-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Buying Time

EXECUTIVE SUMMARY

- SENATE APPROVES EXTENSION OF DEBT LIMIT THROUGH DEC 3

- HOUSE TO VOTE TUESDAY ON DEBT LIMIT HIKE (Hill)

- ECB'S LANE: ECB IS FAR FROM INFLATION "RED ZONE" DESPITE WARNINGS (BBG)

- OECD CLOSE TO FINAL GLOBAL COMPACT ON CORPORATE TAX (FT)

- PBOC DRAINS NET CNY330BN VIA OMOS, MOST IN A YEAR

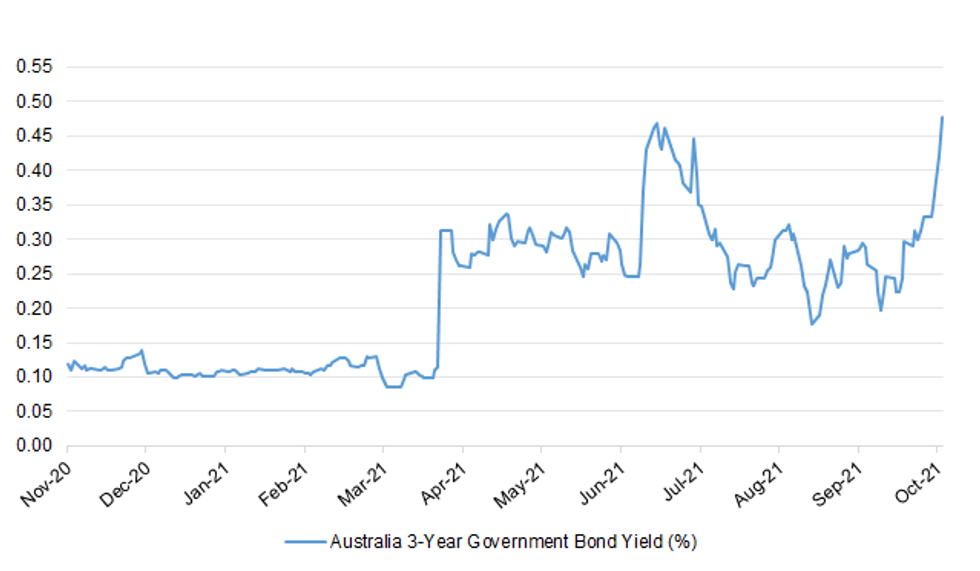

Fig. 1: Australia 3-Year Government Bond Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: High levels of UK inflation could persist for longer than expected, the Bank of England's new chief economist said, suggesting he agrees with the more hawkish elements of the Monetary Policy Committee. "In my view, that balance of risks is currently shifting towards great concern about the inflation outlook, as the current strength of inflation looks set to prove more long-lasting than originally anticipated," said Huw Pill, in his first public remarks since taking office last month. Pill's view, shared in written responses to questions from the UK Treasury committee, suggested the new chief economist could vote in favour of an early rise in interest rates. (FT)

CORONAVIRUS: Expensive PCR tests for foreign travel will be scrapped by half-term, ministers announced today, as they slashed the "red list" to just seven countries. PCRs will be replaced by cheaper lateral flow tests, with passengers having to send a photo of their negative result two days after arriving in the UK. Boris Johnson overruled Sajid Javid, the health secretary, who was pushing plans to force travellers to film themselves taking a lateral flow test amid fears that people could fake their results. (Times)

ECONOMY: A trade body which represents thousands of fuel retailers has called for an independent inquiry into the ongoing fuel supply problems. The Petrol Retailers Association (PRA) said that deliveries were still far too slow and that the recovery is "simply not happening quickly enough." They also suggested that both motorists and forecourt owners need protection to prevent the crisis from occuring again. (Independent)

ECONOMY: U.K. wage growth rose at its strongest pace on record in a survey of job recruiters, indicating strains from a shortage of workers are persisting. The findings from the Recruitment & Employment Confederation and KPMG will add to inflationary pressures that are already ringing alarm bells at the Bank of England. They also indicates difficulty moving people off of furlough and into work following the pandemic, an issue the REC said government should address with more training programs. (BBG)

ENERGY: Ofgem has opened the door to a major relaxation of energy price cap rules that could help prevent a wave of company bankruptcies but also remove protection for consumers from sudden bill hikes. The regulator signalled it was considering a sweeping review of how the energy price cap works in light of recent turmoil in the industry. (Telegraph)

