-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A More Limited Asia-Pac Session After Tuesday's Vol

EXECUTIVE SUMMARY

- CHINA TARGETS CORRUPTION IN SCRUTINY OF SECURITY ISSUANCE SECTOR (BBG)

- JAPAN EXPECTED TO DELIVER AT LEAST $180 BILLION IN NEW STIMULUS (BBG SURVEY)

- DEBELLE AND HARPER REAPPOINTED AT THE RBA

- CHINESE STATE MEDIA CONTINUES TO HIGHLIGHT THE LIKELIHOOD OF TWO-WAY FLUCTUATIONS IN THE YUAN

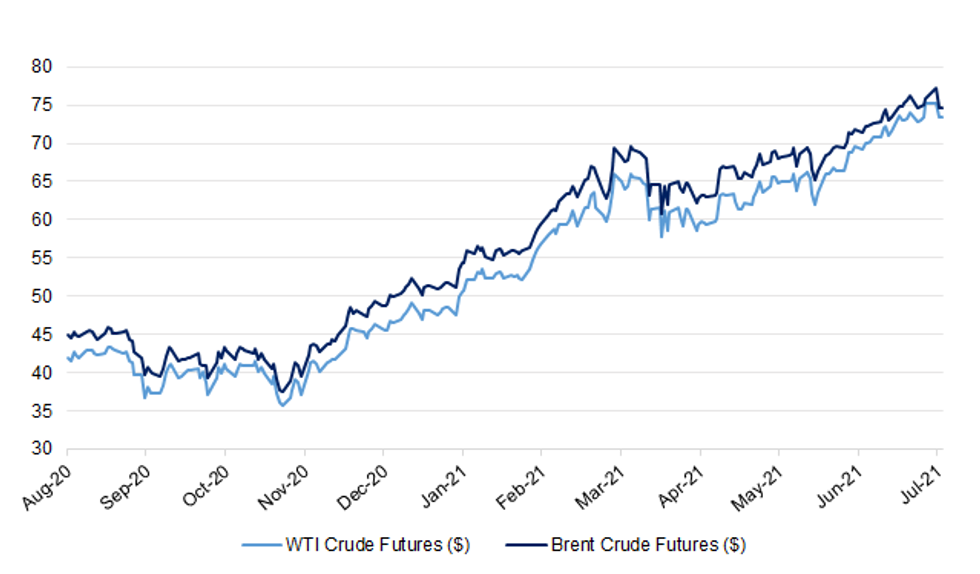

Fig. 1: WTI & Brent Crude Futures ($)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain is unlikely to be free from further waves of the coronavirus before next spring, Chris Whitty said yesterday. He added that returning to normality was likely to take "quite a long time". In a gloomier assessment of the situation than he gave alongside Boris Johnson last Thursday, England's chief medical officer told a conference of local government officials that it was likely to be a "difficult" winter. (The Times)

CORONAVIRUS: So-called long Covid is set to soar among younger people in England when remaining coronavirus restrictions are lifted, England's chief medical officer warned. "Since there's a lot of Covid at the moment and the rates are going up, I regret to say I think we will get a significant amount more long Covid -- particularly in the younger ages where the vaccination rates are currently much lower," Chris Witty said at the Local Government Association's virtual conference Tuesday. Long Covid occurs when a wide range of health problems keep happening weeks or months after patients seemingly recover from even a mild case. (BBG)

CORONAVIRUS: Two million people could contract Covid this summer, potentially meaning up to 10 million must isolate in just six weeks, Guardian analysis shows, prompting warnings over risks to POLITICS: health and disruption to the economy. The figures come as Sajid Javid, the health secretary, said England was entering "uncharted territory" in its wholesale scrapping of lockdown rules from 19 July. New infections could easily rise above 100,000 a day over the summer, he said, more than at any point in the pandemic. (Guardian)

CORONAVIRUS: Fully vaccinated travellers arriving from countries on the amber list are set to avoid quarantine from as early as July 19 as airlines prepare to check vaccine status on flights into Britain for the first time. Ministers will meet tomorrow to sign off a policy that will allow people to travel from amber destinations without isolating for up to ten days. Boris Johnson is believed to favour introducing the system from July 19 to coincide with the lifting of other lockdown restrictions in England. Significant concerns remain over the logistical challenge of the move, though, including the prospect of long queues at the border caused by extra passengers and additional checks. (The Times)

