-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Bounce In E-Minis Extends

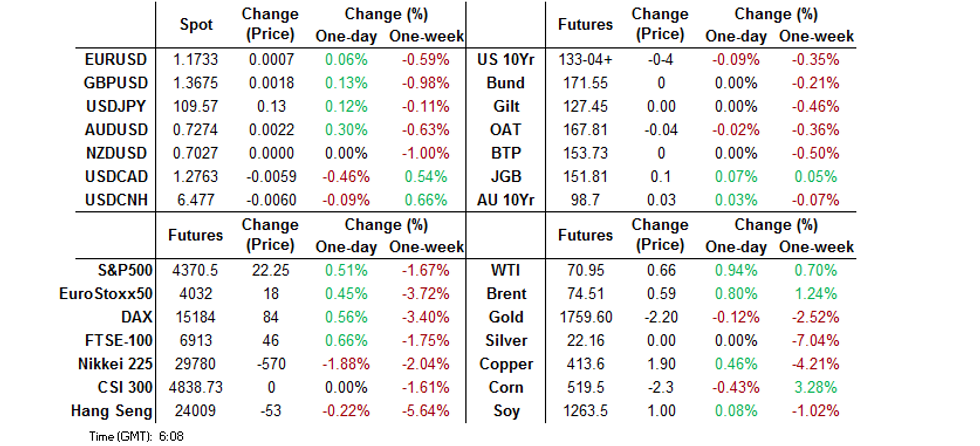

- The S&P 500 e-mini contract has extended its bounce away from Monday's low, perhaps on the back of less worry surrounding contagion stemming from the China Evergrande situation & a bullish note from J.P.Morgan re: equities.

- The OIS space unwound pricing re: the odds of a 50bp hike at the RBNZ's October meeting, with a 25bp hike now perfectly priced in the wake of comments from RBNZ Assistant Governor Hawkesby.

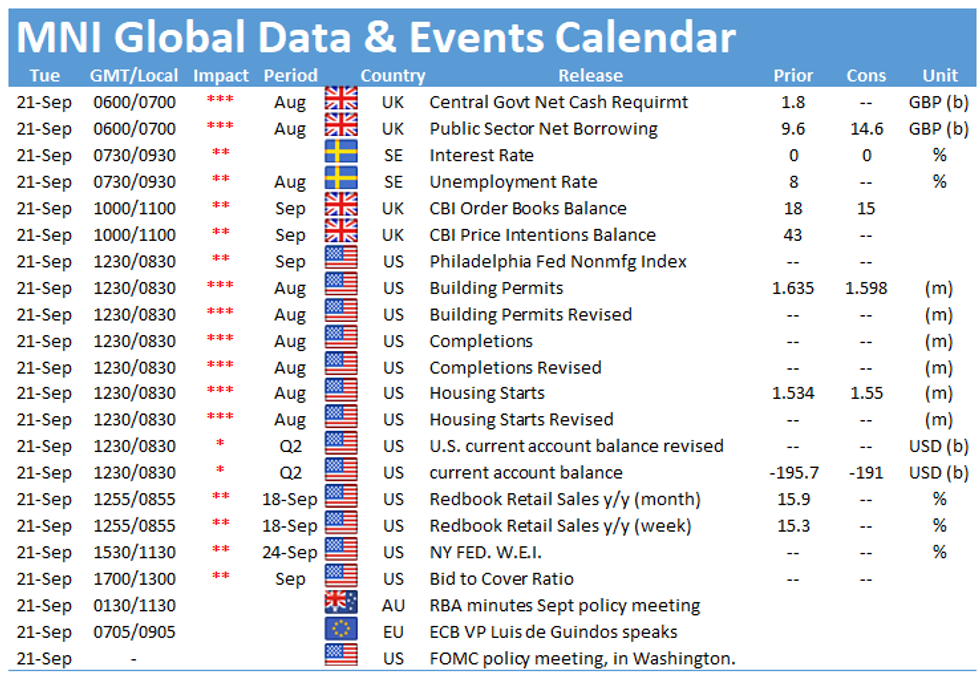

- U.S. building permits and housing starts data is due Tuesday, as is the latest Riksbank decision and comments from ECB Vice President de Guindos.

BOND SUMMARY: Tsys Cheapen, ACGBs Off Highs, JGBs Bid After Long Weekend

A greater sense of stability, which saw the Hang Seng briefly pare all of its early losses at one point, applied some light pressure to the U.S. Tsy space during overnight trade. That left T-Notes -0-04+ at 133-04 ahead of London dealing, while cash Tsys run little changed to 1.5bp cheaper across the curve, with 10s leading the way lower. There wasn't much in the way of notable market flow observed. 20-Year Tsy supply provides the focal point during Tuesday's NY session. Housing starts and building permits data will also cross in NY hours.

- JGBs opened firmer after the long weekend, before ticking away from best levels. The space then saw a fresh, albeit modest bid, aided by domestic equities ticking back towards their intraday lows. Futures last +12, while the belly of the cash JGB curve sits ~1.0bp richer vs. Friday's closing levels. The cover ratio eased at the latest liquidity enhancement auction for off-the-run 1- to 5-Year JGBs, although the metric remained above the 4.00x marker. Elsewhere, the pricing of the spreads moved deeper into negative territory this time out, which is a positive in terms of demand. All in all, the auction was digested smoothly enough.

- Aussie bonds drifted away from best levels after showing higher at the re-open, taking a broader sense of direction from the U.S. Tsy space, although the moves in ACGBs were a little more extreme as participants reacted to the moves witnessed after yesterday's Sydney close and subsequent bounce from lows S&P 500 e-minis. The minutes from the RBA's most recent monetary policy meeting didn't provide much in the way in the way of fresh, material information. YM +1.5 & XM +3.0.

