-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN MARKETS ANALYSIS: Chinese State Media Plays Down Long-Term Impact Of Headwinds For Equities

- Mainland Chinese equity markets calmed a little after Monday's sell-off, with state-owned media flagging short-term headwinds and promoting long-term supportive factors.

- Asia-Pac G10 FX trade was muted amid a lack of notable headline catalysts.

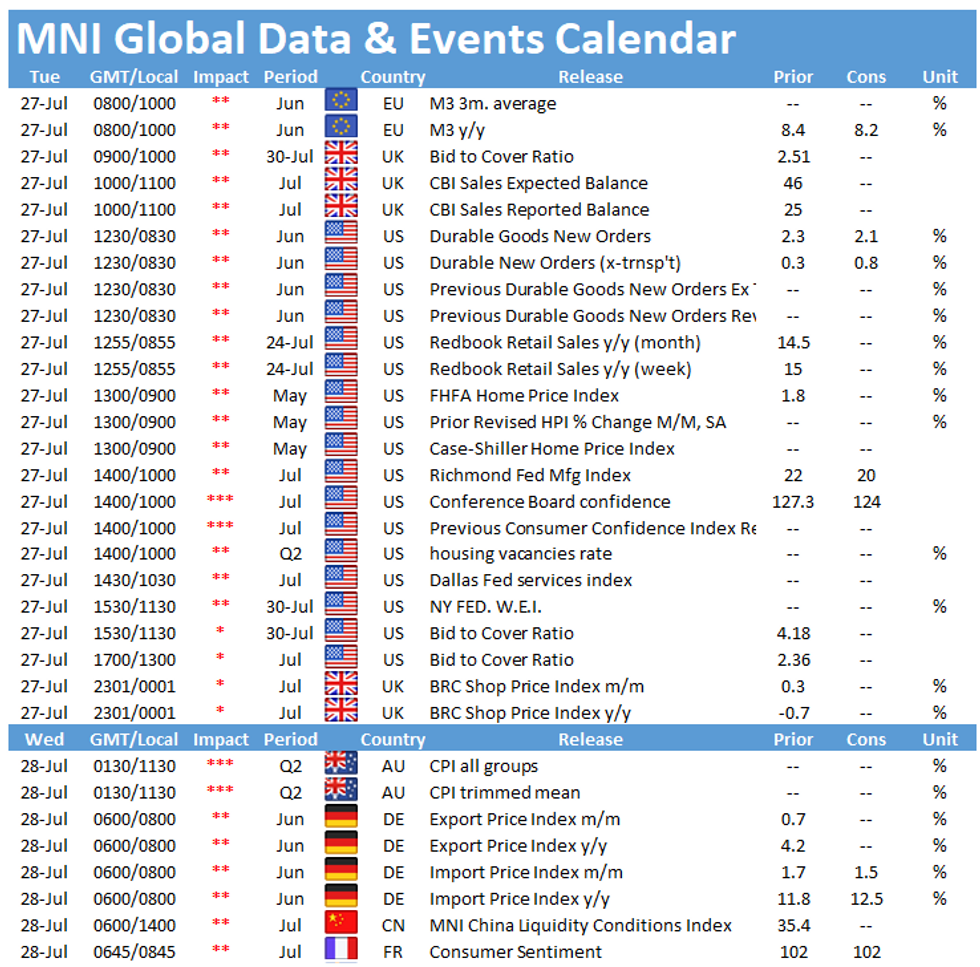

- U.S. durable goods and consumer confidence data, as well as an address from ECB's de Cos, headline the broader docket on Tuesday.

