-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hawks In The Air In NZ

- A hotter than expected Q2 NZ CPI print saw the headline reading print above the RBNZ's target band, triggering another hawkish repricing re: the RBNZ and more aggressive sell-side calls surrounding the central ban's hiking cycle. This left the NZD atop the G10 FX table.

- The BoJ provided no major surprises in its latest monetary policy decision.

- The broader docket is relatively sparse on Friday.

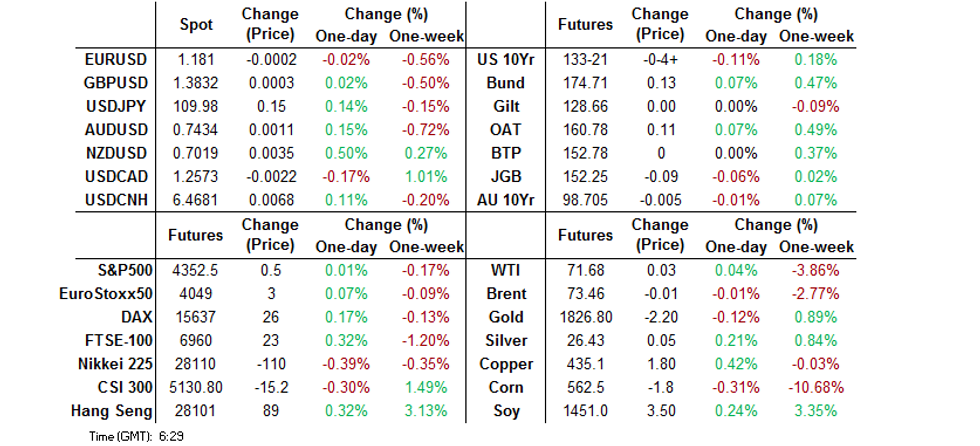

BOND SUMMARY: Core FI Lower Overnight

The modest weakness across the bulk of the JGB curve may have applied some pressure to U.S. Tsys during Asia-Pac hours. T-Notes last print -0-04+ at 133-21, with cash Tsys running 0.5-2.5bp cheaper across the curve, bear steepening in play. Most of the macro headline flow has been centred on Sino-U.S. tensions, while sell-side calls & market pricing re: the RBNZ hiking cycle are becoming more aggressive in the wake of the firmer than expected NZ CPI print for Q2. Flow was dominated by a 5.0K lift of the TYQ1 134.25/135.00 1x2 call spread via block. Retail sales data and the latest UoM sentiment survey will headline the local docket during NY hours. We also note that NY Fed President Williams will speak, but the topic is "culture in the workplace" which limits the scope for market impact.

- JGB futures have extended their drift lower during the early part of the Tokyo afternoon, with the contract now -13 on the day, with little movement in the cash JGB space in the afternoon. The 5- to 20-Year zone of the curve has cheapened by 0.5-1.5bp, with the wings seeing some modest richening. The BoJ offered little in the way of notable surprises in its latest decision, leaving its broader monetary policy settings unchanged and unveiling its green strategy (there will be more on this matter in our full review).

- Aussie bond futures nudged a touch lower in the wake of the blowout Q2 CPI print from across the Tasman, with YM -1.5 and XM at unchanged levels at typing. We have flagged some of the potential hurdles for a break higher in XM i.e. technical resistance and the addition of longs yesterday, although we do reiterate that the post-NZ data dip has been shallow, with the RBNZ-RBA tightening divergence now well-defined. The AU/NZ 2-Year swap spread has moved to fresh cycle lows in the wake of the data release. Elsewhere, a firm round of ACGB Nov '25 supply was seen, likely driven by the supportive matters we identified pre-auction (levels of liquidity in the system, relative international appeal & RBA-adjusted net supply), with the outright richness (at least from a short-term perspective) discounted. The weighted average yield printed 0.97bp through prevailing mids (per Yieldbroker). The reduced auction size (A$700mn) provided artificial support for the cover ratio (would have been around 4.6x if auction size was consistent with the previous auction, all else equal).

FOREX: Inflation Overshoot Sends Kiwi Flying

The kiwi received some further support from hawkish OCR-hike wagers toward the end of a week marked by aggressive RBNZ repricing. Upbeat inflation data provided a catalyst this time, as headline CPI inflation (+3.3% Y/Y) surged past the upper bound of the RBNZ's target range (+1.0%-3.0%) and topped estimates of all economists surveyed by Bloomberg. The kiwi slowly ground off its reaction highs, when the release of the RBNZ's sectoral factor model of core inflation prompted another leap higher. The Reserve Bank's preferred metric of core inflation registered at +2.2% Y/Y in Q2, exceeding the midpoint of the target range.

