-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: COVID Worry Still Rife Amongst Policymakers

EXECUTIVE SUMMARY

- ECB SPLIT ON STIMULUS GUIDANCE AS POLICY MAKERS CONSIDER DRAFTS (BBG)

- UK FREEDOM DAY SHROUDED WITH QUESTIONS, PM & CHANCELLOR ISOLATE AFTER HEALTH SEC TESTS +VE FOR COVID

- AUSTRALIA'S NSW DEEPENS COVID RESTRICTIONS, VICTORIA LOCKDOWN EXTENDS

- RBA TO RETHINK QE TAPER ON DELTA LOCKDOWN (AFR)

- OPEC+ GREEN LIGHTS DEAL TO HIKE OIL OUTPUT IN SAUDI-UAE COMPROMISE

- CHINA KEEPS USING RESERVES TO TAME COMMODITY PRICES (MNI)

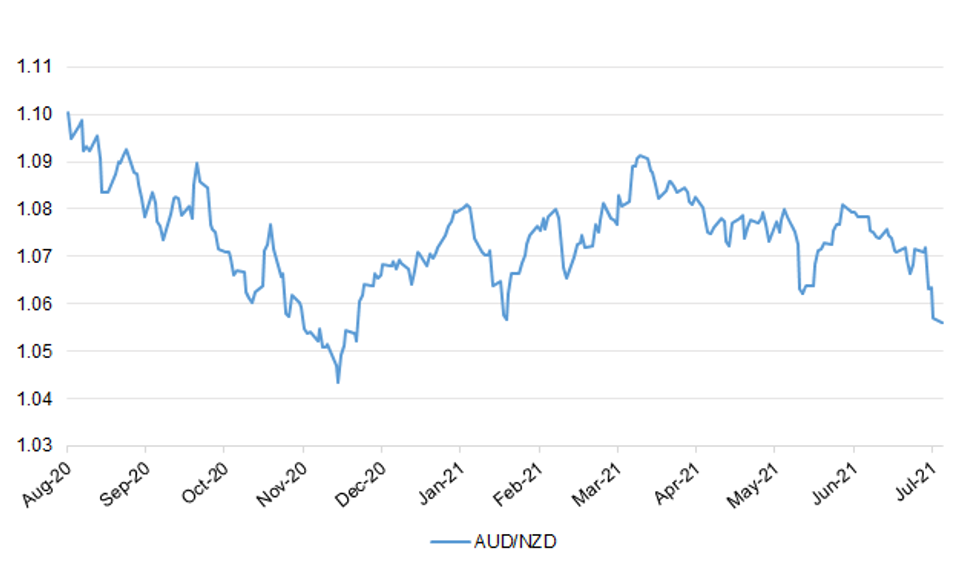

Fig. 1: AUD/NZD

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain could have 200,000 new coronavirus cases a day by mid-August, a leading scientific adviser has warned, as Boris Johnson urged the public to "please, please be cautious". The prime minister defended his decision to lift restrictions in England today despite warnings that it could lead to a surge of hospital admissions and overwhelm the NHS. (The Times)

CORONAVIRUS: The U.K. government said every adult has been offered a first dose of a Covid-19 vaccine and two-thirds of the population has had two shots, as Prime Minister Boris Johnson prepares to lift most curbs in England on Monday. The eight-week gap between first and second inoculations in the U.K. means every adult will have the option of getting both doses by mid-September, the Department of Health and Social Care said. (BBG)

CORONAVIRUS: All children may be offered the Covid vaccine later this year once trials conclude, despite officials being set to stop short of that recommendation on Monday. (Telegraph)

CORONAVIRUS: The UK government reimposed quarantine rules on travelers returning to England from France because of concern at the number of Covid-19 infections there, drawing immediate anger from tourism bodies and airlines. From Monday, anyone arriving from across the Channel will have to isolate at home for up to 10 days and complete two coronavirus tests even if they have two vaccinations, the U.K. Department of Health and Social Care said in a statement Friday. (BBG)

CORONAVIRUS: UK scientists are to carry out a wide-ranging research programme into the causes, diagnosis and treatment of long Covid — a mysterious continuation of chronic symptoms which affects an estimated 10 to 20 per cent of people after coronavirus infection. The National Institute for Health Research has allocated £19.6m to a co-ordinated set of 15 new projects in UK universities. They will study several organs affected by long Covid, including brain, lungs and muscles, as well as the underlying biochemistry of the syndrome. Doctors are becoming increasingly concerned about the future health burden from long Covid as more transmissible variants and loosening restrictions cause infections to soar. (FT)

CORONAVIRUS: Boris Johnson's plan to ask nightclubs and other venues with large crowds to adopt Covid passports from Monday could put unvaccinated patients off receiving a jab, according to a statistician. (Telegraph)

CORONAVIRUS: Half of managers (50%) think the government is lifting coronavirus restrictions too quickly, according to a Chartered Management Institute poll. Shared exclusively with Trevor Phillips on Sunday, it reveals 39% believe the changes are happening at the right pace, while 8% think they are occurring too slowly. Public sector managers were slightly more concerned than private sector managers. And those working in manufacturing were more likely to say the restrictions were easing at the right pace compared with managers in business and other services. (Sky)

CORONAVIRUS: Four out of ten employees currently working from home would consider defecting to another employer if they were forced to return to full-time office working, according to a new poll. The survey found an "overwhelming desire" by office workers for continued flexibility from their bosses even when Covid-19 restrictions are fully lifted. In evidence of likely tension ahead, only 17 per cent of those polled wanted to return to the office full time, while 24 per cent say a return to full-time office working is precisely what their employers are requiring of them. (The Times)

