-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: RBA Sticks With Taper, but Elongates Minimum Life Of Initial Step Down

EXECUTIVE SUMMARY

- UK PM JOHNSON TO UNVEIL GBP10BN A YEAR TAX RISE TO FUND NHS AND SOCIAL CARE (FT)

- RBA STICKS WITH TAPERING, EXTENDS GUARANTEED LIFE OF A$4BN/WEEK PURCHASES

- JAPAN'S ISHIBA BALKS AT RUNNING IN PARTY RACE, IN BOON FOR KONO (NIKKEI)

- CHINA POSTS WIDER THAN EXPECTED TRADE SURPLUS IN AUG

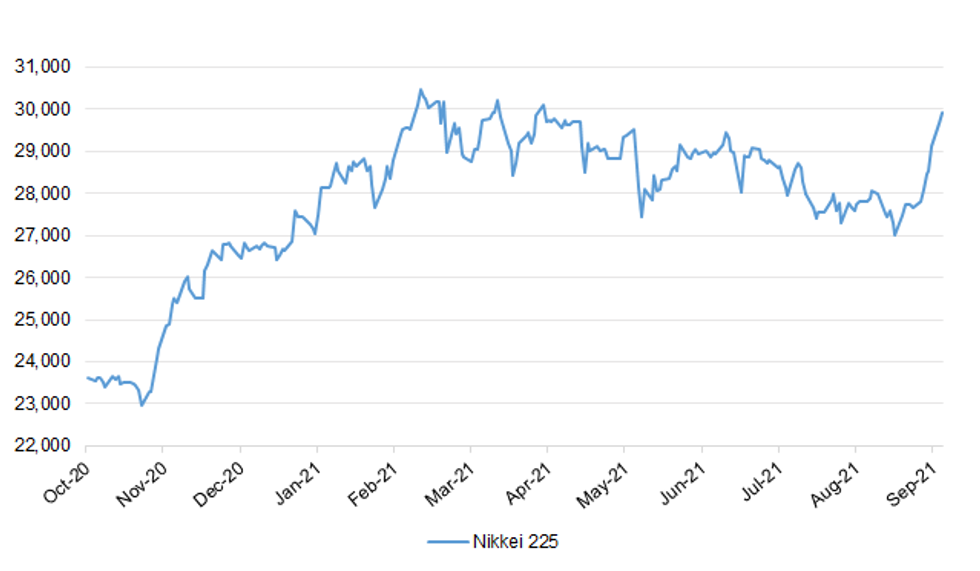

Fig. 1: Nikkei 225

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Rush-hour traffic returned to pre-pandemic levels in parts of the country yesterday as the end of home working and the start of the new school term led to a rise in congestion. Figures showed that roads in London, Birmingham, Wolverhampton, Nottingham, Leicester and Liverpool were as busy as they were in 2019 in a sign that cities are beginning to return to normal. Transport for London confirmed that yesterday morning was the busiest on the Tube for 18 months, since before the first lockdown. The use of buses is also on the rise, with passenger numbers jumping by 71 per cent in a week. (The Times)

CORONAVIRUS: Economists and epidemiologists are increasingly confident that the UK's economic recovery will be able to withstand an autumn rise in coronavirus cases as school term starts, workers return to offices and people socialise more indoors. With Covid-19 vaccines still proving largely effective in limiting severe disease, expert opinion suggests that although a new wave could slow growth in gross domestic product, it was unlikely to reverse it as it did last winter. (FT)

FISCAL: Boris Johnson will on Tuesday defy a torrent of Tory criticism and announce a tax rise of more than £10bn a year, as he seeks to contain spiralling NHS waiting lists and tackle the funding crisis in social care. The prime minister and chancellor Rishi Sunak on Monday tried to persuade furious Conservative MPs that their plan to raise national insurance rates by an expected 1.25 percentage points — for both employees and employers — is unavoidable. (FT)

