-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NFP Day

EXECUTIVE SUMMARY

- FED'S KASHKARI: DELTA MAY THROW WRINKLE INTO TAPER PLAN (RTRS)

- MANCHIN: FED SHOULD REVERSE EASY-MONEY POLICIES (WSJ)

- U.S. FDA COVID-19 VACCINE BOOSTER PLAN COULD BE READY WITHIN WEEKS (WSJ)

- MODERNA RECOMMENDS COVID VACCINE BOOSTER TO PROTECT AGAINST VARIANTS (WSJ)

- RBA DEBATED SUSPENDING QE TAPER; MONITORING COVID CRISIS (DJ)

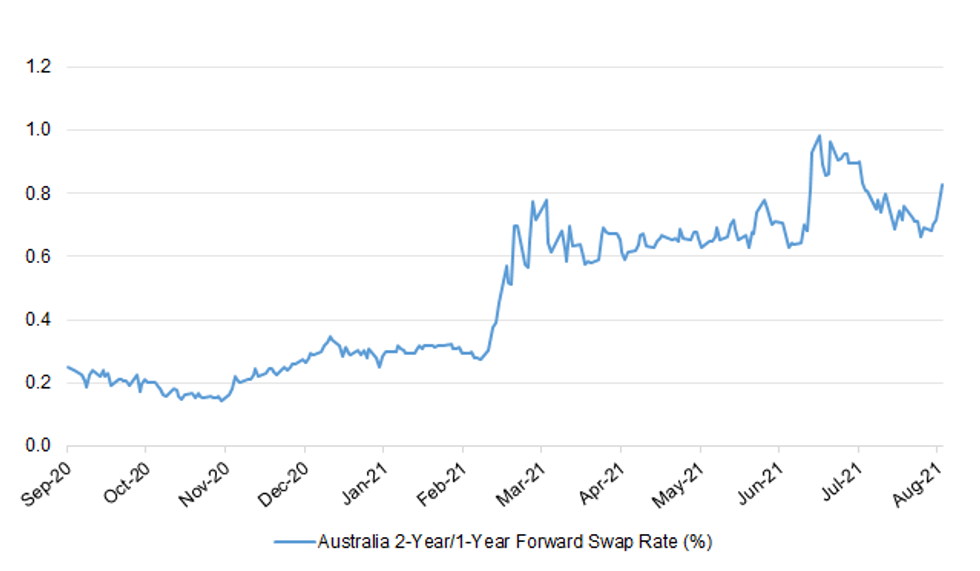

Fig. 1: Australia 2-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Young people will be told to get a coronavirus vaccine or miss out on fun as ministers employ veiled threats to boost waning take-up rates. A billboard and social media campaign will try to convince the under-30s that they will not be able to enjoy themselves fully without having their jabs. Adverts running on platforms such as Instagram, Snapchat and TikTok as well as music radio will tell them to have a jab or "miss out on the good times" as ministers plan to introduce vaccination passports in the autumn. Boris Johnson is said to have been "raging" about relatively low youth uptake and had to be talked out of requiring vaccination for students returning to university in the autumn. (The Times)

CORONAVIRUS: Chancellor of the Exchequer Rishi Sunak unveiled a state-backed insurance plan worth more than 750 million pounds ($1 billion) to boost the U.K. events industry in the wake of the Covid-19 pandemic. The program, called the Live Events Reinsurance Scheme, will run from next month until the end of September 2022, the Treasury said on Thursday in an emailed statement. The government is working with Lloyd's of London and will act as a reinsurer to give insurers the confidence they need to provide cover. The plan is designed to get the 70 billion-pound live events sector up and running again after 18 months of coronavirus restrictions. Music festivals and other businesses have been calling for such a program to reduce the risks of organizing an event in the face of the threat of a resurgent virus. (BBG)

ECONOMY: MNI BRIEF: UK Starting Salaries Up As Worker Supply Slumps

- The UK jobs market continued to power ahead in July, but employers are finding it increasingly difficult to hire the staff needed to fill vacancies, a report published Friday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EUROPE

ITALY: Italy is doubling down on vaccine passports. Following a decision to limit access to activities such as indoor dining to holders of a "green pass" beginning Friday, the Rome-based government has approved new restrictions on travel and schools, Health Minister Roberto Speranza said in press conference on Thursday evening in Rome. (BBG)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Fitch on Norway (current rating: AAA; Outlook Stable)

- Moody's on the Czech Republic (current rating: Aa3; Outlook Stable) & Malta (current rating: A2; Outlook Stable)

- S&P on the European Stability Mechanism (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Luxembourg (current rating: AAA, Stable Trend)

U.S.

