-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: China Evergrande Can't Catch A Break, AUD/NZD Pressured Further

- Headwinds/issues surrounding China Evergrande continued to dominate regional news flow during Asia-Pac hours.

- A firmer than expected Q2 GDP print out of New Zealand allowed market pricing surrounding RBNZ rate hikes to firm up.

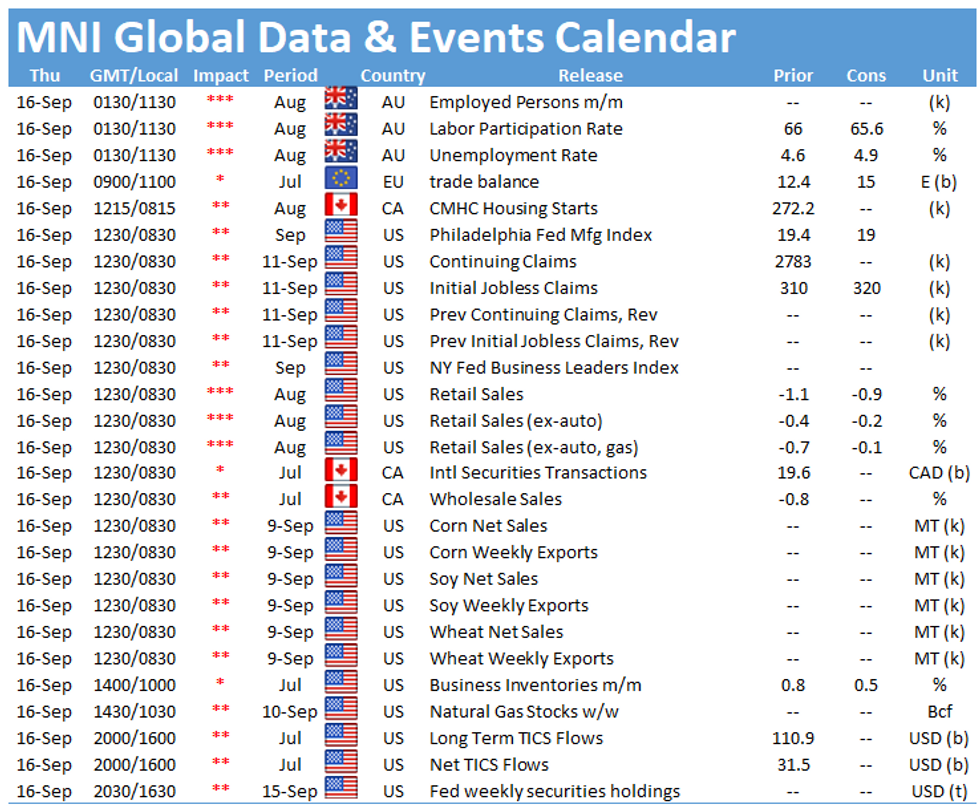

- U.S. retail sales data and ECB speak from LAgarde & Rehn headlines the broader docket on Thursday.

