-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: NZD Leads The Pack On Hawkish RBNZ

- RBNZ to halt LSAP scheme next week, with altered path of least regrets tone leading to markets pricing in an August OCR hike.

- NZD the clear outperformer amongst G10 FX as a result.

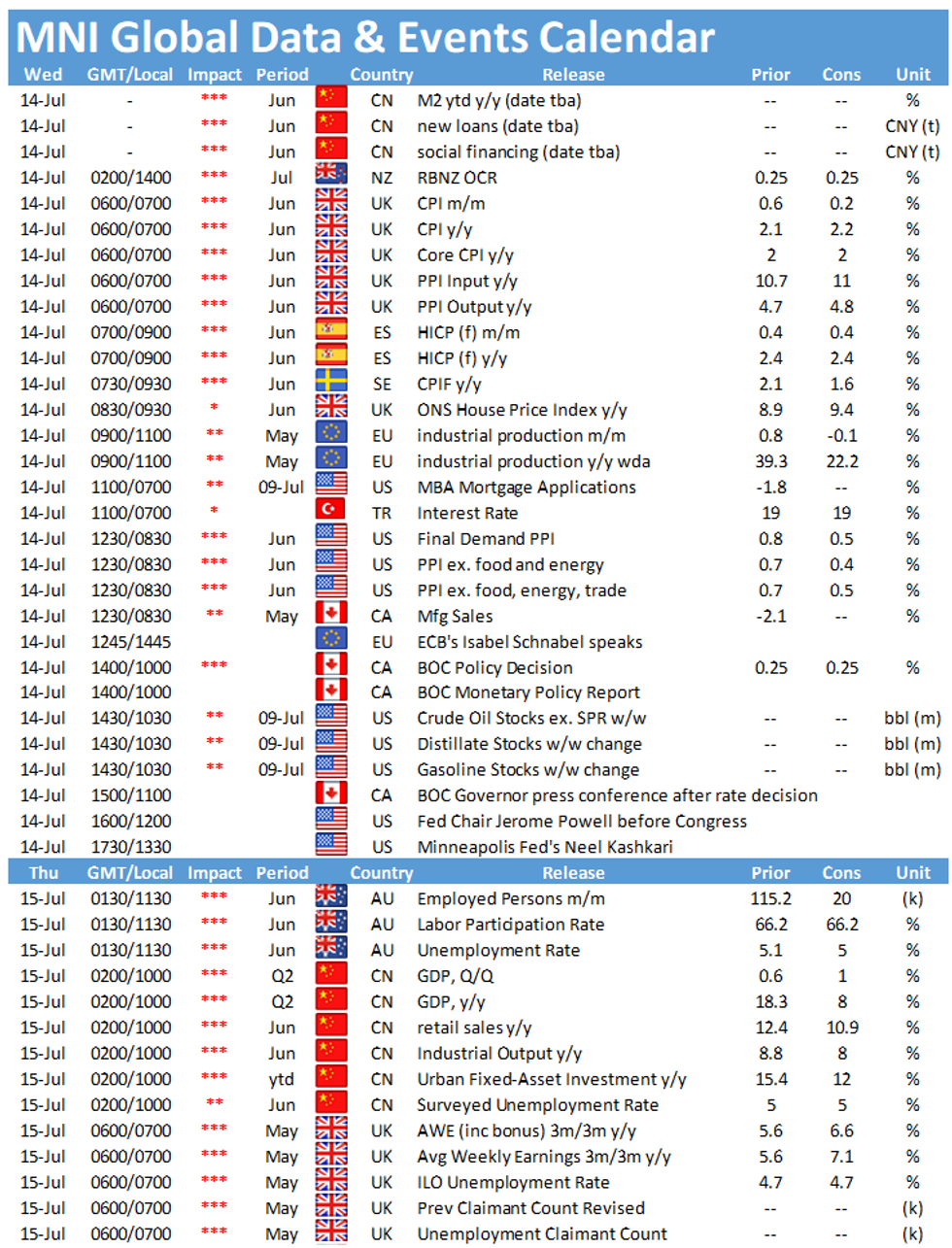

- Fed Chair Powell's testimony on the Hill headlines on Wednesday. We will also get the latest interest rate decisions from the BoC, CBRT & Central Bank of Chile.