BREXIT: The UK has been told to fulfil its commitments on the Northern Ireland Protocol or risk facing daily fines in the European Court of Justice. (Telegraph)

POLITICS: A battle for one of the most powerful posts in the Conservative Party is reaching its climax amid claims that Boris Johnson is plotting to install a loyalist and oust an outspoken critic. Tory grandee Sir Graham Brady, chairman of the powerful 1922 Committee of Conservative backbenchers since 2010, is facing a challenge from a former junior minister, Heather Wheeler. MPs have told Sky News the prime minister wants to remove Sir Graham because of his public criticism of coronavirus lockdowns in TV and radio interviews and newspaper articles and his frequent rebellions in House of Commons votes. (Sky)

EUROPE

FISCAL: Brussels expects to raise nearly €10bn a year from a carbon tax on imports as part of its effort to tackle global warming and will use the money to repay hundreds of billions in EU joint recovery debt. Details of the EU's upcoming Carbon Border Adjustment Mechanism (CBAM) laid out in a legal text, seen by the Financial Times, reveals how the system will work. The so-called carbon border tax forms the cornerstone of Brussels' attempt to protect European industry from foreign competitors that are not subject to the bloc's stringent climate targets. (FT)

ITALY/BTPS: Italy plans to sell 7.5 billion euros ($8.9 billion) of bills due Jul 14, 2022 in an auction on Jul 9. (BBG)

GREECE: Greece plans to re-tighten pandemic measures on bars and clubs after 1,797 new cases were recorded Tuesday, the highest daily increase since June 1. The spike in cases was associated with younger adults attending large night-time entertainment venues, Deputy Citizen Protection Minister Nikos Hardalias said on Tuesday. From July 8, such venues will revert to seated spaces only with capacity limitations, according to Hardalias. (BBG)

U.S.

ECONOMY: MNI INTERVIEW: US Service Sector Hiring In First 2021 Dip - ISM

- Service-sector hiring stumbled through June, falling for the first time in six months as employers struggled to fill open positions and former service workers found employment is less risky industries, ISM survey chair Anthony Nieves told MNI Tuesday. Difficulties in hiring is "absolutely" weighing on the service sector's ability to recover fully from Covid-19 shutdowns, Nieves said, and even though businesses like restaurants are able to open at full capacity in many areas for the first time since last March, a shortage of available workers is inhibiting their ability to do so - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Brooklyn Borough President Eric Adams, a former police captain, won New York City's Democratic mayoral primary, according to The Associated Press. Adams is poised to become New York's second Black mayor if he is elected in November's general election over the Republican nominee, radio host Curtis Sliwa, because winning the primary in the heavily Democratic city is tantamount to winning the election. (CNN)

OTHER

GLOBAL TRADE: The US is piling pressure on the EU to shelve its plans for a levy on digital companies, arguing it could clash with Brussels' pledge to avoid new punitive corporate taxes while negotiations on a landmark global tax deal are being finalised. The principles of the deal were set out in an agreement by 130 countries at the OECD in Paris last week, after winning approval from the G7 group of leading nations last month. Senior US and EU officials will this week hold talks ahead of a meeting of G20 finance ministers in Venice on Friday; the fate of the 27-member bloc's proposed digital levy is expected to feature heavily in the discussions. Janet Yellen, US Treasury secretary, will then meet members of the eurogroup of her opposite numbers in Brussels early next week. (FT)

GLOBAL TRADE: Huawei's chip design arm has struck a deal aimed at building up its domestic supply chain, a local partner said on Tuesday, in a first public move against a U.S. clampdown aimed at cutting its access to vital technology. (Nikkei)

GLOBAL TRADE: Premier Li Keqiang's video conference with UK business leaders on Tuesday, the first formal bilateral business communication this year, will help the UK expand ties with China to cushion its withdrawal from the EU and elevate the UK's global influence, the state-run Global Times said. While Britain will follow the U.S. to make things difficult for China, relations between China and the UK could become more "balanced and mature," as the Boris Johnson government will balance between political dependency on Washington and economic relations with Beijing, and may seek to lift relations with China, the newspaper said. Premier Li urged the UK to provide a fair business environment for Chinese firms investing in the UK, at a time when Chinese semiconductor company Nexperia awaits the UK's approval for its acquisition of UK's largest chip maker Newport Wafer Fab (NWF) the Times reported. (MNI)