FISCAL/POLITICS: Boris Johnson will tell mutinous MPs that the healthcare system is in crisis and they "cannot expect it to recover alone" as he faces a growing red wall rebellion over tax rises. One Conservative frontbencher told the Guardian they were considering their position over a planned national insurance rise to fund an overhaul of social care and tackle the NHS backlog. They questioned the point of serving a government that was not pursuing the 2019 Tory manifesto, with a second pledge, on the pensions triple lock, also set to be broken. A series of MPs from former Labour red wall seats complained that the tax increase would hit workers in their constituencies while leaving pensioners untouched. (Guardian)

FISCAL/POLITICS: Boris Johnson abandoning his vow not to increase national insurance could become a "recruiting cry for fringe parties", the former foreign secretary William Hague has said, as grandees and northern Conservatives warned against the plans to fund social care. Writing in The Times today, Lord Hague of Richmond says if the prime minister breaches his 2019 manifesto promise not to raise the rate of income tax, VAT or national insurance it will become a "defining moment" for him. With Johnson widely expected to announce an increase in national insurance of about 1 percentage point in order to fund a shake-up of social care, Hague says the "political downsides" of going back on his promise would be "very great". (The Times)

BREXIT: Full post-Brexit checks on goods moving from Great Britain to Northern Ireland will still not be applied as a truce holds between the UK and EU. Brexit minister Lord Frost has announced the UK's intent to continue to apply post-Brexit arrangements for Northern Ireland "on the current basis". This is in order to allow talks to continue with the EU aimed at solving a "sausage war" and other disputes between the bloc and the UK related to the Northern Ireland Protocol. (Sky)

ECONOMY: August saw the lowest figure for proposed job cuts for seven years, despite the imminent end of the government's furlough scheme. Figures published by the Insolvency Service show that British employers planned 12,687 job cuts in August, a fall of 11% since July. The data suggests that the predicted surge in unemployment this autumn may be smaller than expected. At the height of the pandemic, firms proposed over 150,000 job cuts a month. Employers planning to make 20 or more staff redundant have to notify the Insolvency Service when they start the process. (BBC)

ECONOMY: Restaurant spending edged higher for the first time since the start of the pandemic in August according data from Barclaycard pointing to a bumper month for the consumer economy. The figures showed overall consumer spending was ahead by 15.4% compared to the same period in 2019 before the coronavirus crisis - thanks to "socialising, shopping and staycations". Restaurants saw an increase of just 0.1% but it was the first positive growth for 17 months after long periods of lockdowns and restrictions. Elsewhere in the hospitality sector, pubs, bars and clubs saw a much sharper rise of 43.4%. Theatre, festival and theme park tickets sales were also strong as were clothes, helped by demand for school uniforms and outfits for workers preparing to return to the office. Travel agents and airlines remained in the doldrums, with each seeing spending more than 50% down on 2019 levels. (Sky)

MARKETS: London's position as a leading global financial centre is under threat without reforms to tax and labour rules alongside other policies to strengthen international trade links and expand into new markets, one of the City's main lobby group has warned. TheCityUK said on Tuesday that the UK capital had declined relative to its biggest competitors such as New York and Hong Kong over the past decade, including its global share of markets such as cross-border bank lending, insurance premium-writing, pension and hedge fund assets. The group has drawn up strategy working with 60 financial services groups that it said would help the UK "regain financial centre leadership in five years". (FT)

EUROPE

ITALY/BTPS: Italy plans to sell 7 billion euros ($8.3 billion) of bills due Sep 14, 2022 in an auction on Sep 9. (BBG)

NORWAY: "The board of Norwegian Oil and Gas Association has decided to support the principle of cash flow tax," Anniken Hauglie, the lobby group's CEO, says in a text message. The industry "largely shares the government's analyzes of the effect of the proposal. It ensures a neutral tax system and predictability for the industry." "At the same time, there will be individual elements in the proposal we will return to in the consultation round, such as the proposal's effect for future exploration." (BBG)

U.S.

