-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Leave ACGB Yields Off The Leash

EXECUTIVE SUMMARY

- U.S. HOUSE DELAYS BIPARTISAN INFRASTRUCTURE BILL VOTE AMID PROGRESSIVES' PUSHBACK

- LAGARDE'S MILD RATES PUSHBACK REFLECTED ECB COUNCIL AGREEMENT (BBG)

- UK LOOKS AT FALLOUT FROM SUSPENDING NORTHERN IRELAND COOPERATION (Sky)

- RBA REFRAINS FROM PURCHASING DEBT IN DEFENCE OF YIELD TARGET

- EVERGRANDE PAYS OVERDUE INTEREST AND AGAIN DODGES DEFAULT (BBG)

- CHINA NDRC: COAL PRICES HAVE ROOM TO FURTHER FALL (BBG)

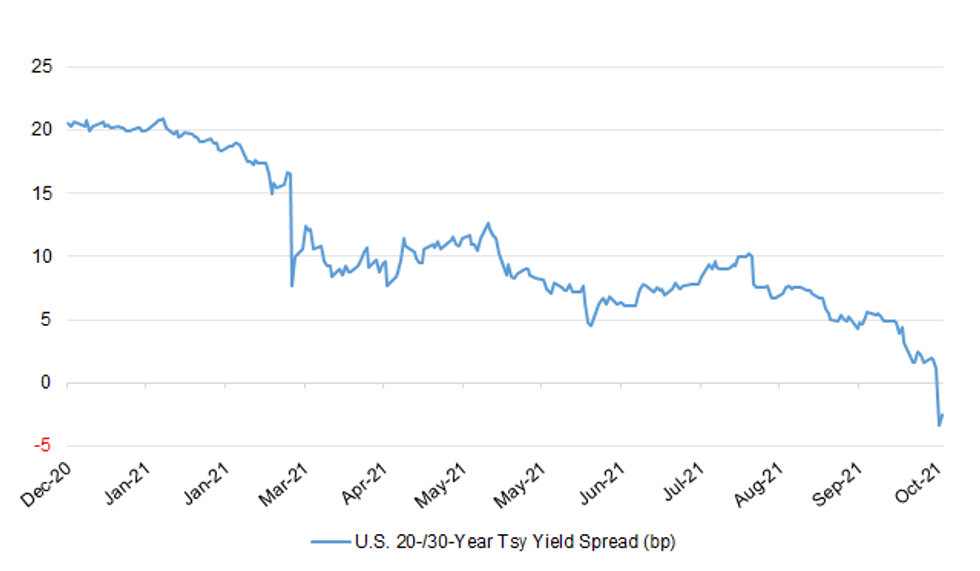

Fig. 1: U.S. 20-/30-Year Tsy Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England will consider whether it should force banks to hold extra capital to cover risks from climate change, as central banks come under pressure to assess any shock to the financial system. The central bank's Prudential Regulation Authority said on Thursday that it would examine whether changes to bank capital buffers might be necessary to manage the impact of climate change, and it would publish its findings by the end of 2022. (FT)

BREXIT: Britain has begun preparations for a major clash with the EU by activating a key government committee to look at the fallout from suspending cooperation over Northern Ireland, Sky News has learnt. Ministers are holding discussions inside the key cabinet committee, which oversaw Brexit fallout preparations, about the repercussions of triggering Article 16, which allows the UK to stop following some parts of the Northern Ireland Protocol. The discussions on the practical implications of triggering the emergency mechanism in the Northern Ireland Protocol are being held in the "XO" cabinet committee, a pivotal institution inside government last year during Brexit talks when facing the threat of "no deal". (Sky)

BREXIT: The French ambassador will be hauled into the Foreign Office for tense talks tomorrow after a British trawler was detained by authorities off France. The Cornelis Gert Jan was held yesterday off Le Havre as France pledged to ban all British vessels from landing catches from next week in retaliation for the government's decision not to grant more fishing licences to French trawlers in British waters. The French maritime minister has described the situation as a "fight". (Times)

CORONAVIRUS: The remaining seven countries on the government's travel red list are to be removed, meaning there will no longer be a requirement for hotel quarantine for arrivals to the UK. Colombia, the Dominican Republic, Ecuador, Haiti, Panama, Peru and Venezuela are being taken off the list from 4am on Monday, which will leave no countries left in the highest category of travel restrictions. (Sky)

