-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Sticks With Taper Plan, RBNZ Unveils Net MacroPru Move

EXECUTIVE SUMMARY

- FED GOV. WALLER SEES TAPER POSSIBLY STARTING IN OCT (CNBC)

- CHINA SHOULD SPUR GROWTH WITH MONETARY, FISCAL POLICY (SEC. TIMES)

- UK PM JOHNSON SCRAPS PLAN FOR AMBER COVID WATCHLIST AFTER CABINET REVOLT (THE TIMES)

- RBA STICKS WITH TAPER PLAN EVEN AS VIRUS DENTS ECONOMY (BBG)

- RBNZ TO FURTHER LIMIT MORTGAGES AMID RELENTLESS HOUSING BOOM (BBG)

- TENCENT TUMBLES AFTER CHINESE MEDIA CALLS ONLINE GAMING "SPIRITUAL OPIUM" (RTRS)

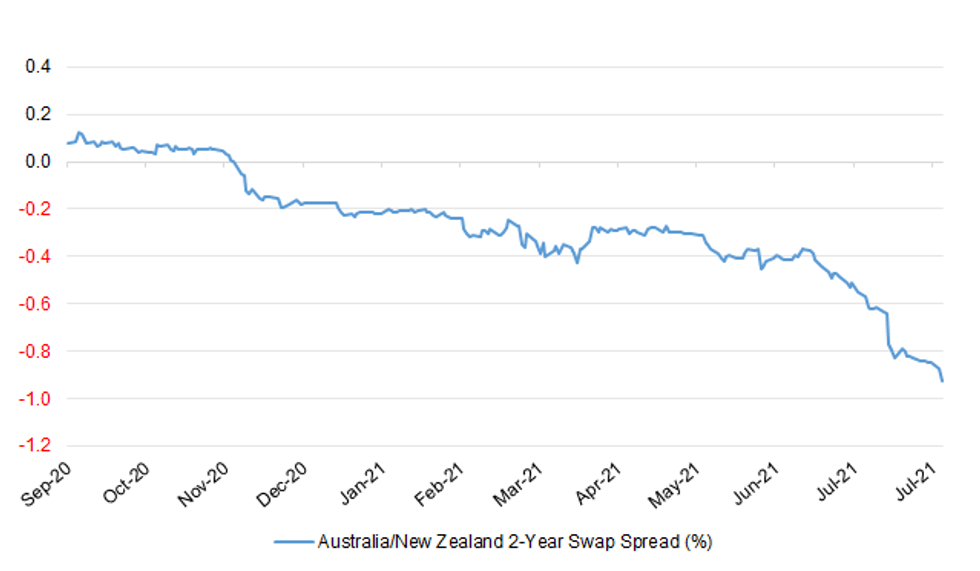

Fig. 1: Australia/New Zealand 2-Year Swap Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The NHS Covid-19 app for England and Wales has been tweaked to reduce the number of people required to self-isolate, the health department announced on Monday following weeks of disruption and staff shortages caused by the "pingdemic". Currently, if an asymptomatic individual reports a positive coronavirus test, the app contacts anyone who has been in close contact with the person in the five days before the test result is reported. (FT)

CORONAVIRUS: Nicola Sturgeon is to set out plans for the lifting of most legal Covid-19 restrictions in a statement to MSPs. The whole of Scotland is currently in level zero of the virus alert system, and the first minister has said she is hopeful of going further on 9 August. This could see physical distancing rules relaxed, the return of office working and larger crowds at events. However, Ms Sturgeon has said some measures like the use of face coverings will remain in place "for some time". She said people should not take progress for granted due to the faster-spreading Delta variant of the virus, saying "appropriate caution" must be taken. (BBC)

CORONAVIRUS: Boris Johnson has abandoned plans to create a new travel watchlist that could have scuppered holiday plans for millions after a revolt by cabinet ministers and Tory MPs. The government had been planning to introduce a new designation to warn holidaymakers which amber countries were at risk of turning red. Travellers returning from those on the red list are required to isolate in hotels for ten days after their arrival at their own expense. Ministers were considering adding Spain to the new list, which would have caused an exodus because up to a million British tourists are on holiday there. There were fears that Greece and Italy could also be included. (The Times)

CORONAVIRUS: Rishi Sunak has told young people that going into the office can be "really beneficial" to their careers and warned that video conferencing was no substitute. The chancellor said that working from home would not have enabled him to build strong relationships that had stood the test of time and he cautioned against allowing remote working to become the norm. Ministers have dropped formal advice to work from home and instead "expect and recommend a gradual return over the summer". Businesses are taking a cautious approach, with millions of workers expected to spend more days at home than in the office after the pandemic triggered a revolution in working patterns. Some ministers believe that the shift may be permanent. (The Times)

ECONOMY: The economy will grow faster than initially expected this year and policymakers should make it clear that they are ready to curb rising inflation, a leading think tank has said. In its latest forecasts, the National Institute of Economic and Social Research said that the economy would expand by 6.8 per cent this year, up 1.1 percentage points from its May report, even though the spread of the Delta variant of coronavirus has created new uncertainty. However, the institute noted that "the recovery is not yet broad-based, being principally driven by the reopening of a few sectors". The institute expects unemployment to peak at 5.4 per cent, just shy of the bank's 5.5 per cent forecast. (The Times)