CORONAVIRUS/ECONOMY: Britain faces disruption to food supplies, transport networks and industry as Covid-19's third wave intensifies, hours before Boris Johnson is set to lift most pandemic restrictions. One of Britain's largest retailers warned of "major disruption" that could leave gaps on shelves, while parts of the London Underground closed yesterday because of the number of staff instructed to self-isolate. (Sunday Times)

CORONAVIRUS/POLITICS: The prime minister and chancellor will now self-isolate as normal after contact with Health Secretary Sajid Javid, who tested positive for coronavirus. The reversal comes just hours after they said they would take part in a pilot scheme involving daily testing. Opposition parties said it suggested there was "one rule for them and another for the rest of us". Downing Street said Boris Johnson will conduct meetings remotely at Chequers. Chancellor Rishi Sunak said on Twitter: "Whilst the test and trace pilot is fairly restrictive, allowing only essential government business, I recognise that even the sense that the rules aren't the same for everyone is wrong." (BBC)

POLITICS: Sir Keir Starmer will move to purge "poisonous" campaign groups from the Labour Party this week as he tries to further isolate the party's far left. Labour's ruling National Executive Committee (NEC) will be asked to proscribe four groups associated with the party that promote communism, claim that antisemitism allegations are overblown and demand that the former leader Jeremy Corbyn has the Labour whip restored. If the move is successful any Labour member who remains publicly affiliated with the groups could be expelled. Sources said that this could run into hundreds of members. (The Times)

FISCAL: Boris Johnson and Rishi Sunak are at loggerheads over plans for a health tax worth up to £10 billion a year to fund long-term reforms to social care and reduce NHS waiting lists. The chancellor is understood to oppose the introduction of a levy despite the prime minister and the health secretary, Sajid Javid, supporting the idea amid growing fears the NHS waiting list could rise from 5.3 million to 13 million. The chancellor feels he is being "bounced" into the plans by the prime minister and health secretary. Last week, Javid, who revealed yesterday that he has Covid, said he had been "shocked" by the growing number waiting for non-Covid NHS treatment. (Sunday Times)

BREXIT: British supermarket groups, including Tesco, Sainsbury's and Asda, said on Sunday they may shift some supply chains from the UK to the European Union unless the future of Britain-Northern Ireland trade is addressed urgently. Current post-Brexit trading arrangements between Britain and Northern Ireland are governed by the Northern Ireland protocol. This was designed to strike a balance between keeping open the province's border with EU member Ireland to protect the 1998 Good Friday peace deal, while stopping goods entering the EU's single market unchecked across that frontier. (RTRS)

BOE: MNI INSIGHT: BOE To Reveal More About QE After Critical Report

- The Bank of England is likely to provide more detail of its assessment of the impact of quantitative easing following criticism in a report by the House of Lords Economic Affairs Committee, with its upcoming review of its tightening strategy giving it the chance for a full explanation, MNI understands. The LEAC report released early on Friday raised concerns about secrecy and political pressures surrounding QE and highlighted the BOE's failure to publish more estimates of the effects of the later rounds of bond purchases - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: People are at their most eager to spend for at least 13 years, according to one poll of consumer confidence. As retailers prepare to ditch more restrictions on so-called Freedom Day, PwC said its Consumer Sentiment Index was showing its rosiest reading since it was launched in 2008. Confidence has improved across all age groups and all regions of the UK, thanks to high levels of vaccination and the lack of opportunity to spend during lockdown, which has left many households with high levels of savings. Asked about disposable income, more households than ever said they expected to be better off in the next 12 months. (The Times)

HOUSING: Sadiq Khan is beginning a controversial housebuilding drive to help fill a gaping hole in Transport for London's budget, in a move that will help Tory ministers meet targets for new homes. (Telegraph)

EUROPE

ECB: European Central Bank policy makers are split over changes to their language on monetary stimulus in draft documents being circulated before next week's Governing Council meeting, according to officials familiar with the matter. The ECB will adjust its guidance on key tools including interest rates on July 22 after it concluded a strategy review this month. That review raised its inflation goal and included a pledge to be especially forceful or persistent in providing support when interest rates are close to their lower limit, as they are now. (BBG)

GERMANY: Peter Altmaier, Germany's economy minister, ruled out further lockdowns and wants to allow major events exclusively for the vaccinated and those who have recovered from Covid-19. "We must and will prevent a new lockdown," Altmaier told the Bild an Sonntag newspaper. "It would be devastating for many shops and restaurants that have been closed for months." Altmaier also said he wants to accelerate vaccinations by deploying mobile vaccination teams spread throughout German cities. (BBG)

GERMANY: German Chancellor Angela Merkel is spending Sunday visiting areas devastated by flooding last week while doing damage control of her own after a gaffe by her heir-apparent a day earlier. Armin Laschet, who heads Merkel's governing conservative party and is its candidate to succeed her in September's election, was filmed Saturday laughing in the background while German President president Frank-Walter Steinmeier promised aid to flood victims. The images caused a backlash from opposition politicians and some members of the public by suggesting Laschet, 60, has an empathy gap. The worst floods in decades killed at least 130 people in Germany, with hundreds more still unaccounted for. (BBG)

GERMANY: Germany's opposition Green party gained in a weekly election poll, narrowing the lead of Chancellor Angela Merkel's conservative bloc to 10 percentage points. Support for the Greens rose 1 point to 18% in the Insa poll. That would be enough to construct a governing majority with the Social Democrats and the pro-business Free Democratic Party if the numbers were replicated in the Sept. 26 national election, according to the Bild am Sonntag newspaper. (BBG)