ECONOMY: Millions of households face higher mortgage payments with interest rate rises expected next week as a result of Rishi Sunak's spending splurge. Concerns about falling living standards intensified today after analysts warned that high inflation and tax rises were likely to more than offset pay rises for most earners. They said that more than a million people would be dragged into the higher rate of tax as a result of a budget that was likely to leave middle earners worse off next year. The Bank of England is also set to be the world's first central bank to increase rates after Sunak promised another £150 billion for public services on Wednesday. (Times)

ECONOMY: Creditors to U.K. businesses are losing patience over debt payment arrears, with an increasing number going to court to recover the money they're owed. The number of county court judgments lodged against companies jumped to 21,769 during the third quarter, 51% more than the previous three-month period and more than twice the amount seen a year earlier. The number of businesses in significant financial distress dropped 14% from the previous quarter with pent-up demand fueling a boom in consumption, the report said. That's helped to ease the immediate threat to companies. (BBG)

EUROPE

ECB: The European Central Bank's Governing Council advised President Christine Lagarde to emphasize their forward guidance but to stop short of saying that financial market interest-rate expectations are wrong. Policy makers argued that investors might have different views on inflation than the central bank, and given high uncertainty around the outlook, outright pushback could backfire. All policy makers agreed that current market pricing showing interest-rate increases next year is unfounded. That background provides context to Lagarde's insistence that she didn't want to judge investor bets, comments that some analysts suggested showed a lack of conviction. (BBG)

EU/U.S.: Europe is edging toward a deal in the coming days to end the transatlantic trade war, but that truce now looks likely to mean Brussels must accept quotas on how much steel can be shipped to the United States without paying higher level tariffs. The contours of a deal now appear to be forming around Europe accepting tariff rate quotas. This would secure an immediate removal of the Trump-era tariffs but would mean that high duties on European metal would kick in again if EU exports surpassed a certain level. EU officials had regarded these kinds of measures as blackmail under Trump, but are now accepting there may be no other way out of the standoff. In a meeting with trade diplomats on Thursday, the European Commission was optimistic that a deal could be reached, two people in the meeting said. But diplomats did not receive more details of any future settlement, as the Commission does not want to undermine the negotiations with Washington. It's also not clear yet whether it will be a long-term solution, the two people said. (Politico)

EU: France is trying to block the European Union from conducting talks on pending trade deals until after its presidential election in April, when incumbent Emmanuel Macron faces a crowded field of candidates. Discussions are ongoing between Paris and the European Commission, the EU's executive arm that plays the central role in trade negotiations. A French diplomat confirmed Paris will oppose trade talks. Talks with New Zealand and Chile are among the negotiations the French government is seeking to freeze. (BBG)

FRANCE/AUSTRALIA: French President Emmanuel Macron spoke with Australian Prime Minister Scott Morrison by telephone on Thursday for the first time since the diplomatic crisis over a scrapped submarine deal last month, the Élysée Palace said. Macron reiterated that Canberra's decision to cancel a deal for conventional-powered French subs in favour of US nuclear vessels "had broken the relation of trust between our two countries," his office said in a statement. "It is now up to the Australian government to propose concrete actions that could embody the will of Australian authorities to redefine the bases of our relationship and pursue joint action in the Indo-Pacific region," it said. (France24)

ITALY: Italian Premier Mario Draghi's government has set aside 12 billion euros ($9.3 billion) to cut taxes on income and businesses as part of a larger plan to boost long-term growth. The cabinet approved the 2022 budget on Thursday which included the proposed tax reductions. About 8 billion of that will go towards the actual tax cuts on people and businesses, including the so called tax wedge, or the difference between what employers pay and what employees see in their pay slips. The rest will be cuts to other taxes. The government also raised the age required to retire, a major stumbling block to approval of the budget that has been overcome. (BBG)

NETHERLANDS: Government formation talks in the Netherlands on Friday became the longest on record, 226 days after the March 17 elections delivered a fractured political landscape that made parties more reluctant than ever to compromise. Dutch government coalitions often take months to form, but this year's post-election talks have been especially drawn out. For months, parties failed to even move beyond the question of who would be allowed at the negotiation table. Meanwhile, pressing matters such as climate change, health care and the strained housing market have been left untouched. (RTRS)

U.S.