PROPERTY: Tory backbenchers have warned Boris Johnson that proposals to scale down his controversial planning reforms will not be enough to avert a big rebellion. The MPs have vowed to keep fighting the Planning Bill and dismissed potential concessions as "window dressing". Nearly 100 of them are set to oppose it in the autumn. Labour has already said that it will vote against what it calls a "developers' charter", raising the prospect of a government defeat. (The Times)

EUROPE

ECB: The European Central Bank's (ECB) decision to keep interest rates at record lows for even longer to boost sluggish inflation threatens monetary stability in the 19-member euro zone, a German conservative business group said on Monday. The ECB said last month it would not hike borrowing costs until it sees inflation reach its 2% target by the mid-point of its forecast horizon, which currently stretches to 2023 and is extended by one year every December. "The rising inflation rates are a troubling warning signal," said Wolfgang Steiger, secretary-general of the CDU Wirtschaftsrat, a business group of 12,000 members that is close to Chancellor Angela Merkel's Christian Democrats (CDU). (RTRS)

U.S.

FED: The Federal Reserve could begin slowing down its bond purchases as early as October under a scenario central bank Governor Christopher Waller set out to CNBC in a Monday interview. Should the August and September jobs report show growth in the 800,000 range, that would get the U.S. economy near its pre-pandemic level and, Waller said, meet the Fed's benchmark for when it starts tightening policy. "In my opinion, that's substantial progress and I think you could be ready to do an announcement in September," he told CNBC's Sara Eisen on "Closing Bell." (CNBC)

FED: Banks reported easier standards and stronger demand for U.S. commercial and industrial loans to firms of all sizes over the second quarter, the Federal Reserve said, citing its July Senior Loan Officer Opinion Survey. Stronger demand also reported for all categories of commercial real estate. For loans to households, banks eased standards across most categories of residential real estate loans and reported stronger demand. In a special question added to this survey, banks were asked about their lending standards compared to conditions since 2005. On balance, banks reported they were at the easier end of that range. (BBG)

ECONOMY: MNI INTERVIEW: US Mfg Price Increases Have Peaked - ISM Chief

- U.S. manufacturing price gains likely peaked in June, the Institute for Supply Management chair Tim Fiore told MNI Monday, and the prices index will fall into the 70s in the months ahead as supply and demand move closer to equilibrium. "I have been comfortable for sure calling this transitory," he said, joining the core of the Federal Reserve in seeing recent price surges as temporary. "I'm encouraged by the fact of the amount of people reporting price increases dropped in the month of July" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: MNI BRIEF: US Treasury Reduces Q3 Borrowing Estimate to $673B

- The U.S. Treasury said Monday it plans to borrow USD673 billion in the third quarter, down USD148 billion from the May estimate of USD821 billion, as the agency adjusts to Biden administration fiscal priorities and a re-imposed debt ceiling. The third-quarter estimate assumes an end-of-September cash balance of USD750 billion, the Treasury said in a statement, and estimates assume enactment of a debt limit suspension or increase. The Treasury said it issued USD319 billion in net debt in the second quarter and expects to borrow USD703 billion in the October to December quarter, assuming an end-of-December cash balance of USD800 billion - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Treasury Secretary Janet Yellen informs Congressional leadership that the Treasury Department has begun using extraordinary measures due to the reinstatement of the debt limit. "I respectfully urge Congress to protect the full faith and credit of the United States by acting as soon as possible," Yellen says in letter to House Speaker Nancy Pelosi. (BBG)

FISCAL: The Senate is gearing up for a fight over amendments to the newly finalized bipartisan infrastructure bill in what could turn into a long and drawn-out process ahead of an anticipated final vote. Amendment votes got underway Monday evening. Senators took up and passed two bipartisan amendments that were approved by wide margins. They dealt with funding for Native American health care facilities and addressing the workforce shortage in the wireless and broadband industry, respectively. Senate Majority Leader Chuck Schumer called for amendment votes to begin earlier in the day on Monday, saying, "The longer it takes to finish the bill, the longer we'll be here." (CNN)

FISCAL: Senate Mitch McConnell told lawmakers Monday he doesn't want an 'artificial timeline' for debate on a $1.2 trillion infrastructure package – as members of his party began a strategy to try to weigh it down with amendments. McConnell, who has helped spike Democratic judicial nominations and top legislative priorities, joined 16 other Republicans in voting to advance President Biden's infrastructure package, which was hammered out through negotiations with 10 Senate Republicans. But on Monday, as the Senate moved to debate the 2,700 page measure, he called for a 'robust bipartisan process' – Senate speak for amendments that could fundamentally alter the tenuous bipartisan agreement. McConnell, the Senate minority leader, called the deal a 'good and important jumping off point for what needs to be a robust and bipartisan process out here on the floor.' (Daily Mail)