FISCAL: U.S. President Biden tweeted the following on Monday: "55 of the biggest companies paid zero in federal income taxes last year. It's just plain wrong. We're going to change that — and use the money we collect to cut taxes for middle class families, make it easier to raise kids and take care of your aging parents, and so much more." (MNI)

OTHER

JAPAN: Former Japanese Defense Minister Shigeru Ishiba has expressed reservations about running in this month's ruling party leadership election as party support grows for a rival, popular vaccination minister Taro Kono. If Ishiba, once seen as a leading contender, skips the race, the Liberal Democratic Party election could become a three-horse race among Kono, former LDP policy chief Fumio Kishida and former internal affairs minister Sanae Takaichi. "If I end up just participating in the race with no chance of winning, it will achieve nothing," Ishiba said in a television interview Monday night. Kono in particular stands to benefit from the absence of Ishiba, who garners a similar level of public support in polling, as rank-and-file party members currently backing Ishiba could throw their weight behind Kono. Asked whether supporting Kono was an option, Ishiba said that "it would be stranger if there weren't any" chance of his doing so, adding that the same is true of Kishida. (Nikkei)

JAPAN: Finance Minister Taro Aso says Japan's next prime minister would ideally be someone who can boost government revenues while also restraining spending. Japan needs to balance economic recovery with the need for fiscal discipline. Japanese people would be affected negatively if a loss of market faith in the country's finances led to a weaker currency and fueled inflation. Separately, he says Prime Minister Yoshihide Suga's decision not to run again must be respected. Suga has gotten high marks from the global community for his handling of the pandemic, Aso says. (BBG)

JAPAN: Takeda Pharmaceutical Co. said the Japanese government agreed to buy 150 million doses of Novavax Inc.'s Covid-19 vaccine that it will manufacture in the nation subject to licensing and regulatory approval. The Japanese drugmaker aims to start distribution of the vaccine in early 2022. Separately, the company said it's working with the health ministry to investigate deaths reported after administration of Moderna Covid-19 vaccines, and that there's no reason to believe that it poses a health hazard or safety risk. (BBG)

BOJ: The Bank of Japan should set a more achievable inflation target to avoid getting stuck with endless stimulus, according to a former deputy governor. "It's about time the BOJ set a realistic price goal rather than rigidly targeting 2%," said Hirohide Yamaguchi, who left the bank in 2013, just before Governor Haruhiko Kuroda took the helm. "We can't see the prospect of inflation reaching it, even after more than eight years." Yamaguchi, the right-hand man under Kuroda's predecessor Masaaki Shirakawa, said the central bank can instead accept a lower inflation goal and and could start winding down stimulus even if the yen strengthened thanks to improved resilience among firms, he said. (BBG)

RBA: The Reserve Bank of Australia said it will stick with a planned tapering of bond purchases to A$4 billion a week, and wait until mid-February to review the program. The decision "reflects the delay in the economic recovery and the increased uncertainty associated with the delta outbreak," Governor Philip Lowe said in a statement announcing the decision Tuesday. "The board will continue to review the bond purchase program in light of economic conditions and the health situation." The Australian dollar advanced as 10 of 16 analysts had expected the central bank to hold off scaling back bond buying from A$5 billion a week. (BBG)

AUSTRALIA: The delta surge in Australia's biggest state is showing signs of slowing after New South Wales recorded 1,220 new infections overnight, falling a third day to the lowest daily number in almost a week. Still, health authorities expect the increase in new infections to peak in mid-September, straining the state's hospital resources. Meantime, Victoria state recorded 246 new infections on Tuesday, equaling the previous day's record as health authorities struggle to bring an outbreak of delta under control. Victoria's seven-day case average has doubled since Sept. 2. (BBG)

RBNZ: Reserve Bank of New Zealand Governor Adrian Orr comments in emailed "update." Says RBNZ continues to work together with all of government and industry to support New Zealand economy "during these challenging times." "As outlined in our latest Monetary Policy Statement, our economy had rebounded more strongly than most countries. Recent data for the New Zealand economy suggested demand had been robust and the economic recovery had broadened. The recent lockdown, however, highlights how unpredictable and disruptive the virus can be." The Monetary Policy Committee's decision to keep the Official Cash Rate on hold at 0.25% "was made in the context of the government's decision to impose Alert Level 4 across the country." "Despite the challenge of Covid-19 coming back into the community, we remain focused on delivering our commitments as kaitiaki of the financial system." (BBG)