FED: Minneapolis Federal Reserve President Neel Kashkari on Thursday said the highly transmissible Delta variant of the novel coronavirus could throw a "wrinkle" into the labor market recovery and the timeline for a reduction in the Fed's asset-purchase program. (RTRS)

FED: Sen. Joe Manchin (D., W.Va.) raised alarms about inflation in a letter to Fed Chairman Jerome Powell on Thursday, calling on the central bank to start reversing the emergency support it has provided during the coronavirus pandemic. "With the recession over and our strong economic recovery well underway, I am increasingly alarmed that the Fed continues to inject record amounts of stimulus into our economy," he wrote. (WSJ)

ECONOMY: MNI REALITY CHECK: US July Hiring Unchecked By Covid Surge

- The pace of hiring in July improved just slightly over June as business optimism increased despite a fresh spike of Covid-19 infections tied to the spread of the Delta variant and renewed mask mandates in some parts of the country, recruiters and industry experts told MNI, although noting a shortage of available workers and continued upward pressure on wages are still slowing growth - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Chuck Schumer moved on Thursday night to cut off debate on the $1.2 trillion bipartisan infrastructure bill, paving the way for swift passage of the sweeping legislation that would enact key elements of President Joe Biden's economic agenda, although exact timing of a final vote is still unclear. Schumer's move to file cloture sets up a key procedural vote on Saturday, which needs 60 votes to end debate on the bill. But senators are still having discussions about a series of votes late Thursday, including a possible vote on final passage. However, given the timing, that seems increasingly unlikely. If the procedural vote goes forward on Saturday, and 60 senators vote to advance the bill, then there would be a limited time for debate followed by additional votes -- and then final passage. At that point, passage could occur as early as Saturday if all senators agree. If not, the vote would slip until early next week. (CNN)

FISCAL: Senate Minority Leader Mitch McConnell promised Thursday that Republicans will not support a debt ceiling hike, just as Democrats have signaled they plan to take a path that would require Republican support. Democrats had talked about including an increase to the nation's borrowing authority in their $3.5 trillion budget plan, but this week indicated they would forgo the measure in the party-line bill. "If our colleagues want to ram through yet another reckless tax and spending spree without our input, if they want all this spending and debt to be their signature legacy, they should leap at the chance to own every bit of it," the Kentucky Republican said on the floor. "So let me make something perfectly clear: if they don't need or want our input, they won't get our help with the debt limit increase that these reckless plans will require," McConnell said. "I could not be more clear. They have the ability to control the White House, to control the House, to control the Senate. They can raise the debt ceiling." (POLITICO)

FISCAL: The Congressional Budget Office (CBO) on Thursday released an analysis saying the $1 trillion bipartisan infrastructure package would add $256 billion to the federal deficit over the next decade, a difficult pill to swallow for GOP senators who have insisted on paying for the entire cost of the legislation. The budget office estimates the bill would increase discretionary spending by $415 billion over 10 years while increasing revenues by $50 billion and decreasing direct spending by $110 billion. "On net, the legislation would add $256 billion to projected deficits over that period," CBO reported in its summary. (The Hill)

CORONAVIRUS: More and more people who were once vaccine hesitant in several Southern states are now getting their first shots as the delta Covid variant rips through areas of the U.S. with low immunizations rates. In Arkansas, Mississippi, Louisiana and Alabama, the seven-day average of daily reported first doses has more than doubled since the start of July, Centers for Disease Control and Prevention data shows, as the outbreak has worsened nationwide. (CNBC)

CORONAVIRUS: The Food and Drug Administration expects to have a strategy on Covid-19 vaccine boosters by early September that would lay out when and which vaccinated individuals should get the follow-up shots, according to people familiar with discussions within the agency. The Biden administration is pushing for the swift release of a booster strategy because some populations -- people age 65 or older and people who are immunocompromised, as well as those who got the shots in December or January shortly after they were rolled out -- could need boosters as soon as this month, two of the people said. Any booster strategy from the U.S. government will have to balance the need to address declining protection for certain people at a time when vaccines remain in short supply in the developing world. (Dow Jones)

CORONAVIRUS: Federal health officials are working "as quickly as possible" to authorize a third Covid-19 vaccine shot for Americans with weakened immune systems, White House chief medical advisor Dr. Anthony Fauci said Thursday. It is clear now that such people – including cancer and HIV patients or those who have had organ transplants – in general do not produce an adequate immune response after receiving two doses of a Covid vaccine, Fauci said. (CNBC)

CORONAVIRUS: Novavax Inc. said it expected to apply for U.S. emergency-use authorization of its Covid vaccine in the fourth quarter, another delay in its bid to gain approval of the closely watched shot. Novavax filed for emergency clearance of its Covid vaccine in India, Indonesia and the Philippines, according to an emailed statement. A study showed a second dose of the shot resulted in four times more protective antibodies against the virus than the first, the statement said. (BBG)

CORONAVIRUS: The Biden administration is considering using federal regulatory powers and the threat of withholding federal funds from institutions to push more Americans to get vaccinated — a huge potential shift in the fight against the virus and a far more muscular approach to getting shots into arms, according to four people familiar with the deliberations. The effort could apply to institutions as varied as long-term-care facilities, cruise ships and universities, potentially impacting millions of Americans, according to the people, who spoke on the condition of anonymity to discuss sensitive conversations. (Washington Post)

