-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Relief Rally For Evergrande, Broader Chinese Equities Struggle

- Liquidation of some of Evergrande's private shareholdings is providing a relief rally for the name, although questions remain whether the move will provide much in the way of meaningful medium-term reprieve for the firm.

- Chinese equities struggle again.

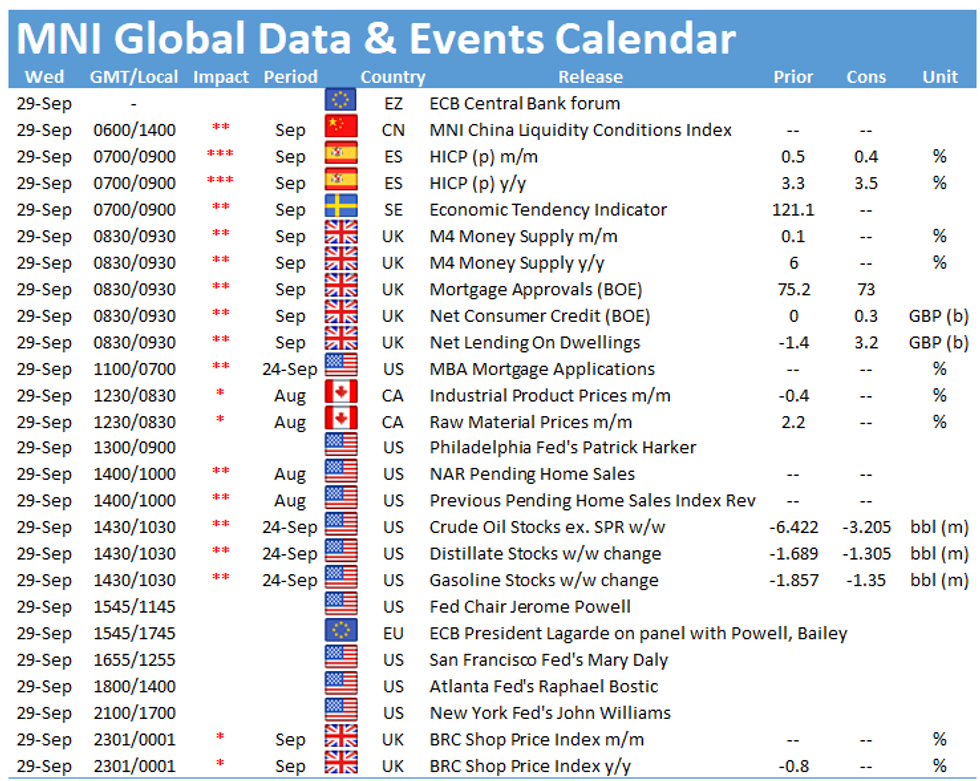

- A slew of central bank speak headlines on Wednesday.