- NZD/USD jumped to $0.7029 after the release of the initial inflation report. AUD/NZD dipped to its lowest point since Feb 4, piercing support from May 27 low of NZ$1.0601 in the process, as the AU/NZ 2-Year swap spread moved to fresh cycle lows.

- Broader commodity-tied FX space traded on a firmer footing, with BBG Commodity Index seen ticking marginally higher. Safe haven currencies went offered, despite negative showing from most regional equity benchmarks. JPY paced losses, shrugging off the latest monetary policy decision from the BoJ.

- USD/CNH extended gains as the PBOC fixed its USD/CNY midpoint at CNY6.4605, 19 pips above sell-side estimate.

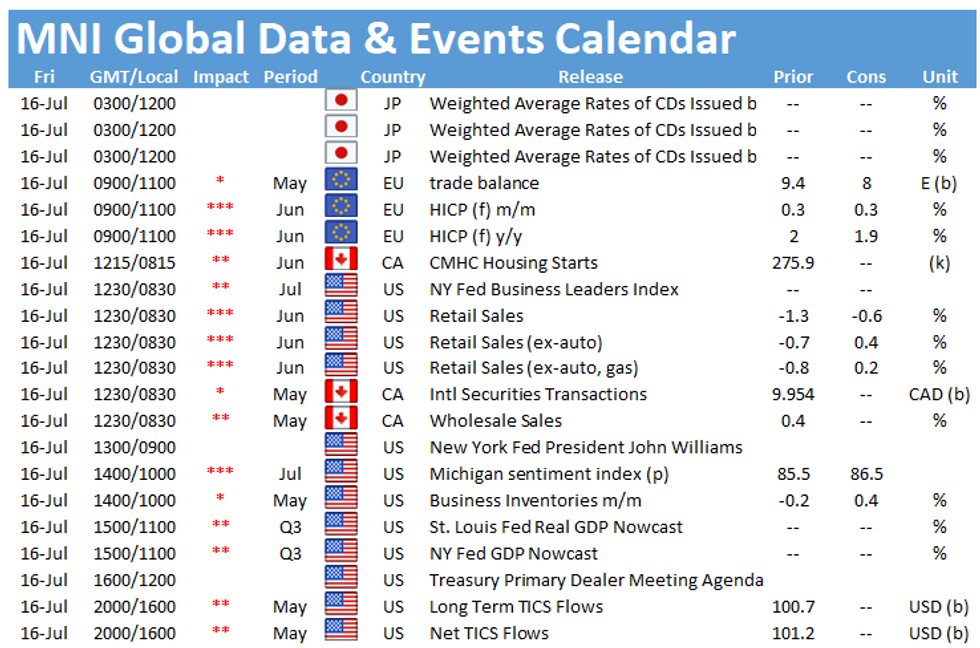

- Final EZ CPI takes focus in Europe. Highlights of the U.S. session include retail sales, flash U. of Mich. Survey & comments from Fed's Williams.

ASIA FX: PHP Leads Gains While TWD Lags

- CNH: Offshore yuan is weaker, US President Biden criticized the Chinese government saying that the situation in Hong Kong is deteriorating and the US was planning to issue an advisory to US businesses as a result and sanction US officials over Hong Kong

- SGD: Singapore dollar is weaker, data showed Singapore June non-oil exports rise 15.9% Y/Y against estimates of 8.0%.

- KRW: Won is flat, fluctuating in a range after a more hawkish than expected BoK yesterday saw KRW strengthen. Coronavirus cases remain elevated but dropped from the previous day.

- TWD: Taiwan dollar is weaker, markets digest the latest earnings report from TSMC where the company issued guidance slightly below estimates and warned that the global chip shortage could start easing in the next few months.

- MYR: Ringgit is stronger. Director-General of Health Noor Hisham suggested that Malaysia's daily Covid-19 case count could fall below 1,000 in October or November, if the current pace of vaccinations is sustained. Noor Hisham added that officials expect all Klang Valley residents to be vaccinated next month.

- IDR: Rupiah is weaker. Indonesia reported another record-breaking surge in new virus cases on Thursday, adding 56,757 infections while S&P lowered growth forecasts.

