-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Touted Evergrande Grace Period Weighs On Risk

EXECUTIVE SUMMARY

- EVERGRANDE SECURES EXTENSION ON JUMBO FORTUNE BOND (REDD)

- FED'S DALY: PANDEMIC WILL SPUR TREASURY MARKET REFORMS (BBG)

- DEMOCRATS' PLANNED TAX-RATE INCREASES IN JEOPARDY DUE TO SINEMA'S OPPOSITION (WSJ)

- WHITE HOUSE TELLS DEMOCRATS CORPORATE TAX HIKE UNLIKELY (RTRS)

- WHITE HOUSE CONSIDERS NEW TAXES ON BILLIONAIRES (WASHINGTON POST)

- CHINA CONDUCTED TWO HYPERSONIC WEAPON TESTS THIS SUMMER (FT)

- BOE TO RAISE RATES TO 0.25% IN Q1, POSSIBLY SOONER (RTRS POLL)

Fig. 1: USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England will be the first major central bank to raise interest rates in the post-pandemic cycle but economists polled by Reuters think the first hike will not come until early next year, later than markets are pricing in. (RTRS)

CORONAVIRUS: Sajid Javid, UK health secretary, warned that England was facing its last chance to avoid a return of coronavirus restrictions this winter as he urged people to take booster jabs and exercise greater caution. In a sharp change of tone from the government at the first Downing Street pandemic press conference in five weeks, Javid warned that current case rates could double to 100,000 a day in the UK. But he refused to bow to pressure to activate the government's "Plan B", a fallback series of measures that would see the return of mandatory face masks and advice to work from home, alongside vaccine passports. "We are not at that point yet," he said. (FT)

CORONAVIRUS: The government is being "wilfully negligent" by refusing to enforce its Plan B strategy for tackling rising COVID infections, doctors have claimed. Health Secretary Sajid Javid confirmed yesterday that additional coronavirus restrictions - which could include face coverings becoming mandatory in some public places - are not going to be introduced in England. But the British Medical Association has warned that Plan B needs to be activated now, with rising infection rates putting the NHS under pressure. (Sky)

CORONAVIRUS: Amid concern that a new twist on the delta variant could be driving the current U.K. coronavirus surge, National Health Service chair David Prior said it's more likely that school-aged children are infecting older people whose vaccine-induced immunity is on the wane. "It's too early to say, but that's what we think is the most likely explanation," Prior said Tuesday evening in an interview at a Boston health conference. (BBG)

FISCAL: Road pricing is inevitable in the UK to replace lost tax revenue as the government phases out petrol and diesel cars in the coming years, transport experts have warned. Treasury papers published on Tuesday, alongside a broader net zero strategy document, outlined how the push towards electric vehicles would create a fiscal black hole requiring "new sources of revenue". While none of the documents referred to road pricing — a concept which ministers are loath to discuss in public because they fear a voter backlash — experts said the government needed to start discussing how such a scheme could work. (FT)

FISCAL: Fresh splits have emerged within the Cabinet over how the country will pay for the Government's push towards achieving net-zero emissions by 2050. Business Secretary Kwasi Kwarteng renewed hostilities with Chancellor Rishi Sunak after he appeared to reject key elements of the Treasury's assessment of the financial effect of decarbonising the economy. The official net-zero review published by the Treasury alongside the Government's long-awaited strategy warned that taxes would need to rise in order to meet the costs of slashing emissions to meet the 2050 target. (The i)

BREXIT: The European Central Bank is pushing banks to add hundreds of extra staff and billions of extra capital to their post-Brexit operations in continental Europe. One of the big surprises of Brexit was how few jobs moved from the City to the EU, with Financial Times research showing only a minimal reduction of London bank jobs in recent years against predictions that tens of thousands of jobs would have to relocate. But bank executives, lawyers and supervisors all told the FT that the ECB is becoming increasingly forceful in its demands that lenders move more resources to the continent to run their European businesses in the aftermath of Brexit. (FT)

ECONOMY: UK employers expect to hand out bigger pay rises next year, according to a closely watched survey that suggests companies already struggling to recruit will offer higher wages to retain existing staff. More than four-fifths of private sector employers expect to increase pay at their next annual review, with the median award set to rise to 2.5 per cent in the year to the end of August 2022, up from the previous year's median of 1.6 per cent, XpertHR, a research group, said on Thursday. Plans for pay freezes, which became widespread during the pandemic, were confined to a handful of companies and a majority of employees were set to receive a bigger wage rise than they had the year before, the survey of about 200 organisations showed. (FT)

POLITICS: The terror threat level currently facing MPs has been raised from "moderate" to "substantial" following a review, the government has announced. Home Secretary Priti Patel told the Commons that police and intelligence services would "properly" reflect the change in their security arrangements. But she added there was no information on "any credible or specific threat". The announcement comes after Conservative MP Sir David Amess was killed in his constituency on Friday. (BBC)

