-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Equities Chop Around As State Media Look To Support

EXECUTIVE SUMMARY

- CHINESE EQUITIES CHOPPY AS STATE-OWNED MEDIA LOOK TO PROP UP SPACE

- ECB'S DE COS: KEEP BOND-BUYING FLEXIBILITY AFTER PANDEMIC (BBG)

- EU PAUSES LEGAL ACTION AGAINST UK OVER NI PROTOCOL 'BREACHES' (BBC)

- AUSTRALIA CPI IN LINE WITH EXP., NOT A GAMECHANGER FOR RBA

- NSW LOCKDOWN EXTENDED, EXTRA FISCAL SUPPORT DEPLOYED

- HEADLINE U.S. MEGA CAP TECH EARNINGS BEAT EXP.

Fig. 1: China CSI 300 Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The daily number of Covid cases recorded in the UK has fallen for a seventh day in a row, to 23,511. Prime Minister Boris Johnson earlier urged people to "remain cautious" and not jump to "premature conclusions" about the falling numbers. There were also a further 131 deaths reported within 28 days of a positive test, the highest number since March. Public Health England said this showed the pandemic was "not over yet" and urged people to still take precautions. (BBC)

CORONAVIRUS: Boris Johnson is on Wednesday expected to approve the reopening of England's doors to double-vaccinated tourists from the EU and the US, in a move that will bring relief to the country's leisure sector. Whitehall officials said UK ministers, led by chancellor Rishi Sunak, had pushed the prime minister to act, arguing that it was safe to start readmitting foreign tourists without the need for quarantine if they had received two jabs. Sunak was particularly concerned that tourist destinations like London would lose out to locations like Paris and Rome now that the EU had decided to admit US visitors. "It could take effect from as early as next week," said one Whitehall official briefed on the ministerial discussions. "Rishi has been leading the way on this." Falling coronavirus case numbers in the UK made the decision easier. (FT)

CORONAVIRUS: Michael Gove has described people refusing to get vaccinated against Covid as "selfish" and suggested they could be "barred" from more venues in future. (Telegraph)

BREXIT: The EU has paused its legal action against the UK for alleged breaches of the Northern Ireland Protocol. It said it was doing so to create the "necessary space" to consider UK proposals for reforming the deal. The legal action was started in March after the UK took unilateral action to change the implementation of the protocol. At that time the UK delayed new checks on food, parcels and pets entering Northern Ireland from Great Britain. (BBC)

FISCAL: The suspension of the pensions triple lock appears to be moving closer after it emerged last night that Conservative MPs are privately being canvassed on their views on dropping the manifesto commitment. (Telegraph)

EUROPE

ECB: The European Central Bank should consider keeping some of the flexibility of its emergency bond-buying program when it transitions to other asset purchases after the Covid crisis, Governing Council member Pablo Hernandez de Cos said. "The main lesson to be drawn" from the program is that the power to skew purchases toward parts of the economy that need it most "has notably increased not only the effectiveness but also the efficiency" of it, the Bank of Spain Governor said Tuesday in a written response to questions from Bloomberg. (BBG)

ITALY: Bank of Italy says less significant banks can resume buybacks and dividendsfrom Q4, while maintaining prudent approach, according to statement. Bank of Italy highlights risk that, after pandemic support runs out, further losses may impact capital trends. (BBG)

U.S.

FISCAL: Senate Democratic leader Chuck Schumer said on Tuesday he was optimistic an agreement could be reached soon on the details of a bipartisan infrastructure plan and hoped a bill could be passed by the end of the week. "I think we're close," he told reporters. (RTRS)

FISCAL: U.S. President Biden tweeted the following on Tuesday: "There are no Democratic roads or Republican bridges — infrastructure impacts us all and I believe we've got to come together to find solutions. That's why I'm working across the aisle to pass the Bipartisan Infrastructure Framework." (MNI)

FISCAL: Key Democrats on Tuesday urged President Joe Biden to extend the federal student loan payment suspension, arguing failure to continue the policy would burden borrowers and hamper the economic recovery. The Biden administration has paused payments, interest accumulation and collections on loans held by the Education Department through Sept. 30. The policy took effect last year as the coronavirus pandemic ravaged the U.S. economy. (CNBC)

CORONAVIRUS: Biden administration officials are debating how to expand vaccine mandates for some federal civilian health care workers as they prepare to put more testing pressure — and requirements — on the rest of the federal workforce, Axios' Jonathan Swan and Hans Nichols report. (Axios)

