-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Geopolitics, China Data & COVID Fear Give Defensive Feel To Asia Trade

EXECUTIVE SUMMARY

- FED'S KASHKARI WANTS 'FEW MORE' STRONG JOB REPORTS BEFORE TAPER (BBG)

- CHINESE ECONOMIC ACTIVITY DATA DISAPPOINTS

- PBOC PARTIALLY ROLLS OVER MATURING MLF

- AUSTRALIAN LOCKDOWNS DEEPEN, LENGTHEN AND WIDEN

- TALIBAN RETAKE AFGHAN CAPITAL AFTER 20 YEARS FIGHTING U.S. (BBG)

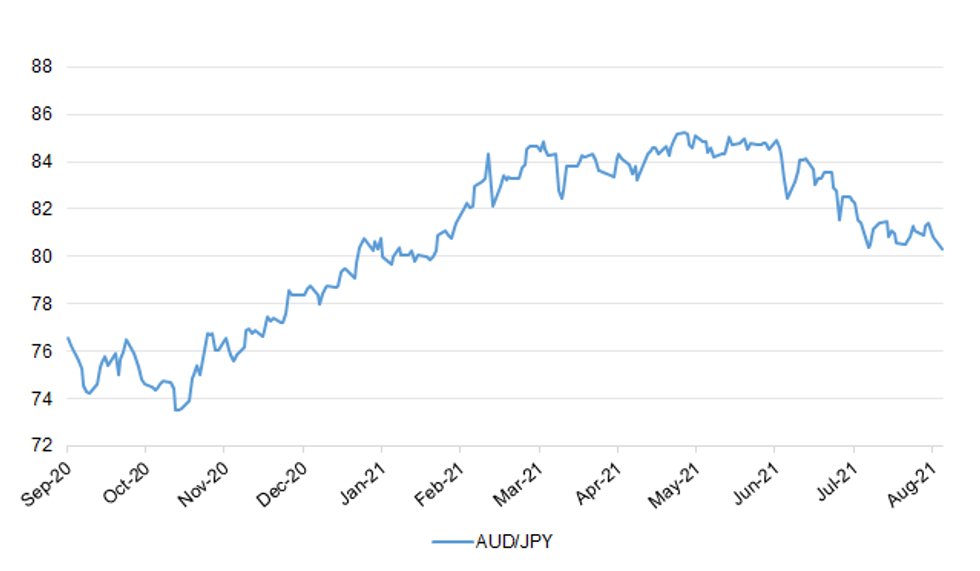

Fig. 1: AUD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: All 16 and 17-year-olds in England will be offered a Covid jab in the next week, with the aim of building up immunity before the return to school or college next month. They will be given a single dose of the Pfizer-BioNTech vaccine. Secondary schools are also being put on alert to provide a vaccination programme to all children aged 12 and over. At present, jabs are offered only to children with health conditions or who live with people at high risk. But last week officials in Whitehall met to discuss the prospect of extending the vaccination programme to all those in the age group. (Sunday Times)

ECONOMY: UK recruitment has surged this year bucking the traditional summer lull in job offers, as agencies warned of staffing shortages across the economy as employers sought to fill roles. In July, the number of permanent vacancies advertised by recruitment agencies rose 43 per cent, and 53 per cent for contract vacancies, compared with the previous year, according to figures released on Monday by the Association of Professional Staffing Companies, a body representing recruitment companies. The jump in vacancies points to a tightening of the jobs market as employers seek to plug staffing gaps prompting some businesses to warn of labour shortages. (FT)

ECONOMY: A million workers are still employed by businesses at risk of closure over the next three months, as the government is poised to withdraw critical Covid support schemes, according to new analysis. One in 16 firms say that they are now at risk of closure in the next quarter, the study by the LSE's Programme on Innovation and Diffusion (POID) has found. While it marks a major rise in confidence since the worst depths of the pandemic in January, there are warnings that the risk to so many workers coincides with the planned end of the furlough jobs scheme and a cut to universal credit by £20 a week. (Observer)

FISCAL/POLICY: Boris Johnson's plan to "level up" the UK will require a similar scale of funding to the near-£2tn reunification of Germany after the fall of the Berlin Wall, a leading thinktank has said. Centre for Cities said the schemes outlined so far by the government were a "drop in the ocean" and that closing the north-south divide would cost hundreds of billions of pounds over decades if done properly. In a stark analysis shared with the Guardian, the non-partisan research group said England's biggest cities, including Birmingham, Manchester and Leeds, have the lowest productivity and life expectancy in western Europe. (Guardian)

FISCAL: Businesses are overwhelmingly in favour of changing the tax year to the end of December to simplify the system and fall in line with global peers. The Office of Tax Simplification said in June that it was exploring shifting the end of the tax year from April 5 to either March 31 or the end of the calendar year. In a survey of 500 small and medium-sized businesses, 91 per cent supported moving the date for filing tax affairs, according to BDO, the accounting firm. Companies said that the transition would have to be planned carefully, with longer deadlines to accomodate the changes, but they supported the inevitable short-term disruption as it would make the UK tax system fit for the 21st century. (The Times)