FISCAL: Congress moved Thursday to extend the nation's surface transportation programs through Dec. 3. House Speaker Nancy Pelosi indicated earlier in the day that she did not favor a short-term extension, given aspirations among some Democratic leaders that the House pass a $1.2 trillion infrastructure bill. But congressional negotiators could not reach an agreement, and debate on the infrastructure bill the Senate passed in August and a broader budget framework Biden described Thursday will continue at least into next week. Congress passed another short-term extension earlier this month, which authorized federal transportation agencies to continue operations through Oct. 31. (WAPO)

FISCAL: House Speaker Nancy Pelosi says in a letter to House Democrats the vote on the bipartisan infrastructure bill has been delayed but that most who were not prepared to vote for the legislation today have expressed their commitment to support it. Pelosi thanks "the overwhelming number of House Democrats" who support both the infrastructure bill and the $1.75 trillion tax and spending package. "As you may recall, we are ready for the Floor vote on the BIF, because the debate on the rule and the bill have already occurred." (BBG)

FISCAL: Sen. Joe Manchin signaled that he could support the $1.75 trillion price tag for Democrats' social spending plan, even as he hasn't said if he supports the overall framework deal. "We negotiated a good number that we worked off of, and we're all dealing in a good faith," Manchin told reporters. Asked if $1.75 trillion was too high, Manchin replied: "That was negotiated." (The Hill)

POLITICS: As President Joe Biden and Democrats try to get a roughly $1.75 trillion package over the finish line, a new poll shows that fewer than half of Americans approve of how they have handled the spending bill. And many say they know little to nothing about it. It's a troubling sign for a party that hopes to make the social spending investments the hallmark of their midterm election campaigns next year. The new poll from the Associated Press-NORC Center for Public Affairs Research finds that 36% of Americans say they approve of Biden's handling of the negotiations over the bill, while 41% disapprove and 23% say they neither approve nor disapprove. Fewer than half say they know a lot or some about the proposals. The new poll also gives Biden his first underwater approval rating for his handling of the economy and shows increasing pessimism about the direction of the country. (ABC News)

EQUITIES: Facebook Inc. is re-christening itself Meta Platforms Inc., decoupling its corporate identity from the eponymous social network mired in toxic content, and highlighting a shift to an emerging computing platform focused on virtual reality. The new name won't affect how the company uses or shares data, and the corporate structure isn't changing. Apps including the flagship social network, Instagram, Messenger and WhatsApp will also keep their monikers. The company said its stock will start trading under a new ticker, MVRS, on Dec. 1. (BBG)

OIL: Top executives of ExxonMobil and other oil giants denied spreading disinformation about climate change as they sparred Thursday with congressional Democrats over allegations that the industry concealed evidence about the dangers of global warming. The oil giant's public statements on climate "are and have always been truthful, fact-based ... and consistent" with mainstream climate science, Woods said. Democrats immediately challenged the statements by Woods and other oil executives, accusing them of engaging in a decades-long, industry-wide campaign to spread disinformation about the contribution of fossil fuels to global warming. "They are obviously lying like the tobacco executives were,″ said Rep. Carolyn Maloney, D-N.Y., chairwoman of the House Oversight Committee. She was referring to a 1994 hearing with tobacco executives who famously testified that they didn't believe nicotine was addictive. The reference was one of several to the tobacco hearing as Democrats sought to pin down oil executives on whether they believe in climate change and that burning fossil fuels such as oil contributes to global warming. (AP)

OTHER

G20: China's President Xi Jinping will participate in the Group of 20 (G20) leaders' summit in Rome on Oct. 30-31 via video link, according to a notice from China's foreign ministry on Friday. He will make a speech at the summit, the notice said. Xi has not left China since early 2020, when the gravity of the COVID-19 pandemic became clear. (RTRS)

GEOPOLITICS: India has deployed recently acquired US-made weaponry along its border with China, part of a new offensive force to bolster its capabilities as the countries remain deadlocked over disputed territory in the Himalayas. (SCMP)

JAPAN: LDP Fighting Uphill Battle To Keep Sole Majority, Many Tight Races Expected