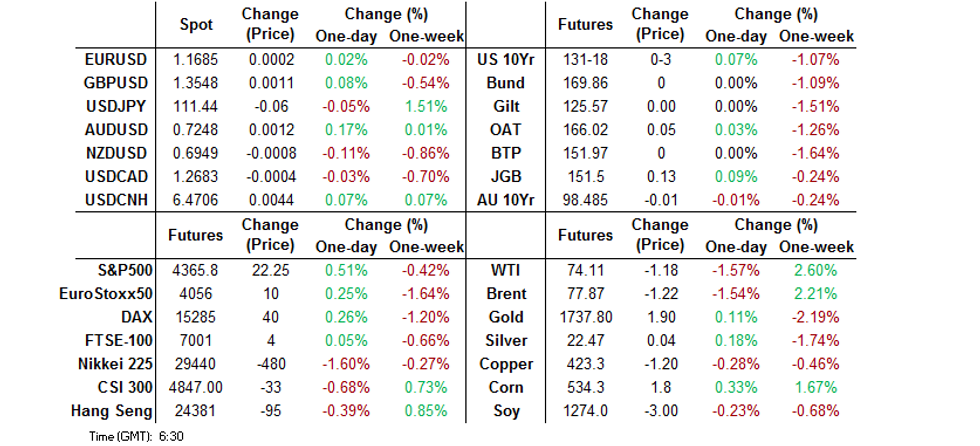

BOND SUMMARY: Latest Dip Bought In Asia

Dip buying has kicked into U.S. Tsys after some initial weakness in early Asia-Pac trade, with Chinese equity markets on the defensive as concerns surrounding the well-documented headwinds for Chinese economic activity weigh on mainland and Hong Kong equity indices ahead of the week-long Chinese holiday, which gets underway on Friday. The earlier disclosed liquidation of some of Evergrande's private shareholdings is providing a relief rally for the name, although questions remain whether the move will provide much in the way of meaningful medium-term reprieve for the firm (as we discussed earlier). T-Notes last +0-02+ at 131-17+, a little shy of their peak, running on ~185K volume. Cash Tsys now sit little changed to ~1.5bp richer across the curve, with the belly leading the rally.

- To recap, the Tsys were subjected to further cheapening pressure on Tuesday, with the curve running steeper as 30s cheapened by ~9bp on the day. The space finished off of cheapest levels with 10s failing to test their mid-June highs in yield terms after various account types stepped in to fade the latest bout of cheapening during early NY hours. Equities came under notable selling pressure on the uptick in yields, with tech leading the weakness. Uncertainty surrounding the debt ceiling/government funding also remained in the mix with Republicans and Democrats still at loggerheads when it comes to avoiding a looming government shutdown. 7-Year supply helped soothe the nerves a little, with the bidding metrics on the solid side (modest downtick to sub-average levels in cover, with dealer takedown holding below the recent average), even as the sale tailed by 0.8bp.

- A raft of Fedspeak headlines Wednesday's NY docket.

FOREX: Return Of Covid Jitters Clips Kiwi's Wings

Selling pressure hit the kiwi after New Zealand reported a spike in daily Covid-19 case count. Officials detected 45 new infections, the most since September 2, after recording just 8 yesterday. This resulted in some dovish RBNZ repricing, with the OIS strip pricing an ~81% chance of a 25bp OCR hike when the MPC convene next week, down 9pp from what was seen before headlines surrounding New Zealand's Covid-19 caseload hit the wires.

- The NZD remained the worst G10 performer, while NZD/USD probed the water below the 61.8% retracement of its Aug - Sep rally, as it registered a fresh one-month low.

- NZD/USD 1-week implied volatility spiked higher, reaching levels not seen since July 9. It last sits at 11.15%, with participants assessing RBNZ outlook ahead of next Wednesday's monetary policy meeting.

- AUD/NZD caught a bid and BBG cited a trader source pointing to the trimming of existing short positions following the release of New Zealand's latest Covid-19 case count. The rate narrowed in on its 50-DMA, while AUD topped the G10 scoreboard.

- Most G10 crosses were happy to tread water, while the DXY ground away from a multi-month peak reached yesterday. USD/JPY touched its highest point since Mar 26, 2020 before erasing gains, with Japan watchers awaiting the outcome of ruling party leadership contest.

- There is central bank speak galore to digest today, with several notable appearances due as part of the ECB's annual Forum on Central Banking, including a panel discussion with Fed, ECB, BoE & BoJ chiefs.

FOREX OPTIONS: Expiries for Sep29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700($994mln), $1.1750(E1.2bln), $1.1800-15(E709mln)

- USD/JPY: Y109.90-00($1.3bln), Y111.00-05($558mln)

- GBP/USD: $1.3680(Gbp997mln)

- USD/CAD: C$1.2620($1.4bln), C$1.2630-40($531mln), C$1.2900($2.0bln)

- USD/CNY: Cny6.4400($1bln), Cny6.4965($700mln)