U.S./CHINA: The United States on Tuesday urged China and the private sector to increase their participation in a G20 debt moratorium for low-income countries hammered by the COVID-19 pandemic, and a common framework for restructuring their debts. (RTRS)

GEOPOLITICS: President Joe Biden said on Tuesday the ransomware attack centered on the Florida information technology firm Kaseya seems to have inflicted only "minimal damage" on American businesses. On Wednesday, Biden will meet with officials from the Justice Department, State Department, the Department of Homeland Security and the intelligence community to discuss ransomware and U.S. efforts to counter it, Psaki said. (RTRS)

JAPAN: Japanese Prime Minister Yoshihide Suga is likely to unveil another economic stimulus package worth at least $180 billion within the next few months, according to a Bloomberg survey. All but one of 18 surveyed economists said the announcement would come before national elections that must be held by early fall. The median forecast was for a package of between 20 trillion yen and 30 trillion yen. (BBG)

JAPAN: The Osaka prefectural government decided Wednesday to ask the Japanese government to maintain business restrictions under a COVID-19 quasi-state of emergency beyond its scheduled end on Sunday. The move comes amid concerns the Tokyo Olympics from July 23 could trigger another surge in infections. Prime Minister Yoshihide Suga is expected to finalize a decision on whether to extend the quasi-state of emergency currently covering Tokyo, Osaka and eight other prefectures at a task force meeting on Thursday. (Kyodo News)

JAPAN: Japan mulls tighter alcohol restrictions in Tokyo area. (Nikkei) JAPAN: Shigeru Omi, the head of the Japanese government's coronavirus advisory panel, said it was desirable to hold the Olympic games without spectators, making a fresh call to ban fans, Kyodo reports. He also said it was important the attendance of Olympic officials, such as IOC members, should be downsized to the minimum possible. (BBG)

AUSTRALIA: A two-week lockdown of Sydney will be extended for at least another seven days as authorities race to stamp out an outbreak of the delta variant that's grown to more than 350 cases since mid-June and has spread to anaged-care facility. Current stay-at-home orders -- except for exercise, essential shopping and medical care -- will remain in place in Greater Sydney until midnight on July 16, New South Wales state Premier Gladys Berejiklian told reporters Wednesday. The lockdown was originally scheduled to end on Friday. Sydney recorded 27 new cases in the community from the day before, with 13 of those in isolation during their infectious period. (BBG)

RBA: Australia's government reappointed Reserve Bank No. 2 Guy Debelle for another five-year term, setting him up to succeed Governor Philip Lowe when he eventually retires from the top role. (BBG)

NEW ZEALAND: New Zealand's medicines regulator has granted provisional approval of the Janssen Covid-19 vaccine for individuals 18 years of age and older. "As a single dose vaccine, it may be useful in hard to reach locations or emergencies, or for those who cannot get the Pfizer vaccine," Covid Response Minister Chris Hipkins said. (BBG)

SOUTH KOREA: New Zealand's medicines regulator has granted provisional approval of the Janssen Covid-19 vaccine for individuals 18 years of age and older. "As a single dose vaccine, it may be useful in hard to reach locations or emergencies, or for those who cannot get the Pfizer vaccine," Covid Response Minister Chris Hipkins said. (BBG)

CANADA: U.S. Trade Representative Katherine Tai on Tuesday told her Canadian counterpart to drop a proposed digital services tax in light of an OECD agreement that commits 131 countries to eliminate such taxes, Tai's office said on Tuesday. (RTRS)

CANADA: MNI INTERVIEW: Canada May Largely Close Covid Job Gap by Aug

- Elevated job postings amid a quickening vaccine rollout suggest solid gains for Canada's June and July employment reports, crucial milestones of the labor market recovery for policy makers, Brendon Bernard, senior economist at Indeed Hiring Lab and a former federal finance department researcher, told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico opened registrations for Covid-19 vaccines to the entire population over 18, an attempt to fulfill the government's promise that all adults would have at least one dose by October. Currently, 37% of the adult population has a shot, according to government statistics, but a rise in the number of Covid cases in recent weeks has led the country to speed up vaccine distribution. (BBG)

