Christian Democratic Union and its Bavaria-based ally, the CSU, polled an unchanged 28% in Insa's poll for Bild am Sonntag, while the Greens declined 1 percentage point to 18%. The Social Democrats, Merkel's junior coalition partner since 2013, polled 17%. (BBG)

FRANCE: France might still be in the throes of the coronavirus pandemic as the delta variant spreads rapidly, but officials and business leaders are looking ahead to a period of recovery and reflecting on the wider outlook for France's political and economic future. "The rebound is very steep, but it's even steeper than last year. So we are quite happy with that," Agnès Bénassy-Quéré, chief economist at the French Treasury, told CNBC Sunday, pointing to the national statistics office raising its growth forecast for France in 2021 to 6%. "The official forecast is still at 5% for 2021 because we are still cautious about the fall. As you were saying, there is a delta variant, and we have kept some restrictions up to the end of the year. So already in the spring, when this forecast was made, it included some restrictions, light restrictions of the second half of the year. So far, we have not changed this forecast, then we will see what happens when we have to build the 2022 budget," he said, speaking to CNBC's Charlotte Reed while attending an economic forum in Aix-en-Provence. (CNBC)

FRANCE: French Finance Minister Bruno Le Maire said it will be difficult for the country to accept the European Commission's requests regarding a proposed reorganization of Electricite de France SA tied to regulatory reform. "It seems very complicated to explain to the French -- not to mention EDF employees -- that we'll give in to the demands of the European Commission, which wishes that EDF wouldn't be a single company anymore," Le Maire said in an interview with LCI television Sunday. "I won't let the European Commission dismantle EDF." (BBG)

FRANCE: A wave of infections may hit France by the end of July because of the delta variant, based on what's happening in the U.K., French Health Minister Olivier Veran said on Twitter. He said cases in France have rebounded in the past five days and urged residents to get vaccinated to limit the wave. (BBG)

GREECE: Greece will no longer go into lockdown, even if there is a new wave of coronavirus, Prime Minister Kyriakos Mitsotakis said in an interview on Sunday with Greek daily Kathimerini. "I cannot make vaccination mandatory. But everyone has to face the consequences [of their actions]. The country will not close again to protect the few unvaccinated," he said. (POLITICO)

IRELAND: Growth in activity in Ireland's services sector increased further in June but cost pressures continued to intensify for firms with input price inflation hitting its highest level since 2008, a survey found on Monday. The AIBIHS Markit Purchasing Managers' Index (PMI) rose to 63.1 from 62.1 in May, the highest level in more than five years. That is up from a 2021 low of 36.2 reported in January when the economy was back in lockdown and marked the fourth successive month the index has crossed the 50-mark separating expansion from contraction. (RTRS)

BONDS: The EU Commission said on Friday it has lifted the ban on two remaining banks previously excluded from syndicated debt sales backing the European Commission's up to 800-billion-euro ($947.92 billion) COVID-19 recovery fund. The commission said in an emailed statement it had "lifted the suspension on the remaining 2 banks from its Primary Dealer Network", though it did not name the banks. (RTRS)

U.S.

FED: Federal Reserve Bank of San Francisco President Mary Daly said the U.S. central bank may be able to start reducing "a little bit" of its extraordinary support for the U.S. economy by the end of this year. "The economy is really shaping up nicely," Daly told the Associated Press in an interview, a recording of which was provided to Reuters by the San Francisco Fed. "It is appropriate to consider tapering asset purchases later this year or early next year," she said. "That timeframe has been evolving of course, but I really see the economy as being able to start functioning more and more on its own, which means we can withdraw a little bit of our accommodation, of course not the majority of it." (RTRS)

CORONAVIRUS: A triumphant President Joe Biden all but announced an end to the pandemic in the U.S. on Sunday, celebrating what he called a "heroic" vaccination campaign on the country's Independence Day holiday. Speaking at a party on the White House's South Lawn, Biden declared that the U.S. had achieved "independence" from the coronavirus. "It no longer controls our lives, it no longer paralyzes our nation and it's within our power to make sure it never does so again," he said, appealing for Americans who have not yet been vaccinated to get their shots. (BBG)

CORONAVIRUS: More than a quarter of people in the U.S. say they're unlikely to get a Covid-19 shot, with 20% saying they definitely won't and 9% saying they probably won't, according to a Washington Post/ABC News poll. That compares with a combined 24% in April in a poll by the same outlets. The data illustrate the challenge for the Biden administration and state and local officials in expanding vaccination beyond the 67% who have received at least one dose, according to the Centers for Disease Control and Prevention. (BBG)