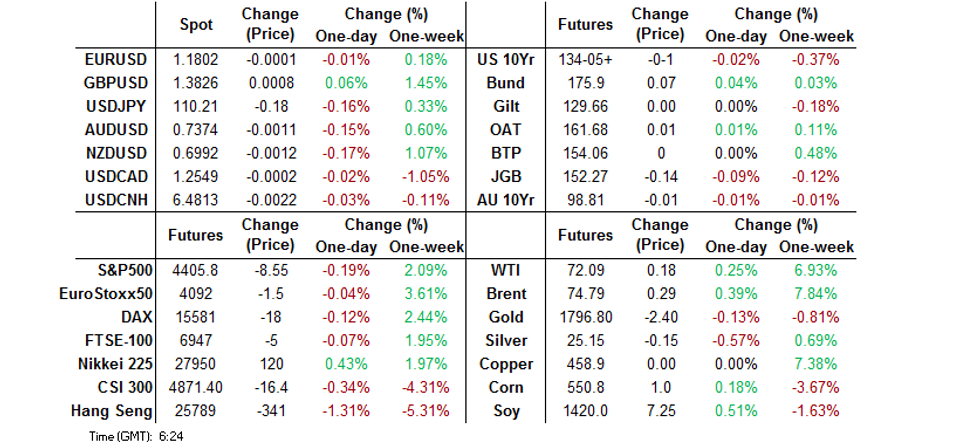

BOND SUMMARY: JGBs Soften, Remainder Of Core FI Looks For A Lead

T-Notes consolidated a little above Monday's late lows in Asia trade, sticking within the confines of a 0-03+ range to last trade -0-01 at 134-05+ (volume is light, running at ~58K). Cash Tsys run little changed to ~1.0bp richer across the curve at typing. Macro headline flow was on the light side, with the major Chinese equity indices trading either side of unchanged after Monday's regulatory-linked slide. Note that a Chinese state-run media outlet published a piece (citing analysts) flagging the "short-term" impact of Monday's headwinds for equities, pointing to expectations for the long-term uptrend to continue. Asia-Pac flow was headlined by a 1.5K lot block buy of UXYH1 (~$199K DV01 equivalent). Tuesday's NY docket will be headlined by durable goods and consumer confidence data, as well as 5-Year Tsy supply.

- JGB futures moved to Tokyo session lows during the afternoon session, having a look through their overnight trough, last -15. The major cash JGB benchmarks run little changed to ~1.5bp cheaper on the day, led by 7s, suggesting the move there may be futures led. The latest 40-Year JGB auction was lukewarm. It saw the high yield print a touch below broader expectations (0.735% vs. the BBG dealer consensus which looked for 0.740%), while the cover ratio nudged lower to 2.716x (6-auction average 2.816x). BoJ Governor Kuroda will speak later in the Tokyo afternoon.

- In Australia, YM +0.5, XM -1.5 after the latter had a look at its overnight low in early Sydney dealing before recovering a little. NSW saw another uptick in new COVID cases today (172). On a more positive note, Victoria has wound back the harshest of its COVID restrictions. The state also declared that it is set to enforce a hard border with the state of NSW. Meanwhile, South Australia confirmed that it is moving out of its own lockdown, although the state Premier stressed that significant restrictions will remain. Q2 CPI data dominates the domestic docket on Wednesday, although the focus on the local COVID situation and perceived transitory nature of the uptick in the inflation readings cloud the potential for lasting market impact in the wake of the release.

FOREX: Risk Aversion Bolsters Yen

The yen picked up a bid as U.S. equity index futures edged lower in a sign that yesterday's risk-on impetus was fading. Fresh news flow was rather light, leaving the familiar themes of China's regulatory steps and virus outbreaks across Asia in focus. Japanese participants are yet to hear the latest address from BoJ Gov Kuroda.

- The Antipodeans were easily the worst performers in G10 FX space, with Australia's Covid-19 situation attracting much attention. Sydney remained under lockdown, even as Victoria and South Australia unwound some restrictions.

- Spot USD/CNH edged lower today, shrugging off the PBOC fix, which fell 7 pips below sell-side estimate. The rate extended losses registered late doors on Monday, but remained within that day's range.

- Most major crosses were happy to hug narrow ranges in Asia-Pac hours.

- U.S. durable goods orders & Conf. Board Consumer Confidence as well as comments from BoJ's Kuroda, RBA's Debelle and ECB's de Cos take focus from here.

FOREX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1725(E805mln), $1.1740-50(E1.4bln), $1.1775(E516mln), $1.1825(E813mln), $1.1850-70(E1.4bln)

- USD/JPY: Y109.00($1.1bln), Y109.50($740mln), Y111.00($632mln)

- AUD/USD: $0.7520(A$851mln)

- USD/CAD: C$1.2380-00($1.2bln), C$1.2600($550mln)

- USD/CNY: Cny6.4815($830mln)

ASIA FX: Most Asia EM FX Higher As Greenback Retreats

Risk sentiment was mixed in the region, but most Asia EM managed to squeeze out small gains as rates played catch up with a lower greenback on Monday.

- CNH: USD/CNH edged lower today, shrugging off the PBOC fix, which fell 7 pips below sell-side estimate. The rate extended losses registered late doors on Monday, but remained within that day's range.

- SGD: Singapore dollar is flat, moving in a narrow range through the session. On the coronavirus front there were reports late on Monday that Singapore is planning to relax more virus restrictions including allowing quarantine-free travel in September

- TWD: Taiwan dollar is slightly stronger, USD/TWD declining from yesterday's closing highs. Markets look ahead to the June monitoring indicator later in the session, the May print was in line with the previous at 41 which denoted the highest reading since 1987.

