-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Evergrande To Make Onshore Bond Coupon Payment, Details Murky

EXECUTIVE SUMMARY

- EVERGRANDE FILING ON YUAN BOND INTEREST LEAVES ANALYSTS GUESSING (BBG)

- PBOC BOOSTS DAILY LIQUIDITY INJECTION

- PBOC LPR FIXINGS UNCHANGED

- RBA SOUNDS WARNING ON HOUSEHOLD DEBT RISK TO FINANCIAL STABILITY (AFR)

- BOJ LEAVES POLICY SETTINGS UNCHANGED, MARKS DOWN VIEW ON EXPORTS AND PRODUCTION

Fig. 1: U.S. 2-Year/2-Year OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England should scrap the last of its quantitative easing plans and start preparing for an increase in interest rates, The Times' panel of economist experts has said. All nine members of the shadow monetary policy committee said the Bank should end the QE programme early, with almost £50 billion of gilts still left to purchase. The Bank's MPC announces its decision on Thursday. (The Times)

ECONOMY: The British public's expectations for inflation over the coming year have shot up by a record amount this month, raising the risk that the Bank of England will send a hawkish message soon, Citi said on Tuesday. The Citi/YouGov monthly inflation expectations survey showed that public inflation expectations for the next 12 months jumped to 4.1% in September from 3.1% in August, the biggest monthly increase since the survey began more than 15 years ago. Longer-term inflation expectations for the next five to 10 years rose to 3.8% in September from 3.5% in August. "Today's data, especially the movement in long-term expectations, suggest growing risks inflation expectations could become de-anchored to the upside. The sharp increase risks a hawkish response from the (Monetary Policy Committee) this week," Citi said. (RTRS)

BREXIT: MNI BRIEF: EU Sefcovic: Do Utmost To Solve NIP By Year End

- EU Commission Vice President Maros Sefcovic said that the EU would do its utmost to find "practical solutions" to the Northern Ireland Protocol by the end of the year. Sefcovic told a press conference that EU-U.K. expert-level talks on the issue are now taking place twice a week and said there are regular contacts with the UK's David Frost - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: Joe Biden has delivered a warning to Boris Johnson not to allow a dispute over the post-Brexit settlement in Northern Ireland to destabilise the Northern Ireland peace process. Speaking alongside the prime minister in the White House, the US president said he felt "very strongly" that any change to the "Irish accords" would undo peace efforts and could result in "a closed border". Johnson has raised alarm bells in Washington by warning in recent months that the UK will not hesitate to trigger Article 16 — the override mechanism that suspends parts of the Northern Ireland protocol, the section of Britain's 2019 Brexit withdrawal agreement that covers trade with the region. (FT)

EUROPE

GERMANY: With only five days to go until Germany's general election next Sunday, Chancellor Angela Merkel sought to give conservative heir apparent Armin Laschet's faltering campaign a last-minute boost. As the three main candidates who hope to succeed her spend the final stretch by crisscrossing the nation in search of undecided voters, Merkel on Tuesday night appeared with Laschet at an event in her electoral district on the Baltic coast. "Laschet will fight for every single job once he is Chancellor," Merkel told the crowd, including hostile anti-lockdown protesters, gathered in the drizzling rain on the market place in Stralsund, about 250 kilometers (155 miles) north of Berlin. (BBG)

FRANCE: A far-right television pundit is consolidating his position as a contender for France's election next year, potentially complicating life for front-runners like President Emmanuel Macron. Eric Zemmour, who has yet to officially declare his candidacy, would obtain 11% of votes in the first round of the April ballot, according to a weekly Harris Interactive-Challenges survey. The previous survey saw Zemmour with 10%, up from 7% the week before. (BBG)

ITALY/BTPS: Italy announces September 24 auction details:

- EUR2.0-2.5bn of 0.00% Jan '24 BTP

- EUR0.75-1.00bn of 0.40% May '30 BTPei

U.S.