CORONAVIRUS: Some people who received the Johnson & Johnson Covid-19 shot in the U.S. are seeking out added doses of a messenger-RNA vaccine, fearing their initial inoculation won't protect them from the virus. Demand for the one-and-done J&J shot has suffered in part due to the perception that it's inferior to the two-dose mRNA vaccines that showed higher efficacy in clinical trials. But it is unclear if mixing vaccines will safely increase protection, and there are fresh signs that J&J's shot is a strong shield against variants. (BBG)

CORONAVIRUS: Anthony Fauci, the top U.S. infectious-disease official, said he doesn't expect another nationwide spike of Covid cases over the delta variant given that a "substantial proportion" of the U.S. population has been vaccinated. He reiterated his warning that places with low level of vaccinations will see a spike in cases, resulting in "two types of America," according to his interview on NBC's "Meet the Press," which will air fully on Sunday. (BBG)

CORONAVIRUS: The U.S. Food and Drug Administration authorized another batch of the main ingredient for Johnson & Johnson's coronavirus vaccine for use after a safety review, the drug regulator said on Friday. The drug substance was produced at an Emergent BioSolutions Inc. plant in Baltimore. A past mix-up at the Bayview facility, which had been producing two vaccines, triggered a sprawling safety review. (BBG)

CORONAVIRUS: The Transportation Security Administration said Friday that airport screenings have climbed above 2019 levels for the first time in the pandemic, signaling strong travel demand during Fourth of July weekend. The TSA screened nearly 2.15 million people on Thursday, close to 3% more than the 2.01 million people who passed through security checkpoints at U.S. airports on July 1, 2019. The trend is unlikely to hold. July 1, 2019 was a Monday and a low point for the week, when screenings increased by more than 706,000 people to peak on July 5. (CNBC)

EQUITIES: In a year when the S&P 500 hit all-time highs every four days, Friday's elevation looked like nothing special. But here's the twist: It marked a seventh straight session of records, a feat not seen since 1997. The benchmark index extended its longest rally since last August as data showed that U.S. job growth surged the most in 10 months, while the unemployment rate edged up to 5.9%. The report helped bolster views that the Federal Reserve won't rush to tighten monetary policy any time soon and risk stifling the economic recovery from the pandemic. (BBG)

OTHER

EU/CHINA: Chinese President Xi Jinping, German Chancellor Angela Merkel and French President Emmanuel Macron are expected to hold a video call this week, said people with knowledge of the matter. The agenda isn't yet known, according to the people, who asked not to be named as the information isn't public. The virtual meeting won't be the first high-level communication between the trio at a time the pandemic has halted most international travel by world leaders. But it comes as tensions simmer between Europe and the world's second-largest economy. (BBG)

GEOPOLITICS: China's Foreign Minister Wang Yi urged the international community on Saturday to build a "Great Wall of Immunity" to battle the COVID-19 pandemic. "We should face the imminent challenges together," Wang, who is also a member of the State Council, or cabinet, told the 9th World Peace Forum held at Tsinghua University in the Chinese capital. "The most urgent priority is to expedite the construction of the 'Great Wall of Immunity' to fend off the virus, surpass political discrimination and carry out international anti-pandemic cooperation." (RTRS)

CORONAVIRUS: Coronavirus cases in Africa are doubling every three weeks, and the continent is on the verge of exceeding its worst week of the pandemic. While the attention in much of the developed world is turning to post-pandemic issues, the least-vaccinated continent is in the grip of a crippling third wave. As the more contagious delta variant starts to spread, cases are rising, hospitals are being overrun, and deaths are mounting. "This third wave is going to be devastating because in Africa and South Africa we couldn't get access to vaccines when we needed them most," said Tulio de Oliveira, director of Krisp, a South African genetic-sequencing institute. (BBG)

CORONAVIRUS: Corporate travel is beginning to rebound as coronavirus restrictions ease in many parts of the world, signalling the first signs of recovery for an industry decimated by the pandemic. Hotels, airlines and travel companies all report a rise in corporate bookings over recent weeks as executives return to the road following months of virtual meetings and video conferences. The recovery is patchy and led by domestic markets where travel is easiest, but the industry has, nonetheless, welcomed signs of pent-up demand. (FT)