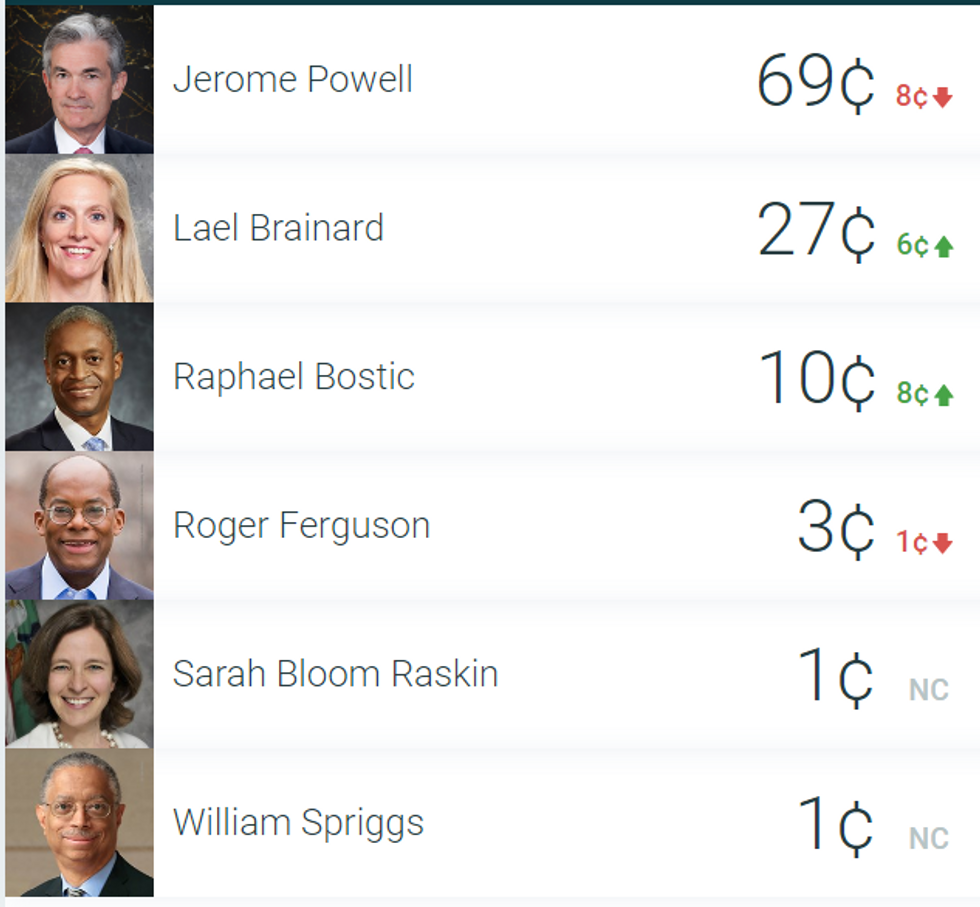

FED: Latest Warren Criticism Gives Slight Hit To Odds Of Term 2 For Chair Powell

Current Fed Chair Jerome Powell's odds when it comes to the next Senate confirmation to Chair the Federal Reserve have taken a slight hit in the wake of the latest round of comments from U.S. Senator Elizabeth Warren, although he remains the favourite within the betting markets. A reminder that Powell's current term is set to conclude in February '22.

- Warren was once again critical of Fed Chair Powell's stance on banking regulation. This provided a slight boost to the odds for Lael Brainard (currently a Governor at the Fed) and Raphael Bostic (currently President of the Atlanta Fed).

Source: PredictIt

Source: PredictIt

ASIA FX: Baht Props Up Performance Table Ahead Of BoT

The greenback softened slightly from Tuesday's closing highs, but broad risk off sentiment kept Asia EM currencies subdued.

- CNH: Offshore yuan is weaker but has picked up from session lows. Evergrande remains in focus, the firm has a $45.2mn coupon payment due on a US$ denominated offshore bond on Wednesday - the company missed a similar payment last week

- SGD: Singapore dollar is weaker but off worst levels, the drop comes even as yields in Singapore rise to the highest levels since June.

- KRW: Won is flat having recovered opening losses. On the coronavirus front there were 2,885 new cases in the past 24 hours. A minister said yesterday that the government expects to transition back to normal life between October and November.

- TWD: Taiwan dollar has declined, on track to drop for a second . The Taiex has seen heavy selling, chip stocks have taken a hit after Micron gave a weaker than expected sales forecast.

- MYR: Ringgit is weaker, DAP leader said that the institutional reforms agreed upon by PM Ismail Sabri's gov't and the opposition Pakatan Harapan alliance will be brought to parliament by March 2022.

- IDR: Rupiah fell, dropping to lowest level in a month. Bulls look for a resumption of gains and a break above the 50-DMA at IDR14,345, while bears eye Sep 22 & 24 lows of IDR14,233 for initial support.

- PHP: Peso is flat, markets digest comments from BSP Director Abenoja that the spike in consumer-price inflation is driven by supply-side factors and can be best tackled by non-monetary measures rather than raising interest rates.