FED: The taper announcement cometh, but just not this week, according to the CNBC Fed Survey. The survey of 32 market participants shows they expect the Federal Reserve to announce a reduction in its $120 billion in monthly asset purchases in November and begin to taper in December. The Fed is expected to cut purchases each month by $15 billion. The first rate hike does not come until the end of next year. "The challenge for officials will be continuing to delink the timing of tapering from eventual rate liftoff amid splintering views within the FOMC," said Kathy Bostjancic, chief U.S. financial market economist at Oxford Economics. (CNBC)

FED: MNI: Fed Reluctant To Mark Neutral Rate Lower - Ex-Officials

- The Federal Reserve will likely resist downgrading its longer-run assessment of neutral interest rates for some time, instead opting to test how the economy fares during the next rate-hiking cycle before it alters its view, former Fed officials told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The Senate Banking Committee's top Republican sharply criticized Federal Reserve Chairman Jerome Powell Tuesday for tolerating what he considers to be the politicization of the nation's central bank. In an interview with Bloomberg News, Senator Pat Toomey of Pennsylvania, unlike many other Republicans, did not endorse Powell for another term as Fed chair. His criticism comes as President Joe Biden deliberates over whether to renominate Powell, or pick someone like Democratic Fed Governor Lael Brainard, the favorite of some outside liberal groups. (BBG)

FISCAL: The House passed a bill on Tuesday evening aimed at funding the government past Sept. 30, and increasing the limit on how much the US can borrow to pay its bills. But the measure is poised to tank in the Senate, as Minority Leader Mitch McConnell has warned many times. The vote was 220-211 with all Democrats in favor over united Republican opposition. The bill would keep the government funded through December 3, setting the stage for another spending fight in two months. It also included a measure to renew the nation's ability to pay its bills until late next year, along with $28.6 billion in emergency disaster relief funding along with federal aid money to resettle Afghan refugees in the US who fled as the Taliban seized power. The measure stands no chance in the Senate as Republicans are lining up behind McConnell's pledge to torpedo the measure. "The debt ceiling will be raised as it always should be, but it will be raised by the Democrats," he said at a Tuesday press conference. Less than a handful of GOP senators could back the measure, falling far short of ten needed for it to clear the filibuster's 60 vote threshold. So the two parties remained in a standoff that could spiral into a government shutdown during the pandemic and potentially spark another financial crisis. (Business Insider)

FISCAL: Senate GOP Leader Mitch McConnell (R-Ky.) and Sen. Richard Shelby (R-Ala.) on Tuesday night offered a competing short-term government funding bill, just as House Democrats passed a stopgap that suspends the country's borrowing limit. The bill from McConnell and Shelby, the top Republican on the Senate Appropriations Committee, does not include a debt ceiling suspension, reflecting the GOP push to divorce government funding from the looming brawl over the nation's borrowing limit. The House-passed bill would suspend the debt ceiling, which kicked back in on Aug. 1, through 2022. (The Hill)

PROPERTY: A group of Democrats on Tuesday introduced a bill that would reinstate a federal eviction moratorium as the delta variant of the coronavirus fuels outbreaks nationwide. The legislation, led by Rep. Cori Bush of Missouri and Sen. Elizabeth Warren of Massachusetts, would give the Department of Health and Human Services permanent authority to enact an eviction ban during public health crises. When the Supreme Court struck down a moratorium put in place by the Biden administration last month, the majority opinion contended the agency lacked the power to implement it. (CNBC)

BANKS: The biggest U.S. banks appear to be sidestepping any fallout from the crisis at indebted developer China Evergrande Group that sparked a widespread selloff in stocks this week. Citigroup Inc. has no direct lending exposure to Evergrande, a spokeswoman said. JPMorgan Chase & Co. and Bank of America Corp. also have no such links, according to people familiar with the matter, who asked not to be identified discussing private information. Bank of America has no indirect exposure because it limits business in China to subsidiaries of U.S. companies, one of the people said. "Our indirect exposure through counterparty credit risk is small and with no single significant concentration," Danielle Romero-Apsilos, a spokeswoman for Citigroup, said in an emailed statement. (BBG)