CORONAVIRUS: Congress' doctor on Tuesday night reimposed a mask-wearing requirement for lawmakers and all others while they are on the House floor, and in hallways and offices. A previous House-floor mask requirement for members and staff had been lifted last month. (BBG)

CORONAVIRUS: Los Angeles Mayor Eric Garcetti and City Council President Nury Martinez announced they would push for mandatory Covid-19 vaccines for City employees, beginning with a requirement that workers either submit proof of vaccination or a weekly negative test. (BBG)

CORONAVIRUS: Students should wear masks and practice social distancing at school to ensure safe in-person learning this fall, top U.S. doctors said Tuesday. Just 30% of 12- to 17-year-olds are fully vaccinated in America, and younger kids won't likely get the shots until well into the school year. That has the American Academy of Pediatrics and other top doctors worried that the delta variant could rip through U.S. schools when kids return to the classroom this fall. (CNBC)

CORONAVIRUS: It's not just Arkansas and Louisiana, where the delta variant has been raging, that are affected by the Centers for Disease Control and Prevention's new recommendation for vaccinated people to mask indoors in some parts of the country. Most major U.S. urban areas also fall under the scope of the advisory. (BBG)

CORONAVIRUS: Texas posted its biggest daily jump in new cases and hospitalizations in almost five months. The Lone Star state detected 6,517 new virus cases, a level of infection not seen since the first week of March, state health department data showed. Meanwhile, 4,982 hospital beds were occupied by virus patients, the highest tally since March 5. (BBG)

EQUITIES: Apple reported strong fiscal third-quarter earnings on Tuesday, demolishing Wall Street expectations. Every one of Apple's major product lines grew over 12% on an annual basis. Apple stock was down 1% in extended trading. Overall, Apple's sales were up 36% from the June quarter last year. iPhone sales increased nearly 50% on an annual basis. (CNBC)

EQUITIES: Alphabet reported Q2 2021 earnings after the bell. The stock rose as much as 4% after hours on the strong numbers, which crushed analyst expectations. otal Google ad revenue increased to $50.44 billion, up 69% from the year-ago quarter, which was hurt by the onset of the Covid pandemic. (CNBC)

EQUITIES: Microsoft shares fell as much as 3% in extended trading on Tuesday after the software and hardware company issued fiscal fourth-quarter earnings and reported a revenue decline for sales of Windows licenses to device makers. Revenue rose 21% year over year in the quarter, which ended June 30, according to a statement. In the previous quarter revenue had increased by 19%. (CNBC)

OTHER

U.S./CHINA: On Monday, The New York Times quoted nuclear weapons experts from the Federation of American Scientists as saying that China has built a new silo for launching nuclear missiles in the Hami prefecture of Northwest China's Xinjiang Uygur Autonomous Region. China now owns 110 silos, according to the US media. On June 30, the Washington Post published the findings of researchers from US think tank James Martin Centre for Nonproliferation Studies, who identified around 120 new silos near the city of Yumen, Northwest China's Gansu Province. The results of both reports are based on pictures taken by commercial satellites. There has been no official Chinese response to these US reports. Some people in China have suggested that those silos claimed by the US might be foundations of wind power plants, though this claim has also not been confirmed by official sources. There are two major reasons why some people in the US, and in the West in general, have been talking more and more about China's nuclear weapons. First, the US has made China its main strategic rivalry. As it has adopted various policies to lay siege to China, the risk of strategic confrontation between the two countries has increased. As the US is strengthening its own nuclear weapons arsenal, it naturally assumes that China will do the same. Second, China's economic and technological strength is sufficient beyond doubt to support the expansion of its nuclear weapons arsenal. It would be easy for China to do so if it wanted to. (Global Times)

U.S./CHINA: China's Hello Inc, an app-based ride services provider backed by Jack Ma's Ant Group, on Tuesday scrapped plans for an initial public offering in the United States against the backdrop of a regulatory crackdown on U.S.-listed Chinese companies. Hello, which offers services in China including two-wheeler services and a carpooling marketplace, said it no longer wishes to publicly float its shares in the United States, according to a regulatory filing. (RTRS)