EUROPE

CORONAVIRUS: Covid cases in Europe have increased for the third consecutive week, World Health Organization officials said at a briefing Wednesday, urging caution as temperatures fall and work, travel and leisure activities return to normal. Europe is the only area out of the WHO's six regions of member states where cases are climbing, researchers wrote in an epidemiological update published Tuesday. There were more than 1.3 million Covid cases reported across the continent over the week ended Sunday, a 7% jump from the prior seven days. (CNBC)

GERMANY: MNI: Politics Looms Over Choice Of Next Bundesbank Chief

- There is no official shortlist of candidates to replace Jens Weidmann as head of the Bundesbank, Berlin sources told MNI, but finance industry and eurosystem officials said those in the running could include his vice-president Claudia Buch and European Central Bank Executive Board member Isabel Schnabel. Other possibilities are Marcel Fratzscher, the highly visible president of the German Institute for Economic Research (DIW Berlin), and former Goldman Sachs banker Joerg Kukies, currently state secretary for financial market and European policy at the Federal Ministry of Finance - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ITALY: Italy's government plans to boost spending by 23.6 billion euros ($27.5 billion) next year, according to a document seen by Bloomberg. Prime Minister Mario Draghi's cabinet on Tuesday afternoon approved an outline of the upcoming budget law, which will now be submitted to the European Commission. The full law must be approved by the Parliament by the end of the year. (BBG)

ITALY: Italian Prime Minister Mario Draghi singled out the U.K.'s handling of the Covid-19 pandemic as a great example -- of what not to do. The former European Central Bank president said the British approach, which involved a sudden lifting of restrictions on a July 19 "Freedom Day," shows the need for nations to slowly reopen. (BBG)

GREECE: George Papandreou, the Greek prime minister who applied for the country's first bailout program, wants to return to the political stage. A decade after his exit, he is standing to lead the Movement of Change party. Papandreou announced his candidacy in a televised statement on Wednesday: "I will contribute with all my powers to make our party big and strong again." (BBG)

SWEDEN: The deviation between market pricing and the Riksbank's repo rate path is not dramatic and will not cause any severe volatility or problems for the central bank, Deputy Governor Per Jansson says at seminar. Riksbank's view is that acceleration of inflation is temporary, Jansson says. While it is hard to find signs of persistently higher inflation in Sweden, concern about price increases is more justified in the U.K. and the U.S. (BBG)

SWEDEN: Swedish residential property prices rose 0.3% on the month in September, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden.

- HOX Sweden rose 1.1% in the 3 months through September and rose 12.4% y/y

- Adjusted for seasonal effects, the index rose 0.5% m/m in September

U.S.

FED: MNI: Quarles Warns 'Significant Upside Risk' for US Inflation

- Federal Reserve Governor Randy Quarles said Wednesday he sees "significant upside risks" to inflation that could force tighter monetary policy even if the labor market falls short of a complete recovery. "My focus is beginning to turn more fully from the rapidly improving labor market to whether inflation begins its descent toward levels that are more consistent with our price-stability mandate," he said in remarks prepared for a Milken Institution conference in Los Angeles. "If inflation does remain more than moderately above 2%, be assured that the FOMC has the framework and the tools to address it" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Cleveland President Loretta Mester said in a CNBC interview Wednesday that she believes it is too soon to start talking about raising short-term interest rates. Ms. Mester, who isn't a voting member of the rate setting Federal Open Market Committee, said she still reckons that high inflation this year will ease back toward the Fed's 2% target next year. (WSJ)

FED: MNI BRIEF: Supply Shortages Pinch Outlook, Fed Beige Book Says

- The U.S. economy grew at a "modest to moderate" rate in a majority of Fed districts, while several districts said the pace of expansion slowed in the survey period, constrained by supply chain disruptions, labor shortages, and uncertainty around the Delta variant, the Fed's Beige Book report said Wednesday. Employment increased at a "modest to moderate" rate in recent weeks as demand for workers was high, but labor growth was dampened by a low supply of workers, the report said. "Many firms offered increased training to expand the candidate pool. In some cases, firms increased automation to help offset labor shortages. The majority of Districts reported robust wage growth," the report said. Across most Fed districts there were "significantly elevated prices, fueled by rising demand for goods and raw materials," the report said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of San Francisco President Mary Daly said the pandemic will spur longer-term reforms of the Treasury market to ensure there's sufficient liquidity in a future crisis and that people are aware of it. The dislocation seen early in the crisis was on a scale that few could have expected, and the reform process will likely several years, Daly said late Wednesday from San Francisco at an online Asian banking forum. "The thing to take away from that is, what do we need to think about for treasury market reform?" Daly said, citing centralized clearing as one of the focus areas. "What do we need to do to make liquidity feel available to People?" (BBG)

FISCAL: Sen. Kyrsten Sinema's opposition to tax increases is causing Senate Democrats to look at financing their sprawling social policy and climate package without raising tax rates on businesses, high-income individuals or capital gains, according to people familiar with the matter. (WSJ)