RBNZ: Reserve Bank deputy governor Geoff Bascand is to leave the central bank in January 2022. Bascand, who has been with the RBNZ since May 2013, said he was leaving to make more time for other interests in his life. "The bank is a special place that makes a massive contribution to New Zealanders' wellbeing. "I have had extraordinary opportunities to participate in a huge range of important initiatives, and work with many wonderful colleagues, but I want to make more time for other interests in my life." (NZ Herald)

BRAZIL: Brazil prepared on Monday for Independence Day demonstrations by supporters of far-right President Jair Bolsonaro, who has called for a show of support for his attacks on the country's Supreme Court that are rattling Latin America's largest democracy. (RTRS)

BRAZIL: Approval rating for Brazilian President Jair Bolsonaro fell to 32% in Sept. from 36% in July, according to Atlas poll. Bolsonaro's govt is rated as bad or terrible by 61% vs 59% in July 24% of people surveyed see govt as good or great vs 26% in July. Former President Luiz Inacio Lula da Silva would have 52.5% in a runoff against Bolsonaro, who would garner 35.9% of votes, according to the poll. Bolsonaro would also lose at runoff scenarios with Ciro Gomes, Luiz Henrique Mandetta, Fernando Haddad and Joao Doria. Online survey of 3,146 people between Aug. 30 and Sept. 4, with a margin of error of +/- 2ppt. (BBG)

BRAZIL: President Jair Bolsonaro should have a plan to help Brazilians, said former president Luiz Inacio Lula da Silva in remarks about the pro-government protests planned for Sept. 7 broadcast on his social media accounts. Lula said that it was expected that Bolsonaro present a measure for Petrobras to sell gasoline at the "real cost" and no longer indexed to the U.S. dollar. This mistaken policy pushed fuel prices higher. Lula said political actions called by Bolsonaro and supporters encourage hatred and violence. Instead of announcing solutions for the country, Bolsonaro calls on supporters to engage in confrontation "against branches of government and democracy." (BBG)

BRAZIL: Brazil institutional and fiscal uncertainties, combined with the effects of the pandemic on global supply and demand, are undermining central bank policy, says Jose Julio Senna, head of the Monetary Studies Center at FGV-IBRE and former director of the Central Bank. (BBG)

SOUTH AFRICA: South African scientists said the so-called C.1.2 variant spread at a slower rate in August than in the prior month, suggesting it's unlikely to become a dominant strain. The new variant accounted for just 1.5% of all virus samples sequenced in the country last month compared with 2.2% in July, according to the Network for Genomic Surveillance South Africa. The variant, first identified in South Africa, has been found in a number of countries including the Democratic Republic of Congo, Mauritius, Portugal, New Zealand and Switzerland. (BBG)

EQUITIES: Tokyo Stock Exchange is considering introducing a 5-minute closing auction window to determine the closing price of shares together with 30-minute extension of trading hours as soon as in 2024, Nikkei reports without attribution. If a decision is taken to extend the trading hours to 3:30pm, the closing auctions would start at 3:25pm. The exchange will also consider ways to restrict investors' attempt to drive prices in their favor such as market participants repeating large bid orders and cancelling them towards the market close. (BBG)

OIL: About 1.5 million barrels per day of oil production in the Gulf of Mexico remain shut in after Hurricane Ida, the Bureau of Safety and Environmental Enforcement said on Monday. A total of 99 oil, gas production platforms remain evacuated after Ida, the regulator said. (RTRS)

CHINA

LGFVS: Local governments in China are expected to issue about CNY500 billion of bonds in September, including about CNY450 billion of special-purpose bonds to boost infrastructure investment, the Securities Daily reported citing Luo Zhiheng, deputy dean of Yuekai Securities Research Institute. China has been accelerating its local bond sales in H2, as the issuance in August reached CNY593 billion, rising 47% from the previous month and setting a new monthly high for the year, the newspaper said. Infrastructure investment in China is likely to rebound moderately from the accumulated 4.6% growth in the first seven months. (MNI)