EUROPE

ECB: European Central Bank Chief Economist Philip Lane pushed back against warnings over accelerating inflation, saying there's "very solid evidence" to believe that the current spike won't last. "The red zone for everyone is if inflation became persistent at a number that's immoderately above the inflation target," Lane said on Thursday. "That's a very far distance from where the euro area is. We have to be the counterweight, honestly, in this debate." Speaking at a conference organized by the ECB and the Federal Reserve Bank of Cleveland, he highlighted that "there's solid reasons to believe that a lot of this is to do with the reopening of the economy and there's very solid reasons to believe there's a significant transitory component." (BBG)

ECB: European Central Bank Governing Council member Bostjan Vasle said the current supply squeeze and labor shortages could entrench accelerating consumer prices for longer. The current spike in inflation is "largely being driven by one-offs or temporary factors and developments related to the pandemic," Vasle said in comments to Bloomberg before a ceremony to mark the 30th anniversary of Bank of Slovenia, which he heads. (BBG)

GERMANY: Germany's Social Democrats (SPD) and potential partners said initial coalition talks had gone well on Thursday, as the leader of the conservative bloc seeking to stay in office hinted he might resign after a poor election showing. The SPD is seeking to form a coalition with the Greens and business-friendly Free Democrats (FDP), which finished third and fourth in the election. The three parties began talks on Thursday and, after all reporting progress, said they would reconvene on Monday. "The talks were intensive and marked by a sincere atmosphere," said SPD general secretary Lars Klingbeil. Separately Armin Laschet, the leader of Merkel's CDU and chancellor candidate for the conservative bloc comprising his party and the Bavarian CSU, signalled he would be willing to resign if that facilitated rival coalition talks between his bloc, the Greens and the FDP. Laschet is fighting for his political life after leading the conservatives to their worst-ever national election result last month. He said he would propose a party congress to decide on a swift "reshuffle" that would look at all roles "from chairman (leader) all the way to the party board." (RTRS)

ITALY: Italy's government will allow clubs and dancing venues to reopen for the first time since the pandemic started in 2020, a further sign the country is going back to normality as the vaccine rollout continues. Mario Draghi's government approved the re-opening of clubs at reduced capacity of 50% indoors and 75% outdoors during a cabinet meeting on Wednesday, according to a statement. The government also decided to allow theaters and cinemas to operate at full capacity. (BBG)

IRELAND: Ireland has finally abandoned its cherished 12.5 per cent corporate tax rate and signed up to a minimum 15 per cent global rate that will cost the country about €2bn in lost revenues. Paschal Donohoe, finance minister, told the Financial Times big businesses could rest assured no more changes would follow the "very, very significant" shift from what had been a cornerstone of Irish policy for more than two decades. The new tax rate will affect 1,556 companies in Ireland employing 500,000 people, among them US tech giants such as Apple, Google, Amazon and Facebook. Ireland now joins 140 countries in agreeing to the effective levy of 15 per cent on major multinationals ahead of a meeting of the OECD on Friday. (FT)

POLAND: Poland's constitutional tribunal has ruled that parts of EU law are not compatible with the Polish constitution, in a dramatic escalation of a battle between Warsaw and Brussels with tens of billions of euros in EU funding at stake. The ruling — in response to a case brought by prime minister Mateusz Morawiecki — caps a five-year legal feud between Poland and the EU, during which the country's conservative-nationalist government has given politicians sweeping powers over the country's judiciary. The fight has also sparked questions about Poland's long-term future in the EU, with the government's critics at home and abroad accusing it of setting the country on course for "Polexit". (FT)

CZECHIA: Billionaire Prime Minister Andrej Babis is poised to win the Czech Republic's elections, though he will fall short of a majority and a series of scandals have hurt his chances of finding partners. (BBG)

US

FED: "I see the inflation risks as tilted to the upside," Cleveland Fed President Loretta Mester says. "My baseline is that we'll see inflation rates move back down as pent-up demand eases and supply-side challenges ease. But, as you know, that's taking longer than people thought," Mester says Thursday during a virtual panel hosted by the European Central Bank and Cleveland Fed. (BBG)

FED: Federal Reserve Governor Lael Brainard's increased influence ahead likely means substantial changes and challenges for the nation's banking system. Considered a progressive who favors tighter reins on financial institutions, particularly the Wall Street powerhouses, Brainard should figure prominently as President Joe Biden weighs who will chair the central bank and who will specifically supervise banks. She is widely expected to get either of those two positions in the coming months. (CNBC)

FISCAL: The U.S. Senate approved legislation Thursday that pulls the nation from the brink of a payment default with a short-term debt-ceiling increase, breaking a weeks-long standoff that rattled financial markets. The vote was 50-48, with no Republicans in favor of the measure that simply kicks the can toward another precarious debt-limit fight in less than two months. The $480 billion increase in statutory borrowing would run out around Dec. 3. The debt limit increase still needs a vote in the House, which has been on break. But Majority Leader Steny Hoyer said Thursday night that representatives would return on Tuesday. The measure is expected to be approved in that chamber. President Joe Biden "looks forward to signing this bill as soon as it passes the House and reaches his desk," White House Press Secretary Jen Psaki said in a statement (BBG)