CORONAVIRUS: The seven-day average of daily coronavirus cases in the U.S. surpassed the peak seen last summer when the nation didn't have an authorized Covid-19 vaccine, CDC Director Dr. Rochelle Walensky said Monday, citing data published over the weekend. U.S. Covid cases, based on a seven-day moving average, reached 72,790 on Friday, according to data compiled by the Centers for Disease Control and Prevention. That's higher than the peak in average daily cases seen last summer, when the country was reporting about 68,700 new cases per day, according to the CDC. The daily average in Covid cases has since dropped, however, falling to 68,326 new cases per day on Saturday and 63,250 new cases per day on Sunday, according to the agency. (CNBC)

CORONAVIRUS: U.S. President Biden tweeted the following on Monday: "Folks, we've officially reached our goal of 70% of adults receiving at least one dose of the vaccine. It's incredible progress, but we still have further to go. If you haven't already, get vaccinated. Let's defeat this virus once and for all." (MNI)

CORONAVIRUS: Peter Marks, head of the U.S. Food and Drug Administration division reviewing Pfizer Inc.'s application for full approval of its vaccine, said in an interview that the agency is moving with urgency to reach a decision on the matter. "I hope not to disappoint the president," Marks said when asked if he will meet President Joe Biden's timeline for approval by September or October. "Everyone here understands the need to do this with the same care and rigor that we always do, and also with speed and urgency, given that we're in the middle of a global pandemic." Marks said the U.S. is experiencing a "very real fourth wave" and also spoke about how the FDA will decide whether booster shots are needed. (BBG)

CORONAVIRUS: The Food and Drugs Administration has authorized a COVID antibody treatment for use as a preventative measure after exposure to the coronavirus. Though the FDA said it should not be considered a vaccine substitute, the monoclonal antibodies can protect against severe illness by overwhelming the infection before it leaves the nose and throat, according to researchers. (Axios)

CORONAVIRUS: Health officials in seven Northern California counties on Monday mandated masks be used in indoor public places, elevating a facial covering recommendation they issued in July to a requirement. The coalition of officials — from Alameda, Contra Costa, Marin, San Francisco, San Mateo, Santa Clara and Sonoma Counties and the City of Berkeley — first advised residents to wear masks indoors regardless of their vaccination status just over two weeks ago. Citing a surge in cases attributed to the highly contagious delta variant, the new mandate will take effect Tuesday. (CNBC)

CORONAVIRUS: New Jersey Gov. Phil Murphy mandated vaccines for a variety of the state's front-line workers at a news conference Monday, setting a Sept. 7 deadline for employees spanning the health care and prison sector. Murphy added that employees who fail to get vaccinated must comply with regular coronavirus testing up to twice per week. The mandate applies to all staff in New Jersey's hospitals, corrections facilities and assisted living centers. "I want to make perfectly clear ... that if we do not see significant increases in vaccination rates among the employees in these settings, we are ready and willing to require all staff to be vaccinated as a condition of their employment," Murphy said at the news conference. (CNBC)

CORONAVIRUS: Louisiana Governor John Bel Edwards reinstated an indoor mask mandate for everyone in the state age 5 and older. "Louisiana is currently in the worst surge of the Covid-19 pandemic so far in terms of case growth rate, percent positivity and hospitalizations," the Democratic governor said in a statement. The new mask mandate will stay in effect until at least Sept. 1. (BBG)

CORONAVIRUS: Denver Mayor Michael Hancock ordered all of the city's 10,000 municipal workers to be vaccinated by the end of September as Covid-19 delta variant infections accelerate. "No one wants to relive the horrors of last year," Hancock said at a news conference Monday. The order also applies to private sector workers in hospitals, nursing homes and related institutions, Hancock said. (BBG)

CORONAVIRUS: Facebook will require all people working at its U.S. campuses to wear masks regardless of their vaccination status effective Aug. 3. "The health and safety of our employees and neighbors in the community remains our top priority. Given the rising numbers of Covid cases, the newest data on Covid variants, and an increasing number of local requirements, we are reinstating our mask requirement in all of Facebook's U.S. offices, regardless of an employee's vaccination status," said Chloe Meyere, a company spokesperson. (BBG)

PROPERTY: President Joe Biden asked the Centers for the Disease Control and Prevention to consider another extension of an evictions moratorium, but the agency's leaders haven't been able to legally justify it, White House Press Secretary Jen Psaki said. Biden made the request Sunday, after a ban on evictions the CDC imposed during the pandemic expired the day before. (BBG)

OTHER

GLOBAL TRADE: China's government quietly issued new procurement guidelines in May that require up to 100% local content on hundreds of items including X-ray machines and magnetic resonance imaging equipment, erecting fresh barriers for foreign suppliers, three U.S.-based sources told Reuters. Document 551 was issued on May 14 by the Chinese Ministry of Finance and the Ministry of Industry and Information Technology (MIIT), with the title, "Auditing guidelines for government procurement of imported products," said one former U.S. government official, who obtained a copy of the previously unreported 70-page catalog and read portions to Reuters, but requested anonymity. The former official said that when China joined the World Trade Organization, it agreed not to issue such internal documents. The document also violated the spirit of the January 2020 Phase One trade deal with the United States, the former official said. "They need to reduce barriers, not create new ones." (RTRS)