GEOPOLITICS: China's top legislative body is set to endorse as early as next month the imposition of a new anti-sanctions law on Hong Kong by inserting the provisions into the city's mini-constitution, the Post has learned. Analysts suggested the move provided the legal underpinning for Hong Kong's adoption of the national legislation, a central government package of retaliatory measures against the West's punitive actions on officials and companies in China. (SCMP)

GEOPOLITICS: Carrying urgent missions to seek alliances as pivots to further implement the US' Indo-Pacific strategy, US Secretary of State Antony Blinken and Pentagon chief Lloyd Austin embarked on tours of India and Southeast Asia on Tuesday - one day after US Deputy Secretary of State Wendy Sherman's visit to China. Experts said the two senior US officials' visits, which aim to build and strengthen a military and diplomatic ambush of China are a "slap in the face" against White House claim that the US is not seeking an anti-China coalition and would become "unaccomplished missions" as most Asian countries will not choose sides between China and the US, since the carrots the US has promised are not comparable to the interests they would lose if they yield to Washington's pressure at the costs of ties with Beijing. (Global Times)

CORONAVIRUS: U.S. Trade Representative Katherine Tai said on Tuesday that she was still engaged in negotiations with World Trade Organization members on ways improve the supply and distribution of COVID-19 vaccines, including a proposed waiver of intellectual property rights for the vaccines. In remarks prepared for delivery to a U.S.-Africa business summit, she did not divulge any progress in the talks since she announced the Biden administration's support for the waiver championed by South Africa and India in May. (RTRS)

JAPAN: Chiba eyes virus emergency along with Saitama & Kanagawa. (Nikkei)

JAPAN: Japan may raise employment insurance premium from FY22. (Nikkei)

AUSTRALIA: Sydney's month-long lockdown will be extended by at least another four weeks, with Australian authorities failing to flatten an outbreak of daily Covid-19 cases that on Wednesday surged to another record. New South Wales state Premier Gladys Berejiklian said the lockdown has been extended until at least August 28. The restrictions began on June 26, when 12 new cases were recorded in the local community. The city's outbreak has since swelled -- fueled by the spread of the highly-contagious delta variant -- with 177 more cases recorded on Wednesday, she told reporters. (BBG)

AUSTRALIA: Locked-down Sydneysiders will receive an additional $150 a week if they have lost more than 20 hours of work, or an extra $75 if they have lost fewer than 20 hours, Prime Minister Scott Morrison says. (ABC)

AUSTRALIA: Thousands of hard-pressed Victorian small and medium businesses are set to benefit from the reintroduced Commercial Tenancy Relief Scheme in a state government effort that will provide rental relief for eligible tenants, as well as an $80 million hardship fund for their landlords. Businesses with an annual turnover of less than $50 million and who can show a hit to their businesses of at least 30 per cent due to coronavirus can claim a proportionate rent reduction. At least half of the rent reduction must be permanently waived, while the rest can be deferred. A mediation service for tenants and landlords will further support fair tenancy negotiations, with tenants and landlords encouraged to enter negotiations directly. The Victorian Small Business Commission will resume its role offering mediation if the parties cannot reach agreement. Landlords will not be able to lock out or evict tenants without a determination from the commission. The tenancy scheme comes on top of a fresh $400 million Victorian business support package which will deliver an additional $400 million to Victorian businesses, with funding to be split 50:50 between the Commonwealth and Victorian government. (Sydney Morning Herald)

AUSTRALIA/CHINA: It's no secret that Australia's allies have gladly absorbed market share in China that Australia lost due to mismanagement of the bilateral relationship with its most important trade partner. Australia and New Zealand have fierce competition within the Chinese market in many areas. New Zealand's exports of agricultural products, livestock products, and seafood to China have all increased significantly. Australia, on the other hand, still relies on rising international iron ore prices, and has continued to allow China-Australia relations to deteriorate. Australia even tries to persuade New Zealand to work with Australia to contain China and jointly safeguard the hegemony of the US in the Asia-Pacific region. Perhaps it is time for Australia to reflect on its China policy: should it continue to sacrifice its own interests to safeguard the US hegemonic strategy? (Global Times)

SOUTH KOREA: South Korea reported a record number of new coronavirus cases over the last 24 hours, according to data from the Korea Disease Control and Prevention Agency's website. Cases hit 1,896 versus 1,365 the previous day, About 35% of the population, or 17.9 million people, have received at least one vaccine dose, while 13.6% of the population completed vaccination. (BBG)