FISCAL: The House will interrupt a scheduled recess next week to vote Tuesday on Senate-passed legislation to extend the debt limit into December. The House, which had been long scheduled to be out of session this week and next coinciding with the Columbus Day holiday, is expected to quickly resume its recess as soon as lawmakers clear the debt limit extension Tuesday night. The House was otherwise scheduled to be out of session until Oct. 19, which is the day after the Treasury Department has estimated the U.S. would default on its debts if Congress hasn't acted by then. (Hill)

FISCAL: Treasury Secretary Janet Yellen told CNN tonight uncertainty in Congress over raising the debt ceiling "is damaging to confidence" of consumers and investors. She went on to say that "everyone including me breathed a sigh of relief that we were able to reach an agreement that gets us to Dec. 3." "It's become increasingly damaging to America to have a debt ceiling," Yellen said. (CNN)

FISCAL: Progressives are mounting a fresh effort to save prized environmental programs in the Democrats' stalled reconciliation bill, with a key group of senators threatening to withhold support of the measure if it doesn't contain tough climate provisions. "Climate cannot and will not be cut," said Senator Ed Markey, a Massachusetts Democrat who helped author the Green New Deal. "Climate must remain up front and center in this reconciliation package." Markey was joined Thursday in front of the Capitol by fellow Democratic Senators Ron Wyden of Oregon, Chris Van Hollen of Maryland, and Tina Smith of Minnesota, along with representatives of the Sunrise Movement and Evergreen Action at an event billed as "no climate, no deal" for the massive spending package being negotiated in Congress. The push, for items that include hundreds of billions of dollars in tax breaks for clean energy, a fee on methane emissions, and a program to encourage utilities to use more renewable sources of power, comes as Democratic infighting forces the party to slash the size of the $3.5 trillion proposal to reach a deal with moderates. (BBG)

POLITICS: As the default deadline approached, McConnell offered to drop GOP opposition if Democrats raised the debt limit by a fixed dollar amount, buying Schumer and his allies more time to find a longer-term solution. Democrats claimed victory after McConnell's offer went public, with some claiming he had "caved" to political pressure. Some GOP lawmakers accused McConnell of giving up his leverage and capitulating to Democratic demands. "This is a complete capitulation," Sen. Lindsey Graham, R-S.C., told Fox News' Jason Donner on Thursday. "The argument made yesterday was, well, this may be more pressure than two Democratic senators can stand regarding changing the filibuster rules. That, to me, is not a very good reason." (Fox)

POLITICS: Donald Trump intends to assert executive privilege in a congressional investigation into the Jan. 6 insurrection at the Capitol, a move that could prevent the testimony of onetime aides, according to a letter sent by lawyers for the former president. (AP)

CORONAVIRUS: Pfizer and BioNTech on Thursday said they submitted an official application asking the Food and Drug Administration for emergency use authorization for their coronavirus vaccine for children between the ages of 5 and 11. Why it matters: If approved, it would become the first coronavirus vaccine for younger children. The Pfizer-BioNTech vaccine has full FDA approval for people 16 and older and has an EUA for those between 12 and 15. (Axios)

EQUITIES: Tesla Inc Chief Executive Elon Musk said on Thursday the electric carmaker plans to move its headquarters from Silicon Valley's Palo Alto, California to Austin, Texas, where it is building a massive car and battery manufacturing complex. (RTRS)

OTHER

OECD: The majority of the world's countries are nearing a milestone on a historic deal led by the OECD that will make international companies pay an extra $100bn in corporate taxes and shift more of their tax bills to countries where they actually conduct their business. In a sign that holdout countries are coming on board, Estonia said late on Thursday that it had resolved its concerns that the deal would undermine its entrepreneurs, joining Ireland in signing up to the emerging accord. Technical talks to iron out the details of the plan, which was first struck in July, are set to conclude in Paris late on Friday. Those close to the negotiations expect significantly fewer holdouts than the nine countries — out of 140 in total — that rejected the common position in July. (FT)

GEOPOLITICS: A US nuclear powered submarine struck an object underwater in the South China Sea on Saturday, according to two defense officials. A number of sailors on board the USS Connecticut were injured in the accident, the officials said. None of the injuries were life-threatening, according to a statement from US Pacific Fleet. It's unclear what the Seawolf-class submarine may have hit while it was submerged. The accident happened as tensions between the US and China soared over the Chinese military's incursions into Taiwan's Air Defense Integration Zone (ADIZ). (CNN)