- The Nikkei and Yomiuri Shimbun have published the results of final opinion polls ahead of this Sunday's general election, which reinforce the impression that the ruling Liberal Democratic Party is fighting an uphill battle to keep a sole majority in the lower house. The final Yomiuri survey (October 26-28) showed that the LDP has maintained strong momentum in the proportional representation component, where they could increase their share of seats to 70 from 66, but a difficult situation in some single-seat districts makes it uncertain if they will be able to hold onto a single-party majority in the House of Representatives. Yomiuri projected that we may see tight races in around 40% of single-seat constituencies and noted that the number of districts in which LDP candidates lag behind increased to 60 from 46 in the early stage of the campaign. The Nikkei came to similar conclusions, noting that races will be tight in 40% of single-seat constituencies. The newspaper suggested that net approval rating of the Kishida Cabinet has deteriorated, with 47% expressing support (up from 46% earlier in the race) and 32% expressing disapproval (up from 29% earlier). (MNI)

RBNZ: Reserve Bank Governor Adrian Orr is urging financial institutions to use their balance sheets to support struggling households and businesses facing higher inflation and interest costs. He said innovation and economic growth largely rest on the attitudes and conduct of financial institutions, particularly over the next year. "Monetary policy has largely run its easing course globally. In the absence of another demand shock that outpaces supply, monetary policy easing has done as much as it can. That means we're going into a very different inflation and interest rate environment. (interest.co.nz)

BOK: South Korean households last month faced the highest loan costs since 2019, following a Bank of Korea interest rate hike in August that was intended to curb excessive borrowing. The interest rate on new bank loans to households averaged 3.18% in September. Mortgage rates rose by 13 basis points to an average of 3.01%, the biggest monthly increase in almost five years. The rise in borrowing costs show the BOK's tightening is feeding through to the broader financial system and making it costlier to take on debt. The government hopes to manage debt growth at 4-5% in 2022, less than half the pace of what's been seen this year, with more stringent loan requirements starting January. (BBG)

SOUTH KOREA: The government said it will raise the private gathering limit to 10 people for the greater Seoul area and scrap business curfews on all multi-use facilities, except nightlife establishments, for four weeks starting next week under a "living with COVID-19" scheme. A "vaccine pass" system, which requires visitors to have a vaccination certificate or negative test result, will be also introduced with a grace period for entry into nightlife establishments, such as bars and nightclubs, and indoor sports facilities. (Yonhap)

TAIWAN: The top U.S. representative to Taiwan says Washington and the democratically ruled island will work together to secure supply chains. Sandra Oudkirk, director of the American Institute in Taiwan, made the comments in her first press conference since being appointed in July. She said the U.S.-Taiwan relationship remained fundamentally unchanged. (BBG)

PHILIPPINES: The Philippines will keep loose movement restrictions and existing capacity limits on businesses in the capital even as Covid-19 cases decline. Metro Manila, which accounts for a third of economic input, will remain under alert level 3 from Nov. 1 to 14. Outdoor establishments can operate at half capacity, while indoor restaurants, gyms, and cinemas are limited to fully-vaccinated customers at 30% capacity, based on earlier guidelines. (BBG)

INDIA: Shaktikanta Das has been reappointed governor of the Reserve Bank of India for another term of three years. Under Das, 64, the central bank endeavored to support growth and maintain liquidity through the worst of the pandemic by slashing interest rates and pursuing quantitative easing. (BBG)

BRAZIL: Brazil's authorities will not tolerate the dissemination of fake news in next year's elections, a Supreme Court justice said on Thursday after an electoral court acquitted far-right President Jair Bolsonaro of such a crime in the 2018 election. People found to be spreading fake news may face prison and any candidate involved could be banned from running, Supreme Court Justice Alexandre de Moraes said. (RTRS)

IRAN: President Biden will meet with U.K. Prime Minister Boris Johnson, French President Emmanuel Macron and German Chancellor Angela Merkel to discuss a path on resuming negotiations for a return to the 2015 Iran nuclear deal, according to White House guidance. The leaders will also discuss shared concerns about the stake of Iran's nuclear program. (BBG)

OIL: OPEC and its allies were presented with a tighter outlook for global oil markets this quarter, a week before ministers meet to discuss output policy. World oil inventories will decline by an average of 1.1 million barrels a day in the fourth quarter, compared with a forecast reduction of 670,000 barrels a day when the panel met last month. Fuel demand will be slightly higher and supply from outside OPEC+ a little lower than previously anticipated. By the end of the year, stockpiles in developed economies will stand 158 million barrels below average, a bigger deficit than the 106 million projected a month ago. (BBG)