SOUTH KOREA: South Korea and Moderna held an online meeting late Tuesday and Moderna agreed to resume delayed vaccine supply from next week, said Prime Minister Kim Boo-kyum. (BBG)

SOUTH KOREA: South Korea's top economic policymaker on Wednesday warned of a housing bubble amid a looming interest rate hike, and vowed to increase the housing supply and tighten lending rules to stabilize the market. Finance Minister Hong Nam-ki expressed worries over the continued housing rally in the Seoul metropolitan area driven by ample liquidity and expectations of a further price hike, which could threaten the financial stability amid the snowballing household debt. "Several housing market indicators are near record highs or have already surpassed previous peaks," Hong said during a meeting on the real estate market. (Yonhap)

CANADA: MNI DATA BRIEF: Canada June CPI Seen 3.2% After Basket Update

- Canada's inflation rate probably slowed to 3.2% in June from 3.6% in May as last year's base effect waned, in the first report incorporating new weights that reflect pandemic spending trends. The CPI probably climbed 0.5% on a monthly basis in June to match May's pace, economists predict Statistics Canada will report Wednesday at 830am EST. Headline year-over-year inflation was the fastest in a decade in May and the June result would be the third month in a row where prices ran faster than the top of the central bank's 1%-3% target band. The Bank of Canada expects CPI to average 3.4% in Q2, 3.9% in Q3 and 3.5% in Q4 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: MNI INTERVIEW: BOC to End Active QE Before Rate Hike-Ex-Adviser

- The Bank of Canada will finish scaling back asset purchases before raising interest rates, former special adviser Thorsten Koeppl told MNI, as it tries to engineer an orderly QE exit amid concerns inflation could push it to tighten faster. Governor Tiff Macklem is already approaching the limit of how far he can push QE, with the central bank moving towards owning 50% of federal government bonds, said Koeppl, who now teaches at Queen's University in Ontario and has also done research for the ECB and New York Fed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: Bank of Canada officials need to "temper their enthusiasm" that strong inflation readings will be short-lived, according to one former governor. There's a chance underlying price pressures in the economy remain above the central bank's 1% to 3% control range into 2023, David Dodge said in an interview, adding that policy makers led by Governor Tiff Macklem should acknowledge that possibility. "By insisting it's all temporary they tend to undermine their own credibility, which is unfortunate," Dodge said by phone Tuesday. "It's better to be humble and say that's what we think, but of course there is a chance things could be different." (BBG)

MEXICO: While risks remain with the pandemic, they have been gradually subsiding, central bank Governor Alejandro Diaz de Leon said in a presentation during a meeting with the national agricultural council. Mexico's economic recovery will accelerate in coming quarters with lower pandemic risk and external sector momentum, but challenges remain. Uncertainty on inflation and long-term global interest rates could generate volatility in international financial markets and impact capital flows to emerging economies. Banxico board will take needed action for inflation to converge to 3% target. (BBG)

MEXICO: Ratings agency Moody's on Tuesday downgraded Mexican state oil giant Pemex one notch lower to Ba3, sending the loss-making company's debt deeper into so-called junk territory. Moody's, in a statement, said the rating was lowered due to "high liquidity risk and increasing business risk as the company faces high debt maturities while it expands its refining capacity and production." (RTRS)

MIDDLE EAST: The United States will maintain a steady drumbeat of airstrikes in Afghanistan as foreign forces exit the country amid rapid battlefield advances by the Taliban. "The United States has increased airstrikes in the support of Afghan forces over the last several days, and we're prepared to continue this heightened level of support in the coming weeks if the Taliban continue their attacks," wrote U.S. Marine Corps Gen. Frank McKenzie in a statement. (CNBC)

CHINA

CORONAVIRUS: State broadcaster CCTV said 48 of the local confirmed coronavirus cases were reported in eastern province of Jiangsu on July 27. The southwestern province of Sichuan reported 3 local cases while Liaoning and Yunnan added 2 cases each. (BBG)

ECONOMY: Some Chinese economic growth indicators may slow in H2 due to both easing effects of higher-bases of comparison but also operating difficulties faced by small businesses and structural employment issues, the 21st Century Business Herald reported summarizing published analysis by 10 related government ministries. If averaged over the last two years to ease the pandemic-caused base effect, both investment and consumption in H1 recorded less than 5% growth, the newspaper said. One reason for the PBOC to cut RRRs in mid-July was anticipated weakening in exports and property investments, the newspaper said. Consumption remains below pre-pandemic era, while chip shortages will constrain auto sales, the newspaper said citing the ministries of commerce and industries. (MNI)