FRANCE: France will limit the use in shopping malls of a contested digital "health pass" that provides evidence of Covid status, even as the spread of the coronavirus accelerates again. In a bid to limit the impact on retailers, the passes will only be required to enter malls with a surface area of more than 20,000 square meters (24,000 square yards), Finance Minister Bruno Le Maire said in an interview with Sunday newspaper JDD. The move comes after thousands of people attended marches on Saturday in major cities to oppose President Emmanuel Macron's plan to use health passes to access venues such as restaurants and cafes. The passes include data on Covid-19 test results and vaccination status. (BBG)

FRANCE: France confirmed it's toughening rules on travel and boosting border checks from Sunday in an effort to contain a spike in cases linked to the Covid-19 delta variant, and to avoid further lockdowns. Travelers from the UK without proof of full vaccination must test negative for Covid-19 within 24 hours of travel, the prime minister's office said in a statement. (BBG)

ITALY: Some Italian regions and holiday destinations including the islands of Sardinia and Sicily and the Adriatic region of Abruzzo are introducing Covid tests at airports for foreign arrivals. Sardinian President Christian Solinas announced Saturday that the region will join Sicily, which has already introduced checks for arrivals from Malta, Spain and Portugal. (BBG)

GREECE: The Greek government issued special measures for the island of Mykonos in response to the latest coronavirus outbreak, including a 24-hour "[p]rohibition of music," Deputy Minister of Civil Protection and Crisis Management Nikos Hardalia announced Saturday. (Axios)

RATINGS: Rating reviews of note from Friday include:

- Fitch affirmed the EFSF's debt at AA

- Fitch affirmed the ESM at AAA; Stable Outlook

- Fitch affirmed Greece at BB; Outlook Stable

- DBRS Morningstar confirmed Ireland at A (high), Trend changed to Positive

- DBRS Morningstar confirmed the Netherlands at AAA, Stable Trend

U.S.

FED: San Francisco Fed President Daly tweeted the following on Friday: "Higher than expected inflation requires detailed analysis. So far, key drivers—airline and used car prices—don't look to be long-lasting. But the Fed has the tools to combat high inflation and a credible track record of using them. We're just not there yet." (MNI)

FED: MNI BRIEF: Fed's Favored CIE Inflation Reaches 7-Year High

- One of the Fed's preferred gauges for inflation expectations climbed to 2.05% in the second quarter, the highest level since 2014. The Index of Common Inflation Expectations nudged up from 2.02% the prior quarter. The gain moves it closer to the highest reading in measurements back to 1999, of 2.15% set in Q1 and Q2 of 2004. The CIE index combines 21 market and survey measures into a single view of how households and businesses expect prices to behave - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Medical Costs to Slow US Inflation Next Year

- U.S. core PCE inflation will slow to just under the central bank's 2% target next year, San Francisco Fed senior economist Adam Shapiro told MNI, as a number of coronavirus-related healthcare laws that have boosted medical prices unwinds along with today's surge in auto prices. "If you add together the 0.5 percentage points from used cars and around 0.3 percentage points from healthcare services, that's a little under a full percentage point that's probably not going to be there next year, and if anything you might see a drag," Shapiro said in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Brad Sherman, a California Democrat in the House of Representatives, was saying what many in his party privately believe when he called for President Joe Biden to reappoint Jay Powell for a second term as chair of the Federal Reserve. "I've lived through two economic crises in Congress: 2008 and 2020. And 2020 was handled much better," Sherman told the Financial Times. "Reassuring people at a time when we are dealing with Covid and some level of inflation is a good idea." Democrats are, at the very least, leaving the door open for Powell to stay on for another four-year stint when his current one expires in February. This comes as deliberations ramp up within the Biden administration over key Fed appointments in the coming weeks. Randal Quarles' tenure as vice-chair for banking supervision is set to end in October, and there is one remaining vacancy on the board of governors. These are pieces of a puzzle that Biden will have to resolve with his economic team. When asked by CNBC on Friday if she would recommend Powell for a second term, Janet Yellen, the US treasury secretary, said she would have "a discussion" with Biden about the issue but was pleased with the central bank's performance. (FT)

FISCAL: Sen. Rob Portman (R-Ohio) criticized Senate Majority Leader Chuck Schumer (D-N.Y.) on Sunday for setting an "arbitrary deadline" to move forward with a bipartisan infrastructure proposal. Portman is a key Republican negotiator, yet Senate leadership aides tell Axios that Schumer won't back away from beginning procedural steps to move the bill — still unwritten — forward this week. (Axios)

FISCAL: Sen. Rob Portman (R-Ohio) said on Sunday that the group of senators pursuing a bipartisan infrastructure deal will no longer be looking at increasing enforcement at the Internal Revenue Service as a way of funding the bill. One of the ways President Biden hoped to pay for his massive infrastructure plan was by infusing the IRS with $40 billion to help it crack down on tax collection and potentially collect $100 billion more in taxes. (Axios)

CORONAVIRUS: The director of the Centers for Disease Control and Prevention sounded the alarm over what she called a "pandemic of the unvaccinated" as COVID-19 cases, hospitalizations and deaths are again on the rise across the U.S. During a Friday news briefing, Rochelle Walensky warned that the latest seven-day average of new cases — tallying an increase of nearly 70% from the previous seven-day average — poses a risk to individuals who are not vaccinated for the coronavirus. (Axios)

CORONAVIRUS: Two Los Angeles officials are pushing back on the county health department's plans to impose the use of masks indoors regardless of vaccination status. Sheriff Alex Villanueva said the order, set to take effect at 11:59 p.m. on Saturday, isn't "backed by science" and contradicts Centers for Disease Control and Prevention guidelines. A county board supervisor said departing from California's state policies creates confusion at the local level. (BBG)

CORONAVIRUS: Governor John Bel Edwards said Louisianans need to "run, not walk" to get vaccinated as the delta variant has pushed cases up almost 200% over last two weeks. He also said the state was in a "fourth surge." "Our hospitals are again stretched thin with limited staff capacity, and the vast majority of Covid patients are not yet fully vaccinated against the illness," the Democratic governor said in a statement. (BBG)