OIL: OPEC and its allies appear set to reaffirm plans to increase crude production by 400,000 b/d in December after an advisory committee saw no major changes in the market's supply/demand outlook, despite calls from major consumers to further boost output to tame three-year high oil prices. Outages such as Hurricane Ida and a global gas shortage prompting switching to oil-fired power has caused crude prices to soar, raising gasoline prices at US gas stations to a level that could dent US President Joe Biden's popularity. (S&P)

CHINA

CHINA/TAIWAN: China must warn the U.S. that it is pushing the bilateral relations to a confrontational direction as some U.S. politicians have successively hyped up the idea of so-called "Taiwan's participation in the United Nations system" and ignored the facts to slander China as a threat to regional stability, said the party-run newspaper People's Daily in a commentary attributed to a pen name Zhong Sheng which is used when the leadership wishes to register its view. The Taiwan issue concerns China's sovereignty and territorial integrity, and China's core interests, the most sensitive issue in Sino-U.S. relations, the newspaper said. If the U.S. continues its "wrongdoings," it will only damage relations, peace in the Taiwan Strait and U.S. interests, the newspaper said. (MNI)

EVEGRANDE: Some China Evergrande Group bondholders received an overdue interest payment shortly before the expiry of a grace period, buying more time for the debt-stricken property developer as it tries to raise cash through asset sales. Certain holders of the 9.5% dollar note maturing in 2024 received notification they had been paid on Thursday. Evergrande skipped an interest payment due Sept. 29, starting the clock on a 30-day grace period before investors could declare a default. It's the second time this month that the debt-stricken property developer avoided default. (BBG)

LENDING: China has not opened the "floodgate" controlling credit to the property industry, nor will it ease its regulatory efforts, the Economic Daily said citing interviews of officials and lenders. While mortgage rates in about 20 cities have declined, including Guangzhou and Shenzhen, they were due to declining demand as falling home prices caused buyers to sideline from purchases, the newspaper said citing Deputy Director Zeng Gang of the state-affiliated thinktank National Institution for Finance & Development. Regulators were also ordered to prioritize loans to first-time buyers, so lenders have given more favorable rates, Zeng said. First-time buyers accounted for 92% of the home purchases at the end of July, he said. Mortgage rates in Beijing have not fallen, the newspaper said. Regulators are still toughening measures to prevent misusing loans to purchase properties, said the daily. (MNI)

POLICY: China plans to tighten data regulation by requiring security checks before overseas use of personal information and other important data, according to draft rules posted on the Cyberspace Administration website. The rules are aimed at protecting personal information and safeguarding national security. Review results are valid for 2 years; data providers that violate the rules will be punished according to laws. (BBG)

COAL: China's coal prices have room to fall further as production costs are much lower than current spot coal prices. NDRC cites initial results from a survey of coal production costs among China's major coal production provinces and key companies. Thermal coal futures plunge 7.8% after the news. (BBG)

COAL: China's move to increase coal production will fill the supply and demand gap in the medium term, which will stabilize market expectation and discourage stockpiling, though coal prices are still unlikely to fall quickly, the Securities Daily reported citing Ming Ming, the chief analyst at CITIC Securities. China's recent daily coal output exceeded 11.5 million tons to the highest this year, an increase of over 1.2 million tons from mid-September, after the National Development and Reform Commission released 18 documents in 10 days to intervene, the newspaper said. Many coal mines lowered the sales prices by as much as CNY360 per ton, the newspaper said. Ming suggested the futures market should be further managed, including limiting holdings and increasing margins to curb speculation, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN TOKYO OCT CPI +0.1% Y/Y; MEDIAN +0.4%; SEP +0.3%