FISCAL: The White House told Democratic lawmakers in a meeting on Wednesday that a proposed hike in corporate taxes is unlikely to make it into a final reconciliation bill, according to a congressional source familiar with the discussions. President Joe Biden had proposed increasing the corporate tax rate from 21% to 28%, which would unwind the tax cuts enacted under Republican former President Donald Trump. (RTRS)

FISCAL: Senior Biden officials briefed top Democratic lawmakers on a potential shift in the party's tax plans on a private call on Wednesday, as the White House searches for unity on how to pay for its multi-trillion-dollar economic package, according to three people with knowledge of the call. While the Biden administration initially proposed increasing the corporate tax rate to 28 percent, a move that would unwind the tax cuts under former president Donald Trump, the president's aides on Wednesday instead discussed an alternative range of tax hikes, likely excluding a corporate tax rate hike as part of a new source of revenue for the package, the people said. Instead, the advisers to President Biden said that they are pursuing a range of ideas that could still raise substantial sums of money from corporations and the rich, including a tax on billionaires' assets that would resemble a more modest version of the wealth tax championed by Sen. Elizabeth Warren (D-Mass.). (Washington Post)

FISCAL: A CNN reporter tweeted the following on Wednesday: "Dems are still haggling over a number of issues: Climate change, Medicare expansion, revenue raisers, increasing the SALT deduction and paid family leave, sources said." (MNI)

FISCAL: Top GOP House leaders and 160 lawmakers called on President Biden Wednesday to fix the U.S. "supply chain crisis" or face a doomed holiday season. In a letter to the president first obtained by Fox News, the Republicans asked that Biden reverse his policies relating to the coronavirus they believe have disrupted U.S. infrastructure abilities and supply chains. "We request that you stop the litany of harmful regulatory actions that are driving up energy costs and to stop attacking the American businesses with vaccine mandates, taxation and government handouts that are disincentivizing work," Ranking Member of the House Transportation and Infrastructure Committee Rep. Sam Graves, R-Mo., who led the letter to Biden, said. (FOX)

CORONAVIRUS: The Food and Drug Administration Wednesday night authorized booster shots of both Johnson & Johnson and Moderna's Covid vaccines, another critical step in distributing extra doses to tens of millions of people. At the same time, U.S. regulators also authorized "mixing and matching" vaccines, allowing Americans to get a booster shot that's a different vaccine from the one used for initial doses. (CNBC)

CORONAVIRUS: FDA officials indicated they would also move quickly to expand eligibility for booster shots as more data become available or if breakthrough cases start to rise in younger adults. "We will not hesitate to drop this age range as we see that that benefit clearly outweighs the risk," said Peter Marks, the head of the agency's Center for Biologics Evaluation and Research. (BBG)

POLITICS: Former President Donald Trump announced Wednesday he will be launching his very own media network, including a social media platform called "TRUTH Social," in order to "stand up to the tyranny of Big Tech." The app appears to be the first project of the Trump Media and Technology Group (TMTG), which will list on the Nasdaq through a merger with Digital World Acquisition Group, according to an announcement tweeted out by spokeswoman Liz Harrington. The transaction values TMTG at up to $1.7 billion, Harrington said. (CNBC)

OTHER

GLOBAL TRADE: The U.K. sealed a trade deal with New Zealand, its latest post- Brexit accord as it seeks new economic allies after leaving the European Union. Britain's Prime Minister Boris Johnson and New Zealand premier Jacinda Ardern agreed to the pact in a video call on Wednesday, according to a statement from the U.K.'s Department for International Trade. The deal includes measures such as improved business-travel arrangements and reduced tariffs on products like clothing, buses, ships and bulldozers, the statement said. (BBG)

U.S./CHINA: President Joe Biden's pick to be ambassador to China drew sharp lines with Beijing over its "aggressive" actions in the Indo-Pacific but said "American strength" gives the U.S. key advantages in the relationship between the world's two largest economies. Nicholas Burns, a longtime diplomat who previously served as U.S. ambassador to NATO and Greece, said China has been the aggressor in its relationship with Taiwan, Vietnam, Japan and the Philippines. He also said he's skeptical about Chinese intentions on issues like 5G technology. (BBG)

EU/CHINA/TAIWAN: European Parliament will send a delegation to visit Taiwan early next month to discuss coping with disinformation and China's Internet interference, Cabinet spokesperson Lo Ping-cheng says at briefing, citing Premier Su Tseng-chang. (BBG)

GEOPOLITICS: The Chinese military conducted two hypersonic weapons tests over the summer, raising US concerns that Beijing is gaining ground in the race to develop a new generation of arms. On July 27 the Chinese military launched a rocket that used a "fractional orbital bombardment" system to propel a nuclear-capable "hypersonic glide vehicle" around the earth for the first time, according to four people familiar with US intelligence assessments. The Financial Times this week reported that the first test was in August, rather than at the end of July. China subsequently conducted a second hypersonic test on August 13, according to two people familiar with the matter. (FT)

JAPAN: Ruling LDP Expected To Keep Simple Majority, Tight Races Eyed

Major Japanese media outlets conducted large-sample opinion polls over the last two days, as official campaigning for the October 31 election kicked off. All of them expect the ruling coalition to secure a simple majority of 233 seats. However, it is unclear if the LDP-Komeito alliance will be able to command an "absolute majority" of 261 lawmakers amid expectations of tight races in many single-seat districts.