BRAZIL: Brazil's government proposal to tax dividends faces pushback which could lead to a rate between 15% and 20%, said a person with knowledge of the matter who asked for anonymity because the discussions aren't public. Economy Ministry, however, will insist on a 20% dividend tax, said the person. (BBG)

BRAZIL: Brazil's lower house of Congress on Tuesday approved the main text of a bill that will allow patents for the production of vaccines and medicines to be broken in cases of a public health emergency or national state of emergency. The bill authorizes Congress to pass a law to break patents without the Executive's approval or support. (RTRS)

BRAZIL: Brazil President Jair Bolsonaro will appoint Andre Mendonca, the current attorney general and a conservative ally, to the Supreme Court, two sources familiar with the matter told Reuters on Tuesday. (RTRS)

RUSSIA: Russia completed its plan to eliminate dollar holdings in its wealth fund as part of efforts to reduce vulnerability to U.S. sanctions. The National Wellbeing Fund boosted the share of euros in its holdings to almost 40%, and the share of yuan to 30% as of July 5, the Finance Ministry said in a statement. It also cut the share of British pounds to 5% and raised the amount in gold to 20%. The transfer took place within the central bank's huge reserves, limiting any market impact. The central bank said last month it wouldn't be adding to its overall gold holdings despite the shift. Tuesday's announcement means the fund has sold $41.5 billion since Finance Minister Anton Siluanov made the announcement last month. (BBG)

RUSSIA: Russian government hackers breached the computer systems of the Republican National Committee last week, around the time a Russia-linked criminal group unleashed a massive ransomware attack, according to two people familiar with the matter. The government hackers were part of a group known as APT 29 or Cozy Bear, according to the people. That group has been tied to Russia's foreign intelligence service and has previously been accused of breaching the Democratic National Committee in 2016 and of carrying out a supply-chain cyberattack involving SolarWinds Corp., which infiltrated nine U.S. government agencies and was disclosed in December. (BBG)

IRAN: Iran has begun the process ofproducing enriched uranium metal, the U.N. atomic watchdog said on Tuesday, a move that could help it develop a nuclear weapon and that three European powers said threatened talks to revive the 2015 Iran nuclear deal. (RTRS)

MIDDLE EAST: The U.S. military has withdrawn more than 90% of its troops and equipment from Afghanistan, the Pentagon announced Tuesday. The update comes about two months ahead of the deadline President Joe Biden had set earlier this year. The United States has been at war in Afghanistan for nearly 20 years. The U.S. military has flown the equivalent of approximately 980 loads of material out of the country by large cargo aircraft, according to an update from U.S. Central Command. (CNBC)

MIDDLE EAST: The Pentagon said on Tuesday that it was aware of reports about a drone attack in Erbil, Iraq, but initial information did not indicate structural damage, injuries or casualties. Pentagon spokesperson Commander Jessica McNulty did not provide more details. (RTRS)

OIL: Biden administration officials are "encouraged" by ongoing OPEC talks and have spoken with officials in Saudi Arabia and the United Arab Emirates in hopes of reaching an agreement to stem the rise in crude prices, White House Press Secretary Jen Psaki said. "We're not a party to these talks but over the weekend and into this week, we've had a number of high-level conversations with officials in Saudi Arabia, the UAE and other relevant partners," Psaki said Tuesday during a briefing at the White House. She declined to specify which U.S. officials were involved but signaled that she didn't expect President Joe Biden to personally make calls. The U.S. hopes talks will lead to an agreement that "will promote access to affordable and reliable energy," she said. The impact of talks on gas prices in the U.S. is of interest to the administration, she said. (BBG)

