-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A Defensive Start To The Week

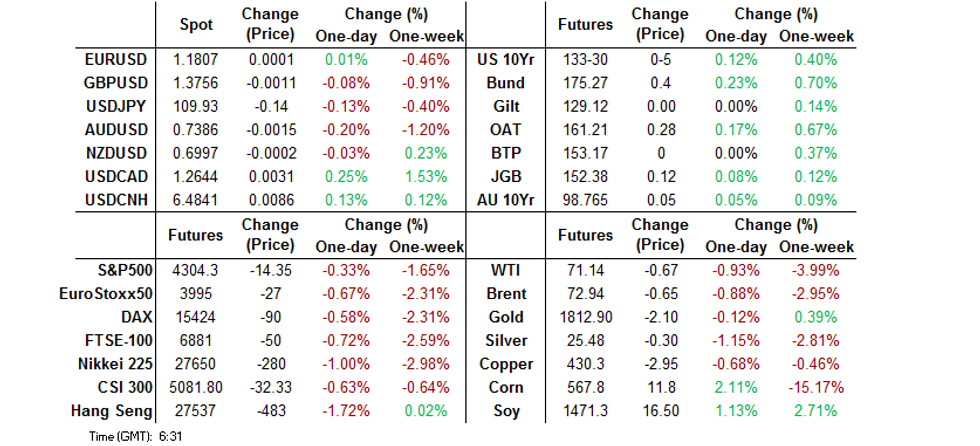

- COVID worry in Asia, lower oil prices, negative equities and slightly lower U.S. Tsy yields give a risk-off feel to the start of a new week.

- A fairly active start to Asia-Pac dealing petered out in terms of broader price action.

- Headline flow has generally been light since the Tokyo re-open, with little of note on Monday's broader docket. Comments from U.S. President Biden on the economic recovery & BoE MPC member Haskel (subject of "will the pandemic 'scar' the economy?") will likely generate the most interest over the next few hours.

BOND SUMMARY: Core FI Firmer In Asia, But Shy Of Best Levels

Several factors resulted in a risk-off feel at the start of the new trading week: General worry surrounding the deepening of COVID impact/fear across several Asia-Pac economies/nations, most notably Australia. The first point allowed equities to extend lower, building on Friday's negative lead from Wall St. U.S. T-Note futures have breached last week's high, with broader volume in the contract running comfortably above average for this time of day. Lower oil prices in the wake of the latest OPEC+ agreement, which will see the group lift crude output by 400K bpd/month from August with several parties to the deal set to receive new baselines during '22 (although the length of the pact has been extended).

- T-Notes have eased from best levels after several pockets of buying supported the space in early Asia-Pac hours. The contract last deals +0-05 at 133-30 on volume of ~150K. Cash Tsys trade little changed to ~1.5bp richer on the day, with light bull flattening in play. President Biden will give remarks on the economic recovery at 11:30 ET (16:30 London).

- There was little in the way of idiosyncracies to note for JGBs, with the broader defensive tone supporting the bulk of the JGB curve. Cash trade saw the major benchmarks richen by as much as ~1.0bp out to 20s years, while paper further out cheapened at the margins. JGB futures built on their overnight gains but faded from best levels (as did U.S. Tsys), last +11 vs. settlement, with the next level of technical resistance (the July 7 high at 152.59) some way off. Longer dated swap spreads are narrower while swaps out to 10-Years have lagged JGBs, as the swap curve has bull flattened.

- Aussie bonds followed the broader theme, with YM +1.5 and XM +4.0, comfortably shy of Sydney highs at typing. From a technical perspective, XM has breached the recent intraday highs, allowing bulls to switch their focus to the 61.8% retracement of the Oct '20 to Feb '21 move lower. Local weekend news flow was almost exclusively focused on the NSW COVID situation, with ~250 business leaders meeting with state Treasury officials to discuss the economic hit of the local COVID outbreak. The weekend also saw the NSW Premier tighten non-essential & construction work restrictions across Greater Sydney, with some tighter movement restrictions also issued across 3 areas of the city. Major local banks have started rolling out support packages for customers as a result. Monday saw the Premier of Victoria confirm that the state's lockdown will be extended, with an announcement coming tomorrow. 2 noted RBA watchers (AFR's Kehoe & WSJ's Glynn) have started to discuss the potential for the RBA to pullback on its tapering decision in recent opinion pieces.