CORONAVIRUS: The White House on Thursday confirmed it may require visitors from abroad to be vaccinated as part of its plans to eventually reopen international travel but said it had yet to decide and would not immediately lift restrictions. (RTRS)

CORONAVIRUS: Hospitals will be required to track and report vaccination status for their health-care personnel to comply with a rule from the Biden administration. The requirement is an effort to "support public health tracking and provide patients, beneficiaries, and their caregivers important information to support informed decision making," according to the Centers for Medicare & Medicaid Services. Hospitals are required to report certain quality measures to the CMS or risk losing funding. (BBG)

CORONAVIRUS: California mandates coronavirus vaccination for all health care workers, affecting more than 2 million people. (AP)

CORONAVIRUS: Some school districts in Florida are pushing back against Republican Governor Ron DeSantis's executive order that forbids them from mandating students to wear masks. DeSantis signed the order on July 30 dictating that schools should leave masking decisions to parents. It also said that if the State Board of Education determines a district is unwilling or unable to comply with the order, the board can withhold the transfer of state funds until the district complies. "The fairest thing to do is to let parents make the decision," DeSantis said during a press conference on Thursday. (BBG)

CORONAVIRUS: BlackRock Inc. and Wells Fargo & Co. are pushing their return-to-office plans back a month to early October, as Wall Street grapples with rising Covid-19 rates across the U.S. BlackRock is allowing workers to choose whether to come into U.S. offices through Oct. 1, according to a memo. Wells Fargo, with almost 260,000 employees, will now begin bringing back staffers who have been working remotely starting Oct. 4 rather than Sept. 7, as previously announced, according to an internal memo Thursday from Chief Operating Officer Scott Powell. (BBG)

CORONAVIRUS: Amazon is postponing a return to the office for its corporate employees until early next year, becoming the latest tech company to do so amid a rise in Covid-19 cases due to the highly contagious delta variant. Corporate employees in the U.S. and some other countries will begin returning to the office beginning Jan. 3, 2022, the company confirmed to CNBC. Previously, Amazon had said it expected most of its employees to begin returning regularly to the office the week of Sept. 7 of this year. (CNBC)

BANKS: The U.S. Federal Reserve announced on Thursday how much each large bank that underwent the most recent stress test will have to hold on their books as capital cushions. The capital requirements for each of the 34 banks are based on how well each firm performed in the June test, and will take effect on Oct. 1. Goldman Sachs and Morgan Stanley were directed to hold the largest amount of capital to guard against losses, facing ratios of 13.4% and 13.2%, respectively. The ratios are part of the new "stress capital buffer" regime established by the Fed, which allows the central bank to set custom capital requirements for each bank, depending on how severely each firm faced losses under the annual stress test. (RTRS)

OTHER

U.S./CHINA: China fell slightly in strategic priority for American companies over the past year as deteriorating relations between the countries continued to weigh heavily on executives, according to the annual US-China Business Council (USCBC) member survey released on Thursday. While China remained among top priorities for US companies, it has become a little less important. As many as 74 per cent of the companies executives surveyed considered China as top or among top five priorities, while that number was as high as 94 per cent a decade ago. (SCMP)

U.S./CHINA: Nearly three dozen of the nation's most influential business groups—representing retailers, chip makers, farmers and others—are calling on the Biden administration to restart negotiations with China and cut tariffs on imports, saying they are a drag on the U.S. economy. The tariffs on electronics, apparel and other Chinese goods, which are paid by U.S. importers, were kept in place in part to ensure that China fulfills its obligations under its 2020 Phase One trade pact with the U.S. In a Thursday letter to U.S. Trade Representative Katherine Tai and Treasury Secretary Janet Yellen, the business groups contend that Beijing had met "important benchmarks and commitments" in the agreement, including opening markets to U.S. financial institutions and reducing some regulatory barriers to U.S. agricultural exports to China. (WSJ)

U.S./CHINA: MNI INTERVIEW: U.S.-China Need Financial Talks Restart - Advisor

- China and the U.S. need to move faster on financial and trade talks even when they agree to disagree, a senior advisor to the Chinese government and founder of the Center for China and Globalization told MNI in an interview. There is a growing risk of a "double-edged sword" of national security concerns fuelling continued tit-for-tat crackdowns by the U.S. and China in trade and business ties that will just end up hurting global economic recovery efforts, said Wang Huiyao, a counselor for China's State Council and president of the Beijing-based think tank CCG - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

U.S./CHINA: MNI INTERVIEW: U.S.-China Trade Deal Chances Slim: Chen Deming

- China and the U.S. are unlikely to agree a Phase Two trade deal as there has been no reset of relations between Beijing and Washington under the Biden administration, a former senior official told MNI in an interview. "I have no big hope that China and the U.S. relationship could make a big breakthrough during Biden's (four-year) term," former Commerce Minister Chen Deming told MNI on the sidelines of an annual conference hosted by the Center for China and Globalization a Beijing-based think tank - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