- KRW: Won is stronger, GDP data was slightly below estimates but the BoK reassured markets that the recovery was still on track.

- MYR: Ringgit is slightly stronger, PM Muhyiddin outlined the governments view that most of Malaysia will embark on the final stages of a recovery plan by October.

- IDR: Rupiah is flat holding steady near a two-year high. As a reminder, Indonesia extended its lockdown measures by a week through Aug 2, but Pres Widodo pledged adjustments to allow SMEs to operate under strict health guidelines.

- PHP: Peso is higher, Pres Duterte delivered his final State of the Nation address to Congress on Monday, pledging to lead the Philippines out of the pandemic, extend support to businesses affected by the Covid-19 outbreak and open the country to more foreign investors.

- THB: Baht gained after returning from a long weekend. The Tourism Authority of Thailand warned that 2021 may see the lowest number of tourist arrivals on record. Focus now moves to the data dump on Friday.

ASIA RATES: China Repo Rates Creep Higher

- INDIA: Bonds under pressure today as risk sentiment improves from yesterday, a small move higher in crude prices could also weigh on bonds. The state debt sale could be supportive today, states are to sell INR 70b debt compared to INR 184bn scheduled in the indicative calendar.

- SOUTH KOREA: Futures are lower today, giving back most of yesterday's gains after closing at session highs. The move has tracked US tsys lower. Coronavirus cases have dropped from record highs seen last week, though authorities warn the peak could be yet to come and have tightened virus restrictions outside the capital. GDP data was slightly below estimates but the BoK reassured markets that the recovery was still on track.

- CHINA: The PBOC matched maturities with injections at its open market operations today, repo rates have crept higher with the overnight rate up 18bps at 2.3122% and the 7-day repo rate up 8bps at 2.2581%, above the PBOC's 2.20% rate but off earlier highs at 2.43%. Futures are lower even as Chinese equity markets remain under pressure. Bonds are hovering around recent highs after a broad rally in Chinese government bond markets, yesterday 10-Year yields touched the lowest since July 2020 at 2.89%.

- INDONESIA: Yields higher across the curve, market seeing some concession ahead of today's IDR 12tn sukuk auction. The finance ministry will issue two new series and reopen two issues. As a reminder, Indonesia extended its lockdown measures by a week through Aug 2, but Pres Widodo pledged adjustments to allow SMEs to operate under strict health guidelines. Officials have also ramped up contact tracing in a bid to stop the spread of new Covid-19 infections.

EQUITIES: China's Stock Crackdown Continues To Spook Investors

Mixed performance for equity markets in the Asia-Pac region; Chinese markets remain under pressure after a sharp sell off on Monday. The regulation crackdown continues to spook investors and has caused speculation over what could be next in the cross hairs though moves today have not been as extreme, the CSI 300 is down 0.7%. The Hang Seng Tech index has seen selling again bringing declines from the start of last week to around 12.5%. Markets in Japan were higher, data showed Japanese services PPI rose 1.4% Y/Y, above estimates of 1.3%. Markets in South Korea are higher, GDP data was slightly below estimates but the BoK reassured markets that the recovery was still on track. In the US futures are lower, coming off closing highs on Monday as major markets finished at yet another record high. Markets will have one eye on the FOMC rate announcement on Wednesday.

GOLD: Struggling To Make A Decisive Move

The initial impulse from lower U.S. real yields and a softer DXY waned on Monday, with gold easing back from best levels even as the move lower in the aforementioned metrics extended. Spot gold then stuck to a tight range in Asia-Pac hours, to last deal little changed around $1,800.oz, with no notable changes to the technical overlay.

OIL: Crude Futures Build On Monday's Late Recovery

Crude futures have crept higher overnight, but operate shy of best levels, with WTI +~$0.25 and Brent +~$0.35.

- The technical picture remains intact for WTI, price is testing the 61.8% retracement of the Jul 6 - 20 downleg at $71.85. A breach of this retracement would strengthen a bullish case and place on hold the recent bearish theme. This would signal scope for a climb towards key resistance at $76.07, the Jul 6 high. A reversal lower would refocus attention on $65.01, Jul 20 low and the key support.

- Brent has tested above $73.87, the 61.8% retracement of the Jul 6 - 20 downleg. A clear breach of this level would strengthen a bullish case and put on hold the recent bearish theme. This would signal scope for a climb towards key resistance at $77.84, the Jul 6 high. A reversal lower is required to refocus attention on $67.44, Jul 20 low.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.