BOE: Bank of England policy makers are being overly-alarmist on their outlook for inflation, economists's forecasts suggest, casting doubt on the need for a significant tightening in policy in the years ahead. While the central bank expects inflation to hit 4% this year and slightly exceed that level in early 2022, economists surveyed by Bloomberg only see it rising to 3.3% by the end of 2021, according to a poll released Monday. It will then peak at 3.5% at the end of the first quarter of next year, the survey said. (BBG)

BOE: Andrew Bailey is off the guest list for this year's "Davos for central bankers" after the pandemic forced organisers to cut down on attendees. The Bank of England Governor will not be attending the Jackson Hole economic symposium in Wyoming, USA, a key event on the central banking calendar. Mr Bailey gave a key speech at last year's conference, but it was delivered virtually due to the pandemic. (Telegraph)

POLITICS: Boris Johnson is expected to delay his much-awaited Cabinet reshuffle until after the COP26 climate change summit in November, and to when the government is confident that the worst of the pandemic has passed. Allies of the UK prime minister said he was eyeing up two reshuffles ahead of the next general election, which must be held before 2024, with the aim of eventually giving a completely new face to his government. Pressure is building from Conservative MPs to refresh his top team this autumn, including changing the education secretary Gavin Williamson who is tipped by government insiders to be replaced by Kemi Badenoch, the equalities minister. But Johnson is likely to resist any decisions until later this year or early 2022. (FT)

EUROPE

ECB: The European Central Bank is likely to announce long-awaited plans to reduce its pandemic-related asset purchases in the next quarter, according to a Reuters poll of economists, most of whom expected the programme to be wrapped up by the end of March. (RTRS)

ECB: European Central Bank President Christine Lagarde will not be attending the high-profile annual Jackson Hole conference of central bankers in late August, an ECB spokesperson said. (RTRS)

GERMANY: Chancellor Angela Merkel's party bloc declined for a second consecutive week in a poll that suggests the Social Democrats are gaining ground ahead of Germany's election in six weeks' time. The Social Democratic Party, which hasn't held the chancellor's office since 2005, pulled ahead of the Greens for the first time in a year in the weekly Insa poll, Bild am Sonntag reported. Support for the SPD rose 2 percentage points to 20%, while Merkel's Christian Democratic-led bloc fell 1 point to 25%, its lowest level since late May. (BBG)

FRANCE: Protesters against France's so-called health pass system are holding marches for a fifth Saturday in a row. Police officials expect around 250,000 people to attend the protests nationwide, compared with about 237,000 a week ago, Agence France-Presse reported. The protests began after President Emmanuel Macron announced in July that the passes -- which show proof of testing or immunization via vaccination or having had the disease -- would become mandatory to get into restaurants, cafes and some other venues. The announcement also prompted a surge in vaccinations in the country. (BBG)

NETHERLANDS: The Netherlands is planning to lift its national social distancing rules from September 20 as coronavirus cases continue to fall and the number of vaccinations rises. Prime Minister Mark Rutte said an earlier peak of cases after restrictions were lifted in July was a "learning experience" and stressed that no step towards easing restrictions is without risk. Nightclubs are to remain closed and the government continues to advise people to take preventative action by self-testing for the virus. (BBG)

BELGIUM: Belgium may require face masks at work and schools throughout the winter, according to advice from government scientists reported by the Belga news service. Coronavirus-related measures would be linked to hospitalizations, with the lowest alarm level requiring masks at work or higher education. Secondary-school pupils may need masks if more than 30 Covid patients are admitted to hospital every day. Children would be home-schooled if more than 95 patients are hospitalized per day. The government must still decide whether to accept the advice. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Luxembourg at AAA; Outlook Stable

- Moody's affirmed Ireland at A2, Outlook changed to Positive from Stable

- S&P affirmed Hungary at BBB; Outlook Stable

- DBRS Morningstar confirmed Belgium at AA (high), Negative Trend

U.S.

FED: A few more strong jobs reports over the coming months would mark enough progress in the recovery from the pandemic to allow the U.S. central bank to begin winding down its bond-buying program, Federal Reserve Bank of Minneapolis President Neel Kashkari said. "If we see a few more jobs reports like the one we just got, then I would feel comfortable saying yeah, we are -- maybe haven't completely filled the hole that we've been in -- but we've made a lot of progress, and now, then will be the time to start tapering our asset purchases," Kashkari said in an interview with Joe Weisenthal and Tracy Alloway on Bloomberg's "Odd Lots" podcast, recorded on August 9. (BBG)

FED: The Federal Reserve will likely lift its zero-interest rate policy next year as the impact of the fast-spreading delta variant has not been that significant on the economy, Alan Blinder, a former Fed vice chair, told Japanese wire service Jiji Press. If the economy keeps recovering, the Fed will likely announce the start of tapering easing policies within two to three months, Jiji on Sunday cited Blinder as predicting. Then, the Fed will gradually reduce the bond purchase amount to zero in eight months, he said. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention gave final approval Friday to start administering Covid-19 booster shots to Pfizer and Moderna vaccine recipients hours after a key panel unanimously voted to endorse third doses for immunocompromised Americans. "At a time when the Delta variant is surging, an additional vaccine dose for some people with weakened immune systems could help prevent serious and possibly life-threatening COVID-19 cases within this population," CDC Director Dr. Rochelle Walensky said in a statement. (CNBC)