HONG KONG: Hong Kong's condensed risk designation system for overseas travel will take effect on Aug. 9, splitting countries into high, medium and low risk. The changes mean residents will be able to return from high-risk areas like the U.K, India and the Philippines. The U.S. and Singapore are among countries designated as medium risk, while Australia and New Zealand are the only ones classified as low-risk. (BBG)

JAPAN: Japan is shifting to home care for most people with COVID-19 to ensure it has enough hospital beds for severe cases as infection rates in the country's capital and other regions spike to record levels, the government's spokesman said on Tuesday. The volume of cases has risen and the nature of infections has changed, with younger people rather than vulnerable elderly people becoming infected, Chief of Cabinet Secretary Katsunobu Kato said at a regular news briefing. The government has so far failed to slow the spread of the virus in Tokyo despite declaring a state of emergency. (RTRS)

JAPAN: Japan's government plans to carry out its unfinished Covid relief measures, Finance Minister Taro Aso says. About 4 trillion yen ($36.6 billion) still unused from reserve fund, Aso tells reporters in Tokyo. Covid-19 response measures have boosted public spending, causing govt financial situation to deteriorate. Closely watching infection situation and economy. (BBG)

RBA: The Reserve Bank of Australia said it will stick with its planned tapering of bond purchases even as Sydney's protracted lockdown is set to push the economy into contraction this quarter. The Australian dollar advanced after Governor Philip Lowe and his board surprised economists by keeping to their plan to reduce the pace of weekly bond purchases to A$4 billion ($3 billion) in September from A$5 billion now, while maintaining the cash rate at 0.1% on Tuesday. "The experience to date has been that once virus outbreaks are contained, the economy bounces back quickly," Lowe said in a statement. "The economy is benefiting from significant additional policy support and the vaccination program will also assist with the recovery." (BBG)

AUSTRALIA: Qantas Airways Ltd. is furloughing an additional 2,500 workers as state border controls inside Australia to stem Covid-19 outbreaks destroys air travel. The airline said Tuesday it expects flights in and out of Sydney in New South Wales state -- which is fighting its biggest virus flareup -- to be closed for at least another two months. That's weeks after the scheduled Aug. 28 end to the city's lockdown. "We're now faced with an extended period of reduced flying," Chief Executive Officer Alan Joyce said in the statement. "It will take a few weeks once the outbreak is under control before other states open to New South Wales and normal travel can resume." The announcement takes total furloughed staff at Qantas to 9,500. (BBG)

RBNZ: New Zealand's central bank said it intends to further restrict access to mortgages as house prices continue to soar. The Reserve Bank plans to reduce the amount of low-deposit lending banks can make from Oct. 1, and will also consider introducing debt-to-income limits and/or interest-rate floors later this year, Deputy Governor Geoff Bascand said in a statement Tuesday in Wellington. A previous tightening of restrictions hadn't seen a sufficient reduction in risky lending and, if house prices were to fall, some buyers could face the possibility of negative equity, he said. New Zealand policy makers are battling one of the hottest property markets in the world, with prices surging 30% in the year through June. The government has already changed tax rules for property investors in an effort to damp demand and, with the economy showing signs of overheating, the RBNZ has signaled it may start raising interest rates as soon as next month. The central bank proposes to restrict the amount of lending banks can make to house purchasers who have less than a 20% deposit to 10% of all new loans, down from 20% at present. It also intends to consult in October on implementing debt-to-income (DTI) restrictions and/or interest-rate floors. (BBG)

NEW ZEALAND: Finance Minister Grant Robertson says he moved as quickly as he thought was responsible, empowering the Reserve Bank (RBNZ) to impose new mortgage lending restrictions. (Interest NZ)

NORTH KOREA: South Korea's National Intelligence Service believes there are no unusual signs on North Korean leader Kim Jong Un's health, Yonhap News reports. South Korean parliament's intelligence committee briefed by the spy agency on North Korean issues on Tuesday. North Korea is willing to take corresponding measures if South Korea and U.S. stop planned military drills. Inter-Korean communication channels which had been cut off for more than a year were restored on Kim Jong Un's request and Kim has shown willingness to improve inter-Korean relations, it said. (BBG)

ASIA: Asia-Pacific likely will grow faster in 2021-22 than the Middle East & North Africa and Latin America, but performance will increasingly diverge within the region, says Moody's Investors Service in a new report. The economic rebound, fuelled in large part by China (A1 stable), masks a range of output losses across the region. "We forecast about 30% of APAC economies will face a modest degree of scarring, experiencing an output decline of 2%-8% below our pre-pandemic forecast GDP levels by 2023. These include mainly lower-to-upper middle-income economies and those struggling to contain a virus resurgence, such as Malaysia (A3 stable), Indonesia (Baa2 stable) and Thailand (Baa1 stable)," says Deborah Tan, a Moody's Assistant Vice President and Analyst. However, more than 40% of the region's economies will have output losses exceeding 8% of pre-pandemic GDP forecast levels. Economies with the deepest scarring generally have concentrated economic structures or weaker institutional capacity. These are economies with lower-middle incomes, with deep scarring likely to increase social risks. In some of these economies, high debt burdens are limiting governments' fiscal space to withstand the pandemic. (Moody's)