- The latest poll from Kyodo News Agency suggested that the LDP is poised to win at least 233 seats. Kyodo noted that LDP-backed candidates "are leading in around 190 of the 289 single-member districts" and the ruling party is "also ahead in proportional representation (...) reflecting returning support for the LDP after (...) Yoshihide Suga stepped down." The main opposition CDP leads in around 50 single-seat districts and is "competitive" in around 40 more, but has only "lacklustre" support in proportional representation.

- The conservative-leaning Yomiuri sees LDP candidates leading in around 120 single-seat districts and lagging in around 40, especially in constituencies where the opposition have fielded joint candidates. Out of the 214 candidates fielded by the CDP in single-seat constituencies, around 30 are seen as having the upper hand. The newspaper's analysis suggested that the LDP may perform well in proportional representation.

- The opinion poll conducted by Asahi showed that 38% of respondents wanted to pick the LDP in party-list vote, while 13% preferred the CDP, with the gap narrowing by 3pp since the previous poll conducted right after the inauguration of the Kishida Cabinet. This coincides with a 4pp drop in PM Kishida's approval rating, which fell to 41%.

- The Mainichi published the results of their own survey, which suggested that the LDP will likely lose some seats, but should defend simple majority once they form a coalition with Komeito. The Mainichi saw tight races in 63 single-seat constituencies and noted that it is uncertain if the ruling coalition will command an "absolute majority."

- The Nikkei published an analysis, which suggested that the LDP-Komeito alliance should retain a simple majority of seats, albeit the race will be tight. As many as 40% of the 289 single-seat constituencies may see ruling coalition and opposition candidates go toe-to-toe, while 20% of respondents said they were still undecided. Meanwhile, it is unclear if the CDP will be able to maintain their previous share of party-list seats. (MNI)

JAPAN: Tokyo set to lower coronavirus alert level on medical system. (FNN)

JAPAN: The BOJ and FSA are assessing if local financial institutions have any remaining Libor-linked contracts that will be difficult to shift to alternative interest rates before the benchmark expires. Japan's financial institutions will be allowed to use synthetic Libor rates if they can't meet the end of December deadline. Still, the BOJ and FSA have clearly signaled that's not a desirable outcome given the rate isn't the same as Libor and the publication of the synthetic rate is scheduled only for one year. (BBG)

NEW ZEALAND: ANZ is making sharp increases to fixed-term home loan carded mortgage rates across the board. The bank is pushing through a +45 basis points increase, far above the recent +25 bps Official Cash Rate increase from the Reserve Bank. ANZ no longer offers any mortgage rates below 3%. And now ANZ's four and five year fixed rates are well above 5%. These changes follow sharp wholesale rate increases in the past few days, that are sticking after their initial jump. Since the surprise CPI jump on Monday, wholesale swap rates have risen about +30 bps. Since the October 6, 2021 RBNZ +25 bps OCR rise, wholesale swap rates have risen about +50 bps. So that means today's +45 bps rise by ANZ is a lesser increase than for wholesale money costs. At the same time, ANZ is also sharply raising term deposit offer rates. (Stuff NZ)

CANADA: Ottawa plans to reveal details tomorrow about its forthcoming proof-of-vaccination system for international travel, a senior government source has confirmed to CBC News. Prime Minister Justin Trudeau is expected to make the announcement tomorrow at 10 a.m. ET in Ottawa. The source with knowledge of the plan spoke on condition of anonymity because they weren't authorized to speak publicly. A media advisory from Immigration, Refugees and Citizenship — which has been tasked with implementing a proof-of-vaccination system for international travel — shows officials from that department will lead a technical briefing with media tomorrow morning, along with officials from the Public Health Agency of Canada, Transport Canada, Indigenous Services Canada and Canada Border Services Agency. (CBC)

BOC: MNI INTERVIEW: BOC Decision Will Overlook CPI Jump- Ex Official

- The Bank of Canada will stick to the view that the strongest inflation since 2003 will be short-lived at next week's rate-setting meeting, balancing language about faster-than-expected recent gains with a cut to its economic growth forecasts, former central bank researcher and CIBC Senior Economist Royce Mendes told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico and the International Monetary Fund are discussing a plan to reduce the nation's $63 billion precautionary credit line by 20% when it comes due for renewal next month, after economic risks from the global pandemic subsided. The IMF and the Mexican authorities last week talked about the proposal to cut access to $50 billion, according to three people familiar with the discussions, who asked not to be named because the conversation was private. (BBG)