CORONAVIRUS: Walgreens is administering additional doses of Pfizer and Moderna to individuals with weakened immune systems, including cancer patients, organ transplant recipients and people living with HIV. The move follows the FDA's emergency use authorization and CDC's guidance for the third vaccine shot. (BBG)

CORONAVIRUS: With a stockpile of at least 100 million doses at the ready, Biden administration officials are developing a plan to start offering Covid-19 booster shots to some Americans as early as this fall, even as researchers continue to hotly debate whether extra shots are needed, according to people familiar with the effort. (New York Times)

CORONAVIRUS: Incoming New York Governor Kathy Hochul said she will be looking at the possibility of a statewide vaccine mandate for indoor activities, as she formulates her pandemic policy after taking over from Governor Andrew Cuomo at the end of the month. "I'm open to all options," she said on Sunday on CNN's "State of the Union." "I will be looking at possibility of mandates, but not saying they're in or out until I know all the facts." (BBG)

CORONAVIRUS: The Texas Supreme Court temporarily suspended local mask mandates passed by a broadening array of counties, cities and school districts trying to tamp down the resurgence of Covid-19 in one of the nation's hottest infection zones. Texas's all-Republican high court acted after Governor Greg Abbott and Texas Attorney General Ken Paxton — both also Republicans — appealed a pair of intermediate appeals court decisions late Friday night. The lower courts had sided with elected officials in Dallas and Bexar counties who sought to proceed with masking ordinances on the advice of their local health officials. (BBG)

CORONAVIRUS: Alabama Gov. Kay Ivey (R) on Friday issued a "limited, narrowly-focused" state of emergency declaration to help hospitals respond to the surge in coronavirus cases, according to AL.com. "I want to be abundantly clear: there will be absolutely no statewide mandates, closures or the like," Ivey said in a press release. "This state of emergency is strategically targeted at removing bureaucracy and cutting red tape wherever we can to allow our doctors, nurses and hospital staff to treat patients that come through their doors." (The Hill)

CORONAVIRUS: Resisting a new law, Oklahoma City Public Schools, the largest school district in the state, announced Friday it is requiring masks on school property as Covid-19 cases increase, the Oklahoman newspaper reported. It's the second Oklahoma school district to defy the state law. In the first three days of school this week, active cases in the Oklahoma City district rose four to 119, Superintendent Sean McDaniel said. (BBG)

CORONAVIRUS: Governor Kate Brown deployed 500 members of the Oregon National Guard on Friday to support hospitals that have been hit with a record number of Covid-19 patients. She spoke the day a renewed mandatory mask order went in place statewide in indoor public spaces, regardless of vaccination status. "I cannot emphasize enough the seriousness of this crisis," the Democratic governor said in a video message, adding that 733 people were hospitalized, 185 of them in intensive care. "When our hospitals are full with Covid-19 patients, there may not be a room for someone needing care after a car crash or a heart attack or other emergency situation." (BBG)

FISCAL: Nine moderate House Democrats are threatening to withhold support from a $3.5 trillion budget blueprint until a bipartisan infrastructure package is signed into law, threatening to unravel plans for moving President Joe Biden's agenda through Congress. "It's time to get shovels in the ground and people to work," the Democrats wrote in a letter to House Speaker Nancy Pelosi dated Thursday. "We will not consider voting for a budget resolution until the bipartisan Infrastructure Investment and Jobs Act passes the House and is signed into law." (BBG)

MARKETS: President Joe Biden plans to name Rostin Behnam to lead the U.S. Commodity Futures Trading Commission, which oversees much of the $582 trillion global derivatives market including cryptocurrency trading, according to people with knowledge of the matter. The White House recently selected Behnam, who's been leading the agency on an interim basis since January, according to the people who weren't authorized to speak publicly. The timing of an announcement is still weeks away, the people said. (BBG)

EQUITIES: It's been two decades since Wall Street analysts were this upbeat. About 56% of all recommendations on S&P 500 firms are listed as buys, the most since 2002. It's one more data point that shows the extent of the euphoria sweeping markets after a blockbuster earnings season. (BBG)

OTHER

CORONAVIRUS: Moderna President Stephen Hoge called it "not surprising" that immunity to the coronavirus would weaken over time and said booster vaccine shots were inevitable. He compared it to boosters needed for the flu or tetanus. (BBG)

JAPAN: The Japanese government will extend its virus state of emergency currently in force in six prefectures including Tokyo, Sankei reported, citing unidentified officials. Kyoto, Hyogo, Fukuoka prefectures, and a decision will be made as soon as Tuesday, according to Sankei. (BBG)

JAPAN: Japan's Shizuoka prefecture to seek covid state of emergency. (NHK)

JAPAN: Japan plans to expand the pool of businesses subject to Covid-19 restrictions to include shops that operate from the basement floor of shopping malls, the Sankei newspaper reported. The view is that these underground shops tend to be crowded for employees, while customers come from a wide range of places, making them prone to virus infections, the report said, without saying where it got the information. (BBG)

