-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: PBoC Looks To Promote Month-End Liquidity, DXY Nudges Away From Tuesday Lows

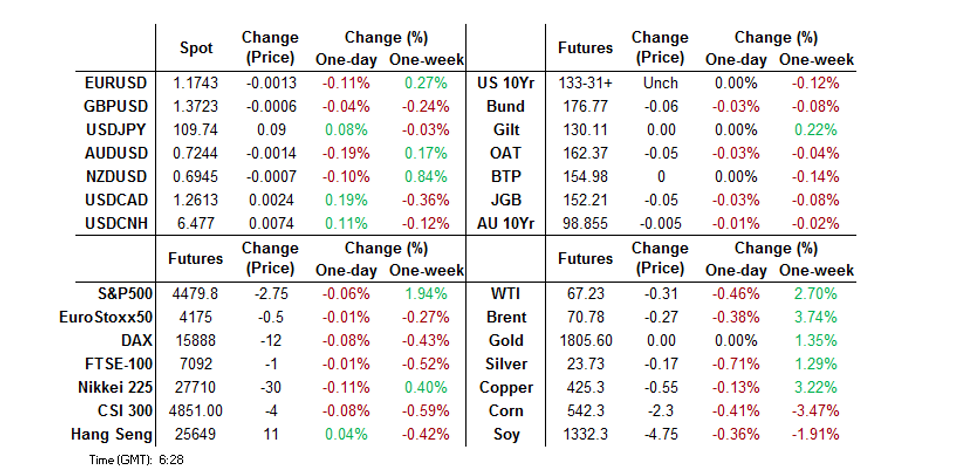

- The major equity metrics and core FI markets lacked any real sense of direction during Asia-Pac trade, while the DXY edged further away from yesterday's session low.

- The PBoC conducted a net liquidity injection via OMOs to manage month-end cash needs, while headline flow surrounding Sino-U.S. relations dominated elsewhere (but failed to move the needle).

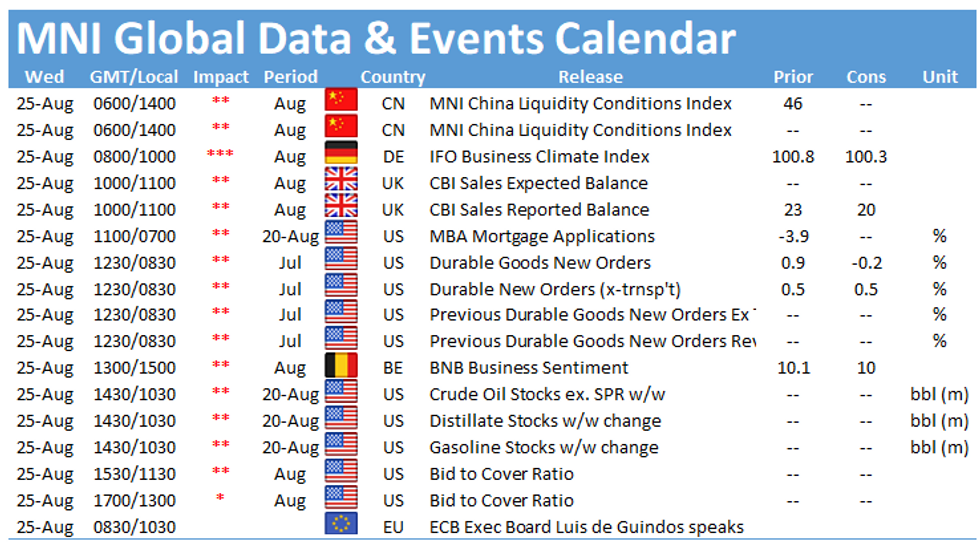

- The latest U.S. durable goods and German Ifo survey headline the broader docket on Wednesday.