CORONAVIRUS: U.S. requirements for preventing the spread of the coronavirus on Florida-based cruise ships must remain in place after a federal appeals court blocked a previous ruling that allowed the state to avoid the regulations. A panel of the 11th U.S. Circuit Court of Appeals voted late Saturday by 2-1 to stay a decision issued last month that barred the U.S. Centers for Disease Control and Prevention from imposing strict pandemic protocols on cruise lines. (BBG)

CORONAVIRUS: Pfizer's COVID-19 vaccine was granted priority review for full approval by the Food Drug Administration for Americans 16 and older, Pfizer and BioNTech announced Friday. A full approval for the Pfizer vaccine could help bolster the U.S. vaccination effort, as many people are reluctant to receive the vaccine under its emergency use status, the Boston Globe notes. (Axios)

OTHER

U.S./CHINA: Treasury Secretary Janet L. Yellen has cast doubt on the merits of the trade agreement between the United States and China, arguing that it has failed to address the most pressing disputes between the world's two largest economies and warning that the tariffs that remain in place have harmed American consumers. Ms. Yellen's comments, in an interview with The New York Times this week, come as the Biden administration is seven months into an extensive review of America's economic relationship with China. The review must answer the central question of what to do about the deal that former President Donald J. Trump signed in early 2020 that included Chinese commitments to buy American products and change its trade practices. (New York Times)

U.S./CHINA: The United States is in talks with China over U.S. Deputy Secretary of State Wendy Sherman's potential visit to China at the end of her upcoming Asia trip if all arrangements come together, a senior State Department official said on Friday. The State Department on Thursday announced that Sherman will visit Japan, South Korea and Mongolia next week but did not mention a stop in China that had been anticipated in foreign policy circles and reported in some media. The official, speaking to reporters on the condition of anonymity, said there was room in Sherman's schedule to go to China and that if the additional stop would be added, it would come at the end of her Asia trip. (RTRS)

U.S./CHINA: Ex-Treasury Secretary Lawrence Summers urged the establishment of an "ongoing" channel of U.S. communication with China following a report that his former department is planning not to resurrect a previous forum for such contacts. "I am concerned about the canceling of dialogue," Summers said Friday on Bloomberg Television's "Wall Street Week." "It seems to me that in many ways, the more fundamental your disagreements, the more important it is that there be some form of communication." (BBG)

U.S./CHINA/HONG KONG: China's foreign ministry branch in Hong Kong said new U.S. sanctions on Chinese officials and its updated business advisory on the city are "extremely rude" and "extremely unreasonable" bullying acts with "despicable intention". The United States imposed sanctions on Friday on seven Chinese officials over Beijing's crackdown on democracy in Hong Kong, Washington's latest effort to hold China accountable for what it calls an erosion of rule of law in the former British colony. (RTRS)

U.S./CHINA/HONG KONG: Friday's announced sanctions and an advisory to US companies operating in Hong Kong underscore the limited leverage Washington has over Beijing's "behaviour" and conflicting pressures it faces from its domestic constituencies, former US officials and analysts said. The Biden administration warned US companies operating in Hong Kong that their data is increasingly subject to mainland monitoring, their executives to detention and their operations to the vagaries of Chinese justice. It also sanctioned seven deputy directors in the Hong Kong Liaison Office – a year after sanctioning the director. "Every time there's some news of China putting more pressure on Hong Kong, there's commensurate pressure on the US side to do something. But they're running out of things to do," said Richard Boucher, a fellow at Brown University's Watson Institute and former US consul general in Hong Kong. (SCMP)

U.S./CHINA/TAIWAN: The Chinese People's Liberation Army and Navy held joint amphibious landing exercises on Friday, a day after a second U.S. military aircraft landed on Taiwan in less than two months, the Communist Party-backed Global Times reported Sunday. The exercises, in waters off the eastern province of Fujian near Taiwan, should be seen as warnings and a deterrent to the U.S. as well as "Taiwan secessionists," the newspaper cited an unidentified military expert as saying. More complex drills will likely be staged in the future, the report said. (BBG)

U.S./CHINA/AUSTRALIA: A second Chinese spy vessel is on track to enter waters off Australia's northeast coast, adding to Beijing's surveillance presence in the area as joint military exercises between Australia and the U.S. kicked off last week, the Australian Broadcasting Corp. reported. Approaching Australia through the Solomon Sea around Papua New Guinea, the vessel joins a larger Chinese auxiliary general intelligence ship that was earlier spotted heading toward the country through the Torres Strait and is being monitored by Australia's defense force, it said. The vessels are expected to monitor the Talisman Sabre exercises, a routine military collaboration training between the U.S. and Australia which take place every two years. (BBG)

JAPAN: Two foreign athletes tested positive for Covid-19 at the Tokyo Olympic Village, the first cases reported among competitors at the village, according to a document from Tokyo's Olympic organizing committee on Sunday. The games, which start July 23, will be the first to be held without spectators as Tokyo grapples with a surge in coronavirus cases that prompted the government to declare a fourth state of emergency in the capital earlier this month. The city reported 1,410 new infections on Saturday, the most since Jan. 21. There are 55 positive cases so far tied to the Tokyo Games. (BBG)

JAPAN: Japan may begin experiments in September to test how quickly it can ease restrictions on eateries and major events once more people have two vaccine doses, Sankei Shimbun newspaper reported. They could include allowing people to attend a large-scale concert after taking PCR or antibody tests to gauge the effectiveness of the shots, said the report, without specifying where it obtained the information. (BBG)