U.S./CHINA/HONG KONG: Thousands of Hong Kong residents are to be offered a temporary "safe haven" in the US, President Joe Biden says. Mr Biden said that because Hong Kong's freedoms were being violated by China, the US would allow visitors to stay for a period of 18 months. Thousands of Hong Kong residents already in the US may benefit. The UK has offered people from Hong Kong a path towards permanent residency following last year's adoption of China's security law for the territory. The law criminalises what are deemed to be acts of secession, subversion, terrorism and collusion. Mr Biden said there were "compelling foreign policy reasons" to allow Hong Kong visitors to stay. He said China had been "undermining its remaining democratic processes and institutions, imposing limits on academic freedom, and cracking down on freedom of the press". He pointed to the arrests of over 100 people, including activists and opposition politicians, under the new security regime. However, Liu Pengyu, the spokesman for China's embassy in Washington, criticised the US government's actions, which he said "disregard and distort facts, and grossly interfere in China's internal affairs". (BBC)

CORONAVIRUS: Moderna Inc. said Thursday it expects people who received its two-dose Covid-19 vaccine to need a booster shot in the fall to keep strong protection against newer variants of the coronavirus. The company said its vaccine remains 90% effective against preventing Covid-19 disease for at least six months, but said it sees a decline in antibody levels after six months, especially against newer strains of the coronavirus including the Delta variant. In a Phase 2 study, a third shot of the original formulation showed robust antibody responses against Covid-19 variants of concern, Moderna said. Moderna Chief Executive Stéphane Bancel said in an interview Thursday that the company plans to seek regulatory approval for its booster shots in September, after it analyzes data from ongoing trials. (WSJ)

CORONAVIRUS: President Xi Jinping pledged to dramatically expand Covid-19 vaccine exports to two billion doses this year, matching commitments by Group of Seven nations amid warnings about inoculation shortages in the developing world. Xi announced the goal Thursday in a written address to the first International Forum on Covid-19 Vaccine Cooperation hosted by Foreign Minister Wang Yi, state broadcaster China Central Television said. The country would also donate $100 million to Covax, the international program backed by the World Health Organization that provides developing countries with vaccines, Xi said. (BBG)

JAPAN: Shionogi aims to file an application for Japan approval of its once-a-day Covid-19 pill by the end of this year, CEO Isao Teshirogi says in interview with the Mainichi newspaper. (BBG)

JAPAN: The Japanese government reached an agreement with Pfizer to receive 6m more doses of its Covid-19 vaccine in the period between July and Sept., nation's vaccine czar Taro Kono said at a news conference Thursday, according to public broadcaster NHK. Japan will now receive a total 76m doses of Pfizer vaccine in the period. (BBG)

RBA: The Reserve Bank of Australia debated suspending a planned reduction in its weekly government bond buying program at its policy meeting Tuesday, but elected to allow fiscal stimulus to do the heavy lifting of the economy as the country faces a potential plunge back into recession amid a worsening Covid-19 outbreak. In a testimony before parliament on Friday, RBA Gov. Philip Lowe said the central bank's board was willing to adjust policy settings, if conditions in the economy continue to deteriorate over the coming months. (MarketWatch)

RBA: MNI: RBA Policy View Expects Bounceback From Recent Lockdowns

- The Reserve Bank of Australia has forecast third quarter GDP growth will see a contraction of 1%, but is still expecting annualised economic growth of 4% by the end of 2021. The forecast is contained in the quarterly Statement on Monetary Policy, released on Friday, which shows that under its baseline scenario the central bank expects the current pandemic lockdowns to cut 75 basis points off its previous GDP forecast for 2021, published in May. The May statement was for a 4.75% growth rate at the end of 2021 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Sydney's daily delta outbreak caseload has risen to another record, with 291 new infections detected and authorities warning the situation in Australia's largest city could worsen. The city has failed to bend the curve of new infections lower despite being in lockdown for almost six weeks. The new cases surpass the previous record number of new infections of 262 on Thursday; one more person died. (BBG)

AUSTRALIA/CHINA: The coming week will also see the country's most populous cities, Sydney, Melbourne and Brisbane, under lockdown. Meanwhile, Australia's vaccination has been slow to get off the ground, with only 20 percent of its population over 16 fully vaccinated. It is conceivable that strengthened epidemic prevention and control measures following the resurgence of the outbreak will have an impact on China-Australia trade. Domestically, China has also seen the spread of the Delta variant in a number of provinces and regions over past weeks, which is almost certain to lead to enhanced quarantine and inspection procedures involving some imported products at Chinese customs. Based on past experience, it is possible that imports of cold-chain food may suffer certain negative impacts in terms of stricter importing procedures. Given the tensions between China and Australia, any minor setback encountered by Australian exports to China could be seen by some Australian politicians as the so-called China's "economic retaliation." Yet, in fact, the China-Australia trade has not been hit as hard as many have claimed. (Global Times)