OTHER

GLOBAL TRADE: MNI BRIEF: EU To Confirm Key US Trade Talks To Go Ahead Sep 29

- The EU and US have decided to proceed with the inaugural meeting of the Trade and Technology Council on Sep 29 in Pittsburgh, with an EU source saying a joint statement is already circulating internally to this effect. EU states have been divided over whether to go ahead or postpone following the AUKUS announcement, sources indicated, although Commission Vice President Valdis Dombrovskis, who is responsible for trade policy, however, made clear his preference for proceeding with the talks internally, sources said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GLOBAL TRADE: The UK hopes to join a trade pact between the US, Mexico and Canada as hopes fade for an imminent bilateral agreement with Washington. The USMCA trade pact was signed by Donald Trump, then US president, with Canada and Mexico last year after a long renegotiation of the existing 1994 Nafta deal between the three countries. The agreement, which was widely backed by Democrats on Capitol Hill, included tightened environmental and labour standards, a new digital chapter and strict rules of origin requirements for the automotive industry. (FT)

U.S./CHINA: The U.S. Department of Justice has launched an investigation into Zoom's proposed $15 billion acquisition of American cloud contact center software Five9, as the deal poses potential national security risks due to "foreign participation," a public filing shows. (Nikkei)

U.S./EU/CHINA: The European Union and the U.S. are cautiously moving to rein in China, seeking stronger enforcement of investment-screening rules and trying to keep technology from being misused to threaten security and human rights, according to a draft of outcomes ahead of key talks that may be postponed. The document, prepared for the inaugural meeting of the U.S.-EU Trade and Technology Council on Sept. 29 and seen by Bloomberg, states the nations will cooperate to promote labor rights, combat forced labor, and that they will work together on export controls to protect international security and support a global level-playing field. They will also jointly resist challenges to their trade policies arising from non-market distortive policies, a reference to China. The draft is subject to change. (BBG)

GEOPOLITICS: Strains in transatlantic ties have been building for years and cannot be reduced to just frustration over Australia scrapping a $40 billion submarine deal with France, the European Commission's industry commissioner Thierry Breton said on Tuesday. Breton said many politicians and citizens in Europe shared a "growing feeling ... that something is broken in our transatlantic relations" after a series of surprises from the Biden administration in recent months. (RTRS)

CORONAVIRUS: President Joe Biden plans to announce an order of 500 million doses of the Pfizer-BioNTech SE vaccine Wednesday, according to two people familiar with the matter, as the president looks to increase donations of shots abroad and ward off criticism about U.S. plans for boosters. Negotiations between the administration and manufacturers are continuing but a deal is poised to be unveiled at a virtual vaccine summit, said the people, who asked not to be named ahead of the announcement. (BBG)

CORONAVIRUS: Chinese President Xi Jinping said Tuesday that China will provide more vaccines against COVID-19 to the world, as well as international assistance. The country will strive to provide a total of 2 billion doses of vaccines to the world by the end of this year, Xi said in his statement delivered via video at the general debate of the 76th session of the United Nations General Assembly. (Global Times)

BOJ: MNI BRIEF: BOJ On Hold; Won't Hesitate to Act If Necessary

- The Bank of Japan board on Wednesday decided to maintain yield curve control policy and left its short-term policy interest rate at -0.1% and the long-term interest rate target at around zero percent, a policy statement released the BOJ showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI BRIEF: BOJ Details New Facility For Climate Change Loans

- The Bank of Japan board on Wednesday released the details of "the Funds-Supplying Operations to Support Financing for Climate Responses" and starts accepting applications for from Sept. 22 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBA: The Reserve Bank of Australia has warned that growing household debt driven by booming property prices could increase the risk of financial instability. The central bank is finding it hard to judge in real time whether prices are out of line with market fundamentals, and said the macro-financial risks posed by growing household debt warranted close attention. "Sharp rises in housing prices that are not associated with fundamentals could lead to instability by raising the risk of a subsequent decline," RBA assistant governor Michelle Bullock said in an online speech on Wednesday. "Whether or not there is need to consider macro-prudential tools to address these risks is something we are continually assessing." (AFR)