JAPAN TOKYO OCT EX-FRESH FOOD +0.1% Y/Y; MEDIAN +0.3%; SEP +0.1%

JAPAN TOKYO OCT CPI EX-FRESH FOOD, ENERGY -0.4% Y/Y; MEDIAN +0.0%; SEP -0.1%

JAPAN SEP UNEMPLOYMENT +2.8%; MEDIAN +2.8%; AUG +2.8%

JAPAN SEP JOB-TO-APPLICANT RATIO +1.16% Y/Y; MEDIAN +1.14%; AUG +1.14%

JAPAN SEP, P INDUSTRIAL PRODUCTION -5.4% M/M; MEDIAN -2.7%; AUG -3.6%

JAPAN SEP, P INDUSTRIAL PRODUCTION -2.3% Y/Y; MEDIAN +0.2%; AUG +8.8%

AUSTRALIA SEP RETAIL SALES +1.3% M/M; MEDIAN +0.4%; AUG -1.7%

AUSTRALIA SEP PRIVATE SECTOR CREDIT +0.6% M/M; MEDIAN +0.5%; AUG +0.6%

AUSTRALIA SEP PRIVATE SECTOR CREDIT +5.3% Y/Y; MEDIAN +5.0%; AUG +4.7%

AUSTRALIA Q3 PPI +2.9% Y/Y; Q2 +2.2%

AUSTRALIA Q3 PPI +1.1% Q/Q; Q2 +0.7%

NEW ZEALAND OCT ANZ CONSUMER CONFIDENCE 98.0; SEP 104.5

NEW ZEALAND OCT ANZ CONSUMER CONFIDENCE -6.2% M/M; SEP -4.7%

Consumer confidence fell 7 points to 98 in October, with both perceptions of current conditions and expectations down sharply. The proportion of people who believe it is a good time to buy a major household item didn't rebound from last month's 20-point fall – it remained at -7. Inflation expectations went ballistic, rising more than 1% to 6.2%. House price inflation expectations lifted from 6.1% to 6.7%. The ANZ-Roy Morgan Consumer Confidence Index fell 7 points to 98 in October, well under its long-term average of just shy of 120. The data suggests trouble ahead for the retail sector. (ANZ)

SOUTH KOREA SEP INDUSTRIAL OUTPUT -1.8% Y/Y; MEDIAN +2.0%; AUG +9.7%

SOUTH KOREA SEP INDUSTRIAL OUTPUT SA -0.8% M/M; MEDIAN -0.3%; AUG -0.7%

SOUTH KOREA SEP CYCLICAL LEADING INDEX CHANGE -0.3; AUG -0.3

SOUTH KOREA NOV BUSINESS SURVEY M'FING 88; OCT 93

SOUTH KOREA NOV BUSINESS SURVEY NON-M'FING 85; OCT 81

CHINA MARKETS

PBOC INJECTS NET CNY100BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operations lead to a net injection of CNY100 billion after offsetting the maturity of CNY100billion reverse repos, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2225% at 09:25 am local time from the close of 2.3249% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday vs 40 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3907 FRI VS 6.3957

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3907 on Friday, compared with the 6.3957 set on Thursday.

MARKETS

SNAPSHOT: RBA Leaves Yield Target Undefended Triggering Speculation Around Next Policy Meeting

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 18.79 points at 28838.9

- ASX 200 down 104.479 points at 7325.9

- Shanghai Comp. up 5.519 points at 3523.936

- JGB 10-Yr future down 8 ticks at 151.31, yield up 0.2bp at 0.095%

- Aussie 10-Yr future down 27.5 ticks at 97.855, yield up 27.1bp at 2.115%

- U.S. 10-Yr future -0-06 at 130-18, yield up 1.58bp at 1.596%

- WTI crude up $0.07 at $82.89, Gold down $4.45 at $1794.47

- USD/JPY up 9 pips at Y113.67

- U.S. HOUSE DELAYS BIPARTISAN INFRASTRUCTURE BILL VOTE AMID PROGRESSIVES' PUSHBACK

- LAGARDE'S MILD RATES PUSHBACK REFLECTED ECB COUNCIL AGREEMENT (BBG)

- UK LOOKS AT FALLOUT FROM SUSPENDING NORTHERN IRELAND COOPERATION (Sky)

- RBA REFRAINS FROM PURCHASING DEBT IN DEFENCE OF YIELD TARGET

- EVERGRANDE PAYS OVERDUE INTEREST AND AGAIN DODGES DEFAULT (BBG)

- CHINA NDRC: COAL PRICES HAVE ROOM TO FURTHER FALL (BBG)

BOND SUMMARY: RBA Stay On Sidelines, Unleashing Surge In ACGB Yields

All eyes were on ACGB space as the RBA defied market expectations and stayed out of the market, instead of stepping in to enforce their ACGB Apr '24 yield target. The Reserve Bank looked through the surge in their target yield over the last two days, but bought A$1.0bn of ACGB Apr '24 last Friday, which fuelled expectations of another such intervention today. Their preference to remain on the sidelines inspired revisions to sell-side calls ahead of the upcoming monetary policy meeting, slated for this coming Tuesday. ANZ and NAB noted that they expect policymakers to scrap their yield target as soon as next week, while NAB added that they now expect the first cash rate hike in mid-2023 rather than in 2024.