BOJ: MNI INSIGHT: BOJ Recovery View Intact Despite Q3 GDP Headwinds

- Bank of Japan policy officials are focused on how the economy evolves in the third quarter as chances for an extension of lockdown conditions in Japan remains and exports take a hit from supply-chain glitches in Southeast Asia even while maintaining a recovery scenario, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Authorities are tightening restrictions, increasing fines and ramping up policing in Sydney in a bid to contain the delta outbreak in Australia's most populous city. (BBG)

AUSTRALIA: Australian authorities reinstated a night curfew and extended COVID-19 lockdown measures in Melbourne for another two weeks to contain an outbreak of the highly infectious Delta coronavirus variant. The current lockdown was due to end on Thursday night but will now run until Sept. 2, Victoria state Premier Daniel Andrews told reporters in Melbourne, the state capital. The state on Monday reported 22 local cases, down from 25 a day earlier. "The rules don't kick in until midnight, but I'm asking people to observe that curfew from 9 p.m. tonight," Andrews said. (RTRS)

AUSTRALIA: The ACT has recorded 19 new locally acquired cases of COVID-19, taking the total number of active cases in Canberra to 28. One of today's new cases was a student at Lyneham High School, who attended classes over four days while infectious. Another of the cases is an aged-care worker who had received one dose of a vaccine and was unwittingly infectious for three shifts at work. The ACT government has also extended the ACT's lockdown — initially set to end this Thursday — for another two weeks, until at least September 2. (ABC)

AUSTRALIA: Darwin, Katherine and Palmerston have been thrown into a snap three day lockdown from midday on Monday after the Northern Territory recorded one new Covid case. The new case is a man in his 30s who is believed to have spent time in the community while infectious, but the source of the infection remains a mystery. Authorities fear he may have been contagious while travelling in a local taxi and an Uber whose drivers then worked throughout the community. (Daily Mail)

RBNZ: The Shadow Board overwhelmingly calls for a tightening in monetary policy at the August Monetary Policy Statement, with many noting an OCR increase would be appropriate. That said, there remained a wide range of views amongst the Shadow Board. Recent developments point to a rise in inflation pressures in the New Zealand economy, reflecting the combination of strengthening demand and COVID-related supply constraints. These constraints include acute labour shortages as border restrictions limit the ability for workers to be brought in and global supply chain disruptions, affecting the ability of businesses to source inventory. Robust demand is allowing businesses to pass on higher costs more easily to customers by raising prices, suggesting inflation pressures will persist in the New Zealand economy. (NZIER)

SOUTH KOREA: South Korean President Moon Jae-in predicted 70% of the country's population will be double vaccinated against Covid by October. He spoke during a speech Sunday marking the nation's Independence Day. (BBG)

SOUTH KOREA/JAPAN: South Korean President Moon Jae-in left the door open for talks with Japan in a speech marking his neighbor's World War II surrender as several Japanese cabinet members visited a war-linked shrine seen by many in Asia as a symbol of its past militarism. In his last Liberation Day speech as president to mark the end of Japan's 1910-1945 colonial rule over the peninsula, Moon said his government was ready to work with Japan on threats to the world such as the coronavirus pandemic and climate change. "We always keep the door open for conversation," he said in a nationally televised address Sunday. (BBG)

NORTH KOREA: The U.S. special representative for North Korea, Sung Kim, is expected to visit Seoul later this month for talks with his South Korean counterpart and a trilateral session involving the Russian nuclear envoy, a diplomatic source said Sunday. Kim is expected to arrive on Saturday for a four-day visit, the source said. It will mark his second trip to South Korea since taking office as Washington's chief nuclear envoy. He last visited Seoul in June. While Kim is in town, Russia's nuclear envoy, Igor Morgulov, is also expected to visit South Korea for possible trilateral talks with their South Korean counterpart Noh Kyu-duk. (Yonhap)

NORTH KOREA: South Korea's President Moon Jae-in said Sunday achieving permanent peace and denuclearization on the Korean Peninsula would contribute to the prosperity of Northeast Asia. (Kyodo)

CANADA: Canada's government announced plans to require vaccinations for employees in the federal government and the transportation sector, as well as for travelers. The plan will begin "early fall" for public sector workers, it was announced at a press conference with Dominic LeBlanc, minister for intergovernmental affairs, and Transport Minister Omar Alghabra. (BBG)

CANADA: MNI: Trudeau Calls Snap Canada Election For Sept 20

- Canada Prime Minister Justin Trudeau called a snap election for Sept. 20, seeking to turn his minority Liberal government into a majority on support for record deficit spending through the pandemic and the vaccine rollout - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico central bank Deputy Governor Jonathan Heath said on Twitter that data on job creation for July was a good figure. However in another tweet, he said "it should be noted the jobs created in the last 12 months are more precarious than those lost due to the pandemic, a usual phenomenon in a recovery phase." (BBG)

MEXICO: Mexico can use a multibillion dollar transfer from the International Monetary Fund to prepay debt, as the country's president is considering, but the government would need to purchase the funds from the central bank, Banxico Governor Alejandro Diaz de Leon said. The IMF's transfer to the central bank of the recently-approved reserves, worth roughly $12 billion, isn't a "donation," Diaz de Leon said in an interview late Thursday. The comments comes after President Andres Manuel Lopez Obrador said earlier this week he was considering using Mexico's share of the windfall to prepay the country's debts. (BBG)