BOJ: MNI BRIEF: BOJ's Kuroda Keeps Optimistic Economy, Price View

- Bank of Japan Governor Haruhiko Kuroda on Monday maintained his optimistic view on the outlook for Japan's economy but repeated that the bank will take more easing if necessary without hesitation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japanese Prime Minister Yoshihide Suga's party gained seats in a Tokyo assembly vote weeks before the Olympics but his ruling bloc failed to score a majority, delivering a mixed result ahead of a national vote expected after the games. Suga's Liberal Democratic Party, which previously had 25 seats in the 127-seat assembly, took 33 spots in the Sunday election, according to data from national public broadcaster NHK. Coalition partner Komeito stayed at 23 seats with the two falling short of a majority in the assembly that represents the city's nearly 14 million residents. (BBG)

JAPAN: Tokyo Olympics organizers are leaning toward barring spectators from events held in large venues such as soccer and track and field, Nikkei reported. (BBG)

AUSTRALIA: Sydney's outbreak of the delta-variant of the coronavirus is raising concern Australia's most-populous city may need to extend its two-week lockdown beyond Friday. The city of about 6 million people recorded 35 new cases in the community on Monday raising the total infections since mid-June to 312. (BBG)

NEW ZEALAND: Auckland house prices remains "stubbornly high", despite winter and the Government's crackdown on property investors. Sale prices by Auckland's largest agency Barfoot & Thompson were up 2.6 per cent in the last month to make annual rises 21.9 per cent. The average price paid was $1,143,328, up 2.6 per cent on May and the median price at $1,109,000 was up 3.4 percent, the company said today. The onset of winter and the new regulations aimed at making home buying less attractive to investors did not dampen the price, or the number of Auckland houses sold in June, it said. "Normally in June sales numbers start to edge lower, but this year we sold 1243 homes, up 3.8 percent on those for the previous month, and both the average and median prices paid were higher than those for May," said managing director Peter Thompson. (NZ Herald)

SOUTH KOREA: South Korean and U.S. governments tentatively agreed to hold joint military drills in the second week of Aug., on a reduced size, DongA Ilbo newspaper reports, citing unidentified government officials. Joint drills were canceled in 1H 2020 due to the coronavirus spread while there were only computer simulation drills in Aug. 2020 and March 2021. (BBG)

SOUTH KOREA: A senior South Korean official warned on Sunday that Covid-19 is spreading at "menacing" speed, with the delta variant now moving at a faster rate. The country will require everyone, including those who have been vaccinated, to wear masks in Seoul and its metropolitan area, where virus cases have spiked, the Korea Disease Control and Prevention Agency said. (BBG)

MEXICO: The Banco de Mexico needs to preserve its sole mandate to fight inflation, Arturo Herrera, Mexico's outgoing finance minister and the president's pick to next lead the country's central bank, said in an interviewwith El Pais. Herrera, whom President Andres Manuel Lopez Obrador has tipped to succeed Alejandro Diaz de Leon at the end of the year, said efforts by central banks to foster growth can be a mistake in emerging markets. "I am convinced that a central bank like Mexico must have a sole mandate," Herrera told El Pais. "It has not been sufficiently understood that reaching stable inflation also indirectly helps growth." (BBG)

BRAZIL: Thousands of protesters across Brazil demonstrated against President Jair Bolsonaro this weekend as pressure mounted on the populist leader over allegations of potential corruption in the procurement of Covid-19 vaccines. The rallies, which took place in at least 13 state capital cities, came a day after the Supreme Court authorised a criminal investigation into whether Bolsonaro engaged in the crime of "prevarication", the dereliction of public duty for reasons of personal interest. Bolsonaro has been accused of not acting on suspicions of wrongdoing after a whistleblower at the Ministry of Health claimed to have personally raised with him concerns about a R$1.6bn ($320m) deal to acquire 20m jabs of Covaxin produced by Bharat Biotech from India. (FT)

RUSSIA: President Joe Biden said "we're not sure" that Russia is behind a massive ransomware attack on managed-service providers as U.S. intelligence officials conduct an investigation. "I directed the full resources of the government to assist in the response if needed," Biden told reporters during a trip to Michigan on Saturday. "We're not sure it's the Russians," Biden said. "I got a brief on the plane. The initial thinking was, it was not Russian government, but we're not sure yet." (BBG)

SOUTH AFRICA: South African regulators have approved Sinovac Biotech Ltd.'s coronavirus vaccine, the first shot developed for the disease by a Chinese company to be sanctioned locally. The South African Health Products Regulatory Authority backed the double-dose CoronaVac candidate made by Sinovac's Life Sciences unit with conditions, according to a statement on Saturday. Those include satisfactory results of ongoing studies and periodic safety updates, SAHPRA said. (BBG)