BRAZIL: Evidence of electoral fraud wasn't presented because it didn't occur, Brazil's top electoral court justice Roberto Barroso said during a speech. (BBG)

BRAZIL: Ciro Nogueira, new Chief of Staff to President Jair Bolsonaro, will submit the proposal for a revamped cash handout program to congressional leaders, CNN Brasil reports without saying how it got the information. (BBG)

RUSSIA: Russia's ambassador to the United States said Washington had asked 24 Russian diplomats to leave the country by Sept. 3 after their visas expire, heightening tensions between the two countries. In an interview with the National Interest magazine published on Sunday, Ambassador Anatoly Antonov did not say whether the U.S. action was prompted by a particular dispute. He said nearly all would be leaving without replacements "because Washington has abruptly tightened visa issuing procedures." U.S. State Department spokesperson Ned Price, responding to the comments, said on Monday that Washington was not using Russian diplomats' visas to retaliate against Moscow. He said the ambassador's characterization was "not accurate." (RTRS)

IRAN: The U.S., Israel and the U.K. all vowed to respond to a deadly drone attack on an Israeli-linked tanker last week in a major waterway for global oil shipments that they blamed on Iran. "There will be a collective response," U.S. Secretary of State Antony Blinken told reporters Monday. Blinken gave no details of what that might entail. Middle East foes Iran and Israel have traded multiple accusations of shipping attacks in recent months. But Thursday's strike off the coast of Oman, which Tehran denied carrying out, was the first to kill crew members -- a Romanian and a Briton. (BBG)

IRAN: Iran will give a "strong and crushing response" to any measures against its interests and national security, state-run Press TV reports, citing an unidentified official. The U.S. and U.K. will be responsible for the consequences of such moves, the official said. (BBG)

MIDDLE EAST: The U.S. and British embassies in Kabul said on Monday the insurgent Taliban may have committed war crimes in southern Afghanistan by carrying out revenge murders of civilians, a charge denied by the insurgents. Suhail Shaheen, a Taliban negotiating team member based in Doha, told Reuters that tweets containing the accusations were "baseless reports." The U.S. mission tweeted a statement accusing the Taliban of killing dozens of civilians in the area of Spin Boldak in southern Kandahar province, the scene of heavy fighting. The statement also was tweeted by the British embassy. "These murders could constitute war crimes; they must be investigated & those Taliban fighters or commanders responsible held accountable," the U.S. embassy tweeted. (RTRS)

IMF: The International Monetary Fund approved the biggest resource injection in its history, with $650 billion meant to help nations deal with mounting debt and the fallout from the Covid-19 pandemic. The creation of the reserve assets -- known as special drawing rights -- is the first since the $250 billion issued just after global financial crisis in 2009, with IMF Managing Director Kristalina Georgieva billing it as "a shot in the arm for the world" that will help boost global economic stability. (BBG)

CHINA

POLICY: The People's Bank of China may shift the focus of monetary policy back to stabilizing growth on the basis of prudence but with more flexibility and accuracy after having tilted to tightening in H1, the Securities Times said in a front-page commentary. The policies may be further loosened marginally should growth faces more pressure at the end of the year, the newspaper said. Fiscal policies may become the leading force promoting growth in the second half as suggested by the Minister of Finance in recent comments. The system of direct fiscal funding channels has been established and local government hidden debt risks have eased, giving more room for speeding up funding through local government special bonds, the newspaper said. (MNI)

POLICY: China should begin to loosen macroeconomic policies from the tightness experienced in the first half, including possibly cutting interest rates and boosting incentives for loaning to private businesses, given an expected slowdown that may stretch into next year, wrote Zhang Ming, deputy director of the Institute of Finance and Banking under the Chinese Academy of Social Sciences in the 21st Century Business Herald. Zhang commented while interpreting the official statement following the politburo meeting on the economy last Friday. The government needs to stabilize investment through infrastructure spending as real estate and manufacturing investments may both weaken, Zhang said. The government must boost funding to rescue struggling small businesses, which will help raise consumption, Zhang said. Inflation may ease in H2 while the authorities may also tolerate a moderate depreciation, allowing more room for loosening, Zhang said. GDP may slow to 6-7% and 5-6% in Q3 and Q4, respectively, after jumping 12.7% in the first half, largely due to the pandemic lockdown last year, according to Zhang. (MNI)

LGFVS: China's financial authorities are expected to allow local governments to accelerate the sales of special bonds to back infrastructure projects and support economic growth from H2 to next year, the China Securities Journal reported citing analysts. Local governments may be able to use up the annual issuance quota of such bonds totaling CNY3.65 trillion, and this could deliver about CNY2.75 trillion yuan to infrastructure investment and add 3.9 pp in infra growth in 2021, the newspaper said citing Luo Zhiheng, the chief analyst at Yuekai Securities. With less than half of the annual quotas used in the first seven months, analysts expect new special bonds to peak in Q3, and continue with CNY1 trillion issued in Q4, the newspaper said. (MNI)