NEW ZEALAND: New Zealand Covid-19 Response Minister Chris Hipkins said the country is "not giving up on getting back down to zero, that is exactly why Auckland is still at Alert Level 3." Director General of Health Ashley Bloomfield said on Monday that New Zealand may not get back to zero cases of Covid-19, but that doesn't mean the country has abandoned its elimination strategy. That means trying to stamp out the virus whenever it is found, Bloomfield told Radio New Zealand. Auckland, the largest city, has been in lockdown for five weeks and won't exit for at least another two, while social distancing and mask-wearing requirements are in place for the rest of the country. Although a handful of new cases continue to be reported daily, health officials are on top of the current outbreak and are aiming to get the vaccination rate over 90% so that restrictions can be eased, Bloomfield said. (BBG)

CANADA: MNI INTERVIEW: Trudeau Has 'De Facto Majority' on Deficits

- Justin Trudeau will press ahead with outsized deficits even after failing to secure a majority government in Monday's election, and his own leadership of Parliament may be free of significant challenges after a campaign where opposition leaders also had setbacks, Peter Donolo, a top adviser to former Liberal Prime Minister Jean Chretien, told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NORTH KOREA: South Korea President Moon Jae-in on Tuesday (Sept 21) addressed the UN General Assembly and repeated a call for a declaration to formally end the 1950-1953 Korean War. "I once again urge the community of nations to mobilise its strengths for the end-of-war declaration on the Korean Peninsula," Moon said in a speech to the annual gathering of the world body. "I propose that three parties of the two Koreas and the US, or four parties of the two Koreas, the US and China come together and declare that the War on the Korean Peninsula is over," he said. (RTRS)

MEXICO: Mexico's government is considering using the $7 billion of international reserves it bought from the central bank this month for purposes other than prepaying debt of the nation's oil giant Pemex, according to three people with knowledge of the matter. Mexico purchased the reserves the same week President Andres Manuel Lopez Obrador said his administration had begun a process to refinance expensive public debt, with his spokesman saying that he was referring to debt owned by Petroleos Mexicanos, as Pemex is known. The move was the latest twist in an attempt by Lopez Obrador to aid the state-owned company, which is the world's most indebted oil major. (BBG)

BRAZIL: Proposal to pay most of the court orders known as 'precatorios' within the spending cap and negotiate the remaining balance between the parties will be sent to Congressional leaders, the head of Senate Rodrigo Pacheco told reporters alongside Lower House speaker Arthur Lira and Economy Minister Paulo Guedes. (BBG)

RUSSIA: Russia will spend around 2.5 trillion roubles ($34 billion) from its National Wealth Fund (NWF) in the next three years to help revive economic growth after the pandemic but must also take care not to drive up inflation, officials said on Tuesday. (RTRS)

IRAN: Iran's Nuclear Program Is 'Galloping Forward,' Blinken WarnsIran's President Ebrahim Raisi said the U.S. is using sanctions as a new means of warfare in a debut before the United Nations General Assembly that was notably absent of any updates on the stalled talks to revive the 2015 nuclear deal. In a prerecorded speech screened at the annual gathering of world leaders in New York City, Raisi, who's subject to direct U.S. sanctions, said his country could never trust Washington after former President Donald Trump abandoned the multiparty accord in 2018. The hard-line cleric who took office in August blamed the U.S.'s bruising sanctions regime for harming Iranians' access to medicines during the coronavirus pandemic. (BBG)

CHINA

CREDIT: China Evergrande Group's onshore property unit said in a vaguely worded exchange filing that it reached an agreement with yuan bondholders on an interest payment due Sept. 23. The unit said that the issue for its 5.8% 2025 bond "has been resolved via negotiations off the clearing house," under a section in the filing on the bond interest payment. But the statement didn't specify how much interest would be paid or when. (BBG)

CREDIT: The International Monetary Fund on Tuesday said it is closely following developments surrounding China Evergrande Group, but believes Beijing has the tools to prevent the situation from turning into a systemic crisis. (RTRS)

CREDIT: China should face up to the crisis at China Evergrande Group and prevent the risks from spreading, China Business News says in an editorial. (BBG)

ECONOMY: China's consumption may rebound from the low level in August as policies to boost consumer demand kick in, the Securities Times said. During the Mid-Autumn Festival, travelers made about 88 million trips inside China, generating CNY37 billion in total tourist revenue, or 87.2% and 78.6% of the pre-pandemic levels in 2019, the newspaper said citing data by the Ministry of Culture and Tourism. The government has released measures to promote spending on new and second-hand vehicles, home appliances, furniture and catering following the sluggish August retail sales data, which would help to unleash more demand in the upcoming consumption peak season in September and October, the newspaper said citing analysts. China's retail sales managed to gain only 2.5% y/y in August, the slowest in a year, down from July's 8.5%. (MNI)