SOUTH AFRICA: A large crowd of ex-South African President Jacob Zuma's supporters gathered around his rural homestead in the eastern KwaZulu-Natal province on Sunday, vowing to resist any attempt by the authorities to arrest him following his conviction on contempt charges. The Constitutional Court on June 29 found Zuma, 79, guilty of violating its order to testify before a judicial panel that's investigating graft during his nine-year tenure. On Saturday, the court agreed to consider Zuma's application to review the judgment and scheduled a hearing for July 12. Its decision probably means that a Sunday deadline for Zuma to hand himself in to start serving his 15-month sentence no longer stands, although the court didn't issue specific instructions in that regard. (BBG)

IRAN: The U.S. Treasury said on Friday it removed sanctions on three Iranians but said this did not reflect a change in its sanctions policy toward Iran and had nothing to do with talks on restoring U.S. and Iranian compliance with the 2015 Iran nuclear deal. The Treasury said it had determined Behzad Ferdows, Mehrzad Ferdows and Mohammad Reza Dezfulian are no longer blocked under Executive Order 13382, which targets proliferators of weapons of mass destruction and their supporters. (RTRS)

EQUITIES: As stocks around the world continue to smash one record after another, some of the world's biggest money managers have a simple message: Get used to it. The likes of BlackRock Inc., State Street Global Markets, UBS Asset Management and JPMorgan Asset Management expect equity markets to keep rising in the second half of the year, with many investors increasingly looking outside the U.S. for more returns. (BBG)

EQUITIES: China expanded a cybersecurity probe beyond Didi Global Inc.to include two other recent U.S. debutantes, moving with surprising swiftness to tighten its control over internet data in the interests of national security. Beijing's latest effort to rein in its top online companies unfolded swiftly over the weekend. Late on Friday, the top internet regulator said it was starting a cybersecurity review of the ride-hailing giant and later ordered app stores to remove its services from their platforms, dealing a major blow to the company just days after it pulled off one of the largest U.S. IPOs of the past decade. The Communist Party-backed Global Times warned in a Monday column that Didi's information hoard posed a threat to individual privacy as well as national security, particularly since its top two shareholders -- SoftBank Group Corp.and Uber Technologies Inc. -- were foreign. Then on Monday, the watchdog announced probes into platforms run by Full Truck Alliance Co. and Kanzhun Ltd., which raised $2.5 billion in their own debuts in past weeks. The series of events shook investors, sending SoftBank down more than 6% and hammering Didi's peers from Tencent Holdings Ltd. and Alibaba Group Holding Ltd. to Meituan. (BBG)

METALS: Codelco, the world's biggest copper producer, posted a 5.8% increase in production for May compared with the same month last year, according to data released by Chilean government agency Cochilco. Codelco output of 152,500 tons was also up from April BHP's giant Escondida saw production slip from both last year and the previous month to 84,800 tons. Countrywide, Chile's copper production of 487,200 tons in May was up from April but below the year-ago result. In the year though May, Chilean production slipped 1.9%, with BHP's Cerro Colorado registering the largest fall with 23% while state-owned Codelco saw a 5.2% increase. (BBG)

OIL: Saudi Arabia and the United Arab Emirates cranked up the tension in their OPEC standoff as the rare diplomatic spat between long-time allies leaves the global economy guessing how much oil it will get next month. The bitter clash has forced OPEC+ to halt talks twice already, with the next meeting scheduled for Monday, putting markets in limbo as oil continues its inflationary surge above $75 a barrel. With the cartel discussing its production policy not only for the rest of the year, but also into 2022, the solution to the standoff will shape the market and industry into next year. The fight between the two key producers broke into public view on Sunday with both countries, which typically keep their grievances within the walls of the royal palaces, airing their differences on television. Riyadh insisted on its plan, backed by other OPEC+ members including Russia, that the group should increase production over the next few months, but also extend its broader agreement until the end of 2022 for the sake of stability. (BBG)

OIL: The United Arab Emirates has pushed back on OPEC+ leaders Saudi Arabia and Russia, claiming its "sovereign right" to negotiate fairer terms for an oil production increase. "For us, it wasn't a good deal," UAE Minister of Energy and Infrastructure Suhail Al Mazrouei told CNBC's Hadley Gamble, referring to OPEC+ production cuts which were based on a "level of production that goes back to 2018." "We knew that the UAE position in that agreement was the worst in terms of comparing our current capacity with the level of production" he said Sunday. "But an agreement is an agreement." Asked if the UAE would be willing to walk away, the minister said "we cannot extend the agreement or make a new agreement under the same conditions. We have the sovereign right to negotiate that." (CNBC)