TURKEY/RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Turkey at BB-; Outlook Stable

BRAZIL: The government's cash allowances under the social program Auxilio Brasil, formerly known as Bolsa Familia, may be adjusted but there are limitations, Economy Ministry's Treasury Secretary Bruno Funchal said, citing the need to make room within the budget. Size of the social program currently stands at around 34b reais, Funchal told in a live webcast hosted by XP Investimentos. (BBG)

BRAZIL: Brazil health regulator Anvisa sent a letter to Pfizer asking for more information on studies about the application of a third dose of the vaccine against Covid-19, agency said in a statement. (BBG)

RUSSIA: Russia's economy grew at the fastest quarterly pace since 2000 as it bounced back from coronavirus lockdowns last year. Growth in the second quarter reached 10.3% compared to the same period of 2020, according to official data released Friday, faster than expected, taking the economy to above its pre-coronavirus level. Retail trade, passenger transit and manufacturing all showed strong growth, the Federal Statistics Service said. The median estimate of 20 economists surveyed by Bloomberg was 10%. The latest result brings Russia in line with other emerging markets that have reported over 10% gross domestic product increases in the second quarter including Poland and the Philippines. (BBG)

SOUTH AFRICA: South Africa's former President Jacob Zuma, currently serving a 15-month jail term for contempt of court, has undergone surgery for an unspecified condition, and is due to have further procedures carried out in coming days. Zuma, whose arrest last month triggered a wave of protests and looting in parts of the country, will remain hospitalized close to his prison, the Pretoria-based Department of Correctional Services said in a statement. No date for his discharge can be predicted, it added. (BBG)

AFGHANISTAN: Taliban leaders marched into Kabul Sunday, preparing to take full control of Afghanistan two decades after they were removed by the U.S. military. The militant group took over the presidential palace, and said it plans to soon declare a new "Islamic Emirate of Afghanistan." Hours earlier, American-backed President Ashraf Ghani fled the country. (BBG)

AFGHANISTAN: Although some voices from the West are expecting China to play a bigger role in Afghanistan after the sudden US pullout, even are speculating that China might send troops to fill the vacuum left by the US, Chinese experts said such speculation is totally groundless, and the most China can do is to evacuate Chinese nationals if a massive humanitarian crisis occurs, or to contribute to post-war reconstruction and development, pushing forward projects under the China-proposed Belt and Road Initiative (BRI) when safety and stability are restored in the war-torn country. (Global Times)

AFGHANISTAN: As Taliban fighters began entering the Afghan capital of Kabul on Sunday, U.S. Secretary of State Antony Blinken defended President Joe Biden's decision to withdraw American troops from the country. He said the U.S. succeeded in its mission of bringing those responsible for the Sept. 11, 2001 terrorist attacks to justice and that remaining in the country was not sustainable. If the U.S. would have stayed, Blinken said, America would be back at war with the Taliban, which he said is at its strongest since 2001. (CNBC)

AFGHANISTAN: UK Prime Minister Boris Johnson has said no one wants Afghanistan to become a "breeding ground for terror", as the Taliban enters capital Kabul. Speaking after a meeting of the emergency Cobra committee, he said the situation "continues to be extremely difficult" and will get even more so. He called on "like-minded" powers to work together and not recognise any new government without agreement. The UK Parliament is being recalled on Wednesday to discuss the situation. (BBC)

AFGHANISTAN: As Taliban leaders continue to meet inside the presidential palace in Kabul and Ashraf Ghani has left the country, the U.N. Security Council has called an emergency meeting for Monday morning. Secretary General António Guterres is scheduled to brief the security council as Taliban leaders continue to call for an "unconditional surrender" with little remaining pushback. (Axios)

OIL: U.S. refinery and chemical plant workers on Friday agreed to focus on pay and health insurance in coming union contract talks, said people familiar with United Steelworkers (USW) union deliberations, setting up a conflict with refiners struggling to throw off losses from weak demand. Proposals setting an agenda for pay increases, improved health insurance and severance pay were adopted at the union's national oil bargaining policy conference conducted online. The national agenda must still be approved by local union members. (RTRS)

CHINA

YUAN: The yuan may face less pressure to gain should China's service trade deficit widens back to its normal pattern, Guan Tao, the global chief economist of BOC Securities, wrote in an analysis on Yicai.com. If domestic demand steadily recovers, imports may accelerate, bringing down current account surplus, Guan wrote. More imports will also increase transportation costs, further widening the usual deficit in transportation service, a trend evident in Q2, said Guan. There may be more outbound Chinese travellers as vaccinations enable some countries to reopen borders, while China's tougher pandemic controls deter inbound traffic, Guan wrote. This may result in more tourism spending overseas than incomes from inbound travers, said Guan. (MNI)

LOCAL GOV'T BONDS: China is expected to accelerate the sales of local government special-purpose bonds in H2, resulting in CNY2.75 trillion total investment in infrastructure this year, the Economic Information Daily said in a front-page report. The local government bonds will stimulate the economy while the transportation and industrial parks that they funded will improve productivity and reduce costs, the newspaper said citing Luo Zhiheng, the chief macro analyst of Yuekai Securities. Manufacturing investment is also expected to increase due to higher costs of industrial products and credit support, the newspaper said citing Zheshang Securities. (MNI)