BRAZIL: Brazil's economy chief said the government could seek a "waiver" to the country's spending cap to fund its new social program, just hours after President Jair Bolsonaro said the extra spending would abide by the fiscal rule. Paulo Guedes said the administration could ask congress for a 30 billion-real ($5.4 billion) waiver to the spending cap, which limits the growth of public expenses, in order to pay for a larger social benefit. The exception would be limited to 2022 and justified by the fact that poor Brazilians are being disproportionately affected by food and fuel inflation, Guedes said at an online event. (BBG)

BRAZIL: Brazil's political wing will decide how to fit the 400 reais benefit into the country's budget, Economy Minister Paulo Guedes said during an event. It is up to lawmaker Hugo Motta, the rapporteur of the court-ordered payments bill known as precatorios, to make possible a social aid of 400 reais. Brazilian govt could not leave poor families who received emergency aid unprotected, said Guedes. President Jair Bolsonaro called for a higher benefit, he added. If govt cannot handle a permanent program, it should aim at transitory one: Guedes (BBG)

BRAZIL: Brazil's govt plans to raise by 20% cash handouts through the so-called Auxilio Brazil social program, whose payments are expected to start in Nov., the Citizenship Minister, Joao Roma, said in a speech at Presidential Palace. (BBG)

IRAN: U.S. envoy for Iran Rob Malley will meet on Friday in Paris with senior diplomats from France, Germany and the U.K. to discuss the stalemate in the nuclear talks with Iran, sources briefed on the meeting told me. Malley will arrive in Paris after a four-day trip to the Gulf. (Axios)

IRAN: Saudi Foreign Minister Prince Faisal bin Farhan al-Saud and U.S. Special Envoy for Iran Robert Malley met in Riyadh on Wednesday to discuss the Iranian nuclear talks, the state news agency SPA said. Prince Faisal and Malley, who earlier visited Qatar on a regional tour to coordinate with Gulf allies, also discussed strengthening "joint action to stop Iranian support for terrorist militias" threatening regional security, SPA added. (RTRS)

ENERGY: Russia is becoming increasingly concerned that surging gas prices risk demand-destruction in its biggest export market. "Such a situation, at the end of the day, is leading to lower consumption, and this will affect our producers, including Gazprom PJSC," President Vladimir Putin said at a government meeting Wednesday that was broadcast by Rossiya 24 TV. "This is why we are not interested in endless growth of energy prices, including gas." (BBG)

OIL: A low oil price would cripple investments and cause a "serious energy crisis" the Saudi Finance Minister tells CNBC in an exclusive interview. (CNBC)

OIL: Libya Oil Minister Mohamed Oun denied a fresh report suggesting he suspended and replaced National Oil Corp. Chairman Mustafa Sanalla. "The circulated letter is fake and wasn't issued by the minister," according to a statement from the ministry. (BBG)

CHINA

PBOC: The People's Bank of China will avoid risk contagion from the Evergrande Group to other developers and to the financial sector, as it is a single case and the spillover effect is generally controllable, said PBOC Governor Yi Gang during the G30 International Banking Seminar on Wednesday, according to a statement on the PBOC website. The central bank will ensure all the creditors and related parties' legal rights being treated fairly, as the PBOC is confident that it can limit the scope and avoid systemic risks, said Yi. Yi also expects rising PPI pressure to ease by the end of the year, though the figure may remain at a high level for the following months, the statement said. (MNI)

PBOC: The PBOC signaled its intention to ensure rising liquidity demanded by more local government bond sales, tax remissions and large maturing MLFs, even as the probability of RRR cuts has declined, the Shanghai Securities News reported citing market participants. The central bank injected CNY100 billion on Wednesday, the first time since the end of September when it for multiple days pumped CNY100 billion to ensure inter-season funding needs, the newspaper said. While the central bank kept LPRs unchanged on Wednesday, it may still lower the lending benchmark in Q4 by as much as 0.1 pp to spur the demand of the real economy and help SMEs, the newspaper said citing analyst Wang Qing of Golden Credit Rating. (MNI)

EVERGRANDE: China Evergrande Group has secured agreement for an extension of more than three months on a $260 million bond issued by Jumbo Fortune and guaranteed by the developer, according to a REDD report citing two sources briefed by the bondholders. The agreement was reached earlier this week after Evergrande agreed to provide extra collateral: REDD Evergrande will seek Guangdong government's opinion before making the delayed dollar coupon payments, without identifying the source of the information. Evergrande did not immediately reply to a Bloomberg request for comment on Thursday. (BBG)