OIL: Iranian Oil Minister Bijan Zanganeh said on Friday he told an OPEC+ meeting that Iran would return to the markets swiftly if U.S. sanctions are lifted, regardless of decisions made by the producer group. "At this meeting, we spoke about Iran's return to the market, and I said that any decision which is made does not affect our will, and that whenever the sanctions are lifted, we will return to the market in the shortest possible time," said Zanganeh, quoted by the Iranian Oil Ministry website SHANA. (RTRS)

OIL: Iraq backs a proposal by the Organization of the Petroleum Exporting Countries and its allies to extend a pact on output curbs until December 2022, Oil Minister Ihsan Abdul Jabbar said on Sunday, adding he expected oil prices to remain at $70 per barrel or above until then. Iraq also agrees with a proposal that the group known as OPEC+ should increase its output by 400,000 barrels per day from August, in line with the pact to gradually lift curbs imposed after the pandemic last year triggered a record price collapse. Speaking at a news briefing in Baghdad, he said Iraq's oil exports will be 2.9 million bpd in July, marking full compliance with the current OPEC agreement. The country exported crude at the same rate in June, official figures show. (RTRS)

OIL: The White House said on Friday it is concerned about the impact of rising oil prices on U.S. consumers but believes producers have ample ability to pump enough crude. "Currently we believe that there is enough spare oil production capacity globally," White House Press Secretary Jen Psaki told reporters. "Because of the restart of (the) global economy and resumption of normal consumer activity there is some impact on oil market conditions," she said. Psaki did not answer a question about whether anyone in the Biden administration had spoken with allies engaged in OPEC+ talks about whether to increase oil output. (RTRS)

CHINA

PBOC: The PBOC may keep total liquidity moderate and focus more on using structural tools to increase support for SMEs as well as green finance, the Shanghai Securities News reported citing analysts. The PBOC has proposed 12 measures to cut payment service fees by CNY24 billion a year, of which CNY16 billion will benefit SMEs, the newspaper said. The PBOC will also continue to smoothen out short-term factors destabilizing liquidity, the newspaper cited analyst Zhou Maohua with Everbright Bank. (MNI)

ECONOMY: China's strong momentum of trade may continue into Q3, and the annual trade growth is expected to reach about 10%, Yicai.com reported citing Huo Jianguo, vice chairman of China Society for World Trade Organization Studies. Though overseas production capacity is recovering in H2, Chinese export orders may not decline, the newspaper said citing Liang Ming, a researcher affiliated with the Ministry of Commerce. Foreign exporters may not be able to provide goods with competitive prices in the short term, and foreign countries' dependence on Chinese products has become the norm since the pandemic began, the newspaper said. (MNI)

FDI: Some experts in China believe that enacting a global minimum tax may reduce foreign investment into China and that Chinese companies, especially those in internet technology, may face new challenges in overseas operations, the Global Times said in a commentary after 130 countries last week backed plans for a global minimum corporate tax of at least 15%. For developing countries, the implementation of a unified global minimum tax may create difficulties for economies struggling in the post-pandemic era, the newspaper said. The final agreement should allocate more taxing rights to developing countries, it said. (MNI)

OVERNIGHT DATA

CHINA JUN CAIXIN SERVICES PMI 50.3; MEDIAN 54.9; MAY 55.1

CHINA JUN CAIXIN COMPOSITE PMI 50.6; MAY 53.8

The Caixin China General Services Business Activity Index came in at 50.3 in June, down from 55.1 the previous month. The June reading was the lowest since April 2020. The services sector expanded for the 14th month in a row in June, but the rate of expansion significantly slowed from the previous month. Both supply and demand in the services sector expanded. The gauges for business activity and total new orders remained in positive territory for the 14th consecutive month in June, but both fell to the lowest in 14 months. The recent resurgence of Covid-19 in the Pearl River Delta had a certain impact on the services sector. External demand marginally improved. The gauge of new export business rose into positive territory, though the rate of expansion was marginal. Employment in the services sector came under pressure. The resurgence of Covid-19, coupled with weakening supply and demand, hurt the labor market. The measure for employment fell into contractionary territory in June for the first time in four New Business Index Sources: Caixin, IHS Markit Employment Index Sources: Caixin, IHS Markit months, though the contraction was not sizable. Also, due to the weak market, service enterprises' outstanding workload decreased. Prices in the service sector were stable, as inflationary pressure eased. High commodity and labor prices continued to push up costs for services companies, but the growth of input prices slowed. The gauge for input prices remained in expansionary territory for the 12th month in June, but fell to the lowest point in nine months. And the gauge of prices charged by service enterprises fell into contractionary territory in June, the first time since July 2020. Market sentiment remained optimistic. Nonetheless, the measure for business expectations fell to the lowest in nine months in June. Some surveyed enterprises were still concerned about the epidemic situation at home and abroad in the near future. (Caixin)