- PHP: Peso is higher, Pres Duterte's spokesman announced that the NCR+ region (Metro Manila and neighbouring provinces) will remain under loose mobility curbs through the end of the month, but no additional restrictions will be implemented.

- THB: Baht is lower. The World Bank downgraded Thailand's growth outlook to +2.2% Y/Y in a report published Thursday from +3.4% forecast in March, noting that the projection may be cut further to +1.2% if Thailand fails to quickly contain the outbreak of Covid-19.

ASIA RATES: Indian Bonds Supported By Issuance & GSAP

- INDIA: Yields lower in early trade. Bonds are supported today by a number of factors including the GSAP announcement and borrowing plan. The short end in particular is expected to be supported after the RBI kept the borrowing programme for the first half of fiscal 2022, the FinMin had said in May that borrowing would be increased in order to provide support funds to states. Instead, the government released INR 750bn from its own borrowings to compensate for a tax revenue shortfall. The Central Bank announced eligible issues for the next GSAP operations yesterday, the RBI will purchase INR 200bn on July 22 and this time has included illiquid paper, a major criticism of the previous operations.

- SOUTH KOREA: Bonds future lower in South Korea, 3-year and 10-year futures plunged after a more hawkish than expected BoK yesterday, the 3-year held the bulk of the move while the 10-year recovered into the close. BoK Governor Lee did briefly reference the bond market yesterday, saying the government could take steps to stabilise markets if needed, which would include buying more bonds. The reference was brief and nothing new from the Governor, though. Elsewhere the government has hired several banks as arrangers to sell foreign-currency denominated bonds according to Yonhap Infomax, the sales could be up to $1.5bn in September. Bank of America Merrill Lynch, Citi, JPMorgan, Credit Agricole, HSBC and KDB have all been hired.

- CHINA: The PBOC matched maturities with injections at its OMO operations today, after rolling over CNY 100bn of MLF funds which equates to additional liquidity of CNY 700bn when takin in conjunction with the 50bps RRR cut last week. Still, repo rates are near the top of recent ranges, the overnight repo rate up 21bps at 2.17%, the 7-day repo rate in line with the PBOC's rate at 2.20%. Futures are flat, holding a tight range after dropping recent highs during yesterday's morning session. In the China Securities Journal there was a report citing a bond investment manager posited that the unchanged MLF rate shows the PBOC is not making dovish moves and the recent policy adjustments have been to address liquidity.

- INDONESIA: Yields higher across the curve with some bear flattening seen, bonds under pressure after S&P cut its 2021 growth forecast for Indonesia by 1ppt due to its coronavirus situation. Indonesia reported another record-breaking surge in new virus cases on Thursday, adding 56,757 infections. Elsewhere, Indonesian Finance Ministry said that the country's fiscal revenue will benefit from a G20 global tax deal, which would allow Jakarta to tax income of large multinational companies.

EQUITIES: Mild Risk Aversion

A negative day for equity markets in the Asia-Pac region amid some mild risk aversion as markets digest recent comments from FOMC Chair Powell and US Tsy Sec Yellen as well as contemplate elevated coronavirus numbers with the delta variant a particular cause of concern. Bourses in mainland China are lower, the CSI 300 down around 0.4%, US President Biden earlier said the Hong Kong situation was deteriorating and said the US are to sanction Chinese officials and give US companies an advisory. In Japan markets are lower, the BoJ kept rates on hold as expected and kept forecasts broadly in line with expectations. Markets in Australia and New Zealand are slightly lower, the NZX 50 coming under pressure after a bumper CPI print added fuel to the hawkish RBNZ narrative. Futures are lower in the US, markets look ahead to retail sales data and a speech from Fed's Williams later today.

GOLD: Bulls Looking Higher Still

A firmer DXY has nullified the downtick in U.S. real yields over the last 24 hours (based on our weighted U.S. real yield monitor), allowing bullion to retrace from Thursday's highs. Spot is little changed at typing, just above the $1,825/oz mark. The 61.8% retracement of the June decline now provides the main point of resistance after a show above the 50-day EMA & 50% retracement of the same move.

OIL: Set For Worst Week Since March

WTI & Brent print ~$0.20 below settlement levels into European hours. Both benchmarks are on track for their worst week since mid-March as OPEC+ members near a deal that would allow the group to increase output. There is also demand concern as the delta variant of coronavirus picks up steam leading to renewed restrictions. From a technical perspective WTI sees support at $70.76, July 8 low and key support, while Brent bears target $72.11 the July 8 low and key near-term support.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.