SOUTH KOREA: South Korea's daily new coronavirus cases remained in the 1,700s for the third straight day Friday amid few signs of a slowdown, triggering the extension of the toughest level of virus restrictions for two additional weeks. (Yonhap)

NORTH KOREA: {NK} North Korea is continuing its nuclear weapons program despite its economy worsening due to COVID, according to a U.N. report obtained by Nikkei. (Nikkei)

NORTH KOREA: Foreign Minister Chung Eui-yong and U.S. Secretary of State Antony Blinken agreed to make continued efforts to engage with North Korea and foster lasting peace on the Korean Peninsula during their phone talks Friday, the foreign ministry said. The talks came after last week's restoration of inter-Korean communication channels fueled hopes for the resumption of nuclear diplomacy with North Korea, though growing optimism for dialogue was tempered by the North's warning that the planned South Korea-U.S. military exercise would cast clouds over inter-Korean relations. "The minister and secretary agreed that the South and the U.S. would continue to make coordinated diplomatic efforts for substantive progress toward the goal of the complete denuclearization and establishment of permanent peace on the Korean Peninsula," the ministry said in a press release. "Especially, the two countries held concrete consultations on ways for cooperation with the North, including humanitarian cooperation, and agreed to continue efforts for engagement with the North," it added. The U.S. State Department said Blinken reiterated U.S. support for inter-Korean reconcilation. (Yonhap)

NORTH KOREA: The U.S. is open to offering humanitarian assistance to North Korea, U.S. Ambassador to the United Nations Linda Thomas-Greenfield said Thursday, signaling Washington's willingness to revive dialogue with Pyongyang. (Nikkei)

TURKEY: Turkey President Recep Tayyip Erdogan names Mahmut Ozer as new education minister, according to Official Gazette. No reason was given for resignation of Selcuk. Erdogan also replaces three deputy education ministers. Separately, Erdogan appoints three vice presidents to statistics agency. (BBG)

MEXICO: Mexico is making the education sector an essential activity, so schools can reopen with social distancing measures even under high Covid-19 alert, Deputy Health Minister Hugo Lopez-Gatell told governors in a meeting. (BBG)

BRAZIL: President Jair Bolsonaro's relentless attack on Brazil's voting system soured his relationship with the Supreme Court, leaving the country on the brink of an institutional crisis. Top Justice Luiz Fux on Thursday canceled plans for a meeting with Bolsonaro and the heads of congress that was intended to defuse rising tensions between them. The move came a day after the court allowed an investigation of the far-right president over his unsubstantiated claims of election fraud. "The president has repeatedly offended and attacked members of this court," Fux said, adding that Bolsonaro continues to sow doubts about the integrity of the country's electoral system. "Facing these circumstances, the Supreme Court informs that it has canceled the previously announced meeting between the heads of government." (BBG)

BRAZIL: Brazil President Jair Bolsonaro said during his weekly broadcast on social media he's questioning justices Luis Roberto Barroso and Alexandre de Moraes not attacking the Supreme Court or top electoral court. Bolsonaro denied fighting with top Supreme Court Justice Luiz Fux and invited him to meet. Bolsonaro defended dialogue between govt powers. (BBG)

BRAZIL: A special lower house committee rejected a constitutional amendment proposed by the allies of President Jair Bolsonaro that would have required a paper record for every vote cast. Committee members voted 23 against and 11 in favor. The bill will still be discussed by lawmakers on lower house floor. Date for discussion wasn't schedule; depends on decision of speaker, Arthur Lira. (BBG)

BRAZIL: Brazil Senate approved a bill that opens a tax debt refinancing program with forgiveness of up to 90% in fines and interest and 100% in charges for debts of companies and individuals, O Estado de Sao Paulo newspaper reported. Debts may be paid in 12 years. Bill will now be analyzed by the lower house. (BBG)

RUSSIA: We regret Russian authorities' restrictions will prevent the @osce_odihr and @oscepa from independently observing the Duma elections. Though observers won't be present, the world will be watching. Russia can't escape the international spotlight.

SOUTH AFRICA: South African President Cyril Ramaphosa appointed the ruling party's head of economic policy Enoch Godongwana as finance minister, after Tito Mboweni resigned. The rand plunged. Mboweni's replacement was among several changes to the cabinet announced by Ramaphosa on Thursday. The appointment of Godongwana, 64, follows months of speculation about Mboweni's position in the government after he said he would favor a return to the private sector. (BBG)

IRAN: Iranian and Western officials have said significant gaps remain in the nuclear talks and have yet to announce when the talks, whose last round ended on June 20, will resume. The United States urged Raisi to resume talks "soon," saying the diplomatic window would not stay open forever. "We hope that Iran seizes the opportunity," State Department spokesman Ned Price said. (RTRS)