U.S./TAIWAN: Small numbers of U.S. special operations forces have been rotating into Taiwan on a temporary basis to carry out training of Taiwanese forces, two sources familiar with the matter said on Thursday, speaking on condition of anonymity. The Pentagon, which historically has not disclosed details about U.S. training or advising of Taiwanese forces, did not specifically comment on or confirm the deployment. "I don't have any comments on specific operations, engagements, or training, but I would like to highlight that our support for and defense relationship with Taiwan remains aligned against the current threat posed by the People's Republic of China," said Pentagon spokesman John Supple. The sources declined to say how long the training had been going on but suggested it predated the Biden administration, which came into office in January. (RTRS)

U.S./HONG KONG: U.S. businesses say lobbying Hong Kong's government about reopening its borders with the rest of the world has been fruitless, a sign of frustration with the city's "Covid Zero" strategy that could undermine the city's future as a global financial hub. Tara Joseph, president of the American Chamber of Commerce in Hong Kong, said her organization has raised concerns to the city's administration in multiple ways, without any response. Even though major companies aren't packing up and leaving the city, businesses are having a difficult time with strict quarantine rules, including attracting talent and weighing relocating departments or operations, she said in an interview Thursday. (BBG)

U.S./SINGAPORE: Singapore is working on allowing quarantine-free entry to travelers from the United States who are vaccinated against COVID-19 before the end of the year, its minister for trade and industry said on Thursday. (RTRS)

U.S./MEXICO: The United States believes its security cooperation with Mexico is "due for an updated look," State Department spokesperson Ned Price said on Thursday, ahead of meetings between senior U.S. and Mexican officials on Friday. "This will really be one of the core elements of the discussions tomorrow," Price said at a regular press briefing, adding that it was an "opportune" time for the two countries to talk about addressing changing security threats, including the trafficking of fentanyl and illicit finance. Secretary of State Antony Blinken will lead the U.S. delegation in Mexico City and will be joined by Secretary of Homeland Security Alejandro Mayorkas, Attorney General Merrick Garland, and other officials. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida at a cabinet meeting Friday instructed relevant ministers to draw up a set of economic measures, such as those for alleviating the fallout of the novel coronavirus pandemic. Steps to support child-rearing families and businesses hit hard by the COVID-19 crisis will likely be among pillars of the package. The Kishida government plans to compile a fiscal 2021 supplementary budget to finance the economy-boosting measures after the Oct. 31 election for the House of Representatives, the all-important lower chamber of the Diet, Japan's parliament, aiming to have it enacted by the end of the year. (Jiji)

JAPAN: An ally of new Japanese Prime Minister Fumio Kishida said capital gains tax could be raised to 25% from the current 20% without affecting stock prices, just as the premier prepares to make his first policy speech in parliament. Kozo Yamamoto, a veteran member of Kishida's faction of the ruling Liberal Democratic Party, also told Bloomberg more than 30 trillion yen ($269 billion) in fiscal spending was needed to help the economy recover from the effects of the coronavirus pandemic. (BBG)

JAPAN: The top bureaucrat in Japan's finance ministry delivered a rare public rebuke to the nation's politicians for ignoring the government's mountain of debt, just as the new government begins discussions over more fiscal stimulus. "The only talk you can hear seems to assume there's a limitless supply of money in the national treasury," Vice Minister of Finance Koji Yano said in an interview published Friday. "Listening to the recent pork-barrel spending debate, I couldn't remain silent anymore." (BBG)

JAPAN: Japan's ruling Liberal Democratic Party (LDP) will call for a sharp rise in the country's defence spending in its election manifesto to be unveiled ahead of the Oct. 31 national lower house election, the Asahi Shimbun daily said on Friday. (RTRS)

JAPAN: Japan will introduce environmental, social and governance considerations for foreign reserves held by the finance ministry, reflecting a need to seriously tackle climate change in order to achieve the country's 2050 carbon neutral goal. The decision to include ESG as a factor for foreign asset holdings is a first for a Group of Seven nation, Finance Minister Shunichi Suzuki said Friday. The ministry didn't disclose the amount of funds that will be affected. (BBG)

RBA: MNI BRIEF: RBA Warns of House Price Risk

- The Reserve Bank of Australia has issued a warning on the risk of "excessive borrowing" due to low interest rates and rising house prices in the quarterly Financial Stability Review - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBNZ: The Reserve Bank of New Zealand – Te Pūtea Matua is adjusting the structure of its Senior Leadership Team. Governor Adrian Orr says the Reserve Bank is well advanced in its transformation to meet its new mandate. "We are aware of our future governance expectations under new legislation. We're strengthening our foundations and how we operate." The changes will result in the Senior Leadership Team expanding from six to eight roles. The additional roles are the General Managers of 'Risk, Compliance and Legal Services' and 'Information and Data Analytics'. (RBNZ)