JAPAN/SOUTH KOREA: Cheong Wa Dae said Monday it remains "uncertain" whether President Moon Jae-in will visit Japan this week. "Currently, the two countries are in consultations (on the issue), but it is still insufficient" in terms of accomplishments expected, a senior Cheong Wa Dae official said in a written statement. It is "uncertain whether (Moon's) visit to Japan and summit talks will take place," the official added on the customary condition of anonymity. (Korea Herald)

AUSTRALIA: New South Wales Premier Gladys Berejiklian refused to rule out further restrictions as cases in Sydney remained stubbornly high despite tough lockdown measures. Australia's most populous state recorded 105 new locally-transmitted coronavirus cases, underscoring the challenge of containing the latest outbreak of the delta variant. "I won't rule out tweaks in the next few days," Berejiklian told reporters Sunday. "Our aim is to quash the virus." Communities in three locations in Sydney were barred from leaving the areas on Saturday, while Berejiklian ramped up restrictions across Greater Sydney, including tougher rules for non-critical retail trading and an order to cease construction work until July 30, when the current lockdown is due to end. (BBG)

AUSTRALIA: Victorian Premier Daniel Andrews has confirmed the state's current lockdown won't end at 11.59pm tomorrow night. "I know this is not the news people want to hear," he said. However, Mr Andrews said the state has dodged "weeks and weeks" of lockdown by issuing stay-at-home orders late last week and not a moment longer. "We have made great progress and we have avoided 1000s of cases. Knowing what we know now, lockdown was the right course, that was the right call at the right time." The Premier says the lockdown extension will be determined by tests which are currently in the lab and he hopes to give an update tomorrow. He added that Victoria's fifth lockdown was clearly the right decision, and to open back up by Wednesday would not be "the right thing to do". (Sydney Morning Herald)

AUSTRALIA: An estimated 250 business leaders, NSW Treasurer Dominic Perrottet and state Treasury officials have held an emergency hook-up to discuss the lockdown of Greater Sydney, as preliminary estimates from the federal Treasury warn of a severe blow to national economic growth. Even before NSW Premier Gladys Berejiklian stopped "treading water" as she described it and threw Greater Sydney into a hard lockdown on Saturday, the federal Treasury forecast that the first three weeks of "lockdown lite" in NSW had already erased half a percentage point off economic growth for the September quarter. Now, with Greater Sydney in hard lockdown as well as the entire state of Victoria, the nation's two largest economies are shut down, meaning the impact will be ever greater. (Australian Financial Review)

AUSTRALIA: Commonwealth Bank has announced an expanded package of support measures for customers affected by tighter restrictions imposed on Sydney residents as delta case numbers rise. CBA CEO Matt Comyn said the bank would offer two-month deferrals on home loans to affected customers located in the Fairfield, Liverpool and Canterbury-Bankstown local government areas, and in the construction and retail sectors. "I want to assure all of our customers across Australia who are today facing tighter restrictions that support is available right now," said Mr Comyn. (Australian Financial Review)

AUSTRALIA: National Australia Bank chief executive Ross McEwan says the bank has seen a rise in calls for help from customers facing financial stress, as he emphasised the need for a fast vaccination rollout to avoid the threat of rolling lockdowns. After banks on the weekend pledged to support lockdown-affected customers, Mr McEwan said as of late last week there had been a 10 per cent rise in calls to the bank from consumers and businesses needing financial help. Until then, it had seen virtually no increase in calls from struggling customers, he said. "[There has been] about a 10 per cent increase so far, and let's see what this week brings," Mr McEwan said. (Sydney Morning Herald)

AUSTRALIA: Australian Prime Minister Scott Morrison's approval ratings fell to the lowest level in more than a year, according to a poll published on Monday, as a sluggish COVID-19 vaccine rollout dented voters' confidence in his conservative government. A Newspoll conducted for The Australian newspaper showed Morrison's public support dropped two points to 51% over the last three weeks, the lowest level since he faced criticism early last year over his response to devastating bushfires. (RTRS)

AUSTRALIA/CHINA: Australia wants to hash out its disputes with China through dialogue, but is willing to be "patient," Canberra's trade minister said in an exclusive interview. (Nikkei)

RBA: If the Reserve Bank of Australia knew two weeks ago the COVID-19 delta variant would force more than 11 million people in Sydney and Melbourne into hard lockdowns, it would not have announced plans to reduce the size of its government bond buying program. RBA governor Philip Lowe is now in a precarious position of having to decide whether to follow through on his tapering schedule in September, or delay the unwinding of the $200 billion quantitative easing (QE) program. (Australian Financial Review)

SOUTH KOREA: South Korea will ban gatherings of more than four people in regions outside the greater Seoul area starting Monday to curb the nationwide spread of the coronavirus, Prime Minister Kim Boo-kyum said Sunday. Most regions outside the wider capital area have been placed under Level 2 measures, in which gatherings of more than eight people are banned. But the government decided to toughen the antivirus scheme, as the non-Seoul metropolitan regions have also seen a surge in new cases in recent days. (Yonhap)

NORTH KOREA: The United States will have to work with China to make progress on North Korea, a senior State Department official said on Friday, ahead of a senior U.S. diplomat's visit to the region. (RTRS)

USMCA: The U.S. is clashing with Mexico and Canada over rules for cars shipped across regional borders, with automakers and governments telling the Biden administration that it's imperiling the success of their new trade pact. The dispute focuses on how to calculate the percentage of a vehicle that comes collectively from the three countries under the U.S.-Mexico-Canada agreement, according to people familiar with the matter, who asked not to be named because conversations are private. The deal took effect last July, replacing the North American Free Trade Agreement, or Nafta, but the new so-called rules of origin are designed to be phased in over several years. (BBG)

CANADA: Quebec, the Canadian province that suffered the most deaths from Covid-19, is resorting to cash and scholarships to boost its vaccination rates and weather the rise of variants. (BBG)