EVERGRANDE: China Evergrande Group scrapped talks to offload a stake in its property-management arm and said real estate sales plunged about 97% during peak home-buying season, worsening its liquidity crisis on the eve of a dollar- bond deadline that could tip the company into default. In statements to the Hong Kong exchange late Wednesday, Evergrande added that it had made no further progress on asset sales and may not be able to meet its financial obligations. Its shares plunged as much as 10.5% on Thursday morning after resuming trading following a three-week halt. (BBG)

PROPERTY: MNI INTERVIEW: Top Excavator Maker Tracks China Property Slump

- China's economy is notably slower after a rapid recovery from the Covid-19 pandemic as property market concerns shake investor confidence, executives at a top construction equipment maker told MNI, adding the slump comes as manufacturers are dealing with a transition to "carbon neutral" processes and equipment by 2060 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PROPERTY: Fitch Ratings has placed 29 Chinese property developers, including Guangzhou R&F Properties, Kaisa Group and Yango Group on its Under Criteria Observation (UCO) status after criteria update, it says in a statement. The UCO status indicates that ratings could change as a result of the application of new or revised criterion following its publication. (BBG)

EQUITIES: Shares of Modern Land China have been suspended from 9am local time pending the release of an inside information announcement, according to Hong Kong stock exchange filing. (BBG)

ENERGY: Chinese Premier Li Keqiang called for "all-out" efforts to ensure coal production and transportation for heating, and continue to crack down on market speculation, the Global Times said citing a State Council meeting. The government vowed to increase gas supply and asked local authorities to keep gas and heating prices stable, the newspaper said. Officials from the country's top planning agency inspected major coal ports, storage and distribution centers and summoned energy companies to ensure coal supply for the winter, the newspaper said. Authorities approved three new mines in Northwest China's Gansu Province on Tuesday, it said. Daily coal output on Monday has exceeded 11.6 million tons, a new high this year. The Zhengzhou Commodity Exchange limited thermal coal futures contracts to curb soaring prices, it said.

OVERNIGHT DATA

CHINA SEP SWIFT GLOBAL PAYMENTS CNY 2.19%; AUG 2.15%

JAPAN SEP SUPERMARKET SALES +3.2% Y/Y; AUG -0.1%

AUSTRALIA Q3 NAB BUSINESS CONFIDENCE -1; Q2 18

The imposition of lockdowns saw business conditions and confidence fall sharply in Q3. Conditions fell sharply but managed to remain in positive territory (down 17pts to +13 index points) as businesses displayed resilience built up through past lockdown experiences and government support continued. Confidence, however, turned negative (down 19pts to -1 index point) with confidence down in all states and industries. According to Alan Oster, NAB Group Chief Economist, "With lockdowns in place for most of Q3, it's unsurprising to see both business conditions and confidence take a fairly large hit for the quarter. The biggest falls were in NSW and Victoria, with conditions in the personal & recreational services sector down a long way." "While conditions deteriorated sharply, they didn't fall to the depths seen during the first lockdowns in 2020. That shows the resilience that the economy has built up by adapting to past lockdowns, as well as the residual strength from earlier in the year and the impact of government support," said Mr Oster. (NAB)

AUSTRALIA SEP RBA FX TRANSACTIONS GOV'T -A$1.505BN; AUG -A$962MN

AUSTRALIA SEP RBA FX TRANSACTIONS MARKET +A$1.518BN; AUG +A$914MN

AUSTRALIA SEP RBA FX TRANSACTIONS OTHER +A$1.759BN; AUG +A$11.994BN

NEW ZEALAND SEP CREDIT CARD SPENDING -12.9% Y/Y; AUG -6.9%

NEW ZEALAND SEP CREDIT CARD SPENDING -3.3% M/M; AUG -15.8%

SOUTH KOREA OCT 1-20 EXPORTS +36.1% Y/Y; SEP +22.9%

SOUTH KOREA OCT 1-20 IMPORTS +48.0% Y/Y; SEP +38.8%

SOUTH KOREA SEP PPI +7.5% Y/Y; AUG +7.4%

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operations lead to a net injection of CNY90 billion after offsetting the maturity of CNY10billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and the issuance of government bonds, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1230% at 09:34 am local time from the close of 2.2097% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Wednesday, flat with the previous trading day.

PBOC SETS YUAN CENTRAL PARITY AT 6.3890 THURS VS 6.4069

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3890 on Thursday, compared with the 6.4069 set on Wednesday, marking the weakest parity since Jun 11, 2021.