CORONAVIRUS: China reported 61 confirmed Covid-19 cases and 23 asymptomatic infections on Tuesday, as the outbreak that originated with a flight from Moscow continues to spread around the country. Cases were discovered in several regions and in Beijing, where local authorities have discouraged people from traveling. (BBG)

CORONAVIRUS: Wuhan in Central China's Hubei Province announced Tuesday it will conduct city-wide COVID-19 testing, as the city has upgraded its epidemic response measures in the face of the recent coronavirus infections, locking down the area where local COVID-19 infections have been reported while upgrading its risk levels. The city metro has adopted stricter anti-epidemic rules, and all schools have been closed. Wuhan reported seven local COVID-19 cases on Monday, breaking the zero infection record since June 2020. A resident of Zhuankou neighborhood who was the first case in the latest spike, transmitted the virus to six other close contacts. The community is now under lockdown and the area was upgraded to medium-risk area, the city health commission said in a statement on Tuesday. (Global Times)

EQUITIES: Shares of online gaming companies, including Tencent Holdings Ltd and NetEase Inc, tumbled on Tuesday after a Chinese state media outlet branded online gaming "spiritual opium" and called for more curbs on the industry. Tencent, China's biggest social media and video games company, tumbled more than 9% in early morning trade, while Netease slumped more than 13%. The article, published by the state-run Economic Information Daily, said many teenagers were addicted to online gaming and that was negatively impacting their growth. The news outlet is affiliated with the official Xinhua news agency. It repeatedly cited Tencent's flagship game Honor of Kings, saying it was the most popular online game played by students, sometimes for up to eight hours a day. "No industry, no sport, can be allowed to develop in a way that will destroy a generation," said the article, which also likened online games to "electronic drugs." (RTRS)

EQUITIES: China's market regulator is probing some auto chip sellers over allegations of pricing manipulations, according to a government statement. The regulator doesn't name any companies. China vows to continue watching chip prices and strengthen punishment of those who hoard chips, manipulate prices or raise prices through collusion. (BBG)

OVERNIGHT DATA

JAPAN JUL TOKYO CPI -0.1% Y/Y; MEDIAN +0.1%; JUN 0.0%

JAPAN JUL TOKYO CORE CPI +0.1% Y/Y; MEDIAN 0.0%; JUN 0.0%

JAPAN JUL TOKYO CORE-CORE CPI 0.0% Y/Y; MEDIAN 0.0%; JUN 0.0%

JAPAN JUL MONETARY BASE +15.4% Y/Y; JUN +19.1%

JAPAN JUL MONETARY BASE END OF PERIOD Y660.9TN; JUN Y659.5TN

AUSTRALIA JUN BUILDING APPROVALS -6.7% M/M; MEDIAN -4.0%; MAY -7.6%

AUSTRALIA JUN PRIVATE SECTOR HOUSES -11.8% M/M; MAY -10.3%

AUSTRALIA JUN HOME LOANS VALUE -1.6% M/M; MEDIAN +2.0%; MAY +4.9%

AUSTRALIA JUN OWNER-OCCUPIER LOAN VALUE -2.5% M/M; MEDIAN 0.0%; MAY +1.9%

AUSTRALIA JUN INVESTOR LOAN VALUE +0.7% M/M; MEDIAN +8.0%; MAY +13.3%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 101.8; PREV. 100.7

Consumer confidence rose by 1.1% last week as restrictions were lifted from Victoria and South Australia. Confidence in their capital cities improved by 2.0% and 2.9% respectively. Sentiment in Brisbane was also up by 2.7%, but the majority of the survey was completed before the three-day lockdown in South East Queensland was announced. Sentiment in Sydney was down a sharp 7.0% as the lockdown in the city was extended by a month. While below the long-run average, overall consumer confidence is well above the levels seen during Melbourne's long second lockdown. This is consistent with the evidence provided by ANZ Job Ads that the economic impact of the current lockdowns is likely to be considerably less than in 2020. (ANZ)

NEW ZEALAND JUL CORELOGIC HOUSE PRICE INDEX +24.8% Y/Y; JUN +22.8%

SOUTH KOREA JUL CPI +2.6% Y/Y; MEDIAN +2.4%; JUN +2.4%

SOUTH KOREA JUL CPI +0.2% M/M; MEDIAN 0.0%; JUN -0.1%

SOUTH KOREA JUL CORE CPI +1.7% Y/Y; MEDIAN +1.5%; JUN +1.5%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1666% at 09:25 am local time from the close of 2.0228% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday vs 39 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4610 TUES VS 6.4660

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4610 on Tuesday, compared with the 6.4660 set on Monday.