TURKEY: Turkish President Recep Tayyip Erdogan's spokesman on Sunday condemned a European Union court decision to allow employers to ban staff wearing Muslim headscarves as appeasing Islamophobia. "The decision by the European Court of Justice on headscarf in the workplace is another blow to the rights of Muslim women with headscarf and will play right into the hands of those warmongers against Islam in Europe," Ibrahim Kalin tweeted. "Does the concept of religious freedom now exclude Muslims?!" (AP)

TURKEY: The Turkish parliament has approved the extension of controversial measures that were imposed following the attempted coup five years ago. Among other areas, the regulations cover the length of police custody. They also extend the possibility that staff at state-run organizations can continue to be sacked as part of the fight to combat terrorist organizations, state news agency Anadolu reported on Sunday. The measures are now in place for a further year, the report said. The ruling Justice and Development Party (AKP), which has a majority in parliament together with its ultra-nationallist ally, had originally called for a three-year extension. (DPA)

BRAZIL: Brazil's President Jair Bolsonaro was discharged from the hospital on Sunday, according to the latest medical bulletin, a day after his doctors declared his condition "really good." The 66-year-old leader was admitted to a Sao Paulo hospital on Wednesday for partial intestinal obstruction. In a Twitter post on Saturday he blamed the condition on the 2018 stabbing while he was on the campaign trail. He's undergone a series of surgeries since the assault. (BBG)

RUSSIA/RATINGS: Rating reviews of note from Friday include:

- S&P affirmed Russia at BBB-; Outlook Stable

SOUTH AFRICA: President Cyril Ramaphosa said on Friday the unrest that has ripped through South Africa in the past week was stabilising and calm has been restored to most of the affected areas, but the destruction will cost the country billions of rand. Ramaphosa was addressing the nation over the rioting that broke out in several parts of the country last week after his predecessor, Jacob Zuma, was jailed for failing to appear at a corruption inquiry. The unrest swiftly degenerated into looting which has destroyed hundreds of businesses and killed over 200 people, driven by widespread anger over the poverty and inequality that persist nearly three decades after the end of white minority rule. The police has arrested over 2,500 people suspected to be involved in inciting violence and that these cases are being prioritised, Ramaphosa said. "It is our firm view that the deployment of our security forces, working together with communities and social partners across the country, will be able to restore order and prevent further violence," he said. "We will extinguish the fires that are raging, and stamp out every last ember." (RTRS)

SOUTH AFRICA: South African authorities are giving vaccinations at the weekend for the first time in the country's economic hub of Gauteng, which has been badly hit by Covid-19. The nation's inoculation program was disrupted by unrest last week in the south-eastern province of KwaZulu-Natal and parts of Gauteng, the regional authority which includes Johannesburg. South Africa has been on virus alert level 4, its second-highest, since late June. (BBG)

IRAN: The U.S. rejected an Iranian effort to separate the fate of four Americans held in Iran from talks on a nuclear deal, calling it an "outrageous effort to deflect blame." The comments by State Department spokesman Ned Price in Washington and Abbas Araghchi, Iran's lead negotiator, are the latest evidence of an impasse in negotiations on a possible U.S. return to the agreement abandoned by former President Donald Trump. (BBG)

COMMODITIES: MNI BRIEF: China Keeps Using Reserves To Tame Commodity Prices

- China will continue to organize the release of state reserves of copper, aluminum and zinc to further ease cost pressures, and commodity prices are expected to gradually return to a reasonable range, said Wan Jinsong, director of the Price Department at the National Development and Reform Commission at a briefing on Monday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OIL: OPEC and its allies clinched an agreement July 18 to raise crude oil production in the coming months, while also allocating five members more generous output quotas starting May 2022, resolving a dispute with the UAE that had threatened to destabilize the oil market and the organization itself. Under the deal, the 23-member OPEC+ coalition will ease its production cuts by 400,000 b/d each month starting in August, amounting to a 2 million b/d total increase by the end of the year. That will help relieve a market that analysts say has grown increasingly tight, with global oil demand on the rise due to seasonal factors and the world's continued emergence from the pandemic. The deal also extends the OPEC+ supply management pact to the end of 2022, from its previous expiry of April 2022. (Platts)

OIL: Russian Deputy Prime Minister Alexander Novak said on Sunday that Russia will raise its oil output in the second half of the year thanks to the new deal agreed by the OPEC+ group of leading oil producing countries to increase their total production. Novak said Russia will start increasing oil output monthly by 100,000 barrels per day from this August and reach pre-crisis level of production in May 2022. Russia would additionally produce some 21 million tonnes of oil this and next year, he said. (RTRS)

OIL: Iraqi Oil Minister Ihsan Abdul Jabbar said on Sunday that the oil market has seen an improvement in demand and a decline in surplus and stockpiles. (RTRS)

OIL: Iran plans to ship a cargo of oil from a port in the Gulf of Oman next week, its first crude export from outside the Persian Gulf and beyond the Strait of Hormuz. "The first vessel has arrived in the Jask region and we expect operations to load heavy crude to start Monday noon," Vahid Maleki, director of the Jask Oil Terminal, told the state-run Islamic Republic News Agency. He didn't elaborate on the size of the cargo or its destination. (BBG)

CHINA

PBOC: The PBOC may cut its one-year Loan Prime Rate, the central bank's guidance for lending, by 5 bp on July 20 when the monthly-set guidance is released, Yicai.com reported citing industry economists. The cut became more likely after the central bank had lowered the required reserve ratios by 0.5 pp for all lenders on July 9, unlocking CNY1 trillion, Yicai said. The PBOC may further cut the RRR by 0.5 pp to help renew as much as CNY2.45 trillion maturing MLF, Yicai said citing economists. The central bank's expected move may come on the rising expectation that the U.S. Federal Reserve may be forced to begin scaling back easing to cool inflation, Yicai said. China's businesses need a financial boost given the lack of fiscal stimulus in H1, including the slower-than-usual issuances of local government debt, the newspaper said citing Lian Ping, the chief economist at Zhixin Investment. (MNI)