MARKETS

SNAPSHOT: Touted Evergrande Grace Period Weighs On Risk

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 450.03 points at 28805.52

- ASX 200 up 5.227 points at 7418.9

- Shanghai Comp. up 16.616 points at 3603.617

- JGB 10-Yr future up 1 tick at 151.33, yield down 0.2bp at 0.092%

- Aussie 10-Yr future up 1.0 tick at 98.175, yield down 1.3bp at 1.795%

- U.S. 10-Yr future -0-06 at 130-14+, yield unch. at 1.657%

- WTI crude up $0.01 at $83.43, Gold up $3.27 at $1785.36

- USD/JPY down 23 pips at Y114.08

- EVERGRANDE SECURES EXTENSION ON JUMBO FORTUNE BOND (REDD)

- FED'S DALY: PANDEMIC WILL SPUR TREASURY MARKET REFORMS (BBG)

- DEMOCRATS' PLANNED TAX-RATE INCREASES IN JEOPARDY DUE TO SINEMA'S OPPOSITION (WSJ)

- WHITE HOUSE TELLS DEMOCRATS CORPORATE TAX HIKE UNLIKELY (RTRS)

- WHITE HOUSE CONSIDERS NEW TAXES ON BILLIONAIRES (WASHINGTON POST)

- CHINA CONDUCTED TWO HYPERSONIC WEAPON TESTS THIS SUMMER (FT)

- BOE TO RAISE RATES TO 0.25% IN Q1, POSSIBLY SOONER (RTRS POLL)

BOND SUMMARY: Off Lows On Wider Flows

Core FI markets have regained some poise in recent dealing after a bit of a drift lower in early Asia-Pac trade. The initial drift lower perhaps focused on yesterday's cheapening in the long end of the Tsy curve & ACGB dynamics.

- The bid seemingly came in after little-known news provider REDD noted that Evergrande Group secured an extension on the maturity of a $260mn bond issued by Jumbo Fortune Enterprises, the JV it is involved in and guarantees the bonds for. The article suggested that the extension period will last more than 3 months, citing sources. The defensive tone may just be a case of the market not liking the continued uncertainty that the 3-month+ grace period indicated in the article may create, as it isn't an ultimate fix to the issues at hand.

- TYZ1 last -0-05+ at 130-15, with some very modest twist flattening witnessed on the cash Tsy curve, although the major benchmarks sit within -/+0.5bp of Wednesday's closing levels. A 10K block buyer of TYZ1 129.50 puts headlined flow overnight. Weekly jobless claims data, the latest Philly Fed business outlook survey, 5-Year TIPS supply, the Tsy's month-end supply announcement and another address from Fed Governor Waller are all due on Thursday.

- JGBs futures were relatively insulated, holding within the confines of the overnight range, even as Japanese equities struggled and the JPY turned bid. Cash trade sees the major JGB benchmarks run little changed to 2bp richer across the curve.

- Over in Sydney YM +3.5 and XM +1.5. Earlier in the day, the RBA held off from enforcing its YCT mechanism, choosing not to purchase ACGB Apr-24 in today's typical purchase window. This weighed YM as some in the market were disappointed (we suggested that the previously flagged move from the RBA earlier this week limited the chances of such purchases today). ACGB Apr-24 traded above 0.16% in yield terms, a little over 6bp above the RBA's 0.10% target, before recovering. Elsehwere, semi issuance saw QTC price A$1.5bn of Aug '33 paper. The bid off lows in ACGBs was in play before the broader rally took hold.

JGBS AUCTION: Japanese MOF sells Y2.8233tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8233tn 6-Month Bills:

- Average Yield -0.1062% (prev. -0.1142%)

- Average Price 100.053 (prev. 100.057)

- High Yield: -0.1062% (prev. -0.1102%)

- Low Price 100.053 (prev. 100.055)

- % Allotted At High Yield: 36.7494% (prev. 81.3913%)

- Bid/Cover: 5.417x (prev. 4.310x)

EQUITIES: Focus On Chinese Property Developers

Thursday saw a relatively mundane round of trade for the major equity indices in Asia, at least at face value, with the notable indices dealing either side of unchanged at typing.

- Still, as has been the case in recent times, there was plenty of focus on the Chinese property developer space. China Evergrande & Hopson both filed resumption of trading notices on the HKEx. This comes after news that the potential sale of the former's property services unit to the latter had collapsed, increasing pressure on the giant as the countdown to official default on its debt continues to tick over. Evergrande lost ~10% on the day, while Hopson added ~5%. Elsewhere in the sector, property developer Modern Land China suspended trading in Hong Kong pending the release of inside information after noting that it continues to face "liquidity issues." Finally, Fitch placed 29 Chinese property developers on UCO after a criteria update.

- U.S. e-minis were little changed to a touch lower, which came in the wake of a modest uptick for both the S&P 500 & the DJIA on Wednesday. The NASDAQ 100 lost a little bit of ground on Wednesday as most of the U.S. Tsy curve cheapened on the day, although the tech index finished off of worst levels.

OIL: Little Changed In Asia, Fresh Cycle Highs Hit

WTI & Brent crude futures are little changed during Asia-Pac dealing after registering fresh cycle highs early in the session. News flow has been relatively light overnight, with a very modest downtick in U.S. e-mini equity futures perhaps helping crude away from highs.