POLICY: China is expected to increase fiscal support while keeping monetary policy stable over the rest of the year, China Daily reports, citing economists. (BBG)

FISCAL: China is also expected to roll out new policies in the second half of this year to expand domestic demand and consumption, China Business News reports, citing analysts. Maintaining stable economic growth is still the top priority for China amid uncertainties. (BBG)

EQUITIES: Investors shouldn't be overly pessimistic about the stock market and there won't be systemic risks, China Securities Journal, one of China's three most widely circulated financial dailies, reports Wednesday, citing analysts. A loose monetary environment will support equity assets, and there is no need to be overly pessimistic due to technical adjustments. There will be no systemic risks in the A-share market as a whole and it is expected to stay turbulent. The market will be divided in the future, with growth stocks, such as electric vehicles and military industry performing well, while the traditional financial and real estate industries experiencing large declines in the early period. (BBG)

EQUITIES: There is no systemic risk in the A-share market and the long-term positive trend won't change, Securities Times, a newspaper backed by People's Daily, says in an editorial Wednesday. China's macro economy is still in a stable recovery stage and short-term fluctuations in the stock market won't change the long-term prospects of A-shares The recent market decline reflects some extent the misunderstanding of policies and the venting of emotions by some funds The fundamentals of the economy haven't changed, and the market will stabilize at any time Investors should have confidence and treat market fluctuations rationally, and make rational investment decisions based on their own risk tolerance. (MNI)

EQUITIES: The recent plunge in China's stock market is unsustainable and the market will gradually stabilize, Securities Daily reports, citing analysts. Market expected to stabilize quickly and gradually regain lost ground on Wednesday or some time afterward. Factors that determine medium-term market trends, such as the economic recovery, macro policies and liquidity, remain unchanged. The inflow of capital will continue in the medium and long term. (BBG)

PROPERTY: Sales of existing properties in China may fall in the second half after an increasing number of city authorities have published "reference prices", the China Securities Journal reported. The southeast city Wuxi became one of the first six cities launching the policy, which allows authorities to discourage irregular pricing, improve supervision, therefore stabilizing the property markets, the newspaper said. The price guides are based on the average of the trading prices and renewed once a year to make sure the prices are deemed reasonable, it said. Sales of preowned homes in Shenzhen in June plunged 80% from a year ago after the city enacted the policy early this year, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN MAY, F LEADING INDEX 102.6; FLASH 102.6

JAPAN MAY, F COINCIDENT INDEX 92.1; FLASH 92.7

AUSTRALIA Q2 CPI +3.8% Y/Y; MEDIAN +3.7%; Q1 +1.1%

AUSTRALIA Q2 CPI +0.8% Q/Q; MEDIAN +0.7%; Q1 +0.6%

AUSTRALIA Q2 CPI TRIMMED MEAN +1.6% Y/Y; MEDIAN +1.6%; Q1 +1.1%

AUSTRALIA Q2 CPI TRIMMED MEAN +0.5% Q/Q; MEDIAN +0.5%; Q1 +0.4%

AUSTRALIA Q2 CPI WEIGHTED MEDIAN +1.7% Y/Y; MEDIAN +1.7%; Q1 +1.3%

AUSTRALIA Q2 CPI WEIGHTED MEDIAN +0.5% Q/Q; MEDIAN +0.5%; Q1 +0.4%

SOUTH KOREA JUL CONSUMER CONFIDENCE 103.2; JUN 110.3

UK JUL BRC SHOP PRICE INDEX -1.2% Y/Y; JUN -0.7%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.3730% at 09:36 am local time from the close of 2.3228% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday vs 54 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4929 WEDS VS 6.4734

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4929 on Wednesday, compared with the 6.4734 set on Tuesday, marking the weakest parity since Apr 23, 2021.