CHINA

YUAN: The yuan is likely to maintain a two-way fluctuation and market participants should not bet on a continued one-way decline, the Economic Daily said in a commentary. China will likely maintain its support policies, including an appropriate monetary environment, as its economic recovery is unbalanced, the global pandemic outlook remains uncertain and the domestic inflation is moderate and controllable, the newspaper said. Yuan assets, including stocks and bonds, continue to attract foreign holdings with large growth potential, the newspaper said. The dollar's appreciation may also be constrained, helping keep China-U.S. rate spread stable, as the Federal Reserve will slow its policy normalization to prevent bursting asset bubbles, the daily said. (MNI)

PBOC: China will focus on establishing a modern central bank, improve the financial supervision system and deepen the reform of financial institutions in the next step, the 21st Century Business Herald reported citing a statement by the Financial Stability and Development Committee. A modern central bank system pays more attention to the use of cost-sensitive regulations, price stability, communication with the public as well as keeping monetary policy independent, the newspaper said. Improving base currency injection mechanism and market-based interest rates are two main themes in building up a modern central bank, the newspaper cited Zhang Chengsi, professor of Renmin University. (MNI)

PBOC: MNI BRIEF: PBOC Should Cut Rates Moderately In H2: Former Official

- China's monetary policy should remain stable with a tilt to looser in the second half of the year, moderately cutting interest rates, so to take precautions against a possible economic slowdown and U.S. rate hikes, wrote Sheng Songcheng, a former director of the People's Bank of China's statistics department in a blog post - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EQUITIES: China's anti-graft bodies are looking into corruption linked to financial risk events and are conducting special inspections on CSRC's securities issuance and registration operations, according to a statement from the Central Commission for Discipline Inspection. The anti-graft authorities call for stepping up financial oversight and corporate internal governance to prevent major financial risks. (BBG)

OVERNIGHT DATA

JAPAN MAY, P LEADING INDEX 102.6; MEDIAN 102.7; APR 103.8

JAPAN MAY, P COINCIDENT INDEX 92.7; MEDIAN 92.7; APR 95.3

SOUTH KOREA MAY BOP CURRENT ACCOUNT BALANCE +$10.7612BN; APR +$1.9099BN

SOUTH KOREA MAY BOP GOODS BALANCE +$6.3674BN; APR +$4.5593BN

CHINA MARKETS

PBOC NET DRAINS CNY90BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation resulted in a net drain of CNY90 billion given the maturity of CNY30 billion reverse repos and CNY70 billion of treasury cash deposits at commercial banks today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:30 am local time from the close of 2.0263% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday vs 44 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4762 WEDS VS 6.4613

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4762 on Wednesday, compared with the 6.4613 set on Tuesday.

MARKETS

SNAPSHOT: A More Limited Asia-Pac Session After Tuesday's Vol

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 354.42 points at 28286.35

- ASX 200 up 49.225 points at 7311

- Shanghai Comp. up 15.392 points at 3545.651

- JGB 10-Yr future up 23 ticks at 152.24, yield down 1.4bp at 0.030%

- Aussie 10-Yr future up 9.5 ticks at 98.62, yield down 9.3bp at 1.377%

- U.S. 10-Yr future +0-02 at 133-09, yield up 0.84bp at 1.357%

- WTI crude up $0.08 at $73.45, Gold up $1.26 at $1798.29

- USD/JPY down 11 pips at Y110.52

- CHINA TARGETS CORRUPTION IN SCRUTINY OF SECURITY ISSUANCE SECTOR (BBG)

- JAPAN EXPECTED TO DELIVER AT LEAST $180 BILLION IN NEW STIMULUS (BBG SURVEY)

- DEBELLE AND HARPER REAPPOINTED AT THE RBA

- CHINESE STATE MEDIA CONTINUES TO HIGHLIGHT THE LIKELIHOOD OF TWO-WAY FLUCTUATIONS IN THE YUAN

BOND SUMMARY: U.S. Tsys Fail To Extend Recent Bid, JGBs & ACGBs Firm A Touch

Asia-Pac investors didn't seem particularly keen to drive a fresh bid in the U.S. Tsy space, which is understandable given the lack of fresh macro catalysts evident since the NY close, alongside the multi-month lows registered in both 10- & 30-Year Tsy yields on Tuesday. This has resulted in some modest cheapening in the space, with T-Notes +0-01+ at 133-08+ as a result, while cash Tsys run little 0.5-1.5bp cheaper, with the 5- to 7-Year zone leading the way. Flow was dominated by a TYU1 block, which saw 2,175 lots lifted (~$176K DV01 equivalent).