PROPERTY: Most Chinese lenders have reduced the shares of residential mortgages in their loans in the first half, compared with the end of last year, although the Postal Savings Bank and the China Construction Bank still exceeded the 32.5% limit imposed by the banking regulator, the China Securities Journal reported citing the 1H income statements disclosed by the banks. Four of the six largest state-owned banks reported gains in bad debt ratios in their real estate portfolios as some developers failed to reach their target sales, the newspaper said. As the authorities tighten controls over the property sector, the banks are expected to be cautious and choose to lend to those industries favoured by the government, such as new manufacturing, said the journal. (MNI)

MARKETS: The China Securities Regulatory Commission will further open up the capital markets to overseas investors, including expanding and improving the Shanghai-London Stock Connect, introducing more international varieties of commodity and financial futures products and recognition of professional qualifications, the China Securities Journal said citing the commission's chairman Yi Huiman. China will further develop the merger of Shanghai, Shenzhen and Hong Kong securities trading standards, and provide fairer and more efficient services to overseas investors participating in the Chinese capital markets, Yi was cited as saying. (MNI)

EQUITIES: China Securities Regulatory Commission Chairman Yi Huiman said the regulator is studying the possibility of share listings through special purpose acquisition companies, or SPACs, according to speech posted on the CSRC website Monday. (BBG)

OVERNIGHT DATA

CHINA AUG TRADE BALANCE +$58.34BN; MEDIAN +$53.20BN; JUL +$56.59BN

CHINA AUG EXPORTS +25.6% Y/Y; MEDIAN +17.3%; JUL +19.3%

CHINA AUG IMPORTS +33.1% Y/Y; MEDIAN +26.9%; JUL +28.1%

JAPAN JUL HOUSEHOLD SPENDING +0.7% Y/Y; MEDIAN +2.4%; JUN -4.3%

JAPAN JUL LABOUR CASH EARNINGS +1.0% Y/Y; MEDIAN +0.4%; JUN +0.1%

JAPAN JUL REAL CASH EARNINGS +0.7% Y/Y; MEDIAN +0.6%; JUN -0.1%

JAPAN JUL, P LEADING INDEX 104.1; MEDIAN 103.5; JUN 104.6

JAPAN JUL, P COINCIDENT INDEX 94.5; MEDIAN 94.3; JUN 94.6

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 100.0; PREV. 101.8

Consumer confidence declined 1.8% last week despite rising vaccination rates and reasonably good economic news in the form of the 0.7% rise in Q2 GDP. Sentiment dropped in Sydney (-5.3%), Melbourne (-0.8%) and Brisbane (-2.9%), while Adelaide (+5.0%) and Perth (+2.3%) lifted. The most notable thing in this week's release is the jump in inflation expectations to its highest level in almost three years. The weekly reading can be volatile so we need to be a bit cautious about overplaying the move, but if sustained it will cement the sharpest jump in inflation expectations since we moved to collecting the data on a weekly basis. (ANZ)

SOUTH KOREA JUL BOP CURRENT ACCOUNT BALANCE +$8.2107BN; JUN +$8.8469BN

SOUTH KOREA JUL BOP GOODS BALANCE +$5.7264BN; JUN +$7.6183BN

UK AUG BRC SALES LIKE-FOR-LIKE +1.5% Y/Y; MEDIAN +3.2%; JUL +4.7%

CHINA MARKETS

PBOC NET DRAINS CNY40BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation resulted in a net drain of CNY40 billion given the maturity of CNY50 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:26 am local time from the close of 2.1385% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday vs 42 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4533 TUES VS 6.4529

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly higher at 6.4533 on Tuesday, compared with the 6.4529 set on Monday.