- THB: Baht has declined, the Bank of Thailand will announce their monetary policy decision today. 3 out of 22 economists in the Bloomberg survey look for a 25bp rate cut.

ASIA RATES: RBI Reverse Repo Results In Rout

- INDIA: Curve twist flattens in early trade. Bonds fell yesterday after the RBI conducted its 7-day reverse repo at 3.99%, 57bps above the previous operation and just shy of the RBI's main benchmark policy rate of 4.00%. The operation caused speculation that the Central Bank is embarking on a path to normalisation earlier than expected. The liquidity drain at a higher rate comes hot on the heels of the RBI's decision to make its GSAP operations neutral by including an equivalent sell leg to the auctions. Market participants await today's T-Bill auction to assess cut off yields for further signs of policy tightening from the RBI.

- SOUTH KOREA: Short end yields are higher with 3-Year futures also seeing some selling pressure, A minister said yesterday that the government expects to transition back to normal life between October and November, this would entail easing social distancing rules for fully vaccinated people as well loosening restrictions on private gatherings. The positive outlook has sparked speculation that the October BoK meeting could be live after the Central Bank hiked 25bps at its previous meeting. 3-Year future is down 5 ticks at 109.24, 10-Year future up 17 ticks at 124.04. 3-Year yield up 4.4bps at 1.650%, US/SK 2-Year yield spread narrows further as a result of the short end buying in South Korea, last at 106.42bps from wides of around 134bps in early Septembe

- CHINA: The PBOC injected a net CNY 40bn of liquidity into the financial system today, the Central Bank is has exclusively used 14-day reverse repos for the past five sessions with the last of the 7-day issues coming due tomorrow. Repo rates diverged with the overnight repo rate briefly dropping to the lowest since June 28, while the 7-day repo rate briefly touched the highest since June 30. Futures are lower, earlier reports that Japan's GPIF would not invest in yuan-denominated Chinese government bonds citing the country's bond-market environment and other factors. The GPIF will continue to use a version of the FTSE Russell World Government Bond Index as its benchmark, an index that does not include Chinese debt. FTSE Russell has said it will add Chinese debt to its benchmark global bond index from October.

- INDONESIA: Yields higher across the curve with some steepening evident. The finance ministry sold IDR 12t of debt at auction yesterday, meeting its indicative target. The ministry also announced it will issue a new series of Islamic T-bills and reopen auction for five series of bonds

EQUITIES: Asia-Pac Markets Slide

A negative day for equity markets in the Asia-Pac time zone, taking a negative lead from the US where major indices saw sharp declines. Markets in Japan lead the way lower with a slide of around 2.5%, the ruling party's leadership election steals the limelight today. Markets in China also lower, Evergrande is in focus with a coupon payment coming due today. In South Korea the KOSPI saw heavy losses after positive reopening comments from a minister sparked speculation that the October BoK meeting could be live. In the US futures have bounced slightly, coming off the back of the worst one-day loss since May, upside is tempered by concerns over the debt ceiling impasse. participants can look forward to UK lending data, Eurozone consumer confidence and a speech from Fed's Harker. Later in the day a raft of Central Bank speakers will appear on a policy panel discussion at ECB Forum on Central Banking.

GOLD: Nudging Away From Tuesday's Lows

A slight richening in U.S. Tsys has allowed bullion to form a base in Asia-Pac hours, with spot last dealing +$6/oz at $1,740/oz. This comes after an aggressive round of Tsy cheapening and an uptick in the broader DXY weighed on gold on Tuesday, with the sell off halting just below $1,730/oz. Bears failed to force a test of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Fedspeak and the latest round of U.S. PCE data as well as the m'fing ISM survey present the main event risks during the remainder of the week.

OIL: Rally On Pause

Crude futures are lower in Asia-Pac trade on Wednesday, adding to Tuesday's losses as the greenback holds most of its gains while a broad risk off tone has weighed on the commodity complex. Data from API yesterday was bearish for oil, with gains in headline crude stocks to the tune of 4.127m bbls and builds in downstream products. If official DoE inventory figures confirm the build it will be the first lift in stockpiles for eight weeks. The modest correction lower in both WTI and Brent prices has done little to deter the near-term uptrend in oil prices, however, with the technical picture still very much bullish. The White House further voiced their view on energy markets, stating that they continue to speak with OPEC on pricing matters, and is looking at every means they have to address the cost of oil.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.