- JGB futures added to their overnight gains during Tokyo trade, with the contract +23 vs. settlement levels at typing. Cash trade saw 7s lead the rally, richening by a little over 2.0bp, indicating that the move may have been futures driven, with the wings of the curve a mere 0.5-1.0bp richer. 30- & 40-Year swap rates dipped a little more than their cash JGB equivalents, narrowing longer dated swap spreads. The offer to cover ratios witnessed at the latest round of BoJ Rinban operations were as follows: 1- to 3-Year: 3.05x (prev. 3.43x), 5- to 10-Year: 3.25x (prev. 2.25x). Note that the 5- to 10-Year operations saw a Y25bn reduction in the purchase size, as prescribed in the Bank's quarterly Rinban plan.

- YM +5.0, XM +9.5 at typing, as Sydney participants built on the overnight bid. A quick look at the open interest data points to fresh shorts driving the YM weakness during Tuesday's session, with that move lower now unwound. The weighted average yield pricing through prevailing mids wasn't particularly strong at today's A$1.0bn round of ACGB Jun '31 supply (0.13bp, per Yieldbroker), with the richening to recent lows in outright yield terms and resultant move in the 3-/10-Year yield spread to multi-month flats likely resulting in a less aggressive bidding stance. Still the cover ratio nudged higher vs. the prev. auction of the line, comfortably topping 3.50x. Local news flow was dominated by the 1-week extension of the Sydney lockdown, although this was widely expected.

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y905bn of JGBs from the market, with the adjustments to purchase sizes already reflected in the BoJ's Rinban plan for Jul-Sep:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity (prev. Y450bn)

- Y30bn worth of floating rate JGBs

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.50% 21 Jun '31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:- Average Yield: 1.3320% (prev. 1.7156%)

- High Yield: 1.3350% (prev.1.7175%)

- Bid/Cover: 3.6700x (prev. 2.8292x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 50.0% (prev. 28.3%)

- bidders 43 (prev. 36), successful 23 (prev. 15), allocated in full 14 (prev. 9)

EQUITIES: Mixed In Asia

The major Asia-Pac equity indices are mixed after a marginally negative lead from Wall St. The Nikkei 225 is underperforming its major peers, shedding around 1.00%, with the uptick in the JPY since Tuesday's Tokyo close and continued speculation/comments surrounding the prospect of 0 fans being allowed to watch the Tokyo Olympics in person hampering sentiment in Japan. Tuesday's late momentum for the CSI 300 has spilled over into Wednesday's session, with the index adding ~1.0% as of typing, despite the clampdown from authorities surrounding some Chinese companies that have U.S. listings. Elsewhere, policymakers have signalled a clampdown on the broader securities sector to try and weed out fraudulent/unscrupulous activity, which could be a negative for some names in the short-term, but brings the prospect of a better regulated market over the medium term. The major U.S. e-minis trade around neutral levels, with some marginal outperformance for the NASDAQ 100.

OIL: Stable After Pullback From Cycle Highs

The recovery and subsequent rally in the broader USD, coupled with a softer than expected U.S. ISM services survey and downtick in equity markets saw oil pull away from cycle highs on Tuesday, before a degree of stability kicked in during Asia-Pac trade, with both WTI & Brent hovering around settlement levels at present. The continued OPEC+ impasse (centring on the Saudi-UAE discord) still garners the bulk of the attention in the space, although most of the sell-side expect a deal to be struck at some point (in typical OPEC+ fashion). A reminder that the latest round of weekly API inventory estimates will hit after hours on Wednesday (one day later than usual owing to the elongated U.S. weekend). The backwardation in both the WTI & Brent futures curves continues to indicate tight markets from a supply perspective.

GOLD: Back From Tuesday's Peak

The reversal from lows and subsequent rally for the broader USD outweighed the move lower in U.S. real yields on Tuesday, with gold pulling back from its ~$1,815/oz peak before settling around $1,800/oz during Asia-Pac hours. Technically, the 50-day EMA provides the initial resistance point, while initial support is seen at the July 2 low ($1,774.4/oz).