MARKETS

SNAPSHOT: RBA Sticks With Taper Plan, RBNZ Unveils Net MacroPru Move

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 153.41 points at 27627.11

- ASX 200 down 25.45 points at 7466

- Shanghai Comp. up 0.021 points at 3464.306

- JGB 10-Yr future up 10 ticks at 152.42, yield down 0.7bp at 0.010%

- Aussie 10-Yr future up 2.0 ticks at 98.845, yield down 2bp at 1.161%

- U.S. 10-Yr future -0-02 at 134-29, yield up 0.33bp at 1.181%

- WTI crude down $0.08 at $71.18, Gold down $2.45 at $1811.18

- USD/JPY down 13 pips at Y109.17

- FED GOV. WALLER SEES TAPER POSSIBLY STARTING IN OCT (CNBC)

- CHINA SHOULD SPUR GROWTH WITH MONETARY, FISCAL POLICY (SEC. TIMES)

- UK PM JOHNSON SCRAPS PLAN FOR AMBER COVID WATCHLIST AFTER CABINET REVOLT (THE TIMES)

- RBA STICKS WITH TAPER PLAN EVEN AS VIRUS DENTS ECONOMY (BBG)

- RBNZ TO FURTHER LIMIT MORTGAGES AMID RELENTLESS HOUSING BOOM (BBG)

- TENCENT TUMBLES AFTER CHINESE MEDIA CALLS ONLINE GAMING "SPIRITUAL OPIUM" (RTRS)

BOND SUMMARY: 2-Way Flow On China Reg. Worry & RBA Sticking With Taper Plans

T-Notes squeezed to Asia-Pac session highs as China outlined a crackdown on auto chip sellers surrounding pricing matters, which came after worry surrounding a clampdown on the internet gaming sector in the wake of comments made by state-run media outlets earlier in the day. Dynamics in the Aussie bond space then pulled Tsys away from best levels. T-Notes -0-02 at 134-30 as a result, with cash Tsys little changed to 0.5bp cheaper across the curve.

- JGB futures stuck to a narrow range, last +10 on the day, with the major cash benchmarks running 0.5-1.5bp richer as 30s outperform. 0.01% in yield terms continues to cap the 10-Year JGB rally. There was no reaction in futures or cash 10s as the latest 10-Year JGB auction provided a mediocre result. The tail widened a touch from the previous round of 10-Year supply but was still relatively narrow. Elsewhere, the cover ratio ticked lower but remained just above the 6-auction average (3.271x). The low price witnessed at the auction provided a marginal miss vs. broader expectations (100.87 per the BBG dealer poll). We highlighted some outright valuation headwinds ahead of supply, although some of the relative value that we touched on may have helped the auction pass without any real problems.

- Aussie bond futures have moved away from best levels of the day in the wake of the RBA decision, with the central Bank not to reneging on its tapering plans. Market consensus looked for the tapering decision to be reversed. The Bank noted short-term uncertainty, while underlining the flexibility of its bond buying and its central scenario re: interest rates, while its medium-term economic projections look in line with wider exp. It also underscored the recent strength witnessed in the labour market and pointed to underlying CPI printing around 2.25% come the end of '23. Expect more colour on the decision in our full review. YM -0.5 with XM +2.5 at typing, with both trading off respective reaction lows.

JGBS AUCTION: Japanese MOF sells Y2.0991tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0991tn 10-Year JGBs:

- Average Yield 0.009% (prev. 0.058%)

- Average Price 100.89 (prev. 100.41)

- High Yield: 0.012% (prev. 0.059%)

- Low Price 100.86 (prev. 100.40)

- % Allotted At High Yield: 31.6719% (prev. 86.3638%)

- Bid/Cover: 3.333x (prev. 3.541x)

EQUITIES: Asia Markets Lower

A negative day for equity markets in Asia, equity markets slipping after gains yesterday but a slightly negative lead from the US. The Hang Seng leads the way lower with losses of almost 1.5%, Tencent has dragged the index down as markets evaluate implications of Beijing's broad crackdown on Chinese internet giants with some negative press reports also doing the rounds. Markets in mainland China are lower by around 0.5%, coronavirus concerns are becoming more of an issue; there were 61 cases in the past 24 hours, up from 55 the day before. As a result of the steadily increasing numbers millions of people have been placed under lockdown. Markets in South Korea and Taiwan are slightly lower, there are some marginal gains in other emerging market indices. In the US futures are slightly higher, e-mini Dow and e-mini S&P contracts seeing small gains and e-mini Nasdaq flat.

OIL: Holding Losses

Crude futures slightly higher but most of Monday's drop. WTI is up $0.07 from settlement levels at $71.33/bbl, Brent is up $0.04 at $72.93/bbl. Oil benchmarks retreated Monday, with the active WTI and Brent futures contracts off over 3.5% despite relatively sanguine markets elsewhere. WTI futures were mean reverting, with prices gravitating towards the 50-DMA at $70.55/bbl. Macro data may have added some weight, with China's manufacturing PMI and the US ISM manufacturing release below expectations. This, twinned with OPEC's recent supply deal weighed on energy markets on Monday. There could be further headwinds the latest wave of coronavirus infections continues to dominate headlines in Asia, the latest figures from Indonesia showed that gasoline usage fell almost 25% due to lockdown restrictions in July while cases in China are ticking higher. Markets look ahead to earnings from BP and US API inventory data.