FOREX: RBNZ Speak Pulls Rug From Beneath NZD Despite Firmer Risk Sentiment

The kiwi went offered amid dovish RBNZ repricing inspired by a speech from Asst Gov Hawkesby, who signalled the Reserve Bank's cautious approach to raising the OCR, noting that "when there is a typical amount of uncertainty, and the risks are evenly balanced, then central banks globally tend to follow a smoothed path and keep their policy rate unchanged or move in 25 basis point increments." Market pricing no longer suggests that participants are sitting on the fence re: October monetary policy meeting. The OIS strip now prices exactly 25bp worth of tightening at the upcoming MPC gathering, which is tantamount to one standard sized OCR hike.

- AUD/NZD rose to its best levels in a week as AU/NZ 2-year swap spread moved away from multi-year lows. The Antipodean cross had been weighed on by growing central bank outlook divergence over the recent months.

- NZD was the odd one out among commodity-tied G10 FX amid an uptick in broader risk appetite. Most high-betas (AUD, CAD, NOK) edged higher as sentiment finally got some reprieve after the recent turmoil surrounding China's Evergrande.

- Selling pressure hit the yen amid reduced demand for safe haven currencies. Although equity benchmarks in Japan ground lower, U.S. e-mini futures managed to register gains.

- Regional liquidity and headline flow were limited by market closures in China, Taiwan and South Korea. China and Taiwan will reopen tomorrow.

- U.S. housing starts & current account balance, Riksbank MonPol decision and comments from ECB Vice Pres de Guindos take focus from here.

FOREX OPTIONS: Expiries for Sep21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E843mln), $1.1800(E655mln), $1.1900-20(E1.6bln)

- USD/JPY: Y108.55-65($651mln), Y109.00($1.3bln), Y109.50($679mln), Y109.65-70($807mln)

- EUR/JPY: Y127.00(E630mln)

- AUD/USD: $0.7315-20(A$585mln)

- USD/CAD: C$1.2675($550mln), C$1.2800($1.5bln)

ASIA FX: USD/Asia Rangebound, THB Lags Behind

Most USD/Asia crosses held fairly narrow ranges, with markets in China, Taiwan and South Korea closed in observance of local public holidays.

- CNH: Spot USD/CNH edged lower as the greenback struggled for any topside momentum. China's markets are set to reopen tomorrow.

- IDR: The rupiah treaded water ahead of the announcement of Bank Indonesia's monetary policy decision.

- MYR: USD/MYR eased from a multi-week high, with broader greenback dynamics undermining the pair.

- PHP: The peso also firmed on the back of USD weakness, amid limited local headline flow.

- THB: The baht was the worst performer in the Asia EM basket after FinMin Arkhom announced on Monday that Thailand will be raising its official debt cap to 70% from 60% of GDP.

EQUITIES: A Little More Stable, E-Mini Bounce Extends

It was a bit of a topsy turvy Asia-Pac session for equities, with markets running in both directions, although the low base that Monday provided re: a relative comparison in stability allowed the market to feel a little more at ease, with e-minis moving further away from Monday's lows after Wall St. trade saw U.S. equities record their worst day in months.

- The Hang Seng fully reversed its early losses at one point, before drifting lower as we moved towards the lunch bell. It would seem that the feeling that the Evergrande situation may prove to be contained as opposed to China's Lehman-like event became a little more widespread during Tuesday's Asia-Pac trade, although we shall see how Chinese onshore markets react when they return from the elongated weekend on Wednesday. Note that S&P pointed towards a likely default on the part of Evergrande, which most now expect.

- The Nikkei 225 shed ~1.5% after the long weekend in Tokyo, playing catch up to the broader risk environment witnessed on Monday.

- A reminder that Monday saw one of J.P.Morgan's noted strategists write that "the market sell-off that escalated overnight we believe is primarily driven by technical selling flows (CTAs and option hedgers) in an environment of poor liquidity, and overreaction of discretionary traders to perceived risks. However, our fundamental thesis remains unchanged, and we see the sell-off as an opportunity to buy the dip." This may have been a supportive factor when it came to Monday's late bounce from lows (as the comments got a wider airing in the financial press).

GOLD: Some Stabilisation After A Breach Of Initial Support

Gold has hugged a tight range during Tuesday's Asia-Pac session, with spot last dealing little changed, just shy of $1,765/oz. This comes after the defensive tone, coupled with some stabilisation in U.S. real yields and the broader USD's pullback from best levels of the day, allowed bullion to regain some poise on Monday. Note that this came after a brief and limited foray bellow the recent lows during a holiday-thinned Asia-Pac session on Monday. Yesterday's low ($1,742.5/oz) now provides initial technical support ahead of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Meanwhile, firm resistance remains located at the Sep 14 high ($1,808.7/oz). Participants await Wednesday's FOMC decision, with a particular focus on the central bank's language surrounding tapering matters.

OIL: Unwinding Some Of Monday's Losses

Crude has advanced since Monday's settlement, with WTI & Brent futures sitting ~$0.70-0.80 above their respective settlement levels, as e-minis move away from their Monday lows.

- Crude supply-demand dynamics continue to underpin in the background, with Shell the latest to flag damages to its facilities in the wake of Hurricane Ida, which will hamper production into '22.

- Broader risk-off flows and an early uptick in the USD (which was subsequently unwound) pressured crude on Monday, with the 2 major benchmarks finishing more than $1.00 lower on the day.

- The weekly API inventory estimates headline on Tuesday ahead of Wednesday's weekly DoE inventory report.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.