- Expectations for an intervention in defence of the yield target were evident, as short-term yields retreated in early trade. Once got past the typical time of the RBA's bond purchase offer announcements, cash ACGBs got battered. Yields surged and last sit +9.7-19.5bp, the curve generally runs steeper, albeit 2s (ACGB Apr '24) underperform. Worth noting that 10-year yield posted its largest daily gain since Mar '20 as it hit session highs. Swings in Aussie bond futures were driven by the same factors and posted sharp pullbacks on the back of the RBA's silence. YM last -8.5 & XM -17.0, hovering close to session lows. Bills trade unch. to 7 ticks lower through the reds. Local data releases (incl. a beat in monthly retail sales) & ACGB Nov '32 supply were ignored, as was the release of the AOFM's weekly issuance plan.

- JGB futures slid to a session low of 151.27, likely on the back of spillover from ACGB space, but recouped those losses later on. The contract last sits at 151.33, 6 ticks shy of previous settlement. Cash JGB yield curve is marginally flatter, as the super-long end outperforms. Japan's preliminary industrial output & Tokyo CPI both missed forecasts, while unemployment remained steady, as anticipated. Uncertainty was elevated ahead of Japan's general election this Sunday.

- ACGB impetus drove T-Notes in early trade, but the latter contract failed to hold onto gains and faltered later in the session. As this is being typed, T-Notes trade -0-03 at 130-21. Cash Tsy yields recovered and sit marginally higher across the curve. Eurodollars last seen -1.0 to +1.0 tick through the reds. Today's U.S. docket features PCE index, MNI Chicago PMI & final Uni. of Mich. Sentiment, while the Fed are in their blackout period.

JGBS AUCTION: Japanese MOF sells Y4.0623tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0623tn 3-Month Bills:

- Average Yield -0.1143% (prev. -0.1098%)

- Average Price 100.0307 (prev. 100.0295)

- High Yield: -0.1117% (prev. -0.1061%)

- Low Price: 100.0300 (prev. 100.0285)

- % Allotted At High Yield: 62.4950% (prev. 89.6278%)

- Bid/Cover: 4.974x (prev. 4.534x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 1.9302% (prev. 1.6137%)

- High Yield: 1.9400% (prev. 1.6150%)

- Bid/Cover: 4.0950x (prev. 5.8850x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 45.1% (prev. 24.9%)

- Bidders 65 (prev. 52), successful 34 (prev. 23), allocated in full 28 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 3 November it plans to sell A$1.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 4 November it plans to sell A$1.0bn of the 25 February 2022 Note & A$1.0bn of the 22 April 2022 Note.

- On Friday 5 November it plans to sell A$1.0bn of the 3.25% 21 April 2025 Bond.

FOREX: RBA Silence Shields AUD From Negative Risk Tone, NZD Lags Behind

The NZD paced losses in G10 FX space as New Zealand reported 125 new community cases of Covid-19, while BBG trader sources pointed to NZD/USD sales by leveraged funds. New Zealand's ANZ Consumer Confidence Index deteriorated in October, with "both perceptions of current conditions and expectations down sharply," while ANZ commented that inflation expectations "went ballistic." NZD 2-year interest rate swap retreated, retracing some of its yesterday's advance.

- AUD knee-jerked higher as the RBA chose not to buy bonds in defence of its yield target. This resulted in revisions to RBA calls from some sell-side desks ahead of the Reserve Bank's imminent monetary policy meeting. ANZ expect the RBA to scrap their ACGB Apr '24 yield target next week, while NAB bought forward their projection of the first cash rate to mid-2023.

- Sales against its Antipodean cousin may have rubbed salt into the kiwi's wounds. AUD/NZD went bid, attacking the round figure of NZ$1.0500. The move coincided with a parallel move in AU/NZ 2-year swap spread.

- Broader risk tone was rather cautious, as underwhelming earnings reports from Amazon and Apple weighed on U.S. e-mini futures. JPY struggled to gain much strength nonetheless, with USD/JPY implied 1-week volatility hitting multi-month highs ahead of Japan's general election this Sunday.

- The European data docket today includes flash GDP & HICP data from the EZ and several Eurozone economies. In NY hours, focus will turn to U.S. PCE, personal income/spending, MNI Chicago PMI as well as Canadian GDP.