SOUTH KOREA: South Korea plans to take active actions to stabilize inflation as the country's consumer prices are expected to grow at a faster pace in October than the previous month, a senior government official said Friday. First Vice Finance Minister Lee Eog-weon said the consumer prices are forecast to grow at a higher rate than 2.5 percent in October due largely to last year's low base effect. (Yonhap)

TAIWAN: Taiwan does not seek military confrontation, but will do whatever it takes to defend its freedom, President Tsai Ing-wen said on Friday, amid a rise in tensions with China that has sparked alarm around the world. (RTRS)

BOC: MNI: Capital Controls Threaten Global Economy, BOC Warns

- Bank of Canada Governor Tiff Macklem warned Thursday the global economy faces some longer-term risks from capital and foreign exchange controls deployed in emerging markets, a danger heightened as central banks prepare to remove emergency stimulus - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's opposition parties are at odds over how to deal with the government's deeply nationalistic bill to return control of the electricity sector to the state, opening an opportunity for the controversial legislation to pass. Fault lines appeared within the opposition bloc soon after President Andres Manuel Lopez Obrador presented the bill last week, triggering a clash over whether to debate the proposal, as some lawmakers have chosen to do, or reject it outright, as others have done. (BBG)

PERU: Peru President Pedro Castillo said on Twitter that Julio Velarde would continue as president of thecentral bank. (BBG)

TURKEY: Turkey has made a request to the U.S. to buy 40 Lockheed Martin-made F-16 fighter jets and nearly 80 modernization kits for its existing warplanes, as the NATO ally looks to modernize its Air Force after the purchase of F-35 jets fell through, sources familiar with the matter said. The deal, worth billions, is still working its way through the Foreign Military Sales process which is subject to approval by the U.S. State Department as well as the U.S. Congress which can block deals. (RTRS)

AFGHANISTAN: As desperate Afghans resort to selling their belongings to buy food, international officials are preparing to fly in cash for the needy while avoiding financing the Taliban government, according to people familiar with the confidential plans. Planning for the cash airlifts is going ahead against the background of a rapidly collapsing economy where money is short, although diplomats are still debating whether Western powers can demand that the Taliban make concessions in return, according to internal policy documents seen by Reuters. The emergency funding, aimed at averting a humanitarian crisis in the face of drought and political upheaval, could see U.S. dollar bills flown into Kabul for distribution via banks in payments of less than $200 directly to the poor - with the Taliban's blessing but without their involvement. (RTRS)

CHINA

PBOC: PBOC will continue LPR reform and make deposit rates more market-oriented, the central bank deputy governor Liu Guoqiang says in an article in China Finance magazine. PBOC will enhance the quality of banks' LPR quotes by publishing historical quotes and make it competitive for banks to become qualified to provide quotes. (BBG)

POLITICS: Chinese President Xi Jinping will attend a commemorative meeting on Saturday to mark the 110th anniversary of the Revolution of 1911. Xi, also general secretary of the Communist Party of China Central Committee and chairman of the Central Military Commission, will deliver an important speech at the event, which is scheduled to be held at the Great Hall of the People in Beijing at 10 a.m. (Xinhua)

PROPERTY: China will maintain the focus on deflating the real estate bubble and reducing risks, and won't change its pace of economic adjustment in order to quell the market, the Global Times said in an editorial. The state-owned tabloid responded to speculation that the widening debt crisis faced by Evergrande, Group, the country's biggest developer, may push the Chinese economy into a "Lehman Brothers" moment. Evergrande's fate remains uncertain as it has been trying to raise funds to resolve its liquidity crisis, the newspaper said. Evergrande's challenges were due to its high leverage and credit bubbles, a shared phenomenon among Chinese developers, said the newspaper. However, Evergrande's recent failure to pay overdue bills is a troubling sign for the entire property industry, which may spread contagion risks to upstream and downstream, said the newspaper. (MNI)

ELECTRICITY: China's banks and financial institutions shall try to meet the reasonable financing needs of coal, steel, non-ferrous metals companies, boost supports for major coal-producing areas and key coal producers to increase the supply of electricity and coal through the winter, the China Securities Journal said citing the China Banking and Insurance Regulatory Commission. The regulator urged institutions to keep the normal order of the coal power industry and the commodities markets, as well as to strictly prevent misuing bancasurance funds to hoard and drive up prices, the journal reported. (MNI)

FOREX: China's foreign exchange reserve fell by 0.97% at the end of September from a month ago to $3.2 trillion, as the rising dollar index led to falling prices of financial assets of "major countries," the Securities Times said citing Wang Chunying, the spokeswoman of the State Administration of Foreign Exchange. China's "resilient" growth will keep the forex reserves stable, but it needs to further boost internal demand and balance risks amid challenges from the global pandemic to changes in the U.S. monetary policy, the newspaper said citing analyst Wen Bin of Minsheng Bank. (MNI)