MARKETS

SNAPSHOT: Chinese Equities Chop Around As State Media Look To Support

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 449.78 points at 27521.21

- ASX 200 down 57.362 points at 7371.4

- Shanghai Comp. down 20.103 points at 3361.08

- JGB 10-Yr future up 5 ticks at 152.34, yield down 0.3bp at 0.015%

- Aussie 10-Yr future up 5.0 ticks at 98.845, yield down 4.9bp at 1.158%

- U.S. 10-Yr future -0-01 at 134-14, yield down 0.33bp at 1.238%

- WTI crude up $0.4 at $72.05, Gold up $6.08 at $1805.16

- USD/JPY down 2 pips at Y109.76

- CHINESE EQUITIES CHOPPY AS STATE-OWNED MEDIA LOOK TO PROP UP SPACE

- ECB'S DE COS: KEEP BOND-BUYING FLEXIBILITY AFTER PANDEMIC (BBG)

- EU PAUSES LEGAL ACTION AGAINST UK OVER NI PROTOCOL 'BREACHES' (BBC)

- AUSTRALIA CPI IN LINE WITH EXP., NOT A GAMECHANGER FOR RBA

- NSW LOCKDOWN EXTENDED, EXTRA FISCAL SUPPORT DEPLOYED

- HEADLINE U.S. MEGA CAP TECH EARNINGS BEAT EXP.

BOND SUMMARY: Core FI Coils In Asia

T-Notes have worked away from lows in Asia-Pac hours, with the gyrations in Chinese equities at the fore once again. Note that state-media took a much more active approach in trying to placate fears re: systemic risks causes by the recent sell off in Chinese equities ahead of the open of Chinese markets. The contract last trades -0-01 at 134-14, 0-04+ off lows, sticking to a 0-05 range overnight. Cash Tsys have seen some modest twist flattening and print between -/+0.5bp across the curve. There has been some light demand for TY upside exposure via ~4.0K of screen lifts in the TYU1 135.50 calls. The latest FOMC monetary policy decision will headline the docket during NY hours. The FOMC will use the July meeting to debate its strategy to taper asset purchases (including timing, pace, and composition). The December FOMC looks like the most likely meeting for a formal announcement. The risks to the July Statement lean hawkish, but the mood could swiftly change with Powell delivering a relatively dovish press conference. Moves in yields since the June FOMC suggest increasing market concerns over the growth outlook, but it's unlikely this will persuade the Fed to change course at this stage.

- Tuesday's bid in U.S. Tsys supported the JGB space during Tokyo trade, as did the downtick in local equity markets. Futures were last +6 vs. settlemen, operating in a narrow trading band within the confines of the overnight range. Cash JGB trade has seen the major benchmarks firm by 0.5-1.5bp, with the super-long end outperforming. A quick look at the results of the latest BoJ Rinban operations (covering 3- to 10-Year JGBs) revealed steady to slightly lower offer/cover ratios when compared to prev. ops covering the respective buckets. Elsewhere, local news flow saw confirmation that Chiba, Saitama & Kanagawa are formally seeking the declaration of a state of emergency re: COVID, while Economy Minister Nishimura warned of a further uptick in COVID cases as we move through this week.

- Aussie bond futures have nudged higher on the back of the largely in line with expected Australian Q2 CPI data and bid in U.S. Tsys. Note that the headline CPI readings provided 0.1ppt beats vs. expectations for both the Q/Q and Y/Y readings, which is minimal in the current environment. The trimmed mean and weighted median readings met the broader consensus. These readings aren't seen as gamechangers for the RBA, given the exp. for transitory headline inflation and continued restrained core inflation prints. NSW provided another uptick in its daily COVID case count, with the Sydney lockdown extended through August 28 (meeting exp.). Fresh fiscal support packages for NSW employees & Victorian businesses impacted by COVID have been deployed.

EQUITIES: China Concerns Linger

Most markets in the Asia-Pac region lower on Wednesday amid fragile risk sentiment following the recent China sell off. Markets in mainland China currently hovering around neutral levels trading without a decisive direction, swinging from gains to loses and back again amid fragile sentiment following the recent sell off and fears over further Chinese regulation. Speculation remains that foreign funds are selling off Chinese assets with unverified rumours that the US may restrict investments in China and Hong Kong. Chinese state media released a piece saying investors shouldn't be worried about the stock plunge. Markets in Japan are lower, pressured by elevated COVID-19 cases. Most other markets in the region trading in the red.

- In the US futures are trading flat, fluctuating around the middle point of the day's range after the Nasdaq saw its biggest single day decline since May yesterday. After market earnings yesterday received a mixed response, Alphabet rose on the back of strong sales but Apple saw declines.