FOREX OPTIONS: Expiries for Oct29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1480-00(E842mln), $1.1595-00(E1.3bln), $1.1645-55(E933mln)

- USD/JPY: Y113.00($674mln), Y113.75-90($1.3bln), Y114.60-75($1.4bln)

- NZD/USD: $0.7210(N$645mln)

- USD/CAD: C$1.2300($982mln), C$1.2345($610mln)

- USD/CNY: Cny6.4750($600mln)

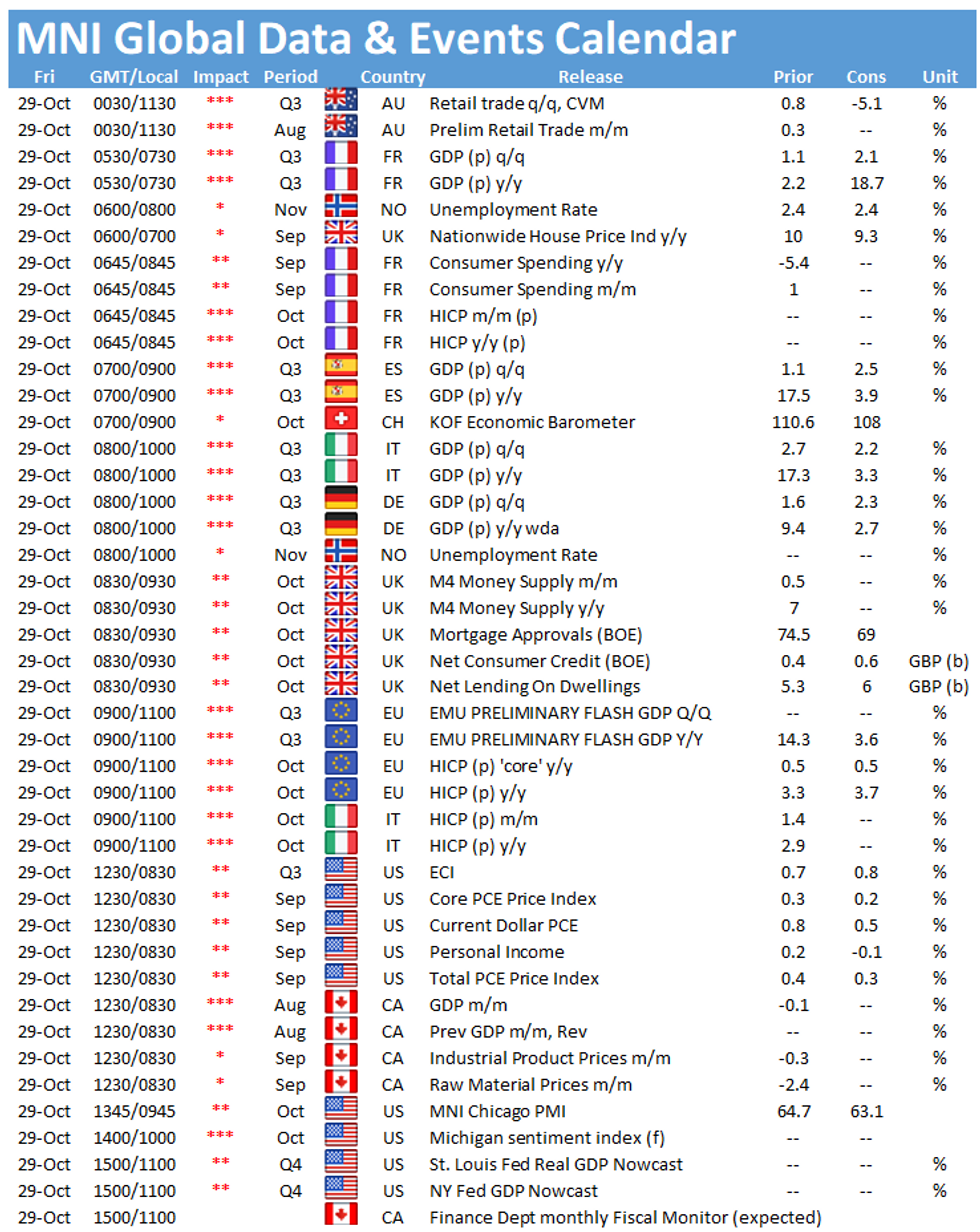

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.