JAPAN JUN, F JIBUN BANK SERVICES PMI 48.0; FLASH 47.2

JAPAN JUN, F JIBUN BANK COMPOSITE PMI 48.9; FLASH 47.8

Businesses in the Japanese service sector reported that activity remained subdued as the country continued to battle the latest wave of COVID-19 infections. The rate of decline eased to a more modest pace, however. Meanwhile, softer declines in both domestic and international sales signalled that demand conditions were beginning to shore up. Moreover, short-term uncertainty appears to be easing as the vaccination programme gathers pace. Firms continued to build capacity in anticipation of increasing demand, though the pace of job creation eased to a four-month low. Service providers also maintained strong optimism that business conditions would improve over the year ahead. Overall private sector activity decreased at the end of the second quarter, with the latest data signalling a broadly unchanged rate of decline. A slower contraction in services activity compared with softer growth of manufacturing production. Confidence about the outlook for private sector activity strengthened in June, despite headwinds from the COVID-19 pandemic. Firms were at their most optimistic since March 2013 amid anticipations that the pandemic would recede and trigger a broad-based recovery supported by stronger demand and the Olympics, which have since been confirmed to allow limited domestic spectators. As a result, IHS Markit estimates the Japanese economy will expand by 2.6% in 2021. (IHS Markit)

AUSTRALIA MAY, F RETAIL SALES +0.4% M/M;MEDIAN +0.1%; FLASH +0.1%

AUSTRALIA JUN, F MARKIT SERVICES PMI 56.8; FLASH 56.0

AUSTRALIA JUN, F MARKIT COMPOSITE PMI 56.7; FLASH 56.1

Business activity continued to increase at a strong rate in June according to the latest IHS Markit Australia Services PMI. While the extension of the Victoria lockdown into June affected some demand and output for the service sector, the overall level of optimism was not significantly diminished. Pressure points across prices and labour were however noticeable through the latest survey. The Prices Charged sub-index soared to a fresh survey high to signal record selling price inflation. This was attributed in part to wage inflation and anecdotal evidence pointed to difficulty in hiring by some firms. Overall service sector performance remained robust in June. This however comes ahead of the Sydney lockdown update, which is expected to affect the performance of the service sector into July. (IHS Markit)

AUSTRALIA JUN ANZ JOB ADVERTISEMENTS +3.0% M/M; MAY +6.8%

AUSTRALIA MAY BUILDING APPROVALS -7.1% M/M; MEDIAN -5.0%; APR -5.7%

AUSTRALIA MAY PRIVATE SECTOR HOUSES -10.3% M/M; APR +5.9%

AUSTRALIA JUN MELBOURNE INSTITUTE INFLATION +3.0% Y/Y; MAY +3.3%

AUSTRALIA JUN MELBOURNE INSTITUTE INFLATION +0.4% M/M; MAY -0.2%

NEW ZEALAND JUN ANZ COMMODITY PRICE INDEX +0.8% M/M; MAY +2.1%

SOUTH KOREA JUN FOREIGN RESERVES $454.11BN; MAY $456.46BN

CHINA MARKETS

PBOC NET DRAINS CNY20BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation resulted in a net drain of CNY20 billion given the maturity of CNY30 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.* The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1727% at 09:24 am local time from the close of 1.8895% on Friday.* The CFETS-NEX money-market sentiment index closed at 41 on Friday vs 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4695 MON VS 6.4712

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4695 on Monday, compared with the 6.4712 set on Friday.