COPPER: The main union at Escondida, the world's largest copper mine, has called on workers in Chile to be ready to strike Escondida Union Asks Members to Be Ready for Strike in Chile with only limited progress so far in mediated talks with owner BHP. In a note to members, the union said the company's proposal hadn't changed substantially in the first three days of mediation. With an initial five-day meditation period requested by the company ending midnight Aug. 9, there is little time remaining to reach a satisfactory proposal, the union said. If the two sides fail to reach a deal by then, they could agree to extend mediation for up to five more business days or a legal strike could start. "We call on you to maintain union unity and discipline and be prepared to face the prospect of an eventual strike'.' In an initial ruling, labor authorities allowed a 50-person emergency team in the event of a strike. (BBG)

OIL: Iraq Finance Minister: OPEC's next battle will be fought over which member exports the most oil. (BBG)

CHINA

POLICY: China is making sure that its goal of preventing risks is aligned with new pro-growth policies, and that leverage is under control when introducing either fiscal or monetary stimulus, the 21st Century Business Herald said commenting on the politburo's emphasis on "cross-cycle" measures in its latest economic meeting. The wording implies an approach not focusing on short-term growth but rather laying a foundation for new growth drivers, such as structural investments that help boost new-energy vehicles, low-cost housing, national pension insurance, and third-child policy, which use leverage to expand private consumption, the newspaper said. (MNI)

MONEY SUPPLY/CREDIT: China's total outstanding aggregate financing in July may have slowed by 0.1 pp to 10.9% y/y, due to slower issuances of government and corporate bonds, the Economic Daily reported citing analysts. The growth rate is now close to the pre-pandemic level and likely to rebound in Q4 due party to faster pace of government bond sales, the newspaper said citing Li Qilin, chief economist of Hongta Securities. Analysts generally expect a looser money supply though are divided on whether the tight credit situation would actually change in H2, the newspaper said. The PBOC may further cut the banks' reserve requirement ratios in Q4 to offset maturing MLFs totaling CNY2.45 trillion, the newspaper said citing Li Chao, chief economist of Zheshang Securities. Some believe the authority will increase lending support for high-end manufacturing, green sectors and SMEs while strictly monitoring the financing in real estate and by local government financing vehicles, the newspaper added. (MNI)

ECONOMY: China's economy is growing steadily but the domestic recovery still remains unstable and unbalanced, while momentum in demand growth is weak, National Development and Reform Commission Vice Chairman Ning Jizhe wrote in a People's Daily commentary. Ning said in the article published on Friday that close attention needed to be paid to new problems that had emerged amid the recovery, such as in the area of employment. Still, China's overall employment situation was generally stable, household incomes were experiencing growth and the country's balance of payments continued to improve, he said. (RTRS)

YUAN: China should first allow wider use of its digital yuan to allow more global use of its currency so that it can bypass the traditional financial information and fund settlement system, controlled by the U.S. and avoid having the U.S. monitor its transactions, wrote Qiao Xinsheng, professor of Zhongnan University of Economics and Law in a commentary run by Securities Times. Qiao suggests starting the process from service trade by allowing Chinese travelers overseas to use digital yuan to exchange local currency in China's state-owned commercial banks' overseas branches, the newspaper said. The traditional financial settlement system is based on the U.S. dollar, while the U.S. can have other countries' trade and investment information as well as imposing sanctions on companies and individuals, the newspaper said. (MNI)

CORONAVIRUS: China reported on Friday its highest daily count for new coronavirus cases in its current outbreak, fuelled by a surge in locally transmitted infections. (RTRS)

OVERNIGHT DATA

JAPAN JUN LABOUR CASH EARNINGS -0.1% Y/Y; MEDIAN +1.1%; MAY +1.9%

JAPAN JUN REAL CASH EARNINGS -0.4% Y/Y; MEDIAN +1.2%; MAY +2.0%

JAPAN JUN HOUSEHOLD SPENDING -5.1% Y/Y; MEDIAN +0.2%; MAY +11.6%

JAPAN JUN, P LEADING INDEX 104.1; MEDIAN 104.2; MAY 102.6

JAPAN JUN, P COINCIDENT INDEX 94.0; MEDIAN 94.0; MAY 92.1

SOUTH KOREA JUN BOP CURRENT ACCOUNT BALANCE +$8.8469BN; MAY +$10.7612BN

SOUTH KOREA JUN BOP GOODS BALANCE +$7.6183BN; MAY +$6.3674BN

CHINA MARKETS

PBOC NET DRAINS CNY20BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation resulted in a net drain of CNY20 billion given the maturity of CNY30 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1166% at 09:28 am local time from the close of 1.9415% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 43 on Thursday vs 33 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4625 FRI VS 6.4691

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4625 on Friday, compared with the 6.4691 set on Thursday.