COAL: China is ordering coal miners to urgently boost production as the energy crisis threatens industries across the world's second-biggest economy and forces Xi Jinping's administration to backtrack on climate change promises. The latest effort by Chinese authorities to combat acute power shortages comes in the wake of high tech manufacturing factories forced to halt or reduce operations over recent weeks and follows warnings that critical industries like food production could also be hit. (FT)

OVERNIGHT DATA

CHINA SEP CAIXIN SERVICES PMI 43.4; MEDIAN 49.2; AUG 46.7

CHINA SEP CAIXIN COMPOSITE PMI 51.4; AUG 47.2

The Caixin China General Composite PMI rose to 51.4 in September from 47.2 the previous month. Both market supply and demand recovered, and improvement in the services sector was stronger than in the manufacturing sector. Impacted by the pandemic, overseas demand was weak. Employment was stable overall. Prices gauges remained high, indicating strong inflationary pressure. Overall, because the impact of the pandemic was less severe in September than the previous month, services quickly rebounded. In contrast, the recovery in the manufacturing sector was limited, showing the economy still faced downward pressure. On the one hand, the epidemic continued to impact demand, supply, and circulation in the manufacturing sector. The state of the epidemic overseas and the shortage of shipping capacity also dragged down total demand. Epidemic control measures have clearly impacted the logistics industry. Domestic demand varied based on different types of goods. The demand for intermediate goods and investment goods was relatively high, while the demand for consumer goods was weak, reflecting consumers' lack of purchasing power. On the other hand, constraints to the supply side were strong as raw material prices remained high and some policy measures restricted production, squeezing employment and eventually weakening demand. The conditions in the services sector were slightly better than in the manufacturing sector, but both input prices and prices charged for services rose at a faster pace, indicating the hidden threat of inflation. In view of this, in the coming months, the government should focus on improving epidemic prevention and control and alleviating supply-side pressure. It should also find a balance among multiple objectives, such as promoting employment, holding raw material prices stable, ensuring a stable and orderly supply, and meeting targets for controlling energy consumption. (Caixin)

JAPAN AUG BOP CURRENT ACCOUNT BALANCE +Y1.6656TN; MEDIAN +Y1.4736TN; JUL+Y1.9108TN

JAPAN AUG BOP CURRENT ACCOUNT BALANCE ADJ +Y1.0426TN; MEDIAN +Y1.1459TN; JUL +Y1.4134TN

JAPAN AUG TRADE BALANCE BOP BASIS -Y372.4BN; MEDIAN -385.3BN; JUL +Y622.3BN

JAPAN SEP ECO WATCHERS SURVEY CURRENT 42.1; MEDIAN 43.0; AUG 34.7

JAPAN SEP ECO WATCHERS SURVEY OUTLOOK 56.6; MEDIAN 48.5; AUG 43.7

JAPAN AUG HOUSEHOLD SPENDING -3.0% Y/Y; MEDIAN -1.2%; JUL +0.7%

JAPAN AUG LABOUR CASH EARNINGS +0.7% Y/Y; MEDIAN +0.4%; JUL +0.6%

JAPAN AUG REAL CASH EARNINGS +0.2% Y/Y; MEDIAN +0.5%; JUL +0.3%

JAPAN SEP BANKRUPTCIES -10.61% Y/Y; AUG -30.13%

CHINA MARKETS

PBOC DRAINS NET CNY330BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on the first trading day after 7-day National Day holiday. The operations lead to a net drain of CNY330 billion after offsetting the maturity of CNY340 billion reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:26 am local time from the close of 2.2743% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 39 on Thursday vs 40 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4604 FRI VS 6.4854

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4604 on Friday, compared with the 6.4854 set before National Day holiday.

MARKETS

SNAPSHOT: Buying Time

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 491.58 points at 28169.79

- ASX 200 up 60.139 points at 7316.8

- Shanghai Comp. up 11.794 points at 3579.961

- JGB 10-Yr future down 7 ticks at 151.33, yield up 1bp at 0.081%

- Aussie 10-Yr future down 7 ticks at 98.32, yield up 6.5bp at 1.65%

- U.S. 10-Yr future -0-05 at 131-07+, yield up 1.58bp at 1.589%

- WTI crude up $0.99 at $79.29, Gold up $1.66 at $1757.41

- USD/JPY up 26 pips at Y111.89

- SENATE APPROVES EXTENSION OF DEBT LIMIT THROUGH DEC 3

- HOUSE TO VOTE TUESDAY ON DEBT LIMIT HIKE (Hill)

- ECB'S LANE: ECB IS FAR FROM INFLATION "RED ZONE" DESPITE WARNINGS (BBG)