MARKETS

SNAPSHOT: RBA Sticks With Taper, but Elongates Minimum Life Of Initial Step Down

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 261.9 points at 29931.45

- ASX 200 down 3.093 points at 7525.2

- Shanghai Comp. up 27.792 points at 3649.651

- JGB 10-Yr future up 10 ticks at 151.98, yield down 1.6bp at 0.035%

- Aussie 10-Yr future up 0.5 tick at 98.765, yield down 0.3bp at 1.255%

- U.S. 10-Yr future -0-04+ at 133-08, yield up 1.7bp at 1.339%

- WTI crude down $0.17 at $69.12, Gold down $1.97 at $1820.96

- USD/JPY down 5 pips at Y109.82

- UK PM JOHNSON TO UNVEIL GBP10BN A YEAR TAX RISE TO FUND NHS AND SOCIAL CARE (FT)

- RBA STICKS WITH TAPERING, EXTENDS GUARANTEED LIFE OF A$4BN/WEEK PURCHASES

- JAPAN'S ISHIBA BALKS AT RUNNING IN PARTY RACE, IN BOON FOR KONO (NIKKEI)

- CHINA POSTS WIDER THAN EXPECTED TRADE SURPLUS IN AUG

BOND SUMMARY: Tsys Cheapen After Long Weekend, RBA Tapers, JGBs Outperform

T-Notes pushed through Monday's trough in overnight trade, before recovering from lows to last trade -0-04+ at 133-08, although the break of yesterday's low means that bears are now targeting the nearby 100-DMA support level. Cash Tsys experienced some twist steepening, with 2s seeing very modest richening, while 7+-Year paper cheapened by ~1.5bp. Headline flow remains light, but today's Asia-Pac session gave regional participants their first opportunity to trade cash Tsys in the wake of Friday's NFP report, so the moves may represent some post-data positioning. The uptick in regional equity markets will also be adding some light pressure to the space, with the post-RBA ACGB impetus allowing the space to move away from cheaps. Asia-Pac flow was headlined by a 2.5k block sale of TYZ1 futures. 3-Year Tsy supply headlines locally on Tuesday.

- JGBs meandered through the morning session after the early twist flattening, with futures supported, last +8 on the day. Comments from Japanese Finance Minister Aso failed to move the needle, as he pointed to a need to balance economic support with fiscal discipline, he also identified the need to boost government revenue while limiting spending. Aso noted that he doubts such measures would promote a weaker JPY and inflation owing to Japan's financial standing. Cash Jgbs saw some outperformance in the belly, which richened by 1.0-1.5bp. The lead up to and results of this afternoon's 30-Year JGB supply may have limited the longer end of the curve a little. The auction 30-Year JGB supply sees the cover ratio hold steady around the 3.00x mark (6-auction average 3.18x), while the tail narrowed a touch vs. the prev. auction as the low price matched broader expectations (proxied by the BBG dealer poll). All in all, it wasn't the firmest auction.

- Aussie bond futures knee-jerked lower on the RBA's decision to maintain its decision to implement a taper of its bond purchases in the coming days, but recovered on the fact that the guaranteed life of the previously outlined A$4bn/week bond purchases now runs until February '22 (it was previously set to be revisited in mid-November), with the Bank pointing to an increase in economic uncertainty and suggesting that the pace of the economic bounce-back is likely to be slower than that seen earlier in the year. YM & XM now print at unchanged levels.

JGBS AUCTION: Japanese MOF sells Y731.1bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y731.1bn 30-Year JGBs:

- Average Yield 0.653% (prev. 0.647%)

- Average Price 101.17 (prev. 101.31)

- High Yield: 0.655% (prev. 0.651%)

- Low Price 101.10 (prev. 101.20)

- % Allotted At High Yield: 71.9741% (prev. 35.9782%)

- Bid/Cover: 3.000x (prev. 3.071x)

EQUITIES: Japan Leads Gains Again

Another mostly positive day for equity markets in Asia; Japan leads gains again with the Nikkei 225 briefly looking above the 30,000 level. Japanese front pages are dominated by political headlines, momentum still seems to be behind Taro Kono, Japan's vaccine czar. Markets in China also higher, tech shares lead gains but upside is broad based after better than expected trade data. In the US futures edged higher as markets prepare to return after the US Labor Day holiday.

OIL: Creeps Higher In Asia As USD Softens

Oil has ground higher through the Asia-Pac session, but is still slightly lower versus Friday settlement levels after ebbing through the session on Monday in holiday thinned trade; the closure of US markets for Labor Day keeping volumes, price action and newsflow relatively muted. A pause in the USD's near-term decline weighed on energy markets on Monday, while the greenback has come under pressure in Asia which has helped crude futures higher. As a reminder Saudi Arabia will cut oil prices for sales to Asia next month by more than double the expected amount, the decision follows OPEC agreement to go ahead with production increases.