MARKETS

SNAPSHOT: NFP Day

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 82.17 points at 27810.38

- ASX 200 up 2.751 points at 7513.9

- Shanghai Comp. down 16.702 points at 3449.847

- JGB 10-Yr future down 8 ticks at 152.30, yield up 0.8bp at 0.015%

- Aussie 10-Yr future down 2.5 ticks at 98.825, yield up 2.6bp at 1.181%

- U.S. 10-Yr future -0-05+ at 134-10+, yield up 1.17bp at 1.235%

- WTI crude up $0.14 at $69.23, Gold down $3.8 at $1800.60

- USD/JPY up 5 pips at Y109.82

- FED'S KASHKARI: DELTA MAY THROW WRINKLE INTO TAPER PLAN (RTRS)

- MANCHIN: FED SHOULD REVERSE EASY-MONEY POLICIES (WSJ)

- U.S. FDA COVID-19 VACCINE BOOSTER PLAN COULD BE READY WITHIN WEEKS (WSJ)

- MODERNA RECOMMENDS COVID VACCINE BOOSTER TO PROTECT AGAINST VARIANTS (WSJ)

- RBA DEBATED SUSPENDING QE TAPER; MONITORING COVID CRISIS (DJ)

BOND SUMMARY: Tsys Drift Lower In Pre-NFP Asia Trade

T-Notes have seen some modest pressure overnight, with Thursday's cheapening impetus seemingly spilling over into Asia-Pac dealing given the lack of macro headline flow, allowing the contract to move through Thursday's trough. Still the contract continues to operate within a fairly narrow 0-05 range, last -0-05 at 134-11, 0-01 off lows. Cash Tsys print ~0.5-1.5bp cheaper on the day, with some modest bear steepening in play. The most notable round of overnight flow has focused on the upside, with the TYU1 134.00/135.00 call spread lifted 10K times (5.0K outright, 5.0K covered). The monthly NFP print headlines the NY docket on Friday.

- JGB futures have played catch up after outperforming overnight, last sitting 8 ticks below yesterday's settlement levels. The cash JGB curve saw some light twist steepening pressure around the belly of the curve, although yields sit within the confines of -/+1.0bp vs. yesterday's closing levels in net terms. The latest round of domestic wage and household spending data provided a notable set of misses vs. exp. A quick reminder that Japan will observe a national & market holiday on Monday, so JGBs will be closed.

- Over in Australia YM is -2.0 & & XM is -2.5 at typing, although the drift lower in U.S. Tsys seems to be the driving factor there, as opposed to developments surrounding the RBA. We had most of the loose details surrounding the RBA's key economic projections on Tuesday, via the statement that accompanied the Bank's latest monetary policy decision. The tone of RBA Governor Lowe's testimony was upbeat (matching the "half full" label on his coffee cup), albeit cognisant of risk, which was reflected in the Bank's '21 projections re: economic growth (only shaving 0.75ppt off of its '21 GDP growth call, despite the recent lockdowns), while the Bank marked its '22 GDP exp. higher, aided by base effects. The Bank's end '21 unemployment rate estimate was left unchanged at 5.0%. Comments surrounding the AUD (effectively happy with AUD weakness, although noting it wasn't a target) & macroprudential matters (no need at present but could be a need in a year or so) generated the most interest when it came to Lowe's address. A$700mn of ACGB Nov '25 supply passed smoothly, with the weighted average yield printing 0.75bp through prevailing mids at the time of supply (per Yieldbroker). The latest AOFM weekly issuance schedule sees a slightly longer long bond on offer next week (ACGB 3.25% 21 June 2039), although the size of that auction will be a tiny A$300mn (A$523K DV01).

JGBS AUCTION: Japanese MOF sells Y4.0613tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0613tn 3-Month Bills:

- Average Yield -0.1106% (prev. -0.1062%)

- Average Price 100.0273 (prev. 100.0265)

- High Yield: -0.1074% (prev. -0.1022%)

- Low Price 100.0265 (prev. 100.0255)

- % Allotted At High Yield: 95.5839% (prev. 9.0816%)

- Bid/Cover: 4.861x (prev. 3.896x)

AUSSIE BONDS: The AOFM sells A$700mn of the 0.25% 21 Nov ‘25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 0.4965% (prev. 0.5080%)

- High Yield: 0.4975% (prev. 0.5100%)

- Bid/Cover: 5.9714x (prev. 6.5743x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 73.3% (prev. 67.8%)

- Bidders 46 (prev. 47), successful 12 (prev. 8), allocated in full 4 (prev. 4)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Tuesday 10 August it plans to sell A$100mn of the 2.50% 20 September 2030 Indexed Bond.

- On Wednesday 11 August it plans to sell A$300mn of the 3.25% 21 June 2039 Bond.

- On Thursday 12 August it plans to sell A$1.5bn of the 26 November 2021 Note & A$500mn of the 25 February 2022 Note.

- On Friday 13 August it plans to sell A$1.2bn of the 4.75% 21 April 2027 Bond.

EQUITIES: Indices A Touch Softer Ahead Of NFP

Mostly negative sentiment in Asia with major equity markets in minor negative to flat territory as coronavirus concerns continue to dampen sentiment across the region while the energy sector weighed as oil posts its worst week this year. Markets in Hong Kong and mainland China are the laggards, down by around 0.7%. There were reports in state media of a continuation of the regulatory crackdown with calls for greater scrutiny on marketing of baby-milk formula. Markets in Japan were hovering around flat, Nintendo tempered upside after missing estimates in its latest earnings report. In the US futures are slightly lower after equity bourses hit a record high yesterday, participants await the latest US NFP data later in the session.