MARKETS

SNAPSHOT: ECB Members Debate Housing's Impact On Inflation

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 159.54 points at 28625.04

- ASX 200 up 8.344 points at 7317.4

- Shanghai Comp. up 5.535 points at 3524.295

- JGB 10-Yr future up 12 ticks at 152.04, yield down 0.4bp at 0.041%

- Aussie 10-Yr future up 4.5 ticks at 98.560, yield down 4.7bp at 1.429%

- U.S. 10-Yr future +0-02+ at 132-24, cash Tsys are closed

- WTI crude down $0.10 at $75.06, Gold up $0.48 at $1787.72

- USD/JPY up 8 pips at Y111.13

- FED'S DALY: APPROPRIATE TO CONSIDER TAPERING LATER THIS YEAR (RTRS)

- ECB'S SCHNABEL: TEMPORARY INFLATION OVERSHOOT NECESSARY (BBG)

- ECB'S KNOT WARNS CENTRAL BANK COULD BE UNDERESTIMATING INFLATION (BBG)

- XI, TOP EUROPEAN LEADERS SAID TO PLAN CALL AS TENSIONS FLARE (BBG)

- GERMANY'S ALTMAIER SPURNS FRENCH PUSH FOR PERMANENT EU DEBT (BBG)

- OPEC+ CRISIS DEEPENS AS SAUDI ARABIA REFUSES TO BUDGE (BBG)

BOND SUMMARY: Volume Hampered By Independence Day Holiday

T-Notes stuck to a 0-03 range overnight, with the contract last +0-02+ at 132-24 operating on volume of ~30K lots, with cash markets set to remain closed on Monday owing to the observance of the U.S. Independence Day holiday. The space has looked through the much softer than expected Chinese Caixin Services PMI print, which slowed to a near-neutral 50.3. The text of the release noted that "the recent resurgence of Covid-19 in the Pearl River Delta had a certain impact on the services sector." A positive, albeit negative factor on the headline reading, was that "the gauge for input prices remained in expansionary territory for the 12th month in June, but fell to the lowest point in 9 months."

- JGB futures gave back a portion of their overnight gains during Tokyo dealing, hitting the bell 12 ticks above settlement levels. Cash JGBs saw the major benchmarks out to 20s trade little changed to ~1.0bp richer, while longer dated paper (30s & 40s) saw very modest cheapening (around 0.5bp worth) ahead of tomorrow's 30-Year JGB supply. There has been a lack of meaningful news flow evident since the Tokyo open, with BoJ Governor Kuroda offering little new in his latest address.

- Aussie bond futures continue to hover around overnight closing levels with a lack of notable catalysts evident early this week, while the proximity to tomorrow's RBA decision will be limiting broader market activity/conviction. As a reminder, the local COVID picture in Sydney seemingly improved over the weekend, although today's figures represented a step back from the positive development. YM +1.5, XM +5.0 at typing. Cash ACGBs have bull flattened, playing catch up to the overnight session moves in futures.

EQUITIES: China & Japan Slip Despite Broadly Positive Risk Tone

A mixed day for equity markets in the Asia-Pac region with volumes thinned by the US holiday. Markets in Japan are lower, data showed services PMI rose to 48.0 in Jun, composite PMI printed 48.9 while over the weekend the Chairman of the LDP's Election Strategy Committee Yamaguchi conceded that Japan's ruling coalition failed to secure an outright majority in the Tokyo Metropolitan Assembly. Markets in China are slightly lower, China June Caixin services PMI printed 50.3 in June from 55.1 in May, the figure denotes the lowest since April 2020. Other markets in the region are higher, boosted by Friday's US jobs report which saw US equities hit record highs for the seventh day in a row.

OIL: OPEC+ Remains At An Impasse

Oil has traded heavy in the Asia-Pac session on Monday; WTI is down $0.09 from settlement levels at $75.07/bbl, Brent is down $0.09 at $76.08/bbl. Markets look ahead to the next round of talks between OPEC+ members with the group at an impasse. Saudi Arabia and the UAE remain at odds over output with both sides taking to the airwaves over the weekend to air grievances. Saudi Arabia claims there is support within the group for extending the declaration of cooperation beyond April 2022 and increasing output, and that the UAE is alone in its dissent. The UAE is firm in its commitment to only a short-term increase and better terms for itself beyond 2022. The group is scheduled to meet again at 1400BST today.

GOLD: $1,800/oz Remains Untouched

Gold has hugged a tight range during Monday's Asia-Pac session, last dealing little changed around $1,785/oz, with activity hampered by the U.S. market holiday. The softer U.S real yield-weaker USD environment that prevailed in the wake of Friday's NFP print pushed bullion higher during the final session of last week, although spot failed to break above $1,800/oz, with key resistance levels untested. The minutes from the FOMC's June meeting (due for release on Wednesday) represent the next notable macro release for gold market participants.