CORONAVIRUS: China's total infections reported on Monday dropped to 16, compared with a peak in daily infections of more than 100 earlier this month. Still, the country's Xinjiang region reported three asymptomatic cases — found through regular testing — in the northwestern Alashankou city that borders Kazakhstan. The trio had no travel history outside of China or any of the Chinese cities battling the Covid resurgence in the past two weeks. (BBG)

CORONAVIRUS: Beijing-based Sinovac, manufacturer of an inactivated Covid-19 vaccine, will seek approval to do further testing on a shot specifically targeting the delta variant of the coronavirus before October this year, state-backed Global Times reported Sunday, citing the company's general manager Gao Qiang in a recent interview. (BBG)

CORONAVIRUS: Chinese vice premier Sun Chunlan has stressed strict, scientific, and accurate measures to combat cluster COVID-19 infections. Sun, also a member of the Political Bureau of the Communist Party of China Central Committee, made the remarks during a research tour to the city of Yangzhou in east China's Jiangsu Province, where a resurgence of COVID-19 has caused cluster infections, from Wednesday to Sunday. Through concerted efforts, Yangzhou has made major progress in curbing the outbreak. Daily new reported cases were declining, and the transmission chain in residential communities has been blocked, an official statement said. Noting that the epidemic prevention and control in Yangzhou are still at a critical juncture, Sun urged efforts to optimize nucleic acid testing plans for better quality and efficacy, adjust the control measures for residential communities according to the test results, and ensure daily and medical supplies for residents under closed-off management. (Xinhua)

EQUITIES: China should tighten regulations of online games to ensure they don't misrepresent history, state media reported after a government-controlled agency criticized the industry earlier this month. Gaming regulators need to step up management and have "zero tolerance for online games that have deviated from the normal track," according to a commentary on the China National Radio website on Saturday, calling games that "wantonly distort" history and historical figures "inferior" and a harmful form of cultural communication. (BBG)

EQUITIES: A former Alibaba manager has been detained in China on suspicion of sexual assault, in a case that has rallied the country's #MeToo movement against tech corporate culture as the sector faces a wide-ranging regulatory crackdown. The scandal has turned renewed scrutiny on China's biggest ecommerce company as authorities have stepped up sweeping policy changes and regulatory interventions in recent weeks that have wiped billions of dollars from the market capitalisations of the country's largest tech companies. (FT)

EQUITIES: China's securities regulators punished 19 institutional investors as authorities tighten scrutiny over price-setting behaviours under a more liberalised listing system. China launched the tech-focused STAR Market in Shanghai in mid-2019, along with the introduction of a U.S.-style, registration-based initial public offering (IPO) system in that market. The Securities Association of China (SAC) said late on Friday that a joint probe recently with the Shanghai Stock Exchange over STAR IPOs had exposed issues with 19 institutional investors. The problems included weak internal controls, inadequate rationale for price-settings, non-compliance with stipulated procedures and improper storage of working papers, the SAC said in a statement, without identifying the companies. (RTRS)