BOND SUMMARY: Steady As She Goes In Asia

T-Notes held to a 0-03 range overnight, last dealing -0-00+ at 133-31, while cash Tsys trade at virtually unchanged levels across the curve. There was a lack of meaningful news headlines during Asia hours. Roll flow bolstered futures volumes, while the options space saw block buys of the USU1 169.50 (+2.0K) and USV1 166.00 (+2.5K) calls. We also saw a small screen buyer of the TYV1 132.00 puts. Looking ahead to NY hours, we will see prelim durable goods data and the latest round of 5-Year supply.

- JGBs futures nudged lower during Tokyo dealing given the impetus from Tuesday's U.S. Tsy trade, last printing 4 ticks below yesterday's settlement levels, while the major cash JGB benchmarks were little changed. The latest round of BoJ Rinban operations saw mixed variations re: the movement in the cover ratios vs. prev. ops, but nothing in the way of sizeable swings. BoJ board member Nakamura didn't bring anything new to the table in his latest address.

- YM -2.0 & XM -1.0 at typing, with early supply-related pressure waning. The daily state COVID case counts saw a new record for NSW (919), while new cases in Victoria pulled back below the 50 level. As a reminder, commentary from Australian PM Morrison and NSW Premier Berejiklian has started to focus on hospitalisation/serious cases in recent days, as opposed to the outright case count. On the supply front the A$1.0bn ACGB May '32 round of supply saw the average price print 0.36bp through prevailing mids at the time of supply (per Yieldbroker), with the cover ratio holding above 5.0x. On the local data front completed construction work for Q2 got the Australia GDP partials off to a soft start.

FOREX: Greenback Takes Lead

The greenback caught a light bid in today's quiet Asia-Pac session, which failed to provide any meaningful catalysts, with participants awaiting Fedspeak out of this week's Jackson Hole meetings.

- NZD slipped after data showed that New Zealand's trade balance flipped to a deficit of NZ$402mn in July from a surplus of NZ$245mn in June, with annual deficit widening to NZ$1.104bn as a result.

- The kiwi trimmed losses later in the session, but the broader commodity-tied FX space continued to trade on the back foot, as crude oil prices faltered.

- Greenback strength drove spot USD/CNH higher, with a softer than expected PBOC fix helping the move. China's central bank set their USD/CNY midpoint at CNY6.4728, 13 pips above sell-sde estimate.

- German Ifo survey, flash U.S. durable goods as well as comments from Fed's Daly & ECB's de Guindos take focus from here.

ASIA FX: Mixed With Risk Events Awaited

The greenback caught a light bid in today's quiet Asia-Pac session, which failed to provide any meaningful catalysts, with participants awaiting Fedspeak out of this week's Jackson Hole meetings.

- CNH: Greenback strength drove spot USD/CNH higher, with a softer than expected PBOC fix helping the move. China's central bank set their USD/CNY midpoint at CNY6.4728, 13 pips above sell-side estimate. The PBOC injected a net CNY 40bn of liquidity into the system via OMO's to maintain liquidity into month end.

- SGD: Singapore dollar heads into Europe flat, markets look ahead to industrial production data tomorrow which is expected to fall 0.9% after a 3.0% decline last time out.

- TWD: Taiwan dollar is flat but spent a good portion of the session in positive territory. Speculation abounds that Taiwan's trade surplus means it is likely to remain on the US tsys FX watchlist when the next report is released, despite evidence of less intervention.

- KRW: The won is flat having given back early gains. South Korea's daily new coronavirus cases spiked to over 2,000 again Wednesday at 2,155.

- MYR: Ringgit is slightly stronger, Malaysia July CPI rose 2.2%, lower than estimates of 2.9%. Elsewhere Malay Mail sources said that Malaysia's new PM Ismail Sabri may be forced to name a Deputy PM from Bersatu in return for their support for his prime ministerial bid.

- IDR: Rupiah is slightly weaker, Tuesday brought a confirmation that Bank Indonesia and the Finance Ministry have struck a deal on their third burden-sharing scheme.

- PHP: Markets closed. Pres Duterte has confirmed that he will run for vice-president in 2022 when his current term expires.