FOREX: GBP Gains On Looming End To UK Covid Rules, NOK & CAD Slip On Weaker Oil

The DXY crept higher as a new week got underway, with U.S. markets closed in observance of the Independence Day. China drew attention in Asia-Pac hours, as its Caixin Services PMI undershot forecasts, while Beijing broadened its cybersecurity probe into tech companies. Elsewhere, BBG sources said that China's Xi will hold talks with Germany's Merkel & France's Macron this week.

- USD/CNH ground lower after the PBOC set its central USD/CNY mid-point at CNY6.4695, 7 pips shy of sell-side estimate. The yuan looked through a considerable miss in Caixin Services PMI, which deteriorated to a near-neutral 50.3 in Jun from 55.1 recorded in May, while also shrugging off Beijing's actions vs. tech firms.

- GBP caught a bid and topped the G10 pile as PM Johnson looked set to confirm that the gov't will lift most of the remaining Covid-19 rules in two weeks and shift emphasis to personal responsibility.

- NOK & CAD underperformed amid a downtick in crude oil prices, as Saudi Arabia & the UAE signalled that their disagreement on output remains unresolved ahead of today's OPEC+ summit.

- Focus turns to a number of services PMI readings as well as comments from ECB Vice Pres de Guindos.

FOREX OPTIONS: Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E1.9bln), $1.1900(E780mln)

- USD/JPY: Y110.25-28($600mln), Y111.00($829mln)

- AUD/USD: $0.7500-05(A$605mln)

- NZD/USD: $0.7025-45(N$506mln)

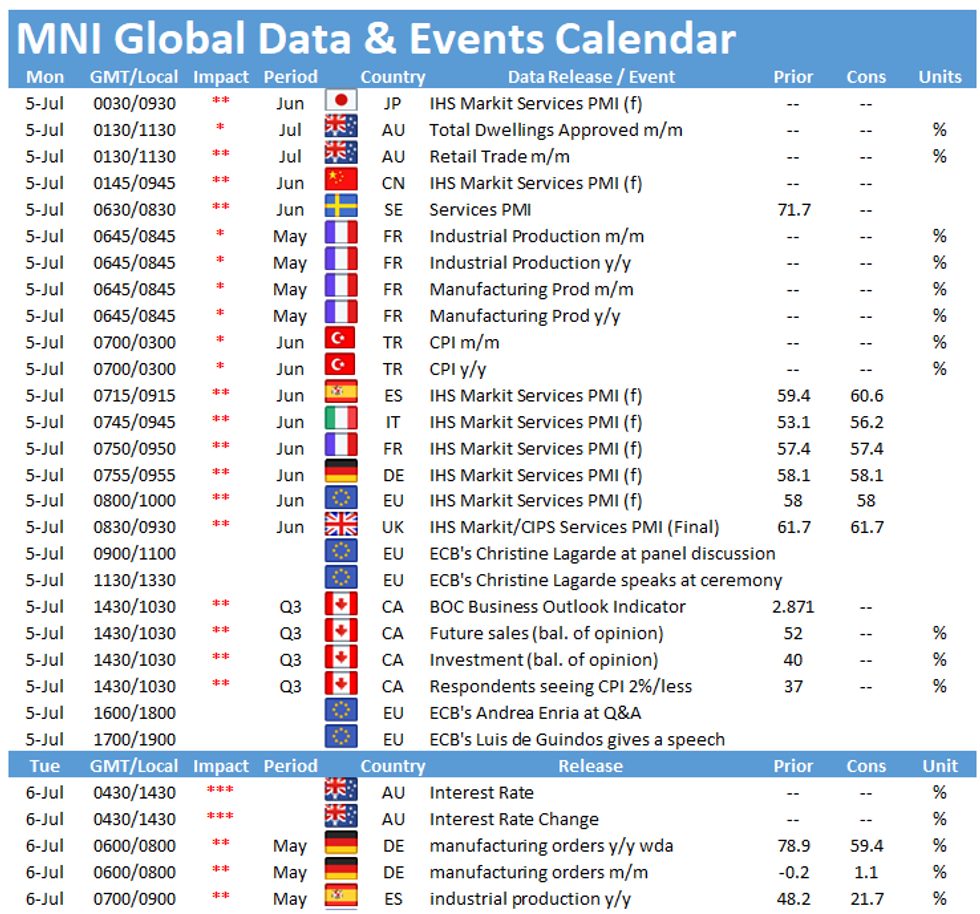

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.