- OECD CLOSE TO FINAL GLOBAL COMPACT ON CORPORATE TAX (FT)

- PBOC DRAINS NET CNY330BN VIA OMOS, MOST IN A YEAR

BOND SUMMARY: Core FI In Retreat After U.S. Senators Buy Time With Debt-Ceiling Vote

U.S. Senate passed a bill extending the federal government's borrowing authority through December 3. The move allows the nation to avert an unprecedented default but sets the scene for another round of difficult horse trading by the end of the year. The passage of the bill kept risk appetite buoyant, following Thursday's optimistic reaction to the news of a bipartisan deal on the matter. U.S. fiscal matters overshadowed regional developments in Asia, including the release of above-forecast Caixin Services PMI out of China, which has returned from a week-long holiday.

- T-Notes extended Thursday's losses and descended onto a key layer of support provided by 131-07, where the contract bottomed out on Sep 28. The level proved resilient and T-Notes last trades -0-04+ at 131-08. Cash Tsy curve bear steepened, yields last sit 1.0-1.4bp higher. Eurodollars last trade 0.5-2.0 ticks lower through the reds. Monthly NFP report is set to steal the limelight later in the day.

- JGB futures reopened on a softer footing and only slightly trimmed losses after the Tokyo lunch break. The contract trades at 151.36, 4 ticks shy of previous settlement. Cash JGB yields curve runs steeper as we type. Japan's household spending shrank faster than expected in August, but contraction in BoP current account surplus was smaller than forecast. The BoJ offered to buy 1-10 Year JGBs at the latest round of its Rinban ops. Participants await monthly Eco Watchers Survey and the first policy speech from PM Kishida.

- Cash ACGB yields pushed higher across the curve, 3-Year yield reached its highest point since March 2020. Aussie bond futures retreated, YM & XM both sit -6.5. Bills operate 1-9 ticks lower through the reds. The ACGB space showed little reaction to the release of the RBA's Financial Stability Review. Developments on the supply front were also ignored, as the AOFM auctioned A$1.0bn of ACGB 21 Apr '27, drawing bid/cover ratio of 5.79x (prev. 3.93x).

JGBS AUCTION: Japanese MOF sells Y4.0614tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0614tn 3-Month Bills:

- Average Yield -0.1198% (prev. -0.1330%)

- Average Price 100.0322 (prev. 100.0361)

- High Yield: -0.1098% (prev. -0.1271%)

- Low Price 100.0295 (prev. 100.0345)

- % Allotted At High Yield: 46.9024% (prev. 94.6548%)

- Bid/Cover: 2.934x (prev. 3.817x)

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.325tn of JGBs from the markets:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.75% 21 Apr ‘27 Bond, issue #TB136:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.75% 21 April 2027 Bond, issue #TB136:

- Average Yield: 0.9920% (prev. 0.7038%)

- High Yield: 0.9950% (prev. 0.7050%)

- Bid/Cover: 5.7950x (prev. 3.9292x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 46.2% (prev. 34.4%)

- Bidders 53 (prev. 54), successful 16 (prev. 28), allocated in full 8 (prev. 10)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 12 October it plans to sell A$150mn of the 0.75% 21 November 2027 I/L Bond.

- On Wednesday 13 October it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 14 October it plans to sell A$1.0bn of the 21 January 2022 Note & A$1.0bn of the 22 April 2022 Note.

- On Friday 15 October it plans to sell A$1.0bn of the 4.25% 21 April 2026 Bond.

EQUITIES: Green Across The Board

Equity markets in Asia finish the week with gains, taking a positive lead from the US where indices recouped some of this week's losses. U.S. Senators passed the bill extending the nation's debt limit through Dec 3 which helped support positive sentiment. The return of markets from China also helped boost sentiment while data earlier in the session showed Caixin services PMI moved back into expansionary territory, the CSI 300 heading into the close with gains of 1.2%. Bourses in Japan led the way higher though seeing gains of over 2%. In the US futures are higher, markets now look to today's US NFP figure with markets expecting job gains of 500k over the month of September, equating to a drop of 0.1ppts in the unemployment rate.

OIL: On Track For Seventh Weekly Gain

Crude futures built on yesterday's gains during the Asia-Pac session on Friday as progress in the US debt ceiling impasse helped support risk sentiment. The rally on Thursday was catalysed by the US Energy Department issuing a statement clarifying that there were no intentions to either release reserves or place a ban on energy exports. For the week crude benchmarks are on track for gains of around 3.5%, the seventh straight weekly gain. For WTI resistance is seen at $80.00 as a psychological round number, then at $80.57 - 1.50 proj of the Aug 23 - Sep 2 - Sep 9 price swing. For Brent resistance seen at $83.47 - high Oct 6.