BOND SUMMARY: U.S. Tsys Flat, JGBs & ACGBs A Little Softer

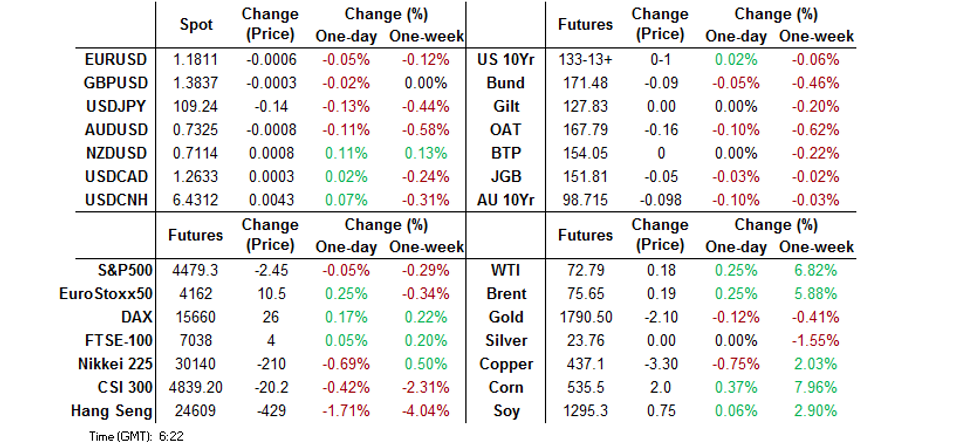

T-Notes held to a narrow 0-03+ range in Asia-Pac hours, shaking off continued regional worry surrounding trouble property developer China Evergrande/pressure on the Hang Seng & equity indices in mainland China. TYZ1 +0-01 at 133-13+, with cash Tsys virtually unchanged across the curve. A 5.0K block buyer of the TYV1 132.75/132.25 put spread dominated flow in the Tsy space, while the short end saw a 5.0K screen lift of the EDM2/U2 spread. Thursday's NY session is set to bring retail sales data for August, the latest round of weekly jobless claims figures and the monthly regional m'fing survey from the Philadelphia Fed.

- Cheapening pressures crept into the JGB space in the wake of the latest round of 20-Year JGB supply. The auction saw the low price meet broader dealer expectations (as proxied by the BBG dealer poll), although the remaining metrics surrounding the auction were nowhere near as firm. The length of the tail widened a little vs. the prev. round of 20-Year supply, while the cover ratio eased (moving back below the 6-auction average of 3.50x), printing at the lowest level witnessed at a 20-Year auction since February in the process. It looks like supply worry and the lack of outright yield on offer may have outweighed the carry and roll proposition/recent, modest cheapening. That left futures -9, while 7+-Year paper cheapened by ~0.5bp in cash trade, with shorter dated paper little changed on the day. 30- & 40-Year swap spreads widened, aiding the pressure. Domestic political headlines continue to be observed but had little impact on the space.

- In Sydney, a quick but contained tick lower for XM saw the contract show below its early Sydney lows, with no news flow apparent at the time. The move may have been related to hedging surrounding the pricing of TCV's new Sep '35 sustainability bond (A$2.5bn in size), with details crossing the wires a little while after. This paper headlined the continued steady round of A$ issuance witnessed in recent sessions. Elsewhere, the larger than expected fall in headline employment in Australia during the month of August provided very little market impact, as hours worked fell, while the drop in the participation rate outweighed the headline fall, resulting in a surprise downtick in the unemployment rate. The market could look through the release given the fact that policymakers expect a swift, sharp bounce back for the economy once COVID restrictions are unwound. YM -2.8 & XM -4.4.

JAPAN: Japan Bought Largest Net Round Of Foreign Bonds Since Nov ‘20 Last Week

Bond flows continue to dominate Japan's weekly international security flow data.

- Japanese investors lodged the largest net round of weekly bond purchases seen since November '20 last week (Y1.7614tn), as most of the major benchmark core global FI metrics cheapened a little.

- Elsewhere, foreign investors registered the third consecutive week of net purchases of Japanese bonds, with an uptick in purchase sizes vs. the previous week, although the level of net purchases didn't reach levels witnessed two weeks ago.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1761.4 | 1043.2 | 2075.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -139.0 | -455.7 | -581.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 951.9 | 432.9 | 2640.3 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 128.7 | 422.8 | 25.4 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Kiwi Gains On Strong GDP Data, Leaving Antipodean Cousin Behind

The Antipodean cross AUD/NZD pierced the psychological NZ$1.0300 barrier and retreated to its worst levels since Apr 2020, after New Zealand's upbeat Q2 GDP report inspired participants to add hawkish RBNZ bets. Quarterly growth not only topped BBG median estimate but was faster than projected by any of the economists taking part in the survey. NZD landed atop the G10 pile in the immediate aftermath of the release and remained the best performer in the space, despite the backward-looking nature of the data.

- Trans-Tasman spillover prompted AUD to blip higher against most G10 peers after the publication of Kiwi GDP figures, but the currency reversed gains later in the session. Domestic labour market report proved noisy, with the data was affected by Australia's lockdown dynamics. The Aussie retreated as employment shrank more than forecast and the decline in participation was deeper than anticipated, even as headline unemployment rate unexpectedly dipped.

- The Australia/New Zealand 2-Year swap spread continued to tighten as the Antipodean data poured fuel on existing central bank outlook divergence. NZ OIS strip prices ~36bp worth of tightening at the next RBNZ meeting, up from ~27bp seen yesterday. In contrast, RBA Gov Lowe earlier this week underscored the cautious approach of Australia's central bank.