FISCAL: China should consider selling more central government debt to boost expansionary fiscal policies given the uncertainties including the recurring pandemic and risks of the U.S. Federal Reserve raising rates, Yu Yongding, a former member of the PBOC's monetary policy committee, said in an interview with the Economic Observer. Monetary policies should play a supporting role to help drive down the government bond yield curve and implement the fiscal stimulus, and the PBOC should even consider QE if necessary, Yu told the newspaper. China should also tolerate relatively high inflation so that the higher commodity costs seen in H2 can be passed downstream to consumer goods, thus help boost business profits and promote recovery, Yu said. (MNI)

FISCAL: China may increase fiscal expansion in Q4 by accelerating local government bond issuances to support growth next year, given weakening leading indicators including PMI's new export order index, property sales and investment, the Securities Times reported citing analysts. Targeted measures to stabilize the operation of SMEs and boosting employment remain the top priority in H2 as growth normalizes, the newspaper said. China's Q2 GDP grew 7.9% y/y, averaging 5.5% over the last two years, lower than 6% in Q2 of 2019, the newspaper added. (MNI)

POLICY: A quiet state-run campaign is ramping up the assimilation of one of China's most recognizable minorities. At Lari, a small Tibetan Buddhist monastery in the Qinghai province, devotees spin prayer wheels under the watchful eye of surveillance cameras and a large portrait of Chinese leader Xi Jinping. To the north, monks at the 127-year-old Xin Monastery say new restrictions on youth participation are making it hard to bring in recruits. Across the region, schools are slashing recruitment of teachers who give classes in Tibetan and replacing traditional artwork with posters of Chinese leaders. (WSJ)

OVERNIGHT DATA

JAPAN JUN TOKYO CONDOMINIUMS FOR SALE +25.7% Y/Y; MAY +556.0%

NEW ZEALAND JUN SERVICES PMI 58.6; MAY 56.3

In the space of three months, the Performance of Services Index (PSI) has gone from indicating scant growth to rapid expansion. In printing at 58.6 in June, the PSI established a June quarter average of 58.7. This compares to the average over the March quarter of 50.2. Certainly, much of the negatively headed feedback to the PSI survey in June related to ongoing problems with supplies, including increased lead times. Complaints also resonated regarding the scarcity of staff, with the closed borders partly to blame. While the PSI is riding high overall, there is still interesting variability in its detail. Two of the strongest industries in June, for instance, were Property & Business (57.3) and Finance & Insurance (55.0). But, really, it's the now very strong force of the PSI, overall, that's the important thing to note. Even stronger in June, of course, was the Performance of Manufacturing Index (PMI), which hit 60.7. (BNZ)

UK JUL RIGHTMOVE HOUSE PRICES +0.7% M/M; JUN +0.8%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:24 am local time from the close of 2.1762% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday, flat from the close of Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4700 MON VS 6.4705

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4700 on Monday, compared with the 6.4705 set on Friday.

MARKETS

SNAPSHOT: COVID Worry Still Rife Amongst Policymakers

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 431.77 points at 27572.86

- ASX 200 down 63.924 points at 7284.2

- Shanghai Comp. down 11.147 points at 3528.157

- JGB 10-Yr future up 11 ticks at 152.37, yield down 0.9bp at 0.016%

- Aussie 10-Yr future up 4.0 ticks at 98.755, yield down 4.3bp at 1.242%

- U.S. 10-Yr future +0-05 at 133-30, yield down 1.17bp at 1.279%

- WTI crude down $0.53 at $71.29, Gold up $2.14 at $1814.19

- USD/JPY down 17 pips at Y109.90

- ECB SPLIT ON STIMULUS GUIDANCE AS POLICY MAKERS CONSIDER DRAFTS (BBG)

- UK FREEDOM DAY SHROUDED WITH QUESTIONS, PM & CHANCELLOR ISOLATE AFTER HEALTH SEC TESTS +VE FOR COVID

- AUSTRALIA'S NSW DEEPENS COVID RESTRICTIONS, VICTORIA LOCKDOWN EXTENDS

- RBA TO RETHINK QE TAPER ON DELTA LOCKDOWN (AFR)

- OPEC+ GREEN LIGHTS DEAL TO HIKE OIL OUTPUT IN SAUDI-UAE COMPROMISE

- CHINA KEEPS USING RESERVES TO TAME COMMODITY PRICES (MNI)

BOND SUMMARY: Core FI Firmer In Asia, But Shy Of Best Levels

Several factors resulted in a risk-off feel at the start of the new trading week: General worry surrounding the deepening of COVID impact/fear across several Asia-Pac economies/nations, most notably Australia. The first point allowed equities to extend lower, building on Friday's negative lead from Wall St. U.S. T-Note futures have breached last week's high, with broader volume in the contract running comfortably above average for this time of day. Lower oil prices in the wake of the latest OPEC+ agreement, which will see the group lift crude output by 400K bpd/month from August with several parties to the deal set to receive new baselines during '22 (although the length of the pact has been extended).

- T-Notes have eased from best levels after several pockets of buying supported the space in early Asia-Pac hours. The contract last deals +0-05 at 133-30 on volume of ~150K. Cash Tsys trade little changed to ~1.5bp richer on the day, with light bull flattening in play.