GOLD: Recovers Some Losses

After declining on Thursday the yellow metal has recovered a chunk of its previous day's losses in the Asia-Pac session despite higher yields in the US as the Senate passed the bill extending the nation's debt limit through Dec 3. Markets look ahead to the US NFP number later in the session, with markets expecting job gains of 500k over the month of September, equating to a drop of 0.1ppts in the unemployment rate. Familiar technical levels in play, resistance seen at $1779.7/87.4 - 50-day EMA / High Sep 22 and key resistance, support at $1721.7 - Low Sep 29 and the bear trigger.

FOREX: Risk Appetite Remains Firm Amid U.S. Debt Ceiling Extension

Fiscal goings-on in the U.S. remained in the spotlight, with the passage of a bill extending U.S. debt limit through early December by the Senate lending support to risk appetite. The bill is expected to win approval from the House, while President Biden said he is ready to sign it into law. The increase in statutory debt ceiling sets the scene for another round of fiscal wrestling by the year-end but provides some short-term reprieve.

- The adoption of the debt-ceiling bill reduced demand for safe haven assets, dragging the yen to the bottom of G10 scoreboard. Participants awaited the first policy speech from Japanese Prime Minister Kishida.

- NZD led gains in G10 FX space after AUD/NZD failed to stage a convincing break above its 100-DMA. Across the Tasman, AUD paid little attention to the publication of the RBA's Financial Stability Report.

- USD/CNH hugged a very tight range as onshore Chinese markets reopened after a week-long holiday. The PBOC set their central USD/CNY mid-point at CNY6.4604, 15 pips above sell-side estimate. The yuan showed a muted reaction to the release of China's Caixin Services PMI, which unexpectedly returned into expansion.

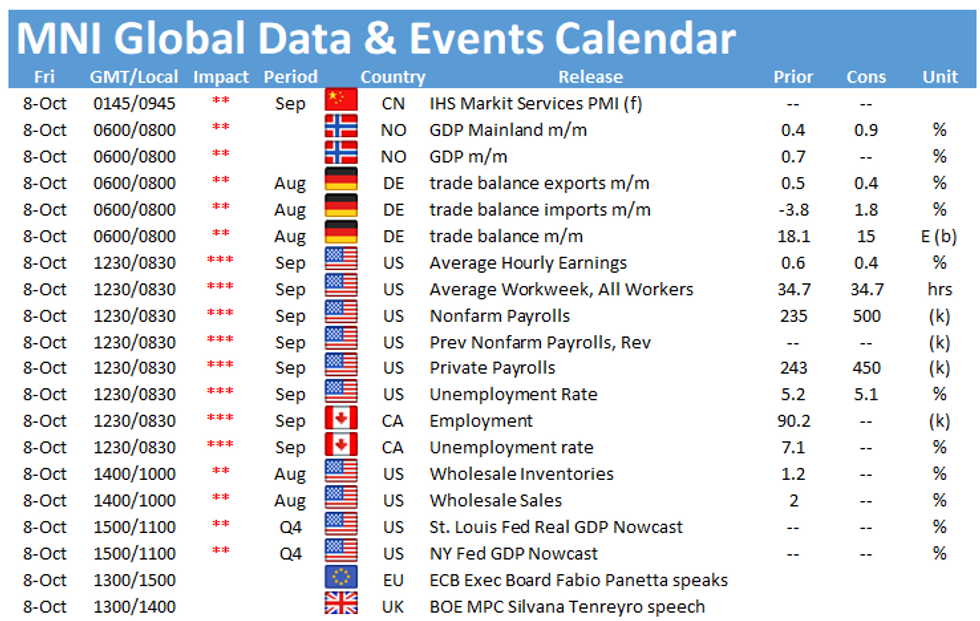

- U.S. labour market report is set to steal the limelight today, while the global data docket also features Canadian jobs data, German trade balance and Norwegian GDP. ECB chief Lagarde will speak alongside U.S. Tsy Sec Yellen.

FOREX OPTIONS: Expiries for Oct08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1450-55(E538mln), $1.1500-05(E954mln), $1.1550(E557mln), $1.1570(E521mln), $1.1600(E1.7bln), $1.1650(E1.6bln), $1.1700(E1.3bln)

- USD/JPY: Y109.75($860mln), Y110.40-50($1.3bln), Y111.00($2.7bln), Y111.50($534mln), Y111.75-90($1.1bln)

- AUD/USD: $0.7300(A$986mln), $0.7335(A$2.1bln)

- AUD/JPY: Y81.00-20(A$715mln)

- USD/CAD: C$1.2500-05($1.3bln), C$1.2530-50($1.6bln), C$1.2670-80($1bln), C$1.2700($1.6bln)

- USD/CNY: Cny6.55($1.3bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.