YUAN: The PBOC will steadily promote yuan internationalization, further expand the cross-border use of yuan under current accounts in businesses such as commodity and e-commerce trade, according to the 2021 RMB Internationalization Report published on the PBOC website. The central bank said it will further broaden cross-border investment and financing channels for the yuan, enrich risk hedging tools, while strengthening the monitoring and early warning of cross-border capital flows. As of end-June, foreign investors hold a total CNY10.26 trillion of financial assets including yuan stocks, bonds, loans and deposits, rising 42.8% y/y. Yuan ranks the fifth among major international payment currencies in June, also the fifth in the official foreign exchange reserve currency composition (COFER) tracked by the International Monetary Fund (IMF). (MNI)

POLICY: China will stop funding coal projects overseas, President Xi Jinping said Tuesday, ending a major source of support for a dirty energy contributing to climate change. Addressing the UN General Assembly, Xi made the promise as he vowed to accelerate efforts to help the world battle the climate crisis. "China will step up support for other developing countries in developing green and low carbon energy and will not build new coal-fired power projects abroad," Xi said in a pre-recorded address. "We should foster new growth drivers in the post-Covid era and jointly achieve leapfrog development, staying committed to harmony between man and nature," Xi said. (AFP)

PROPERTY: China should optimize controls over the real estate market and not hurt those in real demand for housing, the Economic Daily said in a commentary. There are still new residents and young people in large cities with strong desires to purchase homes though without sufficient money, the newspaper said. Their needs should be assured and met to help enlarge the market and ensure its healthy growth, said the newspaper. Those who speculate on houses have the capital and resources to evade policies while the less resourceful but with real needs often fall victims, so the government should further refine policies, said the newspaper. (MNI)

CORONAVIRUS: China's northern city of Harbin will suspend kindergartens, primary and middle schools for one week starting Sept. 22 to control a Covid-19 outbreak in the city, CCTV reports. Instead, all the teaching will be moved online. The city reported 3 covid cases as of 6pm Tuesday. (BBG)

OVERNIGHT DATA

AUSTRALIA AUG WESTPAC LEADING INDEX -0.27% M/M; JUL -0.07%

The Leading Index has held up surprisingly well during this downturn but it seems likely that there is more weakness on the way. For example, while all components have contributed to the slowdown in growth since March, commodity prices and equities have been reasonably resilient. Developments in those markets in September are likely to drag the Index down further. Westpac expects the economy to contract by 4% in the September quarter; show a modest 1.6% recovery in the December quarter as the NSW and Victoria lockdowns are eased and building into a 7.4% surge in growth in 2022. By December we would be expecting to see signs of this recovery in the Leading Index as it paves the way for a very strong rebound in 2022, highlighted by a 5.6% lift in the first half of the year. (Westpac)

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS WEDS

The People's Bank of China (PBOC) injected CNY60 billion via 7-day reverse repos and another CNY60 billion via 14-day reverse repos with the rate unchanged at 2.2% and 2.35%, respectively, on Wednesday. The operations lead to a net injection of CNY90 billion after offsetting the maturity of CNY30 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2143% at 09:47 am local time from the close of 2.2482% on Sep.18.

- The CFETS-NEX money-market sentiment index closed at 40 on Sep.18 vs 47 on Sep.17.

PBOC SETS YUAN CENTRAL PARITY AT 6.4693 WEDS VS 6.4527

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4693 on Wednesday, compared with the 6.4527 set before three-day holiday.