GOLD: Consolidating

Bullion has consolidated around the middle of the recently observed range over the last 24 hours, with the DXY a touch lower and our weighted U.S. real yield monitor a little higher over that horizon. Monday's well-documented taper-related comments from Fed Governor Waller did little to stir bullion, with spot operating well within the confines of the well-defined technical overlay, last dealing at $1,810/oz. Fed Vice Chair Clarida's latest address (Wednesday) and the latest U.S. NFP print (Friday) are set to provide the key inputs for participants during the remainder of the week.

FOREX: Antipodean FX Get Fillip From Hawkish Central Banks

The RBNZ released a statement outlining their intention to step up efforts to reign the roaring housing market by tightening mortgage lending standards. The statement added that the MPC "needs to think about when and how we would return interest rates to more normal levels, which are neither unnecessarily giving the economy a push forward nor holding it back," while the "next opportunity to publicly address this issue is the 18 August Monetary Policy Statement". The Reserve Bank's intensified crackdown on property prices and hawkish rhetoric provided a boost to OCR hike bets, with the OIS strip currently pricing an ~84% chance of a 25bp hike at the August meeting, up from ~65% yesterday. Hawkish RBNZ repricing pushed NZD to the top of the G10 scoreboard in early Asia-Pac trade.

- AUD caught up with its Antipodean cousin, when the RBA defied market consensus and chose to stick with its tapering plan, despite the ongoing resurgence of Covid-19 in Australia. AUD/NZD clawed back its earlier losses in a single bounce following RBA decision announcement, while NZD extended gains vs. other major currencies as spillover from across the Tasman gave it a shot in the arm.

- USD and CAD went offered across the board despite the absence of notable local headline catalysts. Canadian markets were shut Monday in observance of a public holiday.

- Spot USD/CNH was rangebound, with an in-line PBOC fix providing no material impetus.

- U.S. factory orders & final durable goods orders headline the global data docket going forward, while Fed's Bowman will speak at a Fed conference.

FOREX OPTIONS: Expiries for Aug03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-55($1.4bln), $1.1880-00(E1.0bln), $1.2000(E868mln)

- USD/JPY: Y110.00($775mln)

- USD/CAD: C$1.2480($1.2bln)

- USD/CNY: Cny6.4780($1bln), Cny6.5000($1.3bln)

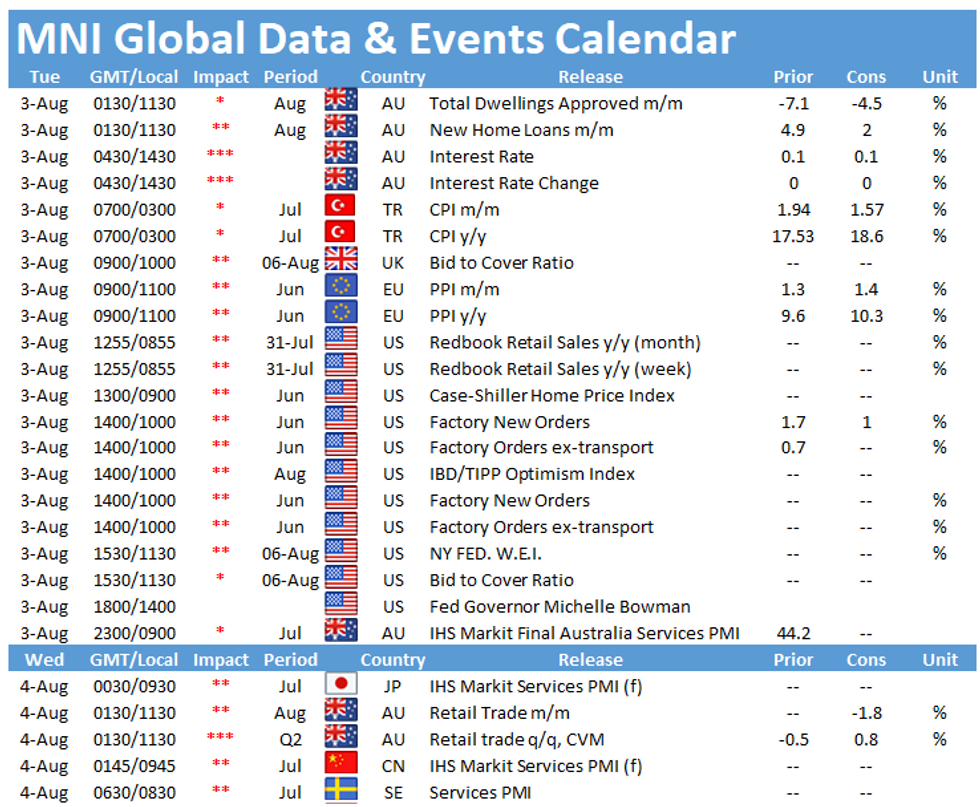

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.