GOLD: As You Were

Gold consolidated below $1,830/oz in holiday-thinned Monday trade, with an uptick in the USD and equities applying some light pressure to the metal. Spot is little changed around $1,825/oz at typing, with a familiar technical overlay in play. Our weighted U.S. real yield monitor has nudged higher in the wake of last week's NFP release but remains well within the confines of the recent range.

FOREX: AUD Whipsaws After RBA Policy Announcement

Most major USD crosses held tight ranges in Asia, albeit the greenback underperformed at the margin for the bulk of the overnight session, with local markets set to reopen after a long weekend. JPY paid little attention to the Nikkei 225's first break above 30,000 since April.

- AUD wavered ahead of the RBA's monetary policy decision. The currency bounced after the RBA decided to stick with its bond tapering plan and said that the setback to economic expansion is expected to be only temporary, but failed to hold onto these gains and retreated into negative territory without much delay.

- NZD clung to the coattails of its Antipodean cousin, ending up as one of the worst G10 performers. A round of comments from RBNZ Gov Orr included little in the way of fresh insights.

- Final EZ GDP, German ZEW Survey & industrial output as well as comments from BoE's Mann & Saunders take focus from here.

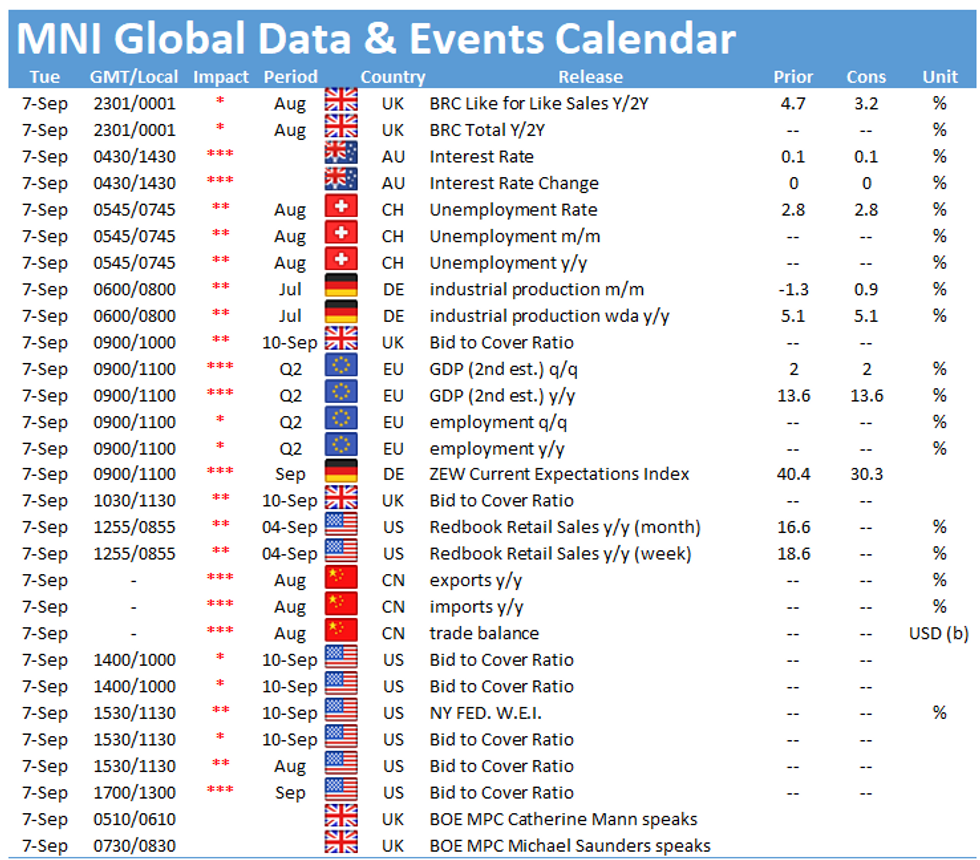

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.