FOREX: Delta Roils Risk In Asia, Oil Weakness Spills Over

Risk sentiment soured amid the unfettered spread of the Delta variant across Asia and a negative lead from Friday's NY session. Crude oil prices fell after OPEC+ struck a deal on output boost, applying pressure to commodity-tied FX. The AUD paced declines as NSW Premier tightened and extended social restrictions in the state. AUD/USD sank under the $0.7400 mark and printed a fresh cycle trough, as it tested support from Dec 7, 2020 low of $0.7373. Meanwhile, AUD/NZD attacked its multi-month low of NZ$1.0557, but struggled to pierce that level.

- Risk aversion generated demand for safe haven currencies, putting the yen atop the G10 scoreboard. PM Suga's approval ratings hit all-time lows as Japan enters the final stretch of its preparations to the Tokyo Olympics with Covid angst looming large. USD/JPY was happy to hold the prior trading day's range.

- Sterling traded on a slightly softer footing, as participants assessed the risks surrounding today's lifting of Covid-19 restrictions in England.

- USD/CNH climbed to its highest point in ten days, even as the PBOC fix was marginally stronger than expected by sell-side analysts.

- We are off to a slow start to the week, with little of note on the global data docket. ECB's Perrazzelli and BoE's Haskel are set to make speeches.

ASIA FX: Lower In Risk-Off Trade

Most Asia EM currencies fell in broad risk off trade as coronavirus concerns dominate the narrative.

- CNH: offshore yuan is weaker with no domestic catalysts evident, USD/CNH climbed to its highest point in ten days, even as the PBOC fix was marginally stronger than expected by sell-side analysts.

- SGD: Singapore dollar is weaker as COVID-19 cases hit an 11-month high. As a result authorities have reimposed stricter measures for dining-in just days after relaxing them and closed nightlight venues.

- KRW: Won is weaker for the first session in four. There were 1,252 new cases in the past 24 hours, meaning cases have been over 1,000 per day for two weeks.

- TWD: Taiwan dollar is weaker, health authorities said the soft lockdown likely will not be extended past the end of this week. TWD could be under pressure from dividend remittances with foreigners expected to convert a large portion of the local currency dividends they are set to receive this year.

- MYR: Ringgit declined, Malaysia's daily count of new Covid-19 infections has eased over the last few days, reaching its lowest point in a week on Sunday. Selangor remains the main contributor of new cases, but Dep PM Ismail Sabri said last Friday that the authorities wouldn't extend enhanced restrictions in the state.

- IDR: Rupiah is lower, Minister Luhut who coordinates emergency Covid countermeasures said that the decision on whether to extend curbs in Java and Bali will be announced in the next few days, while Detik reported that the cabinet approved an extension through the end of July last Friday. As a reminder, Indonesia will observe a religious public holiday tomorrow.

- PHP: Peso fell and is the worst performer in the region, the Philippines detected the first case of the Delta variant of the coronavirus last Friday, which may have weighed on local sentiment at the start to a new week.

- THB: Baht declined, tighter restrictions implemented recently failed to contain the virus, which prompted the authorities to propose even stricter Covid-19 rules through Aug 2 and expand them to three new provinces (Chon Buri, Chachoengsao and Ayutthaya). Stricter curbs in the Greater Bangkok Area and elsewhere are expected to take effect on Tuesday.

ASIA RATES: Bonds Higher In Risk Averse Trade

- INDIA: Yields lower in early trade, Bonds are expected to be supported today due to lower oil prices and the RBI's operation switch. The RBI will convert INR 100bn of shorter dated bonds into longer dated bonds. The RBI sold the full INR 320bn of debt at auction on Friday, demand was decent with primary dealers not forced to take any of the sale. The 6.64% 2035 bond saw a cut-off of 6.7872%.