- The yen garnered some strength on the back of waning risk appetite, which saw U.S. e-mini futures turn red. Japanese political headlines continued to do the rounds, with Chief Cabinet Sec Kato noting that the gov't considers calling a special parliament session for Oct 4 to pick the new PM.

- Looking ahead, U.S. retail sales & jobless claims as well as Canadian housing starts & trade balance will hit the wires later in the day. Speeches are due from ECB's Lagarde & Rehn.

FOREX OPTIONS: Expiries for Sep16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1720-25(E1.3bln), $1.1750(E635mln), $1.1850(E574mln)

- USD/JPY: Y109.30-40($673mln), Y109.70-80($1.3bln), Y110.50-65($1.7bln)

- EUR/GBP: Gbp0.8525-45(E580mln)

- AUD/USD: $0.7360(A$514mln)

- USD/CAD: C$1.2550-75($1.9bln)

- USD/CNY: Cny6.40($1bln), Cny6.45($995mln)

ASIA FX: Mild Risk Aversion Keeps Most Asia EM FX At Bay

Most Asia EM FX softened amid waning risk appetite, as participants mulled the fallout from the Evergrande saga.

- CNH: USD/CNH crept higher amid mild risk aversion. The PBOC set their USD/CNY mid-point at CNY6.4330, 5 pips above sell-side estimate.

- KRW: KRW reopened on a firmer footing but erased most gains thereafter amid escalating arms race on the Korean peninsula. Pyongyang confirmed test-launching rail-borne missiles during a drill held hours before Seoul successfully fired ballistic missiles from a submarine for the first time.

- IDR: The rupiah was among the best performers in Asia EM basket but gave up most of its reopening gains as risk appetite waned. The currency may have drawn some support from strong data released yesterday, with both exports and trade surplus reaching all-time highs in August.

- PHP: The peso underperformed even as Metro Manila switched to a more targeted system governing Covid-19 restrictions. It shrugged off the unexpected growth in Philippine overseas remittances reported yesterday.

- THB: The baht sold off with amid souring risk appetite. Prachachat Turakij reported that the fiscal and monetary policy committee may meet on Sep 20 to discuss raising public debt ceiling to 70% of GDP.

- SGD: Singdollar weakened along most of its regional peers, with little in the way of notable local headline flow.

- Malaysian markets were closed in observance of a local public holiday.

EQUITIES: Most Major Asia-Pac Equity Indices Struggle, Familiar Risks Weigh

The major regional equity indices were mostly lower on Thursday. The Nikkei 225 continued its pullback from the multi-decade highs registered earlier this week. Elsewhere, troubled developer China Evergrande suspended trading of all of its onshore bonds on Thursday, although dealing is set to resume tomorrow. Regulatory headwinds also continued to blight the sectors that Chinese policymakers have targeted in recent months. This allowed the Hang Seng to lead the way lower, shedding ~2% on the day. Australia's ASX 200 was the exception to the broader rule, with the energy sector providing the largest sectoral gain on the energy price dynamics witnessed over the last 24 hours. U.S. e-mini futures traded either side of unchanged during the overnight session, in what was relatively limited, directionless dealing.

GOLD: Lack Of Conviction

Gold continues to meander, dealing either side of $1,800/oz over the last few days, with the eventual modest uptick in U.S. Tsy yields unwinding a portion of Tuesday's U.S. CPI-inspired gains during Wednesday's NY session. Participants look for more clarity come the end of next week's FOMC decision, with the familiar, well-trodden technical overlay for gold remaining in place for now, as spot deals essentially unchanged at $1,795/oz.

OIL: An Uptick In Asia

WTI & Brent crude futures have added ~$0.20 to settlement levels. A reminder that a deeper than expected drawdown in headline crude stocks in the latest DoE inventory report added to the post-API impetus on Wednesday, with the DoE release also providing a drawdown in stocks at the Cushing hub. The distillate and gasoline DoE readings also witnessed drawdowns, although they weren't as deep as broader exp. Several supply side headlines were more negative, although inventory data outweighed those matters, with U.S. Gulf crude production slowly coming back online, the Colonial pipeline pointing to normal operation, while exports from the Libyan oil terminal of Hariga are set to resume.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.