OIL: Crude Futures Creep Higher Supported By Stockpile Data

Crude futures are higher in Asia-Pac trade on Wednesday, supported by stockpile data after US market hours. WTI is up $0.54 from settlement levels at $72.19/bbl, Brent is up $0.48 at $74.96/bbl. API data yesterday showed headline crude stocks fell 4.73m bbls, with the downstream report also bullish as gasoline stocks saw a 6.23m bbl decline and distillate stocks fell 1.88m bbls. If the gasoline print is confirmed it will be the biggest draw since March, while if the headline figure is decline that will represent the ninth draw in 10 weeks. Markets look ahead to US DOE stockpile data later today. Resistance for WTI is seen at $72.43 the high from Jul 26, Brent sees resistance at $75.39 the 76.4% retracement of the Jul 6 - 20 downleg.

GOLD: Glued To $1,800/oz

More of the same for bullion over the last 24 hours, with spot struggling to gain traction either side of $1,800/oz, last printing a touch above the round number. The well-defined technical overlay remains in place.

FOREX: Firmer Crude Supports NOK & CAD, FOMC Decision Eyed

The yen led losses in muted Asia-Pac trade, which saw safe haven currencies unwind some of their Tuesday's gains. The summary of opinions from the BOJ's July monetary policy meeting provided little in the way of fresh insights.

- Australian CPI figures fell in line with expectations (headline readings saw modest 0.1ppt beats) and the Aussie was unfazed. Both Antipodean currencies struggled for any topside momentum. Meanwhile, CAD and NOK caught a modest bid as crude oil strengthened.

- The PBOC set its central USD/CNY mid-point at CNY6.4929, the weakest level in more than 3 months and 6 pips below sell-side estimate. Spot USD/CNH pulled back from a multi-month peak.

- The latest monetary policy decision from U.S. FOMC is set to steal the limelight today.

FOREX OPTIONS: Expiries for Jul28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1790-00(E1.7bln), $1.1820-40(E2.1bln), $1.1850-60(E1.6bln), $1.1880-00(E1.6bln)

- USD/JPY: Y110.00-20($713mln), Y110.25-40($878mln), Y110.65-70($910mln)

- GBP/USD: $1.3685-00(Gbp569mln)

- AUD/USD: $0.7390(A$710mln)

- USD/CAD: C$1.2555-65($510mln)

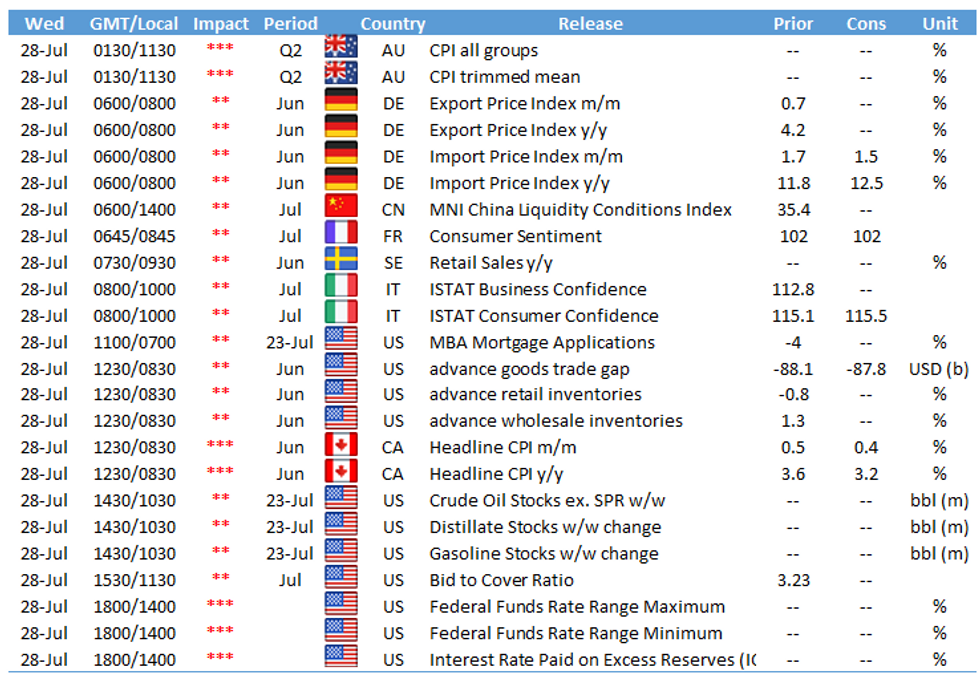

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.