OVERNIGHT DATA

CHINA JUL INDUSTRIAL OUTPUT +6.4% Y/Y; MEDIAN +7.9%; JUN +8.3%

CHINA JUL INDUSTRIAL OUTPUT YTD +14.4% Y/Y; MEDIAN +14.6%; JUN +15.9%

CHINA JUL RETAIL SALES +8.5% Y/Y; MEDIAN +10.9%; JUN 12.1%

CHINA JUL RETAIL SALES YTD +20.7% Y/Y; MEDIAN +21.2%; JUN +23.0%

CHINA JUL FIXED ASSETS EX RURAL YTD +10.3% Y/Y; MEDIAN +11.3%; JUN +12.6%

CHINA JUL PROPERTY INVESTMENT YTD +12.7% Y/Y; MEDIAN +12.9%; JUN +15.0%

CHINA JUL UNEMPLOYMENT 5.1%; MEDIAN 5.0%; JUN 5.0%

CHINA JUL NEW HOME PRICES +0.30% M/M; JUN +0.41%

JAPAN Q2, P GDP +0.3% Q/Q; MEDIAN +0.1%; Q1 -0.9%

JAPAN Q2, P GDP ANNUALISED +1.3% Q/Q; MEDIAN +0.5%; Q1 -3.7%

JAPAN Q2, P GDP NOMINAL +0.1% Q/Q; MEDIAN -0.3%; Q1 -1.0%

JAPAN Q2, P GDP DEFLATOR -0.7% Y/Y; MEDIAN -0.9%; Q1 -0.1%

JAPAN Q2, P GDP PRIVATE CONSUMPTION +0.8% Q/Q; MEDIAN 0.0%; Q1 -1.0%

JAPAN Q2, P GDP BUSINESS SPENDING +1.7% Q/Q; MEDIAN +1.3%; Q1 -1.3%

JAPAN Q2, P INVENTORY CONTRIBUTION % GDP -0.2%; MEDIAN 0.0%; Q1 +0.4%

JAPAN Q2, P NET EXPORTS CONTRIBUTION % GDP -0.3%; MEDIAN -0.2%; Q1 -0.2%

JAPAN JUN, F INDUSTRIAL OUTPUT +23.0% Y/Y; FLASH +22.6%

JAPAN JUN, F INDUSTRIAL OUTPUT +6.5% M/M; FLASH +6.2%

JAPAN JUN CAPACITY UTILISATION +6.2% M/M; MAY -6.8%

NEW ZEALAND SERVICES PMI 57.9; JUN 58.4

In the space of three months, the Performance of Services Index (PSI) has gone from indicating scant growth to rapid expansion. In printing at 58.6 in June, the PSI established a June quarter average of 58.7. This compares to the average over the March quarter of 50.2. Certainly, much of the negatively headed feedback to the PSI survey in June related to ongoing problems with supplies, including increased lead times. Complaints also resonated regarding the scarcity of staff, with the closed borders partly to blame. While the PSI is riding high overall, there is still interesting variability in its detail. Two of the strongest industries in June, for instance, were Property & Business (57.3) and Finance & Insurance (55.0). But, really, it's the now very strong force of the PSI, overall, that's the important thing to note. Even stronger in June, of course, was the Performance of Manufacturing Index (PMI), which hit 60.7. (BNZ)

UK AUG RIGHTMOVE HOUSE PRICES +5.6% Y/Y; JUL +5.7%

UK AUG RIGHTMOVE HOUSE PRICES -0.3% M/M; JUL +0.7%

CHINA MARKETS

PBOC NET DRAINS CNY100BN VIA MLF MONDAY

The People's Bank of China (PBOC) conducted CNY600 billion through one-year medium-term lending facility (MLF) and CNY10 billion via 7-day reverse repos with the rate unchanged at 2.95% and 2.20% respectively on Monday. The operation drained net CNY100 billion from the market as CNY700 billion MLF maturing Tuesday and CNY10 billion maturing today, according to Wind Information.

- The operation aims to fully meet the liquidity demands from the financial institutions and to keep liquidity reasonable and ample, considering the liquidity to be hedged by the the liquidity released by the reserve requirement ratio cut last month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.1860% on Friday.

- The CFETS-NEX money-market sentiment index closed at 39 on Friday vs 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4717 MON VS 6.4799

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4717 on Monday, compared with the 6.4799 set on Friday.

MARKETS

SNAPSHOT: Geopolitics, China Data & COVID Fear Give Defensive Feel To Asia Trade

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 474 points at 27502.7

- ASX 200 down 27.025 points at 7601.9

- Shanghai Comp. up 12.841 points at 3529.14

- JGB 10-Yr future up 15 ticks at 152.34, yield down 1.6bp at 0.015%

- Aussie 10-Yr future up 7.0 ticks at 98.860, yield down 7.3bp at 1.143%

- U.S. 10-Yr future +0-11+ at 134-10, yield down 2.34bp at 1.253%

- WTI crude down $0.77 at $67.67, Gold down $2.34 at $1777.43

- USD/JPY down 16 pips at Y109.43

- FED'S KASHKARI WANTS 'FEW MORE' STRONG JOB REPORTS BEFORE TAPER (BBG)

- CHINESE ECONOMIC ACTIVITY DATA DISAPPOINTS

- PBOC PARTIALLY ROLLS OVER MATURING MLF

- AUSTRALIAN LOCKDOWNS DEEPEN, LENGTHEN AND WIDEN

- TALIBAN RETAKE AFGHAN CAPITAL AFTER 20 YEARS FIGHTING U.S. (BBG)

BOND SUMMARY: Core FI Bid In Asia

The mix of the Taliban taking the Afghan capital of Kabul, lower oil prices, general worry surrounding COVID and a softer than expected round of Chinese economic activity data for July combined to support the broader core FI bid during Asia-Pac hours.

- T-Notes trade +0-12 at 134-10+ as a result, a touch shy of best levels. The major cash Tsy benchmarks run ~1.0-3.0bp richer on the day, with 7s outperforming on the curve. Pockets of TYU1 buying helped to support the space, with that contract running on more than healthy volume of ~162K ahead of European dealing.

- JGBs also benefitted from the broader defensive feel to the session, with continued reports surrounding the potential for a fairly imminent extension of the COVID-related state of emergency in play across several Japanese prefectures (in addition to the scope for the widening of the restrictions to other prefectures) bolstering the bid further. Futures last +15, with cash JGBs running 1.0-2.0bp richer on the day.

- The ACGB space drew support from the broader risk-off theme, in addition to the local COVID situation in Australia. A fresh snap lockdown in Darwin was declared on Monday, with the lockdowns in both Melbourne & the ACT extended. NSW saw restrictions broadened & deepened over the weekend, with harsher implementation of restrictions set to come into play (NSW recorded another record daily COVID case count on Monday). YM +4.0, XM +7.0, with the 10- to 12-Year zone of the cash ACGB curve outperforming.