OIL: Benchmarks On Track For Worst Week Since October

Oil is slightly higher in Asia-Pac trade on Friday, holding gains from Thursday. WTI is up $0.07 from settlement at $69.16/bbl, Brent is up $0.09 at $71.38. Oil is on track to decline around 6.5% this week, which would be the worst weekly performance since October 2020. The bounce Thursday was preceded by lower lows for both contracts, meaning lower lows have now been printed for five consecutive sessions. Hawkish comments from the Israeli defense minister Gantz may have provided a floor for now, as he stated Israel would be willing to adopt a war footing with Iran should the situation require it. For Brent specifically, the move below the 50-day EMA this week looks convincing, with support now exposed at $66.43. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 – 20 downleg.

GOLD: Still Within The Lines, But Bears Look To Test Support

An uptick in the DXY during Asia-Pac hours and consolidation of yesterday's gains in U.S. real yields leaves spot gold trading around the $1,800/oz mark at typing, a handful of dollars below settlement levels. Still, the technical picture we have outlined on many occasions remains intact.

- Initial support is located at the July 23 low ($1,790.0/oz) and initial resistance is seen at the July 15 high/bull trigger ($1,834.1/oz).

- Friday's NFP print represents the clear risk event ahead of the weekend.

FOREX: Lowe Sends Aussie Lower

It was a typically subdued pre-NFP Asia-Pac session, with the AUD taking a hit as RBA Gov Lowe welcomed the depreciation of local currency, although he stated that policymakers are not targeting the exchange rate. Further deterioration in Sydney's Covid-19 situation may have added some pressure to AUD, making it the worst G10 performer.

- USD garnered some strength ahead of today's NFP report, with the DXY rising past yesterday's peak to fresh weekly highs. The loonie was the second strongest G10 currency, diverging from its oil-tied peer NOK, with Canadian jobs report also coming up.

- The final PBOC fix of this week fell in line with sell-side expectations, allowing spot USD/CNH to remain broadly directionless in rangebound trade.

- While U.S. labour market data takes centre stage today, German industrial output and Canadian unemployment will also provide some interest. There are no notable central bank speakers today.

FOREX OPTIONS: Expiries for Aug06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E970mln), $1.1825(E625mln), $1.1895-00(E509mln)

- USD/JPY: Y109.50-70($608mln), Y110.00-10($626mln)

- EUR/GBP: Gbp0.8400(E890mln)

- AUD/USD: $0.7400(A$582mln)

- USD/CAD: C$1.2450-60($1.6bln), C$1.2525($1.1bln), C$1.2600($1.0bln)

- USD/CNY: Cny6.45($725mln)

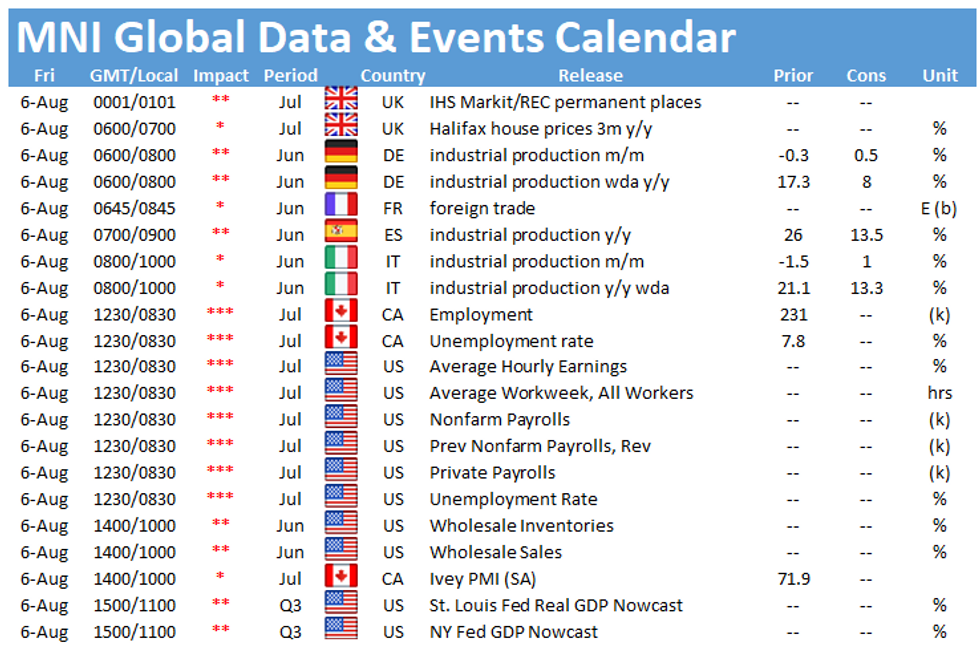

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.