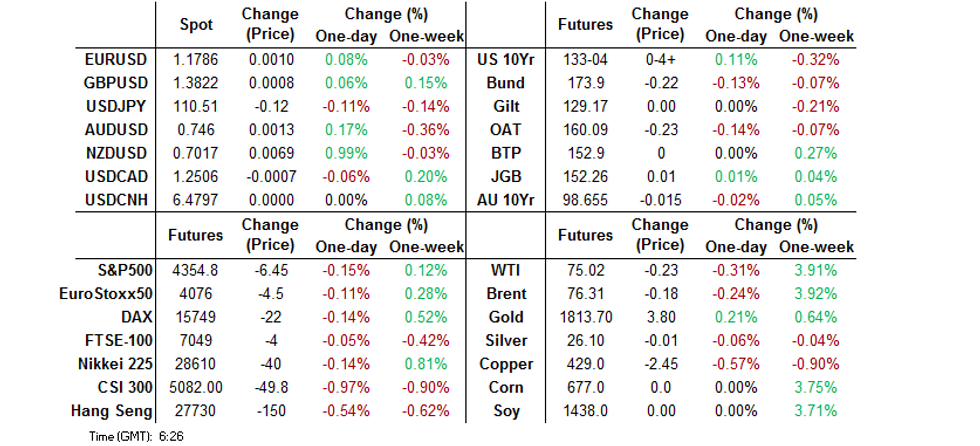

BOND SUMMARY: U.S. Tsys Off Lows, JGBs Unwind Overnight Losses

The space has firmed after T-Notes had a brief and shallow look through Tuesday's low, with that particular contract now +0-04 on the day, printing 133-03+, a touch shy of best levels. The major cash Tsy benchmarks run unch. to 2.0bp richer across the curve. There was little in the way of overt headline flow to trigger the shunt higher. More recently, headlines have crossed the wires noting that Democrats on the Senate Budget Committee have reached an agreement on a $3.5tn fiscal plan, which aims to advance President Biden's Jobs & families initiative without support from the GOP. Overnight flow was dominated by the TYU1 133/132 1x2 put spread which saw ~22K lifted on screen.

- JGB futures have unwound their overnight losses alongside a modest bid in the U.S. Tsy space, with the contract now +2 on the day. Cash JGB trade sees the major benchmark yields print unchanged to 1.0bp lower. Local headline flow remains light. The latest round of BoJ Rinban operations (covering 1- to 10-Year and 25+ Year JGBs) saw steady to lower offer to cover ratios which will have offered some incremental support during afternoon trade. The BoJ's two-day policy meeting gets underway on Thursday. Elsewhere, Thursday will provide the latest liquidity enhancement auction covering off-the-run JGBS with 1- to 5-Years until maturity.

- There was nothing in the way of notable trans-Tasman impetus for ACGBs in the wake of the latest monetary policy decision from the RBNZ, with the stark divergence between the RBNZ & RBA punctuated by the RBNZ's move to declare a halt to its LSAP scheme come the end of next week, while the NZ OIS strip now prices a 65% chance of a rate hike at the end of the RBNZ's August meeting (given the Bank's new least regrets train of thought). Fresh multi-year lows for the Australia/NZ 2-Year swap spread were printed in the process. YM -3.5 & XM -2.5 at typing, with the contracts underwater for the entirety of the Sydney session after struggling overnight. In terms of local news, the Sydney lockdown was extended by 2 weeks, until at least July 30 (most expect a further extension to kick in then), while a handful of new COVID cases were detected in Melbourne. Thursday will bring the latest round scheduled ACGB purchases from the RBA, as well as the latest local monthly labour market report.

FOREX: Hawkish Surprise From RBNZ Sends Kiwi Flying

The RBNZ delivered a hawkish surprise, as it announced an imminent halt to its LSAP programme. The decision caught many off guard, given the RBNZ's aversion to tweak policy at non-MPS meetings, resulting in yet another round of hawkish repricing of future OCR path. A 25bp hike by the end of the November meeting is now fully priced in, with implied odds of an earlier hike in August sitting around 70% (as per BBG WIRP tool). In addition, ANZ, BNZ and ASB brought forward their forecasts of the next hike to August, while Westpac flagged an increased risk of that scenario coming to fruition. The RBNZ's hawkish turn sent the NZD rallying across the board, with a usual degree of trans-Tasman spillover lending support to the AUD.

- NZD/USD pierced the round figure of $0.7000 and rose to a weekly high ($0.7023), with NZD/USD overnight volatility moving further away from a four-month peak printed on Wednesday.

- AUD/NZD tumbled to its lowest point in six weeks, as the Australia/New Zealand 2-Year swap spread tested levels not witnessed since early '16. A sense of concern about the virus situation in NSW continued to linger.

- The DXY ground lower from the off, trimming some of its post-CPI gains. The greenback was the worst G10 performer amid a mixed showing from U.S. e-minis.

- Sterling remained somewhat wobbly as UK PM Johnson's decision to lift remaining Covid-19 restrictions despite a surge in infections generated some angst.

- UK inflation data, EZ industrial output and remarks from ECB's Schnabel & BoE's Ramsden take focus in Europe. In America, Fed Chair Powell testifies to lawmakers, while the BoC deliver their MonPol decision.

FOREX OPTIONS: Expiries for Jul14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-10(E1.1bln), $1.1850(E513mln), $1.1865-85(E996mln)

- EUR/JPY: Y130.75(E880mln)

- USD/CAD: C$1.2200($832mln)

ASIA FX: Won Leads The Way Lower

Most Asia EM currencies weaker as the greenback holds its post-CPI move higher.

- CNH: Offshore yuan is slightly stronger, USD/CNH has hovered around neutral levels. Sino-US tensions could weigh after reports that trade reps from the US and UK met and agreed to tackle China's anti-competitiveness.

- SGD: Singapore dollar is flat, recovering earlier losses. GDP missed estimates, contracting 2.0% in Q2 against estimates of a 1.8% drop.