EQUITIES: Japanese Markets Sustain Heavy Losses

A broadly negative session for equity markets in the Asia-Pac time zone, pressured by weak Chinese data and concerns over the delta variant with COVID-19 case numbers still elevated. There could also be some caution after Afghanistan fell to insurgents with the President fleeing the country. In China the PBOC let CNY 100bn of MLF funds mature, rolling over CNY 600bn. Chinese data was weak with industrial production, retail sales and FAI all missing estimates; indices on mainland China though are proving resilient and have managed to reclaim positive territory. Japan extended the state of emergency to mid-Sept, but earlier in the session data showed GDP was robust and came in well above estimates. Markets in Japan are the laggards, down approximately 1.8%. In the US futures are lower by around 0.3%; US bourses hit another fresh record high on Friday.

OIL: Crude Futures Extend Losses

Crude futures are lower in Asia-Pac trade, extending Friday's decline. WTI is down $0.76 from settlement levels at $67.88/bbl, Brent is down $0.74 at $69.85/bbl. WTI and Brent crude futures continues to fade as the recovery off the Monday low ran out of steam. The weakness on Friday was accelerated by a sharp downtick in the Uni. of Michigan sentiment survey, which dropped 11 points. A drop of that size has only been seen on a handful of occasions: the depths of the COVID crisis, the 2008 financial crisis, Hurricane Katrina and the 1990 Kuwait crisis. Data from China was weak today, with industrial production, retail sales and FAI all missing estimates. WTI crude futures hold south of the 50-day EMA at $69.98, which switches from support to resistance. This reinitiates the downside argument, opening $65.01, Jul 20 low and the key support.

GOLD: Tight Range Despite Broader Risk-Off Flow

Spot gold has stuck to a particularly narrow ~$5/oz range during Asia-Pac hours, last dealing little changed just shy of $1,780/oz. This is despite a distinct risk-off feel to the broader Asia-Pac session. The tumble seen in the early part of last week (which has largely been recouped) has widened the gap between the initial technical lines in the sand, with initial support now located at the Aug 9 low ($1,690.6/oz), while resistance is noted at the July 15 high/bull trigger ($1,834.1/oz).

FOREX: Risk Appetite Sours Amid Raging Covid-19, Soft Chinese Data, Fall Of Kabul

China's disappointing economic activity data put another nail in the coffin of risk appetite, after the seizure of the Afghan capital by Taliban and the deepening Covid-19 crisis in the Asia-Pacific region inspired risk aversion.

- This risk-off cocktail sent AUD tumbling to the bottom of the G10 pile amid the tightening of Covid-19 rules in Australia. Melbourne and ACT extended their lockdowns by two weeks each, while parts of NT were placed under snap restrictions.

- Other commodity-tied currencies retreated in tandem. A degree of political uncertainty surrounding the general election called by PM Trudeau for Sep 20 may have generated an additional headwind for the loonie, amid lack of clarity on the Premier's chance to win an outright majority in parliament.

- Participants flocked into safe haven assets for the benefit of the yen, which topped the G10 scoreboard. Worth noting that Japan's flash Q2 GDP numbers were better than expected, but Sankei reported that the country would extend and expand its state of emergency through mid-Sep.

- The yuan was surprisingly resilient, given underwhelming data released out of China and a soft PBOC fix, with the USD/CNY midpoint set at CNY6.4717, 22 pips above sell-side estimate. Spot USD/CNH bounced off session lows in reaction to the data, but struggled to register any material gains. The rate slipped earlier as the PBOC rolled over CNY600bn of MLF funds, letting CNY100bn mature.

- The global economic docket is fairly empty later today, U.S. Empire Manufacturing & Canadian manufacturing sales take focus from here.

FOREX OPTIONS: Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/GBP: Gbp0.8590-00(E515mln)

- USD/CNY: Cny6.45($1.4bln)

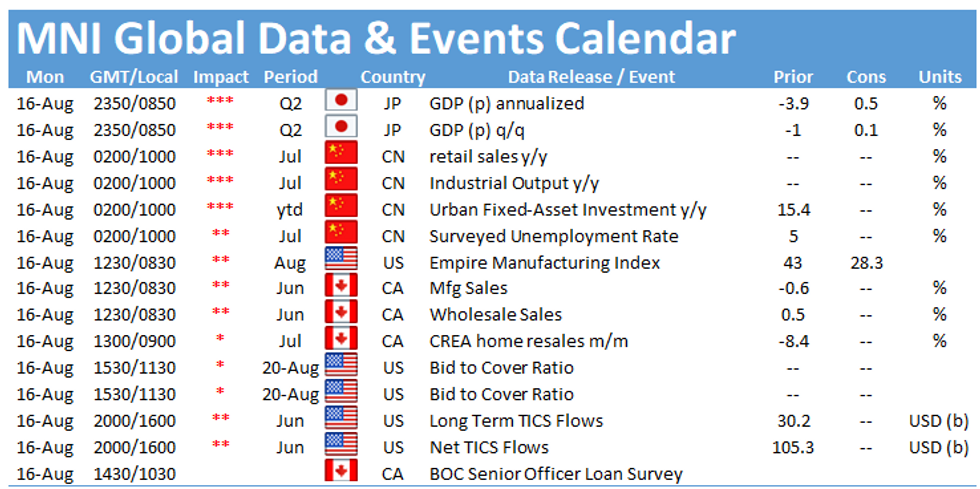

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.