- There was little in the way of idiosyncracies to note for JGBs, with the broader defensive tone supporting the bulk of the JGB curve. Cash trade saw the major benchmarks richen by as much as ~1.0bp out to 20s years, while paper further out cheapened at the margins. JGB futures built on their overnight gains but faded from best levels (as did U.S. Tsys), last +11 vs. settlement, with the next level of technical resistance (the July 7 high at 152.59) some way off. Longer dated swap spreads are narrower while swaps out to 10-Years have lagged JGBs, as the swap curve has bull flattened.

- Aussie bonds followed the broader theme, with YM +1.5 and XM +4.0, comfortably shy of Sydney highs at typing. From a technical perspective, XM has breached the recent intraday highs, allowing bulls to switch their focus to the 61.8% retracement of the Oct '20 to Feb '21 move lower. Local weekend news flow was almost exclusively focused on the NSW COVID situation, with ~250 business leaders meeting with state Treasury officials to discuss the economic hit of the local COVID outbreak. The weekend also saw the NSW Premier tighten non-essential & construction work restrictions across Greater Sydney, with some tighter movement restrictions also issued across 3 areas of the city. Major local banks have started rolling out support packages for customers as a result. Monday saw the Premier of Victoria confirm that the state's lockdown will be extended, with an announcement coming tomorrow. 2 noted RBA watchers (AFR's Kehoe & WSJ's Glynn) have started to discuss the potential for the RBA to pullback on its tapering decision in recent opinion pieces.

JGBS AUCTION: Japanese MOF sells Y2.8531tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8531tn 1-Year Bills:- Average Yield -0.1178% (prev. -0.1161%)

- Average Price 100.118 (prev. 100.116)

- High Yield: -0.1178% (prev.-0.1091%)

- Low Price 100.118 (prev. 100.109)

- % Allotted At High Yield: 94.5600% (prev. 30.1993%)

- Bid/Cover: 4.208x (prev. 4.664x)

EQUITIES: Indices Drop In Risk Off Trade

A broad risk off tone seen to start the week. There is concern around the deepening of COVID impact/fear across several Asia-Pac economies, while movement in other asset classes including oil and T-notes spurred the risk off move. US T-Note futures have breached last week's high, oil prices have fallen after the OPEC+ group reached a deal to increase output. Markets in Japan saw losses of around 1.5%, while mainland China has recovered from session lows but still nursing losses of around 0.5%. Other bourses in the region have seen losses of 0.5%-1.0%. In the US futures are lower, e-mini Dow leading the way down with losses of around 0.5%.

OIL: Crude Futures Lower After OPEC+ Deal

Oil is lower on Monday, pressured after the OPEC+ group agreed to increase output. WTI is down $1.05 from settlement at $70.76/bbl, Brent is down $1.14 at $72.45/bbl. OPEC+ reached a deal to bring an additional 400k bpd of output a month to market until all the remaining 5.8m bpd of output cuts have been restored which would be in September 2022, higher output will start from next month. Under the new agreement UAE, the main dissenter earlier in July, was given a higher baseline for from May 2022, along with Russia, Saudi Arabia, Iraq and Kuwait.

- At current levels WTI is brushing up against key support at $70.76, the July 8 low and key support. Brent has support at $72.11, also the July 8 low.

GOLD: Holding Steady

Bullion failed to really benefit from the defensive feel to Asia-Pac trade, leaving spot in familiar territory around the $1,815/oz mark, sticking within the confines of a tight range, with the well-defined technical parameters intact.

FOREX: Delta Roils Risk In Asia, Oil Weakness Spills Over

Risk sentiment soured amid the unfettered spread of the Delta variant across Asia and a negative lead from Friday's NY session. Crude oil prices fell after OPEC+ struck a deal on output boost, applying pressure to commodity-tied FX. The AUD paced declines as NSW Premier tightened and extended social restrictions in the state. AUD/USD sank under the $0.7400 mark and printed a fresh cycle trough, as it tested support from Dec 7, 2020 low of $0.7373. Meanwhile, AUD/NZD attacked its multi-month low of NZ$1.0557, but struggled to pierce that level.

- Risk aversion generated demand for safe haven currencies, putting the yen atop the G10 scoreboard. PM Suga's approval ratings hit all-time lows as Japan enters the final stretch of its preparations to the Tokyo Olympics with Covid angst looming large. USD/JPY was happy to hold the prior trading day's range.

- Sterling traded on a slightly softer footing, as participants assessed the risks surrounding today's lifting of Covid-19 restrictions in England.

- USD/CNH climbed to its highest point in ten days, even as the PBOC fix was marginally stronger than expected by sell-side analysts.

- We are off to a slow start to the week, with little of note on the global data docket. ECB's Perrazzelli and BoE's Haskel are set to make speeches.

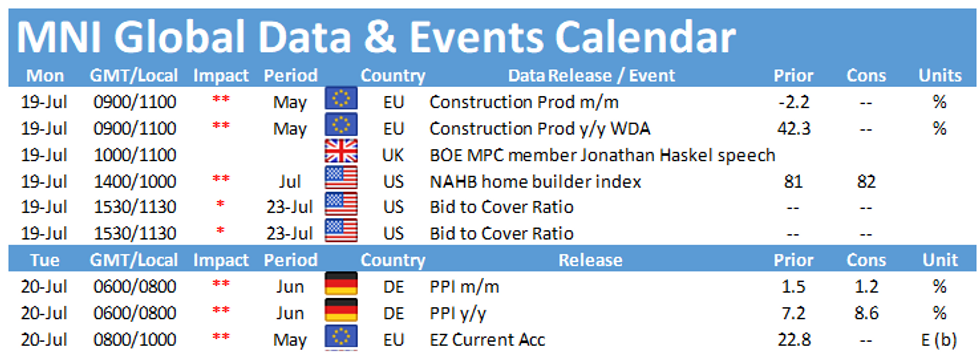

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.