- This comes after a rally on Wednesday, which saw the space receive support from a surprise headline drawdown in crude stockpiles per the DoE, which was accompanied by a drawdown in stocks at the Cushing hub and larger than expected drawdowns in both gasoline & distillate stocks, in addition to a downtick in weekly crude production (providing a more bullish outcome than Tuesday evening's inventory estimates from the API).

- An uptick in the S&P 500 also supported crude, while the Saudi Energy Minister played down chances of: an imminent, larger than pencilled in rise in crude production for OPEC+.

- Elsewhere, there was a call for continued upside in crude prices from the Iraqi oil minister (pointing to the potential for $100/bbl prices in Q1/Q222).

- These factors allowed crude prices to reverse their early losses on Wednesday, resulting in the aforementioned cycle highs.

GOLD: Supported, With Bulls Looking To Key Resistance

The broader DXY is threatening a clean break below Monday's lows, while our weighted U.S. real yield monitor is holding on to most of yesterday's losses. These factors supported bullion on Wednesday, with relatively sedate trade subsequently witnessed in Asia hours, leaving spot a handful of dollars higher, just above $1,785/oz. Bulls still need to take out the October 14 high ($1,800.6/oz), which forms key short-term resistance, before they can turn their focus higher.

FOREX: Risk Switch Flicked To Off, Yuan Defies Softer PBOC Fix

Risk-off flows swept across G10 FX space amid a fairly abrupt change in sentiment, with major crosses unwinding earlier moves, which coincided with a bout of equity weakness. Antipodean currencies turned into the main laggards in G10 FX space after printing fresh multi-month highs against the greenback earlier in the session.

- USD/CNH went offered amid initial greenback weakness, looking through another softer than expected PBOC fix, but almost erased those losses as risk-off flows kicked in.

- JPY jumped onto the top of the G10 pile as the Nikkei 225 retreated, while U.S. e-mini futures ticked lower.

- U.S. weekly jobless claims, EZ consumer confidence and comments from Fed's Waller, ECB's Visco & Riksbank's Breman take focus later in the day.

FOREX OPTIONS: Expiries for Oct21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1734-40(E1.4bln)

- EUR/GBP: Gbp0.8460(E610mln)

- USD/JPY: Y115.30($610mln)

- AUD/USD: $0.7470-75(A$726mln)

- NZD/USD: $0.6950(N$2.3bln)

- USD/CAD: C$1.2650($1.0bln)

- USD/CNY: Cny6.4300($505mln), Cny6.4400($1.2bln)

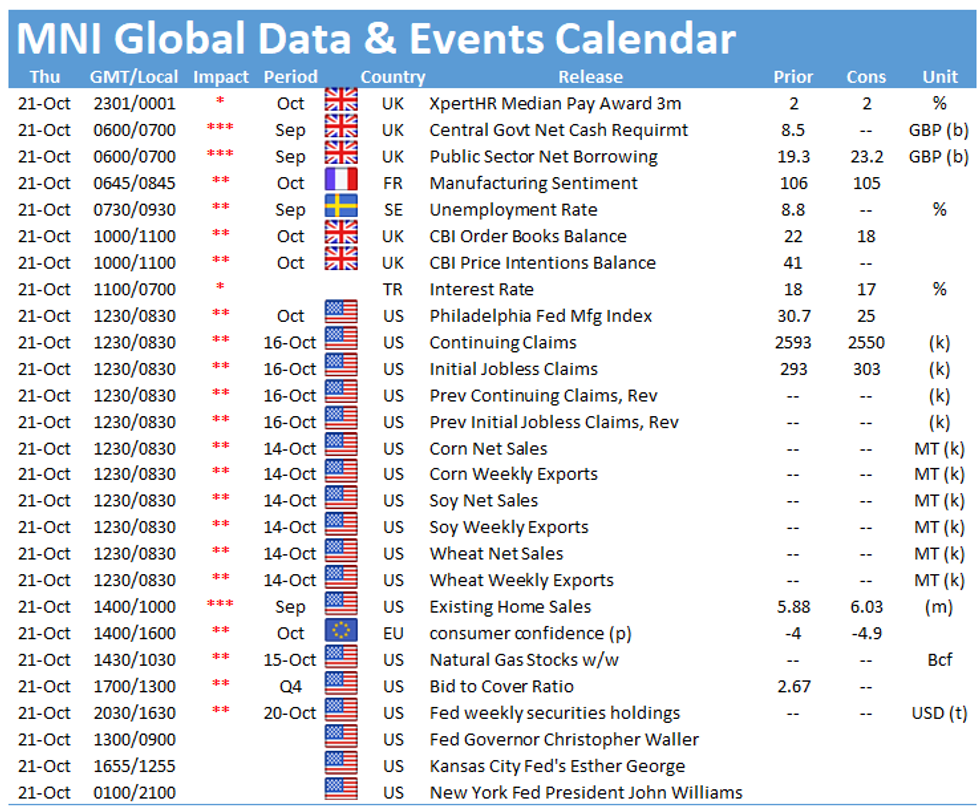

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.