MARKETS

SNAPSHOT: Evergrande To Make Onshore Bond Coupon Payment, Details Murky

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 156.47 points at 29679.59

- ASX 200 up 37.174 points at 7311

- Shanghai Comp. down 10.559 points at 3603.407

- JGB 10-Yr future up 2 ticks at 151.85, yield down 0.5bp at 0.036%

- Aussie 10-Yr future unch. at 98.705, yield down 0.5bp at 1.265%

- U.S. 10-Yr future -0-01+ at 133-04+, yield up 0.68bp at 1.329%

- WTI crude up $0.80 at $71.28, Gold up $1.78 at $1776.31

- USD/JPY up 28 pips at Y109.52

- EVERGRANDE FILING ON YUAN BOND INTEREST LEAVES ANALYSTS GUESSING (BBG)

- PBOC BOOSTS DAILY LIQUIDITY INJECTION

- PBOC LPR FIXINGS UNCHANGED

- RBA SOUNDS WARNING ON HOUSEHOLD DEBT RISK TO FINANCIAL STABILITY (AFR)

- BOJ LEAVES POLICY SETTINGS UNCHANGED, MARKS DOWN VIEW ON EXPORTS AND PRODUCTION

BOND SUMMARY: Evergrande Vol. Evident

Global core FI markets unwound their early Asia-Pac bid and more, before moving back to the middle of their respective daily ranges. Initial worry surrounding all things Evergrande as participants awaited the re-opening of mainland Chinese markets after the elongated holiday weekend subsided. There was some respite for broader risk assets as headlines noted that Evergrande will make a negotiated bond coupon payment for onshore bonds which falls due tomorrow, although no further details were forthcoming. There were no details re: the payment of coupons on a US$-denominated bond also due tomorrow (although there is a 30-day grace period in play there there), nor on the size of the payment that will be made when it comes to the onshore bond coupons. The lack of clarity tempered the broader bounce in risk appetite.

- T-Notes -0-01 at 133-05 as a result, with cash Tsys little changed to 0.5bp cheaper across the curve. The FOMC monetary policy decision headlines the broader docket on Wednesday, with the central bank's commentary surrounding tapering and the particulars within the SEP set to be scrutinised.

- JGB futures last print +4 on the day, after being subjected to the driving forces outlined above. The BoJ's latest monetary policy decision was a bit of a non-event, with the Bank leaving its broader monetary policy settings unchanged, while it lowered its assessment for exports and production. The market will be closed tomorrow as Japan observes a national holiday.

- Over in Sydney, YM unch. & XM +1.0, with longer dated cash ACGBs 1.0bp richer on the day after the space followed the broader gyrations. A$1.0bn of ACGB Apr '26 supply was well received, with the weighted average yield printing 0.97bp through prevailing mids at the time of supply, while the cover ratio printed above 6.00x.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.25% 21 Apr ‘26 Bond, issue #TB142:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.25% 21 April 2026 Bond, issue #TB142:

- Average Yield: 0.5250% (prev. 0.5124%)

- High Yield: 0.5250% (prev. 0.5150%)

- Bid/Cover: 6.1510x (prev. 6.6000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 49.4% (prev. 23.9%)

- Bidders 43 (prev. 53), successful 7 (prev. 13), allocated in full 0 (prev. 5)

EQUITIES: Some Respite On Evergrande Headlines, Although Coupon Payment Details Remain Murky

Equities came under some early pressure in Asia-Pac trade, with worry surrounding all things Evergrande remaining evident as participants awaited the re-opening of mainland Chinese markets after the elongated holiday weekend. There was some respite for broader risk assets as headlines noted that Evergrande will make a negotiated bond coupon payment for onshore bonds which falls due tomorrow, although no further details were forthcoming. There were no details re: the payment of coupons on a US$-denominated bond also due tomorrow (although there is a 30-day grace period in play there there), nor on the size of the payment that will be made when it comes to the onshore bond coupons. The lack of clarity tempered the broader bounce in risk appetite.

- Elsewhere, the PBoC upped its liquidity injections to aid the cyclical month-end tightness in money markets, which would have provided some incremental support for equities.

- China's CSI 300 sits a little over 1% lower on the day, but is off worst levels, while U.S. e-minis sit just above neutral levels. Note that Hong Kong observed a market holiday today.