- KRW: The won is weaker, South Korea confirmed another record high coronavirus cases and tighter movement restrictions outside of the capital. USD/KRW hit the highest since October 2020.

- TWD: Taiwan dollar is flat, recovering from early losses and boosted by reports that Apple plans to increase iPhone production by 20% in 2021.

- MYR: Ringgit is weaker, Malaysia's Director-General of Health Noor Hisham said Tuesday that the daily Covid-19 case count topped 11,000 for the first time on record, amid the spread of the highly transmissible Delta variant. Noor Hisham noted that daily cases can rise further before stabilising.

- IDR: Rupiah declined, Indonesia added 47,899 new Covid-19 infections on Tuesday, the most since the beginning of the pandemic.

- PHP: Peso is weaker, Pres Duterte said that his repeated mentions of the possibility of running for VP were just intended to "scare off" his critics, but he is ready to join the race "if it is good for the country."

- THB: Baht is lower, Thai Cabinet gave a nod to a THB42bn economic aid package for people and businesses affected by the latest round of lockdown regulations, as well as another reduction of utility charges for two months. The latter step will likely exert some downward pressure on consumer-price inflation.

ASIA RATES: China Futures March Higher

- INDIA: Yields mostly higher in early trade. Markets await the release of wholesale price data later today, the print is expected at 12.18% in June from 12.94% previously. Earlier this week data showed consumer prices rose less than expected, but were still above the top end of the central bank's target. Elsewhere, India's long-term foreign currency debt rating was affirmed by S&P at BBB-, the lowest investment grade score, with a stable outlook.

- SOUTH KOREA: Futures opened lower but ground higher through the session to head into the close in positive territory. Risk assets were under pressure as South Korea announced yet another record high of coronavirus cases and tightened movement restrictions outside of the capital. The move higher was supported by the announcement of an additional KRW 60tn spending under the New Deal stimulus plan. FinMin Hong yesterday expressed a preference to avoid additional debt issuance to finance extra budgets.

- CHINA: The PBOC matched maturities with injections again today, repo rates currently steady and within recent ranges; the 7-day repo rate last at 2.1932% just below the PBOC's 2.20% rate. The PBOC cut the RRR by 0.5ppts for most banks last week, a move that is estimated to release around CNY 1tn of liquidity into the system, markets await the results of the MLF tomorrow to see if the PBOC lets the full CNY 400bn roll off and thus reduce the implied additional liquidity. Futures are higher in China, 10-year up 22 ticks as markets adjust to some dovish tweaks from the PBOC, yields have dipped into negative territory following a 5- & 7-year auction, yields on the 10-year hit the lowest since July 2020 yesterday.

- INDONESIA: Yields mixed, market continues to digest the strong sukuk auction yesterday. The government sold IDR 12.5tn of sukuk bonds yesterday, above the IDR 11tn target. Elsewhere, Health Min Sadikin said that virus containment measures implemented in Java and Bali have only reduced mobility by around 6%-16%, which falls short of the government's 20% target. The ministers warned lawmakers that the "hospitals can't endure it more if we fails to reduce movement by at least 20%." Indonesia added 47,899 new Covid-19 infections on Tuesday, the most since the beginning of the pandemic. Officials said that the country faces severe shortages of medical staff and would need 20,000 nurses and 3,000 doctors to deal with the current situation in worst-affected regions.

EQUITIES: Mixed After Negative Lead From US

A broadly negative day for equity markets in the Asia-Pac region. Markets in mainland China are lower by around 1%, weighed on by simmering Sino-US tensions, while there were reports that Cathie Wood sold China tech stocks and warned of a valuation reset. Markets in Japan are down around 0.30% while the KOSPI also came under pressure on reports of a record increase in coronavirus cases. In Taiwan the Taiex managed to squeeze out some gains after reports that Apple is looking to increase iPhone production up to 20% in 2021. The major e-minis are a touch lower on the day.

GOLD: Muted Reaction To U.S. CPI

Hotter than expected U.S. CPI data has failed to push the yellow metal out of its recent range, with spot last dealing ~$5/oz or so higher, a little above $1,810/oz. Ultimately, the spill over from the dip in U.S. real yields was countered by the firming of the broader USD, leaving the well-defined technical picture intact.

OIL: Crude Futures Edge Lower

Crude futures are slightly lower in Asia, dropping after faltering ahead of the week's highs; with WTI & Brent sitting ~$0.20 lower apiece. Despite the drop both benchmarks continue to recover off last week's lows, with Brent (U1) key resistance defined at $77.84, Jul 6 high. Key support undercuts initially at $72.11, Jul 8 low. WTI (Q1) key resistance is at $76.98, Jul 6 high and the bull trigger. Initial firm support lies at $70.76, Jul 8 low. Focus Wednesday turns to the weekly DoE inventory data, with markets expecting another draw of over 4mln bbls for the headline crude numbers. If the print matches estimates it would be eight consecutive weekly decline in stocks. Inventory figures from API yesterday showed crude stocks fell 4.079m bbls, while stocks at Cushing, OK fell 1.59m bbls.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.