- THB: Baht is stronger, BoT Governor said the recovery was to be K-shaped, adding that the debt ceiling could be raised if needed and that SME's hit hard by COVID will receive support. Elsewhere Thailand's Health Ministry will propose to relax curbs on restaurants and allow dine-in services with capacity constraints as the current wave of Covid-19 eases.

ASIA RATES: China Futures Rise As PBOC Injects Month-End Liquidity

- INDIA: Yields mostly higher in early trade, yields in the 10-Year sector have risen some 3bps in the past three sessions as markets assess the rebound in oil prices and the accompanying prospect of inflation, as well as a more hawkish set of central bank minutes earlier this week. The RBI will auction INR 170bn of T-bills today, the market now looks ahead to this week's auctions, and then GDP data next week.

- SOUTH KOREA: Futures hugged a narrow range in South Korea, both the 3-Year and 10-Year heading into the close flat. Markets await the BoK rate announcement tomorrow where opinion is split over whether the Central Bank could implement a 25bps rate hike. South Korea's daily new coronavirus cases spiked to over 2,000 again Wednesday at 2,155. Data yesterday showed household debt hit a record high in Q2 amid the continued record-low interest rate.

- CHINA: The PBOC injected a net CNY 40bn into the financial system heading into month end, a move the Central Bank said was to ensure ample liquidity, bond futures rose sharply while yields slipped, equity markets struggled for direction. Despite the liquidity injection, repo rates are higher on the day, but have come off highs seen at the start of the session, the 7-day repo rate rose back above the overnight rate after inverting yesterday.

- INDONESIA: Yields lower across the curve, some steepening seen. Tuesday brought a confirmation that Bank Indonesia and the Finance Ministry have struck a deal on their third burden-sharing scheme. The central bank will buy IDR215tn of INDOGBs this year and IDR224tn of debt in 2022 via private placements, charging a coupon rate equivalent to its 7-Day Reverse Repo Rate (benchmark policy rate). BBG sources revealed that the plan is supported by majority of lawmakers.

EQUITIES: Treading Water After Rally

Equity markets in Asia struggled to find decisive direction, major markets hovering between minor losses and gains after a strong start to the week. In mainland China major markets are broadly flat, the PBOC injected a net CNY 40bn of liquidity into the system via OMO's to maintain liquidity into month end. Markets in Japan also hovering around neutral, Japan's Covid-19 task force may formalise the declaration of emergency for another eight prefectures today. In the US futures are slightly lower, giving back some of the rally this week. German Ifo survey, flash U.S. durable goods as well as comments from Fed's Daly & ECB's de Guindos take focus from here, while participants await Fedspeak out of this week's Jackson Hole meetings looking further ahead.

GOLD: Looking Below $1,800/oz

The broader USD (DXY) has managed to tick further away from yesterday's session low during Asia-Pac hours, which has put some modest pressure on bullion, pushing spot back below $1,800/oz after a brief look above the recent intraday highs on Tuesday. Spot gold last deals the best part of $10/oz softer, just below $1,795/oz. Participants continue to look to Fed Chair Powell's Friday address, with the usual USD & real yield dynamics taking turns to drive matters in the interim.

OIL: Oil Dips In Asia After Two Day Rally

Crude futures dipped slightly in Asia-Pac trade on Wednesday, benchmarks slipping after closing near session highs after a two day rally. The greenback rose for the first time in two sessions which weighed on oil, while the prospect of the Delta variant also looms over markets. Data yesterday showed headline crude stocks dipped 1.622m bbls, while gasoline and distillate stocks also fell. Markets look ahead to US DoE inventory figures. Our tech analyst says the short-term outlook appears bullish with Monday's price pattern representing a bullish engulfing candle, with gains to the 20day EMA next up at $67.35, support is seen at $61.74 the Aug 23 low. For Brent support is seen at the Aug 23 low of $64.60, resistance at the 20-day EMA $69.98.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.