OIL: API Inventory Estimates & Evergrande News Support Crude

WTI and Brent futures sit ~$0.60 above their respective settlement levels, with the deeper than expected drawdown in the weekly headline crude inventory estimate from API supporting the space. News that Chinese property developer Evergrande will make a negotiated coupon payment on its onshore bond on Thursday also aided the bid, although a lack of clarity surrounding the matter and continued worry re: coupon payments on offshore bonds saw crude off of Asia-Pac highs. The larger than expected drawdown in headline crude stock estimates in the API report was accompanied by a larger than expected drawdown in distillates, a shallower than expected drawdown in gasoline stocks and a drawdown in stocks at the Cushing hub. A quick reminder that Tuesday saw crude nudge higher as U.S. equity markets rebounded from worst levels of the day. We also saw reports pointing to an uptick in OPEC+ production pact compliance during the month of August.

GOLD: Consolidating Into FOMC

Spot bullion deals little changed, just above $1,775/oz, holding onto Tuesday's gains. The technical lines in the sand are well defined. Monday's low ($1,742.5/oz) provides initial technical support ahead of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Meanwhile, firm resistance remains located at the Sep 14 high ($1,808.7/oz). Participants await Wednesday's FOMC decision, with a particular focus on the central bank's language surrounding tapering matters.

FOREX: Evergrande Coupon Payment Agreement, PBOC Liquidity Boost Soothe Nerves

Headlines outlining an agreement between Evergrande's main onshore unit and holders of its yuan bond on coupon payments due Sep 23 provided relief for risk appetite, in the wake of yesterday's reports noting that the Group missed interest payments to two bank creditors. The PBOC helped boost sentiment as it returned from Chinese holidays with a relatively generous liquidity injection. That said, the initial risk-on market reaction moderated somewhat as the Evergrande story received closer scrutiny.

- The combination of the latest goings-on in the Evergrande saga and PBOC liquidity injection soothed the nerves, allowing the yuan to garner some strength. China's central bank set its central USD/CNY mid-point slightly higher than expected and left LPR rates unchanged, but both fixings were overshadowed by aforementioned developments.

- Risk-on impetus from China swept across G10 FX space, providing a shot in the arm for high-beta currencies. The Antipodeans shook off their initial weakness, which prompted NZD/USD to retest yesterday's low in early Asia-Pac trade.

- The yen retreated as Chinese headlines dented demand for safe haven assets. The BoJ left key monetary policy settings unchanged but USD/JPY overnight implied volatility remained in close proximity to two-month highs.

- FOMC monetary policy decision headlines the global data docket today.

FOREX OPTIONS: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1675-85(E1.2bln), $1.1745-50(E703mln)

- USD/JPY: Y109.00($595mln), Y109.45($685mln), Y109.80-00($1.2bln)

- EUR/JPY: Y128.50(E630mln)

- AUD/USD: $0.7250-65(A$787mln)

- USD/CAD: C$1.2750($1.5bln), C$1.2775($640mln), C$1.2840-55($542mln)

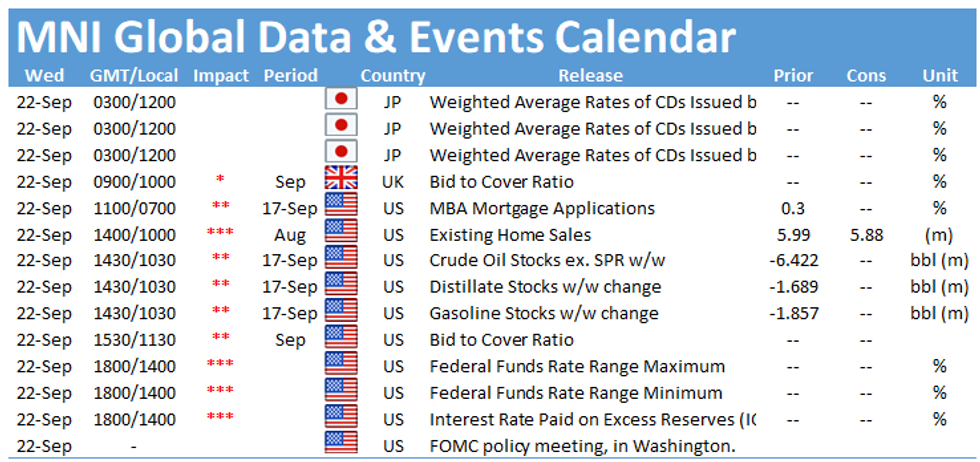

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.