- SOUTH KOREA: Futures higher in South Korea, moving higher at the open and then moving in a range. The move in the 3-year future is more muted due to the hawkish BoK last week. Risk assets under pressure in South Korea as coronavirus cases remain elevated; there were 1,252 new cases in the past 24 hours, meaning cases have been over 1,000 per day for two weeks. A five year auction was taken down smoothly with strong demand.

- CHINA: The PBOC matched maturities with injections at OMO operations today, repo rates have stayed within recent ranges; the overnight repo rate is up 9bps at 2.0989%, the 7-day repo rate is down marginally at 2.1487%. Futures have stayed within Friday's range but are slightly lower on the session, shaking off the general risk off tone of the session.

- INDONESIA: Yields lower across the curve. Min Luhut who coordinates emergency Covid countermeasures said that the decision on whether to extend curbs in Java and Bali will be announced in the next few days, while Detik reported that the cabinet approved an extension through the end of July last Friday. As a reminder, Indonesia will observe a religious public holiday tomorrow. Local media outlets have drawn parallels with the Idul Fitri holidays in May, which have been linked to the origins of the current wave of Covid-19 infections. The gov't banned public celebrations and restricted mass prayers during the upcoming holidays. Bank Indonesia are set to deliver their monetary policy decision on Thursday.

EQUITIES: Indices Drop In Risk Off Trade

A broad risk off tone seen to start the week. There is concern around the deepening of COVID impact/fear across several Asia-Pac economies, while movement in other asset classes including oil and T-notes spurred the risk off move. US T-Note futures have breached last week's high, oil prices have fallen after the OPEC+ group reached a deal to increase output. Markets in Japan & Hong Kong saw losses of around 1.5%, while mainland China has recovered from session lows but still nursing losses of around 0.5%. In the US futures are lower, e-mini Dow leading the way down with losses of around 0.5%.

GOLD: Holding Steady

Bullion failed to really benefit from the defensive feel to Asia-Pac trade, leaving spot in familiar territory around the $1,815/oz mark, sticking within the confines of a tight range, with the well-defined technical parameters intact.

OIL: Crude Futures Lower After OPEC+ Deal

Oil is lower on Monday, pressured after the OPEC+ group agreed to increase output. WTI & Brent print ~$0.60 below their respective settlement levels into London hours, which equates to ~$0.60 from their respective overnight lows. OPEC+ reached a deal to bring an additional 400k bpd of output a month to market until all the remaining 5.8m bpd of output cuts have been restored which would be in September 2022, higher output will start from next month. Under the new agreement UAE, the main dissenter earlier in July, was given a higher baseline for from May 2022, along with Russia, Saudi Arabia, Iraq and Kuwait.

- WTI has a brief and shallow look through key support at $70.76 during Asia trade, the July 8 low and key support. Brent has support at $72.11, also the July 8 low.

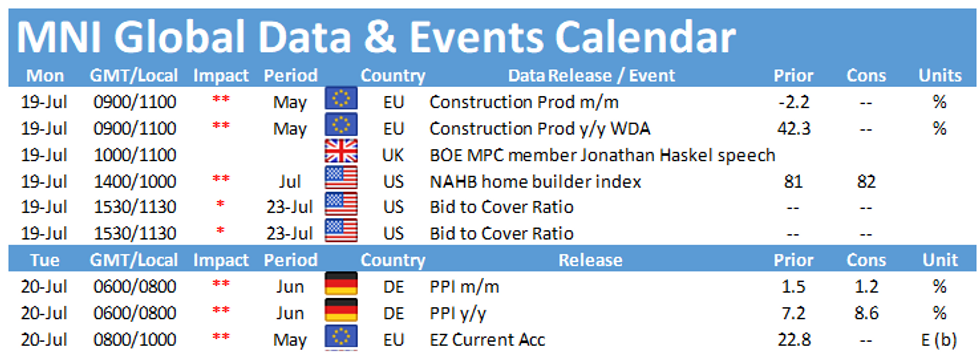

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.