FOREX: Broader Caution Remains, NZD Draws Further Support From OCR Hike Bets

The yen garnered some more strength, building on its Tuesday gains, as a degree of risk aversion lingered on. USD/JPY slipped into the Tokyo fix but trimmed losses after a failure to stage a convincing break under Jun 30 low of Y110.42. Looking ahead, there is $1.1bn worth of USD/JPY options with strikes at Y111.00 rolling off today, with a further $1.1bn of USD calls with strikes at Y111.50 also due to expire at the NY cut.

- High-betas underperformed in risk-off trade, as crude oil remained heavy. AUD/JPY extended losses to a two-week low. In Australia, NSW Premier Berejiklian confirmed that Sydney's lockdown will be extended by at least one week.

- NZD bucked the trend and blipped higher in early Asia-Pac hours, as Westpac brought forward their forecast of the first OCR hike to November this year from August 2022.

- ANZ quickly followed suit, which means the whole Big Four now expects the RBNZ to raise the OCR this autumn. The implied odds of a hike by the November meeting ticked higher (per BBG WIRP tool) after yesterday's sizeable post-QSBO jump.

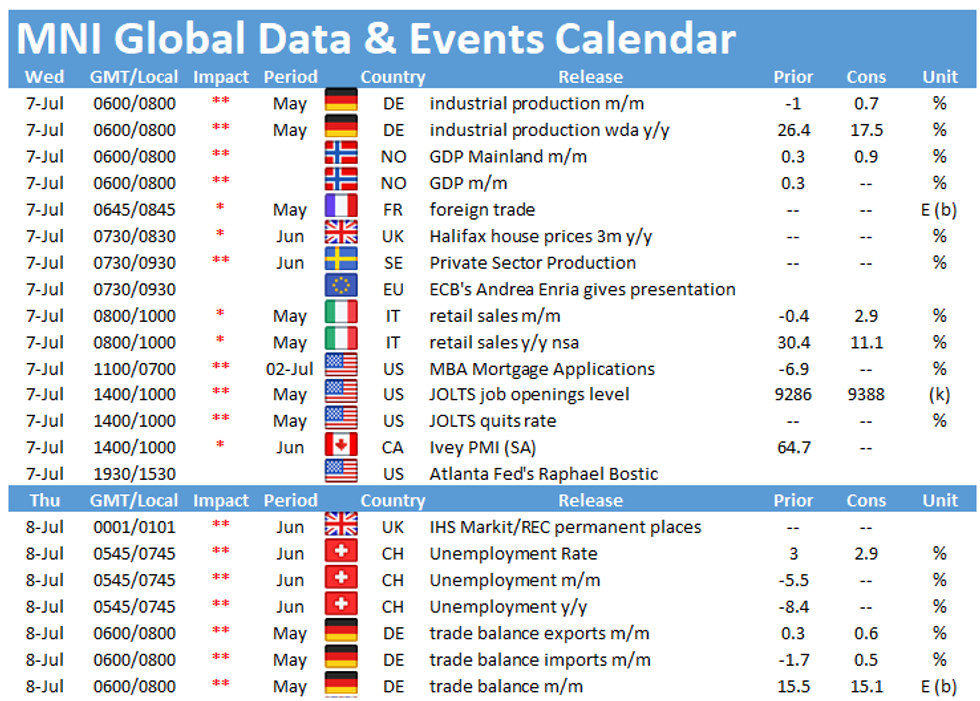

- FOMC Jun MonPol meeting minutes, German & Norwegian industrial output data, Italian retail sales as well as comments from Fed's Bostic & Riksbank's Ohlsson are on the radar today.

FOREX OPTIONS: Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850-70(E822mln), $1.1917-24(E1.5bln), $1.1935-50(E1.1bln)

- USD/JPY: Y109.00($1.1bln), Y109.50-57($738mln), Y111.00($1.1bln), Y111.50($1.1bln-USD calls)

- AUD/USD: $0.7575-80(A$552mln)

- NZD/USD: $0.7140(N$1.1bln-NZD calls), $0.7170-85(N$1.1bln-NZD calls)

- USD/CAD: C$1.2560-70($785mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.